Professional Documents

Culture Documents

Angeles City Vs Angeles City Electric Corporation and RTC Branch 57 GR No. 166134, June 29, 2010 Facts

Angeles City Vs Angeles City Electric Corporation and RTC Branch 57 GR No. 166134, June 29, 2010 Facts

Uploaded by

Cj GarciaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Angeles City Vs Angeles City Electric Corporation and RTC Branch 57 GR No. 166134, June 29, 2010 Facts

Angeles City Vs Angeles City Electric Corporation and RTC Branch 57 GR No. 166134, June 29, 2010 Facts

Uploaded by

Cj GarciaCopyright:

Available Formats

ANGELES CITY vs ANGELES CITY ELECTRIC CORPORATION

AND RTC BRANCH 57

GR No. 166134, June 29, 2010

FACTS:

Angeles Electric Corporation (AEC) was granted a legislative franchise under RA

4079 to construct, maintain and operate an electric light, heat, and power system for the

purpose of generating and distributing electric light, heat, and power for sale in Angeles

City. Pursuant to Section 3-A thereof, AEC’s payment of franchise tax for gross

earnings from electric current sold was in lieu of all taxes, fees and assessments.

However, PD 551 came about and reduced the franchise tax of electric franchise

holders to 2% of their gross receipts from the sale of electric current and from

transactions incident to the generation, distribution and sale of electric current.

When RA 7160 (Local Government Code) was passed into law, it imposed tax on

businesses enjoying franchise, and in accordance, the Sangguniang Panlunsod of

Angeles City enacted Tax Ordinance No. 33, S-93, otherwise known as the Revised

Revenue Code of Angeles City (RRCAC). A petition was then filed with the

Sangguniang Panlunsod by Metro Angeles Chamber of Commerce and Industry, Inc.

(MACCI) of which AEC is a member, seeking the reduction of the tax rates and a review

of the provisions of the RRCAC.

The Bureau of Local Government Finance (BLGF) issued a First Indorsement to

the City Treasurer of Angeles City instructing it to make representations with the

Sangguniang Panlunsod for the appropriate amendment of the RRCAC in order to

ensure compliance with the provisions of the LGC.

Thereafter, AEC paid the local franchise tax to the Office of the City Treasurer on

a quarterly basis, in addition to the national franchise tax it pays every quarter to the

BIR.

The City Treasurer denied AEC’s protest that it was exempt from paying local

business tax, the payment of franchise tax on business resulted to double taxation, the

assessment period has already prescribed, and the assessment and collection of taxes

under RRCAC cannot be made retroactive. The City Treasurer then levied on the real

properties of AEC prompting AEC to file with the RTC an Urgent Motion for Issuance of

a TRO and/or Writ of Preliminary Injunction.

ISSUE:

Whether or not the Local Government Code prohibits an injunction enjoining the

collection of taxes.

RULING:

No. The Local Government Code does not specifically prohibit an injunction

enjoining the collection of taxes. The prohibition of a writ of injunction to enjoin the

collection of taxes applies only to national internal revenue taxes, and not to local taxes.

Unlike the NIRC, the Local Tax Code does not contain any specific provision prohibiting

courts from enjoining the collection of local taxes.

Taxes, being the lifeblood of the government should be collected promptly,

without necessary hindrance or delay. The National Internal Revenue Code of 1997

(NIRC) expressly provides that no court shall have the authority to grant an injunction to

restrain the collection of any national internal revenue tax, fee or charge imposed by the

code. An exception to this rule obtains only when in the opinion of the Court of Tax

Appeals (CTA), the collection thereof may jeopardize the interest of the government

and/or the taxpayer.

You might also like

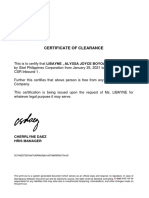

- Certificate of Clearance: Cherrlyne Daez Hris ManagerDocument2 pagesCertificate of Clearance: Cherrlyne Daez Hris ManagerFernan MacusiNo ratings yet

- PSLP 0112174 201411Document1 pagePSLP 0112174 201411soumava chakrabortyNo ratings yet

- In This Chapter We Ve Emphasized That The Elasticity of SupplyDocument1 pageIn This Chapter We Ve Emphasized That The Elasticity of Supplytrilocksp SinghNo ratings yet

- Accomplishment Report For The City AddressDocument4 pagesAccomplishment Report For The City AddressBplo Caloocan100% (1)

- Annex C RR 11-2018 XXXXDocument2 pagesAnnex C RR 11-2018 XXXXMoi EscalanteNo ratings yet

- SMI-Ed Vs CIRDocument1 pageSMI-Ed Vs CIRRodney SantiagoNo ratings yet

- Gancayco Vs CollectorDocument1 pageGancayco Vs CollectorDPMPascuaNo ratings yet

- City of Baguio v. de LeonDocument1 pageCity of Baguio v. de LeonJulia ChuNo ratings yet

- CIR Vs Baier-NickelDocument4 pagesCIR Vs Baier-NickelJohnde MartinezNo ratings yet

- 213 Tax - Republic v. Hizon, 320 SCRA 574Document2 pages213 Tax - Republic v. Hizon, 320 SCRA 574Brandon BanasanNo ratings yet

- Case For DigestDocument11 pagesCase For DigestAudreyNo ratings yet

- Pepsi-Cola Vs ButuanDocument2 pagesPepsi-Cola Vs ButuanKim CajucomNo ratings yet

- LORENZO Vs Posadas GR. No L-43082Document4 pagesLORENZO Vs Posadas GR. No L-43082Joyjoy C LbanezNo ratings yet

- Madrigal Vs RaffertyDocument3 pagesMadrigal Vs RaffertyMJ BautistaNo ratings yet

- Philippine National Oil Company Vs CaDocument2 pagesPhilippine National Oil Company Vs Cajohn vidadNo ratings yet

- Philam Life Vs Sec of Finance, Nov. 24, 2014Document16 pagesPhilam Life Vs Sec of Finance, Nov. 24, 2014LucioJr AvergonzadoNo ratings yet

- Taxation CasesDocument353 pagesTaxation Casesjojazz74No ratings yet

- Case Digest #3 - CIR Vs - Mirant PagbilaoDocument3 pagesCase Digest #3 - CIR Vs - Mirant PagbilaoMark AmistosoNo ratings yet

- Taxation Digest 06.18.12editedDocument5 pagesTaxation Digest 06.18.12editedJason ChanNo ratings yet

- CIR v. PAL (Ortega)Document5 pagesCIR v. PAL (Ortega)Peter Joshua OrtegaNo ratings yet

- Agusan Wood Industries v. DENR DigestDocument2 pagesAgusan Wood Industries v. DENR DigestNic OngNo ratings yet

- SISON V ANCHETADocument4 pagesSISON V ANCHETAMayflor BalinuyusNo ratings yet

- PLDT v. City of DavaoDocument1 pagePLDT v. City of Davaoashnee09No ratings yet

- China Banking Corporation Vs CADocument5 pagesChina Banking Corporation Vs CAFrancis CastilloNo ratings yet

- Accenture Vs CirDocument2 pagesAccenture Vs CirCess EspinoNo ratings yet

- CIR V SolidbankDocument14 pagesCIR V Solidbankrj_guzmanNo ratings yet

- Bonifacio Sy Po Vs CTADocument1 pageBonifacio Sy Po Vs CTALouie SalladorNo ratings yet

- Visayas Geothermal Power Company vs. Cir G.R. No. 197525 June 4, 2014Document2 pagesVisayas Geothermal Power Company vs. Cir G.R. No. 197525 June 4, 2014brian jay hernandezNo ratings yet

- 21 Land Transportation Office v. City of ButuanDocument1 page21 Land Transportation Office v. City of ButuansdfoisaiofasNo ratings yet

- Cir Vs WyethDocument1 pageCir Vs WyethHollyhock Mmgrzhfm100% (1)

- CIR v. Wyeth Suaco Lab.Document3 pagesCIR v. Wyeth Suaco Lab.Angelique Padilla UgayNo ratings yet

- Collector V Goodrich DigestDocument2 pagesCollector V Goodrich DigestmbNo ratings yet

- Atty Ligon Tx2Document92 pagesAtty Ligon Tx2karlNo ratings yet

- Commissioner of Internal Revenue vs. ST Luke's Medical CenterDocument14 pagesCommissioner of Internal Revenue vs. ST Luke's Medical CenterRaquel DoqueniaNo ratings yet

- Philippine American Life and General Insurance Company vs. Secretary of Finance and Commissioner On Internal RevenueDocument1 pagePhilippine American Life and General Insurance Company vs. Secretary of Finance and Commissioner On Internal Revenuehigoremso giensdksNo ratings yet

- Mindanao Shopping Destination Corporation vs. Duterte 826 SCRA 143, June 06, 2017Document40 pagesMindanao Shopping Destination Corporation vs. Duterte 826 SCRA 143, June 06, 2017Niezel SabridoNo ratings yet

- Kepco Vs CIRDocument3 pagesKepco Vs CIRLizzette Dela PenaNo ratings yet

- Eastern Telecommunications Philippines v. CIRDocument1 pageEastern Telecommunications Philippines v. CIRMarcella Maria KaraanNo ratings yet

- Villanueva vs. City of Iloilo, 26 SCRA 578 (1968) : Castro, J.Document5 pagesVillanueva vs. City of Iloilo, 26 SCRA 578 (1968) : Castro, J.billy joe andresNo ratings yet

- Digested Cases in Taxation2Document5 pagesDigested Cases in Taxation2Dakila Maloy100% (1)

- University of The Philippines College of Law: Natcher Vs CA, Heirs of Del RosarioDocument3 pagesUniversity of The Philippines College of Law: Natcher Vs CA, Heirs of Del RosarioSophiaFrancescaEspinosaNo ratings yet

- MCIT ReportDocument13 pagesMCIT ReportfebwinNo ratings yet

- CIR vs. BRITISH OVERSEAS AIRWAYS CORPORATIONDocument1 pageCIR vs. BRITISH OVERSEAS AIRWAYS CORPORATIONAngela Mericci G. Mejia100% (1)

- 3-Cir VS LealDocument3 pages3-Cir VS LealRenEleponioNo ratings yet

- Phil. Home Assurance Corp vs. CADocument1 pagePhil. Home Assurance Corp vs. CACaroline A. LegaspinoNo ratings yet

- CIR Vs Isabela Cultural CorporationDocument2 pagesCIR Vs Isabela Cultural CorporationLauren KeiNo ratings yet

- Kepco vs. CIR Case DigestDocument2 pagesKepco vs. CIR Case DigestJeremiah Trinidad100% (2)

- Abakada Guro Vs ErmitaDocument1 pageAbakada Guro Vs Ermitaapril75No ratings yet

- CIR Vs Standard CharteredDocument2 pagesCIR Vs Standard CharteredFatzie MendozaNo ratings yet

- Philippine Acetylene vs. CIRDocument12 pagesPhilippine Acetylene vs. CIRKeith BalbinNo ratings yet

- Cir Vs Leal, 392 Scra 9 (2002)Document2 pagesCir Vs Leal, 392 Scra 9 (2002)katentom-1No ratings yet

- Republic V Bacolod Murcia DigestsDocument2 pagesRepublic V Bacolod Murcia Digestspinkblush717No ratings yet

- Cir V. Team Sual Corporation: Doctrine/SDocument3 pagesCir V. Team Sual Corporation: Doctrine/SDaLe AparejadoNo ratings yet

- CIR v. Smart CommunicationDocument1 pageCIR v. Smart CommunicationneneneneneNo ratings yet

- 10 Coca-Cola-Philippines-vs-CIRDocument1 page10 Coca-Cola-Philippines-vs-CIRhigoremso giensdksNo ratings yet

- Tax Digest 51 55Document11 pagesTax Digest 51 55glaiNo ratings yet

- Berin Vs Barte DigestDocument3 pagesBerin Vs Barte Digestilovetwentyonepilots100% (1)

- Cyanamid Phil., Inc. vs. Court of Appeals, Et Al. G.R. No. 108067 January 20, 2000 FactsDocument2 pagesCyanamid Phil., Inc. vs. Court of Appeals, Et Al. G.R. No. 108067 January 20, 2000 FactsEdward Kenneth KungNo ratings yet

- Cir v. SolidbankDocument2 pagesCir v. SolidbankChariNo ratings yet

- Chevron Vs CIRDocument2 pagesChevron Vs CIRKim Lorenzo CalatravaNo ratings yet

- The Corporation Code of The PhilippinesDocument98 pagesThe Corporation Code of The PhilippinesJ Velasco PeraltaNo ratings yet

- Commissioner of Internal Revenue Fireman'S Fund Insurance Company and The Court ofDocument2 pagesCommissioner of Internal Revenue Fireman'S Fund Insurance Company and The Court ofjulyenfortunatoNo ratings yet

- Angeles City Vs Angeles City Electric CorporationDocument1 pageAngeles City Vs Angeles City Electric CorporationJesse MoranteNo ratings yet

- Angeles City Vs ACECDocument2 pagesAngeles City Vs ACECAnneNo ratings yet

- Defect in Attestation ClauseDocument2 pagesDefect in Attestation ClausezvatanacioNo ratings yet

- TableDocument2 pagesTablezvatanacioNo ratings yet

- Sexual Harassment OutlineDocument9 pagesSexual Harassment OutlinezvatanacioNo ratings yet

- Cruz Vs DENRDocument1 pageCruz Vs DENRzvatanacioNo ratings yet

- People Vs Amado HernandezDocument1 pagePeople Vs Amado Hernandezzvatanacio100% (1)

- Appellants, Vs - ROSALINA SANTOS, in Her Capacity As Special Administratrix of The Estate of The Deceased MAXIMADocument97 pagesAppellants, Vs - ROSALINA SANTOS, in Her Capacity As Special Administratrix of The Estate of The Deceased MAXIMAzvatanacioNo ratings yet

- Flipkart Labels 26 Mar 2022 11 44Document1 pageFlipkart Labels 26 Mar 2022 11 44Yash ViraniNo ratings yet

- Form 16 SV PDFDocument2 pagesForm 16 SV PDFPravin HireNo ratings yet

- The Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECDocument2 pagesThe Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECSatha SivamNo ratings yet

- Classification of TaxesDocument2 pagesClassification of TaxesJoliza CalingacionNo ratings yet

- Edgar Detoya WorksheetDocument2 pagesEdgar Detoya WorksheetNeilan Jay FloresNo ratings yet

- Soft Copy International TaxDocument11 pagesSoft Copy International TaxOguntimehin AdebisolaNo ratings yet

- Elegant LadyDocument1 pageElegant LadyongshazNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryR S RatanNo ratings yet

- Paystub Golden Limousine, Inc 20210906 20210919Document2 pagesPaystub Golden Limousine, Inc 20210906 20210919Alexander Weir-WitmerNo ratings yet

- Ambika: Tax Invoice OriginalDocument3 pagesAmbika: Tax Invoice OriginalDare DevilNo ratings yet

- INCOME TAX AND GST. JURAZ-Module 3Document11 pagesINCOME TAX AND GST. JURAZ-Module 3hisanashanutty2004100% (1)

- PLOT M193/M194, NAKAWA Industrial Area, P.O.Box 7279 Kampala, UgandaDocument1 pagePLOT M193/M194, NAKAWA Industrial Area, P.O.Box 7279 Kampala, UgandaMichelle SemwogerereNo ratings yet

- Print in Voice DetailsDocument1 pagePrint in Voice DetailsMadhuNo ratings yet

- Authorization LetterDocument7 pagesAuthorization LetterVinceNo ratings yet

- E-Way Bill - 5Document2 pagesE-Way Bill - 5AshishTrivediNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BDocument7 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BMaddy GamerNo ratings yet

- Use Detailed Income Tax Calculator With More Features and Functions For All IndividualsDocument3 pagesUse Detailed Income Tax Calculator With More Features and Functions For All IndividualsVishwaNo ratings yet

- TDS Tax Deduction at Source: Prepared By: Visharad ShuklaDocument25 pagesTDS Tax Deduction at Source: Prepared By: Visharad ShuklaPriyanshi GandhiNo ratings yet

- Date: 12.03.2023 Invoice Number: 340267Document1 pageDate: 12.03.2023 Invoice Number: 340267Gabriela TudorNo ratings yet

- Schedules of Alphanumeric Tax Codes Nature of Income Payment TAX Rate ATC Nature of Income Payment TAX Rate ATC IND Corp Ind CorpDocument1 pageSchedules of Alphanumeric Tax Codes Nature of Income Payment TAX Rate ATC Nature of Income Payment TAX Rate ATC IND Corp Ind CorpMhyckee GuinoNo ratings yet

- Pay Slip Arun Das 04Document1 pagePay Slip Arun Das 04Pritam GoswamiNo ratings yet

- Suspension of Audit - RMC 76-2022Document1 pageSuspension of Audit - RMC 76-2022ECMH ACCOUNTING AND CONSULTANCY SERVICESNo ratings yet

- Yellow - Not Sure, Green - CorrectDocument7 pagesYellow - Not Sure, Green - CorrectIsaiah John Domenic M. CantaneroNo ratings yet

- Inv Ka B1 92887290 102657085633 Mar 2023Document4 pagesInv Ka B1 92887290 102657085633 Mar 2023PrabhuTeja CSGINo ratings yet

- Net Gift and Donor's TaxDocument16 pagesNet Gift and Donor's TaxKj Banal100% (2)