Professional Documents

Culture Documents

Philippines Petroleum Fiscal Regime

Uploaded by

dainty mojares0 ratings0% found this document useful (0 votes)

30 views5 pagesphilippine petroleum fiscal regime

Original Title

23. Philippines Petroleum Fiscal Regime

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentphilippine petroleum fiscal regime

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

30 views5 pagesPhilippines Petroleum Fiscal Regime

Uploaded by

dainty mojaresphilippine petroleum fiscal regime

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

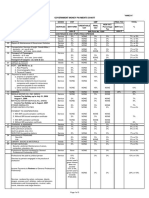

The Philippine Petroleum Fiscal Regime

Contract Area 800-15,000 sq km (offshore); 500-7,500 sq km (onshore)

7 yrs. exploration + 3 yrs. extension +

Contract Term

25 yrs. production + 15 yrs. extension

Signature Bonus USD 50,000 - 250,000

Royalties None

Income Tax Tax rate: 32% - paid out of Government share

Cost oil limit: 70% of gross income;

Cost Oil/Gas

Capital expenditures depreciated over 5 to 10 yrs.

Government share: 60%

Profit Oil/Gas FPIA up to 7.5% of gross proceeds with at least 15%

Filipino participation

State Participation None

FPIA- Filipino Participation Incentive Allowance

SC Profit Sharing

$ 100.00 Gross Proceeds

7.50 less FPIA (to Contractor)

70.00 less Cost Recovery (to Contractor)

22.50 Net Proceeds

$ 13.50 60% Government Share

$ 9.00 40% Contractor's Share

Incentives

• Service fee of up to 40% of net production

• Cost reimbursement of up to 70% gross

production with carry-forward of unrecovered

costs

• FPIA grants of up to 7.5% of the gross

proceeds for service contract with minimum

Filipino company participation of 15%

• Exemption from all taxes except income tax

• Income tax obligation paid out of

government’s share

Incentives

• Exemption from all taxes and duties for importation of

materials and equipment for petroleum operations

• Easy repatriation of investments and profits

• Free market determination of crude oil prices, i.e.,

prices realized in a transaction between independent

persons dealing at arms-length

• Special income tax of 8% of gross Philippine income

for subcontractors

• Special income tax of 15% of Philippine income for

foreign employees of service contractors and

subcontractors

FPIA Schedule of Percentage Incentive

Filipino Participation Allowance (%)

30% - above 7-1/2

27.5% but less than 30% 6-1/2

25% but less than 27.5% 5-1/2

22.5% but less than 25% 4-1/2

20% but less than 22.5% 3-1/2

17.5% but less than 20% 2-1/2

15% but less than 17.5% 1-1/2

Below 15% 0%

You might also like

- TaxDocument19 pagesTaxjhevesNo ratings yet

- Income Taxes For CorporationsDocument35 pagesIncome Taxes For CorporationsKurt SoriaoNo ratings yet

- Train I.ppt - Vers. 10.21.2018Document103 pagesTrain I.ppt - Vers. 10.21.2018Ellard28 saturnoNo ratings yet

- WITHHOLDING TAX OBLIGATIONSDocument152 pagesWITHHOLDING TAX OBLIGATIONSemytherese100% (2)

- Income Tax Definition and RatesDocument70 pagesIncome Tax Definition and RatesMary Fatima LiganNo ratings yet

- Corporation As A TaxpayerDocument27 pagesCorporation As A TaxpayerBSA-2C John Dominic Mia100% (1)

- Worldwide Petroleum Fiscal Regimes Development: Observations and TrendsDocument63 pagesWorldwide Petroleum Fiscal Regimes Development: Observations and TrendsBenny Lubiantara100% (7)

- Tax Reform For Acceleration and Inclusion (Train Law) : Republic Act No. 10963Document41 pagesTax Reform For Acceleration and Inclusion (Train Law) : Republic Act No. 10963maricrisandem100% (2)

- Comparative Incentives - BOI PEZADocument3 pagesComparative Incentives - BOI PEZAayen_buenafeNo ratings yet

- Taxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchFrom EverandTaxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchRating: 5 out of 5 stars5/5 (1)

- Government Money Payments Chart - BirDocument3 pagesGovernment Money Payments Chart - BirVan Caz89% (9)

- Txzaf 2019 Jun QDocument16 pagesTxzaf 2019 Jun QAyomideNo ratings yet

- Company ProfileDocument5 pagesCompany Profiledainty mojares100% (1)

- Midterm Assignment No. 3Document3 pagesMidterm Assignment No. 3XaxxyNo ratings yet

- Global oil and gas tax guide overviewDocument14 pagesGlobal oil and gas tax guide overviewmuki10No ratings yet

- Lec 6 Income Tax RatesDocument4 pagesLec 6 Income Tax Ratesrehan87100% (2)

- Final Tax 2Document25 pagesFinal Tax 2rickmortyNo ratings yet

- Financial Bill 2009Document10 pagesFinancial Bill 2009Tanuj GuptaNo ratings yet

- Highlights of Budget 2023-2024Document4 pagesHighlights of Budget 2023-2024Ayesha ZafarNo ratings yet

- Small Saving Interest Rates in IndiaDocument1 pageSmall Saving Interest Rates in Indiachaskar1983No ratings yet

- Budget Snapshot 2011-12Document22 pagesBudget Snapshot 2011-12Sunil SharmaNo ratings yet

- FRCA Presentation 2017 2018 National Budget 11.08.2017Document23 pagesFRCA Presentation 2017 2018 National Budget 11.08.2017ace kingNo ratings yet

- TXZAF 2019 Dec QDocument17 pagesTXZAF 2019 Dec QKAH MENG KAMNo ratings yet

- Oclarit TAX PEZA Report PPT 1Document31 pagesOclarit TAX PEZA Report PPT 1charissetosloladoNo ratings yet

- Taxation Paper F6 (PKNDocument13 pagesTaxation Paper F6 (PKNMashhood AhmedNo ratings yet

- Tanzania Tax Guide 2012Document14 pagesTanzania Tax Guide 2012Venkatesh GorurNo ratings yet

- Corporate TaxesDocument6 pagesCorporate TaxesfranNo ratings yet

- Budget 2009Document7 pagesBudget 2009JayNo ratings yet

- Income Taxation of Individuals: Citizens: Citizens Resident Non-ResidentsDocument6 pagesIncome Taxation of Individuals: Citizens: Citizens Resident Non-Residentskirsten_bri16No ratings yet

- A Critical Review of The Tax Structure of BangladeshDocument4 pagesA Critical Review of The Tax Structure of BangladeshSumaiya IslamNo ratings yet

- Individual Income Tax Rate Schedule - (Sec. 24 (A) (2) (A) )Document12 pagesIndividual Income Tax Rate Schedule - (Sec. 24 (A) (2) (A) )jimmatthamNo ratings yet

- 02 Corporate Income TaxDocument10 pages02 Corporate Income TaxbajujuNo ratings yet

- Tanzania Revenue Authority Taxes and Duties at a GlanceDocument24 pagesTanzania Revenue Authority Taxes and Duties at a GlanceInnocent IssackNo ratings yet

- Section 80 C and TaxationDocument3 pagesSection 80 C and TaxationdeepeshmahajanNo ratings yet

- F6 (BWA) Taxation PaperDocument11 pagesF6 (BWA) Taxation Papertrue100% (1)

- Individual Income Tax Rate Schedule - (Sec. 24 (A) (2) (A) )Document12 pagesIndividual Income Tax Rate Schedule - (Sec. 24 (A) (2) (A) )jimmatthamNo ratings yet

- RC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeDocument7 pagesRC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeGwyneth GloriaNo ratings yet

- Withholding Tax Bureau of Internal RevenueDocument10 pagesWithholding Tax Bureau of Internal RevenueFunnyPearl Adal GajuneraNo ratings yet

- Finance Bill 2014Document18 pagesFinance Bill 2014Tanvir Ahmed SyedNo ratings yet

- Tax System SriLankaDocument44 pagesTax System SriLankamandarak7146No ratings yet

- GOVERNMENT MONEY PAYMENT GUIDEDocument17 pagesGOVERNMENT MONEY PAYMENT GUIDErickmortyNo ratings yet

- Highlights of The Reforms On Direct Taxation UNDER RA 10963: National Tax Research CenterDocument33 pagesHighlights of The Reforms On Direct Taxation UNDER RA 10963: National Tax Research CenterCourt NanquilNo ratings yet

- Tax PlanningDocument7 pagesTax PlanningCharan AdharNo ratings yet

- Tax Amendment Boolet Final 2020-2021-CompressedDocument40 pagesTax Amendment Boolet Final 2020-2021-CompressedCaesarKamanziNo ratings yet

- Bangladesh Tax Handbook 2008-2009: Key ChangesDocument53 pagesBangladesh Tax Handbook 2008-2009: Key ChangesNur Md Al HossainNo ratings yet

- Incentives and Benefits For Developers Investors and EZ UsersDocument3 pagesIncentives and Benefits For Developers Investors and EZ Usersringku_lushaiNo ratings yet

- TAX RATES AND CLASSIFICATIONS FOR CORPORATE AND INDIVIDUAL TAXPAYERSDocument4 pagesTAX RATES AND CLASSIFICATIONS FOR CORPORATE AND INDIVIDUAL TAXPAYERSsuperultimateamazingNo ratings yet

- Malaysia GST PresentationDocument15 pagesMalaysia GST PresentationJeffreyNo ratings yet

- Train LawDocument41 pagesTrain LawJoana Lyn GalisimNo ratings yet

- 2010 Tax Matrix - Individual AliensDocument2 pages2010 Tax Matrix - Individual Alienscmv mendozaNo ratings yet

- F6PKN 2015 Jun QDocument17 pagesF6PKN 2015 Jun QRihamNo ratings yet

- Salient Tax ChangesDocument32 pagesSalient Tax Changesmir makarim ahsanNo ratings yet

- HumRes TaxDocument3 pagesHumRes TaxJob Noel BernardoNo ratings yet

- Tax Rates - SPSPS ReviewDocument10 pagesTax Rates - SPSPS ReviewKenneth Bryan Tegerero TegioNo ratings yet

- Tabc - Train - Noel N. Cobangbang, CpaDocument117 pagesTabc - Train - Noel N. Cobangbang, CpaIsaac CursoNo ratings yet

- 4/25/2016 21st MCMC 1Document19 pages4/25/2016 21st MCMC 1ShaniNo ratings yet

- TaxpayerDocument4 pagesTaxpayerMickaela Jaira AlvarezNo ratings yet

- RA 7160 - Local Government Code of 1991: Taxation Shall Be UniformDocument6 pagesRA 7160 - Local Government Code of 1991: Taxation Shall Be UniformChad FerninNo ratings yet

- Fiscal Guide ZambiaDocument9 pagesFiscal Guide ZambiaVenkatesh GorurNo ratings yet

- CHAPTER V Reservoir EngineeringDocument2 pagesCHAPTER V Reservoir Engineeringdainty mojaresNo ratings yet

- Reservoir EngineeringDocument10 pagesReservoir Engineeringdainty mojaresNo ratings yet

- Chapter IvDocument39 pagesChapter Ivdainty mojaresNo ratings yet

- Chapter VII and VIIIDocument28 pagesChapter VII and VIIIdainty mojaresNo ratings yet

- Environmental Management and Impact AssessmentDocument10 pagesEnvironmental Management and Impact Assessmentdainty mojaresNo ratings yet

- Chapter IIIDocument57 pagesChapter IIIdainty mojaresNo ratings yet

- Environmental Management and Impact AssessmentDocument10 pagesEnvironmental Management and Impact Assessmentdainty mojaresNo ratings yet

- Bibliography A. Books: AsdfghDocument3 pagesBibliography A. Books: Asdfghdainty mojaresNo ratings yet

- SUMMARY-Design and Development of Automated CERCHAR Abrasivity Index Apparatus For Measurement of Rock AbrasivityDocument8 pagesSUMMARY-Design and Development of Automated CERCHAR Abrasivity Index Apparatus For Measurement of Rock Abrasivitydainty mojaresNo ratings yet

- Operation and Experimental ManualDocument3 pagesOperation and Experimental Manualdainty mojaresNo ratings yet

- ABSTRACT-Design and Development of Automated CERCHAR Abrasivity Index Apparatus For Measurement of Rock AbrasivityDocument1 pageABSTRACT-Design and Development of Automated CERCHAR Abrasivity Index Apparatus For Measurement of Rock Abrasivitydainty mojaresNo ratings yet