Professional Documents

Culture Documents

PDF

Uploaded by

Xyza Faye Regalado0%(1)0% found this document useful (1 vote)

583 views8 pagesOriginal Title

20190808 (1).pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0%(1)0% found this document useful (1 vote)

583 views8 pagesPDF

Uploaded by

Xyza Faye RegaladoCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 8

victors: e*

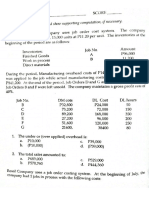

Instr All computations must be in good form.

worksheet

charity Company isa special order manufacturer of metal products. Each period,

company ‘accumulates fairly large quantities of metal shavings and trimmings

from the products it ma nufactures. At least once a month, the scrap metals are

gold to a local scrap metal dealer. This month, scrap sales for shavings not

ceable to any particular jobs total P5,500. In addition, during the current year

{, 200 metal door facings were cut to an incorrect size on job 555 and had to

the

trai

period

be replac d. Although the defective facings cannot be used on job 555, they can

pe sold as salvage for P22.50 each. The cost of cutting, the 200 defective facing is:

Materials (1,200 sq ft of sheet metal x P10) P12,000

Labor (10 hours x P150 per hour) 1,500

Overhead (10 hours x P450 per hour) 4,500

1. The total amount remove from work in process account must be:

a 4,500 c. 18,000

b. P13,500 d. 23,500

Mark Shoe Company had a production run of 10,000 pairs of quality shoes during

the month of June 2016, at the following costs per pair: Materials, P80; Labor, P50;

and Overhead (125% of direct labor cost). Final inspection revealed that 500 pairs

were spoiled which were sold as seconds for P20,000. The good units were then

shipped to the customer at cost plus 50% mark-up on cost.

2. Assuming the spoilage is @ result of changes in the specification of the customer,

the cost per good unit is

a. P190.50 c. P194.62

b. P192.50 d. 200.53

Below are balances and information taken from the records of Bulls

Company for the last quarter of the current year:

Inventories; October 1

Raw Materials 134,000

Work in process Ea

Finished goods

10,800,000,

4,200,000 debit

4,600,000credit

Cost of goods sold

Manufacturing overhead

Supplementary data: ;

(1) During the period, purchases of raw materi

P1,093,400 while physical count of raw mater

that P250,000 were unused at the end of the period

(2) 39,800 direct labor hours were utilized distributed as

follows:

(a) 25,000 hours worked on regular time at 42.50 per hr.

(b) 14,000 hours worked at P42.50 plus 10% special night

premium

(c) 800 hours worked on overtime at regular rate plus

30% OT premium

(3) Overhead is charged to production at 80% of direct labor

costs.

(4) Actual overhead incurred were P1420,000. Overhead

variance is closed to all accounts with overhead elements

only at the end of the year

(5) At the end of the year, records show that work in process

increased by P80,000 while Finished Goods decreased by

als totaled

rials revealed

P150,000.

3, The total factory costs for the quarter amounted to;

a. P3,960,900 ec. P4,147,560

b. P4,022,100 d. P4,376,100

4. The costs of goods manufactured for the quarter amounted to:

a. P3,880,900 c. P4,067,560

b. P3,942,100 d. P4,692,100

At the beginni: i

a e ‘ginning of July, Burnham Company had the following account

Raw materials Control 16,000

Work in Process inventory 26,00

Finished goods inventory 10,000

During July, the following transactions transpired:

* Raw materials were purchased on account, P150,000.

* Direct materials of P42 i

ee ee and indirect materials of P5,000

= 7

e Factory payroll consisted of P100,000 for direct labor employees

and P14,000 for indirect labor employees.

¢ Office salaries totaled P42,200 for the month.

» Utilities of P17,400 were accrued; 60% of the utilities cost is for

the factory area.

© Depreciation of P18,000 was recorded on factory plant and

equipment and P10,000 was recorded for office depreciation.

* Rent of P24,000 was paid on the building. ‘The factory occupies

60% of the building,

«At the end of July, unfinished jobs amounted to P16,600 and

P19,800 of finished goods are on hand. Burnham Company

uses an actual cost system.

5, The total factory cost incurred during the month is:

a. P142,400 <. P213,640

b. P204,240 d. P230,240

Jordan Company has the following balances as of the year ended Dec. 31:

Direct materials inventory P15,000 Dr.

Work in Process inventory 34,500 Dr.

Finished goods inventory P49,500 Dr.

Manufacturing overhead P4,000 Dr.

Cost of goods sold P74,500 Dr.

Additional information:

Cost of direct materials purchased during the year P 41,000

Cost of direct materials requisitioned for the year P 47,000

Cost of goods completed during the year P102,000

Manufacturing overhead applied (120% of DL P-48,000

6, The beginning balance of the, venice goods inventory account is

a. P22,000 P34,500

b. 27,500 a P49,500

Joe Witten is a contractor specializing in custom-built jacuzzis. On May 1, his

ledger contains the following data:

Raw materials inventory P30,000

Work in process inventory 12,200

Manufacturing overhead 2,500 (dt)

the! manufacturing overhead account has debit totals of P12, 500 and credit totals

of P10,000, Subsidiary data for Work in Process Inventory on May 1 include:

JOB COSTS SHEETS

Job by customer Direct materials | Direct Tabor_| overhead =

Manuel 2,500 P2,000 | P1400

Janna 2,000 1,200 840

Marion 900 800 560

A summary of materials requisition slips and time tickets for the month of May

reveals the following:

Job by customer Mat requisition # Time tickets _|

Manuel P 500 P 400

Janna 600 1,000

Marion 2,300 1,300

Jett 2,400 3,300

For general use 1,500 2,600

During May, the following costs were incurred: a) raw materials purchased on

account, P5,000; (b) labor paid, P8,200; (b) manufacturing overhead paid, P1,400.

Overhead was charged to jobs on the basis of direct labor cost at the same rate as

in the previous month. The Jacuzzis for customers Manuel, Janna and Marion were

completed and delivered during May at 75% above cost.

7. The total manufacturing costs to account for in the month of May is

a. P16,000 c. P28,200

b. P24,000 a. P32,300

8. The billing price for the 3 Jacuzzis delivered amount to

a. 13,982.50 cc. P35,332.

b. 32,025 d. 49,350

Miller Co. manufacturing process results in the following units:

Saleable 50,000

Unsaleable (normal) 2,000

Unsaleable (abnormal) 3,000

Total manufacturing costs totaled P99,000.

9, The entry to record the completion of the units is

a. Finished goods 95

Manufacturing overhead pees

Work in process 0

b. Finished Goods (saleable) 90,000

Loss from Spoilage (abnormal) 5,400

Manufacturing overhead (normal) 3,600

Work in process 7

¢. Finished goods 99,000

Work in process

d. Finished goods 93,600

Loss from spoilage 5,400

Work in process

99,000

99,000

99,000

The AAA Manufacturing Company uses a job order costing system at its Davao

plant. The plant has a Machining Department and a Finishing Department. Its job

costing system has direct cost categories (direct

materials and direct

manufacturing labor) and two manufacturing overhead cost pools (the Machining

department, based on machine hours and the Finishing Department, based on

labor cost). The 2016 budget for the plant is as follows:

Ma Finishing

Factory overhead P10,000,000 8,000,000

Direct labor cost 900,000. 4,000,000

Direct labor hours 30,000 160,000

Machine hours 200,000 33,000

During the month of December, the cost record for Job B4 shows the following:

Machining | Fir

Direct materials used P14,000

Direct labor cost 600

Direct labor hours 30

Machine hours 130

At the end of the year, the balances of the following are as follows:

= Machining | Finishing

Manufacturing overhead P11,200,000 P7,900,000

Direct labor cost 950,000 4,100,000

Machine hours 220,000 32,000

oo

10. Assuming that Job B4 consisted of 200 units of product, the manufacturing co

per unit of Job Bd is:

a P33.75 ce. P105.50

b. P45 d, P139.25

11. The over or under applied manufacturing overhead for Davao plant as a whole ig

a. 200,000 under applied

b. 300,000 under applied

c. P500,000 under applied

d. P100,000 over applied

Marikina Leatherworks, which manufactures leather goods, has three

departments. The Assembly Department manufactures various leather products

such as belts, purses, using an automated production process. The Saddle

Department produces handmade saddles and uses very little machinery. ‘The

Tanning Department produces leather and requires little in the way of labor or

machinery, but it does require space and process time. Due to the different

production processes in the three departments, the company uses three different

cost drivers for the application of manufacturing overhead. The cost drivers and

overhead rates are as follows:

Departments Cost drivers Predetermined OH rate

‘Tanning Department — | Square feet of leather _ | P3 per sq, ft.

Assembly department | Machine time P9 per mach. Hr.

Saddle Department —_| Direct labor hour P4 per DL hr.

Direct manufacturing costs per set of saddle and accessory is as follows: Direct

materials (P12.50 per sq. feet); Direct labor (P8.00 per DLH).

‘The company’s saddle and accessory set consists of handmade saddle, two

saddlebags, belt and a vest, all coordinated to match. Each set uses 10 sq, ft of

leather from the Tanning Department, 3 machine hours in the Assembly

Department, and 10 direct labor hours in the Saddle Department, Job No. 305

consisted of 200 saddles and accessory sets,

12. The manufacturing costs per set of saddle is

a. 36.50 c. P117.50

b P205 d. P302

oe antla Machines uses two rates to apply overhead to jobs. One rate is based

Eihe OPP ; the

on mate = other on machine time. The following data relate to

a

Materials related OH pian

Machine related OH 2 pi

Cost of materials used on jobs 3200000

Machine hours 400,000

pata related to three jobs worked on in June follow

Joe xX2-

Material cost P42,000 |

Direct labor cost P32,000

Machine hours 17,000

‘Actual material related overhead was P118,400 and actual machine related

overhead was P185,600.

13, The total amount of overhead variance is

P15,500 overapplied

a

b. P15,500 underapplied

¢ P4.800 underapplied

d. P10,700 underapplied

TOM Manufacturing Company manufactures custom cabinets for modular and

prefabricated housing companies. During the current year, an order of 1,000

customized cabinets was begun and assigned job no. 3635. Custom jobs are

marked at 50% above cost. The total production costs of the 1,000 cabinets are as

follows:

Direct materials ‘292,000

Direct labor (3,000 H @ P52)

Factory overhead, 45.00 per DL hours including

allowance for spoilage of P2.80)

Upon inspection, 100 of the cabinets were found to have defects. Cost of rework

per unit include materials, P40 and % hour. Overhead is applied on the defective

jobs at the same rate.

14. The total costs as basis for billing the customer is:

a P591,850 c. 574,600

b. P583,450 d. P583,000

During June, Soltera Manufacturing Company incurred the following costs on

Job 600 for the manufacture of 200 units of special household gadget:

=

Cost of production

Direct materials Pisoo

Direct labor 8,000

Overhead (150% of DL) an

Reworking costs for 10 units

Dicctanctrial P500

Direct labor 1600

Overhead (150% of DLH) 2,400

15. Assuming the rework was attributable to the (1) exacting specification ofthe jp,

and (2) internal failure due to an employee error, the cost per unit of gadget is

@) 2)

a P140.00 — P155.50

b. 163.68 155.50

c 133.00 133.00

4. 155.50 133.00

Cometa Company uses job order costing system. During the 24 quarter of the

current year, a job order was accepted for 2,000 units which was completed at the

following costs:

Direct materials

Direct labor

Overhead 1.5% of DL cost

P50.00 per unit

24.00 per unit

Final inspection revealed that 100 units are defective within normal level and are

included in the predetermined overhead rate. These units can be reworked at

P12,00 per unit of labor plus overhead at the predetermined rate.

16. The reworked costs should be charged to

a. Work in Process 3,000

b. Loss from spoilage 3,000

©. Manufacturing overhead 3,000

d. Work in Process 1,200

Manufacturing overhead 1,800

Ee Company manufactures quality wooden furniture sets. A job order from Ebie

I — Company of Ohio, USA, for 5 sets of furniture was received. The cost

information related to this order as at year end follows:

* The WIP at the beginni i

eee ginning of the year was 20% less than the WIP inventory

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5811)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Investments in Equity Securities Problems (Victoria Corporation) Year 1Document12 pagesInvestments in Equity Securities Problems (Victoria Corporation) Year 1Xyza Faye Regalado100% (2)

- A.I. MovieDocument2 pagesA.I. MovieXyza Faye Regalado100% (1)

- Group 5 Product Concept: "Christmas-Halloween Box of Personalized Cupcakes"Document1 pageGroup 5 Product Concept: "Christmas-Halloween Box of Personalized Cupcakes"Xyza Faye RegaladoNo ratings yet

- Reviewer in Culinary: PastriesDocument10 pagesReviewer in Culinary: PastriesXyza Faye RegaladoNo ratings yet

- ENTREP - B. Plan Xzftional BakeshopDocument7 pagesENTREP - B. Plan Xzftional BakeshopXyza Faye RegaladoNo ratings yet

- Chap2 Case 1Document1 pageChap2 Case 1Xyza Faye RegaladoNo ratings yet

- Research Paper CH1 CH2Document27 pagesResearch Paper CH1 CH2Xyza Faye RegaladoNo ratings yet

- English SynthesisDocument4 pagesEnglish SynthesisXyza Faye RegaladoNo ratings yet

- Chapter 3Document10 pagesChapter 3Xyza Faye RegaladoNo ratings yet

- Internet Case Studies FinmarDocument17 pagesInternet Case Studies FinmarXyza Faye RegaladoNo ratings yet

- NTS Quick Guide: March 2010 V1.0Document6 pagesNTS Quick Guide: March 2010 V1.0Xyza Faye RegaladoNo ratings yet

- Intacc 1Document17 pagesIntacc 1Xyza Faye RegaladoNo ratings yet

- Confidence Intervals: Calculating The Confidence IntervalDocument5 pagesConfidence Intervals: Calculating The Confidence IntervalXyza Faye RegaladoNo ratings yet

- Case StudyDocument28 pagesCase StudyXyza Faye Regalado100% (1)

- Chi Square AssDocument2 pagesChi Square AssXyza Faye RegaladoNo ratings yet

- Job Order CostingDocument5 pagesJob Order CostingXyza Faye RegaladoNo ratings yet

- Genetically Modified OrganismDocument3 pagesGenetically Modified OrganismXyza Faye RegaladoNo ratings yet

- War On Drugs Reflection PaperDocument2 pagesWar On Drugs Reflection PaperXyza Faye Regalado100% (1)

- 01 Legal Basis of ROTC Program PDFDocument8 pages01 Legal Basis of ROTC Program PDFXyza Faye Regalado100% (1)