Professional Documents

Culture Documents

An Assessment of Budgeting and Budgetary Control Measures of Non-Stock and Non-Profit Schools in Las Pinas City

Uploaded by

Kyle BaladadOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Assessment of Budgeting and Budgetary Control Measures of Non-Stock and Non-Profit Schools in Las Pinas City

Uploaded by

Kyle BaladadCopyright:

Available Formats

University of Perpetual Help System DALTA

Las Piñas Campus

AN ASSESSMENT OF BUDGETING AND BUDGETARY CONTROL MEASURES

OF NON-STOCK AND NON-PROFIT SCHOOLS IN LAS PIÑAS CITY

Basillaje, Ian Nicole A.

Sarmiento, Jomelyn M.

Umayam, Jhann Aries D.

Velante, Adrian M.

A Thesis Presented to the

College of Business and Accountancy

University of Perpetual Help System DALTA

In Partial Fulfillment

Of the Requirements for the Degree

Bachelor of Science in Accounting Technology

Las Piñas City

2018

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

CHAPTER 1

1.1 INTRODUCTION

In the business world today, organizations have developed a variety of

processes and techniques designed to contribute to the planning and control

functions. According to (Churchill, Jr. & Lacobucci, 2010) one of the most

important and widely used of these processes is budgeting. Budgeting involves the

establishment of predetermined goals, the reporting of actual performance results

and evaluation of performance in terms of the predetermined goals. Additionally,

budgetary control systems are universal and have been considered an essential tool

for financial planning. The purpose of budgetary control is to provide a forecast of

revenues and expenditures this is achieved through constructing a model of how

our business might perform financially speaking if certain strategies, events and

plans are carried out.

Most firms use budget control as the primary means of corporate internal

controls, it provides a comprehensive management platform for efficient and

effective allocation of resources. According to (Carr & Joseph) budgetary controls

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

enable the management team to make plans through implementing those plans and

monitoring activities to see whether they conform to the plan, effective

implementation of budgetary control is an important guarantee for the effective

implementation of budget in the organization.

According to (Hokal & Shaw, 2002) with a narrow budgetary control, an

organization can prepare a good budget as a basis for performance management

and standards on a regular basis in order to compare actual performance with the

budget to analyze differences in the results and take corrective measures, which

mainly involves the process of budget implementation, evaluation and control.

Nonprofit organizations (NPO) wrestle continually with maintaining and

improving their operations, especially during today’s uncertain economy. In short,

NPOs must constantly strive for sustainability. A well-planned budget will focus on

the primary goals and objectives of the organization and provide financial and

programmatic adaptability —key ingredients to maximize sustainability.

1.2 BACKGROUND OF THE STUDY

Budgeting is very essential in all organization to enhance the efficiency and

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

effectiveness of business operations. Budgeting is means whereas planning and

control is the yardstick for achieving corporate goals. Today, a budget plays a

greater role in the planning and control process of basically all organization, be it

private or public sector and non-profit-making organizations.

According to (Social Economy Network, 2018) nonprofit organizations are

organized under state law for purposes other than generating profit for its members

or officers. Non-profit organization operations and activities are limited to those

that were identified in its organizational documents. They operate much like for-

profit organizations except that no stock is sold to the public. They are

advantageous because the directors gain the legal protections afforded for-profit

corporations.

The researchers chose this topic for them to be able to know and to understand

deeply the importance of budgeting and budgetary control measures of private

sectors. Additionally, the researchers are former students of private schools during

their elementary and high school education.

The researchers aim to understand the way non-stock and non-profit schools

use their funds. The study was conducted with the desire to gain insight on the

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

budgets of chosen organization and their budgetary control measures. The study

will provide an assessment of budgeting and budgetary control measures used by

non-stock and non-profit organizations in Las Piñas. The purpose of this study is to

assess the budgeting and budgetary control measures of non-stock and non-profit

schools in Las Piñas.

1.3 THEORETICAL FRAMEWORK

There are three theories that support budgetary control of firms namely the

theory of budgeting, budgetary control model and accounting theory in budgetary

control as discussed below:

1.3.1 Planning

Budgets are regarded as the core of efficient control processes, a fundamental

component of effective budgetary control. It plans out subsequent financial

performance giving way to evaluation of strategies financial viability. The most

usual way the process is done is by generating annual budgets and monitoring

activities done against these budgets (Silva and Jayamaha, 2012). The financial

implication of an entity is reflected by its budget (Shields and Young, 2000). Short

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

to medium term objectives play the part of projecting future revenue and

expenditures which provides long term objectives a coordinated management

policy where benchmarks are provided through comparing actual results with the

budgeted plans (Sharma, 2012). Budget preparations leads to the rationality of

considering alternative courses of action (Scott, 2005). Therefore, it has been

established that budgets have multiple functions such as making goals explicit,

coding learning, facilitating control, and contracting with external parties

(Selznick, 2008).

1.3.2 Evaluation

According to (Robinson and Last 2009), a budgeting system is a tool utilized

by entities as a basis for appropriation of revenue and expenditures. It is important

because there is a need to avoid wasting an entity’s resources and to guarantee that

the outputs produced, and services rendered are aligned with the objectives. It

should be able to address the efficiency and effectiveness of expenditures incurred

by the entity (Robinson, 2009). Proper controls should be placed for proper

maintenance and allocation of an organization’s budget. The ability to operate

efficiently leads to more revenue allocated to the organization.

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

1.3.3 Monitoring and Control

In the Budget Control Measure Theory, an organization should install proper

controls to guarantee that proper maintenance and allocation of budgets are

observed. Efficient operations lead to more revenues to be allocated to the

organization. This is the reason budgeting is considered as the control of spending

(Robinson and Last, 2009). According to Theory of Budgeting, the most usual

way budgets are done is by generating annual budgets and monitoring activities

done against these budgets (Silva and Jayamaha, 2012). An example of a budgeting

system is Performance Based Budgeting System. According to (Robinson and Last

2009), PBBS seeks to enhance efficiency and effectiveness of spending. The

process utilizes resources to make sure it aids achieving expected results. Below is

the operational framework of this study:

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

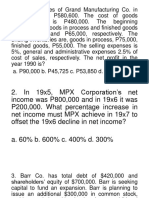

Profile:

1. Operating Years Budgeting & Budgetary

2. School Population Control Measures of

3. Presence of Non-stock and Non-profit

External Audit Schools in Las Piñas.

Guidelines:

1. Allocations

2. Preparation and

Approval of External

Audit if any

3. Budgetary Delegation

4. Budgetary Control and

Reporting

5. Budget Virement

6. Capital Expenditure

7. Monitoring Returns

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

The first box contains the demographic profile of the respondents. It concludes

the operating years, school population and presence of external audit. The

researchers will use this information to answer the statement of the problems of the

study. The second box represents the main variables of the study. And the third box

contains the guidelines of budgetary control measures.

The dotted line that connects the first and second boxes represent the

significant difference of the study in the extent of budgeting and budgetary control

measures when grouped according to profile. The straight line that connects the

second and third boxes represent the relationship of the main variables of the study

to their guidelines.

1.4 STATEMENT OF THE PROBLEM

The study seeks to find out the budgeting and budgetary control measures

of non-stock and non-profit schools in Las Piñas City. It aims to assess the

budgeting and budgetary control measures to their day to day operation and their

long-term objectives.

The budgetary control measure is important not only in the profitable

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

business or organization but also in the non-profit organization. Hence, the

researchers want to answer the question, “Do a budgeting and budgetary control

measures influence non-stock and non-profit schools in Las Piñas?”

Specifically, it aims to answer the following questions:

1. What is the demographic profile of the selected non-stock and non-

profit schools in Las Piñas in terms of:

a. Operating Years

b. School Population

c. Presence of External Audit

2. To what extent do the following budgeting and budgetary control

measures are being practiced in terms of:

a. Planning

b. Evaluation

c. Monitoring and Control

3. Is there a significant difference in the extent of budgeting and budgetary

control measures when grouped according to profile?

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

1.5 OBJECTIVES OF THE STUDY

For the study to properly move forward there is a need to establish objectives

which the study aims to achieve. The objectives of the study are: first, to determine

the effect of demographic profile of selected non-stock and non-profit schools in

Las Piñas. Second, to know the extent of practice of budgeting and budgetary

control measures among private schools in Las Pinas in terms of planning,

evaluation, monitoring and control. And lastly, to determine the extent of

budgeting and budgetary control measures when grouped according to profile.

1.6 HYPOTHESES

At .05 level of significance, below are the hypotheses:

Ho1: There is no significant difference in the practices of budgeting and

budgetary control measures between old and new non-stock and non-

profit schools in Las Piñas.

Ha1: There is a significant difference in the practices of budgeting and

budgetary control measures between old and new non-stock and non-

profit schools in Las Piñas.

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

Ho2: There is no significant difference in the practices of budgeting and

budgetary control measures between large and small non-stock and non-

profit schools in Las Piñas.

Ha2: There is a significant difference in the practices of budgeting and

budgetary control measures between large and small non-stock and non-

profit schools in Las Piñas.

Ho3: There is no significant difference in the practices of budgeting and

budgetary control measures between school with the presence of external

audit and without the presence of external audit of non-stock and non-

profit schools in Las Piñas.

Ha3: There is a significant difference in the practices of budgeting and

budgetary control measures between school with the presence of external

audit and without the presence of external audit of non-stock and non-

profit schools in Las Piñas.

1.7 SCOPE AND LIMITATIONS

The study focuses on budgeting and budgetary control measures of non-stock

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

and non-profit schools in Las Piñas City. To carry out an in-depth and

comprehensive study, at least ten (10) private schools with three (3) knowledgeable

respondents each were randomly selected. These respondents cut cross all the

cadres of the organization.

The statistical methods used by the researchers are t-test and independent t-

test. Also, the methods adopted by the researchers in collecting the data are direct

interviews, observations and the use of questionnaire. Inquiries were also made

both directly through some unusual questions to both the staff and management of

the organization.

1.8 SIGNIFICANCE OF THE STUDY

This study may be beneficial to the following:

Private School. This study may be able to have various schools to understand

the significant rule of budgeting and budgetary control measures in ensuring

successful operation.

Management. This study may help the administrators to see more the

importance of their jobs and ensuring it will do properly and effectively.

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

Future Investors. This study may help the future investors in assessing the

performance of the organization in relation to budget and budgetary control

measures for them to have an idea in decision making of investing to the

organization.

Public School. This study may help the public schools to know the importance

of budgeting and budgetary control measures in the organization. This may

Teachers. This study may serve as an academic basis for future academic

discussions about budget and budgetary control measures of non-stock and

non-profit organization.

BSAT Students. This study may serve as future reference to their future studies

concerning budgeting and budgetary control measures.

Future Researchers and Academician. Researchers and academicians

interested in this area or other related topics can use the findings of this study

to serve as a good source for further research. In addition, an examination of

the various prerequisites of the budgeting system will enable the reader to

better appreciate the use of budget in evaluating performance in relation to

predetermined set goals of the organization.

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

Other Firms. Other firms can benefit from the findings of this study by

adopting proper measures of budget control to ensure efficient and effective

utilization of available budget. The study, having examined the principle of

budgeting; preparation, implementation and control, the other firms was in a

better positioned in dealing with budgets and budgetary control matters. The

findings of this study will provide more insights to the non-profit organization

in setting policies that encourage other firms to use budgets as a performance

evaluation tool.

1.9 DEFINITION OF TERMS

Budget. In this research, the budget serves as the main variable of the study

to assess the budgeting and budgetary control measures of non-stock non-

profit schools in Las Piñas City.

Budgetary Control. In this research, the researchers used the budgetary control

as dependent variables in measuring the effectiveness of the budgeting of an

organization.

Evaluation. In this research, evaluation serves as an independent variable of

this study.

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

External Audit. In this study, the presence of external audit was one of the

demographic profiles of the study. To know if there is a significant difference

in the practices of school with presence of external audit and without the

presence of external audit of non-stock and non-profit schools in Las Piñas

city.

Monitoring and Control. The researchers used monitoring as the independent

variable of the study. It was one of the main variables to assess the

performance of the non-stock and non-profit schools in Las Piñas City.

Non-stock and Non-profit Schools. It is the main variable of the study. The

researchers focus in the non-stock and non-profit schools located in Las Piñas

City.

Operating Years. In this study, operating years was one of the demographic

profiles of the study. The researchers categorized the schools in old and new

based on their operating years.

Planning. In this research, planning used as independent variable of the study

to be able to have a proper evaluation in assessing the performance of the

selected schools.

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

CHAPTER 2

REVIEW OF RELATED LITERATURE

This chapter gives recognition to the concepts and theories of budgeting and

budgetary control measures, budget planning, evaluation, monitoring and control

of private sectors from different books and references which the researchers used

to provide supplementary information. Review of related literature and studies,

foreign and local was conducted for the achievement of the goals and completion

of the study.

2.1 Budget

As (Chartered Institute of Management Accountants CIMA, 2018) official

terminology has defined the terms budget as quantitative expression of a plan for a

defined period. It may include planned sales volumes and revenues; resource

quantities, costs and expenses; assets, liabilities and cash flows. As budgeting

defined, it is a means of coordinating the combined intelligence of an entire

organization into a plan of action based on past performance and governed by

rational judgment of factors that will influence the course of business in the future.

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

The Oxford Advanced Learners’ dictionary defined budget as an estimate or

plan of the money available to somebody and how it will be spent over a period.

Both Horngren and the dictionary emphasized the word plan but planning itself is

found in all aspect of human endeavor, hence planning is a blue print of business

growth and a road map for development that helps in deciding objectives,

quantitatively and qualitatively.

According to (Foster, Datar, & Horngren, 2013) budgeting is a common

accounting tool company use for implementing strategy. Budgeting aids in

planning and controlling the actions companies must undertake to satisfy their

customers and succeed in the marketplace. Budgets provide measures of the

financial results a company expects from its planned activities. By planning,

managers learn to anticipate potential problems and how to avoid them. Instead of

facing unexpected problem, managers can focus their energies on exploiting

opportunities. Remember that, “Few business plans to fail, but many of those that

flop failed to plan.”

Budget is pervasive in all organizations. It interprets organizational objectives

into activities with specific results expected. It promotes coordination by causing

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

communication all throughout an organization and provides a standard which can

be used as a basis for evaluation. Therefore, budgets and its processes are

important parts of management control because they influence behavior and focus

actions toward achieving organizational goals (Van der Stede, 2015).

According to (Burger, 2012) the annual budgets ensure regular checks over

aggregate expenditure and generate full of financial performance statements on

resource utilization but not concerned with long term development plans over the

medium-term activity. Budgeting entails setting of goals, giving an account of

actual financial performance and performance evaluation in terms of set financial

goals.

Budget holders should always know what is routinely expected of them in the

budgetary process and should be ready to secure it at any given time. It is their

responsibility to have a copy of the statement of budgeting premises. They are

expected to be actively participating in budgeting and are aware of any revision

made in budgets submitted to them. They also have the right to a copy of the final

approved budget (Akintoye, 2008)

According to (Proctor 2009), a budget is a means for a non-profit operation to

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

endorse the fulfillment of their larger goals by means of internal financial control.

The budgeting tool must regard different needs than a regular company. It is vital

for a responsible way of keeping track of spending and revenue. Proctor also stated

that the disparity between profit and non-profit organizations is not whether it has

the need to gain profit or not, but rather what is done with it. This would indicate

that non-profit organizations should deliver the excess money back to the

organization to make progress in its purpose. One of the threats for budgeting in a

non-profit organization is the desire to maintain financial control. Since the board

changes annually, it is imperative that budgeting tool is clear and easy to use.

Budgeting is a primary method for enforcing protocol in democracies. Yet the

processes of the preparation of budgets are still plagued by being excluding,

opaque, and arcane. A recent study submitted by (Shapiro and Talmon 2018)

sought to rectifying the problem by providing A Participatory Democratic

Budgeting Algorithm. This algorithm will provide budgets that are

a. Prepared, discussed, and voted upon by comparing with last-year's budget,

b. Quantitative, in that items appear in quantities with potentially varying

costs, and

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

c. Hierarchical, reflecting the organization's structure.

2.1.1 Budget Monitoring

Budget monitoring lays the foundation for effective monitoring and control of

school budgets. This is exposed in the conceptualization of this phenomenon and

the discussion of dimensions related to budget monitoring.

2.2 Budgetary Control

According to (Marginson, 2013) budgetary control refers to the concept of

guaranteeing the systematic and effective utilization of financial resources by the

processes of monitoring, motivation, feedback, and performances by evaluating the

level of individual responsibility center.

( Gadade & Wagh, 2013) Believe that budgetary control is the process of

establishing budgets relating with the various activities, taking applicable actions

to meet the expected performance, and scrutinizing the budgeted figures with the

performances.

Budgetary control is a part of the general system of responsibility accounting

within an organization in accordance with areas of personal responsibilities of the

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

budget holders, income and expenses are analyzed through the consent of financial

monitoring (Tunji, 2013)

According to Howard and Brown (2015), the Theory of Budgeting comes into

the forefront when confronted with inadequate resources influencing performance.

Some factors are surfaced under budget control are well highlighted by the Agency

Theory of the Principal-Agent Relationship.

In the absence of effective Budgetary control (Okpanachi & Mohammed,

2013) determined these badly made coordination of activities, disregard for the set

down procedures and for not paying attention will make the organization

incapacitated.

(Mohamed, Evans, & Tirimba, 2015) Examined how budgetary control can

effect on the performance of Dara-salaam Bank in Somaliland. The objective of

this study aims to determine how responsibility accounting influences an

organizational performance, to research whether variance cost analysis affects

organizational performances and to create how zero-based budgeting affects

organizational performance.

(Kipkemboi, 2013) studied the effect of budgetary control on performance of

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

non-governmental organizations in Kenya. His study determines that budgets are

used for planning, monitoring and control. Based on his study he also concluded

that there is a low positive relationship between budgetary control and

performance. Since there are several factors that may affect the performance of an

NGO, he proposed that budgetary control would not be the only reason for a high

performance.

(Venkatasami, 2015) stated that budgetary control helps to achieve effective

coordination of activities of the varied government ministries and departments by

setting financial goals as a way of attaining predetermined financial performance.

2.3 Determinants of Effectiveness

Based on (Srinivasa, 2013) there are several determinants to effective budget

implementation of budgets among organizations. These included proper planning,

evaluation, monitoring and control of the budget process and staff motivation.

2.3.1 Proper Planning

According to (Dunk, Hopwood, & Shields, 2013) the key to budgetary

control, one must make fully coordinated detailed plan in terms of both financial

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

and quantitative for the future. It must follow the aligned with the organization’s

long-term plans. In certain circumstances, the plan may be impaired. An example

would be economic crises. Some long-term plans are abandoned because of one of

these crises. Which is why policies should be implemented before a budget is

established.

According to (Foster, Datar, & Horngren, 2013) upon the implementation of

a budget, it is important that feedback be made available to managers in charge.

Monthly budget reports are made containing the comparison between budget and

the actual position and identify variances. Proper coordination must be observed to

remove hindrances and to guarantee that the implementation process is handled

effectively to avoid being costly and time consuming.

(Joshi & Abdulla, 2013) defined the patterns of income and expenditure over

an activities life cycle can be used to aid proper planning. An estimated budget for

possible cost on an activity planned should be established.

2.3.1.1 Budget Planning Processes

To carry out budgetary control, it is necessary to formulate a fully co- ordinate

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

detailed plan in both financial and quantitative terms for a forthcoming period. To

prepare proper budget plan, three preconditions were recommended by (Anwar S.

2007) as follows:

1. The preparation process must consultative and participatory in order to

ensure ownership to both the process and the approved budget;

2. A systematic process of prioritization of programs and expenditures, which

is based on informed choices, must take place.

3. Planned outputs, activities, and expenditure allocations in the annual work

plan and budget estimates must be realistic, and achievable

2.3.2 Evaluation

As (Hancock, 2009) discussed, evaluation is a fundamental cause of

effectiveness. Using an evaluation plan, entities can determine the direction their

evaluations take based on priority, resource, time, and skills necessary to achieve

the evaluation. It is necessary to involve the management team in the monitoring of

the evaluation of budgetary control measures to preserve transparency and

effectiveness.

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

Development of an evaluation plan which includes the aid of a workgroup of

stakeholders will cultivate collaboration and the impression of mutual objective

this contributes in accomplishing effective budgetary control (Simiyu, 2015).

2.3.3 Monitoring and Control of Budgetary Process

Monitoring and Control of the budget process also causes effectiveness. As

soon as implemented, budgets are in need of being monitored and controlled to

secure effectiveness of aligning budgets over certain periods of time (Horngren et

al., 2015).

Transparency when it comes to budget planning is beneficial to convincing

investors, development banks and national or international donors to make

monetary resources accessible if proper control and monitoring is established in the

budget process. This is accomplished by ensuring the estimated budget does not

depart from the actual result in order to take appropriate actions where necessary

(Otley and Van der Stede, 2016).

2.3.3.1 Budget monitoring and Evaluation

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

According to (Hancock 2009) budget monitoring and evaluation is a key

determinant for effectiveness, through an evaluation and monitoring, the

organization can clarify what direction the evaluation should take based on

priorities, resources, time, and skills needed to accomplish the evaluation. To

enhance effectiveness and transparency the management team should be actively

involved in the process of monitoring and evaluation of budgetary control

processes and procedures.

2.4 Non-stock and Non-profit Organization

Based on the Corporation Code of the Philippines (Batasang Pambansa Bld.

68) Section 87, a non-stock corporation is one where no part of its income is

distributable as dividends to its members, trustees, or officers, subject to the

provisions of this Code on dissolution: Provided, That any profit which a non-stock

corporation may obtain as an incident to its operations shall, whenever necessary

or proper, be used for the furtherance of the purpose or purposes for which the

corporation was organized, subject to the provisions of this Title.

The provisions governing Stock Corporation, when pertinent, shall be

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

applicable to non-stock corporations, except as may be covered by specific

provisions of this Title. (n)

According to Section 87, Non-stock corporations may be formed or organized

for charitable, religious, educational, professional, cultural, fraternal, literary,

scientific, social, civic service, or similar purposes, like trade, industry, agricultural

and like chambers, or any combination thereof, subject to the special provisions of

this Title governing classes of non-stock corporations. (n)

A non-profit organization is a group organized for purposes other than

generating profit and in which no part of the organization's income is distributed to

its members, directors, or officers. Non-profit corporations are often termed "non-

stock corporations." They can take the form of a corporation, an individual

enterprise (for example, individual charitable contributions), unincorporated

association, partnership, foundation (distinguished by its endowment by a founder,

it takes the form of a trusteeship), or condominium (joint ownership of common

areas by owners of adjacent individual units incorporated under state condominium

acts).

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

2.5 SYNTHESIS OF THE STUDY

Budgets are the core element of the control-process and consequently vital part

to the umbrella concept of performance measurement. Research has shown that

there is no single approach to budgeting suitable for all businesses. Instead, the

suitability of an approach is argued to be contingent upon characteristics of a

business including its size, strategy, structure, and management’s perception of the

uncertainty of the environment within which the business operates to best link its

budgetary control procedures that is planning, evaluation, monitoring and control.

To sum up, a budget is a tool used by organization to make plans that meet the

organization’s objectives. Budgets are given quantitative form, evaluated,

monitored and controlled to make sure the desired results of the plan are met and to

avoid deviation from the plan. Budget monitoring and control are applied to a

budget to maintain its efficiency and effectiveness.

Budgetary control is the process of relating budgets with actual action to meet

expected result of plan and to evaluate performance. It is used to make sure that

financial resources are utilized effectively. However, there are determinants of

effectiveness that must be kept in mind in budgeting control.

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

Proper planning involves proper coordination and adherence to an

organization’s long-term objectives. Evaluation involves determining whether the

plan is effective built the use of priority, time, resources and skills. Monitoring and

control involve making sure plans are being met accordingly. In this study, the

researchers aim to assess the implementation of the concepts in an organization

whose income is used to further the purpose of which they are established for.

2.6 GAP ANALYSIS

During the study, the researchers realized that the budget is fundamental in the

survival of all kinds of organizations. They depend on the budget on a lot of things.

Inefficiency and ineffectiveness in the plan have serious repercussions. Budgeting

and budgeting and budgetary control measures is very important not only in a

profit generating business or organization but also in the non-stock and non-profit

organizations. Every business whether it is profit or non-profit generating should

set a standard when it comes to budgeting.

Budgeting is very important because it is needed, not just simply needed in our

daily lives but also in a non-profit organization. Even though we already know how

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

to do budgeting like what we usually do we still need to know how does this

budgeting runs in a non-profit organization and what will be the cause and effect if

there’s no proper planning, evaluating and control. Budgeting is used as a strategy

in an organization and in non-profit organization it should be easy to use because it

is one of their ways to plan an income and expense or a guide for future as well as

assess its current financial health. Non-profit organization should always review

their budgets because it may change annually.

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

CHAPTER 3

METHODOLOGY

This chapter discussed the approaches and techniques the researchers used

when collecting data, analyzing the data and presenting the findings. These include

the research design, target population and sample, data gathering methods and data

analysis techniques.

3.1 Research Design

The study used a descriptive survey study research design which was aimed at

examining the budgeting and budgetary control measures of non-stock and non-

profit schools in Las Piñas City. A descriptive survey usually concerned with

describing a population with respect to important variables with major emphasis

being establishing the relationship between the variables. The advantage of this

type of research design is that it is easy to understand as recommending by

(Kothari, 2005). This design attempts to collect data from members of the

population and describes existing phenomenon with reference to budgeting

controls.

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

3.2 Population and Sample

The population of the study consists of three (3) respondents each from ten

(10) randomly selected non-stock and non-profit schools in Las Piñas City.

3.3 Sample Design

This study used random sampling method to select ten (10) non-stock and non-

profit schools operating across the Las Piñas City. The advantage of sampling is

that it saves time and resources.

3.4 Data Gathering

The researchers adapted a questionnaire to gather necessary information in this

study. The study used structured questionnaire for purposes of collecting data. The

questionnaires consisted of three (3) parts. The first part of the questionnaire was

all about planning of budget, the second part was about evaluation of budget and

lastly, the monitoring and controlling of budget of the organization. A five (5) point

Likert Scale ranging from strongly agree to strongly disagree was used in

measuring the extent of the responses provided. The structured questionnaires were

given to the knowledgeable respondents at the time when the researchers

conducted their survey. This study also adapted the use of direct interviews and

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

observations in collecting the data needed. Data will be gathered through interview

of the respondents as well as using a questionnaire. To ensure the validity of the

study, a statistician will be involved in interpreting the data gathered through

various instruments. The statistician involved will be an expert in the subject area

in which the study focuses on.

3.5 Data Analysis

Data was analyzed to establish the measures of findings of the study. T-test

and independent t-test was used to determine the significant relationship of the

variables to determine the extent to which budgeting and budgetary control

measures are being practiced in terms of planning, evaluation, monitoring and

controlling.

3.5.1 Descriptive Method

According to (Trochim, 2006)Descriptive statistics are used to describe the

basic features of the data in a study. They provide simple summaries about the

sample and the measures. Together with simple graphics analysis, they form the

basis of virtually every quantitative analysis of data.

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

3.5.2 Independent t-test

According to (Kent State University Libraries, 2018) the Independent

Samples t Test compares the means of two independent groups to determine

whether there is statistical evidence that the associated population means are

significantly different. The Independent Samples t Test is a parametric test.

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

References

Gadade, S. T., & Wagh, A. D. (2013). Evaluating Budgeting and Budgetary Control

Process in Colleges. International Monthly Refereed Journal of Research In

Management & Technology, 2.

Carr, & Joseph. (n.d.). 2000.

Chartered Institute of Management Accountants CIMA. (2018). Retrieved from

http://www.retawprojects.com/uploads/chapter-13-budgets-and-budgetary-

control.pdf

Churchill, Jr., G. A., & Lacobucci, D. (2010). Marketing Research :

Methodological Foundations. Mason, Ohio: Fort Worth: The Dryden press.

Dunk, A. S., Hopwood, A. G., & Shields, M. D. (2013). Role of Budgeting and

Budget process Journal of Management Accounting.

Foster, G., Datar, S. M., & Horngren, C. T. (2013). Cost Accounting: A Managerial

Emphasis (15th ed.). Upper Saddle River: Prentice Hall Inc.

Hancock, G. (2009). Lords of Poverty. London, Uniter Kingdom: Macmillan

Publishers Ltd.

Hokal, A., & Shaw, K. (2002). Managing Progress Monitoring in United Arab

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

Schools , International Journal of Educational Management (Vol. 13).

MCB UP Ltd.

Horngren, C. T., Foster, G., & Datar, S. M. (2013). Cost Accounting: A Managerial

Emphasis (15th ed.). Upper Saddle River, New Jersey: Prentice Hall Inc.

Joshi, P., & Abdulla, J. (2013). "Budgetary Control and Performance Evaluation

Systems in Corporations in Bahrain", Asian Review of Accounting (Vol. 4).

MCB UP Ltd.

Kent State University Libraries. (2018, June 13). Retrieved from

https://libguides.library.kent.edu/SPSS/IndependentTTest

Kipkemboi, S. (2013). Effect of Budgetary control on Performance of Non-

Governmental Organizations in Kenya.

Kothari, C. (2005). Research Methodology: Methods and Techniques. New Delhi:

New Age International (P) Ltd.

Marginson, S. (2013, November 27). Student Self-Formation in International

Education. 18(1), 6-22.

Mohamed, I. F., Evans, K., & Tirimba, O. I. (2015). Analysis of the Effectiveness

of Budgetary Control Techniques on Organizational Performance at Dara-

College of Business Administration and Accountancy

University of Perpetual Help System DALTA

Las Piñas Campus

Salaam Bank Headquarters in Hargeisa Somaliland. International Journal

of Business Management and Economic Research (IJBMER), 6(6), 327-

340.

Okpanachi, J., & Mohammed, N. A. (2013). Budget Target Settings and Effective

Performance Measurement in Nigerian Hospitality Industry. Journal of

Finance and Economics, 1(3), 39-50.

Social Economy Network. (2018, July). Retrieved from

http://www.socialeconomynetwork.org/nonprofit-organizations/

Srinivasa, R. (2013). Current Budgeting Practices in Us Industry. New York: NY:

Quorumm Books.

Tunji, S. T. (2013, December). The Impact Of Budgeting And Budgetary Control

On The Performance Of Manufacturing Company In Nigeria. Journal of

Business Management & Social Sciences Research (JBM&SSR) , 2.

College of Business Administration and Accountancy

You might also like

- Insurance Budgeting and Financial OutcomesDocument33 pagesInsurance Budgeting and Financial OutcomesMaggie DeocarezaNo ratings yet

- Thesis 2 Budgeting Control System and Financial Outcome For Insurance CompanyDocument22 pagesThesis 2 Budgeting Control System and Financial Outcome For Insurance CompanyMaggie DeocarezaNo ratings yet

- Dissertation On Budgetary Control and Financial Performance of Insurance Companies in Makati CityDocument28 pagesDissertation On Budgetary Control and Financial Performance of Insurance Companies in Makati CityMaggie Deocareza100% (1)

- DASAL - The Impact of Budgeting, Planning and Control On The Profitability of Selected Small To Medium Scale Enterprises in Las Pinas City in 2021.Document12 pagesDASAL - The Impact of Budgeting, Planning and Control On The Profitability of Selected Small To Medium Scale Enterprises in Las Pinas City in 2021.shaneNo ratings yet

- The Level of Performance of BS Accountancy 1-1 Students in Their Major Subject, Fundamentals of Accounting Part 1Document9 pagesThe Level of Performance of BS Accountancy 1-1 Students in Their Major Subject, Fundamentals of Accounting Part 1Joshii KunNo ratings yet

- Factors Affecting The Academic Performance of BS AccountancyDocument27 pagesFactors Affecting The Academic Performance of BS AccountancyAyenna LumanglasNo ratings yet

- Compiled Chapters 1 2 3 5Document47 pagesCompiled Chapters 1 2 3 5Pam MendozaNo ratings yet

- Factors for CPA Exam Success at Palawan State UDocument16 pagesFactors for CPA Exam Success at Palawan State UKashato BabyNo ratings yet

- The Impact of Academic Accounting Research On Professional Pract 2009Document46 pagesThe Impact of Academic Accounting Research On Professional Pract 2009JankioNo ratings yet

- Group12 ThesisDocument36 pagesGroup12 ThesisJames Erick LermaNo ratings yet

- Passed 102215Document38 pagesPassed 102215Ken CosaNo ratings yet

- Jpia LetterDocument3 pagesJpia LetterCheng de LongNo ratings yet

- RRLDocument5 pagesRRLJulie Ann SilvaNo ratings yet

- Financial Literacy Amongst Small Scale Farmers in ZambiaDocument13 pagesFinancial Literacy Amongst Small Scale Farmers in ZambiaInternational Journal of Business Marketing and Management100% (1)

- Saint Mary's University: Accounting Knowledge and Skills of Selected Barangay Treasurers in A Second Class MunicipalityDocument10 pagesSaint Mary's University: Accounting Knowledge and Skills of Selected Barangay Treasurers in A Second Class MunicipalityVia MontemayorNo ratings yet

- Status of BSA Graduates in Pilar Bataan: Difficulties in Finding A JobDocument42 pagesStatus of BSA Graduates in Pilar Bataan: Difficulties in Finding A JobArnold Marcelo PalalonNo ratings yet

- Detailed analysis of SMBC research resultsDocument20 pagesDetailed analysis of SMBC research resultsClaudine Keine Kawaii0% (1)

- Thesis, Performance 2Document25 pagesThesis, Performance 2Jezmelyn Antimano60% (5)

- Factors Influencing 2 Year Students To Shift With Bachelor of Science in HotelDocument8 pagesFactors Influencing 2 Year Students To Shift With Bachelor of Science in HotelSherwin Macam Zambale0% (1)

- Research Paper Namin TohDocument47 pagesResearch Paper Namin TohJowee Ann SalesNo ratings yet

- CPALEDocument1 pageCPALERalph Clarence NicodemusNo ratings yet

- The Bachelor of Science in AccountancyDocument3 pagesThe Bachelor of Science in AccountancyTin RobisoNo ratings yet

- Case 5: Carlo Recio Business Policy (40Document6 pagesCase 5: Carlo Recio Business Policy (40Ria Dumapias0% (1)

- Academic Performance and Confidence in Pursuing ABM CoursesDocument25 pagesAcademic Performance and Confidence in Pursuing ABM CoursesNadiaNo ratings yet

- Thesis New Encoded-finaL!Document37 pagesThesis New Encoded-finaL!Jeff Roy Palungya100% (1)

- CPA Seeks Challenging CareerDocument3 pagesCPA Seeks Challenging CareerJhinie GrefaldaNo ratings yet

- 180 84 1 PBDocument12 pages180 84 1 PBLouie De La TorreNo ratings yet

- MainDocument16 pagesMainArjay DeausenNo ratings yet

- Accounting Systems Principles and DevelopmentDocument7 pagesAccounting Systems Principles and DevelopmentjaysonNo ratings yet

- Extent of AIS Implementation by Micro-Enterprises in Bulan, SorsogonDocument45 pagesExtent of AIS Implementation by Micro-Enterprises in Bulan, SorsogonNikki Jean HonaNo ratings yet

- Grand Manufacturing net profit calculationDocument10 pagesGrand Manufacturing net profit calculationRichfredlyn Moreno100% (1)

- Strategic Management - Module 1 - Basic Concepts in Business Policy and StrategyDocument4 pagesStrategic Management - Module 1 - Basic Concepts in Business Policy and StrategyEva Katrina R. LopezNo ratings yet

- Pamantasan NG CabuyaoDocument15 pagesPamantasan NG CabuyaoJudithRavelloNo ratings yet

- Assurance Principles Ethics GovernanceDocument3 pagesAssurance Principles Ethics GovernanceJulrick Cubio EgbusNo ratings yet

- Financial Management Practices and Financial................Document65 pagesFinancial Management Practices and Financial................kindhun100% (1)

- Final ThesisDocument67 pagesFinal Thesisshoaib_hafeez50% (2)

- Correlation of academic and exam performanceDocument10 pagesCorrelation of academic and exam performanceAngelica Magdaraog100% (1)

- Mikong Due MARCH 30 Hospital and HmosDocument6 pagesMikong Due MARCH 30 Hospital and HmosCoke Aidenry SaludoNo ratings yet

- CRISIS MANAGEMENT STRATEGIES OF FAST FOOD CHAINS IN URDANETA CITY PANGASINAN BACANI Et AlDocument119 pagesCRISIS MANAGEMENT STRATEGIES OF FAST FOOD CHAINS IN URDANETA CITY PANGASINAN BACANI Et AlLeonida ViernesNo ratings yet

- RRL ProgressedDocument14 pagesRRL ProgressedMonique100% (1)

- Record Keeping and Performance in SmallDocument60 pagesRecord Keeping and Performance in SmallMila MercadoNo ratings yet

- Revision 2Document51 pagesRevision 2Jomari lester LozadaNo ratings yet

- Great Accounting Topics For Your Research PaperDocument11 pagesGreat Accounting Topics For Your Research PaperJennybabe Peta100% (2)

- Hardbound Thesis 1 29 2020Document116 pagesHardbound Thesis 1 29 2020Renzo MellizaNo ratings yet

- ThesisDocument64 pagesThesisiojnilnjkhNo ratings yet

- Effect of Cash Flow Management Activities On Financial Performance of Manufacturing Companies in NairobiDocument50 pagesEffect of Cash Flow Management Activities On Financial Performance of Manufacturing Companies in NairobiWycliffe Motende0% (1)

- Right of Stoppage in TransitDocument8 pagesRight of Stoppage in TransitMara Shaira SiegaNo ratings yet

- Accounting Research and The Development of Accounting Profession in Nigeria: An Empirical AnalysisDocument15 pagesAccounting Research and The Development of Accounting Profession in Nigeria: An Empirical Analysis41f14nnNo ratings yet

- Performance of Bsa Graduates in The Cpa Licensure ExaminationDocument4 pagesPerformance of Bsa Graduates in The Cpa Licensure ExaminationJeong MeungiNo ratings yet

- CMO No.03 s2007Document225 pagesCMO No.03 s2007Pao AuxteroNo ratings yet

- Recent Accounting Issues in the Philippines: Tax, Exams, ReportingDocument1 pageRecent Accounting Issues in the Philippines: Tax, Exams, ReportingKent Tacsagon100% (1)

- Personal Financial Wellness of Grade 12 ABM StudentsDocument82 pagesPersonal Financial Wellness of Grade 12 ABM StudentsRae SlaughterNo ratings yet

- Chapters 1,2&3Document33 pagesChapters 1,2&3Erika BuenaNo ratings yet

- Experiences of Bachelor of Science in Accountancy in University of MindanaoDocument29 pagesExperiences of Bachelor of Science in Accountancy in University of Mindanaodengs leeNo ratings yet

- Impact of Accounting Information Systems On OrganizationalDocument5 pagesImpact of Accounting Information Systems On OrganizationalA2fahadNo ratings yet

- Students' Perception of The Causes of Low Performance in Financial AccountingDocument48 pagesStudents' Perception of The Causes of Low Performance in Financial AccountingJodie Sagdullas100% (2)

- BSA4 14 AIS in The Hotel Industry Analysis of Usefulness & Ease of UseDocument36 pagesBSA4 14 AIS in The Hotel Industry Analysis of Usefulness & Ease of UsePeter Miguel C. Peñalosa50% (2)

- Expert Q&A SolutionsDocument3 pagesExpert Q&A SolutionsSitiNadyaSefrilyNo ratings yet

- Analyzing DLSU-D's Internal Strengths and WeaknessesDocument11 pagesAnalyzing DLSU-D's Internal Strengths and WeaknessesHeki CacoNo ratings yet

- An Assessment of Budgeting and Budgetary Control Measures of Non-Stock and Non-Profit Schools in Las Pinas CityDocument38 pagesAn Assessment of Budgeting and Budgetary Control Measures of Non-Stock and Non-Profit Schools in Las Pinas CityJustinkyleNo ratings yet

- North FaceDocument5 pagesNorth FaceArianna Maouna Serneo BernardoNo ratings yet

- Does Building Green Create Value?Document4 pagesDoes Building Green Create Value?Natalia ArmentaNo ratings yet

- 5.TN Treasury Code Vol1 77-150Document74 pages5.TN Treasury Code Vol1 77-150Porkodi SengodanNo ratings yet

- ISO 55000 NEW STANDARDS FOR ASSET MANAGEMENT (PDFDrive)Document35 pagesISO 55000 NEW STANDARDS FOR ASSET MANAGEMENT (PDFDrive)Vignesh Bharathi0% (1)

- Advanced Auditing and Professional EthicsDocument54 pagesAdvanced Auditing and Professional EthicsManu JainNo ratings yet

- Résumé Of: Career VisionDocument4 pagesRésumé Of: Career VisionBabu babuNo ratings yet

- Test 2 Aud339 Jan2021 SS Updated PDFDocument5 pagesTest 2 Aud339 Jan2021 SS Updated PDFNUR LYANA INANI AZMINo ratings yet

- Resume - CA Rohit JainDocument1 pageResume - CA Rohit JainArisha NarangNo ratings yet

- Rmbe Afar For PrintingDocument18 pagesRmbe Afar For PrintingjxnNo ratings yet

- Finance (Allowances) Department: G.O.No. 106, DATED 28 Apr Il, 201 4Document2 pagesFinance (Allowances) Department: G.O.No. 106, DATED 28 Apr Il, 201 4Papu KuttyNo ratings yet

- Gold Medal Merit Certificate Policy 2Document2 pagesGold Medal Merit Certificate Policy 2Zaibi ShahNo ratings yet

- SamplingDocument8 pagesSamplingLorrieNo ratings yet

- Gilead: Inkhawmna Hmun: ST Georges Church, ABIDS Pathian Ni Tlai Dar 3:30 PMDocument6 pagesGilead: Inkhawmna Hmun: ST Georges Church, ABIDS Pathian Ni Tlai Dar 3:30 PMCK LalropuiaNo ratings yet

- 2 6 Risk Management PolicyDocument47 pages2 6 Risk Management PolicyRaja ManiNo ratings yet

- Supplemental Guidelines For The Management of The PAMANA - DILG FundDocument14 pagesSupplemental Guidelines For The Management of The PAMANA - DILG FundOffice of the Presidential Adviser on the Peace ProcessNo ratings yet

- Form Land RegistrationDocument3 pagesForm Land RegistrationJulo R. TaleonNo ratings yet

- The Three Key Elements of Professional Skepticism PDFDocument6 pagesThe Three Key Elements of Professional Skepticism PDFSahar FayyazNo ratings yet

- Company Audit Eligibility, Qualification and DisqualificationDocument30 pagesCompany Audit Eligibility, Qualification and DisqualificationChutmaarika GoteNo ratings yet

- PSA 200 Audit Objectives (40Document15 pagesPSA 200 Audit Objectives (40Marko JerichoNo ratings yet

- SBD-FOR DESIGN SUPPLY INSTALLATION TESTING AND COMMISSIONING OF FLOATING BOOMS FACILITIES-Final CompressedDocument127 pagesSBD-FOR DESIGN SUPPLY INSTALLATION TESTING AND COMMISSIONING OF FLOATING BOOMS FACILITIES-Final CompressedMartens HategeNo ratings yet

- IT Equipments - Technical Evaluation of BidsDocument18 pagesIT Equipments - Technical Evaluation of Bidsanish ashokkumarNo ratings yet

- Christy Company Operates in The EntertainmentDocument6 pagesChristy Company Operates in The EntertainmentDoreenNo ratings yet

- Audit PerbankanDocument140 pagesAudit Perbankanmuhammad firmanNo ratings yet

- CMS Company ProfileDocument17 pagesCMS Company ProfileCms IndiaNo ratings yet

- Analysis of Factors Influencing Fraudulent Financial ReportingDocument12 pagesAnalysis of Factors Influencing Fraudulent Financial ReportingTifanny LaurenzaNo ratings yet

- IATF QMS Internal Auditor Exam PaperDocument9 pagesIATF QMS Internal Auditor Exam PaperAnkurNo ratings yet

- Audit II CH 4 Nov 2020Document10 pagesAudit II CH 4 Nov 2020padmNo ratings yet

- 01 - Ethical Issues in Advanced AccountingDocument6 pages01 - Ethical Issues in Advanced AccountingTina Llorca100% (5)

- 2018 SwiggyDocument127 pages2018 SwiggyAnurag BhardwajNo ratings yet

- Miňoza, Mary Grace B.: Professional ObjectivesDocument5 pagesMiňoza, Mary Grace B.: Professional ObjectivesVictor MinozaNo ratings yet