Professional Documents

Culture Documents

Edgar Detoya Worksheet

Uploaded by

Neilan Jay Flores0 ratings0% found this document useful (0 votes)

53 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

53 views2 pagesEdgar Detoya Worksheet

Uploaded by

Neilan Jay FloresCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

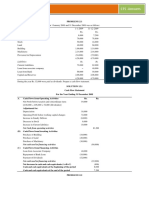

Edgar Detoya, Tax Consultant

Worksheet

For the Year Ended December 31, 2022

Adjusted Trial Income

Trial Balance Adjustment Balance Statement Balance Sheet

No. Account Title Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit

11

0 Cash 93,800 93,800 93,800

12

0 Accounts Receivable 48,000 48,000 48,000

13

0 Fees Receivable (d) 10,000 10,000 10,000

14

0 Supplies 7,200 (a) 2,500 4,700 4,700

15

0 Office Equipment 75,000 75,000 75,000

15

5 Accumulated Depreciation - Office Eqpt. (c) 800 800 800

21

0 Accounts Payable 38,000 38,000 38,000

22

0 Salaries Payable (b) 1,800 1,800 1,800

31

0 Detoya, Capital 150,000 150,000 150,000

32

0 Detoya, Withdrawals 12,000 12,000 12,000

41

0 Consulting Revenue 68,000 (d) 10,000 78,000 78,000

51

0 Salaries Expense 12,000 (b) 1,800 13,800 13,800

52 Supplies Expense (a) 2,500 2,500 2,500

0

53

0 Rent Expense 8,000 8,000 8,000

54

0 Depreciation Expense (c) 800 800 800

Total 256,000 256,000 15,100 15,100 268,600 268,600 25100 78,000

Profit 52,900 52,900

78,000 78,000 243,500 243,500

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Sources of FundsDocument22 pagesSources of FundsImtiaz RashidNo ratings yet

- Rock Guitar BookletDocument12 pagesRock Guitar BookletAnthony ChewNo ratings yet

- FLORES - Working PapersDocument2 pagesFLORES - Working PapersMaureen FloresNo ratings yet

- Christine Sousa BagsDocument8 pagesChristine Sousa BagsKaila Clarisse Cortez100% (5)

- DL1 Dragons of DespairDocument38 pagesDL1 Dragons of DespairHeath Page100% (1)

- Cash Flow Statement Problems PDFDocument32 pagesCash Flow Statement Problems PDFnsrivastav180% (30)

- Sol. Man. - Chapter 9 - Acctg Cycle of A Service BusinessDocument52 pagesSol. Man. - Chapter 9 - Acctg Cycle of A Service Businesscan't yujout100% (4)

- Rosalie Balhag Cleaners Year-End Financial ReportDocument1 pageRosalie Balhag Cleaners Year-End Financial ReportDominique Abrajano100% (1)

- Work Sheet Moises Dondoyano Information SystemDocument1 pageWork Sheet Moises Dondoyano Information SystemRJ DAVE DURUHA100% (5)

- Ily Abella Surveyors May 2022 Trial Balance and Financial StatementsDocument2 pagesIly Abella Surveyors May 2022 Trial Balance and Financial StatementsNeilan Jay FloresNo ratings yet

- Answer Key - Chapter 6 - ACCOUNTINGDocument92 pagesAnswer Key - Chapter 6 - ACCOUNTINGIL MareNo ratings yet

- Email Address For RationalDocument25 pagesEmail Address For RationalpinoygplusNo ratings yet

- DirectionalDocument114 pagesDirectional1234jjNo ratings yet

- Edgar Detoya-Answer KeyDocument14 pagesEdgar Detoya-Answer KeyAMBER GAMERNo ratings yet

- Letters of CreditDocument33 pagesLetters of CreditConnie SulangNo ratings yet

- Financial Statement Worksheet DetoyaDocument8 pagesFinancial Statement Worksheet Detoyasharon emailNo ratings yet

- Jawaban CH 5 - TM 11Document3 pagesJawaban CH 5 - TM 11ahmad shinigamiNo ratings yet

- NO. Account Title: Trial Balance Adjustment Debit Credit Debit CreditDocument2 pagesNO. Account Title: Trial Balance Adjustment Debit Credit Debit CreditJonalyn BañegaNo ratings yet

- J. P. Peralta Computer Clinic Worksheet For The Month Ended December 31, 2020Document2 pagesJ. P. Peralta Computer Clinic Worksheet For The Month Ended December 31, 2020Minjin lesner ManalansanNo ratings yet

- T11 Ans. 1Document1 pageT11 Ans. 1PUI TUNG CHONGNo ratings yet

- Dellosa Cleaners Adjusting Entry For The Year Ended September 30, 2022. Accounts Debit CreditDocument6 pagesDellosa Cleaners Adjusting Entry For The Year Ended September 30, 2022. Accounts Debit CreditJaira AsuncionNo ratings yet

- Jawaban Soal UTS Akuntansi Keu - MenengahDocument4 pagesJawaban Soal UTS Akuntansi Keu - MenengahJessinthaNo ratings yet

- A4 PalacioDocument3 pagesA4 PalacioPinky DaisiesNo ratings yet

- JPP Computer Clinic December 2020 Trial BalanceDocument2 pagesJPP Computer Clinic December 2020 Trial BalanceMinjin lesner ManalansanNo ratings yet

- Description: Tags: 668appgDocument2 pagesDescription: Tags: 668appganon-829526No ratings yet

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- DeceVid Company Final Worksheet PDFDocument1 pageDeceVid Company Final Worksheet PDFAngel Nhova Pepito OmalayNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditVencint LaranNo ratings yet

- ABC Chap 9 SolmanDocument11 pagesABC Chap 9 SolmanKimberly ToraldeNo ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Hilary Aguilar - Quizzes 1-3 - Sheet1Document1 pageHilary Aguilar - Quizzes 1-3 - Sheet1ag clothingNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Financial Accounting MAY / 2019 BBAW2103Document8 pagesFinancial Accounting MAY / 2019 BBAW2103Yung YeeNo ratings yet

- Untitled Spreadsheet - Sheet1Document1 pageUntitled Spreadsheet - Sheet1gnssgtld7No ratings yet

- Group 6 Drill WS & FSDocument12 pagesGroup 6 Drill WS & FSSheilla Dela Torre PaderangaNo ratings yet

- Joyk-Excel 2 3 1Document4 pagesJoyk-Excel 2 3 1api-664350584No ratings yet

- Answer Sheet Mock Test 23Document5 pagesAnswer Sheet Mock Test 23Nam Nguyễn HoàngNo ratings yet

- Fabm2 QuizDocument2 pagesFabm2 QuizXin LouNo ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- TrialBal (1) - 2Document1 pageTrialBal (1) - 2shreygautam12No ratings yet

- 3rd-Long-QuizDocument1 page3rd-Long-QuizRonah SabanalNo ratings yet

- FdnacctDocument20 pagesFdnacctvitobautistaNo ratings yet

- ch12 PDFDocument4 pagesch12 PDFCarmela Isabelle DisilioNo ratings yet

- Mekidelawit Tamrat MBAO9550.14B 2Document23 pagesMekidelawit Tamrat MBAO9550.14B 2mkdiNo ratings yet

- 6) Supplies 5,000 Supplies Expense 5,000Document4 pages6) Supplies 5,000 Supplies Expense 5,000Jerome ValdezNo ratings yet

- Yolanda Reality Work Sheet For The Month Ended April 2020Document2 pagesYolanda Reality Work Sheet For The Month Ended April 2020Hannah DimalibotNo ratings yet

- Accounting 2Document2 pagesAccounting 2reeisha7No ratings yet

- mgt101 Questions With AnswersDocument11 pagesmgt101 Questions With AnswersKinza LaiqatNo ratings yet

- Answer Sheet Mock Test 23-2Document5 pagesAnswer Sheet Mock Test 23-2Nam Nguyễn HoàngNo ratings yet

- Anteneh Assignment 1Document17 pagesAnteneh Assignment 1Abatneh mengistNo ratings yet

- Mahmudin Saepullah - Assignment 5BDocument10 pagesMahmudin Saepullah - Assignment 5BRomi Prabowo De jongNo ratings yet

- Chapter 9 Problem 1 SolutionDocument8 pagesChapter 9 Problem 1 SolutionAustin Coles83% (6)

- Unit NDocument1 pageUnit NjharithpalaciosNo ratings yet

- Accounting Cycle of a Service BusinessDocument59 pagesAccounting Cycle of a Service BusinessArlyn Ragudos BSA1No ratings yet

- AssignmentDocument1 pageAssignmentwajihaabid441No ratings yet

- Worksheet Complete Exercise ns3Document8 pagesWorksheet Complete Exercise ns3Steven consueloNo ratings yet

- Chapter 6 Problem 7 8Document12 pagesChapter 6 Problem 7 8mackyberriesNo ratings yet

- Problem I - SolutionsDocument10 pagesProblem I - SolutionsDing CostaNo ratings yet

- Afar SolutionDocument8 pagesAfar SolutionAsnifah AlinorNo ratings yet

- 7 SynthesisDocument5 pages7 SynthesisCristine Jane Granaderos OppusNo ratings yet

- Trial Balance Adjustments Income StatementDocument3 pagesTrial Balance Adjustments Income StatementAnonymus PershonNo ratings yet

- Vietnam Maritime University group homework on accounting principlesDocument7 pagesVietnam Maritime University group homework on accounting principlesYến Trần HảiNo ratings yet

- Chapter 9 Accounting Cycle of A Service BusinessDocument59 pagesChapter 9 Accounting Cycle of A Service BusinessArlyn Ragudos BSA1No ratings yet

- Chapter 09Document12 pagesChapter 09Dan ChuaNo ratings yet

- Workout PlanDocument2 pagesWorkout PlanNeilan Jay FloresNo ratings yet

- CHAPTER 5 - Problem 5Document1 pageCHAPTER 5 - Problem 5Neilan Jay FloresNo ratings yet

- Edgar Detoya tax recordsDocument5 pagesEdgar Detoya tax recordsNeilan Jay FloresNo ratings yet

- Dr. Marasigan Journal EntriesDocument1 pageDr. Marasigan Journal EntriesNeilan Jay FloresNo ratings yet

- DepEd Tayo Training Series Accomplishment Report Sapang Maragul Integrated School JHS DepartmentDocument6 pagesDepEd Tayo Training Series Accomplishment Report Sapang Maragul Integrated School JHS DepartmentTeng SevillaNo ratings yet

- Creo Simulate Components for Stress and Strain QuantitiesDocument1 pageCreo Simulate Components for Stress and Strain QuantitiesSebastiao SilvaNo ratings yet

- IMSP 21 Operational Control EMSDocument3 pagesIMSP 21 Operational Control EMSEvonne LeeNo ratings yet

- Aluminum Wire Data and PropertiesDocument31 pagesAluminum Wire Data and PropertiesMaria SNo ratings yet

- Hantavirus Epi AlertDocument4 pagesHantavirus Epi AlertSutirtho MukherjiNo ratings yet

- Abortion Guide: Types, Causes and TreatmentDocument46 pagesAbortion Guide: Types, Causes and TreatmentNikhil TyagiNo ratings yet

- Designing An LLC ResonantDocument30 pagesDesigning An LLC Resonant劉品賢No ratings yet

- Isoefficiency Function A Scalability Metric For PaDocument20 pagesIsoefficiency Function A Scalability Metric For PaDasha PoluninaNo ratings yet

- Chord MethodDocument17 pagesChord MethodJedielson GirardiNo ratings yet

- Cisco UCS 5108 Server Chassis Hardware Installation GuideDocument78 pagesCisco UCS 5108 Server Chassis Hardware Installation GuidemicjosisaNo ratings yet

- Install 13 SEER condensing unitDocument9 pagesInstall 13 SEER condensing unitalfredoNo ratings yet

- Project E: The Hubble LawDocument14 pagesProject E: The Hubble LawVanessa MaynardNo ratings yet

- CriticalAppraisalWorksheetTherapy EffectSizeDocument2 pagesCriticalAppraisalWorksheetTherapy EffectSizeFitriArdiningsihNo ratings yet

- Veego Software Selected As One of Asia's 30 Best Tech CompaniesDocument3 pagesVeego Software Selected As One of Asia's 30 Best Tech CompaniesPR.comNo ratings yet

- Review Movie: Title:the Conjuring 2: The Enfield PoltergeistDocument2 pagesReview Movie: Title:the Conjuring 2: The Enfield PoltergeistBunga IllinaNo ratings yet

- 37LG5500Document33 pages37LG5500Toni011973No ratings yet

- Odor Out Brochure PDFDocument4 pagesOdor Out Brochure PDFTitas IlekisNo ratings yet

- Village Panchayat Secretary ApplicationDocument2 pagesVillage Panchayat Secretary Applicationsrpk serverNo ratings yet

- Update ResumeDocument3 pagesUpdate ResumeSubbareddy NvNo ratings yet

- Marketing Plan: Walton NextDocument26 pagesMarketing Plan: Walton NextAnthony D SilvaNo ratings yet

- Garmin Etrex 30Document2 pagesGarmin Etrex 30Desli MunarsaNo ratings yet

- Business Math - Interest QuizDocument1 pageBusiness Math - Interest QuizAi ReenNo ratings yet

- L-Ascorbic AcidDocument3 pagesL-Ascorbic AcidJemNo ratings yet

- Smoothed Bootstrap Nelson-Siegel Revisited June 2010Document38 pagesSmoothed Bootstrap Nelson-Siegel Revisited June 2010Jaime MaihuireNo ratings yet