Professional Documents

Culture Documents

Wrongful Dismissal

Uploaded by

MERCYCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wrongful Dismissal

Uploaded by

MERCYCopyright:

Available Formats

Wrongful dismissal

The Employment Act, 2007 makes a distinction between termination and dismissal. It

distinguishes unfair termination and wrongful dismissal.

Section 41 (1) of the employment Act provides that an employer shall before terminating the

employment of an employee on the grounds of misconduct, poor performance or physical

incapacity explain to an employee in language the employee understands, the reasons for

termination and the employee shall be entitled to have another employee or a shop floor un

ion representative of his choice present during this explanation. The Claimant contends that

the Respondent never explained to him the reasons for intended dismissal.

Furthermore, Section 41 of the Employment Act, 2007 prescribes that in event of termination

on account of misconduct or poor performance, the employee will be given a notice and a

hearing. As was held in Shankar Saklani –Versus- DHL Global Forwarding (K) Limited

[2012]eKLR a notice and a hearing are mandatory and necessary even in cases of summary

dismissal only that in summary dismissal, the notice is permissible to be shorter than is

prescribe by statute or contract

In terms of section 44 of the Act an employer may only resort to summary dismissal when the

employee has, by his or her conduct fundamentally breached his or her obligations arising

under the contract of service. It is only a misconduct that is gross in nature that will entitle the

employer to summarily dismiss an employee. The following instances of misconduct will

amount to gross misconduct as to justify the summary dismissal of an employee, that is to say;

i. absenteeism from work without leave or other lawful cause,

ii. intoxication to the extent of being incapable of performing his or her duties during

working hours,

iii. willful neglect to perform his/her work or doing so carelessly and improperly;

iv. using abusive or insulting language towards his or her employer;

v. failing or refusing to obey lawful commands issued within the scope of his or her

employment by his or her employer or a person placed in authority over him/her by the

employer,

vi. if arrested for a cognizable offence punishable by imprisonment and is not released on

bail or bond or otherwise lawfully set at liberty within 14 days, or

vii. if an employee commits or, on reasonable and sufficient grounds, is suspected of having

committed a criminal offence against or to the substantial detriment of the employer or

the employer’s property.

This list is not exhaustive and there will be other instances not enumerated above.

Section 45 (2) provides that a termination of employment by an employer is unfair the

employer fails to proof:-

a) That the reason for termination is valid.

b) That the reason for the termination is a fair reason(s)

c) That the employment was terminated in accordance with fair procedure.

According to section 47(5) the burden of proving that the dismissal was wrongful rests on the

employee, while the burden of justifying the grounds of wrongful dismissal rests on the

employer.

The test to be applied is now settled. In the case of the Judicial Service Commission v

Gladys Boss Shollei, Civil Appeal No.50 of 2014, this Court cited with approval approval the

following passage from the Canadian Supreme Court decision in Mc Kinley v B.C.Tel. (2001)

2 S.C.R. 161

“Whether an employer is justified in dismissing an employee on the grounds

of dishonesty is a question that requires an assessment of the context of the

alleged misconduct. More Specifically the test is whether the employee’s

dishonesty gave rise to a breakdown in the employment relationship. This test

can be expressed in different ways. One could say, for example, that just

cause for dismissal exists where the dishonesty violates an essential condition

of the employment contract, breaches the faith inherent to the work

relationship, or is fundamentally or directly inconsistent with the employee’s

obligations to his or her employer.”

The remedies for wrongful dismissal are listed under section 49 of the Act and include:-

“(a) the wages which the employee would have earned had the employee

been given the period of notice to which he was entitled under this Act or his

contract of service;

(b) … the proportion of the wage due for the period of time for which the

employee has worked; and any other loss consequent upon the dismissal and

arising between the date of dismissal and the date of expiry of the period of

notice which the employee would have been entitled to by virtue of the

contract; or

(c) the equivalent of a number of months wages or salary not exceeding

twelve months based on the gross monthly wage or salary of the employee at

the time of dismissal,”

In deciding which remedy to give an employee who has wrongfully been dismissed the court

exercises a judicial discretion and like the labour officer will be guided only by the principles

contained in section 49 (4) namely, the wishes of the employee, the circumstances in which

the termination took place including the extent to which the employee contributed to the

termination, the employee’s length of service with the employer,

“(f) …the reasonable expectation of the employee as to the length of time for which

his employment with that employer might have continued but for the termination;

(g) the opportunities available to the employee for securing comparable or suitable

employment with another employer;

(h) the value of any severance payable by law;

(i) the right to press claims or any unpaid wages, expenses or other claims owing to

the employee;

(j) any expenses reasonably incurred by the employee as a consequence of the

termination;

(k) any conduct of the employee which to any extent caused or contributed to the

termination;

(l) any failure by the employee to reasonably mitigate the losses attributable to the

unjustified termination; and

(m) any compensation, including ex gratia payment, in respect of termination of

employment paid by the employer and received by the employee.”

Turning to the award of gratuity, the first thing that we must emphasise is that gratuity, as the

name implies, is a gratuitous payment for services rendered. It is paid to an employee or his

estate by an employer either at the end of a contract or upon resignation or retirement or upon

death of the employee, as a lump sum amount at the discretion of an employer. The employee

does not contribute any sum or portion of his salary towards payment of gratuity. An employer

may consider the option of gratuity in lieu of a pension scheme. Being a

gratuitions payment the contract of employment may provide that the employer shall not pay

gratuity if the termination of employment is through dismissal arising from gross or other

misconduct. But where, like here, the dismissal is not justified and is wrongful the employee

will be awarded gratuity if it is provided for in the contract of employment.

You might also like

- The Appropriations Law Answer Book: A Q&A Guide to Fiscal LawFrom EverandThe Appropriations Law Answer Book: A Q&A Guide to Fiscal LawNo ratings yet

- Law in the Study of Business: The Commonwealth and International Library: Social Administration, Training, Economics and Production DivisionFrom EverandLaw in the Study of Business: The Commonwealth and International Library: Social Administration, Training, Economics and Production DivisionNo ratings yet

- Assignment 5 - Wrongful DismissalDocument3 pagesAssignment 5 - Wrongful DismissalAraceli Gloria-Francisco100% (1)

- Regulation of Lawyers - Ethics - CANDocument63 pagesRegulation of Lawyers - Ethics - CANLola Thomson100% (1)

- Law of FiduciaryDocument2 pagesLaw of FiduciaryravenmailmeNo ratings yet

- Alteration Promises On The Back of An Original Contract - Enforceable?Document21 pagesAlteration Promises On The Back of An Original Contract - Enforceable?Edwin OlooNo ratings yet

- Accounting Funeral Service CompendDocument25 pagesAccounting Funeral Service Compendasafoabe4065No ratings yet

- Corporate Insolvency and Rescue in ZambiaDocument4 pagesCorporate Insolvency and Rescue in ZambiaCHIMONo ratings yet

- Certainty of ObjectsDocument7 pagesCertainty of ObjectsDhanushkaNo ratings yet

- Watteau v Fenwick case analysisDocument9 pagesWatteau v Fenwick case analysisWa HidNo ratings yet

- Criminal Offences Act 1960Document115 pagesCriminal Offences Act 1960fauzia tahiruNo ratings yet

- Law of Tort Case LawsDocument8 pagesLaw of Tort Case LawshrtNo ratings yet

- Contract II PDFDocument214 pagesContract II PDFurbanomadicNo ratings yet

- Guide To Employment Law in Mauritius (May 2009)Document15 pagesGuide To Employment Law in Mauritius (May 2009)Davi Sadaseeven SaminadenNo ratings yet

- Law of Contract PDFDocument28 pagesLaw of Contract PDFtemijohnNo ratings yet

- UK Company Law Case Law Lists 2017Document25 pagesUK Company Law Case Law Lists 2017Ryan WongNo ratings yet

- Contract Law NotesDocument75 pagesContract Law NotesMadzivadondo Daught0% (1)

- English Department - : Thuong Mai UniversityDocument18 pagesEnglish Department - : Thuong Mai UniversityÁnh BarbieNo ratings yet

- Presentation On Offer & AcceptanceDocument51 pagesPresentation On Offer & AcceptanceMohiuddin Muhin100% (1)

- Constitutional Law NotesDocument136 pagesConstitutional Law NotesKenn AdeNo ratings yet

- Remedies For Breach of Contract Under The CISGDocument19 pagesRemedies For Breach of Contract Under The CISGbenNo ratings yet

- Lecture Notes - Sources of LawDocument19 pagesLecture Notes - Sources of LawCherz LynNo ratings yet

- Veil of IncorporationDocument2 pagesVeil of IncorporationShrestha Steve SalvatoreNo ratings yet

- Mortgages SlidesDocument66 pagesMortgages SlidesFuck You100% (1)

- Legal PersonalityDocument17 pagesLegal PersonalityIkra MalikNo ratings yet

- Restitution in Void ContractsDocument11 pagesRestitution in Void ContractsddddNo ratings yet

- A. Express TermsDocument27 pagesA. Express TermscwangheichanNo ratings yet

- Doctrine of RestitutionDocument15 pagesDoctrine of RestitutionBhart BhardwajNo ratings yet

- Essential EconomicsDocument76 pagesEssential EconomicsgnarvaneNo ratings yet

- SCDL - PGDBA - Finance - Sem 1 - Business LawDocument17 pagesSCDL - PGDBA - Finance - Sem 1 - Business Lawapi-3762419100% (1)

- Company Law Assignment AaaDocument3 pagesCompany Law Assignment AaaTinashe Mukuku50% (2)

- ATF Adverse Action and DisciplineDocument46 pagesATF Adverse Action and DisciplinedcodreaNo ratings yet

- School of Business Management College of Business Universiti Utara MalaysiaDocument34 pagesSchool of Business Management College of Business Universiti Utara MalaysiaVishan VasugiNo ratings yet

- In Law of Torts AssignmentDocument4 pagesIn Law of Torts AssignmentRohan MohanNo ratings yet

- CL 9 Democratic RightsDocument25 pagesCL 9 Democratic RightsAarushNo ratings yet

- Constitutional Monarchy, Rule of Law and Good GovernanceDocument462 pagesConstitutional Monarchy, Rule of Law and Good GovernanceAnonymous bUC8uMNo ratings yet

- Application To Set Aside Statutory DemandDocument4 pagesApplication To Set Aside Statutory DemandLennox Allen Kip100% (1)

- Parties Law of Obligations Civil LawDocument6 pagesParties Law of Obligations Civil LawEljoy AgsamosamNo ratings yet

- Associated Chemicals Limited and Hill and Delmain Zambia Limited and Ellis and CompanyDocument4 pagesAssociated Chemicals Limited and Hill and Delmain Zambia Limited and Ellis and CompanyemmanuelmitengoNo ratings yet

- Assignment - Contract LawDocument6 pagesAssignment - Contract Lawadrian marinacheNo ratings yet

- Step-Saver Data Systems, Inc. v. Wyse Technology and The Software Link, Inc, 939 F.2d 91, 3rd Cir. (1991)Document26 pagesStep-Saver Data Systems, Inc. v. Wyse Technology and The Software Link, Inc, 939 F.2d 91, 3rd Cir. (1991)Scribd Government DocsNo ratings yet

- Management ASSIGNMENTDocument12 pagesManagement ASSIGNMENTkazi A.R RafiNo ratings yet

- SEBI - Non-Convertible Debt Securities & Non-Convertible Redeemable Preference SharesDocument18 pagesSEBI - Non-Convertible Debt Securities & Non-Convertible Redeemable Preference SharesDivesh GoyalNo ratings yet

- Act 171 - Local Government Act 1976Document132 pagesAct 171 - Local Government Act 1976Muhammad Shah Nidzinski El-ZamaniNo ratings yet

- THE NATURE AND PHILOSOPHIES OF COMMERCIAL LAWDocument47 pagesTHE NATURE AND PHILOSOPHIES OF COMMERCIAL LAWGideon AlangyamNo ratings yet

- TABL1710 Lecture Wk5 - Exclusion Clauses, Capacity, Privity, Vitiating ElementsDocument10 pagesTABL1710 Lecture Wk5 - Exclusion Clauses, Capacity, Privity, Vitiating Elementsriders29No ratings yet

- Regulation of Limited Liability - Calls for ReformDocument10 pagesRegulation of Limited Liability - Calls for ReformsotszngaiNo ratings yet

- AgreementDocument9 pagesAgreementbuttercupedNo ratings yet

- Indian Contract Act essentialsDocument97 pagesIndian Contract Act essentialsGurumurthy PsNo ratings yet

- Definition and FeaturesDocument4 pagesDefinition and FeaturesnayakNo ratings yet

- What Are The Four Sources of Law in GhanaDocument2 pagesWhat Are The Four Sources of Law in GhanaAlomenu Samuel100% (1)

- Law of Trusts and Equity: Lecture-IDocument17 pagesLaw of Trusts and Equity: Lecture-IKanwal ZehraNo ratings yet

- 2nd AssignmentDocument5 pages2nd AssignmentHassan_BIBM0% (1)

- The need to abolish secret trustsDocument11 pagesThe need to abolish secret trustseuodiaNo ratings yet

- Administrative Law Is That Branch of Law That Governs The Scope and Activities of Government AgenciesDocument3 pagesAdministrative Law Is That Branch of Law That Governs The Scope and Activities of Government AgenciesMiyanda Hakauba HayombweNo ratings yet

- Law of ContractDocument4 pagesLaw of ContractSyibrah AqilahNo ratings yet

- Assignment 2014 Fraudulent Trading (Recklessness)Document17 pagesAssignment 2014 Fraudulent Trading (Recklessness)ShinadeNo ratings yet

- Contract Termination, Auction Bids & Offers ExplainedDocument1 pageContract Termination, Auction Bids & Offers ExplainedlsNo ratings yet

- Labor Law Review Finals Guide Questions and AnswersDocument25 pagesLabor Law Review Finals Guide Questions and AnswersJulie PajoNo ratings yet

- Project Employee Requirements & Termination ProcedureDocument13 pagesProject Employee Requirements & Termination ProcedureAisha Mie Faith FernandezNo ratings yet

- Chapter 15Document42 pagesChapter 15alishahNo ratings yet

- Improving Customers Service at IKEA Using Six Sigma MethodologyDocument9 pagesImproving Customers Service at IKEA Using Six Sigma MethodologydrustagiNo ratings yet

- 02 Project Gap Analysis StrategyDocument16 pages02 Project Gap Analysis Strategyapi-297908709100% (1)

- Effective Communication Skills for the WorkplaceDocument31 pagesEffective Communication Skills for the WorkplaceTheophilus DomobiyoNo ratings yet

- Civil Engineer Cover Letter 2, Sample, Apply Online For A Job, Job Boards, Employment AgencyDocument2 pagesCivil Engineer Cover Letter 2, Sample, Apply Online For A Job, Job Boards, Employment AgencyLaurentNo ratings yet

- Report From GBGH Operational ReviewDocument155 pagesReport From GBGH Operational ReviewMidland_Mirror100% (1)

- Oracle HRMS OverviewDocument76 pagesOracle HRMS OverviewSumit KNo ratings yet

- The Right Way To Manage ExpatsDocument2 pagesThe Right Way To Manage ExpatsShayne RebelloNo ratings yet

- Educ-6 - R.A. 7877Document2 pagesEduc-6 - R.A. 7877Ma. Crizelda Del RosarioNo ratings yet

- Hiller's Layoff NoticesDocument6 pagesHiller's Layoff NoticesClickon DetroitNo ratings yet

- Project Execution Plan: Al-Janadriyah Exhibition Facility, Ar-RiyadhDocument25 pagesProject Execution Plan: Al-Janadriyah Exhibition Facility, Ar-RiyadhJonald DagsaNo ratings yet

- 057 - Bolivar Blueprint Project PlanDocument54 pages057 - Bolivar Blueprint Project PlanbeaumontenterpriseNo ratings yet

- IYOINxYS CSP MenteeGuidelinesDocument19 pagesIYOINxYS CSP MenteeGuidelinesAldera AlNo ratings yet

- INT Company Profile .Document7 pagesINT Company Profile .Pitichai PakornrersiriNo ratings yet

- Current Trends Update - CanadaDocument3 pagesCurrent Trends Update - CanadazinxyNo ratings yet

- Job Interview 2Document9 pagesJob Interview 2Mario TrNo ratings yet

- Advertisment On Adhoc Basis Recruitment For 01 - 07Document2 pagesAdvertisment On Adhoc Basis Recruitment For 01 - 07Raghav PratapNo ratings yet

- BSBMGT608 Assessment InstructionDocument32 pagesBSBMGT608 Assessment Instructionsarah chepwogenNo ratings yet

- HR Professionalism What Do We Stand For 2017 Tcm18 17960Document43 pagesHR Professionalism What Do We Stand For 2017 Tcm18 17960Nico LacatusNo ratings yet

- Introduction To Information Techonology: Mr. XXXXXXDocument29 pagesIntroduction To Information Techonology: Mr. XXXXXXAsad Mazhar100% (1)

- Construction Safety HandbookDocument79 pagesConstruction Safety HandbookMohsin Khan0% (1)

- Thrift Savings Plan TSP-16: Exception To Spousal RequirementsDocument2 pagesThrift Savings Plan TSP-16: Exception To Spousal RequirementsMarsha MainesNo ratings yet

- ILO-ADB report: Covid-19 impact on youth employment in India and Asia-PacificDocument2 pagesILO-ADB report: Covid-19 impact on youth employment in India and Asia-PacificsurajsinghbhadauriaNo ratings yet

- Accounting Performance EvaluationDocument21 pagesAccounting Performance EvaluationAgnes YuNo ratings yet

- International CompensationDocument39 pagesInternational CompensationyogaknNo ratings yet

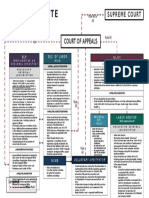

- Labor Dispute Case Flow: Supreme CourtDocument1 pageLabor Dispute Case Flow: Supreme Courtjeffprox69100% (1)

- Zuellig Freight and Cargo SystemsDocument1 pageZuellig Freight and Cargo SystemsCharisse Christianne Yu CabanlitNo ratings yet

- Abusive Behaviour Against SuperiorsDocument18 pagesAbusive Behaviour Against SuperiorsLove VermaNo ratings yet

- This Introduction Represents An Overview of The Field of Work Motivation From A Theoretical Standpoint and LDocument11 pagesThis Introduction Represents An Overview of The Field of Work Motivation From A Theoretical Standpoint and LZach YolkNo ratings yet

- 174571905-IELTS-Advantage-Writing-Skills (2) - 78-86Document9 pages174571905-IELTS-Advantage-Writing-Skills (2) - 78-86hoàng anhNo ratings yet