Professional Documents

Culture Documents

Tutor6 ACC

Uploaded by

Food TraditionalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tutor6 ACC

Uploaded by

Food TraditionalCopyright:

Available Formats

Tutorial Topic 6 - FS with Adjustment

a) Show the workings and adjusting entries for the above adjustments.

1. Inventory on 31 December 2019 = RM 26, 200

2. Dt Drawings RM 4, 500

Cr Purchases RM 2, 500

Cr Cash RM 2, 000

3. AFDD = (RM 33, 550 - RM 2, 000) x 2

= RM 631 (ending balance) – SOFP

4. Doubtful debts expenses = RM 631 - RM 2, 500 + RM 2, 000

= RM 131 - SOPL (Increase in AFDD)

5.

i) Depreciation Building = RM 419, 700 x 10%

= RM 41, 970

Dt Depreciation Building RM 41, 970

Cr Acc depreciation building RM 41, 970

ii) Depreciation Furniture = RM 165, 000 x 10%

= RM 16, 500

Dt Depreciation furniture RM 16, 500

Cr Acc depreciation furniture RM 16, 500

iii) Depreciation Motor vehicle = (RM 90, 000 - RM 29, 000) x 20%

= RM 12, 200

Dt Depreciation motor vehicle RM 12, 200

Cr Acc depreciation motor vehicle RM 12, 200

6. Total interest on loan = RM 472, 500 x 8%

= RM 37, 800

Accrued interest on loan = RM 37, 800 - RM 3, 250

= RM 34, 550

Dt Interest on loan RM 34, 550

Cr Accrued interest on loan RM 34, 550

7. Dt administration expenses RM 1, 500

Cr Accrued administration expenses RM 1, 500

Dt Prepaid rental expenses RM 1, 100

Cr Rental expenses RM 1, 100

8. Dt Accrued interest on fixed deposit RM 725

Cr Interest on fixed deposit RM 725

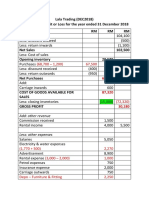

b) Prepare a Statement of Profit or Loss for the year ended 31

December 2019.

Tuah Enterprise

Statement of Profit or Loss for the year ended 31 December 2019

RM RM RM

Sales 458,900

Less: Return inwards (6,000) (6,000)

Discount allowed (8,250)

Net sales 444,650

Less: Cost of goods sold

Opening inventory 22,000

Purchases (312500-2500) 310,000

Less: Return outwards (5,000)

Discount received (6,200)

Net purchases 298,800

Add: Carriage inwards 4.800

Duty on purchases 2,000

Cost of goods purchased 305,600

Cost of goods available for sales 327,600

Less: Closing inventory (26,200) 301,400

Gross profit 143,250

Add: Other Income

Interest on fixed deposit (1775+ 725) 2,500

Less: Operating expenses

Travelling expenses 23,400

Water and electricity expenses 27,000

Rental (21300 - 1100) 20,200

Telephone expense 2,100

Interest on loan (3250 + 34550) 37,800

Administration expenses (9000+1500) 10,500

Insurance expenses 21,250

Salesman's commission 7,300

Salary 18,500

Repair and maintenance 10,000

Carriage outwards 5,700

Doubtful debts 131

Depreciation building 41,970

Depreciation furniture 16,500

Depreciation motor vehicle 12,200 (254,551)

Net Loss (108,801)

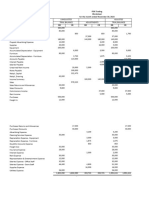

c) Prepare a Statement of Financial Position as at 31

December 2019.

Tuah Enterprise

Statement of Financial Position as at 31 December 2019

RM RM RM

Accumulated Carrying

Cost Depreciation amount

Non-current Assets

Building 419,700 (83,970) 335,730

Furniture 165,000 (69,000) 96,000

Motor vehicle 90,000 (41,2000) 48,800

480,530

Intangible Assets

Patent 52,800

Fixed deposit 93,350

Current Assets

Closing inventory 26,200

Account receivable (33550-2000) 31,550

Less: Allowance for doutful debts (631) 30,919

Cash at bank 157,500

Cash in hand (22500-2000) 20,500

Prepaid rental expenses 1,100

Accrued interest on fixed deposit 725 236,944

863,624

Financed by: Owner's Equity

Capital beginning 437,800

Less: Net loss (108,801)

Drawing (6500+4500) (11,000)

Capital ending 317,999

Non-current Liabilities

Loan from bank 472,500

Current Liabilities

Account payable 37,075

Accrued interest on loan 34,550

Accrued administration expenses 1,500 73,125

863,624

You might also like

- Mellisa O'Connor Statement of Profit or Loss For Year Ended March 31, 2016 $ $ $Document3 pagesMellisa O'Connor Statement of Profit or Loss For Year Ended March 31, 2016 $ $ $Debbie DebzNo ratings yet

- August Q1Document3 pagesAugust Q1tengku rilNo ratings yet

- Individual AssignmentDocument22 pagesIndividual AssignmentEda LimNo ratings yet

- Empire-ProfitDocument4 pagesEmpire-ProfitNur Amira NadiaNo ratings yet

- Financial Accounting Ratios AnalysisDocument5 pagesFinancial Accounting Ratios AnalysisSHARIFAH NOORAZREEN WAN JAMURINo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- Acc Chapter 5Document11 pagesAcc Chapter 5NURUL HAZWANIE HIDNI BINTI MUHAMAD SABRI MoeNo ratings yet

- Eva Trading Group AssignmentDocument8 pagesEva Trading Group AssignmentDoreen OngNo ratings yet

- Solution Additional Exercise 1 Chapter 6 7Document3 pagesSolution Additional Exercise 1 Chapter 6 7Doreen OngNo ratings yet

- PYQ June 2018Document4 pagesPYQ June 2018Nur Amira NadiaNo ratings yet

- Lala Trading DEC2018 - SOPL & SOFP DEC2018 AFTER ADJUSTMENTDocument3 pagesLala Trading DEC2018 - SOPL & SOFP DEC2018 AFTER ADJUSTMENTAFIQ RAFIQIN RAHMADNo ratings yet

- BF4013 Revision Questions Set 2Document2 pagesBF4013 Revision Questions Set 2shazlina_liNo ratings yet

- Chapter 9 - Shareholders' Equity AnalysisDocument4 pagesChapter 9 - Shareholders' Equity AnalysisJudy Ann Acruz100% (1)

- Jawaban Soal UTS Akuntansi Keu - MenengahDocument4 pagesJawaban Soal UTS Akuntansi Keu - MenengahJessinthaNo ratings yet

- December 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesDecember 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- PYQ January 2018Document4 pagesPYQ January 2018Nur Amira NadiaNo ratings yet

- Tuto - Adjusmnt in PNL & BsDocument4 pagesTuto - Adjusmnt in PNL & BsHana YusriNo ratings yet

- Empire Enterprise Profit Loss Statement 2015Document3 pagesEmpire Enterprise Profit Loss Statement 2015Jasmin JimmyNo ratings yet

- Tax 2 Tutorial 2Document6 pagesTax 2 Tutorial 2szh saNo ratings yet

- J. Jarvis Trial Balance As at 31 December 2010Document3 pagesJ. Jarvis Trial Balance As at 31 December 2010Ahmad HaqqyNo ratings yet

- Ans Mini Case 2 - A171 - LecturerDocument14 pagesAns Mini Case 2 - A171 - LecturerXue Yin Lew100% (1)

- Manufacturing P&L and Balance SheetDocument2 pagesManufacturing P&L and Balance SheetcalebNo ratings yet

- Solution Chapter 6 Financial Statements Pre Adjustments 1Document8 pagesSolution Chapter 6 Financial Statements Pre Adjustments 1IsmahNo ratings yet

- Statement of Profit Loss and Financial PositionDocument4 pagesStatement of Profit Loss and Financial Positionbbang bbyNo ratings yet

- Turbo Trading Statement of Comprehensive Income and Financial PositionDocument2 pagesTurbo Trading Statement of Comprehensive Income and Financial PositionDESIREE DESSY MAIDI STUDENTNo ratings yet

- Fa July2023-Far210-StudentDocument9 pagesFa July2023-Far210-Student2022613976No ratings yet

- OCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesOCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- Project 2 FAR270 SummaryDocument6 pagesProject 2 FAR270 SummaryHaru BiruNo ratings yet

- WorkDocument4 pagesWorkhassan KyendoNo ratings yet

- BSBFIN401 Assessment 3Document6 pagesBSBFIN401 Assessment 3Kitpipoj PornnongsaenNo ratings yet

- Financial Statements for Aleesya BhdDocument12 pagesFinancial Statements for Aleesya Bhdanis athirahNo ratings yet

- Laporan Keuangan PT JayatamaDocument2 pagesLaporan Keuangan PT JayatamaKharisma Salsa Putri100% (1)

- SOLUTION DEC 2018 No TicksDocument8 pagesSOLUTION DEC 2018 No Ticksanis izzatiNo ratings yet

- Business Accounting Quiz 2 (Answers) Updated.Document7 pagesBusiness Accounting Quiz 2 (Answers) Updated.Hareen JuniorNo ratings yet

- Solution NIngDocument3 pagesSolution NIngfahim tusarNo ratings yet

- Less: Cost of Goods Sold: Capital ExpenditureDocument3 pagesLess: Cost of Goods Sold: Capital Expenditurefahim tusarNo ratings yet

- Windows 101 Bhd StatementsDocument27 pagesWindows 101 Bhd StatementsShuhada Shamsuddin75% (4)

- Acinac Problem 5Document5 pagesAcinac Problem 5Angelo Gian CoNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditVencint LaranNo ratings yet

- FdnacctDocument20 pagesFdnacctvitobautistaNo ratings yet

- Cash Flow Statement for K BarrettDocument4 pagesCash Flow Statement for K BarrettRajay BramwellNo ratings yet

- Group Assignment Account SEM1Document7 pagesGroup Assignment Account SEM1NUR LIEYANA BINTI MOHD SHUKOR MoeNo ratings yet

- IAL Accounting SB2 AnswersDocument91 pagesIAL Accounting SB2 AnswersThaviksha BulathsinhalaNo ratings yet

- Manufacturing statement and financialsDocument3 pagesManufacturing statement and financialselmudaaNo ratings yet

- Bba 122 Fai 11 AnswerDocument12 pagesBba 122 Fai 11 AnswerTomi Wayne Malenga100% (1)

- Solution Financial Accounting FundamentalsDocument7 pagesSolution Financial Accounting Fundamentalsone thymeNo ratings yet

- MockDocument6 pagesMockWEI QUAN LEENo ratings yet

- Solution AP Test Bank 2Document9 pagesSolution AP Test Bank 2imaNo ratings yet

- Tutorial 23 Financial Statement 1 2 Management SkillsDocument4 pagesTutorial 23 Financial Statement 1 2 Management SkillsOkgar Myint SoeNo ratings yet

- ACC106 Assignment AccountDocument5 pagesACC106 Assignment AccountsyafiqahNo ratings yet

- SS1 - Tenang Bhd Financial Statements AnalysisDocument9 pagesSS1 - Tenang Bhd Financial Statements AnalysisAFIZA JASMANNo ratings yet

- Madaraka Ltd. income statement and financialsDocument17 pagesMadaraka Ltd. income statement and financialsMaryjoy KilonzoNo ratings yet

- Description Income Expenses Assets LiabilitiesDocument12 pagesDescription Income Expenses Assets LiabilitiesNipuna Perera100% (1)

- A211 MC 2 - StudentDocument6 pagesA211 MC 2 - StudentWon HaNo ratings yet

- Fa Pilot Paper AnswerDocument11 pagesFa Pilot Paper Answer刘宝英No ratings yet

- FAR Problem Quiz 2Document3 pagesFAR Problem Quiz 2Ednalyn CruzNo ratings yet

- Red Rose EnterpriseDocument3 pagesRed Rose Enterprisefatin batrisyiaNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- DVM Enterprises Financial Statements AnalysisDocument6 pagesDVM Enterprises Financial Statements AnalysisNicole AlexandraNo ratings yet

- Republic of The PhilippinesDocument49 pagesRepublic of The PhilippinesChe PuebloNo ratings yet

- Unit Trust Examination Mock QuestionsDocument67 pagesUnit Trust Examination Mock QuestionsDavie Cockett100% (2)

- CBSE Class 12 Accountancy - Cash Flow StatementDocument14 pagesCBSE Class 12 Accountancy - Cash Flow StatementVandna Bhaskar38% (8)

- CHP 6 Internal ReconstructionDocument60 pagesCHP 6 Internal ReconstructionRonak ChhabriaNo ratings yet

- Standard Bank Deposit Payment NoticeDocument1 pageStandard Bank Deposit Payment NoticeJoseph ThuoNo ratings yet

- Introduction to Accounting Notes PDFDocument5 pagesIntroduction to Accounting Notes PDFRishi ShibdatNo ratings yet

- IAS 20 and IAS 36 QuestionsDocument6 pagesIAS 20 and IAS 36 QuestionsGonest Gone'stoëriaNo ratings yet

- ABC Ltd capital structure analysisDocument13 pagesABC Ltd capital structure analysisMd Aliul AlimNo ratings yet

- Mang Kanor Trading Blueprint (10!19!15)Document237 pagesMang Kanor Trading Blueprint (10!19!15)Getto Pangandoyon0% (1)

- WSO Resume 119861Document1 pageWSO Resume 119861John MathiasNo ratings yet

- Jaypee Business School: Comparative Analysis of Sharekhan Ltd. With Other Stock Broking HousesDocument72 pagesJaypee Business School: Comparative Analysis of Sharekhan Ltd. With Other Stock Broking HousesLOKESH CHAUDHARYNo ratings yet

- Cred - Statement SbiDocument6 pagesCred - Statement SbiKENA PATELNo ratings yet

- Persona 4 Translation Job Answers - Apply Online Within Minutes. 100% Approval in 1 Hour. Act NowDocument2 pagesPersona 4 Translation Job Answers - Apply Online Within Minutes. 100% Approval in 1 Hour. Act NowAndika WidriantamaNo ratings yet

- Chapter 17 International Banking - Reserves Debt and RiskDocument47 pagesChapter 17 International Banking - Reserves Debt and Riskngletramanh203No ratings yet

- Research Article: Linkage Between Economic Value Added and Market Value: An AnalysisDocument14 pagesResearch Article: Linkage Between Economic Value Added and Market Value: An Analysiseshu agNo ratings yet

- Chapter 29 The Monetary SystemDocument4 pagesChapter 29 The Monetary SystemThan NguyenNo ratings yet

- Commercial BanksDocument7 pagesCommercial BanksRashi BishtNo ratings yet

- Soal Mankeu1-5Document8 pagesSoal Mankeu1-5iwak_pheNo ratings yet

- MB Closes Cooperative Bank of Aurora PDIC To Pay All Valid Insured Deposit ClaimsDocument13 pagesMB Closes Cooperative Bank of Aurora PDIC To Pay All Valid Insured Deposit ClaimsRuffa CayabyabNo ratings yet

- Internship Report For CollegeDocument23 pagesInternship Report For CollegeAaron0% (1)

- BBLD0919Document93 pagesBBLD0919Syifa Musvita Ul BadriahNo ratings yet

- Lease Accounting - Lessee CompDocument5 pagesLease Accounting - Lessee CompAngel DomingoNo ratings yet

- Calculating RAROC For The Corporate Accounts in Bank of BarodaDocument20 pagesCalculating RAROC For The Corporate Accounts in Bank of Barodajagjeetkumar178% (9)

- Vehicle Loans: List of Documents Required To Be Submitted For Hire Purchase LoanDocument17 pagesVehicle Loans: List of Documents Required To Be Submitted For Hire Purchase LoanDr.K.PadmanabhanNo ratings yet

- Direction: Provide The Step-By-Step Solutions To The Following Problems. (5 Items X 5 Points)Document3 pagesDirection: Provide The Step-By-Step Solutions To The Following Problems. (5 Items X 5 Points)Monique BalteNo ratings yet

- Taxflash 2023 08Document6 pagesTaxflash 2023 08yaranami channelNo ratings yet

- The Trial Balance: By: Justine V Andrada Kean Angelie RelatorDocument14 pagesThe Trial Balance: By: Justine V Andrada Kean Angelie RelatorCj BolidoNo ratings yet

- Income Tax Expense CalculationDocument4 pagesIncome Tax Expense CalculationHana Grace MamangunNo ratings yet

- Macro Economics AssignmentDocument11 pagesMacro Economics AssignmentSalman83% (6)