Professional Documents

Culture Documents

Trai Phieu 5 PDF

Uploaded by

NguyenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trai Phieu 5 PDF

Uploaded by

NguyenCopyright:

Available Formats

Fixed-Income Research

Weekly report June 18th, 2018

Fixed-Income Report Round-up

All tenors were issued successfully.

Yield curve fluctuated in a tight band.

Interbank rates remained at a low level.

June 10th – 14th/2019

Yield Curve

In this issue

5.3

Round up

4.8

Bond market

Interest rates 4.3

3.8

3.3

2.8

1Y 2Y 3Y 5Y 7Y 10Y 15Y

This week Last week Last month

Source: Bloomberg, VCBS

VND 4,000 bn was mobilized this week. VND 37,940 bn was traded on the

secondary market.

Le Thu Ha Yield curve fluctuated in a tight band. According to Bloomberg data, 1Y, 2Y, 3Y,

5Y, 7Y, 10Y and 15Y bond yields posted at 3.24% (+2.2 bps), 3.512% (+5.4 bps), 3.642%

+84 24 3936 6990 (ext. 7182)

(+4.5 bps), 3.873% (+5.1 bps), 4.235% (-4 bps), 4.713% (+2.5 bps), 5.082% (-0.8 bps),

ltha_ho@vcbs.com.vn respectively.

Interbank rates remained at a low level. In details, ON – 3M rates posted at 2.975%,

Dang Khanh Linh 3.1%, 3.15%, 3.3% and 3.925%, respectively according to Bloomberg data. Market liquidity

was abundant in recent sessions.

+84 24 3936 6990 (ext. 7183)

dklinh@vcbs.com.vn Foreign investors net bought VND 633.94 bn this week.

SBV net injected VND 5,651 bn via OMO channel.

VCBS Commentary June 17th – June 21st

It should be note that in the upcoming week, FOMC in June is taking place with

expectation of lower level of interest rate. Besides, liquidity in money market is still

See Disclaimer at Page 5 abundant. Hence, with all these factors, bond yields will move in a tight band, the downward

pressure if any shall be affected when Fed announce policies on June 18-19.

Macroeconomic, Fixed-Income,

Financial and Corporation At the present, we do not expect the factor which can make liquidity less ample in

Information updated at the context of stable economy and no strong pressure on exchange rate. We believe that in the

www.vcbs.com.vn/vn/Services/AnalysisResearch

upcoming period, interbank rate will experience a minor change around this present level.

Research Department VCBS Page | 0

Fixed-Income Report

Bond Market

Primary Market

All tenors were issued successfully.

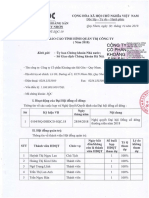

VND 4,000 bn was mobilized this VND 4,000 bn was mobilized this week from ST. Therein, ST planned to issue VND

week. 1,000 bn at 15Y; VND 1,500 bn at 20Y plus VND 1,500 bn at 30Y bond. The demand for

bonds was particularly high in this auction. Especially, 20Y tenor has remarkable registered

volume to offering volume ratio and bond yields decreased considerably. The registered

volume to offering volume ratio for 15Y, 20Y & 30Y tenors were 3.47, 7.99 and 4.67 times

respectively. The average register to offering ratio was 5.22 times. In addition, these tenors

were issued successfully, which indicated the high demand for long-term tenors from

financial institutions, especially insurance companies and investment funds. Wining rate

for 15Y, 20Y and 30Y tenors stood at 5.02% (-1 bps), 5.58% (-5 bps) and 5.85% (-3 bps),

respectively.

VBSP and VDB did not mobilize bond this week.

Winning rates GB Auction results Vol (VND bn)

8.50% 12000

7.50% 10000

6.50% 8000

5.50% 6000

4.50% 4000

3.50% 2000

2.50% 0

Volume 5Y 7Y 10Y

15Y 20Y 30Y

Source: HNX, VCBS

Secondary Market

Average volume each session increased slightly.

VND 37,940 bn (+7.19%) was VND 37,940 bn (+7.19%) was traded on the secondary market. Average trading volume

traded on the secondary market. each session rose slightly to VND 7.609 bn (+7.46%). In detail, Outright and repo values

were at VND 16,474 bn (+25.58% wow) and VND 21,465 bn (-3.63% wow), respectively.

Regarding outright, ST-Bond kept dominating trading volume with 90.09%. Remarkably,

this week a large proportion of bond trading (48.82%) belonged to short-term bond

(<5year) followed by long-term bond (>10 year) (19.95%).

Yield curve fluctuated in a tight band. According to Bloomberg data, 1Y, 2Y, 3Y, 5Y,

7Y, 10Y and 15Y bond yields posted at 3.24% (+2.2 bps), 3.512% (+5.4 bps), 3.642%

(+4.5 bps), 3.873% (+5.1 bps), 4.235% (-4 bps), 4.713% (+2.5 bps), 5.082% (-0.8 bps),

respectively.

Research Department VCBS Page | 1

Fixed-Income Report

Yield Curve

5.3

4.8

4.3

3.8

3.3

2.8

1Y 2Y 3Y 5Y 7Y 10Y 15Y

This week Last week Last month

Source: Bloomberg, VCBS

The US-China trade war temporarily stopped escalating to wait for the results of the

bilateral meeting at G20 summit in Japan on June 28-29, although the possibility of a deal

is quite low. Besides, it should be note that in the upcoming week, FOMC in June is taking

place with expectation of lower level of interest rate. This news support investors’

sentiment for small downward force on bond yields.

Besides, liquidity in money market is still abundant. Hence, with all these factors, bond

yields will move in a tight band, the downward pressure if any shall be affected when Fed

announce policies on June 18-19.

Foreign investors net bought VND Foreign investors net bought VND 633.94 bn this week. Therein, foreign recorded

633.94 bn this week. transactions for all tenors.

Foreign Investment in the secondary market 2018-2019

Net position (Unit: bn.VND)

May 28- June 01

Apr 02- Apr 06

Apr 16- Apr 20

May 14- May 18

June 11- June 15

June 25- June 29

July 09- July 13

July 23- July 27

Jan 07- Jan 11

Jan 21- Jan 25

Apr 08- Apr 12

Apr 22- Apr 26

Aug 06- Aug 10

Aug 20- Aug 24

Oct 01- Oct 05

Oct 15- Oct 19

Nov 12- Nov 16

Nov 26- Nov 30

Dec 10- Dec 14

Dec 21- Dec 28

Apr 30- May 04

Sep 04- Sep 07

Sep 17- Sep 21

Oct 29- Nov 02

Feb 11- Feb 15

Feb 25- Mar 01

Mar 11- Mar 15

Mar 25- Mar 29

May 05 - May 10

May 20 - May 24

June 03 - June 07

Source: HNX, VCBS

INTEREST RATE

Interbank Rates

Interbank rates remained at a low level. In details, ON – 3M rates posted at 2.975%,

Interbank rates remained at a low

3.1%, 3.15%, 3.3% and 3.925%, respectively according to Bloomberg data.

level.

Research Department VCBS Page | 2

Fixed-Income Report

Interbank rates

4.2

3.7

3.2

2.7

ON 1W 2W 1M 3M

This week Last week Last month

Source: Bloomberg, VCBS

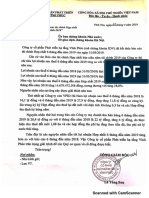

In the afternoon of June 13th, the State Bank of Vietnam (SBV) held the information

session of the banking operation results in the first 6 months of 2019. According to the

reported data, as of June 10, credit growth was 5.75%, the lowest level for 4 years.

Moderate growth encouraged banks to focus on borrowers of better quality, which shall

improve asset quality of banks in the long run.

In the context of stable economy and no strong pressure on exchange rate, we do not expect

the factor which can make liquidity less ample at the present. We believe that in the

upcoming period, interbank rate will experience a minor change around this present level.

Open Market Operation

SBV net injected VND 5,651 bn via

SBV net injected VND 5,651 bn via OMO channel. In detail, VND 70,449 bn of SBV-

OMO channel.

Bills matured this week, while the issuance of new bills was VND 64,799 bn at the time to

maturity of 7 days at rate of 3%. This indicated abundant liquidity and therefore it is

considered a good signal to the market.

Reverse Repo SBV-Bill Oustanding

180

250

x VND 1,000 bn

x VND 1,000bn

160

140 200

120

100 150

80

100

60

40

50

20

- -

Sep-17

Sep-18

Mar-17

May-17

Mar-18

May-18

Mar-19

May-19

Jul-17

Nov-17

Jul-18

Nov-18

Jan-18

Jan-19

Feb-17

Feb-18

Feb-19

Jun-17

Oct-17

Dec-17

Jun-18

Oct-18

Dec-18

Apr-17

Aug-17

Apr-18

Aug-18

Apr-19

Source: Bloomberg, VCBS

END.

Research Department VCBS Page | 3

Fixed-Income Report

APPENDICES

Bond Auctions

Offering Registering Winning Register to Winning rate Winning/

Auction date Tenor volume volume volume Offering Ratio (%) Offering Issuer

ST bills

Government and government-backed bonds

12-Jun-19 15Y 1,000 3,470 1,000 3.47 5.02 100.00% ST

12-Jun-19 20Y 1,500 11,989 1,500 7.99 5.58 100.00% ST

12-Jun-19 30Y 1,500 7,007 1,500 4.67 5.85 100.00% ST

Secondary Market

Week 03 June – 07 June Week 10 June – 14 June

Issuer Value Value share Value Value share

Outright

ST 10,953 83.49% 14,841 90.09%

VDB 2,043 15.58% 1,200 7.29%

VBSP 123 0.94% 433 2.63%

Others - 0.00% - 0.00%

Subtotal (1) 13,119 100.00% 16,474 100.00%

Repo

Repo 22,275 47.74% 21,465 51.30%

Reserve Repo 24,380 52.26% 20,381 48.70%

Subtotal (2) 46,655 100.00% 41,846 100.00%

ST bills

Outright

Repo

Subtotal (3)

Total (1)+(2)+(3) 59,773 58,320

Open Market Operation

Reverse Repo Outright (SBV Bills)

Date Due Offer Balance Outstanding Due Offer Balance Outstanding

01/02- 01/05 29,048 30,640 6,574 57,638 0 0 0 0

01/07- 01/11 52,656 47,823 (4,803) 52,835 0 0 0 0

01/14- 01/18 47,853 52,815 4,962 52,815 0 0 0 0

01/21 - 01/25 52,815 100,336 47,521 100,336 0 0 0 0

01/28 – 02/01 0 52,284 52,284 152,619 0 0 0 0

02/11 - 02/15 32,035 13.796 (18,239) 134,380 0 0 0 0

02/18 - 02/22 134,380 28,681 (105,699) 28,681 0 0 0 0

02/25 - 03/01 28,681 18,971 (9,709) 18,972 0 0 0 0

03/04 - 03/08 18971 13961 (5010) 13,961 0 0 0 0

03/11 – 03/15 13,961 7,587 (6,374) 7,588 0 17,000 17,000 17,000

03/18 - 03/22 7,587 2,728 (4,859) 2,728 17,000 37,500 20,500 37,500

03/25 - 03/29 2,728 1,635 (1,094) 1,635 37,500 4,900 (32,600) 4,900

04/01 - 04/05 1,635 196 (1,439) 196 300 5,200 4,900 -

04/08 - 04/12 195.6 0 (195.6) 0 17,001 10,200 (6,801) 10,200

04/15 - 04/19 0 0 0 0 10,200 5,000 (5,200) 5,000

05/06 - 05/10 514.6 0 (514.6) 0 50,000 25,887 (24,111) 25,887

05/13 - 05/17 0 97.85 97.85 97.85 25,887 48,725 22,838 48,725

05/20 - 05/24 97.85 0 (97.85) 0 48,725 43,720 (5,005) 43,720

05/27 - 05/31 0 0 0 0 43,720 84,799 41,079 84,799

06/03 – 06/07 0 0 0 0 70,449 64,799 (5,651) 64,799

06/10 - 06/14 0 0 0 0 70,449 64,799 (5,651) 64,799

Research Department VCBS Page | 4

Fixed-Income Report

DISCLAIMER

This report is designed to provide updated information on the fixed-income, including bonds, interest rates, some other related. The VCBS analysts

exert their best efforts to obtain the most accurate and timely information available from various sources, including information pertaining to market

prices, yields and rates. All information stated in the report has been collected and assessed as carefully as possible.

It must be stressed that all opinions, judgments, estimations and projections in this report represent independent views of the analyst at the date of

publication. Therefore, this report should be best considered a reference and indicative only. It is not an offer or advice to buy or sell or any actions

related to any assets. VCBS and/or Departments of VCBS as well as any affiliate of VCBS or affiliate that VCBS belongs to or is related to (thereafter,

VCBS), provide no warranty or undertaking of any kind in respect to the information and materials found on, or linked to the report and no obligation to

update the information after the report was released. VCBS does not bear any responsibility for the accuracy of the material posted or the information

contained therein, or for any consequences arising from its use, and does not invite or accept reliance being placed on any materials or information so

provided.

This report may not be copied, reproduced, published or redistributed for any purpose without the written permission of an authorized representative of

VCBS. Please cite sources when quoting. Copyright 2012 Vietcombank Securities Company. All rights reserved.

CONTACT INFORMATION

Tran Minh Hoang Le Thu Ha Dang Khanh Linh

Head of Research Senior Analyst - Economic research Analyst - Economic research

tmhoang@vcbs.com.vn ltha_ho@vcbs.com.vn dklinh@vcbs.com.vn

VIETCOMBANK SECURITIES COMPANY

http://www.vcbs.com.vn

Ha Noi Headquarter Floor 12th & 17th, Vietcombank Tower, 198 Tran Quang Khai Street, Hoan Kiem District, Hanoi

Tel: (84-4)-39366990 ext: 140/143/144/149/150/151

Ho Chi Minh Branch Floor 1st and 7th, Green Star Building, 70 Pham Ngoc Thach Street, Ward 6, District No. 3, Ho Chi Minh City

Tel: (84-28)-3820 8116 Ext:104/106

Da Nang Branch Floor 12th, 135 Nguyen Van Linh Street, Thanh Khe District, Da Nang City. Tel: (+84-236) 3888 991 ext: 801/802

Nam Sai Gon Transaction Unit Floor 3rd, V6 Tower, Plot V, Him Lam Urban Zone, 23 Nguyen Huu Tho Street, Tan Hung Ward, District No. 7, Ho Chi Minh City

Tel: (84-28)-54136573

Giang Vo Transaction Unit Floor 1st, Building C4 Giang Vo, Giang Vo Ward, Ba Dinh District, Hanoi. Tel: (+84-24) 3726 5551

Tay Ho Transaction Unit 1st & 3rd Floor, 565 Lac Long Quan Street, Tay Ho District, Hanoi. Tel: (+84-24) 2191048 (ext: 100)

Hoang Mai Transaction Unit 1st Floor Han Viet Building, 203 Minh Khai Street, Hai Ba Trung District, Hanoi. Tel: (+84-24) 3220 2345

Can Tho Representative Office Floor 1st, Vietcombank Can Tho Building, 7 Hoa Binh Avenue, Ninh Kieu District, Can Tho City.Tel: (+84-292) 3750 888

Vung Tau Representative Office Floor 1st, 27 Le Loi Street, Vung Tau City, Ba Ria - Vung Tau Province. Tel: (+84-254) 351 3974/75/76/77/78

An Giang Representative Office Floor 7th, Vietcombank An Giang Tower, 30-32 Hai Ba Trung, My Long Ward, Long Xuyen City, An Giang Province

Tel: (84-76)-3949843

Dong Nai Representative Office Floor 1st & 2nd, 79 Hung Dao Vuong, Trung Dung Ward, Bien Hoa City, Dong Nai Province. Tel: (84-61)-3918815

Hai Phong Representative Office Floor 2nd, 11 Hoang Dieu Street, Minh Khai Ward, Hong Bang District, Hai Phong City. Tel: (+84-225) 382 1630

Binh Duong Representative Office Floor 3th, 516 Cach Mang Thang Tam Street, Phu Cuong Ward, Thu Dau Mot City, Binh Duong Province.

Tel: (+84-274) 3855 771

Research Department VCBS Page | 5

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Trai Phieu 15Document6 pagesTrai Phieu 15NguyenNo ratings yet

- Trai Phieu 17Document12 pagesTrai Phieu 17NguyenNo ratings yet

- Monthly Report: Fixed-Income ResearchDocument8 pagesMonthly Report: Fixed-Income ResearchNguyenNo ratings yet

- Trai Phieu 14Document6 pagesTrai Phieu 14NguyenNo ratings yet

- Trai Phieu 18Document6 pagesTrai Phieu 18NguyenNo ratings yet

- Trai Phieu 21Document6 pagesTrai Phieu 21NguyenNo ratings yet

- Trai Phieu 29 PDFDocument8 pagesTrai Phieu 29 PDFNguyenNo ratings yet

- Trai Phieu 26 PDFDocument6 pagesTrai Phieu 26 PDFNguyenNo ratings yet

- Quarterly Report: Fixed - Income ResearchDocument9 pagesQuarterly Report: Fixed - Income ResearchNguyenNo ratings yet

- Trai Phieu 6Document6 pagesTrai Phieu 6NguyenNo ratings yet

- Trai Phieu 25Document7 pagesTrai Phieu 25NguyenNo ratings yet

- Trai Phieu 22Document6 pagesTrai Phieu 22NguyenNo ratings yet

- Monthly Report: Fixed - Income ResearchDocument8 pagesMonthly Report: Fixed - Income ResearchNguyenNo ratings yet

- Trai Phieu 27 PDFDocument6 pagesTrai Phieu 27 PDFNguyenNo ratings yet

- Trai Phieu 2Document7 pagesTrai Phieu 2NguyenNo ratings yet

- Trai Phieu 5 PDFDocument6 pagesTrai Phieu 5 PDFNguyenNo ratings yet

- Weekly Report: Fixed-Income ResearchDocument7 pagesWeekly Report: Fixed-Income ResearchNguyenNo ratings yet

- Macroeconomics Research: Quarterly ReportDocument11 pagesMacroeconomics Research: Quarterly ReportNguyenNo ratings yet

- Trai Phieu 9 PDFDocument6 pagesTrai Phieu 9 PDFNguyenNo ratings yet

- Macroeconomic Research April 2019: by A Member of VIETCOMBANKDocument14 pagesMacroeconomic Research April 2019: by A Member of VIETCOMBANKNguyenNo ratings yet

- Trai Phieu 7Document6 pagesTrai Phieu 7NguyenNo ratings yet

- Công Ty C PH N Khoáng S N Sài Gòn Quy NH NDocument5 pagesCông Ty C PH N Khoáng S N Sài Gòn Quy NH NNguyenNo ratings yet

- Trai Phieu 9 PDFDocument6 pagesTrai Phieu 9 PDFNguyenNo ratings yet

- SLS Baocaotaichinh Q3 2019 PDFDocument25 pagesSLS Baocaotaichinh Q3 2019 PDFNguyenNo ratings yet

- SDE Baocaoquantri 2018Document2 pagesSDE Baocaoquantri 2018NguyenNo ratings yet

- MEF Baocaoquantri 2018Document3 pagesMEF Baocaoquantri 2018NguyenNo ratings yet

- IDV Giaitrinh KQKD 6T 2019 Soatxet HopnhatDocument1 pageIDV Giaitrinh KQKD 6T 2019 Soatxet HopnhatNguyenNo ratings yet

- Tổng Công Ty Cổ Phần Y Tế DanamecoDocument14 pagesTổng Công Ty Cổ Phần Y Tế DanamecoNguyenNo ratings yet

- KTS Baocaotaichinh Q3 2019Document31 pagesKTS Baocaotaichinh Q3 2019NguyenNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Thu Thiem Tunnel Construction - Sequence - Immersed - Tunnel PDFDocument36 pagesThu Thiem Tunnel Construction - Sequence - Immersed - Tunnel PDFThông PhanNo ratings yet

- The Escape From VietnamDocument6 pagesThe Escape From VietnamYen Ke ToanNo ratings yet

- Makh LKHTT TenKH Taxid Dia chi Dien thoai Mack ChiNhanh Tong so luongDocument4 pagesMakh LKHTT TenKH Taxid Dia chi Dien thoai Mack ChiNhanh Tong so luonghoangthanhNo ratings yet

- Topic 1Document4 pagesTopic 12356030008chiNo ratings yet

- Southern Vietnam Tour 3 DaysDocument4 pagesSouthern Vietnam Tour 3 DaysDatTranNo ratings yet

- Bài Giảng Phiên Dịch TWODocument105 pagesBài Giảng Phiên Dịch TWOTam HuynhNo ratings yet

- 环球视野Document72 pages环球视野Sun XiangxueNo ratings yet

- Human View in The Ancestor Worship Belief of Chinese in Ho Chi Minh CityDocument9 pagesHuman View in The Ancestor Worship Belief of Chinese in Ho Chi Minh CityIAEME PublicationNo ratings yet

- Profile Long HoangDocument12 pagesProfile Long HoangSheraz ZubairNo ratings yet

- Additional Documents: DATE: 4/7/2020Document2 pagesAdditional Documents: DATE: 4/7/2020Thu ThuNo ratings yet

- Đại Phước, Tam Phước, Hoá An (Kim Oanh)Document233 pagesĐại Phước, Tam Phước, Hoá An (Kim Oanh)Thúy TrầnNo ratings yet

- 4D3N Saigon Tour - Feb - JulyDocument3 pages4D3N Saigon Tour - Feb - JulyAlam RamadhanNo ratings yet

- BCB Dieu Chinh Thong Tin 05 2015Document110 pagesBCB Dieu Chinh Thong Tin 05 2015Quang Hưng VũNo ratings yet

- Tour GuideDocument5 pagesTour Guidebasima88No ratings yet

- CBRE Power-Brand-Building-with Impact Presentation EngDocument158 pagesCBRE Power-Brand-Building-with Impact Presentation Englledo_111No ratings yet

- Mekong Delta Integrated Climate Resilience and Sustainable Livelihoods Project Technical ProposalDocument254 pagesMekong Delta Integrated Climate Resilience and Sustainable Livelihoods Project Technical ProposalBa Tu Tran100% (1)

- Vietnam NewDocument250 pagesVietnam NewKnight DarkNo ratings yet

- List of Danish Companies in VietnamDocument14 pagesList of Danish Companies in VietnamInfo SPUCNo ratings yet

- Form Co Full Cac Loai New 6567Document17 pagesForm Co Full Cac Loai New 6567Tran Anh ThuNo ratings yet

- 19Q1 CBRE Market Insight - HCMC - ENDocument53 pages19Q1 CBRE Market Insight - HCMC - ENChung TranNo ratings yet

- Tong Hop Cac Dang Bai Tap Chia Dong Tu Tieng Anh Lop 6Document32 pagesTong Hop Cac Dang Bai Tap Chia Dong Tu Tieng Anh Lop 6Hana HuyềnNo ratings yet

- My Resume (Nhat Tong)Document2 pagesMy Resume (Nhat Tong)api-3838992No ratings yet

- BitexcoDocument12 pagesBitexcoDương Viết Cương100% (1)

- Vietnam Retail Business Trends in Emerging EconomyDocument11 pagesVietnam Retail Business Trends in Emerging EconomyThanh Phu TranNo ratings yet

- A Guide To Investment and Trade in Vietnam 2020Document96 pagesA Guide To Investment and Trade in Vietnam 2020Nguyễn Văn ĐôngNo ratings yet

- Colorbond Ultra Activate Technical Data Sheet Rev 3 140122Document8 pagesColorbond Ultra Activate Technical Data Sheet Rev 3 140122Nam Hoàng HảiNo ratings yet

- Vietnam A New History Reference GoschaDocument55 pagesVietnam A New History Reference GoschanghiencuulichsuNo ratings yet

- A TestimonyDocument431 pagesA TestimonyNGO Dinh SiNo ratings yet

- Techcombank Exchange Rates AssignmentDocument28 pagesTechcombank Exchange Rates AssignmentOanh TruongNo ratings yet

- Hue As A Traditional City of VietnamDocument18 pagesHue As A Traditional City of VietnamPhi Yen NguyenNo ratings yet