Professional Documents

Culture Documents

Ak 2

Ak 2

Uploaded by

Amelia SaliniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ak 2

Ak 2

Uploaded by

Amelia SaliniCopyright:

Available Formats

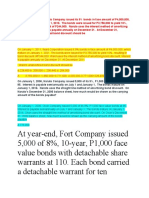

BE14-8 Tan Coorporation issued HK$600,000,000 of 7% bonds on November 1, 2011, fo

The bonds were dated November 1, 2011, and mature in 10 years, with interest payabl

November 1. The effective-interest rate is 6%. prepare Tan's December 31, 2011, adjus

answer :

interest expance $6,446,360

Bonds Payable $ 553,640

Interest Payable $7,000,000

*$644,636,000 x 6% x 2/12 = $6,446,360

$600,000,000 X 7% X 2/12 = $7,000,000

E14-7 (determine proper amounts in accounts balances) presented below are three ind

situations.

a.McEntire Co. Sold $2,500,000 of 11%, 10 years bonds were dated January 1, 2010, an

July 1 and January 1. Determine the amount of interest expense to be reported on July

December 31, 2010.

b.Cheriel Inc. Issued $600,000 of 9% 10 years bonds on June 30, 2010, for $562,500. Th

yield of 10% on the bonds. Interest pay to record if financial statement are issued on O

On October 1, 2010, Chinook Company sold 12% bonds having a maturity value of $80

plus accrued interest, which provides the bondholders with a 10% yield. The bonds are

2010, and mature January 1, 2015, with interest payable December 31 of each years. P

entries at the date of the bond issuance and for the first interest payment.

answer :

You might also like

- Acct Exam 1 AnswerDocument10 pagesAcct Exam 1 Answermiranda100789100% (2)

- MODADV3 Handouts 2 of 2Document21 pagesMODADV3 Handouts 2 of 2Dennis ChuaNo ratings yet

- Bonds PayableDocument6 pagesBonds PayableZerjo Cantalejo100% (8)

- Ch10 LiabilitiesDocument86 pagesCh10 LiabilitiesAnindya BhaswaraNo ratings yet

- Bonds Payable Practice TestDocument9 pagesBonds Payable Practice TestAl-Sinbad Bercasio100% (2)

- Practical Accounting 1 2011Document17 pagesPractical Accounting 1 2011abbey89100% (2)

- Auditing Problems, CRC-ACEDocument9 pagesAuditing Problems, CRC-ACESannyboy Paculio Datumanong100% (1)

- CH 14Document2 pagesCH 14tigger5191100% (1)

- CH 14Document71 pagesCH 14Febriana Nurul HidayahNo ratings yet

- Chapter 14Document5 pagesChapter 14RahimahBawaiNo ratings yet

- Notes Receivable: Junior Philippine Institute of Accountants, Inc. University of The Philippines - VisayasDocument5 pagesNotes Receivable: Junior Philippine Institute of Accountants, Inc. University of The Philippines - VisayasGeorge YoungNo ratings yet

- Latihan 1Document25 pagesLatihan 1Sanda Patrisia KomalasariNo ratings yet

- Bonds Payable Practice Test 1Document6 pagesBonds Payable Practice Test 1Joemel G. GudioNo ratings yet

- Classroom Exercise On Bonds PayableDocument4 pagesClassroom Exercise On Bonds PayablesamuelpingolNo ratings yet

- Bonds Payable ReviewDocument6 pagesBonds Payable ReviewJyasmine Aura V. AgustinNo ratings yet

- Kisi-Kisi Soal Mid PA2Document6 pagesKisi-Kisi Soal Mid PA2Anthie AkiraNo ratings yet

- BUS FPX4060 - Assessment4 1Document12 pagesBUS FPX4060 - Assessment4 1AA TsolScholarNo ratings yet

- Lesson 7 Quick Study With AnswersDocument4 pagesLesson 7 Quick Study With AnswersSissel GoingNo ratings yet

- Prof: John Bo S.Cayetano, Cpa, Mba Assessment For BONDS #01Document2 pagesProf: John Bo S.Cayetano, Cpa, Mba Assessment For BONDS #01John FloresNo ratings yet

- Solved Anne Corp Issued 600 000 5 Bonds Required Prepare The Necessary Journal Entries PDFDocument1 pageSolved Anne Corp Issued 600 000 5 Bonds Required Prepare The Necessary Journal Entries PDFAnbu jaromiaNo ratings yet

- Accounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualDocument7 pagesAccounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualKellyMorenootdnj100% (82)

- Acc412 NCLDocument3 pagesAcc412 NCLNychi SitchonNo ratings yet

- Working 5Document6 pagesWorking 5Hà Lê DuyNo ratings yet

- IA2 Activity4Document8 pagesIA2 Activity4Lalaina EnriquezNo ratings yet

- H1 ReviewFinancialStatementsDocument2 pagesH1 ReviewFinancialStatementsLim Kuan YiouNo ratings yet

- Bond Pricing ProblemsDocument2 pagesBond Pricing Problemsjcolem2No ratings yet

- Slide Chương 9Document53 pagesSlide Chương 9anhtuand.hrcneuNo ratings yet

- Entity A Issues Convertible Bonds With Face Amount ofDocument1 pageEntity A Issues Convertible Bonds With Face Amount ofNicole AguinaldoNo ratings yet

- Chapter 14 Exercises - Set BDocument6 pagesChapter 14 Exercises - Set BHeather PaulsenNo ratings yet

- Homework 7Document4 pagesHomework 7Gia Hân TrầnNo ratings yet

- Current Liabilities and Payroll Accounting: Learning ObjectivesDocument70 pagesCurrent Liabilities and Payroll Accounting: Learning ObjectivesHanifah Oktariza100% (1)

- Blue Mountain Power Company Obtained Authorization To Issue 20 Year BondsDocument1 pageBlue Mountain Power Company Obtained Authorization To Issue 20 Year Bondstrilocksp SinghNo ratings yet

- CH 11Document70 pagesCH 11Ai Latifah100% (2)

- Slide ACT102 ACT102 Slide 04Document61 pagesSlide ACT102 ACT102 Slide 04Muhammad ArdiansyahNo ratings yet

- Ifrs Edition: Preview ofDocument28 pagesIfrs Edition: Preview ofwtf100% (1)

- Exercises Compound Financial InstrumentsDocument1 pageExercises Compound Financial InstrumentsQueeny Mae Cantre ReutaNo ratings yet

- Final Review ProblemsDocument17 pagesFinal Review ProblemsEvan KlineNo ratings yet

- Bonds Payable and Investments in Bonds: Financial and Managerial Accounting 8th Edition Warren Reeve FessDocument49 pagesBonds Payable and Investments in Bonds: Financial and Managerial Accounting 8th Edition Warren Reeve FessCOURAGEOUSNo ratings yet

- Test 1 W AnswersDocument8 pagesTest 1 W AnswersVaniamarie VasquezNo ratings yet

- Acc 201 CH 10Document16 pagesAcc 201 CH 10Trickster TwelveNo ratings yet

- Jawaban 2a Cost AccDocument20 pagesJawaban 2a Cost AccPriscila SiskaNo ratings yet

- CH 10Document86 pagesCH 10Grace Dana100% (1)

- Acc102 W4Document26 pagesAcc102 W4Moheb RefaatNo ratings yet

- Bonds and NotesDocument3 pagesBonds and Notesjano_art21No ratings yet

- Bonds Payable SlidesDocument53 pagesBonds Payable Slidesayesha125865No ratings yet

- Mahusay Acc227 Module 4Document4 pagesMahusay Acc227 Module 4Jeth MahusayNo ratings yet

- Current LiabilityDocument38 pagesCurrent LiabilityRamadhani FirmansyahNo ratings yet

- Time Value of MoneyDocument62 pagesTime Value of MoneyMohit ChawlaNo ratings yet

- CH 14: Long Term Liabilities: The Timelines of The Bonds Will Be As FollowsDocument9 pagesCH 14: Long Term Liabilities: The Timelines of The Bonds Will Be As Followschesca marie penarandaNo ratings yet

- Bond Amortization Methods & Journal EntriesDocument14 pagesBond Amortization Methods & Journal EntriesDishani MaityNo ratings yet

- P7Document2 pagesP7Andreas Brown0% (1)

- 1 - Notes Payable and Bonds Payable - Part 1Document1 page1 - Notes Payable and Bonds Payable - Part 1John Wendell EscosesNo ratings yet

- CH 14Document19 pagesCH 14rujinaakther997No ratings yet

- Chapter 10 and 11 HWDocument4 pagesChapter 10 and 11 HWkanielafinNo ratings yet

- Question and Answer - 8Document30 pagesQuestion and Answer - 8acc-expertNo ratings yet

- Soal Asis Ak2 Pertemuan 1Document2 pagesSoal Asis Ak2 Pertemuan 1Aisya Fadhilla ShamaraNo ratings yet

- Latihan Soal CH 7 - Kelompok 7Document2 pagesLatihan Soal CH 7 - Kelompok 7AshdhNo ratings yet

- DOCXDocument18 pagesDOCXMequen Chille QuemadoNo ratings yet

- Chapter 10Document21 pagesChapter 10RBNo ratings yet