Professional Documents

Culture Documents

Thrift Savings Plan TSP-16: Exception To Spousal Requirements

Uploaded by

Marsha MainesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thrift Savings Plan TSP-16: Exception To Spousal Requirements

Uploaded by

Marsha MainesCopyright:

Available Formats

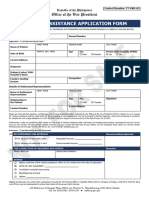

THRIFT SAVINGS PLAN

TSP-16

EXCEPTION TO

SPOUSAL REQUIREMENTS

Use this form to request an exception to the Thrift Savings Plan (TSP) spouse notice and signature requirements. Read the

instructions on the back before completing this form. Type or print the information requested.

I.

INFORMATION 1. Name

Last First Middle

ABOUT YOU

2. TSP Account Number 3. Date of Birth / /

mm dd yyyy

4. Daytime Phone (Area Code and Number) ( ) –

5. Address

Street Address or Box Number

6. City 7. 8.

State/Country Zip Code

9. I am applying for a Thrift Savings Plan: Loan Withdrawal

II.

REQUEST FOR 10. 11. – –

Name of Spouse (Last) (First) (Middle) Spouse’s Social Security Number

EXCEPTION

12. Whereabouts Unknown

For Federal Employees’ Retirement System (FERS) Participants. I am asking for an exception to

the requirement to obtain the signature of my spouse identified above because I do not know where

my spouse is. I have made a good faith effort to locate my spouse in the 90 days before I submitted

this request and have been unable to do so through any person or other source. The required

statements or police, agency, or judicial determinations are attached to this form.

For Civil Service Retirement System (CSRS) Participants. I am asking for an exception to the require-

ment to notify my spouse identified above because I do not know where my spouse is. I have made a

good faith effort to locate my spouse in the 90 days before I submitted this request and have been un-

able to do so through any person or other source. The required statements or police, agency, or judicial

determinations are attached to this form.

13. Exceptional Circumstances

For FERS Participants Only. I am asking for an exception to the requirement to obtain the signature of

my spouse identified above because exceptional circumstances make it inappropriate for me to obtain

my spouse’s signature. A copy of an order or determination of a court or other governmental body that

recites the exceptional circumstances is attached.

III. I certify that the information I have provided in connection with this request is true and complete to the best of my

YOUR knowledge. Warning: Any intentional false statement or willful misrepresentation in this form is a violation of law

SIGNATURE AND that is punishable by a fine or imprisonment for as long as 5 years, or both (18 U.S.C. §1001).

CERTIFICATION

14. 15.

Participant’s Signature Date Signed

IV.

OFFICIAL USE 16. Approved Disapproved 17.

Date

ONLY

PRIVACY ACT NOTICE. We are authorized to request the information you provide statute, rule, or order. It may be shared with congressional offices, private sector audit

on this form under 5 U.S.C. chapter 84, Federal Employees’ Retirement System. We firms, spouses, former spouses, and beneficiaries, and their attorneys. We may dis-

will use this information to identify your TSP account and to process your transaction. close relevant portions of the information to appropriate parties engaged in litigation

In addition, this information may be shared with other Federal agencies for statistical, and for other routine uses as specified in the Federal Register. You are not required

auditing, or archiving purposes. We may share the information with law enforcement by law to provide this information, but if you do not provide it, we will not be able to

agencies investigating a violation of civil or criminal law, or agencies implementing a process your request.

Form TSP-16 (1/2011)

PREVIOUS EDITIONS OBSOLETE

INFORMATION AND INSTRUCTIONS

GENERAL Make a copy of this form and all documents for your records. Mail the original form along with supporting docu-

INFORMATION ments to: TSP Legal Processing Unit, P.O. Box 4390, Fairfax, VA 22038-4390.

For overnight delivery, send the form to: ATTN: TSP Legal Processing Unit, 12210 Fairfax Town Center, Unit 906,

Fairfax, VA 22033.

Or fax the completed form to: 1-703-592-0151. If you have questions, call the toll-free ThriftLine at 1-TSP-YOU-

FRST (1-877-968-3778) or the TDD at 1-TSP-THRIFT5 (1-877-847-4385). Outside the U.S. and Canada, please

call 404-233-4400 (not toll free).

By law, your spouse (including a separated spouse) has certain rights when you withdraw or borrow from your TSP

account. The legal requirements are summarized in the chart below. If you are covered by FERS, it is your respon-

sibility to obtain the signature of your spouse; your spouse’s signature is required to waive the required joint annuity

when you make a post-separation full withdrawal or to consent to your loan, in-service withdrawal, or post-separa-

tion partial withdrawal. If you are covered by CSRS, the TSP is responsible for sending the required notice to your

spouse. The notice does not contain personal information about you; it informs your spouse that you have applied

for a withdrawal or a loan from your TSP account. The notice does not give your spouse a right to the money in

your TSP account.

The TSP will notify you of the decision regarding your request for an exception to the spouses’ rights requirements.

An exception may be granted only under limited conditions.

Activity Retirement System Requirement Exception

{

Loan,

In-Service FERS Consent of spouse Whereabouts unknown or

Withdrawal,

or exceptional circumstances

Partial Withdrawal

After Separation CSRS Notification of spouse Whereabouts unknown

Full

Withdrawal

After Separation

FERS

CSRS

{ Waiver of annuity benefit

by spouse*

Notification of spouse*

Whereabouts unknown or

exceptional circumstances

Whereabouts unknown

* These requirements do not apply if your vested account balance is $3,500 or less at disbursement.

Note: A withdrawal request or Loan Application received within 90 days of an approved exception may be processed as

long as the spouse identified on the form is the spouse for whom the exception has been approved.

SECTION I. and 1 – 9: Complete all of these items.

SECTION II. 10 – 11: Enter your spouse’s name and Social Security number.

12: Whereabouts Unknown. If you are requesting an exception to the spousal requirements because your

spouse’s whereabouts are unknown, you must attach one of the following items to this form:

• a court order which states that the whereabouts of your spouse are unknown, OR

• a police or governmental agency determination issued by the appropriate department or division head which

states that the whereabouts of your spouse are unknown, OR

• three statements, including:

– a statement by you that

(1) provides the full name(s) of your spouse;

(2) clearly states that you are unable to locate your spouse;

(3) states the last time you knew your spouse’s location;

(4) explains why your spouse’s location is not known; and

(5) describes in detail the efforts you have made to locate your spouse in the 90 days

preceding your submission of this request and the results of those efforts; and

– statements from two persons supporting your statement that you do not know your spouse’s location and

describing the person’s knowledge of your efforts within the last 90 days to locate your spouse.

Each statement must be signed and dated and must contain the following statement:

I understand that a false statement or willful misrepresentation in this form is a violation of

law that is punishable by a fine or imprisonment for as long as 5 years, or both (18 U.S.C. §

1001).

13: Exceptional Circumstances (FERS only). If you are a married FERS participant and exceptional circum-

stances make it inappropriate to obtain your spouse’s signature, you must attach either a court order or a govern-

mental agency determination issued by the appropriate department or division head explaining the exceptional

circumstances. For example, a court order could indicate that you and your spouse have been maintaining sepa-

rate residences with no financial relationship for three or more years; or indicate that your spouse abandoned you,

but for religious or other compelling reasons, you chose not to divorce; or state that you may borrow money from or

withdraw all or a portion of your TSP account notwithstanding the absence of your spouse’s signature.

SECTION III. 14 – 15: You must sign and date this section certifying that the information you provided is true and complete to

the best of your knowledge.

SECTION IV. 16 – 17: The TSP completes this section.

Form TSP-16 (1/2011)

PREVIOUS EDITIONS OBSOLETE

You might also like

- Motions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsFrom EverandMotions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsRating: 4.5 out of 5 stars4.5/5 (13)

- JPIA Membership Data Privacy Consent FormDocument2 pagesJPIA Membership Data Privacy Consent FormShena RicamaraNo ratings yet

- Sample Motion to Vacate, Motion to Dismiss, Affidavits, Notice of Objection, and Notice of Intent to File ClaimFrom EverandSample Motion to Vacate, Motion to Dismiss, Affidavits, Notice of Objection, and Notice of Intent to File ClaimRating: 5 out of 5 stars5/5 (21)

- Locator Rev.0Document2 pagesLocator Rev.0Nissin PrecisionNo ratings yet

- Compilation of State and Federal Privacy Laws, 2010 Consolidated EditionFrom EverandCompilation of State and Federal Privacy Laws, 2010 Consolidated EditionNo ratings yet

- Service Provider, Vendor, Supplier, ESP Rev.0Document3 pagesService Provider, Vendor, Supplier, ESP Rev.0Nissin PrecisionNo ratings yet

- Birth Affidavit: Last Suffix First MiddleDocument2 pagesBirth Affidavit: Last Suffix First Middlesidiki millimonoNo ratings yet

- Numident ApproachDocument5 pagesNumident ApproachTitle IV-D Man with a plan100% (1)

- Love Thy Neighbor, Barangay Legal Aid Free Information GuideFrom EverandLove Thy Neighbor, Barangay Legal Aid Free Information GuideNo ratings yet

- Direct Lending Application FormDocument7 pagesDirect Lending Application FormKuan Wen TingNo ratings yet

- Collapse of an Evil Empire: Florida's Most Prolific Insurance Litigator - Based on a True StoryFrom EverandCollapse of an Evil Empire: Florida's Most Prolific Insurance Litigator - Based on a True StoryNo ratings yet

- Sec 1014Document2 pagesSec 1014Michael100% (1)

- Main Form Ssa 1696 Supplement 1 Claimant S Revocation of The Appointment of A RepresentativeDocument2 pagesMain Form Ssa 1696 Supplement 1 Claimant S Revocation of The Appointment of A RepresentativeCarolNo ratings yet

- Bond Application FormDocument2 pagesBond Application FormMark Nathaniel AytinNo ratings yet

- PhilHealth Claim Form 1 GuideDocument2 pagesPhilHealth Claim Form 1 GuideHaykal Salomon LorenaNo ratings yet

- Birth Affidavit: Last Suffix First MiddleDocument2 pagesBirth Affidavit: Last Suffix First Middlebigwheel8No ratings yet

- SEC Complaint FormDocument16 pagesSEC Complaint FormTim BryantNo ratings yet

- Data Sharing AgreementDocument11 pagesData Sharing Agreementjadeandal1111No ratings yet

- Proof of Claim: Federal Deposit Insurance Corporation As Receiver ForDocument3 pagesProof of Claim: Federal Deposit Insurance Corporation As Receiver ForCoral LionNo ratings yet

- Consent For Disclosure of Records Protected Under The Privacy ActDocument2 pagesConsent For Disclosure of Records Protected Under The Privacy ActJaffar HussainNo ratings yet

- Police Vetting Form For The German Exchange Programme 19062023Document3 pagesPolice Vetting Form For The German Exchange Programme 19062023saaisnehnzNo ratings yet

- Application Form Corporation With DPADocument2 pagesApplication Form Corporation With DPAjoyNo ratings yet

- Employee Rev.0Document3 pagesEmployee Rev.0Nissin PrecisionNo ratings yet

- Deed of Assignment - 102018Document5 pagesDeed of Assignment - 102018Kawaii YoshinoNo ratings yet

- EEOC Complaint Against Miami LawDocument3 pagesEEOC Complaint Against Miami LawThe College FixNo ratings yet

- Philippines Background Check FormDocument4 pagesPhilippines Background Check FormNariento QuintosNo ratings yet

- Cenomar Request PSA Form-NewDocument1 pageCenomar Request PSA Form-NewUpuang KahoyNo ratings yet

- Standard Form 85P QuestionnaireDocument11 pagesStandard Form 85P QuestionnaireAlan CartagenaNo ratings yet

- Questionnaire For Public Trust Positions: Purpose of This FormDocument11 pagesQuestionnaire For Public Trust Positions: Purpose of This Formkobich5No ratings yet

- Social Security Release FormDocument2 pagesSocial Security Release FormlaucanelosNo ratings yet

- Standard_Form_85PDocument11 pagesStandard_Form_85Pvincent laneNo ratings yet

- 3288_Martinez Cintron (Ejemplo-No Completar)Document3 pages3288_Martinez Cintron (Ejemplo-No Completar)Eneida Martinez CintronNo ratings yet

- Consent Disclosure Consent Disclosure - CaliforniaDocument4 pagesConsent Disclosure Consent Disclosure - Californianickrock4242No ratings yet

- Combine TSP AccountsDocument2 pagesCombine TSP AccountsjustinfuNo ratings yet

- PSA Cenodeath-Editable FormDocument1 pagePSA Cenodeath-Editable FormJane AvilaNo ratings yet

- Application For Certificate of ComplianceDocument2 pagesApplication For Certificate of CompliancePan Gulf Valves ManufacturingNo ratings yet

- Sec 1014Document2 pagesSec 1014LaLa BanksNo ratings yet

- Authorization For The Social Security Administration (SSA) To Release Social Security Number (SSN) VerificationDocument2 pagesAuthorization For The Social Security Administration (SSA) To Release Social Security Number (SSN) VerificationPatrick Long100% (2)

- Applicant FD 258Document2 pagesApplicant FD 258Robert BonomoNo ratings yet

- Description: Tags: GEN0303bDocument8 pagesDescription: Tags: GEN0303banon-281081No ratings yet

- FBI FP CardDocument2 pagesFBI FP CardYosbanyNo ratings yet

- TSP 70Document15 pagesTSP 70onetimer64100% (1)

- 01 KYC Individual_Final(Legal)_09022021_Editable (5) (1)Document1 page01 KYC Individual_Final(Legal)_09022021_Editable (5) (1)ranshienaganoNo ratings yet

- Ssa 827Document2 pagesSsa 827joshud7264100% (2)

- 0811 Ma App Form Version 190 1Document3 pages0811 Ma App Form Version 190 1vmjjc7jtg2No ratings yet

- Authorization For Release of Information and HIPAA Protected Health Information or The Department of Children's Services and Notification of ReleaseDocument3 pagesAuthorization For Release of Information and HIPAA Protected Health Information or The Department of Children's Services and Notification of ReleaseOlufifehanmi OsikoyaNo ratings yet

- Sav 1048Document7 pagesSav 1048Michael100% (2)

- IRS 3949-A American Bankers AssociationDocument2 pagesIRS 3949-A American Bankers Associationrodclassteam100% (4)

- Ssa 827Document2 pagesSsa 827Brooke UshimawaNo ratings yet

- 2 Order of Adoption of Nonminor DependentDocument2 pages2 Order of Adoption of Nonminor Dependentjaydourman2020No ratings yet

- Petitioner AOS Signature PagesDocument3 pagesPetitioner AOS Signature PagesUblester Baltazar Jr.No ratings yet

- I10 FormDocument1 pageI10 Formleomal320% (1)

- Child Passport ConsentmentDocument2 pagesChild Passport ConsentmentlowelowelNo ratings yet

- Gantes RPHIPAADocument3 pagesGantes RPHIPAAMaritza GantesNo ratings yet

- Form 1583 FLDocument2 pagesForm 1583 FLerichfriedmanNo ratings yet

- DATA PRIVACY CONSENT FORM - NSA ApplicantDocument1 pageDATA PRIVACY CONSENT FORM - NSA Applicantthe judgesNo ratings yet

- Affidavits of UndertakingDocument3 pagesAffidavits of UndertakingJayson GuerreroNo ratings yet

- Application Form NewDocument2 pagesApplication Form NewJhunalyn ManahanNo ratings yet

- 3 Day Notice To ReportDocument1 page3 Day Notice To ReportMarsha MainesNo ratings yet

- Certificate of Service of Process Steele WhitingDocument1 pageCertificate of Service of Process Steele WhitingMarsha MainesNo ratings yet

- Standing Order Addresses Judicial Emergency in Eastern District of CaliforniaDocument5 pagesStanding Order Addresses Judicial Emergency in Eastern District of CaliforniaMarsha MainesNo ratings yet

- Alvarado Fee ScheduleDocument3 pagesAlvarado Fee ScheduleMarsha MainesNo ratings yet

- Certificate of Service of Process of Notice of Trespass Order To Cease and DesistDocument1 pageCertificate of Service of Process of Notice of Trespass Order To Cease and DesistMarsha MainesNo ratings yet

- Apache County Sheriff Id Theft Act July 9 2020Document12 pagesApache County Sheriff Id Theft Act July 9 2020Marsha MainesNo ratings yet

- Case Unassigned Due to Judge's Senior StatusDocument1 pageCase Unassigned Due to Judge's Senior StatusMarsha MainesNo ratings yet

- Thrift Savings Plan TSP-60: Request For A Transfer Into The TSPDocument4 pagesThrift Savings Plan TSP-60: Request For A Transfer Into The TSPMarsha MainesNo ratings yet

- Copyright Notice To All Corporations of Secured LienDocument2 pagesCopyright Notice To All Corporations of Secured LienMarsha MainesNo ratings yet

- TSP Name Change FormDocument2 pagesTSP Name Change FormMarsha MainesNo ratings yet

- APOSTILLE of Secretary of State Colorado For Declaration of SovereignDocument1 pageAPOSTILLE of Secretary of State Colorado For Declaration of SovereignMarsha MainesNo ratings yet

- TSP-92D: Request For Participant Account InformationDocument2 pagesTSP-92D: Request For Participant Account InformationMarsha MainesNo ratings yet

- 1099A UtilityBill BillSmithDocument2 pages1099A UtilityBill BillSmithMarsha Maines100% (2)

- 25 Damning Indisputable Facts..Document5 pages25 Damning Indisputable Facts..the3Dman2009100% (2)

- Truth in Lending Affidavit Challenges Bank of America to Prove Creditor StatusDocument12 pagesTruth in Lending Affidavit Challenges Bank of America to Prove Creditor StatusMarsha Maines100% (14)

- Thrift Savings Plan: Form TSP-3 Designation of BeneficiaryDocument8 pagesThrift Savings Plan: Form TSP-3 Designation of BeneficiaryMarsha MainesNo ratings yet

- Virginia Code § 64.1-57 Powers of FiduciariesDocument7 pagesVirginia Code § 64.1-57 Powers of FiduciariesMarsha MainesNo ratings yet

- Gov Uscourts Ca4 14-2135 35 0Document48 pagesGov Uscourts Ca4 14-2135 35 0Marsha MainesNo ratings yet

- Experian SettlementAgreementDocument40 pagesExperian SettlementAgreementMarsha Maines100% (1)

- INTERNATIONAL BILL OF EXCHANGE - OdtDocument1 pageINTERNATIONAL BILL OF EXCHANGE - OdtMarsha MainesNo ratings yet

- Petition For Writ of CertiorariDocument41 pagesPetition For Writ of CertiorariMarsha MainesNo ratings yet

- Carter Vs Countrywide E.D. Va 2009 Slip OpinionDocument6 pagesCarter Vs Countrywide E.D. Va 2009 Slip OpinionMarsha MainesNo ratings yet

- Unlawful Detainer Action Against Bank of NYDocument9 pagesUnlawful Detainer Action Against Bank of NYMarsha MainesNo ratings yet

- Rico by California Families Filed January Thirtith Two Thousand FourteenDocument255 pagesRico by California Families Filed January Thirtith Two Thousand FourteenMarsha MainesNo ratings yet

- Bank of America Fake Poa's For TrustsDocument12 pagesBank of America Fake Poa's For TrustsMarsha MainesNo ratings yet

- A135782 Arden Integan v. BAC Home Loans Inc.Document24 pagesA135782 Arden Integan v. BAC Home Loans Inc.Marsha MainesNo ratings yet

- Consumer Data Privacy in A Networked World: A Framework For Protecting Privacy and Promoting Innovation in The Global Digital EconomyDocument62 pagesConsumer Data Privacy in A Networked World: A Framework For Protecting Privacy and Promoting Innovation in The Global Digital EconomyDavid Shares0% (1)

- Using A Metes & Bounds Survey To Replace The Deed of TrustDocument28 pagesUsing A Metes & Bounds Survey To Replace The Deed of TrustMarsha Maines100% (6)

- Transcripts PDFDocument79 pagesTranscripts PDFMarsha Maines100% (1)

- The Future of InsurgencyDocument84 pagesThe Future of Insurgencyjohn3963No ratings yet

- The Forum Gazette Vol. 2 Nos. 10 & 11 May 20-June 19, 1987Document20 pagesThe Forum Gazette Vol. 2 Nos. 10 & 11 May 20-June 19, 1987SikhDigitalLibraryNo ratings yet

- UV Gullas Law School Conflict of Laws SyllabusDocument23 pagesUV Gullas Law School Conflict of Laws SyllabuspistekayawaNo ratings yet

- Histo Martial LawDocument18 pagesHisto Martial Law5rx6qmdjm5No ratings yet

- Air 1988 (SC) 1325Document9 pagesAir 1988 (SC) 1325achitaleyNo ratings yet

- Rhine v. Boone, 182 F.3d 1153, 10th Cir. (1999)Document7 pagesRhine v. Boone, 182 F.3d 1153, 10th Cir. (1999)Scribd Government DocsNo ratings yet

- History of Democratic Politics in The PhilippinesDocument16 pagesHistory of Democratic Politics in The PhilippinesEloisa Micah GuabesNo ratings yet

- 023 - Specific Prerformance and Hardship in Case of Residential Houses (242-245)Document4 pages023 - Specific Prerformance and Hardship in Case of Residential Houses (242-245)Shakshi MehtaNo ratings yet

- Auditor Relating Provisions - Series - 39Document4 pagesAuditor Relating Provisions - Series - 39Divesh GoyalNo ratings yet

- SSLTR 2 PMRe Naming Madurai AirportDocument2 pagesSSLTR 2 PMRe Naming Madurai AirportPGurusNo ratings yet

- Bachan Singh Vs State of Punjab 16081982 SCs820055COM876639Document126 pagesBachan Singh Vs State of Punjab 16081982 SCs820055COM876639Aadhitya NarayananNo ratings yet

- SCC NotesDocument3 pagesSCC NotesAngelo NavarroNo ratings yet

- Colonial India Peasant, Tribal MovementsDocument11 pagesColonial India Peasant, Tribal MovementsVIMLESH YADAVNo ratings yet

- Muhammad Ali's Impact On Civil Rights Movement Through His Denial For The Participation in Vietnam WarDocument4 pagesMuhammad Ali's Impact On Civil Rights Movement Through His Denial For The Participation in Vietnam Wartaani chakrabortyNo ratings yet

- CHEESMAN Vs IACDocument1 pageCHEESMAN Vs IACPia SottoNo ratings yet

- Yassour1983 PDFDocument11 pagesYassour1983 PDFDimitrinusNo ratings yet

- LD WillDocument8 pagesLD Willled58No ratings yet

- PD 1586Document5 pagesPD 1586leeashleeNo ratings yet

- SC rules on Baguio City's rescission of parking contractDocument4 pagesSC rules on Baguio City's rescission of parking contractKatherine NavarreteNo ratings yet

- People vs. Alunday: The Government (P) vs. Marijuana Grower (D)Document10 pagesPeople vs. Alunday: The Government (P) vs. Marijuana Grower (D)Jessica BernardoNo ratings yet

- MMDA V Concerned Residents of Manila Bay (Environmental Law)Document16 pagesMMDA V Concerned Residents of Manila Bay (Environmental Law)OpsOlavarioNo ratings yet

- Xam Idea Social Science Standard Class 10 Term 1 MCQDocument169 pagesXam Idea Social Science Standard Class 10 Term 1 MCQ31 Deepan100% (1)

- G O Ms No 81Document4 pagesG O Ms No 81cherryprasaadNo ratings yet

- Sale of Drugs Act 1952 (New)Document17 pagesSale of Drugs Act 1952 (New)Hassan KhamisNo ratings yet

- Difference Between Indian Government and Us Government 78Document3 pagesDifference Between Indian Government and Us Government 78Anime Dark ZoneNo ratings yet

- South Denver Anesthesiologists, P.C. v. Oblachinski - Document No. 12Document4 pagesSouth Denver Anesthesiologists, P.C. v. Oblachinski - Document No. 12Justia.comNo ratings yet

- PDFDocument1 pagePDFJemimah CustodioNo ratings yet

- Angela Butte Vs Manuel UyDocument2 pagesAngela Butte Vs Manuel UyJoe AnnNo ratings yet

- Literature Review 1Document4 pagesLiterature Review 1api-534381583No ratings yet

- DARREN ALLEN State CertificationDocument5 pagesDARREN ALLEN State CertificationTexas WatchdogNo ratings yet

- Unstoppable You: A Teen Girl's Handbook for Joyful LivingFrom EverandUnstoppable You: A Teen Girl's Handbook for Joyful LivingRating: 4.5 out of 5 stars4.5/5 (21)

- Raising Good Humans: A Mindful Guide to Breaking the Cycle of Reactive Parenting and Raising Kind, Confident KidsFrom EverandRaising Good Humans: A Mindful Guide to Breaking the Cycle of Reactive Parenting and Raising Kind, Confident KidsRating: 4.5 out of 5 stars4.5/5 (169)

- How to Talk to Anyone: Learn the Secrets of Good Communication and the Little Tricks for Big Success in RelationshipFrom EverandHow to Talk to Anyone: Learn the Secrets of Good Communication and the Little Tricks for Big Success in RelationshipRating: 4.5 out of 5 stars4.5/5 (1135)

- Briefly Perfectly Human: Making an Authentic Life by Getting Real About the EndFrom EverandBriefly Perfectly Human: Making an Authentic Life by Getting Real About the EndNo ratings yet

- The Guilty Wife: A gripping addictive psychological suspense thriller with a twist you won’t see comingFrom EverandThe Guilty Wife: A gripping addictive psychological suspense thriller with a twist you won’t see comingRating: 4 out of 5 stars4/5 (71)

- Breaking Barriers, Building Strength: A Teen's Journey to Fearless LivingFrom EverandBreaking Barriers, Building Strength: A Teen's Journey to Fearless LivingRating: 4.5 out of 5 stars4.5/5 (25)

- The Waitress: The gripping, edge-of-your-seat psychological thriller from the bestselling author of The BridesmaidFrom EverandThe Waitress: The gripping, edge-of-your-seat psychological thriller from the bestselling author of The BridesmaidRating: 4 out of 5 stars4/5 (65)

- Tech Detox for Teens: Finding Balance in a Digital WorldFrom EverandTech Detox for Teens: Finding Balance in a Digital WorldRating: 4.5 out of 5 stars4.5/5 (26)

- How to Walk into a Room: The Art of Knowing When to Stay and When to Walk AwayFrom EverandHow to Walk into a Room: The Art of Knowing When to Stay and When to Walk AwayRating: 4.5 out of 5 stars4.5/5 (5)

- Queen Bee: A brand new addictive psychological thriller from the author of The BridesmaidFrom EverandQueen Bee: A brand new addictive psychological thriller from the author of The BridesmaidRating: 4 out of 5 stars4/5 (131)

- Summary: I'm Glad My Mom Died: by Jennette McCurdy: Key Takeaways, Summary & AnalysisFrom EverandSummary: I'm Glad My Mom Died: by Jennette McCurdy: Key Takeaways, Summary & AnalysisRating: 4.5 out of 5 stars4.5/5 (2)

- The Bridesmaid: The addictive psychological thriller that everyone is talking aboutFrom EverandThe Bridesmaid: The addictive psychological thriller that everyone is talking aboutRating: 4 out of 5 stars4/5 (129)

- The Happiest Baby on the Block: The New Way to Calm Crying and Help Your Newborn Baby Sleep LongerFrom EverandThe Happiest Baby on the Block: The New Way to Calm Crying and Help Your Newborn Baby Sleep LongerRating: 4.5 out of 5 stars4.5/5 (58)

- For Women Only, Revised and Updated Edition: What You Need to Know About the Inner Lives of MenFrom EverandFor Women Only, Revised and Updated Edition: What You Need to Know About the Inner Lives of MenRating: 4.5 out of 5 stars4.5/5 (267)

- The House Mate: A gripping psychological thriller you won't be able to put downFrom EverandThe House Mate: A gripping psychological thriller you won't be able to put downRating: 4 out of 5 stars4/5 (126)

- Being Mean: A Memoir of Sexual Abuse and SurvivalFrom EverandBeing Mean: A Memoir of Sexual Abuse and SurvivalRating: 4.5 out of 5 stars4.5/5 (55)

- Summary of The Art of Seduction by Robert GreeneFrom EverandSummary of The Art of Seduction by Robert GreeneRating: 4 out of 5 stars4/5 (46)

- Sharing Too Much: Musings from an Unlikely LifeFrom EverandSharing Too Much: Musings from an Unlikely LifeRating: 4.5 out of 5 stars4.5/5 (8)

- Make Him BEG for Your Attention: 75 Communication Secrets for Captivating Men to Get the Love and Commitment You DeserveFrom EverandMake Him BEG for Your Attention: 75 Communication Secrets for Captivating Men to Get the Love and Commitment You DeserveRating: 4.5 out of 5 stars4.5/5 (219)

- His Needs, Her Needs: Building a Marriage That LastsFrom EverandHis Needs, Her Needs: Building a Marriage That LastsRating: 4.5 out of 5 stars4.5/5 (100)

- Secure Love: Create a Relationship That Lasts a LifetimeFrom EverandSecure Love: Create a Relationship That Lasts a LifetimeRating: 5 out of 5 stars5/5 (17)

- Riding the Storm The Emotional Lives of Teenagers: Understanding, Nurturing, and Support in a Changing WorldFrom EverandRiding the Storm The Emotional Lives of Teenagers: Understanding, Nurturing, and Support in a Changing WorldRating: 4.5 out of 5 stars4.5/5 (66)

- Become A Powerful Femme Fatale: 7 Proven Ways to Tap Into Your Dark Feminine Energy and Unleash Your Inner SirenFrom EverandBecome A Powerful Femme Fatale: 7 Proven Ways to Tap Into Your Dark Feminine Energy and Unleash Your Inner SirenNo ratings yet