Professional Documents

Culture Documents

Chap 6 PDF

Uploaded by

Basant OjhaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 6 PDF

Uploaded by

Basant OjhaCopyright:

Available Formats

6

Amalgamation

Question 1

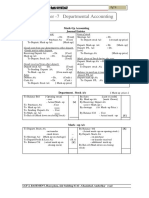

Following are the Balance Sheet of companies as at 31.12.2003:

Liabilities D Ltd. V Ltd. Assets D Ltd. V Ltd.

` ` ` `

Equity share capital Goodwill 6,00,000 ―

(` 100) 8,00,000 6,00,000 Fixed Assets 5,00,000 8,00,000

General Reserve 4,00,000 3,00,000 Investments 2,00,000 4,00,000

Investment Current Assets 4,00,000 3,00,000

Allowance

Reserve ― 4,00,000

Sundry Creditors 5,00,000 2,00,000 ________ ________

17,00,000 15,00,000 17,00,000 15,00,000

D Ltd. took over V Ltd. on the basis of the respective shares value, adjusting wherever

necessary, the book values of assets and liabilities on the basis of the following information:

(i) Investment Allowance Reserve was in respect of addition made to fixed assets by V Ltd.

in the year 1997-2002 on which income tax relief has been obtained. In terms of the

Income Tax Act, 1961, the company has to carry forward till 2006 reserve of ` 2,00,000

for utilization.

(ii) Investments of V Ltd. included 1,000 shares in D Ltd. acquired at cost of ` 150 per

share. The other investments of V Ltd. have a market value of ` 1,92,500.

(iii) The market value of investments of D Ltd. are to be taken at ` 1,00,000.

(iv) Goodwill of D Ltd. and V Ltd. are to be taken at ` 5,00,000 and ` 1,00,000 respectively.

(v) Fixed assets of D Ltd. and V Ltd. are valued at ` 6,00,000 and ` 8,50,000 respectively.

(vi) Current assets of D Ltd. included ` 80,000 of stock in trade received from V Ltd. at cost

plus 25%.

The above scheme has been duly adopted. Pass necessary Journal Entries in the books of D

Ltd. and prepare Balance Sheet of D Ltd. after taking over the business of V Ltd. Fractional

© The Institute of Chartered Accountants of India

6.2 Accounting

share to be settled in cash, rest in shares of D Ltd. Calculation shall be made to the nearest

multiple of a rupee. (16 Marks, May 2004) (PE-II)

Answer

Journal Entries in the Books of D Ltd.

Dr. Cr.

Amount Amount

` `

Business Purchase Account Dr. 12,42,500

To Liquidator of V Ltd. 12,42,500

(For purchase consideration due)

Investments Account Dr. 1,92,500

Goodwill Account (Balancing figure) Dr. 1,00,000

Fixed Assets Account Dr. 8,50,000

Current Assets Account Dr. 3,00,000

To Sundry Creditors Account 2,00,000

To Business Purchase Account 12,42,500

(For assets and liabilities taken over at agreed value)

Liquidator of V Ltd. Dr. 12,42,500

To Equity Share Capital Account (`100) 9,03,600

To Securities Premium Account (`37.50) 3,38,850

To Cash Account 50

(For purchase consideration discharged)

Goodwill Account Dr. 16,000

To Current Assets (Stock) Account 16,000

(For elimination of unrealized profit on unsold stock)

Amalgamation Adjustment Account Dr. 2,00,000

To Investment Allowance Reserve Account 2,00,000

(For incorporation of statutory reserve)

Balance Sheet of D Ltd.

as on 31st December, 2003

Particulars Notes `

Equity and Liabilities

1 Shareholders' funds

a Share capital 1 17,03,600

b Reserves and Surplus 2 9,38,850

© The Institute of Chartered Accountants of India

Amalgamation 6.3

2 Current liabilities

a Trade Payables 3 7,00,000

Total 33,42,450

Assets

1 Non-current assets

a Fixed assets

Tangible assets (5,00,000 + 8,50,000) 13,50,000

Intangible assets 4 7,16,000

b Investments(2,00,000 + 1,92,500) 3,92,500

c Amalgamation Adjustment Account 2,00,000

2 Current assets(7,00,000 – 50 – 16,000) 6,83,950

Total 33,42,450

Notes to accounts

`

1 Share Capital

Equity share capital

17,036 shares of ` 100 each (out of which 9036

shares are issued in favour of vendor for 17,03,600

consideration other than cash)

Total 17,03,600

2 Reserves and Surplus

General Reserve 4,00,000

Securities Premium 3,38,850

Investment allowance reserve 2,00,000 9,38,850

3 Trade payables

Creditors 7,00,000

4 Intangible assets

Goodwill (6,00,000 + 1,00,000 + 16,000) 7,16,000

Working Notes:

1. Calculation of net asset value of shares

D Ltd. V Ltd.

` `

Goodwill 5,00,000 1,00,000

© The Institute of Chartered Accountants of India

6.4 Accounting

Fixed Assets 6,00,000 8,50,000

Investments 1,00,000 3,30,000*

Current Assets 4,00,000 3,00,000

16,00,000 15,80,000

Less: Sundry Creditors 5,00,000 2,00,000

Net assets 11,00,000 13,80,000

Number of shares 8,000 6,000

Value per equity share 137.50 230

*Investments of V Ltd. are calculated as follows: `

Shares in D Ltd. (1,000 × 137.50) 1,37,500

Market value of remaining investments (given) 1,92,500

3,30,000

2. Calculation of Purchase Consideration

`

Value of Assets of V Ltd 15,00,000

Less: Value erosion on investments (` 2,50,000 – 1,92,500) 57,500

Less: Sundry Creditors 2,00,000

12,42,500

Settlement of Purchase Consideration

`

Net assets of V Ltd. 13,80,000

Value of Shares of D Ltd. 137.50

Number of shares to be issued in D Ltd. to V Ltd. (13,80,000 ÷ 137.50) 10,036.36

Less: Shares already held by V Ltd. 1,000

Additional shares to be issued 9,036.36

Total value of shares to be issued (9036 × 137.50) 12,42,450

Cash payment for fractional share (.36 × 137.50) 50

12,42,500

© The Institute of Chartered Accountants of India

Amalgamation 6.5

Question 2

The following is the summarized Balance Sheet of A Ltd. as at 31st March, 2006:

Liabilities ` Assets `

8,000 equity shares of ` 100 each 8,00,000 Building 3,40,000

10% debentures 4,00,000 Machinery 6,40,000

Loan from A 1,60,000 Stock 2,20,000

Creditors 3,20,000 Debtors 2,60,000

General Reserve 80,000 Bank 1,36,000

Goodwill 1,30,000

Misc. Expenses 34,000

(Share issue Expenses)

17,60,000 17,60,000

B Ltd. agreed to absorb A Ltd. on the following terms and conditions:

(1) B Ltd. would take over all assets, except bank balance at their book values less 10%.

Goodwill is to be valued at 4 year’s purchase of super profits, assuming that the normal

rate of return be 8% on the combined amount of share capital and general reserve.

(2) B Ltd. is to take over creditors at book value.

(3) The purchase consideration is to be paid in cash to the extent of ` 6,00,000 and the

balance in fully paid equity shares of ` 100 each at ` 125 per share.

The average profit is ` 1,24,400. The liquidation expenses amounted to ` 16,000. B

Ltd. sold prior to 31st March, 2006 goods costing ` 1,20,000 to A Ltd. for ` 1,60,000.

` 1,00,000 worth of goods are still in stock of A Ltd. on 31st March, 2006. Creditors of A

Ltd. include ` 40,000 still due to B Ltd.

Show the necessary Ledger Accounts to close the books of A Ltd. and prepare the

Balance Sheet of B Ltd. as at 1st April, 2006 after the takeover.

(20 Marks, November 2006) (PE-II)

Answer

Books of A Limited

Realisation Account

` `

To Building 3,40,000 By Creditors 3,20,000

To Machinery 6,40,000 By B Ltd. 12,10,000

To Stock 2,20,000 By Equity Shareholders (Loss) 76,000

© The Institute of Chartered Accountants of India

6.6 Accounting

To Debtors 2,60,000

To Goodwill 1,30,000

To Bank (Exp.) 16,000

16,06,000 16,06,000

Bank Account

To Balance b/d 1,36,000 By Realisation (Exp.) 16,000

To B Ltd. 6,00,000 By 10% debentures 4,00,000

By Loan from A 1,60,000

By Equity shareholders 1,60,000

7,36,000 7,36,000

10% Debentures Account

To Bank 4,00,000 By Balance b/d 4,00,000

4,00,000 4,00,000

Loan from A Account

To Bank 1,60,000 By Balance b/d 1,60,000

1,60,000 1,60,000

Misc. Expenses Account

To Balance b/d 34,000 By Equity shareholders 34,000

34,000 34,000

General Reserve Account

To Equity shareholders 80,000 By Balance b/d 80,000

80,000 80,000

B Ltd. Account

To Realisation A/c 12,10,000 By Bank 6,00,000

By Equity share in B Ltd.(4,880

shares at ` 125 each) 6,10,000

12,10,000 12,10,000

Equity Shares in B Ltd. Account

To B Ltd. 6,10,000 By Equity shareholders 6,10,000

6,10,000 6,10,000

Equity Share Holders Account

To Realisation 76,000 By Equity share capital 8,00,000

To Misc. Expenses 34,000 By General reserve 80,000

To Equity shares in B Ltd. 6,10,000

To Bank 1,60,000

8,80,000 8,80,000

© The Institute of Chartered Accountants of India

Amalgamation 6.7

B Ltd

Balance Sheet as on 1st April, 2006 (An extract)∗

Particulars Notes `

Equity and Liabilities

1 Shareholders' funds

a Share capital 1 4,88,000

b Reserves and Surplus 2 1,07,000

2 Current liabilities

a Trade Payables 3 2,80,000

b Bank overdraft 6,00,000

Total 14,75,000

Assets

1 Non-current assets

a Fixed assets

Tangible assets 4 8,82,000

Intangible assets 5 2,16,000

2 Current assets

a Inventories 6 1,83,000

b Trade receivables 7 1,94,000

14,75,000

Notes to accounts

`

1 Share Capital

Equity share capital

4,880 Equity shares of ` 100 each

(Shares have been issued for consideration

other than cash) 4,88,000

Total 4,88,000

2 Reserves and Surplus (an extract)

Securities Premium 1,22,000

Profit and loss account

∗

In the absence of the particulars of assets and liabilities (other than those of A Ltd.), the complete Balance Sheet of B

Ltd. after takeover cannot be prepared.

© The Institute of Chartered Accountants of India

6.8 Accounting

Less: Unrealised profit (15,000) (15,000)

Total 1,07,000

3 Trade payables

Opening balance 3,20,000

Less: Inter-company transaction cancelled upon

amalgamation (40,000) 2,80,000

4 Tangible assets

Buildings 3,06,000

Machinery 5,76,000

Total 8,82,000

5 Intangible assets

Goodwill 2,16,000

6 Inventories

Opening balance 1,98,000

Less: Cancellation of profit upon amalgamation (15,000) 1,83,000

7 Trade receivables

Opening balance 2,60,000

Less: Intercompany transaction cancelled upon amalgamation (40,000)

Less: Provision for doubtful debts (26,000) 1,94,000

Working Notes:

1. Valuation of Goodwill `

Average profit 1,24,400

Less: 8% of ` 8,80,000 (70,400)

Super profit 54,000

Value of Goodwill = 54,000 x 4 2,16,000

2. Net Assets for purchase consideration

Goodwill as valued in W.N.1 2,16,000

Building 3,06,000

Machinery 5,76,000

Stock 1,98,000

Debtors 2,60,000

Total Assets 15,56,000

© The Institute of Chartered Accountants of India

Amalgamation 6.9

Less: Creditors 3,20,000

Provision for bad debts 26,000 (3,46,000)

Net Assets 12,10,000

Out of this ` 6,00,000 is to be paid in cash and remaining i.e., (12,10,000 – 6,00,000)

` 6,10,000 in shares of ` 125. Thus, the number of shares to be allotted 6,10,000/125 =

4,880 shares.

3. Unrealised Profit on Stock `

The stock of A Ltd. includes goods worth ` 1,00,000 which was sold by B

40,000

Ltd. on profit. Unrealized profit on this stock will be ×1,00,000 25,000

1,60,000

As B Ltd purchased assets of A Ltd. at a price 10% less than the book

value, 10% need to be adjusted from the stock i.e., 10% of ` 1,00,000. (10,000)

Amount of unrealized profit 15,000

Question 3

The following are the Balance Sheets of M Ltd. and N Ltd. as at 31st March, 2009:

(` in lakhs)

Liabilities M Ltd. N Ltd.

Fully paid equity shares of ` 10 each 3,600 900

10% Preference shares of ` 10 each, fully paid up 1,200 -

Capital Reserve 600 -

General Reserve 2,100 -

Profit and Loss Account 780 -

8% Redeemable debentures of ` 1,000 each - 300

Trade Creditors 2,421 369

Provisions 870 93

11,571 1,662

Assets

Plant and Machinery 4,215 468

Furniture and Fixtures 2,400 183

Motor Vehicles - 51

Stock 2,370 444

Sundry Debtors 1,044 237

© The Institute of Chartered Accountants of India

6.10 Accounting

Cash at Bank 1,542 240

Preliminary Expenses - 33∗

Discount on Issue of Debentures - 6

11,571 1,662

A new Company MN Ltd. was incorporated with an authorised capital of ` 15,000 lakhs

divided into shares of ` 10 each. For the purpose of amalgamation in the nature of merger, M

Ltd. and N Ltd. were merged into MN Ltd. on the following terms:

(i) Purchase consideration for M Ltd.’s business is to be discharged by issue of 120 lakhs

fully paid 11% preference shares and 720 lakhs fully paid equity shares of MN Ltd. to the

preference and equity shareholders of M Ltd. in full satisfaction of their claims.

(ii) To discharge purchase consideration for N Ltd.’s business, MN Ltd. to allot 90 lakhs fully

paid up equity shares to shareholders of N Ltd. in full satisfaction of their claims.

(iii) Expenses on the liquidation of M Ltd. and N Ltd. amounting to ` 6 lakhs are to be borne

by MN Ltd.

(iv) 8% redeemable debentures of N Ltd. to be converted into 8.5% redeemable debentures

of MN Ltd.

(v) Expenses on incorporation of MN Ltd. were ` 15 lakhs.

You are requested to:

(a) Pass necessary Journal Entries in the books of MN Ltd. to record above transactions,

and

(b) Prepare Balance Sheet of MN Ltd. after merger. (16 Marks, November, 2009) (IPCC)

Answer

In the books of MN Ltd.

Journal Entries

(` in lakhs)

Dr. Cr.

Business Purchase Account Dr. 9,300

To Liquidator of M Ltd. 8,400

To Liquidator of N Ltd. 900

(Being consideration payable to liquidators of the two companies taken

over)

Plant and Machinery Account (4,215+468) Dr. 4,683

∗

As per para 56 of AS 26, Preliminary expenses should Not appear in the Balance Sheet.

© The Institute of Chartered Accountants of India

Amalgamation 6.11

Furniture and Fixtures Account (2,400+183) Dr. 2,583

Motor Vehicles Account Dr. 51

Stock Account (2,370+444) Dr. 2,814

Sundry Debtors Account (1,044+237) Dr. 1,281

Cash at Bank Account (1,542+240) Dr. 1,782

Preliminary Expenses Account Dr. 33

Discount on issue of Debentures Account Dr. 6

Profit and Loss Account (Refer W.N.) Dr. 120

To 8% Redeemable Debentures of N Ltd. Account 300

To Trade Creditors Account (2,421+369) 2,790

To Provisions Account (870+93) 963

To Business Purchase Account 9,300

(Being incorporation of all the assets and liabilities and the excess of

consideration over the share capital being adjusted against reserves

and surplus)

Liquidator of M Ltd. Account Dr. 8,400

Liquidator of N Ltd. Account Dr. 900

To Equity Share Capital Account (7,200+900) 8,100

To 11% Preference Share Capital Account 1,200

(Being allotment of fully paid shares in discharge of purchase

consideration)

Profit and Loss Account Dr. 6

To Bank Account 6

(Being payment of liquidation expenses of M Ltd. and N Ltd.)

Preliminary Expenses Account Dr. 15

To Bank Account 15

(Being expenses on incorporation of MN Ltd.)

8% Redeemable Debentures of N Ltd. Account Dr. 300

To 8.5% Redeemable Debentures Account 300

(Being conversion of 8% Debentures of N Ltd. into 8.5% Debentures)

Profit and Loss Account Dr. 48

To Preliminary Expenses Account (33+15) 48

(Being Preliminary Expenses are charged to Profit & Loss A/c in the

year it is incurred and not shown in the Balance Sheet as per para 56 of

AS 26)

© The Institute of Chartered Accountants of India

6.12 Accounting

Balance Sheet of MN Ltd.

Particulars Notes ` in lakhs

EQUITY & LIABILITY

1. Shareholders’ Funds

a Share capital 1 9,300

b Reserve & Surplus 2 (174)

2 . Non-Current-Liabilities

a Long- term borrowings 3 300

3. Current-Liabilities

a Trade Payables 2,790

b Short term provisions 4 963.

Total 13,179

ASSETS

1 . Non-current assets

a Fixed assets

Tangible assets 5 7,317

b Other Non-current asset 6 6

2. Current assets

a Inventories 2,814

b Trade receivables 1,281

c Cash and cash equivalents 7 1,761

Total 13,179

Note to Accounts

` in lakhs

1 Share Capital

Authorised share capital

15 crore shares of `10 each 15,000

Issued, subscribed and paid up

810 lakhs Equity shares of `10 each, fully paid Reserves and Surplus 8,100

120 lakhs 11% Preference shares of `10 each, fully paid 1,200

(All the above mentioned shares have been issued for consideration other

than cash)

Total 9,300

© The Institute of Chartered Accountants of India

Amalgamation 6.13

2 Reserves and Surplus

Profit and Loss Account (120+6+48) (174)

3 Long-term borrowings

Secured

8.5% Redeemable Debentures 300

4 Short-term provisions

Others 963

5 Tangible assets

Plant and Machinery 4,683

Furniture and Fixtures 2,583

Plant and machinery 51

Total 7,317

6 Other non-current assets

Discount on Issue of Debentures 6

7 Cash and cash equivalents

Cash at Bank (1,782–6–15) 1,761

Working Note:

Profit and Loss Account (` in lakhs)

Total consideration = ` (8,400 + 900) lakhs 9,300

Less: Share Capital of Companies taken over [` (3,600+1,200+900) lakhs] 5,700

3,600

Amount to be adjusted:

Capital Reserve 600

General Reserve 2,100

Profit & Loss A/c 780 3,480

Debit balance of Profit & Loss Account 120

Question 4

The Balance Sheet of Reckless Ltd. as on 31st March, 2008 is as follows:

`

Assets:

Freehold premises 2,20,000

Machinery 1,77,000

© The Institute of Chartered Accountants of India

6.14 Accounting

Furniture & fittings 90,800

Stock 3,87,400

Sundry debtors 80,000

Less : Provision for doubtful debts 4,000 76,000

Cash in hand 2,300

Cash at bank 1,56,500

Bills receivable 15,000

11,25,000

Liabilities:

60,000 Equity shares of `10 each 6,00,000

Pre-incorporation profit 21,000

Contingency reserve 1,35,000

Profit and loss appropriation account 1,26,000

Acceptances 20,000

Creditors 1,13,000

Provision for income-tax 1,10,000

11,25,000

Careful Ltd. decided to take over Reckless Ltd. from 31st March, 2008 with the following

assets at value noted against them :

`

Bills receivable 15,000

Freehold premises 4,00,000

Furniture and fittings 80,000

Machinery 1,60,000

Stock 3,45,000

¼ of the consideration was satisfied by the allotment of fully paid preference shares of ` 100

each at par which carried 13% dividend on cumulative basis. The balance was paid in the

form of Careful Ltd’s equity shares of ` 10 each, ` 8 paid up.

Sundry Debtors realised ` 79,500. Acceptances were settled for ` 19,000. Income-tax

authorities fixed the taxation liability at ` 1,11,600. Creditors were finally settled with the cash

remaining after meeting liquidation expenses amounting to `4,000.

You are required to :

© The Institute of Chartered Accountants of India

Amalgamation 6.15

(i) Calculate the number of equity shares and preference shares to be allotted by Careful

Ltd. in discharge of consideration.

(ii) Prepare the important ledger accounts in the books of Reckless Ltd.; and

(iii) Pass journal entries in the books of Careful Ltd. with narration.

(16 Marks, May, 2010) (IPCC)

Answer

(i) Calculation of the number of equity shares and preference shares to be allotted by

Careful Ltd. in discharge of purchase consideration

Calculation of purchase consideration: `

Agreed value of assets taken over:

Bills receivable 15,000

Freehold premises 4,00,000

Furniture & fittings 80,000

Machinery 1,60,000

Stock 3,45,000

10,00,000

Discharge of purchase consideration:

1. Amount paid by allotment of 13% preference shares

1

= ` 10,00,000 ×

4

= ` 2,50,000

Number of 13% preference shares of ` 100 each

2,50,000

= = 2,500 preference shares

100

2. Amount paid by allotment of equity shares

= ` 10,00,000 – ` 2,50,000 = ` 7,50,000

Paid up value of one equity share = ` 8 each

Hence, the number of equity shares allotted

` 7,50,000

= = 93,750equity shares

`8

© The Institute of Chartered Accountants of India

6.16 Accounting

(ii) Ledger accounts in the books of Reckless Ltd.

Realisation Account

` `

To Freehold Premises 2,20,000 By Creditors 1,13,000

To Machinery 1,77,000 By Acceptances 20,000

To Furniture & Fittings 90,800 By Provision for tax 1,10,000

To Stock 3,87,400 By Provision for doubtful debts 4,000

To Sundry Debtors 80,000 By Careful Ltd. 10,00,000

To Bills Receivable 15,000 By Cash/Bank:

To Cash/ Bank: Sundry Debtors 79,500

Acceptances 19,000

Provision for tax 1,11,600

Creditors 1,03,700

To Cash/Bank

Liquidation expenses 4,000

To Profit 1,18,000

13,22,500 13,22,500

Cash and Bank Account

` `

To Balance b/d By Realisation A/c

(cash at bank) 1,56,500 Acceptances 19,000

To Cash in hand 2,300 Provision for tax 1,11,600

To Realisation A/c (Debtors) 79,500 By Realisation (Expenses) 4,000

By Realisation A/c

[Creditors (bal fig.)] 1,03,700

2,38,300 2,38,300

Equity Shareholders Account

` `

To 13% Cumulative 2,50,000 By Equity Share Capital 6,00,000

preference shares in

Careful Ltd.

© The Institute of Chartered Accountants of India

Amalgamation 6.17

To Equity Shares in By Pre-incorporation profit 21,000

Careful Ltd. 7,50,000

By Contingency reserve 1,35,000

By Profit & Loss

Appropriation Account 1,26,000

By Realisation Account 1,18,000

10,00,000 10,00,000

Careful Ltd. Account

` `

To Realisation Account 10,00,000 By 13% Cumulative preference 2,50,000

shares in Careful Ltd.

By Equity shares in Careful Ltd. 7,50,000

10,00,000 10,00,000

(iii) Journal Entries in the books of Careful Ltd.

` `

Business purchase Account Dr. 10,00,000

To Liquidator of Reckless Ltd. Account 10,00,000

(Being amount payable to liquidator of Reckless Ltd. for assets

taken over)

Bills receivable Account Dr. 15,000

Freehold premises Account Dr. 4,00,000

Furniture & fittings Account Dr. 80,000

Machinery Account Dr. 1,60,000

Stock Account Dr. 3,45,000

To Business purchase Account 10,00,000

(Being assets taken over from Reckless Ltd.)

Liquidator of Reckless Ltd. Dr. 10,00,000

To 13% Cumulative preference share capital Account 2,50,000

To Equity share capital Account 7,50,000

(Being allotment of 13% cumulative preference shares of `100

each fully paid up and equity shares of `10 each `8 paid up)

© The Institute of Chartered Accountants of India

6.18 Accounting

Question 5

The Balance Sheet of Mars Limited as on 31st March, 2011 was as follow:

Liabilities ` Assets `

Share Capital: Fixed Assets:

1,00,000 Equity shares of ` 10 Land and building 7,64,000

each fully paid up 10,00,000 Current Assets 7,75,000

Reserve and surplus Stock

Capital reserve 42,000 Sundry debtors 1,60,000

Contingency reserve 2,70,000 Less : Provision for 1,52,000

Profit and loss A/c 2,52,000 doubtful debts 8,000

Current Liabilities & Provisions Bill receivable 30,000

Bills payable 40,000 Cash at bank 3,29,000

Sundry creditors 2,26,000

Provisions for income tax 2,20,000

20,50,000 20,50,000

On 1st April, 2011, Jupiter Limited agreed to absorb Mars Limited on the following terms and

conditions:

(1) Jupiter Limited will take over the assets at the following values:

`

Land and building 10,80,000

Stock 7,70,000

Bills receivable 30,000

(2) Purchase consideration will be settled by Jupiter Ltd. as under:

4,100 fully paid 10% preference shares of ` 100 will be issued and the balance will be

settled by issuing equity shares of `10 each at ` 8 paid up.

(3) Liquidation expenses are to be reimbursed by Jupiter Ltd. to the extent of ` 5,000.

(4) Sundry debtors realized ` 1,50,000. Bills payable were settled for ` 38,000. Income tax

authorities fixed the taxation liability at ` 2,22,000 and the same was paid.

(5) Creditors were finally settled with cash remaining after meeting liquidation expenses

amounting to ` 8,000

You are required to:

(i) Calculate the number of equity shares and preference shares to be allotted by Jupiter

Limited in discharge of purchase consideration

© The Institute of Chartered Accountants of India

Amalgamation 6.19

(ii) Prepare the Realisation account, Bank account, Equity shareholders account and Jupiter

Limited’s account in the books of Mars Ltd. (16 Marks, May, 2011) (IPCC)

Answer

(i) Calculation of number of shares to be allotted

Particulars Amount (`)

Land and building 10,80,000

Stock 7,70,000

Bills receivable 30,000

Total 18,80,000

Amount discharged by issue of preference shares 4,10,000

Number of preference shares to be issued (4,10,000/100) 4,100 shares

Amount discharged by issue of equity shares (` 18,80,000 – 4,10,000) 14,70,000

Number of equity shares to be issued (` 14,70,000 / 8) 1,83,750 Shares

(ii) Ledger Accounts in the books of Mars Limited

Realization Account

Particulars ` Particulars `

To Land and building 7,64,000 By Provision for doubtful debts 8,000

To Stock 7,75,000 By Bills payable 40,000

To Sundry debtors 1,60,000 By Sundry creditors 2,26,000

To Bills receivable 30,000 By Provision for taxation 2,20,000

To Bank A/c –liquidation 3,000 By Jupiter Ltd. (purchase

expenses consideration) 18,80,000

To Bank A/c- bills payable 38,000 By Bank A/c- sundry debtors 1,50,000

To Bank A/c –income tax 2,22,000

To Bank A/c –sundry creditors 2,16,000

To Profit transferred to equity

shareholders A/c 3,16,000

25,24,000 25,24,000

Note: Liquidation expenses paid = ` 8,000 – ` 5,000(reimbursed by Jupiter Ltd) = 3,000

Bank Account

Particulars ` Particulars `

To Balance b/d 3,29,000 By Realisation A/c 3,000

To Realisation A/c (payment received (liquidation expenses)

from debtors) 1,50,000 By Jupiter Ltd. 5,000

To Jupiter Ltd. (liquidation expenses) 5,000 By Bills payable 38,000

© The Institute of Chartered Accountants of India

6.20 Accounting

By Income tax 2,22,000

By Sundry creditors

(Bal.fig.) 2,16,000

4,84,000 4,84,000

Equity Shareholders Account

Particulars ` Particulars `

To 10% Preference shares 4,10,000 By Equity share capital A/c 10,00,000

in Jupiter Limited By Capital reserve 42,000

To Equity shares in Jupiter 14,70,000 By Contingency reserve 2,70,000

Limited By Profit and loss A/c 2,52,000

By Realisation A/c (profit) 3,16,000

18,80,000 18,80,000

Jupiter Limited Account

Particulars ` Particulars `

To Realisation A/c 18,80,000 To 10% Preference shares in 4,10,000

Jupiter Limited

To Equity shares in Jupiter

Limited 14,70,000

18,80,000 18,80,000

Question 6

The following was the Balance Sheet of V Ltd. as on 31st March, 2012:

Particulars Note No. Amount

(` in lakhs)

Equity and Liabilities

(1) Shareholders' Funds

(a) Share Capital 1 1,150

(b) Reserves and Surplus 2 (87)

(2) Non-current Liabilities

(a) Long-term Borrowings 3 630

(3) Current Liabilities

Trade Parables 170

Total 1,863

Assets

(1) Non-current Assets

Tangible Assets 4 1,152

© The Institute of Chartered Accountants of India

Amalgamation 6.21

(2) Current Assets

Inventories 380

Trade Receivables 256

Cash and Cash equivalents 5 75

Total 1,863

Notes:

(1) Share Capital

Authorised : ?

Issued, Subscribed and Paid up :

80 lakh Equity Shares of ` 10 each, fully paid up 800

35 lakh 12% Cumulative Preference Shares

of ` 10 each, fully paid up 350

Total 1,150

(2) Reserves and Surplus

Debit Balance of Profit & Loss Account (87)

Total (87)

(3) Long-Term Borrowings

10% Secured Cumulative Debentures of

` 100 each, fully paid up 600

Outstanding Debenture Interest 30

Total 630

(4) Tangible Assets

Land and Buildings 445

Plant and Machinery 593

Furniture, Fixtures and Fittings 114

Total 1,152

Balance at Bank 69

Cash in hand 6

Total 75

On 1st April, 2012 P Ltd. took over the entire business of V Ltd. on the following terms:

V Ltd.'s equity shareholders would receive 4 fully paid equity shares of P Ltd. of ` 10 each

issued at a premium of ` 2.50 each for every five shares held by them in V Ltd.

Preference shareholders of V Ltd. would get 35 lakh 13% Cumulative Preference Shares of

` 10 each fully paid up in P Ltd., in lieu of their present holding.

© The Institute of Chartered Accountants of India

6.22 Accounting

All the debentures of V Ltd. would be converted into equal number of 10.5% Secured

Cumulative Debentures of ` 100 each, fully paid up after the take over by P Ltd., which would

also pay outstanding debenture interest in cash.

Expenses of amalgamation would be borne by P Ltd. Expenses came to be ` 2 lakh. P Ltd.

discovered that its creditors included ` 7 lakh due to V Ltd. for goods purchased.

Also P Ltd.'s stock included goods of the invoice price of ` 5 lakh earlier purchased from V

Ltd., which had charged profit @ 20% of the invoice price.

You are required to :

(i) Prepare Realisation A/c in the books of V Ltd.

(ii) Pass journal entries in the books of P Ltd. assuming it to be an amalgamation in the

nature of merger. (16 Marks, November 2012) (IPCC)

Answer

Realisation Account in the books of V Ltd.

` in lakhs ` in lakhs

To Land and Buildings A/c 445 By 10% Secured Cumulative 600

Debentures A/c

To Plant and Machinery A/c 593 By Outstanding Debenture 30

interest A/c

To Furniture, Fixtures & Fittings 114 By Trade payables A/c 170

A/c

To Inventories A/c 380 By P Ltd. A/c 1,150

To Trade Receivables A/c 256 (purchase consideration -

Refer working note)

To Bank A/c 69

To Cash in Hand A/c 6

To Equity Shareholders A/c 87

(Profit on Realisation)

1,950 1,950

Journal Entries in the books of P Ltd.

Dr. Cr.

` in lakhs ` in lakhs

1 Business Purchase A/c Dr. 1,150

To Liquidator of V Ltd. A/c 1,150

(Being purchase consideration due)

2 Land and Buildings A/c Dr. 445

© The Institute of Chartered Accountants of India

Amalgamation 6.23

Plant and Machinery A/c Dr. 593

Furniture, Fixtures & Fittings A/c Dr. 114

Inventories A/c Dr. 380

Trade Receivables A/c Dr. 256

Bank A/c Dr. 69

Cash in Hand A/c Dr. 6

Profit and Loss A/c Dr. 87

To 10% Debentures A/c 600

To Outstanding Debenture interest A/c 30

To Trade payables A/c 170

To Business Purchase A/c 1,150

(Being assets and liabilities taken over from V Ltd.

under the scheme of amalgamation in the nature of

merger)

3 Liquidators of V Ltd. A/c Dr. 1,150

To Equity Share Capital A/c 640

To 13% Cumulative Preference Shares A/c 350

To Securities Premium A/c 160

(Being discharge of consideration, by allotment of 64

lakh equity shares of ` 10 each at a premium of ` 2.50

per share & 35 lakh 13% cumulative preference shares

of ` 10 each at par)

4 10% Secured Cumulative Debentures A/c Dr. 600

To 10.5% Secured Cumulative Debentures A/c 600

(Being 10% Secured Cumulative Debentures of V Ltd.

converted into 10.5% Secured Cumulative Debentures

of P Ltd.)

5 Outstanding Debenture interest A/c Dr. 30

To Bank A/c 30

(Being outstanding debenture interest paid in cash by

P Ltd.)

6 Goodwill A/c Dr. 2

To Bank A/c 2

(Being amalgamation expenses met by P Ltd.)

7 Trade Payables A/c Dr. 7

© The Institute of Chartered Accountants of India

6.24 Accounting

To Trade Receivables A/c 7

(Being settlement of mutual liability )

8 Profit and Loss A/c Dr. 1

To Inventories A/c (5 x 20%) 1

(Being unrealized profit on stock purchased from V Ltd

written off from the inventories of P Ltd.)

Working Note:

Calculation of Purchase Consideration payable by P Ltd.

` in lakhs

Payment to preference shareholders:

13% Cumulative Preference Shares of ` 10 each (35 lakh shares × ` 10) 350

Payment to equity shareholders:

(80 lakh shares x 4/5)= 64 lakhs equity shares @ `10 640

Securities Premium (64 lakhs equity shares @ ` 2.5) 160

Total purchase consideration 1,150

Question 7

The summarized Balance Sheet of Srishti Ltd. as on 31st March, 2014 was as follows:

Amount (`) Amount

Liabilities Assets

(`)

Equity Shares of ` 10 fully paid 30,00,000 Goodwill 5,00,000

Export Profit Reserves 8,50,000 Tangible Fixed Assets 30,00,000

General Reserves 50,000 Stock 10,40,000

Profit and loss Account 5,50,000 Debtors 1,80,000

9% Debentures 5,00,000 Cash & Bank 2,80,000

Trade Creditors 1,00,000 Preliminary Expenses 50,000

50,50,000 50,50,000

Anu Ltd. agreed to absorb the business of Srishti Ltd. with effect from 1st April, 2014.

(a) The purchase consideration settled by Anu Ltd. as agreed:

(i) 4,50,000 equity Shares of ` 10 each issued by Anu Ltd. by valuing its share @

` 15 per share.

(ii) Cash payment equivalent to ` 2.50 for every share in Srishti Ltd.

(b) The issue of such an amount of fully paid 8% Debentures in Anu Ltd. at 96% as is

sufficient to discharge 9% Debentures in Srishti Ltd. at a premium of 20%.

© The Institute of Chartered Accountants of India

Amalgamation 6.25

(c) Anu Ltd. will take over the Tangible Fixed Assets at 100% more than the book value,

Stock at ` 7,10,000 and Debtors at their face value subject to a provision of 5% for

doubtful Debts.

(d) The actual cost of liquidation of Srishti Ltd. was ` 75,000. Liquidation cost of Srishti Ltd.

is to be reimbursed by Anu Ltd. to the extent of ` 50,000.

(e) Statutory Reserves are to be maintained for 1 more year.

You are required to:

(i) Close the books of Srishti Ltd. by preparing Realisation Account, Anu Ltd. Account,

Shareholders Account and Debenture Account, and

(ii) Pass Journal Entries in the books of Anu Ltd. regarding acquisition of business.

(16 Marks, IPCC May, 2014)

Answer

(i) Purchase consideration computation `

Cash payment for (3,00,000 x ` 2.5) 7,50,000

Equity Shares (4,50,000 x ` 15) 67,50,000

75,00,000

In the books of Srishti Ltd.

Realisation Account

` `

To Goodwill 5,00,000 By 9% Debentures 5,00,000

To Tangible Fixed Assets 30,00,000 By Creditors 1,00,000

To Stock 10,40,000 By By Anu Ltd. 75,00,000

To Debtors 1,80,000 (Purchase consideration)

To Cash & Bank A/c 2,55,000

(2,80,000- 25,000)

To Cash & Bank A/c 25,000

(Realization expenses)

To Profit on realization

transfer to shareholders 31,00,000

81,00,000 81,00,000

Equity Shareholders A/c

` `

To Preliminary expenses 50,000 By Equity Share Capital 30,00,000

© The Institute of Chartered Accountants of India

6.26 Accounting

To Equity Shares in Anu Ltd. 67,50,000 By Export Profit Reserves 8,50,000

To Cash & Bank A/c 7,50,000 By General Reserves 50,000

By P & L A/c 5,50,000

By Realization A/c 31,00,000

75,50,000 75,50,000

9% Debentures Account

` `

To Realization A/c 5,00,000 By Balance b/d 5,00,000

Anu Ltd.

` `

To Realization A/c 75,00,000 By Share Capital 67,50,000

By Bank A/c 7,50,000

75,00,000 75,00,000

(ii) Journal Entries in the books of Anu Ltd.

` `

1 Business Purchase A/c Dr. 75,00,000

To Liquidator of Srishti Ltd 75,00,000

(Being business of Srishti Ltd. taken over)

2 Tangible Fixed Assets Dr 60,00,000

Stock Dr 7,10,000

Debtors Dr 1,80,000

Cash & Bank A/c Dr 2,55,000

Goodwill A/c (Bal. fig.) Dr 10,64,000

To Provision for doubtful debts 9,000

To Liability for 9 % Debentures 6,00,000

To Creditors 1,00,000

To Business Purchase account 75,00,000

(Being assets and liabilities taken over)

3 Amalgamation Adjustment A/c Dr. 8,50,000

To Export Profit Reserves 8,50,000

(Being statutory Reserves taken over)

4 Goodwill Dr. 50,000

© The Institute of Chartered Accountants of India

Amalgamation 6.27

To Bank A/c 50,000

(Liquidation expenses reimbursed))

5 Liquidator of Shristi Ltd. Dr. 75,00,000

To Equity Share Capital 45,00,000

To Securities Premium 22,50,000

To Bank A/c 7,50,000

(Being purchase consideration discharged)

6 Liability for 9% Debentures ( 5,00,000 x 120/100) Dr. 6,00,000

Discount on issue of debentures 25,000

To 8% Debentures (6,00,000 x 100/96) 6,25,000

(Being liability of debenture holders’ discharged)

© The Institute of Chartered Accountants of India

You might also like

- Unit - 4: Amalgamation and ReconstructionDocument54 pagesUnit - 4: Amalgamation and ReconstructionAzad AboobackerNo ratings yet

- RTP June 19 AnsDocument27 pagesRTP June 19 AnsbinuNo ratings yet

- Cash ManagementDocument14 pagesCash ManagementSushant MaskeyNo ratings yet

- Compiler CAP II Cost AccountingDocument187 pagesCompiler CAP II Cost AccountingEdtech NepalNo ratings yet

- Suggested Answer CAP II June 2017rDocument104 pagesSuggested Answer CAP II June 2017rBAZINGANo ratings yet

- CA IPCC Accounting Guideline Answers May 2015Document24 pagesCA IPCC Accounting Guideline Answers May 2015Prashant PandeyNo ratings yet

- Pe2 Acc Nov05Document19 pagesPe2 Acc Nov05api-3825774No ratings yet

- Home Work Section Working CapitalDocument10 pagesHome Work Section Working CapitalSaloni AgrawalNo ratings yet

- 5 6084915055709651012Document8 pages5 6084915055709651012Ajit Yadav100% (1)

- Chapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Debentures. Practice QuestionsDocument53 pagesChapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Debentures. Practice QuestionsMercy GamingNo ratings yet

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsDocument158 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.No ratings yet

- Group - I Paper - 1 Accounting V2 Chapter 13 PDFDocument13 pagesGroup - I Paper - 1 Accounting V2 Chapter 13 PDFjashveer rekhiNo ratings yet

- Decemeber 2020 Examinations: Suggested Answers ToDocument41 pagesDecemeber 2020 Examinations: Suggested Answers ToDipen AdhikariNo ratings yet

- PCC 2008 NPO QuestionDocument10 pagesPCC 2008 NPO QuestionVaibhav MaheshwariNo ratings yet

- Accounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of IndiaDocument53 pagesAccounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of IndiaHarikrishna100% (1)

- 13 17227rtp Ipcc Nov09 Paper3aDocument24 pages13 17227rtp Ipcc Nov09 Paper3aemmanuel JohnyNo ratings yet

- Scanner CAP II Income Tax VATDocument162 pagesScanner CAP II Income Tax VATEdtech NepalNo ratings yet

- Not For Profit OrganizationDocument69 pagesNot For Profit OrganizationDristi SaudNo ratings yet

- Study Note 3, Page 114-142Document29 pagesStudy Note 3, Page 114-142s4sahithNo ratings yet

- 7948final Adv Acc Nov05Document16 pages7948final Adv Acc Nov05Kushan MistryNo ratings yet

- CAP II Scanner Corporate LawDocument121 pagesCAP II Scanner Corporate LawEdtech NepalNo ratings yet

- RTP Dec 18 QNDocument21 pagesRTP Dec 18 QNbinu100% (1)

- Paper - 3: Cost and Management Accounting Questions Material CostDocument31 pagesPaper - 3: Cost and Management Accounting Questions Material CostMohammed Mustafa KampuNo ratings yet

- Revision Test Paper CAP II Dec 2017Document163 pagesRevision Test Paper CAP II Dec 2017Dipen AdhikariNo ratings yet

- Chapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesDocument17 pagesChapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesAyush AcharyaNo ratings yet

- Accounting From Incomplete Records For BookDocument21 pagesAccounting From Incomplete Records For BookbinuNo ratings yet

- Coc Departmental Accounting Ca/Cma Santosh KumarDocument11 pagesCoc Departmental Accounting Ca/Cma Santosh KumarAyush AcharyaNo ratings yet

- Chapter 9 Accounting For Branches Including Foreign Branches PDFDocument61 pagesChapter 9 Accounting For Branches Including Foreign Branches PDFAkshansh MahajanNo ratings yet

- CA Inter Cost Important Questions For CA Nov'22Document93 pagesCA Inter Cost Important Questions For CA Nov'2202 Tapasvee ShahNo ratings yet

- Practice Accounts Prime PDFDocument56 pagesPractice Accounts Prime PDFShraddha NepalNo ratings yet

- Suggested Answer CAP II June 2018Document128 pagesSuggested Answer CAP II June 2018Pradeep Bhattarai67% (3)

- PartnershipDocument28 pagesPartnershipAdi Murthy100% (2)

- CA Inter Adv Accounts (New) Suggested Answer Dec21Document30 pagesCA Inter Adv Accounts (New) Suggested Answer Dec21omaisNo ratings yet

- 3246accounting - CA IPCCDocument116 pages3246accounting - CA IPCCPrashant Pandey100% (1)

- Job CostingDocument18 pagesJob CostingBiswajeet DashNo ratings yet

- Group 2 May 07Document73 pagesGroup 2 May 07princeoftolgate100% (1)

- Partnership PDFDocument28 pagesPartnership PDFBasant OjhaNo ratings yet

- Incomplete Records (Single Entry)Document15 pagesIncomplete Records (Single Entry)Kabiir RathodNo ratings yet

- LEVERAGE Online Problem SheetDocument6 pagesLEVERAGE Online Problem SheetSoumendra RoyNo ratings yet

- TYBAF UnderwritingDocument49 pagesTYBAF UnderwritingJaimin VasaniNo ratings yet

- Adv Accounts - AmalgamationDocument31 pagesAdv Accounts - Amalgamationmd samser50% (2)

- Extracted Chapter 1Document103 pagesExtracted Chapter 1PalisthaNo ratings yet

- Account Past Questions Compilation (2009june - 2020 Dec.)Document246 pagesAccount Past Questions Compilation (2009june - 2020 Dec.)Prashant Sagar Gautam100% (2)

- Suggested - Answer - CAP - II - June - 2010 2Document85 pagesSuggested - Answer - CAP - II - June - 2010 2Dipen AdhikariNo ratings yet

- Branch Accounting Examination BankDocument71 pagesBranch Accounting Examination BankNicole TaylorNo ratings yet

- Problem 5: XY LTDDocument4 pagesProblem 5: XY LTDAF 1 Tejasri PamujulaNo ratings yet

- CA Ipcc Costing Suggested Answers For Nov 20161Document12 pagesCA Ipcc Costing Suggested Answers For Nov 20161Sai Kumar SandralaNo ratings yet

- Amalgamation Accounting Cp6 3Document28 pagesAmalgamation Accounting Cp6 3Divakara ReddyNo ratings yet

- 18 Chapter4 Unit 1 2 Hire Purchase and Instalment PaymentDocument17 pages18 Chapter4 Unit 1 2 Hire Purchase and Instalment Paymentnarasimha_gudiNo ratings yet

- CS Exec - Prog - Paper-2 Company AC Cost & Management AccountingDocument25 pagesCS Exec - Prog - Paper-2 Company AC Cost & Management AccountingGautam SinghNo ratings yet

- Direct Materials APFL Uses A Weighted Average Method For The Pricing of Materials IssuesDocument5 pagesDirect Materials APFL Uses A Weighted Average Method For The Pricing of Materials IssuesAbimanyu ShenilNo ratings yet

- Illustrations AmalgamationDocument4 pagesIllustrations Amalgamationajay2741100% (1)

- Corporate Law RTP CAP-II June 2016Document18 pagesCorporate Law RTP CAP-II June 2016Artha sarokar100% (1)

- © The Institute of Chartered Accountants of IndiaDocument39 pages© The Institute of Chartered Accountants of IndiaGowriNo ratings yet

- 11 AmalgmationDocument38 pages11 AmalgmationPranaya Agrawal100% (1)

- Contract Costing (Unsolved)Document6 pagesContract Costing (Unsolved)ArnavNo ratings yet

- Answers To NavneetDocument12 pagesAnswers To NavneetPawan TalrejaNo ratings yet

- Class Problem: 2Document7 pagesClass Problem: 2Riad FaisalNo ratings yet

- FR (New) A MTP Final Mar 2021Document17 pagesFR (New) A MTP Final Mar 2021ritz meshNo ratings yet

- Hsslive Xii Acc 5 Dissolution of A Partnership Firm KeyDocument6 pagesHsslive Xii Acc 5 Dissolution of A Partnership Firm Keypirated wallahNo ratings yet

- Paper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Document56 pagesPaper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Basant OjhaNo ratings yet

- Answer To MTP - Final - Syllabus 2012 - Dec2015 - Set 1: Paper - 18 - Corporate Financial ReportingDocument26 pagesAnswer To MTP - Final - Syllabus 2012 - Dec2015 - Set 1: Paper - 18 - Corporate Financial ReportingBasant OjhaNo ratings yet

- Tax of NepalDocument61 pagesTax of NepalBasant OjhaNo ratings yet

- Paper-8: Cost and Management Accounting: Revisionary Test Paper - Intermediate - Syllabus 2008 - Dec 2014Document70 pagesPaper-8: Cost and Management Accounting: Revisionary Test Paper - Intermediate - Syllabus 2008 - Dec 2014Basant OjhaNo ratings yet

- Bos 28432 CP 14Document53 pagesBos 28432 CP 14Basant Ojha100% (1)

- Partnership PDFDocument28 pagesPartnership PDFBasant OjhaNo ratings yet

- Chap 3Document56 pagesChap 3Basant OjhaNo ratings yet

- Re HerringDocument360 pagesRe Herringragh01101622No ratings yet

- Financial Statements AutosavedDocument13 pagesFinancial Statements AutosavedAries Gonzales Caragan83% (6)

- Assessment Paper and Instructions To CandidatesDocument3 pagesAssessment Paper and Instructions To CandidatesJohn DoeNo ratings yet

- True Wealth - Outlawed For 41 Years, Now Legal Again PDFDocument14 pagesTrue Wealth - Outlawed For 41 Years, Now Legal Again PDFJohn PatlolNo ratings yet

- Charts Amalgamation and WindupDocument25 pagesCharts Amalgamation and WindupPradeep KumarNo ratings yet

- MCQ FimDocument13 pagesMCQ FimVIVEK SHARMA100% (3)

- 13-Interest Rate Risk ManagementDocument13 pages13-Interest Rate Risk ManagementSANCHI610No ratings yet

- SEBI Grade A 2020: Commerce & Accountancy: Cash Flow Statement, Fund Flow Statement, Financial Statement Analysis & Ratio AnalysisDocument20 pagesSEBI Grade A 2020: Commerce & Accountancy: Cash Flow Statement, Fund Flow Statement, Financial Statement Analysis & Ratio Analysismrinal kumarNo ratings yet

- Objective Type Questions On DerivativesDocument5 pagesObjective Type Questions On DerivativesEknath Birari100% (1)

- A) B) C) D)Document15 pagesA) B) C) D)Atteique AnwarNo ratings yet

- Charles P. Jones and Gerald R. Jensen, Investments: Analysis and Management, 13th Edition, John Wiley & SonsDocument21 pagesCharles P. Jones and Gerald R. Jensen, Investments: Analysis and Management, 13th Edition, John Wiley & SonsAnnisa AdriannaNo ratings yet

- EOM II - TEST - 10-03-2024 - Attempt Review - Welcome To Learning at NibmDocument33 pagesEOM II - TEST - 10-03-2024 - Attempt Review - Welcome To Learning at Nibmkiran.edamakantiNo ratings yet

- Financial Analysis of Noon Sugar Mills (2005, 2006 &2007)Document12 pagesFinancial Analysis of Noon Sugar Mills (2005, 2006 &2007)Sherdil MahmoodNo ratings yet

- AngelList Report 1652104059Document22 pagesAngelList Report 1652104059Piero PratolongoNo ratings yet

- Summary of Pas 36Document5 pagesSummary of Pas 36Elijah MontefalcoNo ratings yet

- The Complete Breakout Trader Day Trading John Connors PDFDocument118 pagesThe Complete Breakout Trader Day Trading John Connors PDFKaushik Matalia78% (9)

- NSI Financial Statement Q1 2020 (Signed)Document63 pagesNSI Financial Statement Q1 2020 (Signed)Trip RudraNo ratings yet

- Valuation of Airthread April 2012Document26 pagesValuation of Airthread April 2012Perumalla Pradeep KumarNo ratings yet

- Cbse Class 11 Accountancy Sample Paper Set 1 AnswersDocument14 pagesCbse Class 11 Accountancy Sample Paper Set 1 AnswersPÁRTH ŠHÄRMÃNo ratings yet

- Banana Chips Customer ServiceDocument3 pagesBanana Chips Customer ServiceJecelmae MacapepeNo ratings yet

- ADYEY Deep Dive 3Document28 pagesADYEY Deep Dive 3zeehenNo ratings yet

- Chapter # 2: Organizing Financial AssetsDocument14 pagesChapter # 2: Organizing Financial AssetsTabish KhanNo ratings yet

- Baumol Model of Cash ManagementDocument1 pageBaumol Model of Cash ManagementMichelle Go100% (2)

- 7160 - FAR Preweek ProblemDocument14 pages7160 - FAR Preweek ProblemMAS CPAR 93No ratings yet

- How To Value Earnings Growth YardeniDocument12 pagesHow To Value Earnings Growth YardenisuksesNo ratings yet

- Time Value ExercisesDocument2 pagesTime Value ExercisesJamesTho0% (3)

- Week 4Document3 pagesWeek 4karanjeet singhNo ratings yet

- RCR 17A Dec 31, 2022 RevisedDocument180 pagesRCR 17A Dec 31, 2022 RevisedjvNo ratings yet

- Financial Analysis ProjectDocument13 pagesFinancial Analysis ProjectAnonymous NflYP4O100% (1)

- FIN 605.Ch 1Document45 pagesFIN 605.Ch 1Torun SoktyNo ratings yet