Professional Documents

Culture Documents

Accounting for Business Combinations and Internal Reconstructions

Uploaded by

binuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting for Business Combinations and Internal Reconstructions

Uploaded by

binuCopyright:

Available Formats

CAP II Advance Accounting- June 2019

Write Short Notes

Question 20:

(a). Leases

(b). Re-Insurance

(c). Contingent Assets

(d). Non Banking Assets

(e) Accounting Estimates

(f). Components of financial statements

(g). Watch List in Loan loss provisioning

(h). Government Accounting System in Nepal

(i). Outsourcing the Accounting function to third party

(j) Compilation of accounting information for agricultural farm

The Institute of Chartered Accountants of Nepal 14

CAP II Advance Accounting- June 2019

SUGGESTED ANSWERS HINT

Business Combination

Solution 1:

Journal Entries in the Books of DD Ltd.

Dr. Cr.

Amount Amount

Rs. Rs.

Business Purchase Account Dr. 1,242,500

To Liquidator of SS Ltd. 1,242,500

(For purchase consideration due)

Investments Account Dr. 192,500

Goodwill Account (Balancing figure) Dr. 100,000

Fixed Assets Account Dr. 850,000

Current Assets Account Dr. 300,000

To Sundry Creditors Account 200,000

To Business Purchase Account 1,242,500

(For assets and liabilities taken over at agreed value)

Liquidator of SS Ltd. Dr. 1,242,500

To Equity Share Capital Account (Rs. 100) 903,600

To Securities Premium Account (Rs. 37.50) 338,850

To Cash Account 50

(For purchase consideration discharged)

Goodwill Account Dr. 16,000

To Current Assets (Stock) Account 16,000

(For elimination of unrealized profit on unsold stock)

Amalgamation Adjustment Account Dr. 200,000

To Investment Allowance Reserve Account 200,000

(For incorporation of statutory reserve)

Balance Sheet of DD Ltd.

as on 32nd Ashadh 2075

Liabilities Amount Assets Amount

Rs. Rs.

Equity Share Capital: Fixed Assets (500,000 + 850,000) 1,350,000

17,036 shares of Rs. 100 each (out of Goodwill

which 9036 shares are issued in favour (6,00,000 + 1,00,000 + 16,000) 716,000

of vendor for consideration other than 1,703,600 Investments (200,000 + 192,500) 392,500

cash)

General Reserve 400,000 Current Assets

Securities Premium 338,850 (7,00,000 – 50 – 16,000) 683,950

Investment Allowance Reserve 200,000 Amalgamation Adj. Account 200,000

Sundry Creditors 700,000

3,342,450 3,342,450

The Institute of Chartered Accountants of Nepal 15

CAP II Advance Accounting- June 2019

Working Notes:

1. Calculation of net asset value of shares

DD Ltd. SS Ltd.

Rs. Rs.

Goodwill 500,000 100,000

Fixed Assets 600,000 850,000

Investments 100,000 330,000*

Current Assets 400,000 300,000

1,600,000 1,580,000

Less: Sundry Creditors 500,000 200,000

Net assets 1,100,000 1,380,000

Number of shares 8,000 6,000

Value per equity share 137.50 230

Rs.

*Investments of SS Ltd. are calculated as follows:

137,500

Shares in DD Ltd. (1,000 137.50)

192,500

Market value of remaining investments (given)

330,000

2. Calculation of Purchase Consideration

Rs.

Net assets of SS Ltd. 380,000

Value of Shares of DD Ltd. 137.50

Number of shares to be issued in DD Ltd. to SS Ltd. (13,80,000 137.50) 10,036.36

Less: Shares already held by SS Ltd. 1,000

Additional shares to be issued 9,036.36

Total value of shares to be issued (9036 137.50) 1,242,450

Cash payment for fractional share (.36 137.50) 50

1,242,500

Solution 2:

Computation of Purchase Consideration

Rs.

Value of 15,000 equity shares @ Rs.80 per share = Rs.12,00,000

Shares to be issued by Y Co. Ltd. (Rs. 12,00,000/120 per share = 10,000 12,00,000

shares @ Rs.120 each)

11% Preference shareholders to be issued equivalent 11% Redeemable 5,00,000

Debentures by Y Co. Ltd.

Total Purchase Consideration 17,00,000

The Institute of Chartered Accountants of Nepal 16

CAP II Advance Accounting- June 2019

Journal Entries in the books of Y Co. Ltd.

Rs. Rs.

Business Purchase A/c Dr. 17,00,000

To Liquidator of X Co. Ltd. 17,00,000

(Being the amount payable to X Co. Ltd’s liquidator)

Land & Building A/c Dr. 10,00,000

Plant & Machinery A/c Dr. 7,00,000

Furniture & Fittings A/c Dr. 2,00,000

Stock in Trade A/c Dr. 3,00,000

Sundry Debtors A/c Dr. 2,00,000

Cash & Bank A/c Dr. 1,00,000

To Sundry Creditors 2,00,000

To Capital Reserve (Balancing figure) 6,00,000

To Business Purchase 17,00,000

(Being the value of assets and liabilities taken over from X Co. Ltd.)

Liquidators of X Co. Ltd. Account Dr. 17,00,000

To Equity Share Capital 10,00,000

To Securities Premium Account 2,00,000

To 11% Debentures 5,00,000

(Being purchase consideration discharged)

Internal Reconstruction

Solution 3:

Journal Entries in the Books of Hilltop Ltd.

Dr. Cr.

Rs. Rs.

(i) Equity Share Capital (Rs. 10 each) A/c Dr. 50,00,000

To Equity Share Capital (Rs. 5 each) A/c 25,00,000

To Reconstruction A/c 25,00,000

(Being conversion of 5,00,000 equity shares of Rs. 10 each

fully paid into same number of fully paid equity shares of Rs.

5 each as per scheme of reconstruction.)

(ii) 9% Preference Share Capital (Rs.100 each) A/c Dr. 20,00,000

To 10% Preference Share Capital (Rs.50 each) A/c 10,00,000

To Reconstruction A/c 10,00,000

(Being conversion of 9% preference share of Rs. 100 each

into same number of 10% preference share of Rs. 50 each

and claims of preference dividends settled as per scheme of

reconstruction.)

(iii) 10% First Debentures A/c Dr. 4,00,000

10% Second Debentures A/c Dr. 6,00,000

Trade Creditors A/c Dr. 1,00,000

Interest on Debentures Outstanding A/c Dr. 1,00,000

Bank A/c Dr. 1,00,000

The Institute of Chartered Accountants of Nepal 17

CAP II Advance Accounting- June 2019

To 12% New Debentures A/c 7,00,000

To Reconstruction A/c 6,00,000

(Being Rs. 6,00,000 due to A (including creditors) cancelled

and 12% new debentures allotted for balance amount as per

scheme of reconstruction.)

(iv) 10% First Debentures A/c Dr. 2,00,000

10% Second Debentures A/c Dr. 4,00,000

Trade Creditors A/c Dr. 50,000

Interest on Debentures Outstanding A/c Dr. 60,000

To 12% New Debentures A/c 4,10,000

To Reconstruction A/c 3,00,000

(Being Rs. 3,00,000 due to B (including creditors) cancelled

and 12% new debentures allotted for balance amount as per

scheme of reconstruction.)

(v) Trade Creditors A/c Dr. 1,75,000

To Reconstruction A/c 1,75,000

(Being remaining creditors sacrificed 50% of their claim.)

(vi) Directors' Loan A/c Dr. 1,00,000

To Equity Share Capital (Rs. 5) A/c 60,000

To Reconstruction A/c 40,000

(Being Directors' loan claim settled by issuing 12,000 equity

shares of Rs. 5 each as per scheme of reconstruction.)

(vii) Reconstruction A/c Dr. 15,000

To Bank A/c 15,000

(Being payment made for cancellation of capital

commitments.)

(viii) Bank A/c Dr. 1,10,000

To Reconstruction A/c 1,10,000

(Being refund of fees by directors credited to reconstruction

A/c.)

(ix) Reconstruction A/c Dr. 10,000

To Bank A/c 10,000

(Being payment of reconstruction expenses.)

(x) Provision for Tax A/c Dr. 1,00,000

To Bank A/c 80,000

To Reconstruction A/c 20,000

(Being payment of tax for 80% of liability in full settlement.)

The Institute of Chartered Accountants of Nepal 18

CAP II Advance Accounting- June 2019

(xi) Reconstruction A/c Dr. 47,20,000

To Goodwill A/c 10,00,000

To Patent A/c 5,00,000

To Profit and Loss A/c 15,00,000

To Discount on issue of Debentures A/c 1,00,000

To Land and Building A/c 2,00,000

To Plant and Machinery A/c 6,00,000

To Furniture & Fixture A/c 1,00,000

To Computers A/c 1,20,000

To Trade Investment A/c 1,00,000

To Stock A/c 3,00,000

To Debtors A/c 2,00,000

(Being writing off of losses and reduction in the value of

assets as per scheme of reconstruction.)

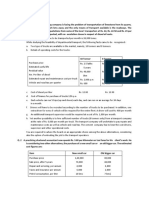

Cash Flow Statement

Solution 4:

Cash Flow Statement

Particulars Amount Amount

Cash Flow from Operating Activities

Net Profit before Taxation (given) 229,500

Adjustment for Depreciation (WN 2) 83,700

Debenture Interest (150,000x8%x6/12) 6,000

Provision for Doubtful Debts 9,900

Profit/gain on sale of plant (WN 1) (7,500) 92,100

Operating profit before working capital changes 321,600

Increase in Inventory (115,500)

Increase in Trade Receivables (150,000)

Increase in Trade Payables 35,400 (230,100)

Net cash flow from Operating Activities (A) 91,500

Cash Flow from Investing Activities

Purchase of Plant & Machinery (WN 3) (234,000)

Purchase of Trade Investments (141,000)

Sale of machinery 21,000

Net cash flow from Investing Activities (B) (354,000)

Cash Flow from Financing Activities

Proceeds from issue of 8% Debentures (net) 147,000

Interest paid on 8% Debentures (6,000)

Dividends paid in respect of earlier years (90,000)

Net Cash flow from Financing Activities (C) 51,000

Net Increase/(Decrease) in Cash and Cash Equivalents (A+B+C) (211,500)

Working Notes:

1. Profit on sale of Plant = WDV at disposal – sale value

= (54,000-40,500) – 21,000

= 7,500

The Institute of Chartered Accountants of Nepal 19

CAP II Advance Accounting- June 2019

2. Depreciation for current year = 43,200 + 40,500 = 83,700

3. Cash flow towards assets purchase = Increase in Plant & machinery at cost + cost of plant sold

= 180,000 + 54,000 = 234,000

Insurance Claim

Solution 5:

Memorandum Trading Account

(01.04.2075 to 20.10.2075)

Particulars Rs. Particulars Rs.

To Opening stock 240,000 By Sales Rs. (620,000 – 80,000) 540,000

To Purchases Rs. (280,000 + 40,000) 320,000 By Closing stock – Bal. fig. 155,000

To Gross profit – 25% of sales 135,000

695,000 695,000

Stock destroyed by fire:

Rs.

Stock on the date of fire 155,000

Less: Stock salvaged 31,000

Stock destroyed by fire 124,000

Loss of Stock

Insurance Claim Amount of Policy

Value of Stock on the date of fire

Rs. 124,000

Rs. 100,000 Rs. 80,000

Rs. 155,000

Working note:

Stock on 1st Shrawan, 2075 was valued at 10% lower than cost.

Hence, original cost of the stock as on 1st Shrawan, 2075 would be:

Rs. 216,000

100 Rs. 240,000

90

Solution 6:

a. Turnover in last financial year 450,000

Add: 25% increase 112,500

Total turnover 562,500

b. Net profit = 10% of 562,500 = 56,250

c. Total Standing Expenses = 90,000+31,250=121,250

d. Gross profit = Net profit + Standing Charges = 56,250+121,250=177,500

Hence, insurance policy amount should be Rs. 177,500.

The Institute of Chartered Accountants of Nepal 20

CAP II Advance Accounting- June 2019

Contract Accounting:

Solution 7:

Particulars Rs. in crore

Cost of construction of bridge incurred upto 32.3.2075 4.00

Add: estimated future cost 6.00

Total estimated cost of construction 10.00

Contract price (12 crore x 1.05) 12.60 crore

State of completion

Percentage of completion till date to total estimated cost of construction

= (4/10) X 100 = 40%

Revenue and profit to be recognized for the year ended 32.3.2075

Proportion of total contract value recognized as revenue = contract price x % of completion

= Rs. 12.60 crore x 40% = 5.04 crore

Profit for the year ended 32.3.2075 = Rs. 5.04 crore less Rs. 4 crore = 1.04 crore.

Hire Purchase Transactions

Solution 8:

In the books of Sallaghari Corporation

Hire Purchase Trading Account

for the year ended 32nd Ashadh, 2075

Dr. Cr.

Amount Amount

Rs. Rs.

To Hire Purchase Stock 50,000 By Hire Purchase Sales 25,95,000

(20 Rs. 2,500) (W.N. 2)

To Goods sold on Hire 36,00,000 By Stock Reserve 10,000

Purchase (120Rs.30,000) (Rs. 50,000 20%)

To Bad Debts (W.N. 4) 8,000 By Goods sold on Hire Purchase 7,20,000

To Loss on Repossession 12,000 (Rs. 36,00,000 20%)

Less: Instalments not yet By Hire Purchase Stock 10,50,000

due 4,000 8,000 [(650+420+ 140) Rs.

2,500]

To Stock Reserve 2,10,000

(Rs.10,50,000 20%)

To Profit and Loss Account 4,99,000

(Transfer of Profit) ________

43,75,000 43,75,000

Issue of Shares and Debentures

Solution 9:

Books of Pokhara Co. Ltd.

Journal Entries

Bank A/c Dr. 6,000,000

To Share Application A/c 6,000,000

(Being application amount received)

The Institute of Chartered Accountants of Nepal 21

CAP II Advance Accounting- June 2019

Share Application A/c Dr. 6,000,000

To Share Capital A/c 4,000,000

To Bank A/c 1,200,000

To Share Allotment A/c 800,000

(Being application money transferred to share capital,

refunded and excess transferred to allotment )

Share Allotment A/c Dr. 10,000,000

To Share Capital A/c 6,000,000

To Share Premium A/c 4,000,000

(Being allotment amount due)

Bank A/c Dr. 9,016,000

Calls in Arrear A/c Dr. 184,000

To Share Allotment A/c 9,200,000

(Being allotment money received except from Mr. Subash)

Share First Call A/c Dr. 6,000,000

To Share Capital A/c 6,000,000

(Being first call amount due)

Bank A/c Dr. 5,700,000

Calls in Arrear A/c Dr. 300,000

To Share First Call A/c 6,000,000

(Being first call money received except from Mr. Subash

and Mr. Dhiraj)

Share Capital A/c Dr. 320,000

Share Premium a/c Dr. 80,000

To Calls in Arrear A/c 304,000

To Share Forfeiture A/c 96,000

(Being forfeiture of shares of Mr. Subash)

Share Final Call A/c Dr. 3,920,000

To Share Capital A/c 3,920,000

(Being final call amount due)

Bank A/c Dr. 3,800,000

Calls in Arrear A/c Dr. 120,000

To Share Final Call A/c 3,920,000

(Being final call money received except from Mr. Dhiraj)

Share Capital A/c Dr. 600,000

To Calls in Arrear A/c 300,000

To Share Forfeiture A/c 300,000

(Being forfeiture of shares of Mr. Dhiraj)

Bank A/c Dr. 720,000

Share Forfeiture A/c Dr. 80,000

To Share Capital A/c 800,000

(Being re-issue of shares @ 90 to Mr. Gopal as fully paid up)

Share Forfeiture A/c Dr. 268,000

To Capital Reserve A/c 268,000

(Being forfeiture amount transferred to capital Reserve

A/c)

Working Note:

1. No. of Shares applied by Mr. Subash = (240,000/200,000) x 4,000 = 4,800

2. Amount paid my Mr. Subash at the time of application = 4,800 x 20 = 96,000

The Institute of Chartered Accountants of Nepal 22

CAP II Advance Accounting- June 2019

3. Forfeiture amount available for use = full of Mr. Dhiraj (300,000) + half of Mr. Subash (96,000/2) =

348,000

4. Amount Transferred to capital reserve = 348,000 – 80,000 = 266,000

Underwriting of Shares and Debentures

Solution 10:

(a) Statement showing the underwriters’ liability (No. of shares)

Particulars A & Co. B & Co. C & Co.

Gross Liability 120,000 120,000 120,000

Less: Firm underwriting 10,000 10,000 10,000

110,000 110,000 110,000

Less: Marked applications 72,500 84,000 131,000

37,500 26,000 (21,000)

Less: Unmarked applications distributed to A &

Co. and B & Co. in equal ratio (11,250) (11,250) Nil

26,250 14,750 (21,000)

Less: Surplus of C & Co. distributed to A & Co. and

B & Co. in equal ratio (10,500) (10,500) 21,000

Net liability (excluding firm underwriting) 15,750 4,250 Nil

Add: Firm underwriting 10,000 10,000 10,000

Total liability (No. of shares) 25,750 14,250 10,000

(b) Computation of amounts payable by underwriters

Liability towards shares to be subscribed @ 120 per 3,090,000 1,710,000 1,200,000

share

Less: Commission (5% on 1.2 lakhs shares @ 100 each)

600,000 600,000 600,000

Net amount to be paid by the underwriters 2,490,000 1,110,000 600,000

(c) In the Books of Nepal Capital Ltd.

Journal Entries

Particulars Dr. Cr.

Rs. Rs.

Underwriting commission A/c Dr. 1,800,000

To A & Co. A/c 600,000

To B & Co. A/c 600,000

To C & Co. A/c 600,000

(Being underwriting commission on the shares underwritten)

A & Co. A/c Dr. 3,090,000

B & Co. A/c Dr. 1,710,000

C & Co. A/c Dr. 1,200,000

To Equity share capital A/c 5,000,000

To Share premium A/c 1,000,000

(Being shares including firm underwritten shares allotted to

underwriters)

The Institute of Chartered Accountants of Nepal 23

CAP II Advance Accounting- June 2019

Bank A/c Dr. 4,200,000

To A & Co. A/c 2,490,000

To B & Co. A/c 1,110,000

To C & Co. A/c 600,000

(Being the amount received towards shares allotted to

underwriters less underwriting commission due to them)

Incomplete Records

Solution 11:

Trading and Profit and Loss Account

for the year ended 32nd Ashadh, 2075

Rs. Rs.

To Opening Stock 6,10,000 By Sales

To Purchases (W.N. 3) 84,10,000 Cash 73,80,000

To Gross profit c/d 9,30,000 Credit (W.N. 2) 19,20,000 93,00,000

(10% of 93,00,000) By Closing stock 6,50,000

99,50,000 99,50,000

To Sundry expenses (W.N. 6) 5,80,700 By Gross profit b/d 9,30,000

To Discount allowed 36,000 By Discount received 28,000

To Depreciation 15,000

(15% Rs. 1,00,000)

To Net Profit 3,26,300

9,58,000 9,58,000

Balance Sheet as at 32nd Ashadh, 2075

Liabilities Amount Assets Amount

Rs. Rs.

Capital Furniture & Fittings 1,00,000

Opening balance 2,50,000 Less : Depreciation 15,000 85,000

Less : Drawing 2,40,000 Stock 6,50,000

10,000 Trade Debtors 1,52,000

Add : Net profit 3,26,300 3,36,300 Bills receivable 75,000

Bills payable 1,40,000 Unexpired insurance 2,000

Trade creditors 6,10,000 Cash in hand & at bank 1,27,300

Outstanding expenses 5,000

10,91,300 10,91,300

Working Notes :

1. Bills Receivable Account

Rs. Rs.

To Balance b/d 60,000 By Cash 3,40,000

To Trade debtors 3,70,000 By Trade creditors 15,000

(Bills endorsed)

By Balance c/d 75,000

4,30,000 4,30,000

The Institute of Chartered Accountants of Nepal 24

CAP II Advance Accounting- June 2019

2. Trade Debtors Account

Rs. Rs.

To Balance b/d 1,48,000 By Cash/Bank 15,10,000

To Credit sales 19,20,000 By Discount allowed 36,000

(Balancing figure) By Bills receivable 3,70,000

By Balance c/d 1,52,000

20,68,000 20,68,000

3. Memorandum Trading Account

Rs. Rs.

To Opening stock 6,10,000 By Sales 93,00,000

To Purchases (Balancing figure) 84,10,000 By Closing stock 6,50,000

To Gross Profit (10% on sales) 9,30,000

99,50,000 99,50,000

4. Bills Payable Account

Rs. Rs.

To Cash/Bank 8,15,000 By Balance b/d 1,25,000

To Balance c/d 1,40,000 By Creditors (balancing figure) 8,30,000

9,55,000 9,55,000

5. Trade Creditors Account

Rs. Rs.

To Cash/Bank 75,07,000 By Balance b/d 5,80,000

To Discount received 28,000 By Purchases (as calculated 84,10,000

To Bills receivable 15,000 in W.N. 3)

To Bills payable 8,30,000

To Balance c/d (balancing figure) 6,10,000

89,90,000 89,90,000

6. Computation of sundry expenses to be charged to Profit & Loss A/c

Rs.

Sundry expenses paid (as per cash book) 6,20,700

Add : Prepaid expenses as on 31–3–2074 2,000

6,22,700

Less : Outstanding expenses as on 31–3–2074 45,000

5,77,700

Add : Outstanding expenses as on 32–3–2075 5,000

5,82,700

Less : Prepaid expenses as on 32–3–2075 (Insurance paid till Kartik, 2075) 2,000

5,80,700

Ratio Analysis

Solution 12:

A. Application of Ratios for computing missing figures

1. Sales Since GP Ratio and NP Ratio are 40% and 10% of Sales respectively, Other

Expenses debited to P&L Account= 40% - 10% = 30% of Sales.

The Institute of Chartered Accountants of Nepal 25

CAP II Advance Accounting- June 2019

Since Other Expenses + Depreciation debited in P&L A/c = Rs. 25 Lakhs + Rs. 5

Lakhs = Rs. 30 Lakhs, Sales = 30÷ 30% = Rs. 100 Lakhs

2. Gross Profit = 40% of Sales = Rs. 40Lakhs

3. Net Profit = 10% of Sales = Rs. 10 Lakhs

4. Credit Sales Cash Sales to Credit Sales = 16:9.

Hence, Credit Sales = Total Sales × 9/25= 100x9/25 Rs. 36 Lakhs

5. Debtors = Credit Sales × 2 months / 12 months = Rs. 36×2/12= Rs. 6 Lakhs

6. Average Stock = COGS× 2 months ÷ 12 months = (Sales – GP) × 2/12= 60×2/12 = Rs. 10 Lakhs

7 Closing Stock Average Stock = (Opening Stock + Closing Stock) ÷ 2= 10 Lakhs.

Opening Stock = Closing Stock – 4 Lakhs.

On substituting,

(Closing Stock - 4 + Closing Stock) ÷ 2 = 10;

Hence, Closing Stock = Rs.12 Lakhs

Therefore Opening Stock = 12 – 4 = Rs. 8 Lakhs

8. Purchases COGS = Opening Stock + Purchase – Closing Stock .

Since COGS = Sales – GP = 100 – 40 = 60, Opening and Closing Stock are known, on

Substitution, Purchase will be the bal. figure = Rs. 64 Lakhs

9. Creditors = Credit Purchase ×1.5 months ÷12 months

= 64 × 1.5 / 12 = Rs. 8 Lakhs

10. Current Assets Current Ratio = 2.5; Current Assets(CA) ÷Current Liabilities( CL) = 2.5;

Hence, CA= 2.5 CL. Since CL= Creditors = Rs.8 Lakhs,

On substitution, CA = 2.5×8 Lakhs = Rs. 20 Lakhs

11. Fixed Assets = Depreciation ÷ Deprn. Rate = Rs.5 Lakhs ÷20%=Rs.25Lakhs

12. Net Block = Gross Block – Depreciation = Rs. 25 Lakhs – Rs. 5 Lakhs = Rs. 20 Lakhs

13. Cap. Employed = Fixed Assets + Net Working Capital =20+ (20-8) =Rs.32 Lakhs

14. Debentures Capital Employed= Debt. +Equity= Debentures+(Capital + R & S)= Rs. 32 Lakhs,

of which P&L = Rs. 10 Lakhs.

Hence, Debentures + Share Capital = Rs. 22 Lakhs.

Since Debentures to Share Capital = 10%, Debentures

= Rs. 22× 10/ 110 = Rs. 2 Lakhs

1. Trading and Profit and Loss Account for the year ended 32nd Ashadh

Particulars Rs. Lakhs Particulars Rs. Lakhs

To Opening Stock 8 By Sales 100

To Purchases 64 By Closing Stock 12

To Gross Profit c/d 40

Total 112 Total 112

2. Balance Sheet as on 32nd Ashadh

Liabilities Rs. Lakhs Assets Rs. Lakhs

Equity Share Capital 20 Fixed Assets 20

Profit and Loss Account 10 Current Assets

Debentures 2 Debtors 6

Creditors 8 Stock 12

Cash – bal. figure 2

Total 40 Total 40

The Institute of Chartered Accountants of Nepal 26

CAP II Advance Accounting- June 2019

Profit or Loss Pre and Post Incorporation

Solution 13:

Statement showing calculation of profits for pre and post incorporation periods

For the year ended 31.3.2072 (15 months)

Particulars Total Ratio Pre Post

Gross Profit 14,040,000 1:8 1,560,000 12,480,000

Less: Salaries 2,340,000 1:12 180,000 2,160,000

Depreciation 360,000 1:4 72,000 288,000

Advertisement 1,404,000 1:8 156,000 1,248,000

Discount 2,340,000 1:8 260,000 2,080,000

Managing Director’s Salary 180,000 Post - 180,000

Office/showroom rent 1,440,000 Actual 180,000 1,260,000

Miscellaneous office expenses 240,000 1:4 48,000 192,000

Interest paid 1,902,000 Actual 702,000 1,200,000

Goodwill (loss) 38,000 -

Net Profit - 3,872,000

Working note:

Particulars Pre Post

1. calculation of time ratio = 1:4 1st Baisakh to 31.3.2071 1.4.2071 to 31.3.2072

3 months 12 months

2. Calculation of sales ratio = 1:8 3x1 = 3 12 x 2 = 24

3. Calculation of staff salary ratio = 3x1 = 3 12 x 3 = 36

1:12

4. calculation of interest 234,00,000 x 12% for 3 100,00,000 x 12% for 1 year

months Rs. 1200,000

Rs. 702,000

5. Calculation of Rent

(i) additional rent 60,000x9 = 540,000

(ii) regular rent = (1440,000-540000) 900,0000X3/15 = 180,000 900,0000X12/15 = 720,000

= 900,000

Calculation of gross profit = sales – cost of goods sold = 468,00,000-327,60,000 = 140,40,000

Liquidator’s Final Statement

Solution 14:

Liquidator’s Final Statement

Receipts Rs. Rs. Payments Rs. Rs.

Cash at Bank 60,000 Liquidation expenses 4,600

Assets realised:

Sundry Debtors 160,000 Liquidator’s remuneration (W.N. 1) 30,400

Stock 120,000 Debenture holders:

Plant & Machinery 360,000 640,000 10% debentures 200,000

Surplus from Land & Interest accrued (W.N.2) 15,000 215,000

Buildings: Preferential creditors 30.000

Amount realised 340,000 Unsecured creditors 370,000

Less: Secured Preference shareholders:

The Institute of Chartered Accountants of Nepal 27

CAP II Advance Accounting- June 2019

Creditors 100,000 240,000 10% Preference Share

Capital 200,000

Arrear dividend 40,000 240,000

Equity Shareholders

(W.N. 3) :

Rs. 17.50 per share

on 2,000 shares 35,000

Rs. 2.50 per share

on 6,000 shares 15,000 50,000

940,000 940,000

Working Notes:

(1) Liquidator’s remuneration Rs.

3% on Assets realised (3% of Rs. 980,000) 29,400

2% of the amounts distributed among Equity Shareholders

(2/102 × Rs. 51,000) 1,000

30,400

(2) Interest accrued on 10% debentures

Interest accrued as on 31.3.2073 10,000

Interest accrued upto the date of payment

(upto 31st Ashwin, 2073) 5,000

15,000

(3) Amount payable to Equity Shareholders

Equity Share Capital 510,000

Less: Surplus available for Equity Shareholders 50,000

Loss to be borne by them 460,000

Loss per Equity share (Rs. 460,000/8,000) 57.50

Amount payable to Equity shareholders:

Each Equity share of Rs. 75 paid up 17.50

Each Equity share of Rs. 60 paid up 2.50

Accounting for Partnership

Solution 15:

Realization Account

Particulars Rs. Rs. Particulars Rs.

To Sundry assets at book value 790,000 By Creditors 70,000

To Anil's capital – creditors 70,000 By Cash – surrender of policy 84,000

To Partner's capital – profit: By Anil's capital – motor car 14,000

Anil (1/2) 29,100 By Anil's capital – debtors* 110,200

Sunil (3/10) 17,460 By SR Ltd – consideration 640,000

Rahim (1/5) 11,640 58,200

918,200 918,200

* Rs. 116,000 less 5%.

The Institute of Chartered Accountants of Nepal 28

CAP II Advance Accounting- June 2019

Anil's Capital & Current Account

Particulars Rs. Particulars Rs.

To Realisation A/c – motor cars 14,000 By Balance b/d 290,000

To Realisation A/c – debtors 110,200 By Realisation A/c – creditors 70,000

To Shares in SR Ltd. 220,000 By Realisation A/c – profit 29,100

To Cash 44,900

389,100 389,100

Sunil's Capital & Current Account

Particulars Rs. Particulars Rs.

To Shares in SR Ltd. 132,000 By Balance b/d 174,000

To Cash 59,460 By Realisation A/c – profit 17,460

191,460 191,460

Rahim's Capital & Current Account

Particulars Rs. Particulars Rs.

To Shares in SR Ltd. 88,000 By Balance b/d 136,000

To Cash 59,640 By Realisation A/c – profit 11,640

147,640 147,640

SR Ltd.

Balance Sheet as on 1st Shrawan, 2074

Liabilities Rs. Assets Rs. Rs.

Share capital: Fixed assets:

Authorised: Goodwill 146,000

10,000 12% pref. shares of Rs. 20 each 200,000 Premises 40,000

25,000 ordinary shares of Rs. 20 each 500,000 Machinery 140,000

700,000

Issued and paid up: Motor cars 40,000

8,000 12% pref. shares of Rs. 20 each 160,000 Furniture 25,000 391,000

22,000 ordinary shares of Rs. 20 each 440,000 Current assets:

Stock 150,000

Bank balance 48,000 198,000

Preliminary expenses 11,000

600,000 600,000

Working notes:

(i) Purchase consideration:

Rs.

Cash 80,000

Ordinary shares (Rs. 520,000 – Rs. 80,000) 440,000

The Institute of Chartered Accountants of Nepal 29

CAP II Advance Accounting- June 2019

Preference shares – discharge of Anil's loan 120,000

Total 640,000

(ii) Computation of goodwill:

Rs. Rs.

Purchase consideration 640,000

Less: Assets taken over:

Machinery 140,000

Motor cars 40,000

Furniture 20,000

Stock 150,000

Bank balance 144,000 494,000

Goodwill 146,000

(iii) Bank balance:

Rs. Rs.

Bank balance taken over 144,000

Less: Purchase consideration discharged 80,000

Purchase of furniture from Anil 5,000

Formation expenses 11,000 96,000

Balance 48,000

(iv) Preference shares issued:

Rs.

For discharging Anil's loan (Rs. 20 × 6,000) 120,000

For purchasing premises owned by Anil (Rs. 20 × 2,000) 40,000

Total 160,000

(v) Furniture:

Rs.

Taken over from partnership 20,000

Separately purchased Anil's personal furniture 5,000

Total 25,000

Accounting for Non-profit making organization

Solution 16:

Kathmandu Books Circle Society

Income and expenditure account for the year ended Ashadh 31, 2074

Dr. Cr.

Expenditure Amount Incomes Amount

To, Electric charges 7,200 By, Entrance fees 7,500

To, Postage & stationary 5,000 25% of 30000

To, Telephone charges 5,000

To, Rent 88,000 By Membership subscription 200,000

Add: Outstanding 4,000 92,000 Less: Received in Advance (10,000) 190,000

To, Salaries 66,000

Add: Outstanding 3,000 69,000 By, Sale proceeds of paper 1,500

By, Hire of lecture hall 20,000

To, Amortization & By, Interest on securities

8,000

Depreciation (WN-1) (WN-2)

Electrical fittings 15,000 Add: Receivable 500 8,500

The Institute of Chartered Accountants of Nepal 30

CAP II Advance Accounting- June 2019

Furniture 5,000

By, Deficit -excess of

Books 46,000 66,000 16,700

expenditure over Income

244,200 244,200

Kathmandu Books Circle Society

Balance sheet as on Ashadh 31, 2074

Liabilities Amount Assets Amount

Capital fund 793,000 Electrical fittings 150,000

Add: Entrance fees

22,500 Less: Depreciation (15,000) 135,000

capitalization

Less: Excess of expenses

(16,700) 798,800 Furniture 50,000

over income

Less: Depreciation (5,000) 45,000

Outstanding Expense Digital Books 460,000

Rent 4,000 Less: Amortization (46,000) 414,000

Salaries 3,000 7,000

Investment in Securities 190,000

Membership subscription in advance 10,000 Accrued interest 500 190,500

Cash at bank 20,000

- Cash in hand 11,300

815,800 815,800

Working Notes

1 Depreciation & Amortization 2 Interest on securities

Electrical fittings @10% 15,000 Interest @5% p.a. on 150,000 full year 7,500

Furniture @10% 5,000 Interest @5% p.a. on 40,000 half year 1,000

Digital Books @10% 46,000 Total 8,500

Total 66,000 Less: Received (8,000)

Receivable 500

Accounting for Banks

Solution 17:

As per the provision of the NRB Directives, a bank can provide credit up to 25% of its core capital to a single

party. This limit is called the single obligor limit (SOL). While calculating the SOL, core capital of previous

quarter shall be taken as base. In case any excess credit than SOL, additional 100% provision shall be made

for such excess credit amount.

Before calculating the provision amount, SOL of the bank shall be tested upon.

Computation of SOL and credit amount in excess of SOL

Particulars Amount

Core Capital

Paid up Equity Share Capital 171,010

General reserve 155,432

Retained earnings 87,886

Un-audited current year cumulative profit 31,991

Less: Deferred Revenue expenses (2,884)

Total Core capital 443,435

The Institute of Chartered Accountants of Nepal 31

CAP II Advance Accounting- June 2019

Single obligor limit ( 25% of the core capital) 110,859

Loan to single party 125,000

Loan in excess of SOL 14,141

Computation of loan loss provision amount as per NRB Directive

Computation of Loan Loss Provision amount

Categories Loan Amt Provision Provision

Rate Amount

Not due or <=3 months Pass 1,673,000 1% 16,730

>1 months <= 3 months Watch list 100,000 5% 5,000

>3 months <= 6 months Sub-standard 13,612 25% 3,403

>6 months <= 12 months Doubtful 782 50% 391

>12 months Loss 2,198 100% 2,198

Total 1,689,592 27,722

Additional provision for loan in excess of SOL 14,141

Total Provision amount 41,863

Mechi Bank Ltd

Movement in Provision Amount

For Third Quarter of Fiscal Year 2074/75

Amount in NPR

Particulars Amount

Opening Provision amount 16,983

Closing Provision amount 41,863

Movement in provision amount (addition during the quarter) 24,880

Accounting for Departments

Solution 18:

Departmental Profit & Loss (Adjustment) Account

Particulars A Rs. B Rs. C Rs. Particulars A Rs. B Rs. C Rs.

To Services from A 9,240 4,950 By Services from A to B 9,240

To Supplies from B 35,760 6,480 By Services from A to C 4,950

To Supplies from C 400 5,600 By Services from B to A 35,760

To Charge in respect of

staff 4,400 1,100 By Services from B to C 6,480

To Increase in Dept.

Profit 30,700 By Services from C to A 400

(or Decrease in Dept.

Loss) By Services from C to B 5,600

By Recovery in respect of

Staff 1,100 4,400

By Decrease in Dept.

The Institute of Chartered Accountants of Nepal 32

CAP II Advance Accounting- June 2019

Profit

(or Increase in Dept.

Loss) 25,270 5,430

40,560 46,640 11,430 40,560 46,640 11,430

Notes:

10% has been added to cost of A dept. services to find out transfer price for B and C. 20% has been added to

costs of supplies of B dept. to find out transfer price for A and C dept.

Working Note:

Statement showing transfer price

From Dept. To Dept. Cost/ Value (Rs.) Transfer Price (Rs.)

A B 8,400 9,260

A C 4,500 4,950

B A 29,800 35,760

B C 5,400 6,480

C A 400 400

C B 5,600 5,600

Nepal Accounting Standards (NAS)

Solution 19:

(a) As per NAS-2 Inventories, inventory should be valued at the lower of cost and net realizable

value. Inventories should be written down to net realizable value on an item-by-item basis in

the given case:

Items Historical Cost Net Realizable Value Valuation of Closing Stock

(Rs. in Lakhs) (Rs. in Lakhs) (Rs. in Lakhs)

A 40.00 28.00 28.00

B 32.00 32.00 32.00

C 16.00 24.00 16.00

88.00 84.00 76.00

Hence, closing stock will be valued at Rs. 76 lakhs

(b). An asset is recognized in the balance sheet when it is probable that the future economic benefits

will flow to the enterprise and the asset has a cost or value that can be measured reliably.

An asset is not recognized in the balance sheet when expenditure has been incurred for which it is

considered improbable that economic benefits will flow to the enterprise beyond the current

accounting period. Instead such a transaction results in the recognition of an expense in the

income statement. This treatment does not imply either that the intention of management in

incurring expenditure was other than to generate future economic benefits for the enterprise or

that management was misguided. The only implication is that the degree of certainty that

economic benefits will flow to the enterprise beyond the current accounting period is insufficient

to warrant the recognition of an asset.

c). As per NAS-12, Revenue from Sale of goods shall be recognized when all the following conditions

have been satisfied:

i. The entity has transferred to the buyer the significant risks and rewards of ownership of

goods;

The Institute of Chartered Accountants of Nepal 33

CAP II Advance Accounting- June 2019

ii. The entity retains neither continuing managerial involvement to the degree usually

associated with ownership nor effective control over the goods sold;

iii. The amount of revenue can be measured reliably;

iv. It is probable that the economic benefits associated with the transaction will flow to the

entity; and

v. The cost incurred or to be incurred in respect of the transaction can be measured reliably.

d). As per NAS-16 ‘ Property, Plant & Equipment’, the depreciation method applied to an asset shall

be reviewed at least at each financial year end and, if there has been a significant change in the

expected pattern of consumption of the future economic benefits embodied in the asset, the

method shall be changed to reflect the changed pattern. Such a change shall be accounted for as

a change in an accounting estimate in accordance with NAS 08.

As per NAS ‘Accounting Policies, Changes in Accounting Estimates & Errors’, changes in

accounting estimates shall be adjusted prospectively that means the effect of a change in an

accounting estimate shall be included in the determination of net profit or loss in:

(a) The period of the change, if the change affects the period only; or

(b) The period of the change and future periods, if the change affects both.

In the given case, the company can change the method of depreciation from year 2074-75 if the

conditions set aside in above paragraph have been fulfilled.

Depreciation for year 2074-75 and net book value of Machine as on 32.3.75 after Rs.

effect of the change

Book value of Machinery as on 01.04.2074 2,05,000

Current year depreciation as per new method (WDV) (205,000 X 20%) 41,000

Net Book value as on 32.03.2075 (205,000–41,000) 1,64,000

Working Note:

Book Value of Machinery and Depreciation under SLM as on 01-04-2074

Rs.

Cost of Machine purchased on 01.04.2072 3,25,000

Less: Residual Value 25,000

Depreciable amount 3,00,000

Useful life of Machine 5Years

Depreciation for 2 Years (Rs.3,00,000x2/5) 1,20,000

Book value as on01.04.2074 2,05,000

e). ‘Other Comprehensive Income’s per NAS

Other comprehensive income comprises items of income and expenses (including reclassification

adjustments) that are not recognized in profit and loss as required or permitted by other NFRSs.

The components of other comprehensive income include;

1. changes in revaluation surplus

2. re-measurements of defined benefit plans

3. gains and losses arising from translating the financial statements of a foreign operation

The Institute of Chartered Accountants of Nepal 34

CAP II Advance Accounting- June 2019

4. gains and losses from investments in equity instruments measured at fair value through other

comprehensive income in accordance NFRS related with financial instruments

5. the effective portion of gains and losses on hedging instruments in a cash flow hedge

6. for particular liabilities designed as at fair value through profit or loss, the amount of the

change in the fair value that is attributable to changes in the liability’s credit risk.

Solution 20:

(a). Leases

A lease is a contract calling for the lessee (user) to pay the lessor (owner) for use of the property.

A rental agreement is a lease in which the asset is tangible property. Leases for intangible

property can include use of a computer program (similar to a license, but with different

provisions), or use of a radio frequency (such as a contract with a cell-phone provider). It is a

written agreement under which a property owner allows a tenant to use the property for a

specified period of time and rent. The lease will either provide specific provisions regarding the

responsibilities and rights of the lessee and lessor, or there will be automatic provisions as a result

of local law. In general, by paying the negotiated fee to the lessor, the lessee (also called a tenant)

has possession and use (the rental) of the leased property to the exclusion of the lessor and all

others except with the invitation of the tenant.

(b). Re-insurance

In general insurance there are risks which, because of their magnitude or nature, one insurance

company cannot afford to cover, e.g., aviation insurance. Generally, in such cases, an insurance

company insures the whole risk itself and lays off the amount it has accepted to other insurance of

reinsurance companies, retaining only that much risk which it can absorb.

A reinsurance transaction may thus be defined as an agreement between a 'ceding company' and

a 're-insurer' whereby the former agrees to 'cede' and the later agrees to accept a certain specified

share of risk or liability upon terms as set out in the agreement.

(c). Contingent Assets

An entity shall not recognize a contingent asset.

1. Contingent assets usually arise from unplanned or other unexpected events that give

rise to the possibility of an inflow of economic benefits to the entity. An example is a

claim that an entity is pursuing through legal processes, where the outcome is uncertain.

2. Contingent assets are not recognized in financial statements since this may result in the

recognition of income that may never be realized. However, when the realization of

income is virtually certain, then the related asset is not a contingent asset and its

recognition is appropriate.

3. A contingent asset is disclosed, as required by paragraph 89, where an inflow of

economic benefits is probable.

4. Contingent assets are assessed continually to ensure that developments are appropriately

reflected in the financial statements. If it has become virtually certain that an inflow of

economic benefits will arise, the asset and the related income are recognized in the

financial statements of the period in which the change occurs. If an inflow of economic

benefits has become probable, an entity discloses the contingent asset.

The Institute of Chartered Accountants of Nepal 35

CAP II Advance Accounting- June 2019

(d). Non Banking Assets (NBA)

Bank can sale the property which has taken as collateral security, against loan and advances given

to the borrower in case of default, to recover outstanding principal and interest amount. If such

properties couldn’t be sold through auction then the bank can assume the properties in its own

name. Such assumed property is called ‘Non Banking Asset (NBA)’. Recognition of the NBA should

be done at lower of total outstanding amount (principal plus accrued interest thereon as on the

date of assume) and prevailing market value of the properties. The difference between the two

should be recorded as an expense in the year of assume. As per the requirement of the Unified

Directives of Nepal Rastra Bank (NRB), 100% provision should be provided to total value of NBA

from the year of assume. It means institution shouldn’t hold NBA.

(e) Accounting Estimates

As a result of the uncertainties in business activities, many financial statement items cannot be

measured with precision but can only be estimates. These are called accounting estimates.

Therefore, the management makes various estimates and assumptions of assets, liabilities,

incomes and expenses as on the date of preparation of financial statements. This process of

estimation involves judgments based on the latest information available.

Examples of estimation in some fields are:

i) Estimation of useful life of depreciable assets.

ii) Estimation of provision to be made for bad and doubtful debts.

(f). Components of financial statements

Following are components of financial statements comprises:

(a) a statement of financial position as at the end of the period;

(b) a statement of profit or loss and other comprehensive income for the period;

(c) a statement of changes in equity for the period;

(d) a statement of cash flows for the period;

(e) notes, comprising significant accounting policies and other explanatory information;

(g). Watch list in Loan loss provisioning

Nepal Rastra Bank (NRB) has formulated a new category of loan for provisioning purposes. As per

the NRB’s Rule, all loans are required to be classified into 5 different categories including Watch

List whereby 5% of the total loan is required to be kept as provisioning though the provision can

be reversed when the loan becomes performing later. Provision made for watch list loans is a

general loan loss provision. As per the circular issued by NRB, the loans having the following

characteristics are to be classified as Watch List loans:

1. If interest and principal repayments are overdue for more than a month.

2. Short term/Working Capital Loans that are not renewed on time and are renewed on

temporary basis.

3. Loan and advances to customers/ group of customers who have been categorized as non

performing by other banks and financial institutions.

The Institute of Chartered Accountants of Nepal 36

CAP II Advance Accounting- June 2019

4. Firms/Companies/Organizations having negative net worth or net loss though interest and

principal are served on regular basis.

5. Loan and advances having multiple banking exposure more than Rs. 1 billion and have not

entered into consortium agreement.

6. Specifically specified by NRB after due inspection.

(h). Government Accounting System in Nepal

Government Accounting System in Nepal is generally on Cash Basis. It has set chart of accounts

under which revenue and expenditure are accounted for. It follows double entry system;

however, do not follow the mercantile system of accounting. Government accounting system

broadly classifies expenditure into administrative and development expenses. Accounting system

followed by the government differentiates Capital expenditures and revenue expenditure in its

subsidiary records. Office of the Financial Comptroller General specifies the chart of accounts

under which all the government revenue and expenditure are to be accounted for.

(i). Outsourcing the Accounting function to third party

Recently a growing trend has developed for outsourcing the accounting function to a third party.

The consideration for doing this is to save cost and to utilize the expertise of the outsourced

party. The third party maintains the accounting software and the client data, does the processing

and hands over the report from time to time.

Benefits of outsourcing the accounting function to third party:

1. The organization that outsources its accounting function is able to save time to concentrate

on the core areas of business activity.

2. The organization is able to utilize the expertise of the third party in undertaking the

accounting work.

3. Storage and maintenance of the data is in the hand of professional people.

4. The organization is not bothered about people leaving the organization in key accounting

positions. The proposition is proving to be economically and more sensible as they do not

have train the people again. Hence the training cost is saved.

(j) Compilation of accounting information for agricultural farm

Agricultural activities are carried on mostly in an unorganized manner. Generally, the farmer does

not have office and also does not find time for day to day record keeping. The transactions and

events of such agricultural activities are also not supported by vouchers or other documents in

most of the cases. Therefore, it is essential to maintain a Diary to record happenings of the day.

This Diary becomes the source document for record keeping. The following registers are required

for compilation of the accounting information of agricultural activities:

i. Cash Book: to record cash transactions.

ii. Fixed Assets Register: to record details of fixed assets such as description of assets, cost

of purchases/construction/generation, disposal, depreciation and balance.

iii. Loan Register: to record borrowings from bank, cooperatives and other agencies trade

creditors along with interest paid or payable.

iv. Stock Register: to record details of input, output and by-product – receipts, utilization,

wastage and balance.

v. Debtors and Creditors Register: to record credit transactions classified by parties involved.

The Institute of Chartered Accountants of Nepal 37

CAP II Advance Accounting- June 2019

vi. Register for National Transactions: to record transactions between farm and farm

household.

vii. Cost Analysis Register: to record crop-wise input and output inclusive of apportionment of

common costs and finding out crop profit.

The Institute of Chartered Accountants of Nepal 38

Paper 2:

Audit And Assurance

CAP II Audit and Assurance- June 2019

REVISION QUESTION

Question No 1:

Explain the process of filing complaints against member and members holding certificate of

practice.

Question No 2:

As an auditor, comment on the following situations/statements:

You are a partner in Ashok Kumar & Associates, Chartered Accountants. You are approached by Mr

Yogendra, the managing director of Nepal Brewery Ltd, who asks your firm to become auditors of his

company. In return for giving you this appointment Mr Yogeendra says that he will expect your firm

to waive 50 per cent of your normal fee for the first year's audit. The existing auditors, Mukul

Pandey & Associates, have not resigned but Mr Yogendra informs you that they will not be re-

appointed in the future.

What action should Ashok Kumar & Associates take in response to the request from Mr

Yogedra to reduce their first year's fee by 50 per cent?

Is Mukul Pandey & Associates within their rights in not resigning when they know Mr

Yogendra wishes to replace them? Give reasons for your answer.

Question No 3

BKS & Associates, a chartered accountant firm is yet to receive their professional fee from Ms Nepal

Liquor Ltd. In spite of the overdue of the fees for past 3 years, it has yet again appointed the same

firm to conduct the annual audit of the organization. In the light of the code of conduct or the

pronouncement from the ICAN, is it appropriate for the firm to continue the engagement. Explain.

Question No 4:

Mr. Nabin, the partner of the firm Prabin & Associates, says that since he has formally e-mailed the

audit opinion along with the financial statements to the company as accepted therefore he does not

require signing the audit report. Comment.

Question No 5:

Pink Pvt. Ltd., manufacturing noodles, has valued at the year end its closing stock of packed finished

goods for which firm sales contracts have been received, at realizable value inclusive of profit and

cash incentive. As at the year end, the ownership of the goods has not been transferred to the

buyers.

Question No 6:

Distinguish between Audit Reports and Certificates:

Question No 7:

The internal auditor of the company has been asked by the managing director of the company to

ensure that no qualifications are made by the statutory auditor in his report. What are the points

that need to be examined and reported to the managing director by the chief of internal audit in

respect of the following items:

I. Fixed assets:

II. Inventory; and

III. Loans granted or taken

The Institute of Chartered Accountants of Nepal 40

You might also like

- Chap 6Document27 pagesChap 6Basant OjhaNo ratings yet

- Cash ManagementDocument14 pagesCash ManagementSushant MaskeyNo ratings yet

- Suggested - Answer - CAP - II - June - 2011 4Document64 pagesSuggested - Answer - CAP - II - June - 2011 4Dipen Adhikari100% (1)

- Revision Test Paper CAP II Dec 2017Document163 pagesRevision Test Paper CAP II Dec 2017Dipen AdhikariNo ratings yet

- Chap 3Document56 pagesChap 3Basant OjhaNo ratings yet

- Not For Profit OrganizationDocument69 pagesNot For Profit OrganizationDristi SaudNo ratings yet

- Corporate Law RTP CAP-II June 2016Document18 pagesCorporate Law RTP CAP-II June 2016Artha sarokar100% (1)

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsDocument158 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.No ratings yet

- CAP III - Suggested Answer Papers - All Subjects - June 2019 PDFDocument133 pagesCAP III - Suggested Answer Papers - All Subjects - June 2019 PDFsantosh thapa chhetriNo ratings yet

- Suggested - Answer - CAP - II - June - 2010 2Document85 pagesSuggested - Answer - CAP - II - June - 2010 2Dipen AdhikariNo ratings yet

- Revision - Test - Paper - CAP - II - June - 2017 9Document181 pagesRevision - Test - Paper - CAP - II - June - 2017 9Dipen AdhikariNo ratings yet

- CAP II Scanner Corporate LawDocument121 pagesCAP II Scanner Corporate LawEdtech NepalNo ratings yet

- TYBAF UnderwritingDocument49 pagesTYBAF UnderwritingJaimin VasaniNo ratings yet

- PCC 2008 NPO QuestionDocument10 pagesPCC 2008 NPO QuestionVaibhav MaheshwariNo ratings yet

- Problem 5: XY LTDDocument4 pagesProblem 5: XY LTDAF 1 Tejasri PamujulaNo ratings yet

- CA IPCC Accounting Guideline Answers May 2015Document24 pagesCA IPCC Accounting Guideline Answers May 2015Prashant PandeyNo ratings yet

- Practice Accounts Prime PDFDocument56 pagesPractice Accounts Prime PDFShraddha NepalNo ratings yet

- CA Inter Cost Important Questions For CA Nov'22Document93 pagesCA Inter Cost Important Questions For CA Nov'2202 Tapasvee ShahNo ratings yet

- Paper - 1: AccountingDocument18 pagesPaper - 1: AccountingJerry HuffmanNo ratings yet

- CHARTERED ACCOUNTANCY PROFESSIONAL CAP-II REVISION TEST PAPERDocument21 pagesCHARTERED ACCOUNTANCY PROFESSIONAL CAP-II REVISION TEST PAPERbinu100% (1)

- Bos 24780 CP 5Document114 pagesBos 24780 CP 5NmNo ratings yet

- Departmental Accounting ProblemsDocument12 pagesDepartmental Accounting ProblemsRajesh NangaliaNo ratings yet

- Branch AccountsDocument4 pagesBranch Accountsnavin_raghuNo ratings yet

- Advanced Accounting SolutionsDocument75 pagesAdvanced Accounting SolutionsDipen AdhikariNo ratings yet

- Accounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of IndiaDocument53 pagesAccounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of IndiaHarikrishna100% (1)

- Direct Materials APFL Uses A Weighted Average Method For The Pricing of Materials IssuesDocument5 pagesDirect Materials APFL Uses A Weighted Average Method For The Pricing of Materials IssuesAbimanyu ShenilNo ratings yet

- Investment AccountDocument2 pagesInvestment AccountQuestionscastle Friend67% (3)

- Department AccountsDocument9 pagesDepartment Accountssridhartks100% (1)

- Financial AccountingDocument60 pagesFinancial AccountingSurajNo ratings yet

- Chartered Accountancy Professional CAP-II TitleDocument104 pagesChartered Accountancy Professional CAP-II TitleBAZINGANo ratings yet

- Illustrations AmalgamationDocument4 pagesIllustrations Amalgamationajay2741100% (1)

- Chapter - 5: Toppers Institute N.P.O.-QuestionsDocument32 pagesChapter - 5: Toppers Institute N.P.O.-QuestionsVivek kumarNo ratings yet

- Compiler CAP II Cost AccountingDocument187 pagesCompiler CAP II Cost AccountingEdtech NepalNo ratings yet

- Partnership PDFDocument28 pagesPartnership PDFBasant OjhaNo ratings yet

- Graded Illustrations on Capital Budgeting TechniquesDocument57 pagesGraded Illustrations on Capital Budgeting TechniquesVishesh GuptaNo ratings yet

- Decemeber 2020 Examinations: Suggested Answers ToDocument41 pagesDecemeber 2020 Examinations: Suggested Answers ToDipen AdhikariNo ratings yet

- Accounts Ques Nov06Document48 pagesAccounts Ques Nov06api-3825774No ratings yet

- Profit Prior to Incorporation AccountsDocument7 pagesProfit Prior to Incorporation AccountsParul Bhardwaj VaidyaNo ratings yet

- Suggested Answer CAP II June 2018Document128 pagesSuggested Answer CAP II June 2018Pradeep Bhattarai67% (3)

- LEVERAGE Online Problem SheetDocument6 pagesLEVERAGE Online Problem SheetSoumendra RoyNo ratings yet

- Selling Goods Through Agents: Consignment Accounts ExplainedDocument43 pagesSelling Goods Through Agents: Consignment Accounts ExplainedSWAPNA IS FUNNYNo ratings yet

- Corporate Accounting ProblemDocument6 pagesCorporate Accounting ProblemparameshwaraNo ratings yet

- Suggested Answer Paper CAP III Dec 2019Document142 pagesSuggested Answer Paper CAP III Dec 2019Roshan PanditNo ratings yet

- Underwriting of Shares & Debentures - CWDocument32 pagesUnderwriting of Shares & Debentures - CW19E1749 BALAJI MNo ratings yet

- 11 CaipccaccountsDocument19 pages11 Caipccaccountsapi-206947225No ratings yet

- Coc Departmental Accounting Ca/Cma Santosh KumarDocument11 pagesCoc Departmental Accounting Ca/Cma Santosh KumarAyush AcharyaNo ratings yet

- Fire Insurance ClaimsDocument43 pagesFire Insurance ClaimsArshad Mohd100% (1)

- Hire Purchase PeqDocument21 pagesHire Purchase PeqRishikaNo ratings yet

- Scanner CAP II Income Tax VATDocument162 pagesScanner CAP II Income Tax VATEdtech NepalNo ratings yet

- Chapter # 6 Departmental AccountDocument36 pagesChapter # 6 Departmental AccountRooh Ullah KhanNo ratings yet

- Adv Accounts - AmalgamationDocument31 pagesAdv Accounts - Amalgamationmd samser50% (2)

- CS Exec - Prog - Paper-2 Company AC Cost & Management AccountingDocument25 pagesCS Exec - Prog - Paper-2 Company AC Cost & Management AccountingGautam SinghNo ratings yet

- Advanced Accounts 1 PDFDocument304 pagesAdvanced Accounts 1 PDFJohn Louie NunezNo ratings yet

- Solutions To Text Book Exercises: Non-Trading ConcernsDocument12 pagesSolutions To Text Book Exercises: Non-Trading ConcernsM JEEVARATHNAM NAIDUNo ratings yet

- Non Profitable Organs at IonDocument12 pagesNon Profitable Organs at IonAMIN BUHARI ABDUL KHADERNo ratings yet

- 123 - AS Question Bank by Rahul MalkanDocument182 pages123 - AS Question Bank by Rahul MalkanPooja GuptaNo ratings yet

- Suggested Answer CAP II December 2016Document88 pagesSuggested Answer CAP II December 2016Nirmal ShresthaNo ratings yet

- Class Problem: 2Document7 pagesClass Problem: 2Riad FaisalNo ratings yet

- Sample Question Paper Accountancy (055) : Class XII: 2017-18Document15 pagesSample Question Paper Accountancy (055) : Class XII: 2017-18AvinashNo ratings yet

- Cap III Group I RTP Dec 2023Document111 pagesCap III Group I RTP Dec 2023meme.arena786No ratings yet

- Insurance ActDocument29 pagesInsurance ActMr. Shopper NepalNo ratings yet

- Finance Suggested Short Notes CompilationDocument15 pagesFinance Suggested Short Notes CompilationbinuNo ratings yet

- Advanced Auditing & Assurance Trend AnalysisDocument2 pagesAdvanced Auditing & Assurance Trend AnalysisbinuNo ratings yet

- NAS 17Document17 pagesNAS 17binuNo ratings yet

- WHT, Advance Tax & Others (CAP II)- Summary NoteDocument10 pagesWHT, Advance Tax & Others (CAP II)- Summary NotebinuNo ratings yet

- Interim Reporting Nas 34Document34 pagesInterim Reporting Nas 34binuNo ratings yet

- Ind As 19Document86 pagesInd As 19binuNo ratings yet

- Paper 1 Advaned Financial ReportingDocument691 pagesPaper 1 Advaned Financial ReportingShruti DahalNo ratings yet

- Steps For Accessing The Recorded Videos From NBELS For Students of Danfe CollegeDocument1 pageSteps For Accessing The Recorded Videos From NBELS For Students of Danfe CollegebinuNo ratings yet

- Income Tax 2074-75 TransDocument9 pagesIncome Tax 2074-75 TransbinuNo ratings yet

- Name: Date of Birth (DOB) : Gender: Permanent Address: Current Address: Contact NoDocument2 pagesName: Date of Birth (DOB) : Gender: Permanent Address: Current Address: Contact NobinuNo ratings yet

- Income Tax 2075-2076Document8 pagesIncome Tax 2075-2076binuNo ratings yet

- 2021 IfsDocument210 pages2021 IfssimonnyinyisanNo ratings yet

- AFR Consolidation TrendDocument1 pageAFR Consolidation TrendbinuNo ratings yet

- Overhead ControlDocument1 pageOverhead ControlbinuNo ratings yet

- Budget Highlights - Crowe Nepal (78-79)Document72 pagesBudget Highlights - Crowe Nepal (78-79)binuNo ratings yet

- Deepak Kumar Yadav ProposalDocument15 pagesDeepak Kumar Yadav ProposalbinuNo ratings yet

- Service CostingDocument6 pagesService Costingbinu100% (1)

- Non Integrated AccountingDocument4 pagesNon Integrated AccountingbinuNo ratings yet

- Finance Act Vs Ordinance Nepal - 78-79 (Final)Document24 pagesFinance Act Vs Ordinance Nepal - 78-79 (Final)binuNo ratings yet

- Overhead 3Document3 pagesOverhead 3Prabin sthaNo ratings yet

- Internal Reco Dec 2020Document12 pagesInternal Reco Dec 2020binuNo ratings yet

- Dissolutioni of Partnership FirmDocument69 pagesDissolutioni of Partnership FirmbinuNo ratings yet

- Nsa 520 SM UpdatedDocument8 pagesNsa 520 SM UpdatedbinuNo ratings yet

- Nsa 230 Application Material UpdatedDocument12 pagesNsa 230 Application Material UpdatedbinuNo ratings yet

- Investment For Cap 11Document8 pagesInvestment For Cap 11binuNo ratings yet

- UnlockedDocument45 pagesUnlockedmanojNo ratings yet

- Isa 706Document18 pagesIsa 706Jong de JavuNo ratings yet

- Audit Commintee and Corporate GovernanceDocument7 pagesAudit Commintee and Corporate GovernancebinuNo ratings yet

- 44614bos34430pmcp2 PDFDocument16 pages44614bos34430pmcp2 PDFsuraj doogarNo ratings yet

- Income-Tax-Calculator 2023-24Document8 pagesIncome-Tax-Calculator 2023-24AlokNo ratings yet

- Adam Arvidsson Brands, Meaning and Value in Media Culture.Document2 pagesAdam Arvidsson Brands, Meaning and Value in Media Culture.Silvina Tatavitto0% (1)

- Culpable Homicide Section 299 and 300 of IPCDocument8 pagesCulpable Homicide Section 299 and 300 of IPCdinoopmvNo ratings yet

- DWM - Basic - Updated - R1 (Autosaved)Document27 pagesDWM - Basic - Updated - R1 (Autosaved)lataNo ratings yet

- Electrical MentorDocument3 pagesElectrical Mentoresk1234No ratings yet

- Mariolis y Tsoulfidis (2016) Modern Classical Economics and RealityDocument253 pagesMariolis y Tsoulfidis (2016) Modern Classical Economics and RealityJesús Moreno100% (1)

- Regulations & Syllabus - Executive Mba: © ONLINE CAMPUS, Bangalore - 79 WebsiteDocument12 pagesRegulations & Syllabus - Executive Mba: © ONLINE CAMPUS, Bangalore - 79 WebsitepunNo ratings yet

- Malaysia Sewerage Industry Guideline Volume 1Document281 pagesMalaysia Sewerage Industry Guideline Volume 1Asiff Razif100% (1)

- HE 100 7 Educ GoalsDocument2 pagesHE 100 7 Educ GoalsMavis Li Liao100% (1)

- 2022-02-03 Adidas Global Supplier ListDocument179 pages2022-02-03 Adidas Global Supplier ListTrần Đức Dũng100% (1)

- Computer Network Applications and UsesDocument31 pagesComputer Network Applications and Usessandhya bhujbalNo ratings yet

- PR2012Mar8 - Leveraging Success From North East Asia To South East AsiaDocument2 pagesPR2012Mar8 - Leveraging Success From North East Asia To South East AsiaMrth ThailandNo ratings yet

- Indian Grocery Translations - English to TamilDocument8 pagesIndian Grocery Translations - English to TamilmkNo ratings yet

- Ethical Theories and Principles in Business EthicsDocument4 pagesEthical Theories and Principles in Business EthicsMuhammad Usama WaqarNo ratings yet

- In The Court of Hon'Ble District Judge Pune, at Pune CAVEAT APPLICATION NO. - OF 2012Document2 pagesIn The Court of Hon'Ble District Judge Pune, at Pune CAVEAT APPLICATION NO. - OF 2012AniketNo ratings yet

- GMRC 5 - 4th Quarter ExaminationDocument12 pagesGMRC 5 - 4th Quarter ExaminationTeacher IanNo ratings yet

- Shooting An ElephantDocument2 pagesShooting An ElephantShilpaDasNo ratings yet

- BMA5108 - Technopreneurship Course Outline: Aims and ObjectivesDocument9 pagesBMA5108 - Technopreneurship Course Outline: Aims and ObjectivesCydney Amodia TevesNo ratings yet

- The Analysis of Code Mixing in Short StoryDocument13 pagesThe Analysis of Code Mixing in Short StoryDharWin d'Wing-Wing d'AriestBoyz100% (1)

- Creating New Market SpaceDocument5 pagesCreating New Market SpacePriyank BavishiNo ratings yet

- Forced Removal: The Division, Segregation, and Control of The People of South AfricaDocument96 pagesForced Removal: The Division, Segregation, and Control of The People of South Africas_annaNo ratings yet

- Indian Initiatives in Traceability Approaching Towards Single Window CertificationDocument55 pagesIndian Initiatives in Traceability Approaching Towards Single Window CertificationAman KhannaNo ratings yet

- Application For Admission To Master of Computer Applications (MCA) COURSES, KERALA: 2010-2011Document5 pagesApplication For Admission To Master of Computer Applications (MCA) COURSES, KERALA: 2010-2011anishbaiNo ratings yet

- CyberOps Associate - CA - Lab Answers Archives - InfraExam 2022Document4 pagesCyberOps Associate - CA - Lab Answers Archives - InfraExam 2022arunshanNo ratings yet

- Burwood Council LSPS Summary OnlineDocument3 pagesBurwood Council LSPS Summary OnlineDorjeNo ratings yet

- The Last Psychiatrist Vol 86Document197 pagesThe Last Psychiatrist Vol 86Vegawuya PisoaraNo ratings yet

- IBAs in Timor-Leste Low ResDocument90 pagesIBAs in Timor-Leste Low ResInug WaeNo ratings yet

- 2022-2023 UA Room & Board RatesDocument1 page2022-2023 UA Room & Board RatesKiranvarma KakarlapudiNo ratings yet

- Framework of Understanding Taxes in The Philippines-1Document9 pagesFramework of Understanding Taxes in The Philippines-1Mergierose DalgoNo ratings yet

- Smoke Values and Cut-Off Speeds Per Engine Type: en-GBDocument7 pagesSmoke Values and Cut-Off Speeds Per Engine Type: en-GBruanNo ratings yet