Professional Documents

Culture Documents

Corporate Liquidation

Uploaded by

ace zero100%(6)100% found this document useful (6 votes)

16K views24 pagesAccounting

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAccounting

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

100%(6)100% found this document useful (6 votes)

16K views24 pagesCorporate Liquidation

Uploaded by

ace zeroAccounting

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 24

Bn

0 building owned by

1. Philippine National Bank holds a P500,000 note secured by a

Luigi Software, which has filed for bankruptey. If the property hasa book: et

of B00. 000 and a fair market value of P450,000, what ia the best way

the notes held by Philippine National Bank? The bank has

a. Asecured claim of P500,000. ‘

b. Anunsecured claim of P500,000. ‘ :

c. Asecured claim of P450,000 and an unsecured claim of P50,000.

d. Asecured claim of P50,000 and an unsecured claim of P50,000.

(Adapted)

2. Xand YInc. owes the Xylo Corporation P60,000 on account, which is secured by

accounts receivable with a book value of 50,000. The unsecured portion 15

considered a claim under the bankruptcy law, X and Y has filed for bankruptcy.

Ite statement of affairs lists the accounts receivable securing the Xylo account

with an estimated realizable value of P45,000. Ifthe dividend to general unsecured

creditors is 80%, how much can Xylo expect to receive? ,

a. P60,000 c. P57,000

d. 48,000

b. 58,000

(Adapted)

P Corporation is a parent, having purchased 60% of S Company's common stock

at par value forP600,000. S Company isin financial difficulty. The parent granted

an unsecured loan of P200,000 to the subsidiary. An accounting statement of

affairs for § Company shows a dividend of 30%. P Corporation can expect to

receive on the loan of appropriately:

“a. P120,000 c.

b. 60,000 a.

(Adapted)

P Corporation is a parent, having purchased 60% of S Company’s common stock

at par value for P600,000. S Company is in financial difficulty. The parent granted

as unsecured loan of P200,000 to the subsidiary. An accounting statement of

affairs for S Company shows a dividend of 30%. P Corporation can expect to

receive payment for its Investment in S Company of approximately:

a. P600,000 c. P108,000

b. — 180,000 d, 0

(Adapted)

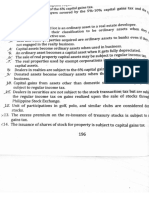

1. fe i ©

20 12. © 2, dt

3 Ob 13. a 2. Oc

7 a 14 a 24, ad.

a) 15. bb 25. 0d

6. c 160 a 26. 0 a

ve c 17. d 27. ©

8. a 18 oc 28. 0 a

9. d 19. a 29. b

10. b 20. b 30. b

1 ©

The P500,000 notes payable to PNB is considered as partially secured liabilities

wherein a property with a fair market value of P450,000 is used as collateral.

Therefore, PNB is secured to receive P450,000 because of the property while the

balance of P50,000 of the notes is unsecured.

2 ©

The P60,000 owes to Xylo Corp. is considered a partially secured labilities.

Accounts receivable with a realizable value of P45,000 is pledged to secure the

liability. Therefore, the estimated amount to be paid to Xylo Corp. would be as

follows:

Accounts Receivable at net realizable value . P45,000

Add: Portion of free assets used to pay the unsecure:

amount: (P60,000 — P45,000) x .80.... 12,000.

Estimated amount to be paid to partially secured

liabilities ..... P57,000 (c)

3. @)

Since the P Corp. expect to recover P.30 for every P1 liability. Therefore, the

unsecured liability of SCompany that would be paid were as follows:

Unsecured loan ... -- P200,000

Multiplied by: Expected recovery per peso

unsecured creditors ... 30%

P 60,000 (b)

5. Kent Ine, has foreed into bankruptey and has begun to liquidate. Unsecured

claima will be paid at tho rate of 40 conta on the peso. Apex Co. holds a non-

torent honring note recoivable fromm. Kent in the ‘amount of P100,000,

collatorialized by machinery with a liquidation value of P25,000.

(o bo realized by Apox on thie note receivable is:

a. P26,000 ¢, — P66,000

b. 40,000 d. 65,000 (AICPA)

a sauidatits aseets

6. Seco Corp. was forced into bankruptcy and isin the Braces Of ade on tie

a A Or edt bparing note receivable from Seco

. Hale holda a 230,000 noni: pat-be: Faas 1asof

volaioratized by an asset with a book value of P35,000 and a liquidation value o

P6,000, The amount to be realized by Hale on this note is

a. —P6,000 c. P 15,000

b, 12,000 a. 17,000 (atcpay

i i d interest on

Bluoprint, Inc, signed a note payable to its bank for P10,000. Accrued in

the mot on February 28, 2004 amounts to P250. The note is secured by ingentory,

with a book value of P12,000. The invent is sold for P8,000 an f apeeeute

creditors receive 30 percent of their claims. The bank should receive the following

amount in settlement of the note and interest:

a. P10,250 c. P8,675

b, 10,000 d. 8,000

a

(Adapted)

8 The trust for Ardolio, Inc. prepares 4 statement of affairs which shows that

unsecured creditors whose claims total P60,000 may expect to receive

approximately P36,000 if assets are sold for the benefit of creditors.

* Michael is an employee whois owed P750.

+ Meldcan holds a note for P1,000 on which interest of P50 is accrued;

nothing has been pledged on the note.

Compboy holds a note of P6,000 on which interest of P300 is accrued:

securities with a book value of P6,500 and a present market value of

P5,000 are pledged on the note.

Serpor holds a note for P2,500 on which interest of P150 is accrued

roperty with a book value of P2,000

Bre er iA riedeh ee and a present market value of

How much may each of the following creditors hope to receive?

Michael Meldean Compboy Serpor

¥ Pe 2 . ¥ 0 PO

3

a 350 1,060 3780 at

630 5,780 2,650

(Adantoa\

Chapter 2

ent for

involves pay™s

twand payables transacte

ate balance sheet. So;

d in the usual

U0.

No. 3, except that the quest

inilar to ;

is ana any. Remember thatreceivables

+ Big proble

ti in S Company. ; v

its Investmens and subsidiary still exist on their separate i

between Pavey or payment ia made, it will still be journalte’) does not

when like an ordinary collection or payment of an acc

rant atall the investment in subsidiary account.

idati machinery.

e oo Co. has a secured claim for the P25,000 liquidation value 27 ite te

‘The remaining P75,000 (P100,000 note — P26,000) is an unseoi™ eth ae

that unsecured claims will be paid at the rate of P.40 cents on.

Apex will receive:

P25,000

Machinery at liquidation value ...

Add: Portion of free assets used to pay the unsecured 30,000

t

amount: (P100,000 = P25,000) x 40% ...

55,000 (c)

6 © : :

Claims of secured creditors be satisfied before any unsecured claims are paid.

Hale is a secured creditor in the amount of P5,000 (the liquidation value of the

collateral). The remainder of Hale’s claim (P30,000 — P5,000 = P25,000) is an

unsecured claim, because it is not secured by any collateral. Therefore, Hale,

will receive a total of P15,000 on this note:

Asset at liquidation value P 5,000

Add: Portion free assets used to pay the unsecured.

amount: (P30,000 — P5,000) x .40..... .! 10,000

P_ 15,000 (©)

7 ©

Inventory, at selling price

Add: Portion free assets used to pay the unsecured. sisi

amount (P10,250—P8,000) x 30%... 675

P8,675 (c)

. @

Michael's salary is an unsecured with priori receiy

Made: F060 a, 000 P60, 000 aay ee A mou

ee as +(P6,300 5 P5,000) x 60% = P5,780

por: Y secured creditor, receive P2,650 (P2,500+ P1650) (d)

10.

Corporate Liquidation

101

9. Erap Co. filed a volu,

voluntary bankruptcy petition on August 15, 2008, and the

statement of affairs reflects the following amounts;

Estimated

Book current

Assets: value = __value_

aan pledged with fully secured creditors P 300,000 370,000

ts pledged with partially secured

creditors, 180,000 120,000

Free assets...

420,000 320,000

P_ 900,000

Liabilities:

Liabilities with priority P70,000

Fully secured creditor 260,000

Partially secured creditors 200,000

Unsecured creditors .. 540,000

P1,070,000 ,

Assume that the assets are converted to cash at the estimated current values

and the business is liquidated. What amount of cash will be available to pay

unsecured nonpriority claims?

a. P240,000 c. — P320,000

b. 280,000 d. 360,000

(AICPA)

Zamora and Co., Inc. purchased a Cadillac automobile with little cash down and

signed a note, secured by the Cadillac, for 48 easy monthly payments. When the

company files for bankruptcy, the balance due on the Cadillac amount to

P6,000,000. The car has a book value of P8,000,000 and a net realizable value of

P4,000,000. The unsecured creditors of Zamora and Co. can expect to receive 50

percent of their claims. In the liquidation, the bank that holds the note on the

Cadillac should receive:

a. P6,000,000 c. P4,000,000

b. 5,000,000 d. 38,000,000

(AICPA)

Corporate Liquidation

including priority claims, ie

9 @

The total cash available to pay all unsecured claims, seve

the cash obtained from free assets (P320,000) and any exo" cash available from

ed to satisfy those

assets pledged with fully secured creditors after they are ust

claims (P370,000 — P260,000 = P110,000).

Therefore, the amount of cash to pay unsecured nonpriority claims:

‘Assets pledged to fully secured creditors,

at current value... P370,000

Less: Fully secured creditors . 260,000

Excess cash from assets pledged to fully :

secured creditors... P110,000

Add: Free assets, at current value 320,000

Total free assets . 430,000

Less: Liabilities with priority 70,000

Net free assets .... P360,000 (4)

10. ©)

Car-cadillac, at net realizable value ... ‘4,000,000

‘Add: Portion of free assets used to pay unsecured ,

amount: (P6,000,000 — P4,000,000) x 50% .. .. 3,000,000

5,000,000 (b)

i. © \

To compute the estate deficit before the actual realization and liquidation is simply

ie. Assets = Liabilities + Stockholders’

to formulate the basic accounting equation,

equity. Therefore: /

Assets, at net realizable VALUE Leesesepsesees P105,000

Less: Liabilities

Per books...

Add: Unrecorded interest 500 130,500

Estate (deficit) equity before realization and

liquidation ............ ‘P(25,500) ()

Chapter 2

102

any?

11. | The following data are provided by the Troubled ComP

P150,000

405,000

Assets at book value

Assets atnet realizable value 60,000

Liabilities at book value: 70,000

Fully secured mortgage ....

Unsecured accounts and notes pay@!

Unrecorded liabilities:

500

Interest on bank notes a

Estimated cost of administering estate -

The court has appointed a trustee to liquidate the company:

jabilities should

ts and liabilities s1

The journal entry made by the trustee to record the ass¢ an

include an estate deficit of.

a. P31,500 c. P25,500

b. 31,000

d. 25,000 (Adapted)

in ared by

12. Using the same information in Number 11, the statement of affairs prepared by,

the-trustee at this time should include an estimated deficiency

+ creditors of:

a. P45,000 c. P31,500

. 39, . 25,000

b. 000 d. (Adapted)

13. Nah Lugi Corporation is in bankruptcy and is ‘being liqGidated by a court-appointed

trustee. The financial report that follow was prepared by the trustee just before

thé final cash distribution:

: Assets:

Cash ...... P100,000

Approved Claims:

Mortgage payable (secured by property

that was sold for P50,000) P 80,000

Accounts payable, unsecured . "

Administrative expenses payable, a £0,000

unsecured ...

i ble, d 8,000

Salaries payable, unsecure 2,000

P140,000

—=

2 Chapter 2

12. ©) .

‘Total assets at net re: P1059

alizable value .. F ‘ ;

Less: Fully secured liabilities 80.000

Total free assets ... Fg

Less: Unsecured creditors with priority — 6,000

administrative expenses... P 39,000

Net free assets......

Less: Unsecured creditors without priority 70,000

Unsecured accounts and notes payable - *500 70,500

Interest on bank notes .. cate a

Estimated deficiency to unsecured creditors ... Nee

ret 100,000

Cash available ... 50,000

Less: Mortgage payable secured by property s ——

Amount available to unsecured creditors .... ote P 50,000

Less:Unsecured creditors with priority

Administrative expenses . P 8,000 A

Salaries payable ... 2,000 10,

Net free assets or amount available to unsecured

» creditors without priority ... Ss P_40,000

Expected recovery percentage of unsecured creditors

P40,000 / (P80,000 — P50,000) + P50,000..... posenope OE 50

Therefore, the cash is distributed as follows:

Unsecured creditors with priority ... P 10,000

Partially secured creditors:

Property at selling price ...

Add: Portion of free assets used

to pay the unsecured

amount (P80,000— P50,000)x 50% 15,000 65,

Unsecured Creditors without Priority es

P50,000 x .50....

.- P50,000

25,000

P100,000 (a)

Corporate Liquidation ae

i ee mig

Fine Administrative expenses are for trustees and other costs of Seas

e debtor corporation’s estate.

How should the P100,000 be distributed to the following creditors?

Unsecured Partially Unsecured

Creditors Secured. Creditors

LW aa ir P80,000 20,000

b. 10,000 80,000 10,000

c. 5,000 65,000 25,000

d. 10,000 65,000 25,000

(Adapted)

14, OnDecember 18, 2008, the statement of affairs of Downside Company, whichis

in bankruptcy liquidation, included the following:

Assets pledged for fully secured liabilities P100,000

Assets pledged for partially secured liabilities .. 40,000

Free assets.. 120,000

Fully secured liabilitie: 80,000

Partially secured liabilities 50,000

Unsecured liabilities with priority’. 60,000

Unsecured liabilities without priority ...... 90,000

Compute the estimated amount to be paid to:

Fully Unsecured. Partially Unsecured

Secured Liabilities Secured Liabilities

Liabilities w/ Priority Liabilities without priority

a. » P80,000 P60,000 P50,000 + P70,000

b. 64,000 60,000. 48,000 88,000

ce. 80,000 48,000. 60,000 72,000

d. 80,000 60,000 > 48,000 72,000

(Adapted

113

Comporate Liquidation

14. @

Assets pledged to fully secured liabilitie: r ea

Less: Fully secured liabilities ..... an

Excess of assets pledged to fully secured liabilities Bs 600)

(free assets of fully secured liabi

Add: Free assets sn 120,000

Total free assets to unsecured liabilities 140,000

Less: Unsecured liabilities with priority 80,000

Net free assets P_80,000.

Unsecured liabilities:

Partially secured liabilities ww. , P50,000,

Less: Assets pledged to partially

secured liabilities ine) 40,000, : -F, 10,009,

Unsecured liabilities without priority .. 90,000.

P100,000

Total unsecured liabilities ...

Expected Recovery Percentage of Unsecured Liabilities:

Net free assets 80,000

—— 80%

P100,000

Total unsecured liabilities

~ Therefore, the estimated amount to be paid to each creditors are:

Amount — “% of Recovery

Fully secured liabilities .... ‘ P80,000 100% (80/80)

Unsecured liabilities with priority ! ‘60,000 100% (60/60)

Partially Secured Liabilities:

Assets we P40,000

Add: Portion of free assets to pay i

unsecurred creditors

(P50,000—P40,000)x 80% 8,000 48,000 96% (48/50)

Unsecured liabilities without priority:

(P90,000 x 80%) ..... 72,000 80% (72/80)

Total... P260,000* (d)

Chapter 2

104

. 7 ,in bankruptcy

16. Amounts related to the statement of affairs of Windup Company,

liquidation as April 1, 2008, were as follows:

Assets pledged for fully secured liabilities .

Assets pledged for partially secured liabilitie:

Free assets...

Fully secured liabilities

Partially secured liabilities

Unsecured liabilities with priority

Unsecured liabilities without. priority

itors, and (2) the

Compute the: (1) total estimated deficiency to unsecured efedtare, anil 2) the

costs per peso that unsecured creditors may’ expect to rec

Company.

; (2) P.81

a. (1) P 78,000; (2). P.76 c. . (1) P108,000; ¢

: 158,000; (2) P.61

b. (1) P108,000; (2) P.70 a @)P: ae

16. The following data were taken from the statement of affairs for Liquo Company:

Assets pledged for fully secured liabilities

(fair value, P75,000) ..... ,

Assets pledged to partially. secured liabilities

(fair value, P52,000)..... 74,000

Free assets (fair value, P40,000).. 70,000

Unsecured liabilities with priority 7,000

Fully secured liabilities 30,000

Partially secured liabilities ... 60,000

Unsecured liabilities without priority 112,000

Compute the: (1) total estimated deficiency to unsecured creditors, and (2) the

expected recovery per peso of ‘unsecured claims.

a. (1) 42,000; (2) P65 ce ()P 0; (2) P1.00

b. (@ 3,000; (2) P98 a. (1) P42,000; @) P 70

(Adapted)

ii Chapter 2

meme aioe nd ODI

“y i

“he total ontimated amount to be paid to creditors of P260,000 can be

sounterchocked by determining the total assets (at fair value):

Asiete plodgod to fully secured liabiltie FO

sacts pledged t tii i is a

MrosAnaen a 0 partially secured liabilitie: 120,000

260,000

15. ®

(1) Estimated deficiency to unsecured creditors: P 80,000

Assets pledged to fully secured liabilities 60,000.

Less: Fully secured liabilities oa ane

i 20,

Free assets of fully secured liabilities Ee 000

Add: Free assets ........ c

‘ 2,000.

‘Total free assets to unsecured liabilities ah 000

Less: Unsecured liabilities with priority ——

100

Net free assets .... PEpzON

Less: Unsecured liabilities

Partially secured liabilities a ..-. P80,000

Less: Assets pledged to partially

secured liabilities ..... .. 50,000 P 30,000

Unsecured liabilities without priority ...... 330,000

Total unsecured liabilities ...... f P360,000

Estimated deficiency to unsecured liabilities... P108,000 (b)

(@) Expected Recovery Percentage of Unsecured Liabilities:

‘ P252,000/P360,000...... 70% or P.70 (b)

Or, alternatively: (for estimated deficiency to unsecured creditors):

Estimated (gain) loss or realization:

(none, because hook value is assumed

to be the fair value) PO

Add: Administrative expense: 0

Unrecorded expenses/ liabilities 0

~~

o

105

Me

Gorportte Liguidaion, we a

ich there are 2°

17. Katherine, a CPA, has prepared a statement of affairs este oe ‘located to

claims or liens are expected to produce P70,000, whiel Meee ve some ‘of the

neecured claime of all classes totaling P108,000. The follo

claims outstanding:

Accounting fees for Katherine, P1,5

An unrecorded note for P1,000, on w1

held by Angie. :

3. Anote for P3,000 secured by P4,000 receivables,

collectible doy.

4. API1,500 oe 2 which P30 of interest has accrued, hel i

Property with a book value of P1,000 and a market vi ae

pledged to guarantee payment of principal and interest

5. Unpaid income taxes of P3,500.

00.

hich P60 of interest has accrued,

we

estimated to be 605

d by Joyots-

‘P1,800 is

Compute the estimated payment to partially secured creditors:

a. P1,060 c. P2,490

d. 2,790

b. 1,950

a ed ath che

18. The creditors if the Rogerod Corporation agreed to a liquidation based ont

statement of affairs, supgested thet unsecured creditors, without priority would

receive approximately P.60 on the peso. The unsecured creditors are intereated i

determining whether the preliminary estimate still seems appropriate. Tar ot

was originally assigned noncash assets of P1,480,000 and creditors cl Sea

follows: fully secured, P670,000; partially secured, P400,000; unsecure ws b

priority, P200,000, and unsecured without priority, P320,000. Assets with a bool

value of P45,000 and unsecured liabilities (without priority) of P35,000 were

subsequently discovered. Assets with a total book value of. 'P740,000 were sold for

P715,000 net. Fully secured liabilities of P410,000 and partially secured liabilities

of P280,000 were paid. Remaining liquidation expenses were estimated to be

30,000.

Assume the remaining noncash assets have an estimated net realizable value as

follows:

Assets traceable to fully secured creditors ... P240,000

Assets traceable to partially secured creditors .. 110,000

Remaining assets ... 382,000

Determining the revised estimate of the dividend to be received by ‘unsecured

creditors without priority:

a. 100.00% ce. 45.97%

b. 66.17% d. Cannotbe determined

115

Corporate Liquidation

Less: Loss borne by the owners/stockholders’ equity

‘Total assets (P80,000 + P50,000 +

P272,000) .. . 402,000

Less: Total liabilities (P60,000 +

P80,000 + P40,000 + P330,000)_510,000

Stockholders’ equity (deficiency) ......2108,000

16. (a)

@) Estimated deficiency to unsecured creditors:

Assets pledged to fully secured liabilities, at fair value P. 75,000

Less: Fully secured liabilities .. — 80.000

Free assets of fully secured liabilitie: 45:00

Add: Free assets, at fair value 140,900,

‘Total free assets to unsecured liabilities .

Less: Unsecured liabilities with priority

Net free assets...

Less: Unsecured liabilities:

Partially secured liabilities .....

Less: Assets pledged to partially

secured liabilities, fair value ....

52,000 "P 8,000

Unsecured liabilities without priority ...... 112,000

Total unsecured liabilities P120,000

Estimated deficiency to unsecured liabilities... P 42,000 (a)

Or, alternatively:

Estimated (gain) loss on realization:

Loss on realization of assets pledged to

fully secured liabilities (P90,000 - P'75,000) ...... P 15,000

Loss on realization of assets pledged to partially

secured liabilities (P74,000—- P52,000)....

Loss or realization of free assets (P70,000 — P40. 000) 30,000

Add: Administrative expenses ..

Unrecorded expenses / liability a

Total estimated net loss ....

———

H6. Chapter 2

Less: Loss borne by the owners/stockholders’ equity:

Total assets at book value

(P90,000 + P74,000 + P70,000) ......... P234,000

Less: Total liabilities (P7,000 + P30,000

P60,000 + P112,000) 209,000 _ 25,000

Estimated deficiency to unsecured creditors 42,000 (a)

@ ° Expected Recovery per peso of unsecured claims: '

P78,000/P120,000 P___.65 (a)

17. @,

Total Free Assets P 70,000

Less: Unsecured Ce!

Administrative expenses — accounting fees P1,500

Unpaid income taxes ... 3,500 5,000

Net Free Assets .. P_65,000

Total Unsecured Creditors without Priority:

Total Unsecured Claims of all classes P 105,000

Less: Unsecured Creditors with Priority 5,000

Total Unsecured Creditors without Priority P100,000

% of Recovery; P65,000/ P100,000 = 65%

Estimated payment to partially secured creditors

Realizable value of A/R (60% x P60,000) .. P 2,400

390

Add: Unsecured Portion: 65% (P3,000 - P2,400

Total ....

Corporate Liquidation ue

18.

19.

©

Unsecured.

Fully Partially

Secured _ Secured

Original balance .aouin,

Subsequently discovered

items...

Sale of assets e

Payment of liabilities

Estimated liquidation

45,000

715,000 (740,000)

+ (690,000)

expente.....

30,000 (20,000)

P 25,000 P 785,000 P260,000 P120,000 280,000 355,000 (155,000)

Balance to date..

Anticipated transactions:

Liquidation of remaining

assets .... 8,000)

Piynuan or 732,000 (785,000)

creditors...

Pa (240,000) (240,000)

secured creditors... (10,

Reallocation of secured Marre) bene

AMOUR vanes (20,000) _ (40,000) ___ 30,000

Anticipated balance... P407,000 P___0 Po P 0 230,000 385,000 (208,000)

Anticipated dividend to unsecured creditors without priority:

Assets available to unsecured creditors (P407,000 — P230,600)

Claims of unsecured creditors without priority

Dividend (P177,000 — P385,000)

177,000

P835,000

45.97%

m ;

stimated losses on realization of assets sve. 2,000,000

Less: Estimated gains on realization of assets...... P1,440,000

Additional assets* 1,280,000 _ 2,720,000

Estimated net (ain) or logs in assets realization P( 720,000)

Add: Additio: jabilities** .. 960,000

Estimated net (gain) or loss P 240,000

Less: Stockholders equit i

Ganital stock, 2,000,000

Deficit... 1,200,000, 800,000

Estimated amount to be recovered by stockholders P_ 560,000

Therefore, the pro-rate payment on the peso is:

Estimated amount to be recovered by stockholders P560,000 P70 @

Stockholders’ Equity * Paooo00° 22

*Additional assets are assets completely written-off in the books in the past year

but subsequently have a realizable value.

** Additional liabilities, are liabilities in addition to the recorded liabilities in the

balance sheet, In other words, they are unrecorded liabilities and expenses.

Examples are liquidation expences uch as administrative andimectoe eee totikey

on damage suits, acquired interest on mortgage payable, unbilled creditor's fees

an e.

ail ; Chapter 2

the following

vt of ab

, me!

19. Palubog Co. is insolvent and its stal® 1,440,000

information: 2,000,000

1,280,

Estimated gains on realization atts . 960,000

Estimated losses on realization 2,000,000

Additional assets 1,200,000

Additional liabilities

pital stock

Deficit .. (estimated amount to be

The pro-rate payment on the peso t0 stockolers

recovered by stockholders) is:

PST

a. P30 co (Adapted)

b.43 ante ee

1.As of March 31,

oe ince January i.

20. Zero Na Corp. has been undergoing liquidation SiNC®""" conted below:

. A jquidation is

its condensed statement of realization and liquidation

Assets: P1,375,000

Assets to be realized 750,000

i 1,200,000

1,375,000

s P1,875,000

\ Liabilities not liquidated 1,700,000

ej. —Liabilities to be liquidated 2,250,000

-Tiabilities assumed 1,625,000

Revenues and Expenses;

Supplementary charges P.

oe 135000

The net gain (loss) for the three-month period ending March 31 ig: G25

a. P250,000

b. (625,000) a 426,000

750,000

(Adapted)

Corporate Liguidetion |

Greece am

Items 2 1 t)

hrough 33 are based on the following data:

The Palubog C

and quasicreorgans, has decided to seek liquidation after previous restructuring

balance sheet as of Mon ttmpts failed. The company has the following condensed

of May 1, 2008:

Liabilities and Stockholders’ Equity

Accrued payroll P 40,000 =

Loans from offic 50,000

2 Accounts payable

~a, Equipment loan payal

Business loan payable

Common stock

Deficit

Total ..

. P702,000)

The equipment loan pay

able is secured by specific plant assets having a book

P40, . ce P300,000 and a realizable value of P350,000. Of the accounts payable,

value of Pas ented by inventory which has a cost of P40,000 and a liquidation

Roce ah 000. The balance of the inventory has a realizable value of P32,000.

ceivables with a book value and market value of P100,000 and P80,000

respectively have been pledged as collateral on the business loan payable. The

balance of the receivables have a realizable value of P150,000.

(Adapted)

21. Assuming trustee expenses of P12,000 in addition to recorded liabilities, which of

the remaining unsecured creditors has the next highest order of priority.

@ Accrued payroll c. Loan from officer

Equipmentloan payable d. Business loan payable

22. The realizable value of assets pledged with fully secured creditors is:

a. P459,000 c. P40,000

by 44,000 d. 489,000

23. Of those creditors who are partially secured, their unsecured amounts are:

a. 430,000 c. P540,000

by : 110,000 d. 120,000

24. The total realizable value of free assets to unsecured creditors before unsecured

creditors with priority is:

a. — P628,000 c, P220,000

b. 232,000 Ce 198,000.

108

26.

26.

Chapter

The dividend to unsecu: i

i red cr

unsecured creditors (rounded) ee anaes rm

a. 90%

b. 100% (er 88%

d. 76%

Estimated deficiency to ‘unsecured creditors is:

a Pe

c. P 2,000

chy 22,000 d 12,000

. Estimated loss on asset disposition ig:

51,000 i

a. 5 }

c. 51,000

b. 89,000 @ 901000 a

. Estimated gain as asset disposition is:

/@) 56,000 52,000

p.54,000 a 6000

. Estimated amount paid to unsecured creditors with priority is:

a. 10,000 fe) -P 40,000

b. 30,000 < 110,000

|. Estimated amount paid to fully secured creditors is:

@ 40,000 c, -P470,000

b. 390,000 a. 430,000

. Estimated amount paid to unsecured creditors without priority is:

a. 70,000 cc. P20,000

&} 61,600 a. 50,000

. Estimated payment to partially secured creditorsis:

a. P358,800 c. P168,000

bs 516,800 d. 430,000

. Estimated payment to creditors is (discrepancy is expected due to rounding off).

a. P580,000 ¢., P571,000

b. 659,600 @, 668,400

:

ie Chapter 2

[Se

= © sement of Realization and Liquidation Credits:

P 1,200,000

Aseets realized .. 1,375,000

Assets not realize 2,250,000

Liabilities to be liquidated . 4,625,000

Liabilities assumed .... 2,800,000

ts* . area

Supplementary credit 9,250,000

21.

22. @)

Total credits...

Statement of Realization and Liquidation. Debits:

Bs | P1,375,000

aoets to bere 750,000

Aaa oie 1,875,000

Liabilities liquida 1'700,000

Liabilities not liquidate 3'125,000

Supplementary charge** . a

P8,825,000

Total Debits .....

P_425,000 (c)

Net gain for the three month period...

nue or income items such sales,

interest income,

*Supplementary credits are revel

etc.

**Supplementary debits are cost and expense items such as purchases, expenses,

etc,

@) ;

Claims of unsecured creditors must be satisfied to whatever extent possible in

the following order of priority:

1. _ Expenses to administer the estate.

2. Unpaid salaries, etc.

Ofall the assets listed only inventory is classified as an asset pledged to fully

secured creditors with a realizable value of P44,000 (book value of accounts

payable is P40,000)

Corporate Liquidation ue

23. (b)

The partially secured creditors are as follows:

Liabilities Realizable Value/Secured Unsecured

Equipment loan payable .. " P360,000 350,000 P 10,000

Business loan payable ...... 180,000 80,000 100,000

P430,000 P110,000 (b)

24. @

The realizable value of assets are as follows:

Cost Realizable Value

Cash ....... . P 12,000 P 12,000

Receivables (net). 100,000 80,000

Receivables (net).. 180,000 150,000

Inventory 40,000 44,000

Inventory 30,000 32,000

Plant assets (net) 300,000 350,000

Total .......... P668,000

Less:Fully secured creditors.

(accounts payable) .... 40,000

Partially secured creditors

(refer to No. 23) 430,000

Total free assets available to unsecured creditors ..... P198,000 (d)

Refer to No. 25 for alternative computation,

raptor 2

120____—— aa

ae Ge pledged to fully secured credito!

Inventory, at liquidation v value P 44,000

Less: Accounts payable... __ 40,000

Free assets of fully secured creditors . jdabaenensens P 4,000

ts:

a pee P 12,000

(book value, P280,000—P100,000) 150,000

Inventory, realizable value

(book value, P70,000 — P40,000) ....

‘Total free assets to unsecured creditors ......

Less: Unsecured creditors with priority

‘Accrued payroll ..

Net free assets

32,000 194,000

P198,000

40,000

P158,000

Unsecured Creditors:

Partially secured creditors (refer to No. 23)

Equipment loan payable... .. P360,000

Less: Plant assets, at realizable

value.....

350,000 P 10,000

P180,000

80,000 100,000 110,000

Business Joan payable ....

Less: Receivable at market value

Unsecured creditors without priority:

Loans from officer ...

P 50,000

Accounts payable 60, 000— P40, ,000) 20,000 70,000

Total unsecured creditors P180,000

ixpected recovery percent

ti ,

P158,000/P 180.000 age of unsecured creditors (rounded):

88% (c)

y

Comorate Liquidation i

26. &)

Net free assets (No. 25)... 158,000

-180,000

27.

28.

29,

Total unsecured creditors (No. 25)

Estimated deficiency to unsecured creditors .. P_22,000 (b)

or, alternatively:

Estimated losses on realization of assets:

Receivables [(P80,000 + P150,000) —P280,000]

Prepaid expenses*

Goodwill** ..

Less: Estimated gains on realization of assets:

Inventory [(P44,000 + P32,000)-P70,000] P 6,000

Plant assets (P350,000 —P300,000) - __50,000 __ 56,000

Estimated net (gains) or loss on realization of

é P 34,000

assets

Add: Unrecorded liabilities/expenses

Estimated net (gains) or loss...

Less: Loss borne by owners/stockholders’ e

Common stock

Deficit

Estimated deficiency to unsecured creditors ......

P 34,000

aquity:

*Normally, no realizable value is assigned to prepaid expenses because the amount

is relatively immaterial.

**TIn the event of liquidation, goodwill is considered worthless.

@

Refer to No. 26.

@

Refer to No. 26.

© -

Refer to No. 25. Since assets amounting to P198,000 is available for payment,

therefore, creditors of this class should expect to recover the full amount of 'P40,000.

, SS, SS

Chapter 2

122 mie

Zhe . . .

: fee to No. 25. Since assets with a realizable/liquidation value of Lerten

available to secure this type of creditor, therefore, creditors of this class sho’

expect to recover the full amount of P40,000.

31.

Unsecured creditors without priority:

70,000 x 88%.... ~- B 61,600(b)

32, @)

Partially secured creditors

Assets at realizable value: (refer to No. 25)

350,000 + P80,000.... - P480,000

Add: Portion of free assets used to pay

unsecured creditors without priority

[360,000 + P180,000) -P430,000] x 88%......... _ 96,800

526,800 (b)

33. @

Amount % of Recovery

Fully secured reditors (No. 30) .......... P 40,000 100% (40/40)

Partially secured creditors (No. 32)..... 526,800 98% (626.8/540)

Unsecured creditors with priority

(No. 29). . 40,000 100% (40/40)

Unsecured creditors without ‘priority

(No. 30)... es 61,600 88% (61.6/70)

P668,400* (d)

*Discrepancy of P400 due to rounding-off and this can be i

4 proven by adding th

total assets at realizable value, i.e. P668,000 (refer to No. 24) Re

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Standard CostingDocument11 pagesStandard Costingace zeroNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- MAS MidtermDocument6 pagesMAS Midtermace zeroNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Franchise p3Document4 pagesFranchise p3ace zeroNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Quiz p2Document6 pagesQuiz p2ace zeroNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Int AssetDocument21 pagesInt Assetace zeroNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

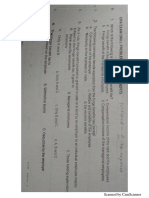

- Items of Gross Income Subject To RegularDocument2 pagesItems of Gross Income Subject To Regularace zeroNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Statements 3Document69 pagesStatements 3ace zeroNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Q19 - Audit Procedures, Evidence and DocumentationDocument7 pagesQ19 - Audit Procedures, Evidence and Documentationace zero0% (1)

- p2 Home OfficeDocument9 pagesp2 Home Officeace zeroNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Developing Our Future Professionals - Cross-Cultural Dialogues in The Workplace - LCC and HCC Characteristics EHall PDFDocument1 pageDeveloping Our Future Professionals - Cross-Cultural Dialogues in The Workplace - LCC and HCC Characteristics EHall PDFace zeroNo ratings yet

- Intermediate Examination: Suggested Answers To QuestionsDocument21 pagesIntermediate Examination: Suggested Answers To Questionsace zeroNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Inc Tax CGTDocument15 pagesInc Tax CGTace zero80% (5)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Scanned by CamscannerDocument9 pagesScanned by Camscannerace zeroNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- PromoDocument1 pagePromoace zeroNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Rit ExclusionDocument21 pagesRit Exclusionace zeroNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Scanned by CamscannerDocument4 pagesScanned by Camscannerace zeroNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)