Professional Documents

Culture Documents

Safari - 22-Apr-2019 at 5:47 PM PDF

Uploaded by

Surbhi Mohindru0 ratings0% found this document useful (0 votes)

9 views1 pageThis document provides details about two capital budgeting projects for XYZ Ltd:

1) A proposal to build, operate and transfer a 35km road section for Rs. 200 crores to be financed through equity of Rs. 50 crores and loans of Rs. 150 crores. Toll revenue is estimated at Rs. 50 crores annually for 15 years. Calculate the project IRR and equity IRR, ignoring corporate tax.

2) A manufacturing unit is considering two plant purchase proposals with details on cost, installation charges, life, scrap value, and output provided. Calculate the relevant rates of return for selection.

Original Description:

Original Title

Safari - 22-Apr-2019 at 5:47 PM.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides details about two capital budgeting projects for XYZ Ltd:

1) A proposal to build, operate and transfer a 35km road section for Rs. 200 crores to be financed through equity of Rs. 50 crores and loans of Rs. 150 crores. Toll revenue is estimated at Rs. 50 crores annually for 15 years. Calculate the project IRR and equity IRR, ignoring corporate tax.

2) A manufacturing unit is considering two plant purchase proposals with details on cost, installation charges, life, scrap value, and output provided. Calculate the relevant rates of return for selection.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageSafari - 22-Apr-2019 at 5:47 PM PDF

Uploaded by

Surbhi MohindruThis document provides details about two capital budgeting projects for XYZ Ltd:

1) A proposal to build, operate and transfer a 35km road section for Rs. 200 crores to be financed through equity of Rs. 50 crores and loans of Rs. 150 crores. Toll revenue is estimated at Rs. 50 crores annually for 15 years. Calculate the project IRR and equity IRR, ignoring corporate tax.

2) A manufacturing unit is considering two plant purchase proposals with details on cost, installation charges, life, scrap value, and output provided. Calculate the relevant rates of return for selection.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

SFM Imp Q ... thari.

pdf Sign in

Page 11 of 393

CA Final SFM CA Mayank Kothari

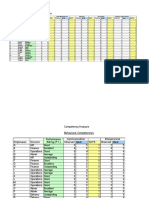

1. Capital Budgeting

No.1. Question Reference

1 2. XYZ Ltd. an infrastructure company is evaluating a PM_Q13_2.11

proposal

and transfer

to build,aoperate

section of 35 km of road at a project cost

of `200 crores

financed as to be

Equity share capital `50 crores, loans at the interest rate

follows.

of 15% p.a.

financial from

institutions `150 crores. The project after

completion

traffic and awill

tollbewillopen

be collected

to for a period of 15 years

the road. The company

from the vehicles using is also required to maintain the

road during

years and afterthetheabove 15

completion of that period, it will be

handed

zero value.

overIt to

is estimated

NHAI at that the toll revenue will be

`50 annual

the crores toll

per collection

annum and expenses including

to

maintenance of roads will The

5% of the project cost. company considers

amount

writing

the off the

project in 15total cost

years onofa straight line basis. For

corporate

the company incomeis allowed

tax purposes

to take depreciation @

The

10% financial

on WDV institutions

basis. are agreeable for the

repayment

annual instalments-

of the loan consisting

in 15 of

principle and

Calculate interest.

project IRR and equity IRR.

2 3. A

Ignore

manufacturing

corporateunit tax. engaged in the production of PM_Q12_2.9

automobile

considering

partsaisproposal of purchasing one of the two

given

plants, details of which are

below: Plant A Plant B

Cost `20,00,000 `38,00,000

Installation Charges `4,00,000 `2,00,000

Life 20 years 15 years

Scrap Value after Full Life `4,00,000

`4,00,000

Output per minute (units) 200 400

1|P

PM- Practice Manual Oct 2018, SM –

SUPP- Supplementary ge

Study Material

Page Dec / Module,

11 2019, 393

SUGG- Suggested Answers

You might also like

- NISM Series V A MFD Certification Examination June 2022 FinalDocument521 pagesNISM Series V A MFD Certification Examination June 2022 FinaladithyaNo ratings yet

- Capital BudgetingDocument6 pagesCapital Budgetingkaf_scitNo ratings yet

- 41-Trading The Golden RatioDocument5 pages41-Trading The Golden RatioparirahulNo ratings yet

- Economy Lecture HandoutDocument38 pagesEconomy Lecture HandoutEdward GallardoNo ratings yet

- 2009 EFB2 InfopackDocument24 pages2009 EFB2 Infopackဇမ္ဗူ ဟိန်းNo ratings yet

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNo ratings yet

- EBS GL Interview QuestionsDocument17 pagesEBS GL Interview QuestionsSivakumar KandasamyNo ratings yet

- 143 Quiz4Document3 pages143 Quiz4Leigh PilapilNo ratings yet

- Basic Principles of TaxationDocument22 pagesBasic Principles of TaxationJacq CalaycayNo ratings yet

- Quiz - Chapter 13 - Acctg For BotDocument3 pagesQuiz - Chapter 13 - Acctg For BotMark CanoNo ratings yet

- Capital Expenditure DecisionDocument4 pagesCapital Expenditure DecisionSayan MitraNo ratings yet

- MCQ - Capital BudgetingDocument2 pagesMCQ - Capital BudgetingRamainne Ronquillo0% (1)

- PhilPaSS PrimerDocument22 pagesPhilPaSS PrimerCoolbuster.NetNo ratings yet

- Hybrid AnnuityDocument11 pagesHybrid AnnuitySumitAggarwal100% (1)

- Problems On Lease and Hire PurchaseDocument2 pagesProblems On Lease and Hire Purchase29_ramesh17050% (2)

- Questions On LeasingDocument5 pagesQuestions On Leasingriteshsoni100% (2)

- P3 Strategic Financial Management Question and Answer Dec 2014Document21 pagesP3 Strategic Financial Management Question and Answer Dec 2014CLIVENo ratings yet

- AFM Capital Budgeting AssignmentDocument5 pagesAFM Capital Budgeting Assignmentmahendrabpatel100% (1)

- Written Recitation - AnswerDocument2 pagesWritten Recitation - AnswerJoovs JoovhoNo ratings yet

- Highway & Railway Projects (1) - 25.09.2017-Final AmendedDocument46 pagesHighway & Railway Projects (1) - 25.09.2017-Final AmendedprashantwathoreNo ratings yet

- Additional Question Sheet LawiDocument27 pagesAdditional Question Sheet LawiPratyusha khareNo ratings yet

- Chap-11 - Economic and Financial AnalysisDocument7 pagesChap-11 - Economic and Financial Analysisnidha hamidNo ratings yet

- MN20501 Lecture 9 Review ExerciseDocument3 pagesMN20501 Lecture 9 Review Exercisesamvrab1919No ratings yet

- Problems On Cash FlowsDocument4 pagesProblems On Cash FlowsDeepakNo ratings yet

- Class Exercise - 3 Lease FinancingDocument4 pagesClass Exercise - 3 Lease Financinggaurav shettyNo ratings yet

- Class Leasing ProblemsDocument5 pagesClass Leasing Problemskarthinathan100% (1)

- PGP CF 2019 Additional Practice Questions - Nov 2019Document4 pagesPGP CF 2019 Additional Practice Questions - Nov 2019Deepannita ChakrabortyNo ratings yet

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocument7 pagesCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNo ratings yet

- Financial Accounting and Reporting-IDocument7 pagesFinancial Accounting and Reporting-IWasim SajadNo ratings yet

- Final Mock by TSB CFAP6 S2020Document5 pagesFinal Mock by TSB CFAP6 S2020Umar FarooqNo ratings yet

- Capital AllowanceDocument9 pagesCapital AllowanceAlfred MphandeNo ratings yet

- 30779rtpfinalnov2013 2Document26 pages30779rtpfinalnov2013 2Waqar AmjadNo ratings yet

- Capital BudgetingDocument5 pagesCapital BudgetingbballalNo ratings yet

- 4a. Capital BudgetingDocument6 pages4a. Capital BudgetingShubhrant ShuklaNo ratings yet

- FR Super 200 QuestionsDocument345 pagesFR Super 200 QuestionswipeyourassNo ratings yet

- Institute of Business Administration: Diploma in Taxation-Batch 4 Provincial Sales Tax On Services AssignmentDocument3 pagesInstitute of Business Administration: Diploma in Taxation-Batch 4 Provincial Sales Tax On Services AssignmentALI HUSSAINNo ratings yet

- Business Finance Decisions: Certified Finance and Accounting Professional Stage ExaminationsDocument4 pagesBusiness Finance Decisions: Certified Finance and Accounting Professional Stage ExaminationsRamzan AliNo ratings yet

- 2015-Spring-F18-CIA Revision Practice QuestionsDocument2 pages2015-Spring-F18-CIA Revision Practice QuestionsMayal AhmedNo ratings yet

- Part 2 Long Term Decision 1Document4 pagesPart 2 Long Term Decision 1Aye Mya KhineNo ratings yet

- Module 3 - Capital Budgeting - 3A - Questions 2022-23Document10 pagesModule 3 - Capital Budgeting - 3A - Questions 2022-23Manya GargNo ratings yet

- Adjusted Present Value Method of Project AppraisalDocument7 pagesAdjusted Present Value Method of Project AppraisalAhmed RazaNo ratings yet

- Scmpe RTP M23Document36 pagesScmpe RTP M23govarthan1976No ratings yet

- 4 2illustrationDocument4 pages4 2illustrationRitwik BasudeoNo ratings yet

- Acc 223 CB PS1 2021 QDocument8 pagesAcc 223 CB PS1 2021 QAeyjay ManangaranNo ratings yet

- Capital Allowance 2220Document58 pagesCapital Allowance 2220YanPing AngNo ratings yet

- Investment Appraisal QB 1-24Document20 pagesInvestment Appraisal QB 1-24Md. Rabiul Hoque100% (1)

- Cap BudDocument3 pagesCap BudRarajNo ratings yet

- 2023 Budget EIA Clarification - Information - 26JAN2023Document13 pages2023 Budget EIA Clarification - Information - 26JAN2023Jatin ReshamiyaNo ratings yet

- BFD W15Document5 pagesBFD W15Ahmed Raza Mir NewNo ratings yet

- Wind MPDocument3 pagesWind MPBala JiNo ratings yet

- Illustrative Examples: Example 1: The Grantor Gives The Operator A Financial Asset Arrangement TermsDocument9 pagesIllustrative Examples: Example 1: The Grantor Gives The Operator A Financial Asset Arrangement TermsMuhammad Umar FarooqNo ratings yet

- AFM Test 1Document3 pagesAFM Test 1Syeda IsmailNo ratings yet

- F18 BFDDocument4 pagesF18 BFDHaiderRazaNo ratings yet

- Corrigendum - Mehsana PmgsyDocument3 pagesCorrigendum - Mehsana PmgsyALOKNo ratings yet

- Op 01067101003 00010671Document8 pagesOp 01067101003 00010671Shaikh adnanNo ratings yet

- Caf-01 Far-I (Mah SS)Document4 pagesCaf-01 Far-I (Mah SS)Abdullah SaberNo ratings yet

- Module-Leasing and Hire Purchase Calculation of Lease RentalsDocument5 pagesModule-Leasing and Hire Purchase Calculation of Lease RentalsSINDHU NNo ratings yet

- CapbudgetingproblemsDocument3 pagesCapbudgetingproblemsVishal PaithankarNo ratings yet

- Notes On Capital BudgetingDocument3 pagesNotes On Capital BudgetingCheshta Suri100% (1)

- Infra Emkay 151014Document113 pagesInfra Emkay 151014SUKHSAGAR1969No ratings yet

- Capital Budgeting ProblemsDocument4 pagesCapital Budgeting ProblemsLiana Monica Lopez0% (1)

- Toll Road Project Case StudyDocument6 pagesToll Road Project Case StudyHéctor Augusto DíazNo ratings yet

- Notes - Capital AllowanceDocument8 pagesNotes - Capital AllowanceDIVA RTHININo ratings yet

- AFM Capital BudgetingDocument16 pagesAFM Capital BudgetingmahendrabpatelNo ratings yet

- Hind Petrochemicals Company (HPC) : T e A M 1Document3 pagesHind Petrochemicals Company (HPC) : T e A M 1diksha dagaNo ratings yet

- GRICL - Credit Analysis and ResearchDocument2 pagesGRICL - Credit Analysis and ResearchAnkit GoelNo ratings yet

- Revised Mutul Fund ProjectDocument37 pagesRevised Mutul Fund Projectlucky137No ratings yet

- Al Anwar Ceramic Tiles Company SAOGDocument11 pagesAl Anwar Ceramic Tiles Company SAOGAnila AslamNo ratings yet

- Border Control and Security Module 1Document38 pagesBorder Control and Security Module 1freshe RelatoNo ratings yet

- IAS 37 - Provisions & ContingenciesDocument3 pagesIAS 37 - Provisions & ContingenciesDawar Hussain (WT)No ratings yet

- Competency Framework Download FINALDocument2 pagesCompetency Framework Download FINALShebin DominicNo ratings yet

- Project Report - Shubham MehtaDocument48 pagesProject Report - Shubham Mehtaefc3wNo ratings yet

- Edi Rahadini & Bambang Tri Bawono, 1193-1201Document9 pagesEdi Rahadini & Bambang Tri Bawono, 1193-1201argo victoriaNo ratings yet

- 7201-7205 Greenleaf Avenue (For Lease)Document1 page7201-7205 Greenleaf Avenue (For Lease)John AlleNo ratings yet

- ACCT3109 Assignment Discussion Q Ch6Document2 pagesACCT3109 Assignment Discussion Q Ch6Ailsa MayNo ratings yet

- Compound Interest Practice QuesDocument12 pagesCompound Interest Practice QuesKothapalli VinayNo ratings yet

- Compitancy Map For Skill MatrixDocument6 pagesCompitancy Map For Skill MatrixNitin JainNo ratings yet

- FLDGDocument6 pagesFLDGSaurabh MalooNo ratings yet

- Invitation To Bid: (Cebu Housing Hub)Document18 pagesInvitation To Bid: (Cebu Housing Hub)Joseph Gabriel BandongNo ratings yet

- Embedded Value: Practice and TheoryDocument33 pagesEmbedded Value: Practice and TheoryJacquelyn GeorgeNo ratings yet

- Model AGM Notice of Sarswat PDFDocument56 pagesModel AGM Notice of Sarswat PDFMandar Kadam100% (1)

- 6 Step Advice Process: Best Practice Advice ChecklistDocument2 pages6 Step Advice Process: Best Practice Advice Checklistdenny suci kurniaNo ratings yet

- Position of Weaker SectionsDocument25 pagesPosition of Weaker Sectionspulkit magoNo ratings yet

- IFAC PAO Tax Advisor Guidance PDFDocument14 pagesIFAC PAO Tax Advisor Guidance PDFDelia StoicaNo ratings yet

- 20180326-Suissegold-100g UBSGold Bullion Bar 999.9 FineDocument5 pages20180326-Suissegold-100g UBSGold Bullion Bar 999.9 FineMUHAMMAD AMRI BIN MUHAMMAD SUM (JKM)No ratings yet

- Project Profile For Lyantonde Animal Feed Mill - Table of ContentsDocument4 pagesProject Profile For Lyantonde Animal Feed Mill - Table of ContentsInfiniteKnowledge100% (1)

- Nenaco - Dis As of December 2017 - 17apr2018. - FBB3C PDFDocument182 pagesNenaco - Dis As of December 2017 - 17apr2018. - FBB3C PDFPaula Del Castillo ArichetaNo ratings yet

- Format of Purchase OrderDocument2 pagesFormat of Purchase OrdersbpathiNo ratings yet

- A Project Report On "Role of Bajaj Finserv in Consumer Durable Lending "Document38 pagesA Project Report On "Role of Bajaj Finserv in Consumer Durable Lending "Aniket KarnNo ratings yet