Professional Documents

Culture Documents

Jawaban Soal UTS Akuntansi Keu - Menengah

Uploaded by

JessinthaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jawaban Soal UTS Akuntansi Keu - Menengah

Uploaded by

JessinthaCopyright:

Available Formats

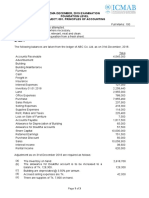

IBEK Co.

Work Sheet

December 31, 2018

Income Balance

Trial Balance Adjustments Statement Sheet

Account Debit Credit Debit Credit Debit Credit Debit Credit

Cash 35,000 35,000

Accounts Receivable 91,000 91,000

Allowance for Doubtful Accounts 1,800 (b) 2,000 3,800

Inventory, 12/31/01 84,000 (a) 8,000 92,000

Long-Term Investments 27,500 27,500

Land 53,400 53,400

Buildings 112,500 112,500

Accumulated Depreciation—Bldg 26,780 (c) 10,500 37,280

Accounts Payable 47,300 47,300

Mortgage Payable 99,500 99,500

Capital Stock, $5 par 175,000 175,000

Retained Earnings, 12/31/2017 14,840 14,840

Dividends 9,670 9,670

Sales 359,000 359,000

Sales Returns 12,890 12,890

Sales Discounts 7,540 7,540

Purchases 159,000 (a) 159,000

Purchase Discounts 6,780 (a) 6,780

Freight-In 6,300 (a) 6,300

Selling Expenses 62,350 (d) 8,600 70,950

Office Expenses 38,900 38,900

Insurance Expense 14,000 (f) 4,000 10,000

Supplies Expense 4,800 (e) 1,250 3,550

Taxes—Real Estate and Payroll 9,500 (h) 2,340 11,840

Interest Revenue 550 (g) 850 1,400

Interest Expense 3,200 (i) 1,780 4,980

Cost of Goods Sold .……... .……... (a) 150,520 150,520

Doubtful Accounts Expense .……... .……... (b) 2,000 2,000

Depreciation Expense—Buildings .……... .……... (c) 10,500 10,500

Selling Expenses Payable .……... .……... (d) 8,600 8,600

Supplies .……... .……... (e) 1,250 1,250

Prepaid Insurance .……... .……... (f) 4,000 4,000

Interest Receivable .……... .……... (g) 850 850

Real Estate and Payroll

Taxes Payable .……... .……... (h) 2,340 2,340

Interest Payable .……... .……... (i) 1,780 1,780

Income Taxes Payable .……... .……... (j) 14,692 14,692

Income Tax Expense .……... .……... (j) 14,692 14,692

731,550 731,550 211,312 211,312 338,362 360,400 427,170 405,132

Net Income 22,038 22,038

360,400 360,400 427,170 427,170

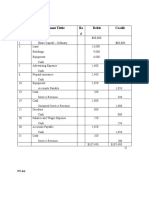

ABCD, Inc.

Statement of Cash Flows (Direct Method)

For the Year Ended December 31, 2018

Cash flows from operating activities:

1

Cash receipts from customers $ 698,600

Cash payments for:

Inventory $ 367,800 2

Operating expenses 176,800 3

4

Interest expense 3,800

5

Income taxes 33,600 582,000

Net cash provided by operating activities $ 116,600

COMPUTATIONS:

1

Cash receipts from customers:

Accounts receivable at beginning of year $ 26,600

Add: Sales on account 704,000

Total accounts to be collected $ 730,600

Less: Accounts receivable at the end of year 32,000

Total cash received from customers $ 698,600

2

Cash payments for inventory:

Inventory at end of year $ 21,000

Add: Cost of goods sold 368,000

Total goods available for sale $ 389,000

Less: Inventory at beginning of year 25,400

Purchases for the year on account $ 363,600

Add: Accounts payable at the beginning of year 11,200

Total accounts to be paid $ 374,800

Less: Accounts payable at the end of year 7,000

Total cash paid for inventory $ 367,800

3

Cash payments for operating expenses:

Operating expenses $ 185,000

Less: Noncash item: Depreciation expense (7,000)

Less: Interest expense reported separately (2,800)

Add: Prepaid insurance at the end of year 5,600

Less: Prepaid insurance at beginning of year (4,000)

Total cash paid for operating expenses $ 176,800

4

Cash payments for interest:

Interest expense $ 2,800

Add: Interest payable at beginning of year 2,000

Less: Interest payable at end of year (1,000)

Total cash paid for interest $ 3,800

5

Cash payments for income taxes:

Income tax expense $ 37,600

Add: Income taxes payable at beginning of year 8,000

Less: Income taxes payable at end of year (12,000)

Total cash paid for income taxes $ 33,600

Oom Feii Corporation

Balance Sheet

December 31, 2019

Assets Liabilities

Current assets:Current liabilities:

Cash $ 8,500 Accounts payable $ 3,400

Investment securities 5,250 Current portion of bonds

Accounts receivable, net 21,350 payable 2,500

Inventory 31,000 Loan due on demand 7,000

Land held for resale 8,000 Dividends payable 15,000

Other current assets 10,200 Other 2,000

Total current assets $ 84,300 Total current liabilities $ 29,900

Long-term liabilities:

Noncurrent assets: Bonds payable $ 7,500

Investments $ 2,750 Other liabilities 15,750

Property, plant, and Total long-term

equipment, net 56,800 liabilities $ 23,250

Restricted cash: Total liabilities $ 53,150

For preferred stock 19,000 Owners' Equity

For equipment 4,000 Preferred stock $ 19,000

Advance to company Common stock 50,000

president 4,000 Retained earnings 66,800

Other noncurrent assets 13,600 Less: Treasury stock (4,500)

Total noncurrent Total owners' equity $131,300

assets $100,150 Total liabilities and owners'

Total assets $184,450 equity $184,450

COMPUTATIONS:

Cash: $12,500 – $4,000 (a)

Investment securities: $8,000 – $2,750 (b)

Other current assets: $14,200 – $4,000 (c)

Property, plant, and equipment: $64,800 – $8,000 (h)

Restricted cash: $19,000 (g)

$4,000 (a)

Investments: $2,750 (b)

Advance to company president: $4,000 (c)

Current portion of bonds payable: $2,500 (d)

Loan due on demand: $7,000 (e)

Dividends payable: $15,000 (f)

Long-term liabilities: $32,750 – $2,500 (d) – $7,000 (e)

Preferred stock: $19,000 (g)

Retained earnings: $81,800 – $15,000 (f)

Treasury stock: formerly shown incorrectly as long-term asset

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Yolanda Reality Work Sheet For The Month Ended April 2020Document2 pagesYolanda Reality Work Sheet For The Month Ended April 2020Hannah DimalibotNo ratings yet

- Tum CompanyDocument4 pagesTum CompanyNguyen My Khanh (K18 HCM)No ratings yet

- Compreh Problems - AAA - SolutionDocument28 pagesCompreh Problems - AAA - SolutionNicola NaberNo ratings yet

- Financial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Document4 pagesFinancial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Mwilah Joshua ChalobaNo ratings yet

- Nguyen My Khanh - 25 - Mc1802Document6 pagesNguyen My Khanh - 25 - Mc1802Biên KimNo ratings yet

- Bba 122 Fai 11 AnswerDocument12 pagesBba 122 Fai 11 AnswerTomi Wayne Malenga100% (1)

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- Worksheet Complete Exercise ns3Document8 pagesWorksheet Complete Exercise ns3Steven consueloNo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- Financial Accounting MAY / 2019 BBAW2103Document8 pagesFinancial Accounting MAY / 2019 BBAW2103Yung YeeNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditVencint LaranNo ratings yet

- Answer Key - Chapter 6 - ACCOUNTINGDocument92 pagesAnswer Key - Chapter 6 - ACCOUNTINGIL MareNo ratings yet

- 2019-12 ICMAB FL 001 PAC Year Question December 2019Document3 pages2019-12 ICMAB FL 001 PAC Year Question December 2019Mohammad ShahidNo ratings yet

- Appendix C End-Of-Period Spreadsheet (Work Sheet) For A Merchandising BusinessDocument14 pagesAppendix C End-Of-Period Spreadsheet (Work Sheet) For A Merchandising BusinessLan Hương Trần ThịNo ratings yet

- Trial Balance Adjustments FinancialsDocument2 pagesTrial Balance Adjustments FinancialsMichelle BabaNo ratings yet

- Illustration KK Co. Perpetual ClosingDocument9 pagesIllustration KK Co. Perpetual ClosingNAOL BIFTUNo ratings yet

- Quiz For Week 7 Answer Key PR 1 and 4Document3 pagesQuiz For Week 7 Answer Key PR 1 and 4Joshuakenallen ricabuertaNo ratings yet

- Akuntansi Keuangan 1Document15 pagesAkuntansi Keuangan 1Vincenttio le CloudNo ratings yet

- Accounting journal entries and trial balancesDocument15 pagesAccounting journal entries and trial balancesSamuel PurbaNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Accountancy & Auditing-IDocument4 pagesAccountancy & Auditing-Izaman virkNo ratings yet

- Suggested Solutions June 2007Document12 pagesSuggested Solutions June 2007kalowekamoNo ratings yet

- Westmont PLCDocument5 pagesWestmont PLCmutuamutisya306No ratings yet

- (A) Alpha Bit Design Worksheet For The Month Ended October 31, 2020Document5 pages(A) Alpha Bit Design Worksheet For The Month Ended October 31, 2020Sergio NicolasNo ratings yet

- Tutor6 ACCDocument4 pagesTutor6 ACCFood TraditionalNo ratings yet

- Laporan Keuangan PT JayatamaDocument2 pagesLaporan Keuangan PT JayatamaKharisma Salsa Putri100% (1)

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Arty DutyDocument5 pagesArty DutySiti Hajar KhalidahNo ratings yet

- 2008 LCCI Level 1 (1017) Specimen Paper AnswersDocument4 pages2008 LCCI Level 1 (1017) Specimen Paper AnswersTszkin PakNo ratings yet

- Unadjusted Trial Balance Adjusting Journal Entries Account Debit Credit Debit CreditDocument5 pagesUnadjusted Trial Balance Adjusting Journal Entries Account Debit Credit Debit CreditChristine RepuldaNo ratings yet

- Soal A - Home Office Vs Branch (40%) : DimintaDocument2 pagesSoal A - Home Office Vs Branch (40%) : DimintaAlvin Prabu WNo ratings yet

- Chapter 10Document22 pagesChapter 10Dan ChuaNo ratings yet

- Ch5 Additional Q OnlyDocument13 pagesCh5 Additional Q OnlynigaroNo ratings yet

- Journal Entries Problem 1Document4 pagesJournal Entries Problem 1Sarah Nelle PasaoNo ratings yet

- Final Proj Sy2022-23 Agrigulay Corp.Document4 pagesFinal Proj Sy2022-23 Agrigulay Corp.Jan Elaine CalderonNo ratings yet

- Fa July2023-Far210-StudentDocument9 pagesFa July2023-Far210-Student2022613976No ratings yet

- Review Accounting 1Document9 pagesReview Accounting 1jhouvanNo ratings yet

- Soal - Home Office Vs Branch (40%) : Total Informasi TambahanDocument2 pagesSoal - Home Office Vs Branch (40%) : Total Informasi Tambahanshani100% (1)

- ASSIGNMENTSDocument13 pagesASSIGNMENTSJpzelleNo ratings yet

- Final accounts for year ending 1992Document50 pagesFinal accounts for year ending 1992kalyanikamineniNo ratings yet

- Jay Cesar system developer worksheet adjustmentsDocument4 pagesJay Cesar system developer worksheet adjustmentsAdam CuencaNo ratings yet

- Leah May Santiago Income Statement and Balance SheetDocument5 pagesLeah May Santiago Income Statement and Balance SheetRudsan TurquezaNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Untitled Spreadsheet - Sheet1Document1 pageUntitled Spreadsheet - Sheet1gnssgtld7No ratings yet

- Hercules Poirpt PDFDocument4 pagesHercules Poirpt PDFsy yusuf73% (11)

- Chapter 5 Quiz-AnswerDocument4 pagesChapter 5 Quiz-AnswerkakaoNo ratings yet

- Tugas Kelompok 1-AI-03102023Document3 pagesTugas Kelompok 1-AI-03102023sheila eka putriNo ratings yet

- Answer Key - Chapter 6 - ACCOUNTING1Document19 pagesAnswer Key - Chapter 6 - ACCOUNTING1IL MareNo ratings yet

- Tutorial 14 Introductory Accounting Teaching Assistant TeamDocument2 pagesTutorial 14 Introductory Accounting Teaching Assistant TeamAris KurniawanNo ratings yet

- December 2010 TC1ADocument10 pagesDecember 2010 TC1AkalowekamoNo ratings yet

- Sanguine Company Trial Balance and Financial StatementsDocument1 pageSanguine Company Trial Balance and Financial StatementsJohn Paul Cristobal0% (1)

- 1-1hkg 2002 Dec ADocument8 pages1-1hkg 2002 Dec AWing Yan KatieNo ratings yet

- Suggested Solutions June 2008Document11 pagesSuggested Solutions June 2008kalowekamoNo ratings yet

- BF4013 Revision Questions Set 2Document2 pagesBF4013 Revision Questions Set 2shazlina_liNo ratings yet

- Asm ACCOUNTINGDocument16 pagesAsm ACCOUNTINGVũ Khánh HuyềnNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Ch11 Beams12ge SMDocument28 pagesCh11 Beams12ge SMKharisma Pardede33% (3)

- Post Office Savings Schemes ExplainedDocument14 pagesPost Office Savings Schemes ExplainedAbhishek KapoorNo ratings yet

- 2007-6-26 SEC SpeechDocument158 pages2007-6-26 SEC SpeechDiane SternNo ratings yet

- Responsibility Accounting Problems and SolutionsDocument12 pagesResponsibility Accounting Problems and SolutionsHiraya ManawariNo ratings yet

- Sector Rotation Over Business CyclesDocument34 pagesSector Rotation Over Business CyclesHenry Do100% (1)

- IBPS PO Previous Year Question Paper 2017: Quantitative Aptitude (Questions & Solutions)Document19 pagesIBPS PO Previous Year Question Paper 2017: Quantitative Aptitude (Questions & Solutions)shrchtNo ratings yet

- Corporate Behavioural Finance Chap06Document14 pagesCorporate Behavioural Finance Chap06zeeshanshanNo ratings yet

- Trading BookDocument49 pagesTrading BookjamesNo ratings yet

- Financial ManagementDocument98 pagesFinancial Managementkcmiyyappan2701No ratings yet

- A Comparitive Study On Mutual FundsDocument58 pagesA Comparitive Study On Mutual Fundsarjunmba119624No ratings yet

- Cfa Level2 Fra Intercorporate Investments v2 PDFDocument43 pagesCfa Level2 Fra Intercorporate Investments v2 PDFDevesh Garg100% (1)

- Financial Ratio AnalysisDocument54 pagesFinancial Ratio AnalysisWinnie GiveraNo ratings yet

- BricksDocument18 pagesBricksBiniyam ALemNo ratings yet

- Malaysian Financial System IntroductionDocument36 pagesMalaysian Financial System IntroductionpedoqpopNo ratings yet

- 9101 - Partnership FormationDocument2 pages9101 - Partnership FormationGo FarNo ratings yet

- Dwnload Full Financial Markets Institutions and Money 3rd Edition Kidwell Solutions Manual PDFDocument35 pagesDwnload Full Financial Markets Institutions and Money 3rd Edition Kidwell Solutions Manual PDFinactionwantwit.a8i0100% (12)

- Poa Text BookDocument548 pagesPoa Text BookSiennaNo ratings yet

- Hkustiems Huang Why Did The Peer To Peer Lending Market Fail in China tlb61Document4 pagesHkustiems Huang Why Did The Peer To Peer Lending Market Fail in China tlb61wjh20061126No ratings yet

- MODULE 3 - BankingDocument5 pagesMODULE 3 - BankingKeiko KēkoNo ratings yet

- Primary and Secondary MarketsDocument34 pagesPrimary and Secondary MarketsAahaanaNo ratings yet

- Accounting Concepts and Business Performance Quiz 1 QuestionsDocument9 pagesAccounting Concepts and Business Performance Quiz 1 QuestionsMohammad Usman TanveerNo ratings yet

- ACC501 - Final Term Papers 02Document17 pagesACC501 - Final Term Papers 02RanoRoseNo ratings yet

- Chapter 3 - Tutorial - With Solutions 2023Document34 pagesChapter 3 - Tutorial - With Solutions 2023Jared Herber100% (1)

- Fin 242 FullDocument5 pagesFin 242 FullIzzaty AffrinaNo ratings yet

- FSA - Ch06 - Liquidity of Short-Term Assets Related Debt-Paying AbilityDocument46 pagesFSA - Ch06 - Liquidity of Short-Term Assets Related Debt-Paying AbilityAmine AbdesmadNo ratings yet

- Life Insurance in India: Strategic Shifts in A Dynamic IndustryDocument4 pagesLife Insurance in India: Strategic Shifts in A Dynamic IndustrysatishcreativeNo ratings yet

- Unicord PLC - The Bumble Bee Decision - Case AnalysisDocument6 pagesUnicord PLC - The Bumble Bee Decision - Case AnalysisgrubstanNo ratings yet

- Test Bank For Financial Statement Analysis Valuation 4th Edition by Easton Mcanally Sommers ZhangDocument30 pagesTest Bank For Financial Statement Analysis Valuation 4th Edition by Easton Mcanally Sommers ZhangJames Martino100% (35)

- How Corporations Raise Venture Capital and Issue SecuritiesDocument24 pagesHow Corporations Raise Venture Capital and Issue SecuritiessumanNo ratings yet

- The Economist Finance Outlook 2024Document9 pagesThe Economist Finance Outlook 2024Malik Kashif Nawaz NoulNo ratings yet