Professional Documents

Culture Documents

Meta Trader 4

Uploaded by

Alexis Chinchay AtaoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Meta Trader 4

Uploaded by

Alexis Chinchay AtaoCopyright:

Available Formats

MetaTrader 4, also known as MT4, is an electronic trading platform widely used by

online retail foreign exchange speculative traders. It was developed by MetaQuotes

Software and released in 2005. The software is licensed to foreign exchange brokers

who provide the software to their clients. The software consists of both a client

and server component. The server component is run by the broker and the client

software is provided to the broker�s customers, who use it to see live streaming

prices and charts, to place orders, and to manage their accounts.

The client is a Microsoft Windows-based application that became popular mainly due

to the ability for end users to write their own trading scripts and robots that

could automate trading. In 2010, MetaQuotes released a successor, MetaTrader 5.

However, uptake was slow and as of April 2013 most brokers still used MT4. While

there is no official MetaTrader 4 version available for Mac OS, some brokers

provide their own custom developed MT4 variants for Mac OS.[2][3][4]

Contents

1 History

2 Functionality

3 Components

4 Products

5 See also

6 References

7 External links

History

Its developer, MetaQuotes Software, had previously released a number of versions of

the MetaTrader platform starting in 2002. MetaTrader 4 was a significantly enhanced

version and was released in 2005.[5]

Between 2007 and 2010, a number of brokerages added the MT4 platform as an optional

alternative to their existing trading software due to its popularity with traders

and the large number of third party scripts and advisors.[citation needed]

In October 2009, a significantly re-coded MetaTrader 5 went into public beta

testing.[6] The first MT5 live account was subsequently launched by InstaForex in

September 2010.[7] In 2013 and 2014, the MQL4 programming language was completely

revised eventually reaching the level of MQL5. Starting from build 600, MQL4 and

MQL5 use unified MetaEditor.[8]

Functionality

A chart from the MT4 trading screen

The client terminal includes a built-in editor and compiler with access to a user

contributed free library of software, articles and help. The software utilizes a

proprietary scripting language, MQL4/MQL5,[9][10][11] which enables traders to

develop Expert Advisors, custom indicators and scripts. MetaTrader's popularity

largely stems from its support of algorithmic trading.

Yahoo! hosts a large group (over 12,000 members) devoted to development of free

open source software for MetaTrader.[12]

MT4 is designed to be used as a stand-alone system with the broker manually

managing their position and this is a common configuration used by brokers. However

a number of third party developers have written software bridges enabling

integration with other financial trading systems for automatic hedging of

positions. In late 2012 and early 2013, MetaQuotes Software began to work towards

removing third-party plugins for its software from the market, suing and warning

developers and brokers.[13]

MetaTrader provide two types of trading orders, Pending Orders and Market Orders.

Pending orders will be executed only when the price reaches a predefined level,

whereas Market orders can be executed in one of the four modes: Instant execution,

Request execution, Market execution, and Exchange execution.[14] With Instant

execution, the order will be executed at the price displayed in the platform. Its

advantage is that the order will be executed at a known price. However, a good

trading opportunity can be missed when the volatility is high and the requested

price cannot be served.[15] Request execution mode enables trader to execute a

Market order in two steps � first, a price quote is requested, then, a trader

decides whether to buy or sell using the received price. A trader has several

seconds to decide if the received price is worth trading. Such mode offers a

certain knowledge of price combined with guaranteed execution at that price. The

tradeoff is the reduced speed of execution, which can take a lot longer than other

modes.[16] With Market execution, the orders will be executed with broker's price

even if it is different from that displayed in the platform. The advantage of this

mode is that it allows trading without any sort of requotes. However, deviation can

get considerable during volatile price changes.[17] In Exchange execution mode, the

order is processed by the external execution facility (the exchange). The trade is

executed according to the current depth of market.[18]

You might also like

- MetaTrader 4 (1)Document4 pagesMetaTrader 4 (1)MubashirNo ratings yet

- MT4 Basics: Toolbars, Charts, OrdersDocument20 pagesMT4 Basics: Toolbars, Charts, Ordersbirko6180% (5)

- Quotex Success Blueprint: The Ultimate Guide to Forex and QuotexFrom EverandQuotex Success Blueprint: The Ultimate Guide to Forex and QuotexNo ratings yet

- Hentak FXDocument2 pagesHentak FXmohamad hifzhanNo ratings yet

- Expert Advisor Programming and Advanced Forex StrategiesFrom EverandExpert Advisor Programming and Advanced Forex StrategiesRating: 5 out of 5 stars5/5 (2)

- MetaTrader 4 101Document20 pagesMetaTrader 4 101liamsjunk100% (2)

- MetaTrader 4 and MQL 4 OverviewDocument15 pagesMetaTrader 4 and MQL 4 OverviewRoberto Báez MoralesNo ratings yet

- Social Trading For Beginners:: How To Start Copying The Best Traders Today; Social Trading DummiesFrom EverandSocial Trading For Beginners:: How To Start Copying The Best Traders Today; Social Trading DummiesNo ratings yet

- Met A Trader Manual v1.01Document21 pagesMet A Trader Manual v1.01Santhosh KumarNo ratings yet

- Demystifying Digital Currency Trading Platforms: A Beginner's GuideFrom EverandDemystifying Digital Currency Trading Platforms: A Beginner's GuideNo ratings yet

- An Introduction To MQL4 ProgrammingDocument2 pagesAn Introduction To MQL4 ProgrammingBiantoroKunartoNo ratings yet

- Attention - GIBXChange Will Launch MT5 Function SoonDocument3 pagesAttention - GIBXChange Will Launch MT5 Function SoonGIBX MT5No ratings yet

- MT5 Quick GuideDocument33 pagesMT5 Quick GuideKambadur KarthikeyNo ratings yet

- Complete Global Private Label Forex Offer SolutionDocument12 pagesComplete Global Private Label Forex Offer SolutionChristos VoulgarisNo ratings yet

- m4m Mt5 ManualDocument44 pagesm4m Mt5 ManualElsaNo ratings yet

- Activtrades - Metatrader5 User Guide: - Version 2.0 - (April 2013) © Activtrades PLCDocument61 pagesActivtrades - Metatrader5 User Guide: - Version 2.0 - (April 2013) © Activtrades PLCadolfo richaniNo ratings yet

- One-Click Trade Pro MT4 EADocument13 pagesOne-Click Trade Pro MT4 EAMichael MarioNo ratings yet

- EA Asia User GuidedcscsfcdfvvsDocument24 pagesEA Asia User GuidedcscsfcdfvvsAly DianisNo ratings yet

- Wall Street Forex RobotDocument19 pagesWall Street Forex RobotCryptoFX100% (3)

- Use Python With MetatraderDocument2 pagesUse Python With MetatraderAndrei NohaiNo ratings yet

- Sacjcbkjcbndonbwe OnDocument1 pageSacjcbkjcbndonbwe OnpannyformeNo ratings yet

- Importance of Technology in Finance Trading001Document2 pagesImportance of Technology in Finance Trading001peterNo ratings yet

- Tradingbot SampleDocument34 pagesTradingbot SampleMauricio AlbiniNo ratings yet

- WWW Mt4greylabel Com Meta-Trader-5Document9 pagesWWW Mt4greylabel Com Meta-Trader-5Mt4 Grey LabelNo ratings yet

- Article To Translate - Trend Following StrategiesDocument1 pageArticle To Translate - Trend Following Strategiesledapij1No ratings yet

- Manual Mql4 Del MetaeditorDocument599 pagesManual Mql4 Del MetaeditorAndres Vilchez100% (1)

- What Is QuotexDocument8 pagesWhat Is QuotexquotexbrokerloginNo ratings yet

- Guide To MT4: Learn How To Use The MT4 Trading PlatformDocument36 pagesGuide To MT4: Learn How To Use The MT4 Trading PlatformsuksanNo ratings yet

- Wallstreet Forex Robot: User GuideDocument18 pagesWallstreet Forex Robot: User GuidePetrus PurbadiNo ratings yet

- Wallstreet Forex Robot: User GuideDocument18 pagesWallstreet Forex Robot: User GuideAugusto CesarNo ratings yet

- ForexRealProfitEA v5.11 Manual 12.21.2010Document29 pagesForexRealProfitEA v5.11 Manual 12.21.2010RODRIGO TROCONIS100% (1)

- MQL5 Site - 'The Algorithm of Ticks' Generation Within The Strategy Tester of The MetaTrader 5 Terminal - MQL5 ArticlesDocument6 pagesMQL5 Site - 'The Algorithm of Ticks' Generation Within The Strategy Tester of The MetaTrader 5 Terminal - MQL5 Articlesmarciosantos_advNo ratings yet

- DMA Faqs ISVsDocument2 pagesDMA Faqs ISVscvf100% (1)

- DOTS User Manual v4210Document58 pagesDOTS User Manual v4210Bull433No ratings yet

- EA ManualDocument13 pagesEA Manualmangelbel6749100% (2)

- 1 CtraderDocument59 pages1 CtraderNasNo ratings yet

- Strategy Builder User Guide PDFDocument31 pagesStrategy Builder User Guide PDFdarklink0808No ratings yet

- Mega DroidDocument89 pagesMega DroidLeoMonicaRaresChiricaNo ratings yet

- WWW Mt4greylabel Com Meta-Trader-4Document10 pagesWWW Mt4greylabel Com Meta-Trader-4Mt4 Grey LabelNo ratings yet

- Kwakol Is The Easiest Way To Industry On The Marketplacesdjhfk PDFDocument1 pageKwakol Is The Easiest Way To Industry On The Marketplacesdjhfk PDFwavepriest53No ratings yet

- User Guide: Multi Terminal For Hidden ArbitrageDocument41 pagesUser Guide: Multi Terminal For Hidden ArbitrageAriel Arby100% (7)

- mql4 BookDocument459 pagesmql4 BookQasim Awan100% (2)

- MQL 4Document1,665 pagesMQL 4Muhammad Bin AslamNo ratings yet

- WebPROfit Manual FXGM 3 1Document47 pagesWebPROfit Manual FXGM 3 1sharonworld2000No ratings yet

- Profit Overview: Quick Links in The Profit User GuideDocument21 pagesProfit Overview: Quick Links in The Profit User GuideAbiodun RichardNo ratings yet

- Introduction To MQL 4 ProgrammingDocument2 pagesIntroduction To MQL 4 Programmingemagist0% (1)

- Practical Programming in Mql4Document456 pagesPractical Programming in Mql4asd ystywmbrNo ratings yet

- Forex Gold Investor: User GuideDocument28 pagesForex Gold Investor: User GuideNovica SladojeNo ratings yet

- Eightcap Tips To Start A Forex Trading With A Demo AccountDocument9 pagesEightcap Tips To Start A Forex Trading With A Demo AccountEight CapNo ratings yet

- Mega DroidDocument89 pagesMega Droidalibi.mokusNo ratings yet

- Getting Started With R TraderDocument38 pagesGetting Started With R TraderNem ProdutorNo ratings yet

- ENG Westernpips Private-User GuideDocument45 pagesENG Westernpips Private-User GuideThiago HenriqueNo ratings yet

- Forex Trading doc (1)Document4 pagesForex Trading doc (1)MubashirNo ratings yet

- Forex Trading Guide .2.0Document53 pagesForex Trading Guide .2.0Alexandro DiraNo ratings yet

- Ofm DownloadDocument17 pagesOfm DownloadSajid GiNo ratings yet

- Automated Forex TradingDocument7 pagesAutomated Forex Trading1dariusjsbcglobalNo ratings yet

- Smart Health Care System Using Sensors, Iot Device and Web PortalDocument12 pagesSmart Health Care System Using Sensors, Iot Device and Web PortalHendi PrayogiNo ratings yet

- Free Ip Address Tracker (Ipat) : Reviewer'S GuideDocument10 pagesFree Ip Address Tracker (Ipat) : Reviewer'S Guidesamsung samsungNo ratings yet

- Sidra Mudassar AssignmentDocument19 pagesSidra Mudassar AssignmentAyesha ArshadNo ratings yet

- 360eyes User GuideDocument16 pages360eyes User GuideMarcusNo ratings yet

- IMaster MAE V100R023C10SPC150 Upgrade Expert Operation Guide (Virtual Cluster Remote Cold Backup System, TaiShan)Document101 pagesIMaster MAE V100R023C10SPC150 Upgrade Expert Operation Guide (Virtual Cluster Remote Cold Backup System, TaiShan)muthurfeNo ratings yet

- Ericsson AP 20eDocument255 pagesEricsson AP 20eirozaNo ratings yet

- Blog Skins 375936Document8 pagesBlog Skins 375936aisyahkarinaNo ratings yet

- KampasDocument1 pageKampasSamer aneNo ratings yet

- Development of Mathematics, 1950-2000Document1,392 pagesDevelopment of Mathematics, 1950-2000Anderson AlfredNo ratings yet

- Comparative Study of CouchDB and MongoDB - NoSQL Document Oriented DatabasesDocument3 pagesComparative Study of CouchDB and MongoDB - NoSQL Document Oriented DatabasesNITESHWAR BHARDWAJNo ratings yet

- Implementing Rules RA 9184Document76 pagesImplementing Rules RA 9184marifer_fagelaNo ratings yet

- ACOS 4.1.4 Web Application Firewall Guide: For A10 Thunder™ Series and AX™ Series 21 February 2018Document182 pagesACOS 4.1.4 Web Application Firewall Guide: For A10 Thunder™ Series and AX™ Series 21 February 2018Ghajini SanjayNo ratings yet

- Oracle Fusion Middleware ConceptsDocument34 pagesOracle Fusion Middleware ConceptsVGNo ratings yet

- Radyne DMD50 Firmware Installation InstructionsDocument25 pagesRadyne DMD50 Firmware Installation InstructionsGromit32No ratings yet

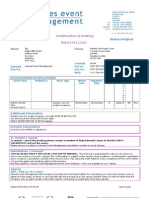

- Confirmation of Booking Ref:2172111101: Client VenueDocument1 pageConfirmation of Booking Ref:2172111101: Client VenueGufranAhmedNo ratings yet

- INOVOLA DevelopmentDocument20 pagesINOVOLA DevelopmentJafar Al-RashidNo ratings yet

- AVG 7.5 Anti-Virus Free EditionDocument22 pagesAVG 7.5 Anti-Virus Free EditionkhikhoanhtuanNo ratings yet

- Web Services ArchitecturesDocument15 pagesWeb Services Architecturesapi-3728532No ratings yet

- LS Training 2018-2019Document36 pagesLS Training 2018-2019stevanlodoNo ratings yet

- Set Up Google Cloud Console for Enterprise SolutionsDocument93 pagesSet Up Google Cloud Console for Enterprise SolutionsNaveen100% (1)

- Motel 6 Discount Motel Rooms - Budget Motel - by Motel 6Document2 pagesMotel 6 Discount Motel Rooms - Budget Motel - by Motel 6Mario ChávezNo ratings yet

- Mail Merge: Michael B. BotalonDocument25 pagesMail Merge: Michael B. BotalonMargerie FrueldaNo ratings yet

- Embedded Systems PDFDocument79 pagesEmbedded Systems PDFsatyaNo ratings yet

- Hacking SimplifiedDocument17 pagesHacking Simplifiedsamarth kariaNo ratings yet

- OPSYS Presentation EDDs 180619Document24 pagesOPSYS Presentation EDDs 180619gabriela.corina337006No ratings yet

- Seminar ReportDocument28 pagesSeminar Reporter_saritajain92No ratings yet

- Commerce Server 10.1 Technical Overview WhitepaperDocument35 pagesCommerce Server 10.1 Technical Overview Whitepaperboiled_iceNo ratings yet

- Cyber Law in IndiaDocument4 pagesCyber Law in Indiadrishti guptaNo ratings yet

- 32 Responsive Email Templates For Your Small BusinessDocument13 pages32 Responsive Email Templates For Your Small BusinessPrabhul Kumar0% (1)

- Faq Next47 Partnership With Techstars: 1 - Questions About Techstars AcceleratorDocument3 pagesFaq Next47 Partnership With Techstars: 1 - Questions About Techstars AcceleratorSubhasis MahapatraNo ratings yet