INSTITUTE of BUSINESS MANAGEMENT

College of Business Management

Department of Accounting and Finance

Theory & Practice of Financial Management

FIN – 408

Overall aims of course

The objective of the course is to introduce fundamental concepts underlying financial

management. The main concepts examined include financial planning & forecasting

financial statements, time value of money, bond and stock valuation, cost of capital, and

capital budgeting. Students will be able to understand the specific techniques and decision

rules that are used to help maximize the value of the firm.

Intended learning outcomes of course (ILOs)

Knowledge and understanding:

Students should be able to:

provide an overview of financial management

understand the key issues in financial management

interpret financial statements

understand the financial planning process

understand the time value of money and its impact on stock prices

comprehend how timing of cash flows affects asset values and rates of return

understand types of bonds

highlight the types of risks to which both bond investors and issuers are exposed

discuss procedures for determining the values of and rate of return on bonds

demonstrate how the cost of capital is used to help make many important decisions,

especially the decision to invest or not invest in shares

understand the basics of stock valuation

determine the cost of debt and cost of equity capital using various methods

comprehend capital budgeting techniques

Intellectual skills

Students should be able to

forecast financial statements

Page 1 of 12

� quantify investment risk and returns

calculate present and future value of annuities

calculate value of bonds and stocks

estimate cost of capital

use various capital budgeting techniques to take financial decisions

Professional and practical skills

After completion of the course the students should be able to:

analyze the financial strengths and weaknesses of any business entity

take calculated investment decisions as financial managers of an organizations

General and transferable skills

Knowledge obtained in the course will:

enhance understanding of key factors underlying financial management

facilitate personal financial decision making

be applied in professional life

Course Content

Session Topic

Class and course introductions.

1

General Introduction to Finance

Goals and Governance of the Firm

Financial Management revolves around making financing and investment

decisions. Financial managers together with other managers in the

organization identify business opportunity and decide whether to invest or

not; and if the answer is yes then how to finance it. Therefore we start this

course with differentiating between financing and investment decisions. We

1,2 also discuss the different forms of organizations focusing on corporations.

Then we will discuss the financial goals of the corporations; profit

maximization vs. shareholders’ wealth maximization. We also discuss agency

conflicts and how organizations attempt to resolve these conflicts.

Learning Outcomes:

1. Give examples of the investment and financing decisions that

financial managers make.

Page 2 of 12

� 2. Distinguish between real and financial assets.

3. Cite some of the advantages and disadvantages of organizing a

business as a corporation.

4. Describe the responsibilities of the CFO, treasurer, and controller.

5. Explain why maximizing market value is the logical financial goal of

the corporation.

6. Explain why value maximization is not inconsistent with ethical

behavior.

7. Explain how corporations mitigate conflicts and encourage

cooperative behavior.

Pedagogy

1. Pre class independent study

2. Lecture discussion

3. Problem solving

4. Assignment

Financial Statements Analysis

Here we will look at the financial statements. It will be assumed that students

have taken the basic accounting course and are well aware of the four basic

financial statements, namely, income statement, balance sheet, statement of

retained earnings and the cash flow statement. We discuss the main items of

the statements and how the information contained within the statements

should be interpreted. We will discuss the important differences between

profits and cash flows and market and book values. In the following

discussions we will explain how the financial statements are used to evaluate

the performance of the business. For this, we will learn to calculate some

ratios and use them to comment on the company’s performance. We discuss

four broad categories of ratios: leverage, profitability, efficiency and liquidity.

3,4,5,6,7

Learning Outcomes

1. Interpret the information contained in the balance sheet, income

statement, and statement of cash flows.

2. Distinguish between market and book values.

3. Explain why income differs from cash flow.

4. Understand the essential features of the taxation of corporate and

personal income.

5. Calculate and interpret market value and market value added for a

public corporation.

6. Calculate and interpret some key measures of firm performance,

including economic value added, and the rates of return on equity,

assets, and capital.

7. Calculate and interpret measures of a firm's efficiency, leverage, and

Page 3 of 12

� liquidity.

8. Show how profitability depends on efficiency and profit margin.

9. Understand how a company's sustainable growth is related to its

payout policy and its return on equity.

10. Compare the company's financial standing with its main competitors

and with its own position in earlier years..

Pedagogy

1. Pre class independent study

2. Lecture discussion

3. Problem solving

4. Class activity on ratio analysis of any local listed company

Financial Planning

In initial chapters we discussed that the financial managers need to decide

between investment opportunities and plan how to raise finances for those

investments. The decision must add value to the whole organization and

increase shareholders wealth. Therefore these decisions are taken after

thorough discussions and planning. That’s why financial planning is required.

The financial plan allows managers to think about the implications of

alternative financial strategies and how to ease out any inconsistencies in the

firm’s goal. We will first of all discuss the components of a typical financial

plan and then the use of financial model and finally firm’s need for new

financing.

Long term financial planning leads to short term financial plans. Short term

financial decisions generally involve short lived assets and liabilities. Short

term financial planning is easier than long term financial but is equally

8,9,10,

important.

13

Learning Outcomes

1. Describe the contents and uses of a financial plan.

2. Construct a simple financial planning model.

3. Estimate the effect of growth on the need for external financing.

4. Understand why the firm needs to invest in net working capital.

5. Show how long-term financing policy affects short-term financing

requirements.

6. Trace a firm's sources and uses of cash and evaluate its need for short-

term borrowing.

7. Develop a short-term financing plan that meets the firm's need for

cash.

8. Evaluate the costs of various sources of short-term financing.

Pedagogy

1. Pre class independent study

Page 4 of 12

� 2. Lecture discussion

3. Problem solving

4. Assignments

Time Value of Money

In this topic we will understand the relationship between the values of money

today and the value in the future. We start by looking at how funds invested at

a particular interest rate will grow over time. Then we will look at the amount

that we need to invest today in order to earn a specified amount in the future

and also adjust it for inflation.

Learning Objectives:

1. Calculate the future value to which money invested at a given interest

rate will grow.

2. Calculate the present value of a future payment.

14,15,16 3. Calculate present and future values of a series of cash payments.

4. Find the interest rate implied by present and future values.

5. Compare interest rates quoted over different time intervals—for

example, monthly versus annual rates.

6. Understand the difference between real and nominal cash flows and

between real and nominal interest rates.

7. Loan Amortization

Pedagogy:

1. Pre class independent study

2. Lecture discussion

3. Problem solving

4. Assignments

Working Capital Management

Working capital management involves management of the current assets and

current liabilities of the firm. This basically means how organizations ensure

that they have sufficient level of these assets and liabilities. The four main

types of current assets that will be discussed are accounts receivables,

17,18 inventory, cash and short term securities, but emphasis is on Accounts

receivable and inventory for practice. Different techniques are explained to

properly manage these components of working capital.

Learning Outcomes

1. Describe the usual steps in a firm's credit management policy.

2. Measure the implicit interest rate on credit sales.

3. Describe how firms assess the probability that a customer will pay its

Page 5 of 12

� bills.

4. Decide whether it makes sense to grant credit to customers.

Pedagogy

1. Pre class independent study

2. Lecture discussion

3. Problem solving

4. Assignments

19

Bond Valuation

If companies need money in the short term, they can borrow it form the bank.

However if they need money for long term investments, they generally issue

bonds, which can be termed as long term loans. Bond valuation involves

simple time value of money computations.

Intended Learning Outcomes

1. To understand key features of bonds and calculate bond value

2. Distinguish between bond’s coupon rate, current yield and yield to

maturity

3. Calculate the market price of the bond

4. Understand the relationship between bond prices and interest rates

Pedagogy:

1. Pre class independent study

2. Lecture discussion

3. Problem solving

4. Assignments

20 Stock Valuation

Corporations can raise money for investments by borrowing or by issuing

new shares. We will start by looking at how stocks are bought and sold; what

determines the stock prices and how stock valuation formulas can be used to

infer rates of returns that investors are expecting.

Intended Learning Outcomes

1. Understand difference between common and preferred equity.

2. Calculate the price of the stock given the future earnings and growth

rates

3. Use stock valuation to infer the expected rates of return on common

stock

Page 6 of 12

� Pedagogy:

1. Pre class independent study

2. Lecture discussion

3. Problem solving

4. Assignments

21,22 Cost of Capital

Chapter 11

Brigham and Ehrhardt

Most companies are financed by a mix of securities including common stock,

bonds, preferred stock and other securities. Each of these securities have

different risks and therefore investors in them look for different rates of

returns

Under this situation company’s cost of capital is no longer just the return on

common of stock but is a weighted average of cost of different securities that

the company is using for financing.

Intended Learning Outcomes

Calculate firm’s capital structure

To understand the cost of equity and debt securities

Calculate WACC

Understand why WACC is the appropriate discount rate for capital

budgeting

Pedagogy:

1. Pre class independent study

2. Lecture discussion

3. Problem solving

4. Assignments

Capital Budgeting Techniques

Investment decisions aka capital budgeting decisions are critical to any firm’s

success. These decisions may involves substantial cash flows and have long

term consequences. Company’s shareholders expect managers to only invest

24,25, in that project that adds value to the company and increases shareholders’

wealth. Therefore the managers must invest in projects whose costs are less

than their revenues. The difference between the project’s cost and revenues is

called net present value; which is one of the techniques of project appraisal.

NPV, with other techniques, helps the management to evaluate projects and

select the one that adds maximum value to the firm.

The techniques discussed are NPV, IRR and profitability index.

Page 7 of 12

� Learning Objectives

1. Calculate the net present value of an investment.

2. Calculate the internal rate of return of a project and know what to look

out for when using the internal rate of return rule.

3. Explain why the payback rule doesn't always make shareholders better

off.

4. Use the net present value rule to analyze three common problems that

involve competing projects: (a) when to postpone an investment

expenditure, (b) how to choose between projects with unequal lives,

and (c) when to replace equipment.

5. Calculate the profitability index and use it to choose between projects

when funds are limited.

Pedagogy

1. Pre class independent study

2. Lecture discussion

3. Problem Solving

4. Assignment

Operating and Financial Leverage

Leverage refers to use of fixed assets in order to increase or level up

profitability. In this topic we will discuss how managers achieve the balance

in operating and financial leverage.

Learning Outcomes

1. Use sensitivity, scenario, and break-even analyses to see how project

profitability would be affected by an error in your forecasts.

26 2. Understand why an overestimate of sales is more serious for projects

with high operating leverage.

3. Recognize the importance of managerial flexibility in capital

budgeting.

Pedagogy

1. Pre class independent study

2. Lecture discussion

3. Problem Solving

4. Assignments

Term Report Presentations (Example)

It will be in the form of book report and will be a group assignment. There

27,28

will be 6-7 members in a group given the strength of the class. Students may

make their own groups.

Page 8 of 12

� The report should have:

1500 – 2000 words

Font: Times New Roman, Font size 12. Heading should be font size

16 and subheadings should be font size 14.

Left, right, top and bottom margins: 1inch

Line spacing: 1.5 lines

In the book report students will compare three institutions in the same sector.

For example if a group has chosen banking sector than comparison can be

drawn between HBL, UBL and MCB. Two or more groups may choose the

same sector but different companies.

There will be following 4 components of the book report:

1. Executive Summary

2. General overview of the companies, industry, business environment,

recent changes in regulatory environment, and current trends in the

sector (like mergers of banks etc). Regulatory information can be

acquired from the following websites:

a. For corporate sector, non-banking finance sector, insurance,

professional service providers and capital market:

www.secp.gov.pk

b. For banks: www.sbp.org.pk

3. Analyze financial statements for 3 years by performing Ratio

Analysis, and commenting on the results. Financial Statements are

generally available on company’s’ website. Ratios calculated should

be industry specific e.g. for banks there are certain ratios which

State Bank of Pakistan has made compulsory.

4. All the calculations (ratio analysis) must be enclosed as appendices.

Teaching and learning methods

The course is interactive between the class and the instructor. Through power point lecture

presentations, problem solving, and specific class room activities, students will have the

opportunity to use the concepts, ideas, and strategies presented in class. Problem-solving

sessions occur in both individual (primarily) and team (occasionally) settings.

This introductory undergraduate course will incorporate a lecture and assignments-based

approach to the concepts of financial management. Students are encouraged to read the book

and chapters beforehand in order to develop a better understanding.

Lectures, class discussions, home exercises and quizzes, case studies, and presentations will

be conducted. The lectures are designed to reinforce and expand upon, not to substitute for,

what students learn from the assigned readings and study.

Page 9 of 12

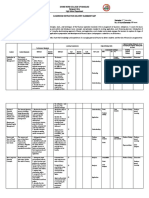

�Student assessment methods

Rubrics for Marking

Skills Advanced Proficient Basic Minimal

Comprehension Always Frequently Usually Unsatisfactory

and Analysis understands the understands the understands the knowledge of key

key issues in key issues in key issues in issues in financial

financial financial financial management.

management. management. management. Inadequate

Accurately Able to Familiar with understanding of

interprets interpret financial financial

financial financial statements but statements.

statements and statements and sometimes faces Generally

demonstrates demonstrates difficulty in unable to

excellent good analytical financial analyze

analytical skills skills analysis financial data

due to weak

concepts

Planning and Excellent Good Satisfactory Unsatisfactory

Forecasting understanding of understanding of understanding of understanding of

the financial the financial the financial the financial

planning planning planning process. planning process.

process. Able to process. Able to Occasionally Finds difficulty in

conduct conduct high faces difficulty in financial

financial level financial financial forecasting

forecasting forecasting forecasting

using various

techniques

Decision Always Frequently Usually Rarely

Making understands the understands the understands the understands the

techniques techniques techniques techniques

required to take required to take required to take required to take

calculated calculated calculated calculated

investment investment investment investment

decisions as decisions as decisions as decisions as

financial financial financial financial

managers of an managers of an managers of an managers of an

organization organization organization organization

Problem Always finds a Frequently Usually seeks Rarely seeks out

Solving number of ways seeks out other out other ways to other ways to

to solve the ways to solve solve the solve the problem

Page 10 of 12

� problem on own the problem, and problem, but and frequently

initiative rarely needs occasionally needs support

support or needs support and guidance

guidance or guidance

Personal Always Frequently Usually Rarely

Management demonstrates demonstrates demonstrates demonstrates

personal personal personal personal

management management management management

skills, and is skills skills skills

eager to learn

Team work Always Frequently Usually Rarely

demonstrates demonstrates demonstrates demonstrates

effective effective effective effective

teamwork skills teamwork skills teamwork skills, teamwork skills,

and often takes and rarely needs and occasionally and frequently

initiative in a support or needs support or needs support and

group setting guidance in guidance guidance. Often

that exceeds teamwork wants to work

required skills activities independently

Participation in Always Frequently Usually Rarely

projects and participates in participates in participates in participates in

tasks required projects required projects required projects required projects

and tasks. and tasks. and tasks. and tasks.

Completes all Completes most Completes some Completes few

assignments and assignments and assignments and assignments and

projects projects projects. projects

Weight

Assessment methods ….. to access Scheduled week

age

1 Quizzes Knowledge and understanding 3, 4, 5

10%

2 Assignments Knowledge and understanding 9 10%

Class participation and Intellectual and analytical

3 4 to 13 10%

others skills

4 1st Mid Term test Knowledge and understanding 6 15%

5 2nd Mid Term test Professional skills 11 15%

6 Final exam Professional skills 16 40%

Page 11 of 12

� Total 100%

Recommended Texts:

Textbook:

Fundamentals of Corporate Finance - Richard A. Brealey, Stewart C. Myers & Alan J.

Marcus. Sixth Edition

Financial Management. Theory & Practice, Eugene F. Brigham and Micheal C. Ehrhardt.

10th Edition

Page 12 of 12