Professional Documents

Culture Documents

REVENUE MEMORANDUM CIRCULAR NO. 6-2019 Issued On January 17, 2019

REVENUE MEMORANDUM CIRCULAR NO. 6-2019 Issued On January 17, 2019

Uploaded by

Jhenny Ann P. Salem0 ratings0% found this document useful (0 votes)

8 views1 pageThis revenue memorandum clarifies provisions around coal producers acting as collecting agents for excise tax. It requires coal producers to file Excise Tax Return Form 2200M and remit collected excise taxes from first buyers/possessors through the Electronic Filing and Payment System by the 10th day after the close of the month when the sale occurred. It also mandates coal producers submit an alphabetical list of first buyers/possessors through a dedicated email address each month.

Original Description:

BIR

Original Title

RMC-6

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis revenue memorandum clarifies provisions around coal producers acting as collecting agents for excise tax. It requires coal producers to file Excise Tax Return Form 2200M and remit collected excise taxes from first buyers/possessors through the Electronic Filing and Payment System by the 10th day after the close of the month when the sale occurred. It also mandates coal producers submit an alphabetical list of first buyers/possessors through a dedicated email address each month.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageREVENUE MEMORANDUM CIRCULAR NO. 6-2019 Issued On January 17, 2019

REVENUE MEMORANDUM CIRCULAR NO. 6-2019 Issued On January 17, 2019

Uploaded by

Jhenny Ann P. SalemThis revenue memorandum clarifies provisions around coal producers acting as collecting agents for excise tax. It requires coal producers to file Excise Tax Return Form 2200M and remit collected excise taxes from first buyers/possessors through the Electronic Filing and Payment System by the 10th day after the close of the month when the sale occurred. It also mandates coal producers submit an alphabetical list of first buyers/possessors through a dedicated email address each month.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

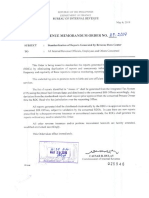

REVENUE MEMORANDUM CIRCULAR NO.

6-2019 issued on January 17, 2019

clarifies the provisions of Revenue Memorandum Circular No. 105-2018, particularly

on the filing by the Coal Producers (acting as Collecting Agent) of Excise Tax

Declaration, using BIR Form No. 2200M (Excise Tax Return for Mineral Products) and

the remittance of the Excise Taxes on coal collected from the first buyers/possessors.

The Producer/Collecting Agent shall file, via Electronic Filing and Payment

System (eFPS), and remit the Excise Tax collected form first buyers/possessors using

BIR Form 2200M on or before the 10th day following the close of the month when the

sale, transfer or disposition of coal was made. The name and Tax Identification

Number (TIN) of the Coal Producer/Collecting Agent shall be reflected in the Form.

Upon filing by the Producer/Collecting Agent of BIR Form 2200M, an

alphabetical list of first buyers/possessors (showing the TIN, volume of coal sold and

corresponding Excise Tax collected) shall be submitted through email at dedicated BIR

email address.

All Coal Producers/Collecting Agents mandated to use the eFPS in filing BIR

Form 2200M are required to submit on a monthly basis, via email at

coal.attachment@bir.gov.ph, or via the attachment facility of eFPS (once it is made

available), the alphalist of first buyers/possessors covering sale, transfer or disposition

of coal beginning January 2019 and every month thereafter.

You might also like

- Letter To SuppliersDocument1 pageLetter To SuppliersCarol Ledesma Yap-Pelaez100% (5)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Rmo - No. 14-2019Document21 pagesRmo - No. 14-2019Jhenny Ann P. Salem100% (1)

- REVENUE MEMORANDUM CIRCULAR NO. 4-2018 Issued On January 11, 2018 ProvidesDocument1 pageREVENUE MEMORANDUM CIRCULAR NO. 4-2018 Issued On January 11, 2018 ProvidesAnonymous c19rbKRNo ratings yet

- Tax AmnestyDocument38 pagesTax AmnestyElsha dela penaNo ratings yet

- Senate - 2019 March 25Document1 pageSenate - 2019 March 25BernewsAdminNo ratings yet

- Manual Book 1770 PDFDocument46 pagesManual Book 1770 PDFHafiedz SNo ratings yet

- CIR vs. Lancaster Philippines, IncDocument19 pagesCIR vs. Lancaster Philippines, IncCharish DanaoNo ratings yet

- Tax DigestsDocument69 pagesTax DigestsXara Paulette Delos ReyesNo ratings yet

- Revenue Regulation 2-99Document5 pagesRevenue Regulation 2-99Joanna MandapNo ratings yet

- 167.SAMELCO-1 Vs CIRDocument11 pages167.SAMELCO-1 Vs CIRClyde KitongNo ratings yet

- Quarterly Income A5 EngDocument4 pagesQuarterly Income A5 EngKasendereNo ratings yet

- Manual Instruction - 1770 - 2010 - English PDFDocument46 pagesManual Instruction - 1770 - 2010 - English PDFHafiedz SNo ratings yet

- General CircularsDocument39 pagesGeneral CircularsSubramanya Seeta Ram PrasadNo ratings yet

- Samar I Electric Coop V CIR 2014 Digest 2Document5 pagesSamar I Electric Coop V CIR 2014 Digest 2freak200% (1)

- The Procedure Observed For E AuctionDocument1 pageThe Procedure Observed For E AuctionKishor KNo ratings yet

- BIR Issuances Availability of eBIR Forms Package Version 6.3Document13 pagesBIR Issuances Availability of eBIR Forms Package Version 6.3Mark Lord Morales BumagatNo ratings yet

- G.R. No. 167274 - Commissioner of Internal Revenue v. Fortune Tobacco CorporationDocument11 pagesG.R. No. 167274 - Commissioner of Internal Revenue v. Fortune Tobacco CorporationRam Migue SaintNo ratings yet

- Tax Appeal E026 of 2020Document8 pagesTax Appeal E026 of 2020Meru CityNo ratings yet

- TDS Declarartion - 1Document3 pagesTDS Declarartion - 1canamanagrawal11No ratings yet

- CIR Vs Negros Consoliated FarmersDocument14 pagesCIR Vs Negros Consoliated FarmersMary.Rose RosalesNo ratings yet

- Samar-I Electric Coop V CIR (2014) DigestDocument2 pagesSamar-I Electric Coop V CIR (2014) Digestviktoriavillo67% (3)

- Forward Eauction Terms ConditionsDocument12 pagesForward Eauction Terms ConditionsKind ManNo ratings yet

- New Cyprus Tonnage Tax LegislationDocument1 pageNew Cyprus Tonnage Tax LegislationPHS HAdjizacharias & CoNo ratings yet

- Instruction For The Completion of Income Tax Return For Corporate in IndonesiaDocument51 pagesInstruction For The Completion of Income Tax Return For Corporate in IndonesiaJonathan Bara DiskaPutra KrisnantoNo ratings yet

- 1 MondayDocument6 pages1 MondayCeline Marie Libatique AntonioNo ratings yet

- THE Ministry of FinanceDocument19 pagesTHE Ministry of FinancePhương Trần Đỗ NgọcNo ratings yet

- CIR V Negros ConsolidatedDocument2 pagesCIR V Negros ConsolidatedVerchelleNo ratings yet

- Sub Point 1 SPT PPN (English)Document1 pageSub Point 1 SPT PPN (English)Achmad ArdanuNo ratings yet

- CIR V Estate of Benigno Toda JRDocument9 pagesCIR V Estate of Benigno Toda JRParis LisonNo ratings yet

- RMC 47-2019Document2 pagesRMC 47-2019RichardNo ratings yet

- 0605Document6 pages0605Ivy TampusNo ratings yet

- G.R. No. 212735, December 05, 2018 CIR Vs NEGROS CONSOLIDATED FARMERS MULTI-PURPOSE COOPERATIVEDocument10 pagesG.R. No. 212735, December 05, 2018 CIR Vs NEGROS CONSOLIDATED FARMERS MULTI-PURPOSE COOPERATIVEJavieNo ratings yet

- Digest RR 8-2019Document2 pagesDigest RR 8-2019Nikki GarciaNo ratings yet

- Webupload CIR Scan0035Document1 pageWebupload CIR Scan0035Ahmad Mir MoinNo ratings yet

- For Amo WebinarsDocument79 pagesFor Amo WebinarsLiezl Tizon ColumnasNo ratings yet

- G.R. No. 147188 September 14, 2004 Commissioner of Internal Revenue Vs - The Estate of Benigno P. Toda, JR.Document2 pagesG.R. No. 147188 September 14, 2004 Commissioner of Internal Revenue Vs - The Estate of Benigno P. Toda, JR.micheleNo ratings yet

- CIR Vs Lancaster CIRDocument18 pagesCIR Vs Lancaster CIRAerith AlejandreNo ratings yet

- Bir 0605Document11 pagesBir 0605Sheelah Sawi0% (1)

- REVENUE MEMORANDUM CIRCULAR NO. 2-2018 Issued On January 8, 2018 ProvidesDocument2 pagesREVENUE MEMORANDUM CIRCULAR NO. 2-2018 Issued On January 8, 2018 ProvidesAnonymous HQymOK61No ratings yet

- Rmo 1981Document228 pagesRmo 1981Mary graceNo ratings yet

- Samar-1 Electric Coop. v. CirDocument1 pageSamar-1 Electric Coop. v. CirLoNo ratings yet

- Cta 3D CV 08259 D 2015may27 RefDocument50 pagesCta 3D CV 08259 D 2015may27 Refanorith88No ratings yet

- Samar-I Electric Cooperative, Petitioner, vs. Commissioner of Internal Revenue, Respondent.Document18 pagesSamar-I Electric Cooperative, Petitioner, vs. Commissioner of Internal Revenue, Respondent.Maria Nicole Vaneetee100% (1)

- RMC No. 5-2009Document1 pageRMC No. 5-2009CROCS Acctg & Audit Dep'tNo ratings yet

- TAX-304 (VAT Compliance Requirements)Document5 pagesTAX-304 (VAT Compliance Requirements)Edith DalidaNo ratings yet

- CIR vs. Fortune Tobacco Corporation G.R. Nos. 167274 75 July 21 2008Document15 pagesCIR vs. Fortune Tobacco Corporation G.R. Nos. 167274 75 July 21 2008Yen LlorenteNo ratings yet

- CCC CCDocument12 pagesCCC CCBhagol AjahNo ratings yet

- Cebu Portland Cement v. CIRDocument3 pagesCebu Portland Cement v. CIRKeila Garcia100% (1)

- Panay Electric Company, Inc. v. Commissioner of Internal RevenueDocument24 pagesPanay Electric Company, Inc. v. Commissioner of Internal RevenueVince Lupango (imistervince)No ratings yet

- No. of Issuance Subject Matter Date of Issue RR No. 5-2018: Full TextDocument2 pagesNo. of Issuance Subject Matter Date of Issue RR No. 5-2018: Full TextShaira SalandaNo ratings yet

- Regional Bench - Court No.2: (Rajrappa, District - Ramgarh, Pin - 829150.)Document8 pagesRegional Bench - Court No.2: (Rajrappa, District - Ramgarh, Pin - 829150.)RISHAV KUMARNo ratings yet

- Goldfield Consol. Mines Co. v. Scott, 247 U.S. 126 (1918)Document5 pagesGoldfield Consol. Mines Co. v. Scott, 247 U.S. 126 (1918)Scribd Government DocsNo ratings yet

- Declaration For 206AB 206CCA 4 1 1 2 1 2Document1 pageDeclaration For 206AB 206CCA 4 1 1 2 1 2Khalid ShaikhNo ratings yet

- Registration, Taxation & Accounting Compliance of Construction IndustryDocument52 pagesRegistration, Taxation & Accounting Compliance of Construction IndustryJohn Erick FernandezNo ratings yet

- Supreme Court: Statement of The CaseDocument12 pagesSupreme Court: Statement of The Casedaim0nesNo ratings yet

- My Tax Espresso Newsletter Apr2023Document18 pagesMy Tax Espresso Newsletter Apr2023Claudine TanNo ratings yet

- CIR v. Mirant Pagbilao Corporation, G.R. No. 180434, January 20, 2016Document9 pagesCIR v. Mirant Pagbilao Corporation, G.R. No. 180434, January 20, 2016samaral bentesinkoNo ratings yet

- RR No. 9Document9 pagesRR No. 9John Paul de leonNo ratings yet

- Report on the Cost of Living in Ireland, June 1922From EverandReport on the Cost of Living in Ireland, June 1922No ratings yet

- RMC 23Document1 pageRMC 23Jhenny Ann P. SalemNo ratings yet

- Memorandum Circular: InternalDocument1 pageMemorandum Circular: InternalJhenny Ann P. SalemNo ratings yet

- RMO No.5-2019Document2 pagesRMO No.5-2019Jhenny Ann P. SalemNo ratings yet

- Office Codes AND: Revised Revenue RegionsDocument2 pagesOffice Codes AND: Revised Revenue RegionsJhenny Ann P. SalemNo ratings yet

- Of in The Act: Modification Nos.2551M12551Q Implementation (RA) For CollectionDocument2 pagesOf in The Act: Modification Nos.2551M12551Q Implementation (RA) For CollectionJhenny Ann P. SalemNo ratings yet

- Rno 29-2019Document1 pageRno 29-2019Jhenny Ann P. SalemNo ratings yet

- Rmo - No. 21-2019Document2 pagesRmo - No. 21-2019Jhenny Ann P. SalemNo ratings yet

- I. in II. - ": Revenue Memorai (DumDocument1 pageI. in II. - ": Revenue Memorai (DumJhenny Ann P. SalemNo ratings yet

- The Philippines Department of Finance Bureau of Internal Revenue Quezon CityDocument8 pagesThe Philippines Department of Finance Bureau of Internal Revenue Quezon CityJhenny Ann P. SalemNo ratings yet

- Rmo 13-2019Document1 pageRmo 13-2019Jhenny Ann P. SalemNo ratings yet

- RMO No. 25-2019Document7 pagesRMO No. 25-2019Jhenny Ann P. SalemNo ratings yet

- RMC 1-2019 PDFDocument1 pageRMC 1-2019 PDFJhenny Ann P. SalemNo ratings yet

- RMC 10-2019 PDFDocument1 pageRMC 10-2019 PDFJhenny Ann P. SalemNo ratings yet

- Rmo 27-2019Document1 pageRmo 27-2019Jhenny Ann P. SalemNo ratings yet