Professional Documents

Culture Documents

TCC - Psfu

Uploaded by

VengOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TCC - Psfu

Uploaded by

VengCopyright:

Available Formats

For General Tax Questions

TRANSACTION TAX call our Toll Free

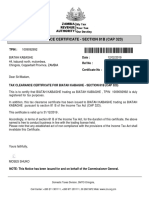

CLEARANCE CERTIFICATE

0800117000

(Issued under Sec. 134 Income Tax Act, CAP 340) Or log onto URA web portal

https://ura.go.ug

Issue Date: 20/10/2017 Notice - DT- 2091

Certificate Reference Number Certificate Barcode

DO02182834775

URA hereby certifies that the applicant whose particulars appear below has complied with the required tax

obligations for the tax period from: 01/01/2017 to: 31/12/2017

Section A: Applicant’s Particulars

Taxpayer Identification Number (TIN) 1002290351

Taxpayer’s Legal Name CRJE (EAST AFRICA) LIMITED

Taxpayer Business Name

Physical Address 55, CHWA II RD, MBUYA BARACKS, KAMPALA, NAKAWA DIVISION, NAKAWA

DIVISION,MBUYA BARACKS

Section B: Addressee’s Particulars

Taxpayer Identification Number (TIN)

Addressee’s Legal Name* Government of Uganda-represented by Private Sector Foundation Uganda (PSFU)

Addressee’s Business Name

Transaction Reference Number

Phone Contact 256 - 312214600 Email jkyewalabye@cedp.go.ug

Section C: Purpose of TCC

This TCC has been issued to the applicant for the purpose below:

1) Supplying goods or services to a Ministry, Department or Agency of Government

Section D: Official URA Representative

Name of Issuing Officer Sam Besigye

Designation of Issuing Officer supervisor Contact Number

This Certificate has been issued for and on behalf of the Commissioner / Commissioner General

Dear client, you may check the validity of this T.C.C on the URA web portal: https://ura.go.ug using the

reference number (above) or visit the nearest Domestic Tax Office.

Note: This Tax Clearance Certificate is VALID only;

i.If its presented in relation to the Tax period specified above

ii.If submitted to the Addressee and for the Purpose specified above.

iii.If not cancelled by the Commissioner/Commissioner General.

You might also like

- NY Petition For Writ of Habeas CorpusDocument5 pagesNY Petition For Writ of Habeas CorpusNY Criminal LawyerNo ratings yet

- Complaint Breach of Fiduciary DutiesDocument30 pagesComplaint Breach of Fiduciary DutiesOneMust88% (8)

- Department of Homeland SecurityDocument2 pagesDepartment of Homeland SecurityMathew MartinNo ratings yet

- Power of Attorney: XXXXXX (Name of The Company)Document3 pagesPower of Attorney: XXXXXX (Name of The Company)Anonymous AVTazyRlNo ratings yet

- SPA - Process of Docu (Transfer Title)Document2 pagesSPA - Process of Docu (Transfer Title)Yabun Paloma89% (227)

- CBP Bond Form Completion GuideDocument5 pagesCBP Bond Form Completion Guideph34rm3No ratings yet

- Chapter 5 - Statcon DigestsDocument10 pagesChapter 5 - Statcon DigestsPaulo Miguel GernaleNo ratings yet

- Board Resolution Appointing Corporate OfficersDocument2 pagesBoard Resolution Appointing Corporate OfficersJayson Ababa100% (4)

- Structural Steel Standard SANS 50025 / EN 10025:2004: Macsteel Trading Macsteel VRN Tel: 011-871-4600 Tel: 011-861-5200Document11 pagesStructural Steel Standard SANS 50025 / EN 10025:2004: Macsteel Trading Macsteel VRN Tel: 011-871-4600 Tel: 011-861-5200JakesNo ratings yet

- Structural Steel Standard SANS 50025 / EN 10025:2004: Macsteel Trading Macsteel VRN Tel: 011-871-4600 Tel: 011-861-5200Document11 pagesStructural Steel Standard SANS 50025 / EN 10025:2004: Macsteel Trading Macsteel VRN Tel: 011-871-4600 Tel: 011-861-5200JakesNo ratings yet

- Structural Steel Standard SANS 50025 / EN 10025:2004: Macsteel Trading Macsteel VRN Tel: 011-871-4600 Tel: 011-861-5200Document11 pagesStructural Steel Standard SANS 50025 / EN 10025:2004: Macsteel Trading Macsteel VRN Tel: 011-871-4600 Tel: 011-861-5200JakesNo ratings yet

- Torts and Damages GuideDocument19 pagesTorts and Damages GuideVictor GalangNo ratings yet

- Notice of Assessment Tax Ref No SXXXX913EDocument1 pageNotice of Assessment Tax Ref No SXXXX913EilamahizhNo ratings yet

- Michigan Child Protective Services Audit 2018Document111 pagesMichigan Child Protective Services Audit 2018Beverly Tran100% (1)

- VAT Certificate - Valve TechDocument1 pageVAT Certificate - Valve TechPower Tech IndustriesNo ratings yet

- Lavadia Vs CosmeDocument2 pagesLavadia Vs CosmeEllen Glae DaquipilNo ratings yet

- Drafting PleadingDocument26 pagesDrafting PleadingShreya guptaNo ratings yet

- UAE VAT Tax Invoice TemplateDocument1 pageUAE VAT Tax Invoice TemplateQuincy Joy Bartolome PasaholNo ratings yet

- Document Pack 9ST99MJR PDFDocument6 pagesDocument Pack 9ST99MJR PDFMohamed Diaa Mortada100% (1)

- Teezer Lubumbe Mwamfuli1584384146919tpin - CertificateDocument1 pageTeezer Lubumbe Mwamfuli1584384146919tpin - CertificateBlessings Mutanda0% (1)

- Gaa v CA exemption of laborer's wagesDocument4 pagesGaa v CA exemption of laborer's wagesPerry YapNo ratings yet

- Outsourcing Tender Sept 2017 PDFDocument99 pagesOutsourcing Tender Sept 2017 PDFAntonNo ratings yet

- Cor - Indonesia PDFDocument1 pageCor - Indonesia PDFsyaefulNo ratings yet

- Erc 2023-2024Document1 pageErc 2023-2024IBRAHIM HOSENNo ratings yet

- New Zealand TINDocument6 pagesNew Zealand TINBálint FodorNo ratings yet

- Y3 and Personal Data Form 2Document5 pagesY3 and Personal Data Form 2Shakil AhmedNo ratings yet

- PT SRI RATU INDONESIA CISDocument3 pagesPT SRI RATU INDONESIA CIS2km presentNo ratings yet

- Print VAT Registration - GOV - UkDocument11 pagesPrint VAT Registration - GOV - Uksiva kumarNo ratings yet

- Dissolution of A CorporationDocument8 pagesDissolution of A Corporationggsteph100% (1)

- QT12009Document2 pagesQT12009Piyush SrivastavaNo ratings yet

- Bangladesh VAT Registration Certificate for K&C ALLIANCE LTDDocument1 pageBangladesh VAT Registration Certificate for K&C ALLIANCE LTDMd. S H MarufNo ratings yet

- DBS TT Form 1Document3 pagesDBS TT Form 1christian barciaNo ratings yet

- Obaidul Quader's Income Tax CertificateDocument9 pagesObaidul Quader's Income Tax CertificateNetra NewsNo ratings yet

- Receipt - LinkedIn January PDFDocument2 pagesReceipt - LinkedIn January PDFNikolaxMNo ratings yet

- READ Civ ProDocument51 pagesREAD Civ PromtabcaoNo ratings yet

- Application Form For MSB Licence - Eng - 22032013Document8 pagesApplication Form For MSB Licence - Eng - 22032013Shahrizan NoorNo ratings yet

- Uganda Tourism Act SummaryDocument27 pagesUganda Tourism Act Summarympuuga abdunasserNo ratings yet

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document52 pagesCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)jeanieNo ratings yet

- Petroleum Licence Application Form PDFDocument10 pagesPetroleum Licence Application Form PDFnicholas idungafaNo ratings yet

- 1601 C CompensationDocument2 pages1601 C Compensationjon_cpaNo ratings yet

- BUSLIC Business Licence FormDocument10 pagesBUSLIC Business Licence Formcrew242No ratings yet

- Go Green and Receive Your Income Tax Notices Electronically: WWW - Iras.gov - SG Mytax - Iras.gov - SGDocument2 pagesGo Green and Receive Your Income Tax Notices Electronically: WWW - Iras.gov - SG Mytax - Iras.gov - SGJinchi WeiNo ratings yet

- Casa Statement 201028130002457 PDFDocument2 pagesCasa Statement 201028130002457 PDFSiti MariamNo ratings yet

- GNM-EXPORT LICENCE - Edit - 1626157788133Document1 pageGNM-EXPORT LICENCE - Edit - 1626157788133benard ayomahNo ratings yet

- Annex A - 1701A Jan 2018 - RMC 17-2019Document2 pagesAnnex A - 1701A Jan 2018 - RMC 17-2019Joe75% (4)

- Statement of Account: Date Transaction Type Amount NAV in INR (RS.) Price in INR (RS.) Number of Units Balance UnitDocument1 pageStatement of Account: Date Transaction Type Amount NAV in INR (RS.) Price in INR (RS.) Number of Units Balance Unitee206023No ratings yet

- Application For Export Bills For CollectionDocument2 pagesApplication For Export Bills For CollectionsrinivasNo ratings yet

- Request for a Business NumberDocument5 pagesRequest for a Business Numberrouzbeh1797No ratings yet

- U.S. Customs Form: CBP Form 226 - Record of Vessel Foreign Repair or Equipment PurchaseDocument2 pagesU.S. Customs Form: CBP Form 226 - Record of Vessel Foreign Repair or Equipment PurchaseCustoms FormsNo ratings yet

- Domestictransferorder 600 047406400 20190622 133322Document1 pageDomestictransferorder 600 047406400 20190622 133322Arslan Ali100% (1)

- Remittance Advice - Emily Bano AriquezDocument1 pageRemittance Advice - Emily Bano AriquezEdmil Jhon AriquezNo ratings yet

- Income Tax Form of BangladeshDocument3 pagesIncome Tax Form of BangladeshNaimul Haque NayeemNo ratings yet

- ConsolidateStatement Mar 2023 00939908 UnlockedDocument5 pagesConsolidateStatement Mar 2023 00939908 UnlockedCoid CekNo ratings yet

- Ing Vysya Bank Limited: Statement of AccountDocument4 pagesIng Vysya Bank Limited: Statement of Accountanoop_mishra1986No ratings yet

- Mini Statement 1Document2 pagesMini Statement 1Aashish ChaudhariNo ratings yet

- FORMULARDocument1 pageFORMULARAlexandru AgacheNo ratings yet

- Saudi Arabia TINDocument2 pagesSaudi Arabia TINseekusNo ratings yet

- Mari Mengenal Swift Dan Standar SDocument7 pagesMari Mengenal Swift Dan Standar SM. abdul MuizNo ratings yet

- Balance B/F - 1.00Document1 pageBalance B/F - 1.00kumbirai john chiparaNo ratings yet

- SWIFT Credit Dnepr Bank ListDocument2 pagesSWIFT Credit Dnepr Bank Listtarungupta1986_66389No ratings yet

- Financial Statements - WPIDocument24 pagesFinancial Statements - WPIeuwillaNo ratings yet

- Salary Slip (31109291 April, 2018)Document1 pageSalary Slip (31109291 April, 2018)Hassan RanaNo ratings yet

- EPOnlineSvcAccessApplnForm CompileDocument11 pagesEPOnlineSvcAccessApplnForm CompileRia ArguellesNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument15 pagesInstructions / Checklist For Filling KYC FormAdarsh SinghNo ratings yet

- Us52018000000006 PDFDocument1 pageUs52018000000006 PDFAnonymous xQGMgYNo ratings yet

- New Vendor Code Template For New ERP - M3Document8 pagesNew Vendor Code Template For New ERP - M3anurag_gpuraNo ratings yet

- Receipt Fund Trannsfer Chirantan 110118Document1 pageReceipt Fund Trannsfer Chirantan 110118s_banerjeeNo ratings yet

- E9d30c8 4837smartDocument1 pageE9d30c8 4837smartSantoshNo ratings yet

- Tax Invoice: Invoice Number G0057870 Invoice DateDocument1 pageTax Invoice: Invoice Number G0057870 Invoice DateshamNo ratings yet

- Fd2dbTraditional & Mordern Formats of Finanancial StatementsDocument6 pagesFd2dbTraditional & Mordern Formats of Finanancial StatementsAmitesh PandeyNo ratings yet

- Etrade Bank Deposit Slip PDFDocument2 pagesEtrade Bank Deposit Slip PDFAdamNo ratings yet

- Zambia Tax Clearance CertificateDocument1 pageZambia Tax Clearance CertificateIsrael Harrington MatamboNo ratings yet

- Se 19040047928444Document3 pagesSe 19040047928444yuanda syahfitraNo ratings yet

- Dan 2Document1 pageDan 2Mwesigwa DaniNo ratings yet

- Conference Services & Workshop (Quotation)Document1 pageConference Services & Workshop (Quotation)Tonie MbugaNo ratings yet

- AVEVA Bocad Steel Product BrochureDocument2 pagesAVEVA Bocad Steel Product BrochureVengNo ratings yet

- Block or Unblock Programs in Windows Defender FirewallDocument2 pagesBlock or Unblock Programs in Windows Defender FirewallVengNo ratings yet

- Unlicensed OpenBridge Modeler en 2Document7 pagesUnlicensed OpenBridge Modeler en 2VengNo ratings yet

- Basis Functions for Efficient Serendipity Finite Element MethodsDocument25 pagesBasis Functions for Efficient Serendipity Finite Element MethodsVengNo ratings yet

- Ag5 Uses Aecosim Building Designer For Comprehensive Building Information ModelingDocument2 pagesAg5 Uses Aecosim Building Designer For Comprehensive Building Information ModelingVengNo ratings yet

- 1101 0645 PDFDocument7 pages1101 0645 PDFVengNo ratings yet

- Introduction To Sap BridgeDocument53 pagesIntroduction To Sap BridgeNGUYEN100% (8)

- AVEVA Bocad Steel Product BrochureDocument2 pagesAVEVA Bocad Steel Product BrochureVengNo ratings yet

- 1101 0645 PDFDocument7 pages1101 0645 PDFVengNo ratings yet

- Technology Advancements in 2050 and How The World Will Look LikeDocument11 pagesTechnology Advancements in 2050 and How The World Will Look LikeVengNo ratings yet

- RCDC (Sacd) - Release Note - 8.0.0Document6 pagesRCDC (Sacd) - Release Note - 8.0.0mayasNo ratings yet

- SE USG 300 en Symbol Editor User's GuideDocument55 pagesSE USG 300 en Symbol Editor User's GuideamadhubalanNo ratings yet

- Transfer Model Data with Analytics ProgramsDocument10 pagesTransfer Model Data with Analytics ProgramsVengNo ratings yet

- P.D.FDocument5 pagesP.D.FVengNo ratings yet

- 1101 0645 PDFDocument7 pages1101 0645 PDFVengNo ratings yet

- Understanding The Differences: Leadership vs. ManagementDocument10 pagesUnderstanding The Differences: Leadership vs. ManagementVengNo ratings yet

- Technology Advancements in 2050 and How The World Will Look LikeDocument11 pagesTechnology Advancements in 2050 and How The World Will Look LikeVengNo ratings yet

- Certification PDFDocument1 pageCertification PDFVengNo ratings yet

- Advanced Financial Management (AFM) : Syllabus and Study GuideDocument20 pagesAdvanced Financial Management (AFM) : Syllabus and Study GuideSunnyNo ratings yet

- A Review of The HL-93 Bridge Traffic Load Model Using An ExtensivDocument18 pagesA Review of The HL-93 Bridge Traffic Load Model Using An ExtensivVengNo ratings yet

- ConSteel - ENG PDFDocument3 pagesConSteel - ENG PDFVengNo ratings yet

- 07 Ongkingco - v. - Sugiyama20210424-12-1ylslv7Document27 pages07 Ongkingco - v. - Sugiyama20210424-12-1ylslv7Jakie CruzNo ratings yet

- A.M. No. 20-07-10-SC, January 12, 2021Document30 pagesA.M. No. 20-07-10-SC, January 12, 2021Better UnnamedNo ratings yet

- AO - 2004-019.PDF Minors Travelling AbroadDocument10 pagesAO - 2004-019.PDF Minors Travelling Abroaddempe24No ratings yet

- Manorville Fire District Election NoticeDocument1 pageManorville Fire District Election NoticeRiverheadLOCALNo ratings yet

- Unresolved audit observations and recommendationsDocument15 pagesUnresolved audit observations and recommendationsAbu Maguinda SultanNo ratings yet

- Accessible Communities CaliforniaDocument57 pagesAccessible Communities CaliforniaprowagNo ratings yet

- Project Report GSTDocument57 pagesProject Report GSTVidhi RamchandaniNo ratings yet

- Philippines Indigenous Peoples FrameworkDocument5 pagesPhilippines Indigenous Peoples FrameworkLhee BhanNo ratings yet

- Uniform Civil Code-Constitutional AspectsDocument3 pagesUniform Civil Code-Constitutional AspectsAbhijith AUNo ratings yet

- Crim Compilation Title One To FourDocument150 pagesCrim Compilation Title One To Fourgem_mataNo ratings yet

- Invoice TemplateDocument3 pagesInvoice TemplatepalanisathiyaNo ratings yet

- DOJ Department Circular No. 41Document4 pagesDOJ Department Circular No. 41Nica GasapoNo ratings yet

- Uitm Kampus Seremban 3: Budget 2018 PresentationDocument6 pagesUitm Kampus Seremban 3: Budget 2018 PresentationAddin 114No ratings yet

- Case Digest Sposes Ocampo v. DionisioDocument5 pagesCase Digest Sposes Ocampo v. DionisioROSASENIA “ROSASENIA, Sweet Angela” Sweet AngelaNo ratings yet

- Suplico Vs Neda G.R. No. 178830 July 14, 2008Document1 pageSuplico Vs Neda G.R. No. 178830 July 14, 2008Fraicess GonzalesNo ratings yet

- Internship Report - HARSH GUPTADocument5 pagesInternship Report - HARSH GUPTAHarsh GuptaNo ratings yet

- Atty Suspended for Misconduct in GuamDocument4 pagesAtty Suspended for Misconduct in Guamjovani emaNo ratings yet

- Supreme Court rules on compounding non-compoundable offencesDocument20 pagesSupreme Court rules on compounding non-compoundable offencesKARTHIKEYAN MNo ratings yet