Professional Documents

Culture Documents

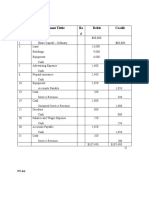

J. P. Peralta Computer Clinic Worksheet For The Month Ended December 31, 2020

Uploaded by

Minjin lesner Manalansan0 ratings0% found this document useful (0 votes)

49 views2 pagesOriginal Title

Worksheet

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

49 views2 pagesJ. P. Peralta Computer Clinic Worksheet For The Month Ended December 31, 2020

Uploaded by

Minjin lesner ManalansanCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Accounts Trial Balance Adjustments Adjusted T/B Income Statement Balance Sheet

J. P. Peralta Computer Clinic

Debit Credit Debit WorksheetDebit

Credit Credit Debit Credit Debit Credit

For the Month Ended December 31, 2020

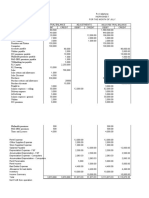

Cash 118,914 118,914 118,914

Accounts Receivable 20,400 20,400 20,400

Notes Receivable 1,000 1,000 1,000

Tools 21,000 21,000 21,000

Furniture & Fixtures 8,000 8,000 8,000

Office Equipment 15,000 15,000 15,000

Repair Equipment 15,000 15,000 15,000

Accounts Payable 12,360 12,360 12,360

Notes Payable 19,200 19,200 19,200

Loan Payable 50,000 50,000 50,000

J.A. Peralta, Capital 95,000 95,000 95,000

J.A. Peralta, Drawing 6,000 6,000 6,000

Computer Service Income 75,475 8) 2000 73,475 73,475

Interest Income 14 3) 2.67 16.67 16.67

Salaries Expense 16,000 4) 16,000 32,000 32,000

Rent Expense 6,000 9) 3000 3,000 3,000

Supplies Expense 4,560 1) 3,287 1,273 1,273

Taxes & Licenses Expense 2,425 10) 120 2,545 2,545

Insurance Expense 3,000 3,000 3,000

Interest Expense 6,000 7) 96 6,096 6,096

Utilities Expense 1,250 1,250 1,250

Advertising Expense 7,500 2) 5,000 2,500 2,500

TOTALS 252,049 252,049

Unused Supplies 1) 3,287 3,287 3,287

Prepaid Advertising 2) 5,000 5,000 5,000

Accrued Interest Income 3) 2.67 2.67 2.67

Salaries Payable 4) 16,000 16,000 16,000

Depreciation - Furniture. And Fixtures 5) 800 800 800

Depreciation - Office Equipment 5) 1,500 1,500 1,500

Depreciation - Repair Equipment 5) 122.5 122.5 122.5

Accum. Dep’n - Furniture and Fixture 5) 800 800 800

Accum. Dep’n - Office Equipment 5) 1,500 1,500 1,500

Accum. Dep’n – Repair Equipment 5) 122.5 122.5 122.5

Impairment Loss 6) 1,020 1,020 1,020

Allowance for Impairment Loss 6) 1,020 1,020 1,020

Interest Payable 7) 96 96 96

Unearned Service Income 8) 2000 2000 2000

Prepaid Rent 9) 3000 3000 3000

Taxes and License Payable 10) 120 120 120

TOTALS 32,948.17 32,948.17 271,710.17 271,710.17 55,109.17 73,491.67 213,314.00 201,505

Net Income 18,382.5 11,808.

TOTALS 73,491.67 213,314.

You might also like

- JPP Computer Clinic December 2020 Trial BalanceDocument2 pagesJPP Computer Clinic December 2020 Trial BalanceMinjin lesner ManalansanNo ratings yet

- ACCTG - Worksheet Quality AutoDocument1 pageACCTG - Worksheet Quality AutoCab Vic100% (1)

- FdnacctDocument20 pagesFdnacctvitobautistaNo ratings yet

- ABC Company Worksheet Year-End Financials 2021Document1 pageABC Company Worksheet Year-End Financials 2021por wansNo ratings yet

- 6) Supplies 5,000 Supplies Expense 5,000Document4 pages6) Supplies 5,000 Supplies Expense 5,000Jerome ValdezNo ratings yet

- Lou Bernardo Company 2016 Financial StatementsDocument3 pagesLou Bernardo Company 2016 Financial Statementsangel cao100% (2)

- KAPS Beauty Salon Trial Balance and AdjustmentsDocument7 pagesKAPS Beauty Salon Trial Balance and AdjustmentsRochelle BuensucesoNo ratings yet

- AdjustingDocument7 pagesAdjustingKrisha JohnsonNo ratings yet

- mgt101 Questions With AnswersDocument11 pagesmgt101 Questions With AnswersKinza LaiqatNo ratings yet

- WS MerchDocument5 pagesWS Merchjeonlei02No ratings yet

- 7 SynthesisDocument5 pages7 SynthesisCristine Jane Granaderos OppusNo ratings yet

- Accounting journal entries and trial balancesDocument15 pagesAccounting journal entries and trial balancesSamuel PurbaNo ratings yet

- Allan & WallyDocument10 pagesAllan & WallyLaura OliviaNo ratings yet

- Practice Problem SolutionDocument15 pagesPractice Problem SolutionTherese Noelle R. ARMADA100% (1)

- MGT 101Document13 pagesMGT 101MuzzamilNo ratings yet

- Accounting-ABM WorksheetDocument5 pagesAccounting-ABM WorksheetPrincess AlontoNo ratings yet

- Quiz SolutionDocument3 pagesQuiz SolutionKim Patrick VictoriaNo ratings yet

- Activities and Assesment 2Document4 pagesActivities and Assesment 2Mante, Josh Adrian Greg S.No ratings yet

- Christine Sousa BagsDocument8 pagesChristine Sousa BagsKaila Clarisse Cortez100% (5)

- Mekidelawit Tamrat MBAO9550.14B 2Document23 pagesMekidelawit Tamrat MBAO9550.14B 2mkdiNo ratings yet

- MODULE 8 Learning ActivitiesDocument5 pagesMODULE 8 Learning ActivitiesChristian Cyrous AcostaNo ratings yet

- Finals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaDocument6 pagesFinals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaMica Mae CorreaNo ratings yet

- Real Realty financial statementsDocument4 pagesReal Realty financial statementsbadNo ratings yet

- AnswerDocument3 pagesAnswerRE GHANo ratings yet

- Financial Statement - With Adjustments - DPP 13Document4 pagesFinancial Statement - With Adjustments - DPP 13dhruvNo ratings yet

- Bachelor of Management With Honours (Bim)Document11 pagesBachelor of Management With Honours (Bim)Aizat Ahmad100% (3)

- Yolanda Reality Work Sheet For The Month Ended April 2020Document2 pagesYolanda Reality Work Sheet For The Month Ended April 2020Hannah DimalibotNo ratings yet

- Therese Zyra Lipang - Worksheet Activity - 10 Column WsDocument4 pagesTherese Zyra Lipang - Worksheet Activity - 10 Column WsJuvelyn Repaso100% (1)

- Finacc 8-3Document5 pagesFinacc 8-3FakerPlaymakerNo ratings yet

- ACTIVITY111111101Document6 pagesACTIVITY111111101VanessaNo ratings yet

- Basic Accounting Midterm ExamDocument11 pagesBasic Accounting Midterm ExamC J A SNo ratings yet

- Worksheet Complete Exercise ns3Document8 pagesWorksheet Complete Exercise ns3Steven consueloNo ratings yet

- Ily Abella Surveyors May 2022 Trial Balance and Financial StatementsDocument2 pagesIly Abella Surveyors May 2022 Trial Balance and Financial StatementsNeilan Jay FloresNo ratings yet

- Izzy WorksheetDocument30 pagesIzzy Worksheetelriatagat85No ratings yet

- FLORES - Working PapersDocument2 pagesFLORES - Working PapersMaureen FloresNo ratings yet

- ULOa Let's Analyze Week 8 9Document4 pagesULOa Let's Analyze Week 8 9emem resuentoNo ratings yet

- Adjusted trial balance income statement balance sheet closing entries post closing trial balanceDocument1 pageAdjusted trial balance income statement balance sheet closing entries post closing trial balanceiya RasonableNo ratings yet

- ANS - 1 (A, B, C)Document5 pagesANS - 1 (A, B, C)Nazir AhmadNo ratings yet

- Answer Key - Chapter 6 - ACCOUNTINGDocument92 pagesAnswer Key - Chapter 6 - ACCOUNTINGIL MareNo ratings yet

- Journalizing Transaction (Ezekiel Lapitan)Document3 pagesJournalizing Transaction (Ezekiel Lapitan)Ezekiel LapitanNo ratings yet

- Problem 6 1 Answer KeyDocument7 pagesProblem 6 1 Answer Keyanika.delalunaNo ratings yet

- Group 6 Drill WS & FSDocument12 pagesGroup 6 Drill WS & FSSheilla Dela Torre PaderangaNo ratings yet

- Empowerment Technologies - G12 MEEDocument11 pagesEmpowerment Technologies - G12 MEEMac Reniel EdoraNo ratings yet

- Fabm 1Document5 pagesFabm 1Lady Aleah Naharah P. AlugNo ratings yet

- Accounting1 Hannah Travel and ToursDocument5 pagesAccounting1 Hannah Travel and ToursMarielle Mae Burbos100% (1)

- Vang Management Services Year-End WorksheetDocument8 pagesVang Management Services Year-End WorksheetFrizky Triputra CahyahanaNo ratings yet

- Midterm - Activity 3 - COmpleting The Accounting CycleDocument15 pagesMidterm - Activity 3 - COmpleting The Accounting CyclePampulan, Angela MayNo ratings yet

- ANALYZING BUSINESS TRANSACTIONSDocument3 pagesANALYZING BUSINESS TRANSACTIONSPhaelyn YambaoNo ratings yet

- Exam 2 Review SolutionDocument6 pagesExam 2 Review Solutionsimonedana97No ratings yet

- CA-Ipcc Old Course: Advanced AccountingDocument125 pagesCA-Ipcc Old Course: Advanced AccountingAruna Rajappa100% (1)

- Answer Key - Chapter 6 - ACCOUNTING1Document19 pagesAnswer Key - Chapter 6 - ACCOUNTING1IL MareNo ratings yet

- FDNACCT C35A Group Project Group 3Document21 pagesFDNACCT C35A Group Project Group 3cNo ratings yet

- FABM2 Servicing PT - Problem (2)Document2 pagesFABM2 Servicing PT - Problem (2)jesmeraldaNo ratings yet

- My Company Unadjusted Trial Balance December 31, 2018 Debit CreditDocument9 pagesMy Company Unadjusted Trial Balance December 31, 2018 Debit CreditRey Joyce AbuelNo ratings yet

- FABM-1-LAS-APRIL-082024Document12 pagesFABM-1-LAS-APRIL-082024gwynethpolia11No ratings yet

- Adjusting entries for end of year financial statementsDocument4 pagesAdjusting entries for end of year financial statementsNajia SalmanNo ratings yet

- Assignment TwoDocument10 pagesAssignment TwoTeke TarekegnNo ratings yet

- Bohol Pension House 1Document7 pagesBohol Pension House 1Chloe Cataluna86% (7)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- PDFViewerDocument2 pagesPDFViewerKunal GiriNo ratings yet

- EMU Faculty of Business and Economics 2015-16 Spring Semester Final ExamDocument7 pagesEMU Faculty of Business and Economics 2015-16 Spring Semester Final Exame110807No ratings yet

- Tender Evaluation Example ReportDocument15 pagesTender Evaluation Example ReportNhial Panom PuotNo ratings yet

- SALES TAX Java Problem Solution - TotwrksDocument1 pageSALES TAX Java Problem Solution - TotwrksBaala ChandarNo ratings yet

- Introduction To Economics For WeeblyDocument21 pagesIntroduction To Economics For WeeblyDivergeNo ratings yet

- VSL Strand Post Tensioning Systems Technical Catalogue - 2019 01Document55 pagesVSL Strand Post Tensioning Systems Technical Catalogue - 2019 01Frederick NaplesNo ratings yet

- Staples: Good Service Is Good Business It's Really That SimpleDocument7 pagesStaples: Good Service Is Good Business It's Really That Simplepdy2No ratings yet

- 3 Marks Q 11 1STDocument6 pages3 Marks Q 11 1STDINESH KUMAR SENNo ratings yet

- Tax Invoice for Clayplus Premium Grade Ceramic Floor Mount Western ToiletDocument1 pageTax Invoice for Clayplus Premium Grade Ceramic Floor Mount Western Toiletkumar praweenNo ratings yet

- Cash Disbursement JournalDocument1 pageCash Disbursement JournalRhea Mikylla ConchasNo ratings yet

- Sejarah MitsuboshiDocument4 pagesSejarah MitsuboshiCitra Adelina SitorusNo ratings yet

- Micro Plastics India - Micro Plastics To Invest 500 CR in Tamil Nadu Toy Plant - The Economic TimesDocument1 pageMicro Plastics India - Micro Plastics To Invest 500 CR in Tamil Nadu Toy Plant - The Economic TimescreateNo ratings yet

- Chapter 6 (Cost Theory)Document20 pagesChapter 6 (Cost Theory)AldrinNyandangNo ratings yet

- Assignment No 2Document5 pagesAssignment No 2Ghulam Awais SaeedNo ratings yet

- Saln Am DomingoDocument4 pagesSaln Am DomingoKiemer Terrence SechicoNo ratings yet

- Company Master DataDocument1 pageCompany Master DataSUBHAJITNo ratings yet

- Pestel Analysis of Cleaning Service IndustryDocument4 pagesPestel Analysis of Cleaning Service IndustryRh Wribhu100% (1)

- Importance of Industries for Indian Economic DevelopmentDocument17 pagesImportance of Industries for Indian Economic DevelopmentHarniazdeep SinghNo ratings yet

- (A) (B) (C) (D) (E) 2. (A) (B) (C) 3. (A) (B) (C) (D) (E)Document7 pages(A) (B) (C) (D) (E) 2. (A) (B) (C) 3. (A) (B) (C) (D) (E)Lilik SuryawanNo ratings yet

- Philippine National Standard: Agricultural Machinery - Cassava Digger - SpecificationsDocument13 pagesPhilippine National Standard: Agricultural Machinery - Cassava Digger - SpecificationsAlfredo CondeNo ratings yet

- Tax Invoice: (Original For Recipient)Document5 pagesTax Invoice: (Original For Recipient)rockNo ratings yet

- Ifrs 9 PresentationDocument26 pagesIfrs 9 PresentationJean Damascene HakizimanaNo ratings yet

- Albion Sigma Purlin BrochureDocument36 pagesAlbion Sigma Purlin BrochureDoug WeirNo ratings yet

- Project Management AgreementDocument6 pagesProject Management AgreementAHMADNo ratings yet

- Strategy Execution - DiscussionDocument22 pagesStrategy Execution - DiscussionAayushya ChaturvediNo ratings yet

- Framed Formwork Framax Xlife: User InformationDocument124 pagesFramed Formwork Framax Xlife: User InformationJozef JostNo ratings yet

- Pakistan and Global Financial CrisisDocument12 pagesPakistan and Global Financial Crisiswaqas ghouri100% (2)

- Notes From PT 365 2022Document1 pageNotes From PT 365 2022Atul KumarNo ratings yet

- Case Study11Document5 pagesCase Study11Abdulaziz Saad Al BayatiNo ratings yet

- FSA Chapter 7Document3 pagesFSA Chapter 7Nadia ZahraNo ratings yet