Professional Documents

Culture Documents

(Intermediate Financial (Intermediate Financial Accounting 1A) Accounting 1A)

Uploaded by

Jayne Carly Cabardo0 ratings0% found this document useful (0 votes)

33 views16 pagesAcctg

Original Title

Lec

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAcctg

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

33 views16 pages(Intermediate Financial (Intermediate Financial Accounting 1A) Accounting 1A)

Uploaded by

Jayne Carly CabardoAcctg

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 16

(Intermediate Financial

Accounting 1A)

LECTURE AID

2016

ZEUS VERNON B. MILLAN

Chapter 1 Overview of

Accounting

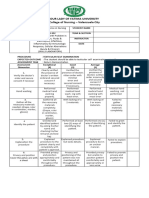

Learning Objectives

• Define accounting and understand its

basic purpose.

• Understand the basic concepts applied in

accounting.

• Know the branches of accounting and

sectors in the practice of accountancy.

• Understand the need for financial

reporting standards and how they are

developed.

• Appreciate the reason for the adoption of

International Financial Reporting

Standards.

IFA PAR !A" #eus $ernon %. &illan

Definition of Accounting

• Accounting is the process of identifying'

measuring' and communicating econo(ic

infor(ation to per(it infor(ed )udg(ent and

decisions by users of infor(ation.

AAA (American Association of Accountants)

(OTIO!AL ALICATIO!" RO#LE$ 1%2" &1'

IFA PAR !A" #eus $ernon %. &illan

Tree im)ortant acti*ities inc+uded in te definition of accounting

1, Identifying % the process of analy*ing events and transactions to

deter(ine whether or not they will be recogni*ed in the boo+s.

,nly accountable events are recogni*ed in the boo+s.

2, $easuring % involves assigning nu(bers' nor(ally in (onetary

ter(s' to the econo(ic transactions and events.

-, Communicating % the process of transfor(ing econo(ic data

into useful accounting infor(ation' such as financial state(ents

and other accounting reports' for disse(ination to users.

(OTIO!AL ALICATIO!" RO#LE$ 1%2" &2'

IFA PAR !A" #eus $ernon %. &illan

TYPES OF EVENTS

1. External events – events which involve an entity and an external

party .

a. Exchange (reciprocal transfer) – reciprocal giving and receiving

b. Non-reciprocal transfer – “one way” transaction

c. External event other than transfer – an event that involves

changes in the economic resources or obligations of an entity

caused by an external party or external source but does not involve

transfers of resources or obligations.

2. Internal events – events which do not involve an external party.

d. roduction – the process by which resources are transformed into

finished goods.

e. !asualt" – an unanticipated loss from disasters or other similar

events.

(OTIO!AL ALICATIO!" RO#LE$ 1%2" &-'

IFA PAR !A" #eus $ernon %. &illan

$easurement .ases

1. Historical Cost - price based on past echange

2. Current Cost – price based on current echange

3. Realizable (settlement) value – net cash that could currently

be obtained by selling the asset in an orderly disposal.

4. Present value / price based on future echange

5. Fair value - the price that would be received to sell an asset or

paid to transfer a liability in an orderly transaction between (ar+et

participants at the (easure(ent date.

6. Fair value less costs to sell / Costs to sell are the incre(ental

costs directly attributable to the disposal of an asset' excluding

finance costs and inco(e ta epense.

7. Revalue amount is the asset0s fair value at the date of the

revaluation less any subse1uent accu(ulated depreciation and

subse1uent accu(ulated i(pair(ent losses.

!. "n#lation$a%uste costs / a(ounts ad)usted to the (easuring

unit current at the reporting date.

(OTIO!AL ALICATIO!" RO#LE$ 1%2" &/'

IFA PAR !A" #eus $ernon %. &illan

#asic )ur)ose of accounting

• he basic purpose of accounting is to provide

infor(ation about econo(ic activities intended

to be usefu+ in maing economic decisions.

IFA PAR !A" #eus $ernon %. &illan

Ty)es of accounting information c+assified as to users needs

• &eneral 'ur'ose accounting infor(ation - designed to

(eet the common needs of (ost state(ent users. his

infor(ation governed by the Philippine Financial

Reporting Standards (PFRSs).

• 'ecial 'ur'ose accounting infor(ation - designed to

(eet the specific needs of particular state(ent users.

his infor(ation is provided by other types of

accounting' e.g.' (anagerial accounting' ta basis

accounting' etc.

(OTIO!AL ALICATIO!" RO#LE$ 1%2" &

IFA PAR !A" #eus $ernon %. &illan

%asic Accounting 2oncepts

• &oin concern assum'tion - the entity is assu(ed to carry

on its operations for an indefinite period of ti(e.

• e'arate entit* / the entity is treated separately fro( its

owners.

• table monetar* unit - a(ounts in financial state(ents are

stated in ter(s of a co((on unit of (easure3 changes in

purchasing power are ignored.

• +ime Perio / the life of the business is divided into series of

reporting periods.

• ,aterialit* conce't / infor(ation is (aterial if its o(ission

or (isstate(ent could influence econo(ic decisions.

• Cost$bene#it 4Reasonable assurance5 Pervasive constraint5

2ost constraint6 / the cost of processing and co((unicating

infor(ation should not eceed the benefits to be derived fro( it.

IFA PAR !A" #eus $ernon %. &illan

%asic Accounting 2oncepts - 2ontinuation

• -ccrual asis o# accountin / effects of transactions are recogni*ed

when they occur 4and not as cash or its e1uivalent is received or paid6 and

they are recogni*ed in the accounting periods to which they relate.

• Historical cost conce't 42ost principle6 / the value of an asset is to be

deter(ined on the basis of ac1uisition cost.

• Conce't o# -rticulation / all of the co(ponents of a co(plete set of

financial state(ents are interrelate .

• Full isclosure 'rinci'le / financial state(ents provide sufficient

detail to disclose (atters that (a+e a difference to users' yet sufficient

condensation to (a+e the infor(ation understandable' +eeping in (ind

the costs of preparing and using it.

• Consistenc* conce't / financial state(ents are prepared on the basis of

accounting principles which are followed consistently fro( one period to

the net.

• ,atc/in (Associating cause and effect) – costs are recogni*ed as

epenses when the related revenue is recogni*ed.

(OTIO!AL ALICATIO!" RO#LE$ 1%2" &6

IFA PAR !A" #eus $ernon %. &illan

%asic Accounting 2oncepts - 2ontinuation

• 0ntit* t/eor* / the accounting ob)ective is geared towards the 'ro'er

income etermination. It e(phasi*es the income statement and is

ee(plified by the e1uation “ -ssets iabilities Ca'ital .

• Pro'rietar* t/eor* / the accounting ob)ective is geared towards the

'ro'er valuation o# assets! It e(phasi*es the i(portance of the

balance s/eet and is ee(plified by the e1uation “ -ssets iabilities

Ca'ital !

• Resiual euit* t/eor* / this theory is applicable where there are two

-ssets

classes of shares issued' ordinary and preferred. he e1uation is “

iabilities Pre#erre /are/olers 0uit* rinar*

/are/olers 0uit*!

• Fun t/eor* / the accounting ob)ective is the custody and ad(inistration

of funds.

• Realization / the process of converting non-cash assets into cash or

clai(s to cash.

• Pruence 42onservatis(6 / the inclusion of a degree of caution in the

eercise of the )udg(ents needed in (a+ing the esti(ates re1uired under

conditions of uncertainty ' such that assets or inco(e are not overstated and

liabilities or epenses are not understated.

(OTIO!AL ALICATIO!" RO#LE$ 1%2" &3'

Common .rances of accounting

• Financial accountin8 Financial Re'ortin - focuses on general purpose

financial state(ents.

• ,anaement accountin / focuses on special financial reports geared

towards the needs of an entity0s (anage(ent.

• Cost accountin - the syste(atic recording and analysis of the costs of

(aterials' labor' and overhead incident to production.

• -uitin " a syste(atic process of ob)ectively obtaining and evaluating evidence

regarding assertions about econo(ic actions and events to ascertain the degree of

correspondence between these assertions and established criteria and

co((unicating the results to interested users.

• +a9 accountin - the preparation of ta returns and rendering of ta advice'

such as deter(ination of ta conse1uences of certain proposed business

endeavors.

• &overnment accountin - the accounting for the national govern(ent and its

instru(entalities' focusing attention on the custody of public funds and the

purpose or purposes to which such funds are co((itted.

(OTIO!AL ALICATIO!" RO#LE$ 1%2" &4'

5our sectors in te )ractice of accountancy

1. Practice o# Public -ccountanc* " involves the rendering of audit or

accounting related services to (ore than one client on a fee basis.

2. Practice in Commerce an "nustr* - refers to e(ploy(ent in the private

sector in a position which involves decision (a+ing re1uiring professional

+nowledge in the science of accounting and such position re1uires that the holder

thereof (ust be a certified public accountant.

3. Practice in 0ucation8-caeme / e(ploy(ent in an educational institution

which involves teaching of accounting' auditing' (anage(ent advisory services'

finance' business law' taation' and other technically related sub)ects.

4. Practice in t/e &overnment / e(ploy(ent or appoint(ent to a position in an

accounting professional group in govern(ent or in a govern(ent/owned and5or

controlled corporation' including those perfor(ing proprietary functions' where

decision (a+ing re1uires professional +nowledge in the science of accounting' or

where a civil service eligibility as a certified public accountant is a prere1uisite.

(OTIO!AL ALICATIO!" RO#LE$ 1%2" &'

IFA PAR !A" #eus $ernon %. &illan

Accounting standards in te i+i))ines

• i+i))ine 5inancia+ Re)orting 7tandards (5R7s' are

Standards and #nterpretations adopted by the Financial Reporting

Standards 2ouncil 4FRS26. hey co(prise"

1, i+i))ine 5inancia+ Re)orting 7tandards (5R7s'8

2, i+i))ine Accounting 7tandards (A7s'8 and

-, Inter)retations

(OTIO!AL ALICATIO!" RO#LE$ 1%2" &10'

IFA PAR !A" #eus $ernon %. &illan

OPEN FORUM

QUESTIONS????

REACTIONS!!!!!

END

(E9ERCI7E7" RO#LE$ 1%6'

IFA PAR !A" #eus $ernon %. &illan

You might also like

- This Study Resource WasDocument8 pagesThis Study Resource WasMubarrach MatabalaoNo ratings yet

- Quiz 4 - Conceptual Framework For Financial ReportingDocument7 pagesQuiz 4 - Conceptual Framework For Financial ReportingZariyah RiegoNo ratings yet

- Principles of Accounting, Historical Cost & Current Cost ApproachesDocument2 pagesPrinciples of Accounting, Historical Cost & Current Cost ApproachesAthirah RosleeNo ratings yet

- Regulatory Framework PerspectiveDocument5 pagesRegulatory Framework PerspectiveSelva Bavani SelwaduraiNo ratings yet

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Governmental and Nonprofit Accounting: Environment and CharacteristicsDocument12 pagesGovernmental and Nonprofit Accounting: Environment and CharacteristicsMadchestervillainNo ratings yet

- Assignment Guide Title PageDocument19 pagesAssignment Guide Title PageAli NANo ratings yet

- ISA16 Framework NotesDocument43 pagesISA16 Framework NotesMary ANo ratings yet

- The Effects of Changes in Foreign Exchange Rates: Indian Accounting Standard (Ind AS) 21Document27 pagesThe Effects of Changes in Foreign Exchange Rates: Indian Accounting Standard (Ind AS) 21pg0utamNo ratings yet

- Meaning and Definition of AccountingDocument13 pagesMeaning and Definition of AccountingArjun SrinivasNo ratings yet

- Chapter 01 - The Role of The Public Accountant in The American EconomyDocument15 pagesChapter 01 - The Role of The Public Accountant in The American Economyrezwan124No ratings yet

- (112026708) Kieso - Inter - Ch01 - IFRSDocument68 pages(112026708) Kieso - Inter - Ch01 - IFRSzozop69No ratings yet

- Lecture NotesDocument32 pagesLecture NotesRavinesh PrasadNo ratings yet

- Module 1 - Updates in Financial Reporting StandardsDocument5 pagesModule 1 - Updates in Financial Reporting StandardsJayaAntolinAyuste100% (1)

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- IFRS PresentationDocument49 pagesIFRS Presentationunni Krishnan100% (9)

- Cfas Prelim Module 1-2Document33 pagesCfas Prelim Module 1-2Lian MaragayNo ratings yet

- Accounting GlossaryDocument242 pagesAccounting GlossaryNelson FernandezNo ratings yet

- IFRS Functional Currency CaseDocument23 pagesIFRS Functional Currency CaseDan SimpsonNo ratings yet

- Chapter 7Document15 pagesChapter 7rachel banana hammockNo ratings yet

- CFAS ReviewerDocument6 pagesCFAS ReviewerAziNo ratings yet

- SM Chapter 01Document36 pagesSM Chapter 01mfawzi010No ratings yet

- Introduction To Accounting NotesDocument9 pagesIntroduction To Accounting NotesBhoomi KachhiaNo ratings yet

- Conceptual FrameworkDocument5 pagesConceptual FrameworkElla CunananNo ratings yet

- Full Download Cornerstones of Financial Accounting Canadian 2nd Edition Rich Solutions ManualDocument36 pagesFull Download Cornerstones of Financial Accounting Canadian 2nd Edition Rich Solutions Manualcolagiovannibeckah100% (28)

- Chapter 1 The Conceptual Framework: 1. ObjectivesDocument18 pagesChapter 1 The Conceptual Framework: 1. Objectivessamuel_dwumfourNo ratings yet

- Overview of Accounting Standards PAS 1-23Document16 pagesOverview of Accounting Standards PAS 1-23John DavisNo ratings yet

- SCDL PGDBA Finance Sem 1 Management AccountingDocument19 pagesSCDL PGDBA Finance Sem 1 Management Accountingamitm17No ratings yet

- Master of Valuation Real Estate-II Unit-12 Page 255 To 271Document17 pagesMaster of Valuation Real Estate-II Unit-12 Page 255 To 271Udit TiwariNo ratings yet

- Conceptual Framework Chapter 1-10Document112 pagesConceptual Framework Chapter 1-10Earone MacamNo ratings yet

- Louw12 AuditingDocument44 pagesLouw12 Auditingredearth2929No ratings yet

- MGT401 Course HandoutsDocument224 pagesMGT401 Course HandoutsUsman Ali100% (1)

- Anunt Ops Fin ExternDocument2 pagesAnunt Ops Fin Externarina888No ratings yet

- Int I Midterm ReviewDocument7 pagesInt I Midterm ReviewshevinakNo ratings yet

- Chap001 Test BankDocument107 pagesChap001 Test BankJames Stallins Jr.No ratings yet

- Far ReviewerDocument4 pagesFar ReviewerliliumNo ratings yet

- Financial Statements at a GlanceDocument88 pagesFinancial Statements at a GlanceSAMSON ALBERT SALAS100% (1)

- Section 1: Introduction To Principles of AccountsDocument6 pagesSection 1: Introduction To Principles of AccountsArcherAcsNo ratings yet

- Acc 1011 - Note 1Document7 pagesAcc 1011 - Note 1kayodetosin62No ratings yet

- Midterm AcctgDocument47 pagesMidterm AcctgRie AerisNo ratings yet

- Financial Reporting PDFDocument67 pagesFinancial Reporting PDFlukamasia93% (15)

- Bba-1st Sem AccountancyDocument344 pagesBba-1st Sem AccountancyShravani SalunkheNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Accounting System Short Notes Du Bcom Hons Chapter 1Document7 pagesAccounting System Short Notes Du Bcom Hons Chapter 1ishubhy111No ratings yet

- Accounting in International BusinessDocument23 pagesAccounting in International BusinessanashussainNo ratings yet

- Overview of AccountingDocument8 pagesOverview of AccountingCrystal Irish HilarioNo ratings yet

- Statement of Financial PositionDocument56 pagesStatement of Financial PositionRisty Ridharty DimanNo ratings yet

- Repaso Capítulo 2 ContabilidadDocument9 pagesRepaso Capítulo 2 ContabilidadpaulaNo ratings yet

- Lesson 1 CFASDocument14 pagesLesson 1 CFASkenneth coronelNo ratings yet

- MGT Chapter 03 - AnswerDocument10 pagesMGT Chapter 03 - Answerlooter198No ratings yet

- Auditing and Assurance Solutions To QuestionsDocument79 pagesAuditing and Assurance Solutions To QuestionsMadchestervillain50% (8)

- By Mani SajnaniDocument47 pagesBy Mani SajnanimaniNo ratings yet

- ACCT 860: Financial Accounting Week 1: NZ FrameworkDocument34 pagesACCT 860: Financial Accounting Week 1: NZ FrameworkNam PhamNo ratings yet

- CORPORATE REPORTING NotesDocument30 pagesCORPORATE REPORTING Notesvinnieparmar100% (1)

- Preliminary Auditing Planning: Understanding The Auditee's BusinessDocument27 pagesPreliminary Auditing Planning: Understanding The Auditee's BusinessGilang RamadhanNo ratings yet

- CHAP 1 FinaccDocument19 pagesCHAP 1 FinaccQuyên NguyễnNo ratings yet

- The Last LeafDocument1 pageThe Last LeafJan JanNo ratings yet

- The Last LeafDocument1 pageThe Last LeafJan JanNo ratings yet

- Process - Cost Spoilage PDFDocument5 pagesProcess - Cost Spoilage PDFJayne Carly CabardoNo ratings yet

- The Last LeafDocument1 pageThe Last LeafJan JanNo ratings yet

- The Last LeafDocument1 pageThe Last LeafJan JanNo ratings yet

- The Last LeafDocument1 pageThe Last LeafJan JanNo ratings yet

- The Last LeafDocument1 pageThe Last LeafJan JanNo ratings yet

- Con & ObliconDocument1 pageCon & ObliconJayne Carly CabardoNo ratings yet

- Income Taxation by Nick Aduana Answer KeyDocument113 pagesIncome Taxation by Nick Aduana Answer KeyJonbon Tabas100% (1)

- Ampongan and Abano Bus Law PDFDocument29 pagesAmpongan and Abano Bus Law PDFJayne Carly CabardoNo ratings yet

- Philippines Tax Rates Guide for Individuals and BusinessesDocument3 pagesPhilippines Tax Rates Guide for Individuals and BusinesseserickjaoNo ratings yet

- Philippines Tax Rates Guide for Individuals and BusinessesDocument3 pagesPhilippines Tax Rates Guide for Individuals and BusinesseserickjaoNo ratings yet

- Process - Cost Spoilage PDFDocument5 pagesProcess - Cost Spoilage PDFJayne Carly CabardoNo ratings yet

- Reducing Defects and CostsDocument31 pagesReducing Defects and CostsRyan CapistranoNo ratings yet

- Manufacturing Test BankDocument12 pagesManufacturing Test BankJayne Carly CabardoNo ratings yet

- Contracts & ObliconDocument1 pageContracts & ObliconJayne Carly CabardoNo ratings yet

- Manufacturing Test BankDocument12 pagesManufacturing Test BankJayne Carly CabardoNo ratings yet

- Test Bank - Inc TX-MDGDocument5 pagesTest Bank - Inc TX-MDGjaysonNo ratings yet

- StudentDocument16 pagesStudentJayne Carly CabardoNo ratings yet

- Balance Sheet and Statement of Cash FlowsDocument55 pagesBalance Sheet and Statement of Cash FlowsJayne Carly Cabardo100% (2)

- Chapter 1 Partnership Formation Test BanksDocument46 pagesChapter 1 Partnership Formation Test BanksRaisa Gelera91% (23)

- Auditing Theory MCQs by SalosagcolDocument31 pagesAuditing Theory MCQs by SalosagcolYeovil Pansacala79% (62)

- Auditing Theory MCQs by SalosagcolDocument31 pagesAuditing Theory MCQs by SalosagcolYeovil Pansacala79% (62)

- Auditing Theory MCQs by SalosagcolDocument31 pagesAuditing Theory MCQs by SalosagcolYeovil Pansacala79% (62)

- Auditing Theory MCQs by SalosagcolDocument31 pagesAuditing Theory MCQs by SalosagcolYeovil Pansacala79% (62)

- Taxation Quizzer PDFDocument61 pagesTaxation Quizzer PDFPrince Guese86% (7)

- Auditing Theory MCQs by SalosagcolDocument31 pagesAuditing Theory MCQs by SalosagcolYeovil Pansacala79% (62)

- A Rose For EmilyDocument1 pageA Rose For EmilyJayne Carly CabardoNo ratings yet

- IAS 23 Borrowing Costs OverviewDocument23 pagesIAS 23 Borrowing Costs OverviewJayne Carly CabardoNo ratings yet

- DWDM On: Dense Wavelength Division Multiplexing Optical NetworkDocument81 pagesDWDM On: Dense Wavelength Division Multiplexing Optical NetworkNataša Mihić BoskovićNo ratings yet

- Book ReviewDocument3 pagesBook ReviewEilegnaNo ratings yet

- Repaso 5to Grado 3°trimestreDocument25 pagesRepaso 5to Grado 3°trimestreFany BalderramaNo ratings yet

- BS NursingDocument5 pagesBS NursingDenise Louise PoNo ratings yet

- Advocate - Conflict of InterestDocument7 pagesAdvocate - Conflict of InterestZaminNo ratings yet

- Study Plan - PharmD Curriculum ReformDocument23 pagesStudy Plan - PharmD Curriculum ReformRayonesh RayanaNo ratings yet

- NSTP 2 Community ServiceDocument19 pagesNSTP 2 Community ServiceTessia EralithNo ratings yet

- MST Components Enable New Nanosatellite CapabilitiesDocument10 pagesMST Components Enable New Nanosatellite CapabilitiesibrahimwngNo ratings yet

- The Multi-Objective Decision Making Methods Based On MULTIMOORA and MOOSRA For The Laptop Selection ProblemDocument9 pagesThe Multi-Objective Decision Making Methods Based On MULTIMOORA and MOOSRA For The Laptop Selection ProblemAnkushNo ratings yet

- Tackling Addiction: From Belfast To Lisbon: An In-Depth InsightDocument32 pagesTackling Addiction: From Belfast To Lisbon: An In-Depth InsightSonia EstevesNo ratings yet

- Vibrational Behaviour of The Turbo Generator Stator End Winding in CaseDocument12 pagesVibrational Behaviour of The Turbo Generator Stator End Winding in Casekoohestani_afshin50% (2)

- Ms. Irish Lyn T. Alolod Vi-AdviserDocument17 pagesMs. Irish Lyn T. Alolod Vi-AdviserIrish Lyn Alolod Cabilogan100% (1)

- High risk patient dental questionsDocument3 pagesHigh risk patient dental questionsFoysal SirazeeNo ratings yet

- ALS Metallurgy - Gold Extraction ProcessDocument8 pagesALS Metallurgy - Gold Extraction ProcessalxmalagaNo ratings yet

- Conway - On Unsettleable Arithmetical ProblemsDocument8 pagesConway - On Unsettleable Arithmetical ProblemsfreafreafreaNo ratings yet

- Cryosurgery and ElectrosurgeryDocument51 pagesCryosurgery and ElectrosurgeryVeerabhadra RadhakrishnaNo ratings yet

- AtropineDocument6 pagesAtropineNiluh Komang Putri PurnamantiNo ratings yet

- Thesis Jur ErbrinkDocument245 pagesThesis Jur Erbrinkgmb09140No ratings yet

- 3 Pehlke. Observations On The Historical Reliability of OT. SJT 56.1 (2013)Document22 pages3 Pehlke. Observations On The Historical Reliability of OT. SJT 56.1 (2013)Cordova Llacsahuache Leif100% (1)

- Csir Ugc Net - Life Sciences - Free Sample TheoryDocument12 pagesCsir Ugc Net - Life Sciences - Free Sample TheorySyamala Natarajan100% (1)

- The Innovator's Secret WeaponDocument9 pagesThe Innovator's Secret WeaponNaval VaswaniNo ratings yet

- Chapter5 EthDocument30 pagesChapter5 EthVictoriasecret PerfumeNo ratings yet

- Ayurveda Fact Sheet AustraliaDocument2 pagesAyurveda Fact Sheet AustraliaRaviNo ratings yet

- Advanced Image Stylization With Extended Difference-of-GaussiansDocument10 pagesAdvanced Image Stylization With Extended Difference-of-Gaussianse_gorodinskyNo ratings yet

- Carte Tehnica Panou Solar Cu Celule Monocristaline SunPower 345 WDocument4 pagesCarte Tehnica Panou Solar Cu Celule Monocristaline SunPower 345 WphatdoggNo ratings yet

- Common Mistakes in Legal EnglishDocument4 pagesCommon Mistakes in Legal Englishfreshbreeze_2006No ratings yet

- Excel 2003 - CompleteDocument387 pagesExcel 2003 - CompleteRazvan PetrariuNo ratings yet

- Dawn Ullmann - ReferenceDocument1 pageDawn Ullmann - Referenceapi-418750957No ratings yet

- Anderson (1987) - Julio Cortázar, La Imposibilidad de NarrarDocument24 pagesAnderson (1987) - Julio Cortázar, La Imposibilidad de NarrarValNo ratings yet

- Testicular Self ExamDocument3 pagesTesticular Self ExamChristine JoyNo ratings yet