Professional Documents

Culture Documents

Business Combination: Straight Problems

Uploaded by

Cil0 ratings0% found this document useful (0 votes)

114 views1 pageAFAR

Original Title

Business Combination

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAFAR

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

114 views1 pageBusiness Combination: Straight Problems

Uploaded by

CilAFAR

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

BUSINESS COMBINATION

STRAIGHT PROBLEMS

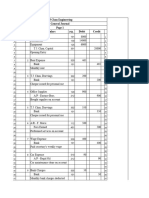

Problem 1 – Computations of Goodwill or IFA Problem 2 – Merger Combination

HARD Company acquired the net assets of SOFT The following summarized balance sheets were prepared

Enterprises on August 1, 2018 The carrying and fair for the RED Company and WHITE Company on December

values of SOFT Enterprises at the date of acquisition 31, 2018, just before the combination. On this date, RED

follows: acquires the net assets of WHITE and issues 12,000 new

Carrying shares in consideration thereof. The issued shares have a

Value Fair Value market value of P35 each.

Cash P20,000 P20,000

Accounts receivable 40,000 40,000 Assets Red White

Merchandise Inventory 60,000 70,000 Cash P140,000 P50,000

Plant and Property 450,000 460,000 Accounts Receivable 120,000 35,000

Patent 60,000 55.000 Land 220,000 50,000

Total assets P630,000 P645,000 Buildings (net) 350,000 210,000

Equipment (net) 410,000 125,000

Accounts Payable P30,000 P30,000 TOTAL P1,240,000 P470,000

Long-term-debt 400,000 370,000

Capital Stock 120,000 Liabilities & Equity

APIC 20,000 Accounts payable P160,000 P55,000

Retained Earnings 60,000 Bonds payable 200,000 100,000

Total Equities P630,000 P400,000 Common stock, P 10 par 400,000 180,000

Paid-in Capital in excess of par — 25,000

HARD issued the following considerations in exchange for Retained earnings 480,000 110,000

the net assets of SOFT. TOTAL P1,240,000 P470,000

1. 50,000, P1 par shares of HARD Company. Fair value-

P2.75 at August 1, 2018. The following market values have been agreed upon by

2. HARD agreed to pay additional cash consideration for the parties over some of WHITE’s net assets items:

the value of any decrease in the share price below

P2.75 for the 50,000 shares issued. The guarantee is Accounts Receivable, P30,000; Land, 60,000; Buildings,

for 90 days and is to expire on October 30, 2018. P250,000; Equipment, P150,000; and Bonds payable,

HARD believes there was only a 20% chance the price P110,000.

of the shares would fall to P2.60 during the guarantee

period. RED Company also paid out-of-pocket costs: P8,000 for

3. Cash of P90,000; P30,000 to be paid on date of direct acquisition costs; P15,000 for stock issuance and

exchange and the balance in one year's time. The registration; and P2,000 for indirect acquisition expenses.

incremental borrowing rate of HARD is 10% per

annum. Required:

4. SOFT Enterprises was currently being sued by an 1. Prepare a schedule for the computation of goodwill or

enraged client; the company's lawyers believe there's income from combination.

a 95% chance it will win the case. The expected 2. Prepare the necessary journal entries in the books of

damages in the event SOFT lost the case is P250,000. RED Company and WHITE Company.

5. An old-model Toyota delivery van carried in the books 3. Balance sheet of Red Company immediately after the

of HARD at P50,000, net of P10,000 accumulated merger business combination.

depreciation. The fair value at the date of the

exchange is P35,000.

In addition to the purchase consideration HARD

had an out-of-pocket costs of P8,520 for direct

acquisition cost; P2,000 for issuing and

registering the shares; and P1,500 indirect cost.

Required:

1. Prepare a schedule for the determination of the cost

of combination.

2. Prepare a schedule for the computation of the fair

value of the net assets.

3. Determine goodwill or excess from the business

combination, and

4. Prepare journal entries to record the acquisition of

the net assets of SOFT in the books of HARD.

You might also like

- Afar First Mock Cpa Board Exam Nov 20 2020 FOR POSTING PDFDocument11 pagesAfar First Mock Cpa Board Exam Nov 20 2020 FOR POSTING PDFJamaica David50% (2)

- IR 2 - Mod 6 Bus Combi FinalDocument4 pagesIR 2 - Mod 6 Bus Combi FinalLight Desire0% (1)

- Star River Assignment-ReportDocument15 pagesStar River Assignment-ReportBlessing Simons33% (3)

- Afar - Business Combinations - Mergers Ellery de Leon Far Eastern UniversityDocument3 pagesAfar - Business Combinations - Mergers Ellery de Leon Far Eastern UniversityRyan Joseph Agluba Dimacali50% (2)

- Buscommmmmmmm 1Document7 pagesBuscommmmmmmm 1Erico PaderesNo ratings yet

- Pa2 M-1415Document4 pagesPa2 M-1415Ronnelson PascualNo ratings yet

- Quizzer WK 1 - 1A FORMATIONDocument5 pagesQuizzer WK 1 - 1A FORMATIONRonalyn BayucanNo ratings yet

- Consolidated BS - Date of AcquisitionDocument2 pagesConsolidated BS - Date of AcquisitionKharen Valdez0% (1)

- Practical Accounting P-2Document7 pagesPractical Accounting P-2KingChryshAnneNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Mutual Fund RatiosDocument9 pagesMutual Fund RatiosAamir Ali ChandioNo ratings yet

- Case 1 - Computations of GW or IFADocument3 pagesCase 1 - Computations of GW or IFAJem Valmonte0% (1)

- Unit 4 - Business CombinationDocument2 pagesUnit 4 - Business CombinationJeselyn Solante AriarNo ratings yet

- C1 Business Combi AssignmentDocument2 pagesC1 Business Combi AssignmentkimberlyroseabianNo ratings yet

- Business CombinationDocument3 pagesBusiness Combinationlov3m3No ratings yet

- Abc-Problems With SolutionsDocument5 pagesAbc-Problems With SolutionsJohn JackNo ratings yet

- Drill Business CombinationDocument4 pagesDrill Business CombinationPrankyJellyNo ratings yet

- Chapter 14 Advacc2Document58 pagesChapter 14 Advacc2Aimee DyingNo ratings yet

- Accounting Ae2020Document3 pagesAccounting Ae2020elsana philipNo ratings yet

- Acc113 P1 QuizDocument5 pagesAcc113 P1 QuizEDELYN PoblacionNo ratings yet

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- Partnership Formation ProblemsDocument3 pagesPartnership Formation Problemsai kawaiiNo ratings yet

- Bus Com Nvestment in Associates, Consolidated EtcDocument4 pagesBus Com Nvestment in Associates, Consolidated EtcAlaine Doble CPANo ratings yet

- Business CombinationDocument10 pagesBusiness CombinationCloudKielGuiang0% (1)

- Quiz-Acc 114Document4 pagesQuiz-Acc 114Rona Amor MundaNo ratings yet

- Exercises (7-27-18)Document2 pagesExercises (7-27-18)Justin ManaogNo ratings yet

- Straight ProblemsDocument12 pagesStraight Problemsnana100% (2)

- BUSCOM ActivityDocument14 pagesBUSCOM ActivityLerma MarianoNo ratings yet

- Cpareviewschoolofthephilippines ChanchanDocument8 pagesCpareviewschoolofthephilippines ChanchanDavid David100% (1)

- Business Combination Quiz 1Document5 pagesBusiness Combination Quiz 1Ansherina AquinoNo ratings yet

- Consolidated FS at Date of AcquisitionDocument1 pageConsolidated FS at Date of Acquisitionassoc.uls2324No ratings yet

- Buscom SPDocument16 pagesBuscom SPCatherine Joy Vasaya100% (1)

- Accounting For Business CombinationsDocument5 pagesAccounting For Business CombinationsJohn JackNo ratings yet

- Business Combination 2Document3 pagesBusiness Combination 2Jamie RamosNo ratings yet

- Topic 10 - Practice ProblemsDocument2 pagesTopic 10 - Practice ProblemsAnna Mariyaahh DeblosanNo ratings yet

- Problems Week 1 2Document6 pagesProblems Week 1 2Maria Jessa HernaezNo ratings yet

- Test BankDocument38 pagesTest BankSophia Marie MoratoNo ratings yet

- 1 Formation 1Document7 pages1 Formation 1martinfaith958No ratings yet

- Partnership Formation: AssignmentDocument6 pagesPartnership Formation: AssignmentLee SuarezNo ratings yet

- Name: Section: Date: Score: Long Exam On Non-Profit Organization and Business CombinationDocument2 pagesName: Section: Date: Score: Long Exam On Non-Profit Organization and Business CombinationLiezelNo ratings yet

- Accounting For Business Combination - Recit & SeatworkDocument5 pagesAccounting For Business Combination - Recit & SeatworkZYRENE HERNANDEZNo ratings yet

- HO1 Partnership Formation and OperationDocument3 pagesHO1 Partnership Formation and OperationChristianAquinoNo ratings yet

- 2018cpapassers PDFDocument4 pages2018cpapassers PDFBryan Bryan BacarisasNo ratings yet

- Practical Accounting 2Document4 pagesPractical Accounting 2RajkumariNo ratings yet

- Accounting For Business Combinations Pre 7 - Midterm QuizzesDocument2 pagesAccounting For Business Combinations Pre 7 - Midterm QuizzesJalyn Jalando-onNo ratings yet

- Accounting For Business Combinations Pre 7 - Midterm QuizzesDocument2 pagesAccounting For Business Combinations Pre 7 - Midterm QuizzesJalyn Jalando-onNo ratings yet

- AtcpDocument2 pagesAtcpnavie VNo ratings yet

- Advanced Financial Accounting and Reporting: G.P. CostaDocument27 pagesAdvanced Financial Accounting and Reporting: G.P. CostaryanNo ratings yet

- Activity 1 PartnershipDocument4 pagesActivity 1 PartnershipJanet AnotdeNo ratings yet

- Midterm Exams - Pract 2 (1st Sem 2012-2013)Document13 pagesMidterm Exams - Pract 2 (1st Sem 2012-2013)jjjjjjjjjjjjjjjNo ratings yet

- ABC PracticeSet1 2020-2Document5 pagesABC PracticeSet1 2020-2heyheyNo ratings yet

- Problems Lecture - Partnership FormationDocument4 pagesProblems Lecture - Partnership FormationNiccoRobDeCastroNo ratings yet

- ACC 113 Accounting For Business Combinations Common Final Exam SY2122 1SDocument24 pagesACC 113 Accounting For Business Combinations Common Final Exam SY2122 1SGiner Mabale StevenNo ratings yet

- Consolidated FS at Date of AcquisitionDocument2 pagesConsolidated FS at Date of AcquisitionRafael BarbinNo ratings yet

- Mbination 0 Consolidated FSDocument28 pagesMbination 0 Consolidated FSShe Rae Palma100% (2)

- Consolidated Financial Statements - Acquistion DateDocument52 pagesConsolidated Financial Statements - Acquistion DateXavier AresNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- What Every Real Estate Investor Needs to Know About Cash Flow... And 36 Other Key Financial MeasuresFrom EverandWhat Every Real Estate Investor Needs to Know About Cash Flow... And 36 Other Key Financial MeasuresRating: 4.5 out of 5 stars4.5/5 (9)

- First AssessmentDocument3 pagesFirst AssessmentCilNo ratings yet

- AFAR1 Chap 1Document7 pagesAFAR1 Chap 1CilNo ratings yet

- Business Combination: Straight ProblemsDocument1 pageBusiness Combination: Straight ProblemsCilNo ratings yet

- Management Information Systems Suggested AnswersDocument1 pageManagement Information Systems Suggested AnswersCilNo ratings yet

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- Ch14 Long Term LiabilitiesDocument39 pagesCh14 Long Term LiabilitiesBabi Dimaano Navarez67% (3)

- CA 03 - Cost Accounting CycleDocument6 pagesCA 03 - Cost Accounting CycleJoshua UmaliNo ratings yet

- Chapter 2 AccountingDocument12 pagesChapter 2 Accountingmoon loverNo ratings yet

- Resa Oct 2012 Pract 1 First Preboard W Answers PDFDocument10 pagesResa Oct 2012 Pract 1 First Preboard W Answers PDFGuinevereNo ratings yet

- Corporate Liquidation & Reorganization T&FDocument2 pagesCorporate Liquidation & Reorganization T&FLugh Tuatha DeNo ratings yet

- 13 Essential Accounting PrinciplesDocument3 pages13 Essential Accounting PrinciplesRae MichaelNo ratings yet

- Chapter 14: Financial Ratios and Firm PerformanceDocument43 pagesChapter 14: Financial Ratios and Firm Performancebano0otaNo ratings yet

- Accounting - Enron Scandal PDFDocument27 pagesAccounting - Enron Scandal PDFArjit AgrawalNo ratings yet

- Exam 2015 QuestionsDocument14 pagesExam 2015 QuestionsFami FamzNo ratings yet

- PT Pyridam Farma TBK: Dan Entitas Anak/And SubsidiariesDocument72 pagesPT Pyridam Farma TBK: Dan Entitas Anak/And SubsidiariesRastia YusaNo ratings yet

- Applied Economics Module Week 5Document5 pagesApplied Economics Module Week 5Billy Joe100% (1)

- Edelweiss Twin Win 6.60% - Aug 2019 - UpdatedDocument10 pagesEdelweiss Twin Win 6.60% - Aug 2019 - UpdatedspeedenquiryNo ratings yet

- Friendley S Miniature Golf and Driving Range Inc Was Opened OnDocument1 pageFriendley S Miniature Golf and Driving Range Inc Was Opened Ontrilocksp SinghNo ratings yet

- Test Bank Financial Accounting 6E by Libby Chapter 13Document50 pagesTest Bank Financial Accounting 6E by Libby Chapter 13Ronald James Siruno MonisNo ratings yet

- BUS 6140 Module 5 WorksheetDocument19 pagesBUS 6140 Module 5 WorksheetBryan MooreNo ratings yet

- Chapter 3 Cost Accounting Cycle Multiple Choice - TheoriesDocument36 pagesChapter 3 Cost Accounting Cycle Multiple Choice - TheoriesAyra Pelenio100% (2)

- YTL Power International BHD Review AR2015 TimFippsDocument33 pagesYTL Power International BHD Review AR2015 TimFippsTim FippsNo ratings yet

- Financial Budget: Reporter: Katherine MiclatDocument57 pagesFinancial Budget: Reporter: Katherine MiclatMavis LunaNo ratings yet

- BBPW3103 - Topic02 - EnglishDocument67 pagesBBPW3103 - Topic02 - EnglishclairynaNo ratings yet

- Itc Limited Technical AnalysisDocument27 pagesItc Limited Technical AnalysisrajdeeplahaNo ratings yet

- CLV - CalculationDocument10 pagesCLV - CalculationUtkarsh PandeyNo ratings yet

- Companies Condonation of Delay Scheme, 2018Document5 pagesCompanies Condonation of Delay Scheme, 2018SameerNo ratings yet

- (7.2) Continue With TJ Chan Engineering (Worksheet and Classified Balance Sheet)Document11 pages(7.2) Continue With TJ Chan Engineering (Worksheet and Classified Balance Sheet)clumzeegaming8No ratings yet

- What Is Clause 49Document3 pagesWhat Is Clause 49Kaushik ShahNo ratings yet

- A Project Report On: "Capital Structure"Document57 pagesA Project Report On: "Capital Structure"Sankalp PariharNo ratings yet

- Tiaan Ayurvedic 2018Document61 pagesTiaan Ayurvedic 2018Puneet367No ratings yet

- Acctg1 PDF Instruction ManualDocument115 pagesAcctg1 PDF Instruction ManualhannahNo ratings yet