Professional Documents

Culture Documents

FLORES - Working Papers

Uploaded by

Maureen Flores0 ratings0% found this document useful (0 votes)

25 views2 pagesOriginal Title

FLORES_Working Papers.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views2 pagesFLORES - Working Papers

Uploaded by

Maureen FloresCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

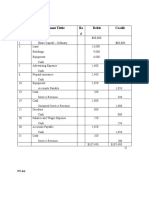

DETOYA TAX CONSULTANT

Working Paper

December 31, 2020

Unadjusted trial Adjusting entries Adjusted trial balance Income Statement Balance Sheet Post-Closed Trial

balance Balance

Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit

Cash P 93,800 P 93,800 P 93,800 P 93,800

Supplies 7,200 (1) 2,500 4,700 4,700 4,700

Accounts Receivables 48,000 (4) 10,000 58,000 58,000 58,000

Office Equipment 75,000 75,000 75,000 75,000

Accumulated (3) 800 P 800 P 800 P 800

Depreciation

Accounts Payable P 38,000 38,000 38,000 38,000

Salaries Payable (2) 1,800 1,800 1,800 1,800

Detoya, Capital 150,000 150,000 190,900 190,900

Detoya, Drawings 12,000 12,000 12,000 -

Service Revenue 68,000 (4) 10,000 68,500 78,000 -

Rent Expense 8,000 8,000 8,000 -

Salaries Expense 12,000 (2) 1,800 13,800 13,800 -

Supplies Expense (1) 2,500 2,500 2,500 -

Depreciation Expense- (3) 800 800 -

Office Equipment 800

Totals P 256,000 P 256,000 P 15,100 P 15,100 P 268,600 P 268,600 P 25,100 P 78,000 P 243,500 P 190,600 P 231,500 P 231,500

Net Income 52,900 52,900

Totals P 78,000 P 78,000 P 243,500 P 243,500

You might also like

- Pacalna - The Fashion Rack Super FinalDocument45 pagesPacalna - The Fashion Rack Super FinalAnifahchannie PacalnaNo ratings yet

- Accounting Reviewer PDFDocument13 pagesAccounting Reviewer PDFJireh Dugayo80% (5)

- Project Report On Mutual FundsDocument104 pagesProject Report On Mutual FundsAshutosh Negi89% (9)

- Section 1: Accrued Revenue: Mastering Adjusting EntriesDocument4 pagesSection 1: Accrued Revenue: Mastering Adjusting EntriesMarc Eric Redondo50% (2)

- Answer 1Document7 pagesAnswer 1Mylene HeragaNo ratings yet

- FDNACCT C35A Group Project Group 3Document21 pagesFDNACCT C35A Group Project Group 3cNo ratings yet

- P 7-15 Common Stock Value: All Growth ModelsDocument8 pagesP 7-15 Common Stock Value: All Growth ModelsAlvira FajriNo ratings yet

- PWC Real Estate Monetization StrategiesDocument28 pagesPWC Real Estate Monetization StrategiesAbdulkareem Tawili100% (1)

- CAE Separate Financial Statements 31-03-2022 EnglishDocument77 pagesCAE Separate Financial Statements 31-03-2022 EnglishMuhammad TohamyNo ratings yet

- Financial Analysis and Benchmarking of InditexDocument34 pagesFinancial Analysis and Benchmarking of InditexAdelina Patricia SanduNo ratings yet

- Cost Audit Report CRA 3 (In Excel)Document50 pagesCost Audit Report CRA 3 (In Excel)MOORTHYNo ratings yet

- Basic BookkeepingDocument80 pagesBasic BookkeepingCharity CotejoNo ratings yet

- Para and Luman: Partnership InvestmentDocument6 pagesPara and Luman: Partnership InvestmentDaphne RoblesNo ratings yet

- Lesson 1 - Introduction To LedgerDocument18 pagesLesson 1 - Introduction To LedgerNikhita MehraNo ratings yet

- DAWN Editorials - November 2016Document92 pagesDAWN Editorials - November 2016SurvivorFsdNo ratings yet

- ACTIVITY 04 - Analyzing TransactionsDocument6 pagesACTIVITY 04 - Analyzing TransactionsJohn Luis Cordova CacayurinNo ratings yet

- Prepare financial statementsDocument27 pagesPrepare financial statementsMohammed AkramNo ratings yet

- And Distributing Accounting Reports To PotentialDocument41 pagesAnd Distributing Accounting Reports To PotentialREVELNo ratings yet

- 7 - Chart of AccountsDocument12 pages7 - Chart of Accountscharlene gonzalesNo ratings yet

- Similarity and Difference Between Accounting Concept and ConventionDocument23 pagesSimilarity and Difference Between Accounting Concept and ConventionravisankarNo ratings yet

- Holy Cross of Davao College: Other Campuses: Camudmud (IGACOS), Bajada (SOS Drive)Document3 pagesHoly Cross of Davao College: Other Campuses: Camudmud (IGACOS), Bajada (SOS Drive)Haries Vi Traboc Micolob100% (1)

- Accounting Books CompilationDocument2 pagesAccounting Books CompilationSarah Asher Ocampo0% (2)

- Quality in Customer-Supplier RelationshipsDocument28 pagesQuality in Customer-Supplier RelationshipsHelena MontgomeryNo ratings yet

- Small Business Tax PlanningDocument3 pagesSmall Business Tax Planningi_aam_zigeunerNo ratings yet

- Module 2Document8 pagesModule 2ysa tolosaNo ratings yet

- Next-X Inc - FinalDocument9 pagesNext-X Inc - FinalJam Xabryl AquinoNo ratings yet

- Jamieson Drugs HR Case AnalysisDocument8 pagesJamieson Drugs HR Case AnalysisGerald JaderNo ratings yet

- Formation of DD and EE partnershipDocument3 pagesFormation of DD and EE partnershipmiss independent100% (1)

- Accounting For Corporation - Activity AssignmentDocument12 pagesAccounting For Corporation - Activity AssignmentXiu MinNo ratings yet

- Big Hoss Barbershop Financial PlanDocument8 pagesBig Hoss Barbershop Financial Plancucku4u0% (1)

- Understanding T AccountsDocument2 pagesUnderstanding T AccountsNichole John ErnietaNo ratings yet

- Gray Electronic Repair ServicesDocument1 pageGray Electronic Repair ServicesFarman AfzalNo ratings yet

- Ch05-Job CostingDocument35 pagesCh05-Job Costingemanmaryum7No ratings yet

- FAQs On CA Zambia CertificationDocument3 pagesFAQs On CA Zambia CertificationHUMPHREY KAYUNYINo ratings yet

- Advanced Certification - Study Guide (For Tax Season 2017)Document7 pagesAdvanced Certification - Study Guide (For Tax Season 2017)Center for Economic Progress100% (4)

- Business Plan TemplateDocument7 pagesBusiness Plan TemplateRohan LabdeNo ratings yet

- Advantages of Ordinary Share CapitalDocument26 pagesAdvantages of Ordinary Share CapitalMoses Bisan DidamNo ratings yet

- IAS 12 Income Taxes Standard ExplainedDocument40 pagesIAS 12 Income Taxes Standard ExplainedfurqanNo ratings yet

- HO No. 3 - Business TaxDocument4 pagesHO No. 3 - Business TaxMariella Louise CatacutanNo ratings yet

- Financial Transaction WorksheetDocument3 pagesFinancial Transaction Worksheetjen 01No ratings yet

- Introduction to Business TaxesDocument60 pagesIntroduction to Business TaxesRobilyn BollosaNo ratings yet

- Basic Accounting EquationDocument17 pagesBasic Accounting EquationArienaya100% (1)

- Completing The Accounting ProcessDocument23 pagesCompleting The Accounting ProcessFretchie Anne C. LauroNo ratings yet

- Module 4 - Introduction To Partnership and Partnership FormationDocument14 pagesModule 4 - Introduction To Partnership and Partnership Formation1BSA5-ABM Espiritu, CharlesNo ratings yet

- Inventory Management at Makerere University Business School and Its Impact On The Revenue Performance of Small and Medium EnterprisesDocument16 pagesInventory Management at Makerere University Business School and Its Impact On The Revenue Performance of Small and Medium EnterprisesKIU PUBLICATION AND EXTENSIONNo ratings yet

- Special Accounting JournalsDocument7 pagesSpecial Accounting JournalsHo Ming LamNo ratings yet

- Accounting: Quantitative Information Primarily Financial inDocument19 pagesAccounting: Quantitative Information Primarily Financial inleeeydoNo ratings yet

- Managerial Economics ReviewerDocument26 pagesManagerial Economics ReviewerAlyssa Faith NiangarNo ratings yet

- How to Write a Position PaperDocument9 pagesHow to Write a Position PaperKen CruzNo ratings yet

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- Tax Quiz 3 Q Tax 1Document4 pagesTax Quiz 3 Q Tax 1bimbyboNo ratings yet

- MODCOS2 Business CaseDocument8 pagesMODCOS2 Business CaseLou Brad IgnacioNo ratings yet

- Topic 4 - Adjusting Accounts and Preparing Financial StatementsDocument18 pagesTopic 4 - Adjusting Accounts and Preparing Financial Statementsapi-388504348100% (1)

- ICQDocument12 pagesICQAndrew LamNo ratings yet

- Understanding Cash Flow Movements and AnalysisDocument12 pagesUnderstanding Cash Flow Movements and AnalysisRozaimie Anzuar0% (1)

- Application and Analysis Exercises 28.1 and 28.2Document8 pagesApplication and Analysis Exercises 28.1 and 28.2Peper12345No ratings yet

- Financial Statements ExplainedDocument9 pagesFinancial Statements ExplainedTokie TokiNo ratings yet

- Fundamentals OF Accounting: Accounting by Meigs, Williams, Haka, BettnerDocument64 pagesFundamentals OF Accounting: Accounting by Meigs, Williams, Haka, BettnerAliya SaeedNo ratings yet

- Accounting For A Professional Service Business: The Combination JournalDocument33 pagesAccounting For A Professional Service Business: The Combination Journallovelyn seseNo ratings yet

- What is an External AuditDocument5 pagesWhat is an External AuditRohit BajpaiNo ratings yet

- Letter of ApprovalDocument2 pagesLetter of Approvaldebbie cortesNo ratings yet

- MAHUSAYLAW211 REFLECTIVE ESSAY - Module 2Document4 pagesMAHUSAYLAW211 REFLECTIVE ESSAY - Module 2Jeth MahusayNo ratings yet

- Workbook1 PDFDocument73 pagesWorkbook1 PDFSchool FilesNo ratings yet

- Module 1 Lesson 1 - Reading Activity No. 1Document4 pagesModule 1 Lesson 1 - Reading Activity No. 1Sam BayetaNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Accounting journal entries and trial balancesDocument15 pagesAccounting journal entries and trial balancesSamuel PurbaNo ratings yet

- Activities For Module 1 (BSA I-1)Document7 pagesActivities For Module 1 (BSA I-1)Maureen FloresNo ratings yet

- FLORES-Activities For Module 1Document4 pagesFLORES-Activities For Module 1Maureen FloresNo ratings yet

- Name: Flores, Maureen Devega - Section: BSA I-1 Instructor: Prof. Marilou Calales ScoreDocument3 pagesName: Flores, Maureen Devega - Section: BSA I-1 Instructor: Prof. Marilou Calales ScoreMaureen FloresNo ratings yet

- NSTP Pre Assessment TemplateDocument3 pagesNSTP Pre Assessment TemplateMaureen FloresNo ratings yet

- NSTP 1: Pre-AssessmentDocument3 pagesNSTP 1: Pre-AssessmentMaureen FloresNo ratings yet

- Activities For Module 5 (BSA I-1)Document5 pagesActivities For Module 5 (BSA I-1)Maureen FloresNo ratings yet

- Activities For Module 2 (BSA I-1)Document9 pagesActivities For Module 2 (BSA I-1)Maureen FloresNo ratings yet

- Philippine Flag MeaningDocument2 pagesPhilippine Flag MeaningMaureen FloresNo ratings yet

- Activities For Module 4 (BSA I-1)Document5 pagesActivities For Module 4 (BSA I-1)Maureen FloresNo ratings yet

- MOCKSQE1stYEAR2015 Questionnairev4Document13 pagesMOCKSQE1stYEAR2015 Questionnairev4Jinky P. RefurzadoNo ratings yet

- Activities For Module 12 (BSA I-1)Document3 pagesActivities For Module 12 (BSA I-1)Maureen FloresNo ratings yet

- Activties For Module 3 (BSA I-1)Document4 pagesActivties For Module 3 (BSA I-1)Maureen FloresNo ratings yet

- Activities For Module 1 (BSA I-1)Document7 pagesActivities For Module 1 (BSA I-1)Maureen FloresNo ratings yet

- Tiga Laba Laundry Shop Trial BalanceDocument5 pagesTiga Laba Laundry Shop Trial BalanceMaureen FloresNo ratings yet

- Annex 4 Eye Test For Driver Applicants PDFDocument1 pageAnnex 4 Eye Test For Driver Applicants PDFMaureen FloresNo ratings yet

- Annex 4 Eye Test For Driver Applicants PDFDocument1 pageAnnex 4 Eye Test For Driver Applicants PDFMaureen FloresNo ratings yet

- Perceptions of The Consumers Towards Referral Marketing in Terms of Statement CredibilityDocument2 pagesPerceptions of The Consumers Towards Referral Marketing in Terms of Statement CredibilityMaureen FloresNo ratings yet

- Milmodule Recana Edroso PDFDocument75 pagesMilmodule Recana Edroso PDFMaureen FloresNo ratings yet

- Sched Mo CystDocument1 pageSched Mo CystMaureen FloresNo ratings yet

- Table of ContentsDocument13 pagesTable of ContentsMaureen FloresNo ratings yet

- Submitted By: Jerome Nasayao: Patrick PistonDocument161 pagesSubmitted By: Jerome Nasayao: Patrick PistonMaureen FloresNo ratings yet

- Golden Acres National High School-Senior High School DepartmentDocument46 pagesGolden Acres National High School-Senior High School DepartmentMaureen FloresNo ratings yet

- Civil ReviewerDocument73 pagesCivil ReviewerMarie Joy EngayNo ratings yet

- How Will I Be Able To Enter and Survive College Amidst The Global PandemicDocument2 pagesHow Will I Be Able To Enter and Survive College Amidst The Global PandemicMaureen FloresNo ratings yet

- Group 2 - Final Iii PDFDocument79 pagesGroup 2 - Final Iii PDFMaureen FloresNo ratings yet

- Certificate of Completion: Maureen FloresDocument1 pageCertificate of Completion: Maureen FloresMaureen FloresNo ratings yet

- Tell Me Something About YourselfDocument1 pageTell Me Something About YourselfMaureen FloresNo ratings yet

- Presenting The Senior High School Completers From 12 - Accountants School Year 2019 - 2020 MaleDocument3 pagesPresenting The Senior High School Completers From 12 - Accountants School Year 2019 - 2020 MaleMaureen FloresNo ratings yet

- Question Bank For NPODocument17 pagesQuestion Bank For NPOSanyam BohraNo ratings yet

- Fin622 Mid Term Enjoy PDFDocument7 pagesFin622 Mid Term Enjoy PDFAtteique AnwarNo ratings yet

- Financial Due Diligence - ChecklistDocument6 pagesFinancial Due Diligence - ChecklistRanganathan PKNo ratings yet

- Solvency-Ability of An Entity To: Transactions and UseDocument6 pagesSolvency-Ability of An Entity To: Transactions and UseCarl Yry BitengNo ratings yet

- IAS-37 Provisions, Liabilities and Contingencies ExplainedDocument15 pagesIAS-37 Provisions, Liabilities and Contingencies ExplainedAtka FahimNo ratings yet

- Bank Governance, Regulation, Supervision, and Risk Reporting - FINALDocument47 pagesBank Governance, Regulation, Supervision, and Risk Reporting - FINALben salah mounaNo ratings yet

- Icfai Foundation For Higher Education University: A Project Report ONDocument12 pagesIcfai Foundation For Higher Education University: A Project Report ONkishore kittuNo ratings yet

- Intacc Chapter 1Document2 pagesIntacc Chapter 1Niño Albert EugenioNo ratings yet

- GL DescriptionDocument22 pagesGL Descriptionsanyu1208No ratings yet

- Statement of Account: State Bank of IndiaDocument3 pagesStatement of Account: State Bank of Indiavishalasharma0% (1)

- Entrepreneurship Lecture No: 27 BY Ch. Shahzad Ansar Entrepreneurship Lecture No: 27 BY Ch. Shahzad AnsarDocument8 pagesEntrepreneurship Lecture No: 27 BY Ch. Shahzad Ansar Entrepreneurship Lecture No: 27 BY Ch. Shahzad Ansarskeleton1sNo ratings yet

- Arias, Kyla Kim B. - Garcia's Health Care - 2Document11 pagesArias, Kyla Kim B. - Garcia's Health Care - 2Kyla Kim AriasNo ratings yet

- 8 Steps Buying Business GuideDocument17 pages8 Steps Buying Business GuideDivyesh GandhiNo ratings yet

- Chapter 2Document22 pagesChapter 2John Edwinson JaraNo ratings yet

- Receivables Management: Dr.K.P.Malathi ShiriDocument19 pagesReceivables Management: Dr.K.P.Malathi ShiriSruthy KrishnaNo ratings yet

- Entrepreneurship Chapter 7Document22 pagesEntrepreneurship Chapter 7Muhammad shahzadNo ratings yet

- 12 Accountancy Lyp 2017 Foreign Set3Document41 pages12 Accountancy Lyp 2017 Foreign Set3Ashish GangwalNo ratings yet

- TPG - Annual Report 2020 Income Statemnt 1Document2 pagesTPG - Annual Report 2020 Income Statemnt 1Pei Ling Ch'ngNo ratings yet

- Idbi Bank Compensation PolicyDocument17 pagesIdbi Bank Compensation Policyvicku1004No ratings yet

- Financial Management-Ch01Document32 pagesFinancial Management-Ch01hasan jabrNo ratings yet

- Krispy Kreme Case - Executive SummaryDocument2 pagesKrispy Kreme Case - Executive SummaryNicole Minh DaoNo ratings yet

- 2013 Annual Reports PDFDocument276 pages2013 Annual Reports PDFMilenia AndiniNo ratings yet

- Create a Balance SheetDocument8 pagesCreate a Balance SheetJerarudo BoknoyNo ratings yet

- Income Taxation ExplainedDocument15 pagesIncome Taxation ExplainedJustin Andre SiguanNo ratings yet