Professional Documents

Culture Documents

1cce7e625 342424 PDF

Uploaded by

Vivencio Pinguel0 ratings0% found this document useful (0 votes)

27 views1 pageOriginal Title

1cce7e625_342424 (2).pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

27 views1 page1cce7e625 342424 PDF

Uploaded by

Vivencio PinguelCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

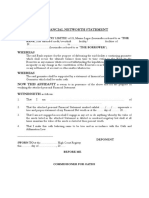

SEMIANNUAL COUNCIL AUDIT REPORT

FOR PERIOD ENDED DECEMBER 31, 20

Due By: FEBRUARY 15

COUNCIL NO. ________________ CITY _________________________________________ STATE__________________________

SCHEDULE A — MEMBERSHIP

ADDITIONS INS. ASSO. TOT. DEDUCTIONS INS. ASSO. TOT.

Total members start of period Suspensions

Initiations Deaths

Transfers from other councils Withdrawals

Transfers—assoc. to insurance Transfers—assoc. to insurance

Transfers—ins. to associate Transfers—ins. to associate

Re-entries Tranfers to other councils

Total for period Total deductions

Minus total deductions Do not include inactive insurance members in this section.

Number members end of period See Knights of Columbus Leadership Resources (#5093) booklet.

SCHEDULE A — ALTERNATIVE

Our council uses Member Management/Member Billing. The requirement for completing Schedule A is satisfied.

SCHEDULE B — CASH TRANSACTIONS

FINANCIAL SECRETARY TREASURER

Cash on hand beginning of period $___________________ Cash on hand beginning of period $___________________

Cash received—dues, initiations $___________________ Received from financial secretary $___________________

Cash received from other sources: Transfers from sav./other accts. $___________________

(Explain kind and amount) Interest earned $___________________

___________________$__________ Total receipts $___________________

___________________

___________________$__________ Disbursements

___________________$__________ $___________________ Per capita: Supreme Council $___________________

Total cash received $___________________ State council $___________________

Transferred to treasurer $___________________ General council expenses $___________________

Cash on hand at end of period $___________________

___________________ Transfers to sav./other accts. $___________________

Miscellaneous $___________________

Total disbursements $___________________

Net balance on hand $___________________

___________________

SCHEDULE C — ASSETS AND LIABILITIES

ASSETS LIABILITIES

Cash: Due Supreme Council:

Undeposited funds $_________________ Per capita $________________

Bank — Checking acct. $_________________ Supplies $________________

— Savings acct. $_________________ Catholic advertising $________________

— Money market accts. $_________________ Other $________________

Due from _______ members $_________________ Due state council $________________

Number

Total current assets $_________________

_________________ Advance payments by ______ members $________________

Number

Less: current liabilities $_________________ Misc. liabilities

Net current assets $_________________

_________________ _________________ $________________

Other Assets: _________________ $________________

Short term CD $_____________ _________________ $________________

Money Market Total current liabilities $________________

________________

Mutual Funds $_____________ Signed this _______ day of ____________________ 20 ______

Misc. assets $_____________ ________________________________________ Grand Knight

Total other assets $_________________ ________________________________________ Trustee

Total assets $_________________

_________________ ________________________________________ Trustee

________________________________________ Trustee

Please complete all items. Insert “None” where no figures are to be shown.

SEND ONE COPY TO: Council Accounts COPIES TO: State Deputy, District Deputy, Council File

Email: council.accounts@kofc.org

Fax: 855-228-1396

Mail: 1 Columbus Plaza, New Haven, CT 06510 Available in electronic format at kofc.org/forms

1295 12/16

*All U.S. Councils must file form 990 with IRS annually. For info call 203-752-4281 or refer to Officer’s Desk Reference.*

You might also like

- Semiannual Council Audit Report Ending Dec 31stDocument1 pageSemiannual Council Audit Report Ending Dec 31starmand resquir jrNo ratings yet

- RCM Deposit Cover SheetDocument2 pagesRCM Deposit Cover SheetDaya AnandaNo ratings yet

- Application For Loan FillableDocument2 pagesApplication For Loan FillableRheon M JosephNo ratings yet

- Termination of MembershipDocument1 pageTermination of Membershipmarkanthonymailig100% (1)

- Final Paycheck Acknowledgment-KHDocument2 pagesFinal Paycheck Acknowledgment-KHJennifer CooperriderNo ratings yet

- Dilg Xi Employees Multi-Purpose CooperativeDocument2 pagesDilg Xi Employees Multi-Purpose CooperativeDILG STA MARIANo ratings yet

- Annual Financial SampleDocument1 pageAnnual Financial SampleChayne Donato MolingNo ratings yet

- Estimate of Monthly Expenditures: AccountsDocument1 pageEstimate of Monthly Expenditures: Accountsa1haniNo ratings yet

- Bonus Loan ApplicationDocument1 pageBonus Loan ApplicationAugieray D. MercadoNo ratings yet

- Fee Waiver Request FormDocument2 pagesFee Waiver Request FormRajesh MukkavilliNo ratings yet

- Scholarship ApplicationDocument3 pagesScholarship Applicationyolanda SanchezNo ratings yet

- Loan Application: Annex 1Document18 pagesLoan Application: Annex 1NinoSawiranNo ratings yet

- Couples For Christ Couples For Christ: ( - HRS) ( - HRS) ( - HRS)Document2 pagesCouples For Christ Couples For Christ: ( - HRS) ( - HRS) ( - HRS)AlexgwapoNo ratings yet

- Financial Accounting of CYO FundsDocument5 pagesFinancial Accounting of CYO FundsSampson ArthurNo ratings yet

- 3300 Petty Cash PDFDocument1 page3300 Petty Cash PDFRemy CaperochoNo ratings yet

- Petty Cash Voucher Petty Cash Voucher: NO. - DATE: - NO.Document3 pagesPetty Cash Voucher Petty Cash Voucher: NO. - DATE: - NO.Matthew DelgadoNo ratings yet

- Financial Management and BudgetingDocument14 pagesFinancial Management and BudgetingShafana HamidNo ratings yet

- Income Tax CheckoffDocument2 pagesIncome Tax CheckoffZach EdwardsNo ratings yet

- Pre Qualification WorksheetDocument1 pagePre Qualification WorksheetVictoria BoreingNo ratings yet

- TIPS Document Request FormDocument4 pagesTIPS Document Request FormAndrewNo ratings yet

- Breakdown of Wages: Deductions Breakdown of Wages: DeductionsDocument3 pagesBreakdown of Wages: Deductions Breakdown of Wages: DeductionsDONANo ratings yet

- Business Profit and Loss FINISHEDDocument2 pagesBusiness Profit and Loss FINISHEDguilloctmNo ratings yet

- Attachment A: Child Support Arrears Worksheet: Case No.Document1 pageAttachment A: Child Support Arrears Worksheet: Case No.anon-882977No ratings yet

- Mortgage Appln Co-G 2020Document8 pagesMortgage Appln Co-G 2020Jameow321No ratings yet

- Budget Worksheet: Income ItemsDocument2 pagesBudget Worksheet: Income ItemsBusinessNo ratings yet

- 4 We Care Loan FormDocument2 pages4 We Care Loan FormJaneth ApatNo ratings yet

- Bsheet PersonalDocument1 pageBsheet PersonalDavidNo ratings yet

- C B P - G: A) Brief of Company ProfileDocument5 pagesC B P - G: A) Brief of Company ProfileShuhan Mohammad Ariful HoqueNo ratings yet

- BMCE Business Loan Application Form - EmmaDocument4 pagesBMCE Business Loan Application Form - EmmaJulius YawsonNo ratings yet

- Business Brokerage Intake FormDocument1 pageBusiness Brokerage Intake FormDon WennerNo ratings yet

- Personal Financial Statement Prepared For - OnDocument3 pagesPersonal Financial Statement Prepared For - OnKola AdeyoolaNo ratings yet

- Dumaguete Cathedral Credit Cooperative (Dccco) : Application For LoanDocument2 pagesDumaguete Cathedral Credit Cooperative (Dccco) : Application For LoanCatherine MedadoNo ratings yet

- Liquidation FormDocument2 pagesLiquidation FormRoh MerNo ratings yet

- 501c3 Nonprofit Organiza3on Dona3on ReceiptDocument2 pages501c3 Nonprofit Organiza3on Dona3on Receiptajez02No ratings yet

- Assignment FABM2 Bank FormsDocument2 pagesAssignment FABM2 Bank FormsMylene SantiagoNo ratings yet

- Purchase OrderDocument2 pagesPurchase OrderRox BlancaNo ratings yet

- Cleaning Receipt TemplateDocument1 pageCleaning Receipt Templategulam anzerNo ratings yet

- Monthly Progress BillingDocument1 pageMonthly Progress BillingMohammedIrfanAhmedNo ratings yet

- Gdfi Promissory NoteDocument2 pagesGdfi Promissory NoteLy M. LumapagNo ratings yet

- Official Receipt PrintDocument1 pageOfficial Receipt PrintPugga MonNo ratings yet

- Financial Networth StatementDocument4 pagesFinancial Networth Statementjames agboNo ratings yet

- Travel expenses claim formDocument3 pagesTravel expenses claim formSahil RanaNo ratings yet

- Cash Payment Receipt TemplateDocument1 pageCash Payment Receipt TemplateAndrei Pascua100% (2)

- PBC Disclosure StatementDocument2 pagesPBC Disclosure StatementJugger AfrondozaNo ratings yet

- Hourly Invoice: Description Hours Rate ($) Total ($)Document2 pagesHourly Invoice: Description Hours Rate ($) Total ($)Heptagon AutomotiveNo ratings yet

- Accntng ComceptsDocument2 pagesAccntng ComceptsOsman Raza MalikNo ratings yet

- Indiana Revenue Cash Bond FormDocument2 pagesIndiana Revenue Cash Bond FormArgie BasbasNo ratings yet

- Templates For Seminar - Mav1Document43 pagesTemplates For Seminar - Mav1Jaymar RegalaNo ratings yet

- Deposits/Payments: Please Print ClearlyDocument1 pageDeposits/Payments: Please Print ClearlyAnonymous NFGneM7DNNo ratings yet

- 05 Staff Loan ApplicationDocument2 pages05 Staff Loan ApplicationBernadette Sambrano EmbienNo ratings yet

- DEposit PDFDocument1 pageDEposit PDFAnonymous NFGneM7DNNo ratings yet

- Pesonet - Rtgs FormDocument1 pagePesonet - Rtgs FormPaul ReaNo ratings yet

- All Forms With CC Processing Fee and FundsDocument1 pageAll Forms With CC Processing Fee and Fundsapi-344301223No ratings yet

- Income and Expense ReportDocument4 pagesIncome and Expense ReportunvicadeamNo ratings yet

- Bermudian Articles - Account of Property of Deceased.Document2 pagesBermudian Articles - Account of Property of Deceased.adel belkacemNo ratings yet

- Housing Loan Application InsightsDocument4 pagesHousing Loan Application InsightsDebargha 2027No ratings yet

- Branch Office - Dholewal - : 4a.notional Concessions For 6 MonthsDocument7 pagesBranch Office - Dholewal - : 4a.notional Concessions For 6 Monthsifb.ludhianaNo ratings yet

- VIII (A) Agreement With VDZ + A Consulting Re Skatepark Study $73,789Document15 pagesVIII (A) Agreement With VDZ + A Consulting Re Skatepark Study $73,789Dan LehrNo ratings yet

- Authority To DebitDocument1 pageAuthority To DebitAlfredo Garcia100% (2)

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Constitutional Law 1 Syllabus and Cases on Legislative and Executive DepartmentsDocument13 pagesConstitutional Law 1 Syllabus and Cases on Legislative and Executive DepartmentsAdrian AlamarezNo ratings yet

- Y Oughal Ne WsDocument48 pagesY Oughal Ne WsmwmccarthyNo ratings yet

- Bharat MalaDocument29 pagesBharat MalaNavin GoyalNo ratings yet

- "Remembering The Past": ConsciousnessDocument2 pages"Remembering The Past": Consciousnessnona jean ydulzuraNo ratings yet

- Office Furniture Catalogue EnquiryDocument12 pagesOffice Furniture Catalogue EnquiryAdela MărgineanuNo ratings yet

- Achievement Gaps Mindset Belonging FeedbackDocument4 pagesAchievement Gaps Mindset Belonging FeedbackResearchteam2014No ratings yet

- Enhancing Role of SMEs in Indian Defence Industry1 PDFDocument84 pagesEnhancing Role of SMEs in Indian Defence Industry1 PDFINDIRA PALNINo ratings yet

- IMD DataDocument10 pagesIMD DataThe ManNo ratings yet

- Essay On The Food Security in IndiaDocument8 pagesEssay On The Food Security in IndiaDojo DavisNo ratings yet

- Past Papers P2 Day 10Document6 pagesPast Papers P2 Day 10Haaris UsmanNo ratings yet

- Sopa de LetrasDocument2 pagesSopa de LetrasLuisa Fernanda ArboledaNo ratings yet

- CustomAccountStatement22 12 2019 PDFDocument10 pagesCustomAccountStatement22 12 2019 PDFHR MathanloganNo ratings yet

- The Warrior KingDocument4 pagesThe Warrior Kingapi-478277457No ratings yet

- Ebook PDF CJ 2019 1st Edition by James A Fagin PDFDocument51 pagesEbook PDF CJ 2019 1st Edition by James A Fagin PDFphilip.pelote179100% (32)

- UP v. Calleja - G.R. No. 96189 - July 14, 1992 - DIGESTDocument4 pagesUP v. Calleja - G.R. No. 96189 - July 14, 1992 - DIGESTFe A. Bartolome0% (1)

- Case DigestDocument4 pagesCase DigestSarabeth Silver MacapagaoNo ratings yet

- Business PlanDocument12 pagesBusiness PlanSaqib FayyazNo ratings yet

- Form b1Document7 pagesForm b1Ahmad ZuwairisyazwanNo ratings yet

- Government Procurement Reform Act PDFDocument16 pagesGovernment Procurement Reform Act PDFliemorixNo ratings yet

- Gokuldham Marathi Prelim 2023Document8 pagesGokuldham Marathi Prelim 2023Aarushi GuptaNo ratings yet

- UN Supplier Code of Conduct. United Nations.Document4 pagesUN Supplier Code of Conduct. United Nations.Daniel BorrEka MalteseNo ratings yet

- Final Gaz Commerce Regular Part 1 2016Document222 pagesFinal Gaz Commerce Regular Part 1 2016Arbab JhangirNo ratings yet

- P15a PPT SlidesDocument18 pagesP15a PPT Slidesdiktiedu5984No ratings yet

- Set Down Servant!: . J J J. ' F R - 'Document7 pagesSet Down Servant!: . J J J. ' F R - 'Kora LapaNo ratings yet

- DuburyDocument1 pageDuburyapi-349551287No ratings yet

- QTS Class Action Complaint & SummonsDocument20 pagesQTS Class Action Complaint & SummonsLong Beach PostNo ratings yet

- Financial Performance and Position HighlightsDocument100 pagesFinancial Performance and Position HighlightsSHAMSUL ARIF ZULFIKAR HUSNINo ratings yet

- Megastructures - Petronas Towers Malaysia - NOCHE - BT5Document3 pagesMegastructures - Petronas Towers Malaysia - NOCHE - BT5Jerick NocheNo ratings yet

- IMI ScriptDocument130 pagesIMI ScriptDiego JacobsNo ratings yet

- Bussiness Plan Pasarmu Dot IdDocument25 pagesBussiness Plan Pasarmu Dot IdAnand ZidanNo ratings yet