Professional Documents

Culture Documents

Documents For GST Registration

Uploaded by

Tacho taxOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Documents For GST Registration

Uploaded by

Tacho taxCopyright:

Available Formats

Documents for GST Registration

Any individual endeavor taxable intra-state supply of goods/services with a yearly total turnover of more

than INR 20 lacs (INR 10 lacs for some the North Eastern and other exceptional class States) or

undertaking between state supply (with no edge restricted) are obligatorily required to acquire GST

registration.

GST enlistment number or GSTIN is a special 15-digit number given by the tax experts to screen tax

installments and compliances of the enrolled individual

Various arrangements of documents will be required relying on the constitution of business or the sort

of GST enrollment that is gotten

Most recent Update!

7th March 2019

The CBIC has advised that GST enlistment isn't required if yearly turnover is beneath Rs 40 lakhs just if

there should arise an occurrence of a provider of goods with the exception of:

a) Cases of necessary GST registration

b) Icecream, consumable ice, container masala, tobacco and its substitutes

c) Those creation deals inside States of Arunachal Pradesh,

Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikkim, Telangana, Tripura and Uttarakhand

d) Choosing Voluntary enlistment

The notice will be powerful from first April, 2019.

*Bank record subtleties:

For financial balance subtleties, a duplicate of dropped check or concentrate of passbook/bank

proclamation (containing the first and last page) must be transferred. (in JPEG design/PDF position, most

extreme size – 100 KB)

**Address confirmation:

Transfer any of the accompanying documents:

Property tax receipt

Civil Khata duplicate

Power bill duplicate

Possession deed/document (on account of claimed property)

Rent/lease understanding (if there should arise an occurrence of rented/leased property) – To

be submitted alongside (a), (b) or (c)

Assent letter/NOC from the proprietor (if there should be an occurrence of assent course of

action or shared property) – To be submitted alongside (a), (b) or (c)

1.Constitution of Business

The following documents are required to obtain GST registration depending on the types of business or

constitution.(Individual/Company etc.)

Category of Documents required for GST registration

persons

Sole PAN card of the owner

proprietor / Aadhar card of the owner

Individual

Photograph of the owner (in JPEG format, maximum size – 100 KB)

Bank account details*

Address proof**

Partnership PAN card of all partners (including managing partner and authorized

firm signatory)

(including Copy of partnership deed

LLP)

Photograph of all partners and authorized signatories (in JPEG format,

maximum size – 100 KB)

Address proof of partners (Passport, driving license, Voters identity

card, Aadhar card etc.)

Aadhar card of authorised signatory

Proof of appointment of authorized signatory

In the case of LLP, registration certificate / Board resolution of LLP

Bank account details*

Address proof of principal place of business**

HUF PAN card of HUF

PAN card and Aadhar card of Karta

Photograph of the owner (in JPEG format, maximum size – 100 KB)

Bank account details*

Address proof of principal place of business**

Company PAN card of Company

(Public and Certificate of incorporation given by Ministry of Corporate Affairs

Private)

(Indian and Memorandum of Association / Articles of Association

foreign)

PAN card and Aadhar card of authorized signatory. The authorised

signatory must be an Indian even in case of foreign companies/branch

registration

PAN card and address proof of all directors of the Company

Photograph of all directors and authorised signatory (in JPEG format,

maximum size – 100 KB)

Board resolution appointing authorised signatory / Any other proof of

appointment of authorised signatory (in JPEG format / PDF format,

maximum size – 100 KB)

Bank account details*

Address proof of principal place of business**

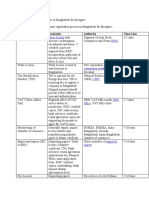

2. Class of GST Registration

Various kinds of documents will be required to be submitted on GST entry for GST enlistment relying on

the sort of GST enrollment required. This depends on the idea of exercises being completed by the

substance. [http://blogs.tachotax.com/gst-registration/]

A point by point rundown of documentation prerequisites for each kind of GST enlistment is given under

below:

GST Registration Documents Checklist

Nature of GST Registration Purpose of Registration Documents to be Uploaded

Normal taxpayer registration For undertaking a taxable PAN card of Company (only in case of company)

(including composition supply of goods / or

dealer, Government services

departments and ISD

registrations)

Certificate of incorporation given by Ministry of

Corporate Affairs / Proof of constitution of

business

Memorandum of Association / Articles of

Association (only in case of company)

PAN card and Aadhar card of authorized

signatory. Authorised signatory must be an

Indian even in case of foreign companies /

branch registration

PAN card and address proof of all directors of

the Company (partners in case of firm)

Photograph of all directors and authorised

signatory (in JPG format, maximum size – 100

KB)

Board resolution appointing authorised signatory

/ Any other proof of appointment of authorised

signatory (in JPEG format / PDF format,

maximum size – 100 KB)

Bank account details*

Address proof of principal place of business**

Read our article on documents checklist depending

on types of business structure

GST practitioner For enrolling as GST Photo of the applicant (in JPG format, maximum

practitioner size – 100 KB)

Address proof of professional address

Proof of qualifying degree (Degree certificate)

Pension certificate (only in case of retired

Government officials)

TDS registration For deducting tax at Photo of drawing and disbursing officer (in JPG

source format, maximum size – 100 KB)

PAN and TAN number of the person being

registered

Photo of authorised signatory (in JPG format,

maximum size – 100 KB)

Proof of appointment of authorised signatory

Address proof of tax deductor**

TCS registration For collecting tax at source PAN number of the person being registered

(E-commerce operators) Photo of authorised signatory (in JPG format,

maximum size – 100 KB)

Proof of appointment of authorised signatory

Address proof of tax collector **

A non-resident OIDAR For online service 1. Photo of authorised signatory (in JPG format,

service provider providers not having any maximum size – 100 KB)

place of business in India

2. Proof of appointment of authorised signatory

3. Bank account in India*

4. Proof of non-resident online service provider

(eg: Clearance certificate issued by Government

of India, License issued by original country or

certificate of incorporation issued by India or any

other foreign company)

Non-resident taxable person For non-residents Photo and Proof for the appointment of an Indian

(NRTP) occasionally undertaking authorised signatory

taxable supply of goods /

or services in India

In case of individuals, scanned copy of the

passport of NRTP with VISA details. In case of

business entity incorporated outside India,

unique number on the basis of which the Country

is identified by the Government of that country

Bank account in India*

Address proof**

Casual taxable person For non-registered Photo and Proof for the appointment of an Indian

domestic persons authorised signatory

occasionally undertaking

taxable supply of goods /

or services in India

Proof of constitution of business

Bank account in India*

Address proof**

UN bodies/embassy For obtaining Unique Photo of authorised signatory

Identification Number to

claim the refund of taxes

paid on goods/services

Proof of appointment of authorised signatory

Bank account in India*

You might also like

- Sample Chart MMI Human DesignDocument1 pageSample Chart MMI Human DesignThe TreQQerNo ratings yet

- BL - Corporation CodeDocument25 pagesBL - Corporation CodePrincessAngelaDeLeon0% (1)

- Oath of Office of Club OfficersDocument2 pagesOath of Office of Club OfficersAvelino Sumagui97% (78)

- Crim Law Case Digests 2008 (Mat)Document72 pagesCrim Law Case Digests 2008 (Mat)Erlinda Hollanda Silva100% (2)

- Honasan II v. DOJ PanelDocument5 pagesHonasan II v. DOJ PanelC.G. AguilarNo ratings yet

- Vendor Registrartion Form For TataDocument6 pagesVendor Registrartion Form For TataAnubhav Srivastava100% (2)

- DOASDocument11 pagesDOASric releNo ratings yet

- Prisco Vs CirDocument1 pagePrisco Vs CirIda ChuaNo ratings yet

- National Steel Corp Vs CA (Digested)Document2 pagesNational Steel Corp Vs CA (Digested)Lyn Lyn Azarcon-Bolo100% (4)

- Research Age Criminal Liability PDFDocument15 pagesResearch Age Criminal Liability PDFRhuejane Gay MaquilingNo ratings yet

- 4 - BDRRMC 2Document2 pages4 - BDRRMC 2Robert Tayam, Jr.No ratings yet

- GST Registration Procedure Chapter 2Document22 pagesGST Registration Procedure Chapter 2Amreen kousarNo ratings yet

- 058 Hilado v. CIR PDFDocument2 pages058 Hilado v. CIR PDFJuno GeronimoNo ratings yet

- GST Registration Document ChecklistDocument2 pagesGST Registration Document ChecklistBabai Mandal100% (1)

- GST RegistrationDocument3 pagesGST RegistrationJabagodu SP & CoNo ratings yet

- Unit - II Indirect Taxation-1Document55 pagesUnit - II Indirect Taxation-1praveensenthamarai25No ratings yet

- Templete For AllDocument18 pagesTemplete For AllCommerce Adda ConsultancyNo ratings yet

- 349 & 199 Exp GSTDocument3 pages349 & 199 Exp GSTsilk smitaNo ratings yet

- Documents Needed For GST Registration IncludeDocument3 pagesDocuments Needed For GST Registration IncludeShilpiNo ratings yet

- Membership Updated Form 06.10.22Document5 pagesMembership Updated Form 06.10.22Sirajia CngNo ratings yet

- Membership Application Form-May 2019Document5 pagesMembership Application Form-May 2019Sarfraz KhanNo ratings yet

- Goodyear Vendor Creation Form Apac2Document4 pagesGoodyear Vendor Creation Form Apac2reihan narendraNo ratings yet

- Annexure - B - PPT - On - GST 123 MigrationDocument48 pagesAnnexure - B - PPT - On - GST 123 Migrationshyam sunder sainiNo ratings yet

- Exporter-CPRS 1631229480Document8 pagesExporter-CPRS 1631229480Chasmere MagloyuanNo ratings yet

- Membership Form Updated April 12 2023 1Document5 pagesMembership Form Updated April 12 2023 1Chaudhary Mehtab Shaukat AdvNo ratings yet

- Gstin Declaration 01Document2 pagesGstin Declaration 01ranjitNo ratings yet

- Private Limited Company Registration IndiaDocument1 pagePrivate Limited Company Registration IndiaBIZINDIGONo ratings yet

- Revised Organizational MGMTDocument13 pagesRevised Organizational MGMTGirlie-Mae Espinueva EstiocoNo ratings yet

- GST Certificate Sample - Check GST Certificate OnlineDocument5 pagesGST Certificate Sample - Check GST Certificate OnlineSaurabh dasNo ratings yet

- BCIF - Ver7 Back With SignatureDocument1 pageBCIF - Ver7 Back With SignatureKatrina JarabejoNo ratings yet

- GST MasterDocument22 pagesGST MasterShubham DhimaanNo ratings yet

- Membership Application FormDocument5 pagesMembership Application FormTanvir Ahmed100% (2)

- Vendor Application Form: (Please Click For A Sample Format)Document3 pagesVendor Application Form: (Please Click For A Sample Format)MITRANZO PAYANo ratings yet

- Form Registrasi ShopeeFoodDocument3 pagesForm Registrasi ShopeeFoodtekaneduwekNo ratings yet

- The Rawalpindi Chamber of Commerce & IndustryDocument4 pagesThe Rawalpindi Chamber of Commerce & IndustryNasir BashirNo ratings yet

- Document Checklist (Non Income Documents)Document2 pagesDocument Checklist (Non Income Documents)Hussain bashaNo ratings yet

- Account Opening Form For Non-IndividualDocument6 pagesAccount Opening Form For Non-IndividualDeb Kumar SarkarNo ratings yet

- 02.check List-Migration To GSTDocument4 pages02.check List-Migration To GSTSHRAUNo ratings yet

- Gujarat Chamber of Commerce & Industry: Member No.: - Receipt No.: - DateDocument2 pagesGujarat Chamber of Commerce & Industry: Member No.: - Receipt No.: - DateZeal EducationNo ratings yet

- Associate Membership - ChecklistDocument1 pageAssociate Membership - ChecklistDatabase managementNo ratings yet

- Vendor - Form CopDocument1 pageVendor - Form CopMaaz KhanNo ratings yet

- Form Registrasi ShopeeFoodDocument3 pagesForm Registrasi ShopeeFoodTelor CeplokNo ratings yet

- Membership Application Form: Philippine Chamber of Commerce and IndustryDocument2 pagesMembership Application Form: Philippine Chamber of Commerce and IndustryJ SalesNo ratings yet

- Documentary Requirements Per Government Agency in Organizing A BusinessDocument2 pagesDocumentary Requirements Per Government Agency in Organizing A BusinessLawrence YusiNo ratings yet

- Request For Providing KYC Documents: in Case of IndividualsDocument3 pagesRequest For Providing KYC Documents: in Case of IndividualsVishal Yadav100% (1)

- Companies Registration LawsDocument10 pagesCompanies Registration Lawsdavid smackerNo ratings yet

- 2023 KYBP Profile and Services (Latest Promo)Document14 pages2023 KYBP Profile and Services (Latest Promo)Kenny Diego ChenNo ratings yet

- Checklist For FintreeDocument2 pagesChecklist For Fintreeshrijit “shri” tembhehar0% (1)

- Checklist For Enrolment With GST Portal 09012017Document8 pagesChecklist For Enrolment With GST Portal 09012017Mahaveer P UpadhyeNo ratings yet

- Form of Business OrganizationDocument2 pagesForm of Business OrganizationNicah AcojonNo ratings yet

- Merchant On-BoardingDocument31 pagesMerchant On-BoardingSantoshNo ratings yet

- Bank Procedure and FormalitiesDocument59 pagesBank Procedure and Formalitiesrakesh19865No ratings yet

- Incorporation ChecklistDocument9 pagesIncorporation ChecklistharishgokuNo ratings yet

- GST RegistationDocument5 pagesGST RegistationTarasankar BhattacharjeeNo ratings yet

- SPL LeafletDocument2 pagesSPL LeafletAjantha SathasivamNo ratings yet

- Change of Address OSS - Same MunicipalityDocument7 pagesChange of Address OSS - Same MunicipalityYohan AlamsyahNo ratings yet

- Start-Up Docs ReqdDocument1 pageStart-Up Docs ReqdamiteshnegiNo ratings yet

- Company Registration Process in Bangladesh For ForeignerDocument3 pagesCompany Registration Process in Bangladesh For ForeignerYasir ArafatNo ratings yet

- The Bhopal School of Social Sciences: Subject: Indirect Taxes Topic: Documents Required For VAT & CSTDocument7 pagesThe Bhopal School of Social Sciences: Subject: Indirect Taxes Topic: Documents Required For VAT & CSTAmit VermaNo ratings yet

- GST Reg ChecklistDocument35 pagesGST Reg ChecklistShaik MastanvaliNo ratings yet

- Introduction of The CompanyDocument25 pagesIntroduction of The CompanynareshNo ratings yet

- Registration GuideDocument13 pagesRegistration GuideEmil A. MolinaNo ratings yet

- Procedure For GST Registration in Schedule 3Document8 pagesProcedure For GST Registration in Schedule 3darshan.deeranNo ratings yet

- Business ImplementationDocument28 pagesBusiness ImplementationMariaAngelaAdanEvangelistaNo ratings yet

- IEC RegistrationDocument2 pagesIEC RegistrationLopamudracsNo ratings yet

- EVS Documentation RequirementsDocument1 pageEVS Documentation RequirementsJack MaynorNo ratings yet

- REGISTRATION On GST NotesDocument6 pagesREGISTRATION On GST NotesRohan SinhaNo ratings yet

- What Are The List of Documents Required For GST Registration?Document16 pagesWhat Are The List of Documents Required For GST Registration?Dhiraj Ranjan RayNo ratings yet

- PhonePe PG - Onboarding DocumentsDocument1 pagePhonePe PG - Onboarding DocumentsDr. Ashwin Raja MBBS MSNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- R1001 The IALA Maritime Buoyage System Ed1.1 June 2017 1Document28 pagesR1001 The IALA Maritime Buoyage System Ed1.1 June 2017 1Syed Aqib AliNo ratings yet

- Legal Requirements For Online BusinessDocument12 pagesLegal Requirements For Online BusinesssylviaerubasaNo ratings yet

- First Division (G.R. NO. 149152: February 2, 2007) Rufino S. Mamangun, Petitioner, V. People of THE PHILIPPINES, Respondent. Decision Garcia, J.Document6 pagesFirst Division (G.R. NO. 149152: February 2, 2007) Rufino S. Mamangun, Petitioner, V. People of THE PHILIPPINES, Respondent. Decision Garcia, J.Anne GeliqueNo ratings yet

- Daily Time Record: Civil Civil Service Form No. 48Document2 pagesDaily Time Record: Civil Civil Service Form No. 48HowardNo ratings yet

- MCCLATCHEY v. ASSOCIATED PRESS - Document No. 11Document3 pagesMCCLATCHEY v. ASSOCIATED PRESS - Document No. 11Justia.comNo ratings yet

- Professional Ethics Law Course File-1Document23 pagesProfessional Ethics Law Course File-1Kshamaa KshamaaNo ratings yet

- Maneka Gandhi CasenoteDocument5 pagesManeka Gandhi Casenotesorti nortiNo ratings yet

- Bl-Mal ch9Document17 pagesBl-Mal ch9Mindblowing SahilNo ratings yet

- AQUINO v. SISONDocument5 pagesAQUINO v. SISONian clark MarinduqueNo ratings yet

- 9084 Practice Exercises (For Examination From 2023)Document59 pages9084 Practice Exercises (For Examination From 2023)Attiya OmerNo ratings yet

- Bernas v. CincoDocument15 pagesBernas v. CincoI took her to my penthouse and i freaked itNo ratings yet

- Ll/.epublit of Tbe Llbilippines $upreme Qrourt:fflanila: ChairpersonDocument14 pagesLl/.epublit of Tbe Llbilippines $upreme Qrourt:fflanila: ChairpersonRainNo ratings yet

- Burial Assistance Application FormDocument2 pagesBurial Assistance Application Formkorina vivasNo ratings yet

- Activity2. MidtermDocument2 pagesActivity2. MidtermGirlynne TerenNo ratings yet

- 78 (2a) PR eDocument5 pages78 (2a) PR eAvuyile TshofutiNo ratings yet

- CHAPTER 7 ObliconDocument3 pagesCHAPTER 7 ObliconShanelle Tamayo NapolesNo ratings yet

- 2020 Gallery of AthletesDocument4 pages2020 Gallery of AthletesLovilyn EncarnacionNo ratings yet

- ASLARONA V ECHAVEZDocument2 pagesASLARONA V ECHAVEZCheza BiliranNo ratings yet

- 1 Mock Memorial Moot Court Competition 2021Document16 pages1 Mock Memorial Moot Court Competition 2021vishwas nagori100% (1)