Professional Documents

Culture Documents

HSL PCG Pick of The Week - Parag Milk Foods - 07 Jan - 2016 - 20170107162436 PDF

HSL PCG Pick of The Week - Parag Milk Foods - 07 Jan - 2016 - 20170107162436 PDF

Uploaded by

arpit85Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HSL PCG Pick of The Week - Parag Milk Foods - 07 Jan - 2016 - 20170107162436 PDF

HSL PCG Pick of The Week - Parag Milk Foods - 07 Jan - 2016 - 20170107162436 PDF

Uploaded by

arpit85Copyright:

Available Formats

INVESTMENT IDEA 07 Jan 2017

PCG RESEARCH

Parag Milk Foods

Industry CMP Recommendation Buying Range Target Time Horizon

BUY at CMP and add on

Packaged Foods Rs. 263 Rs. 263 – 233 Rs. 308 – 370 3-4 Quarters

Declines

HDFC Scrip Code PARMIL Company Background

BSE Code 539889

Parag Milk Foods Ltd (PMF) is a value‐added player in dairy Industry. The company commenced operations

NSE Code PARAGMILK in 1992 with collection and distribution of milk and have developed a dairy‐based branded consumer

Bloomberg PARAG products Company with an integrated business model. It manufactures a diverse range of products which

include cheese, Ghee, Butter, fresh milk, whey proteins, paneer, curd, yoghurt, milk powders and dairy

CMP as on 06 Jan - 17 263 based beverages targeting a wide range of consumer groups through several brands. The company’s

Equity Capital (Rs Cr) 84.2 aggregate milk processing capacity is 2mn lpd and their cheese plant has the largest production capacity at

a single location in India, with a raw cheese production capacity of 40 MT per day. 'Gowardhan' and 'Go',

Face Value (Rs) 10 their flagship brands, are among the leading ghee, cheese and other value added product brands in India.

PMF uses only cow milk and sources ~80% of it directly from farmers, village collection centres and chilling

Equity O/S (Cr) 8.4

centres. PMF has two dairy plants – one at Manchar, Pune, Maharashtra with processing capacity of 1.2mn

Market Cap (Rs cr) 2213 lpd and another at Palamaner in Andhra Pradesh, set up in 2010, with processing capacity of 0.8mn litre

per day.

Book Value (Rs) 82

Avg. 52 Week

127302

Volumes

52 Week High 357 Over the years it has developed strong relationships with the farmers in proximity to its facilities which aid

in procurement of raw milk at competitive prices. The supply chain network includes cow milk procurement

52 Week Low 202 from 29 districts across Maharashtra, Andhra Pradesh, Karnataka, and Tamil Nadu. The company procures

around 1m litres per day currently with the help of 4,300 village level collection centres, reaching

2,30,000+ farmers across its catchment areas and 114 chilling centres and bulk coolers across both its

Shareholding Pattern (%) plants. The distribution strength of Parag has improved over the years and now has an established pan-

Promoters 47.8 India distribution network of 15 depots, 104 super stockists and over 3,000+ distributors which services its

products to around 2,00,000+ retail outlets. Going forward, we expect Parag to build on this distribution

Institutions 41.0 network and expand its presence across country. It is targeting to increase direct distribution reach by

~10% per annum for next 3-5 years. Brands of Parag (Go, Gowardhan) already enjoys good awareness and

Non Institutions 11.2

equity in South and West. Management is targeting to shift the profile of brand spends towards above the

line activities. This, coupled with expanding product portfolio augurs well from top-line growth perspective.

PCG Risk Rating* Yellow

* Refer to Rating explanation

Kushal Rughani

kushal.rughani@hdfcsec.com

Private Client Group - PCG RESEARCH Page |1

Investment Rationale:

PCG RESEARCH

Strong Branded play in the Dairy Segment; Recommend BUY

Opportunity size in Dairy is huge and in turn offers strong growth visibility for branded players. Parag Milk,

with its strengths on procurement, distribution, innovation and management bandwidth is best placed among

its peers. While most of the listed Dairy players are either regional in nature or have dominant B2B

positioning, Parag offers a pan-national branded dairy play with large B2C focus. This, coupled with

expanding product portfolio augurs well from overall growth perspective. The stock trades at 22x/16x of our

FY18E/FY19E earnings while it is available at FY18/FY19 EV/EBITDA of 11.4x/8.7x. The stock is slightly

expensive to some peers but the higher valuation is justified by lower share of institutional sales, stronger

brands, distribution reach, and strong execution history. Moreover, given the focus on innovation an

increasing distribution network, PMF is set to post revenue CAGR of 14.3%, led by 17% CAGR for value-

added products during FY16-19E. Additionally, recent IPO proceeds would not only reduce leverage but also

help meet capex requirement, thereby accelerating profitability and improvement in return ratios. We

forecast 130bps margin expansion over the same period led by operating leverage and change in products

mix. We expect company to post robust PAT cagr of 41% led by improvement in operational performance

and lower interest out go over FY16-19E; we forecast Rs16.3 EPS for FY19. PMF trades at 16x FY19E P/E,

valuations do not adequately factor in the strong long term growth prospects (EPS CAGR 41% over FY16-

19E). We recommend BUY on Parag Milk Foods (PMF) at CMP and add on dips to Rs 233 with sequential price

targets of Rs 308 and Rs 370 (based on ~23x FY19E earnings) over the next 3-4 quarters.

Investment Rationale

Preferred Play in Dairy Theme

Parag Milk (PMF) is a branded play on the attractive dairy industry in India. The company’s large B2C mix,

well segmented brands, expanding value-added product portfolio and increasing distribution presence should

ensure 14% revenue CAGR in FY16-19E in the value-added products segment. Investments in procurement,

manufacturing, supply chain, people and branding are being front ended. This, we believe, will lay the

foundation for strong long-term profitable growth. Further, improving cash flows and the recent funding

through an IPO will ensure lower interest costs, thereby accelerating profit growth.

The India dairy industry has been represented in the listed space through a host of business models. Some

are focused on the institutional business with a low share of branded sales, while some market liquid milk

with a low share of value-added products. Further, some are plain marketers of value added products with no

back-end in place. We believe that the best model is one with strong procurement/manufacturing base at the

back-end and consumer-centric brand focused business at the front-end. Such a model brings with it the dual

advantage of cost efficiency and pricing power. PMF, with its procurement/manufacturing capabilities and

major skew to the B2C space, is the closest in the listed space to an ideal business mix.

Private Client Group - PCG RESEARCH Page |2

PCG RESEARCH

IPO Highlights

In May-2016, Parag Milk came out with an IPO of total 3.4 cr equity shares at Rs 215 per share which was

oversubscribed ~2x. From the IPO, PMF raised Rs 300cr through fresh equity and Rs 470cr of offer for sale

(OFS) gave partial exit to (1) two PE investors Motilal Oswal and IDFC, and (2) the promoter family. The IPO

proceeds would be used to augment its milk processing capacity at both the plants and increase production

capacity of value‐added products such as cheese, paneer, flavoured milk and whey Product. Moreover, PMF

will also set up an R&D facility and some of the funds for marketing activities. Company utilized Rs 100cr to

pay down working capital loans. Stock currently quotes at 20% premium to its IPO Price and 26% below its

all-time high price touched in July-2016. Post IPO, promoters holding came down from 62% to 48%.

Cheese – One of the key segment for Parag

Parag is one of the largest manufacturers of cheese in the country with a share of over 32% in the cheese

market (largely institutional – hotels, restaurants and caterers (HoReCa). Cheese accounted for 18% of its

top-line and has grown at CAGR of 22% in FY14-16. Parag’s cheese plant at Manchar (Pune) currently has a

capacity of 40mt/day, which will be increased to 60mt/day in the current fiscal year funded by proceeds from

the IPO. The plant is capable to producing cheese in 75 stock-keeping units under a wide range, including

cheddar, mozzarella, processed and gourmet cheese. The cheese facility runs at 80-85% capacity. Expansion

in cheese is in line with its strategy of focusing on value added and higher margin products. While Parag has

a strong presence in the institutional segment (HoReCa) wherein it supplies to McCain Foods, Jubilant

Foodworks, Sam’s Pizza, Mother Dairy, etc, the network expansion and increase in advertisement and

promotional expense should improve retail share of cheese products as well. The cheese market is

completely organized due to the product being highly capital intensive, and is currently an Rs2200cr market

in India, growing at a CAGR of ~20%. The cheese market in India is expected to grow at a similar pace for

the next three years also driven by increase of cheese usage in traditional food dishes, penetration &

premiumisation of the category and growth in the consumption of western dishes where cheese is among the

main ingredients. We expect Parag’s cheese revenue to grow at 17% CAGR over FY16-FY19 to Rs 440cr.

Ghee – Growth driven by shift from unorganized to organized

Ghee (clarified butter) is the largest consumed dairy product in India after liquid milk and curd. It is a key

ingredient in Indian recipes. As of 2016, the ghee market stood at Rs 81,100cr, growing at CAGR of 14%,

and is currently large pie is occupied by unorganized players. Amul is the largest player in the organized

ghee market. Retail accounts for 55% of the total organized market. Parag is the largest cow ghee brand in

India and is also known as the category creator. The market for ghee is expected to grow at CAGR of 14% to

Rs 1,37,500 cr by 2020. ~22% of the Ghee market is covered by organized players. We expect Parag’s ghee

revenue to grow at 12% CAGR over FY16-FY19E to Rs 500cr.

Private Client Group - PCG RESEARCH Page |3

PCG RESEARCH

Whey Protein – niche category with superior margin

Whey is a component of milk protein, it is the liquid which is left after the removal of casein and fat from milk

in the manufacturing of coagulated products. It is obtained as a by-product during the manufacturing of

cheese, paneer and chhana. The total whey produced in the country can be broadly classified into two

categories (i) acid whey which is inedible and accounts for 65% of the total production by volume; and (ii)

sweet whey which is edible and accounts for the remaining market 35% of production by volume. Key

players in the Indian sweet whey market include Amul, Parag Milk and Schreiber Dynamix.

Whey is a by-product of cheese which needs to be processed and refined further to be sold as a branded

product. Currently Parag sells whey only to institutional customers, (leading supplier to Nestle and UTH

Beverage Factory) but is now setting up a processing and refining facility which will cater to retail consumers.

Whey as a category is not developed in India vs. developed markets; it is currently ~Rs 350cr category and

is expected to scale up to Rs 1200cr 2020. Whey protein contributed only 3.5% of Parag’s total business in

FY16; however, it entails superior margins. We expect Parag’s whey protein revenue to grow at 58% cagr

over FY16-FY19E to Rs 230cr.

Integrated Business Model – Farm to Home “Pride of Cows”

Dairy Farming - In 2005, Parag set up Bhagyalaxmi Dairy Farms at Manchar (Pune) to educate farmers about

best practices of breeding, feeding, animal management and improving productivity. The farm houses >

2,000 Holstein breed cows, as well as a fully automated rotary milking parlor to milk cows without human

intervention and ensure that milk is not exposed to any impurities in the environment. The cows at the farm

have an average milk yield of 25-30 litres/day compared to the Indian average of 6-7 liters. The premium

fresh milk produced by the farm is sold to around 20,000 customers in Mumbai and Pune under the “Pride of

Cows” brand.

Parag currently meets a significant portion of its milk requirement (~85%) directly from farmers in 29

districts across Maharashtra, Andhra Pradesh, Karnataka and Tamil Nadu. The company procures ~1mn liters

of milk per day currently through 4,300 village level collection centers reaching 2.5 lakh+ farmers across its

catchment areas. It currently has 114 chilling centers and bulk coolers across both its Manchar and

Palamaner processing plants and plans to add 75 new bulk milk coolers and 100 automated milk collection

systems, which will be installed at under-penetrated villages and will thus expand the milk procurement

base.

UHT (Ultra Heat Treated) milk

High growth area UHT is a form of milk that is treated at temperature of at least 135 degree Celsius to kill

the harmful bacteria. UHT milk is an Rs 4500cr market, growing exponentially off a small base. Amul is the

largest player in UHT milk segment in India, while Parag is the largest private player. UHT milk market is

expected to grow at a CAGR of 25% to Rs 10400cr by 2020. We expect Parag’s UHT Milk revenues to post

28% revenue cagr and would reach to Rs 180cr.

Private Client Group - PCG RESEARCH Page |4

PCG RESEARCH

Brands Products Target consumers

Fresh milk in many variants,

Curd products, Ghee, Paneer,

Butter, Whey, Shrikhand,

Gulab Jamun mix & Milk Household consumption

powders

Cheese products, UHT milk, Children and the

Fresh milk: Go Kidz, Curd: youth, primarily

Fruit yoghurts in six flavours, for direct

Fresh cream and beverages consumption

Youth and

travellers as a

Flavoured milk in various

source of instant

Flavours

nourishment

Farm-to-home concept

targeted at household

Premium Cow Milk consumers seeking

premium quality cow‘s

milk

Source: Company, HDFC sec Research

Private Client Group - PCG RESEARCH Page |5

PCG RESEARCH

Q2 FY17 Update

Revenue growth impacted by decline in SMP sales

Parag Milk Foods’ net sales were up 0.7% to Rs 470cr. Revenue growth was muted as Skimmed Milk Powder

(SMP) sales declined by 31% to Rs 440mn. Excluding SMP business, net sales increased by 6% as Fresh milk

sales increased by 13% to Rs 97cr aided by 6-7% price hike while Milk product sales were up by 5% to Rs

326cr largely impacted by weakness in rural markets (25-30% of sales). While cheese business continues to

grow ahead of market growth of 16-18%, Ghee sales were impacted due to price hike and subdued demand

in rural markets. In terms of regions, demand was impacted by drought in Maharashtra and Tamil Nadu while

heavy rains impacted the sales in North eastern markets.

Improved mix led to higher gross margins

Gross margins were up by 370bps (60bps QoQ) at 30.5% aided by continued decline in low margin SMP sales

and increase in share of value added products. Moreover, company had taken price hike of 8% in Cow ghee

in the middle of the quarter, ahead of market, in order to offset the impact of increase in raw milk prices.

Employee cost increased by 10%. Other expenses increased by 31% largely on account of a) increased A&P

expense behind core brands by 100bps and b) higher milk handling cost due to lower buying of semi-finished

goods. The management has stated that A&P spends were higher in the quarter due to pre festive branding

exercise; however, overall FY17 spends will not be at the same run rate as Q2. Resultant EBITDA was down

by 9.0% with margin decline of 80bps to 8.0%.

Demonetisation won’t Impact much

Overall impact on procurement for the organised dairy sector was minimal as payments are largely executed

through banking channel. PMF makes digital payment to the chilling centres; majority of its farmer network

gets payment from village collection centres, which are also completely through banking channel.

The distributor channel was impacted for initial 8-10 days due to delayed payment from retailers. While the

retail off take in urban areas (~80% of B2C sales for PMF) is returning to normalcy, the inventory levels at

the retailer end have already started reducing. Company has extended credit period to the distributors on

selective basis and things are gradually improving.

Private Client Group - PCG RESEARCH Page |6

PCG RESEARCH

Intends to open > 100 Gowardhan shopees over the next 12 months

Parag Milk Foods plans to open 120 to 150 Gowardhan shopees in 2017 and has started its pilot

in Hyderabad.

Parag has second largest share of India's cheese market, is present in both packaged milk and milk

products. The company plans to convert its existing shops in Maharashtra to the uniform format to be

designed under Gowardhan Shopee. Company intends to develop these shopees on franchise basis.

The company has also plans to expand the number of brands it owns from existing four to total of

seven by the end of next year. 'Milk Rich' will be the fifth brand of the company in dairy whitener

category. It will not be just re-branding of the existing Gowardhan dairy whitener.

Parag will be launching its sixth brand in the category of whey products. Company has set up separate

factory for whey consumer products like protein mix powder which would drive revenues from FY18

onwards.

Indian Dairy Industry Outlook

In 2014, India‘s dairy industry was worth ~Rs 4,061 billion, posted CAGR of 15.4% during 2010 to 2014.

Total production of milk and dairy products in India is expected to increase from 147 Million Metric Tonne

(MMT) in 2015 to 189 MMT in 2021, and total consumption of milk and dairy products is expected to increase

from 138 MMT in 2015 to 192 MMT in 2021. India‘s dairy industry is expected to maintain growth at CAGR of

approximately 14.9% between 2015 to 2020, to reach value of Rs 9,397 billion by 2020. In India, milk

consumption mainly consists of buffalo milk at 49% followed by cow milk at 48% as on financial year 2014.

However, cow milk is growing at a faster pace than buffalo milk and is expected to account for the majority

of the total milk consumed in line with the developed markets. On a state level, Uttar Pradesh, Rajasthan and

Andhra Pradesh were the largest milk producers ‘accounted for 17.7%, 10.5% and 9.8% of total milk

production in 2014, respectively. Further, of the 35 states and union territories in India, cow milk is dominant

in 24 states and union territories. The top five cow milk producing states in India currently are Tamil Nadu,

Uttar Pradesh, Rajasthan, Maharashtra and West Bengal.

During 2010 to 2014, the organised segment recorded at a CAGR 20.7% whilst the unorganised segment

grew at 14.2% CAGR during the same period. However, the unorganised segment still dominates the Indian

dairy industry at 80% compared to the organised segment at 20% by value in 2014. The organised segment

is expected to post CAGR of 19.5% between 2015 and 2020 and would account for approximately 25.5% of

the Indian dairy industry by 2020. The unorganised segment is expected to post CAGR of 13.2% during the

same period and is expected to account for 74.5% of the total Indian dairy industry by 2020.

Private Client Group - PCG RESEARCH Page |7

PCG RESEARCH

Premium Valuations justified; Recommend BUY with TP of Rs 370

Branded value-added dairy products category is the most attractive category in the dairy market. This

category is not only growing at a faster pace than overall category (1.5x growth), but is also far more

profitable. PMF has a strong value-added portfolio across categories (cheese, UHT milk, yogurt, fresh cream,

dairy whitener and milk based beverages). Two thirds of PMF’s FY16 revenues came in from value-added

products. We expect PMF’s valuation discount versus F&B peers to narrow. Opportunity size in Dairy is huge

and in turn offers strong growth visibility for branded players. Parag, with its strengths on procurement,

distribution, innovation and management bandwidth is best placed among its peers. While most of the listed

Dairy players are either regional in nature or have dominant B2B positioning, Parag offers pan-national

branded dairy play with large B2C focus.

The stock trades at 22x/16x our FY18/FY19 earnings estimates and at FY18/FY19 expected EV/EBITDA of

11x/8.7x. The stock is slightly expensive to some peers but the higher valuation is justified due to lower

share of institutional sales, stronger brands, distribution reach, and strong execution history. Moreover, given

the focus on innovation an increasing distribution network, PMF is set to post revenue CAGR of 14.3%, led by

17% CAGR for value-added products during FY16-19E. Additionally, recent IPO proceeds should not only

reduce leverage but also help meet capex requirement, thereby accelerating profits and improving return

ratios. We forecast 170bps margin expansion over the same period led by operating leverage and change in

products mix. We expect company to post robust PAT cagr of 41% led by improvement in operational

performance and lower interest out go over FY16-19E; we forecast Rs16.3 EPS for FY19. PMF trades at 16x

FY19E P/E, valuations do not adequately factor in the strong long-term growth prospects (EPS CAGR of 41%

during FY16-19E). We recommend BUY on Parag Milk Foods (PMF) at CMP and add on dips to Rs 233 with

sequential price targets of Rs 308 and Rs370 (based on ~23x FY19E earnings) over the next 3-4 quarters.

We believe stock has potential to give consistent returns over the next 5-7 years.

Risks and Concerns

Parag’s manufacturing operations are largely dependent on the supply of cow milk, which is the

primary raw material for all the dairy products. Given the seasonal nature of the dairy industry, cattle

farming patterns and no formal agreements with the farmers, availability of raw milk keeps on

fluctuating which thereby could adversely impact the running of its operations.

Business operations are dependent on supply of large amounts of raw milk, and an inability to procure

adequate amounts of quality raw milk at competitive prices could adversely affect results of

operations. Also, volatility in milk prices can impact margins which in turn could hurt profitability.

Private Client Group - PCG RESEARCH Page |8

PCG RESEARCH

Working capital of the company is stretched given the high debtor days given to distributors and the

high processing time in some of the value added products like cheese.

Competitive intensity is high in the category with some strong regional players and few pan India

players like (Amul & Mother dairy), which may impact pricing and margins of the company. Moreover,

large market size of unorganized segment also remains key concern.

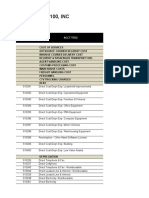

Financial Summary (Rs cr)

(Rs Cr) FY14 FY15 FY16 FY17E FY18E FY19E

Sales 1089 1444 1645 1780 2048 2453

EBITDA 83 109 149 162 200 264

Net Profit 17 28.9 49 62.9 97.6 137

EPS (Rs) 2.0 3.4 5.8 7.5 11.6 16.3

P/E 132.9 76.3 44.8 35.1 22.6 16.1

EV/EBITDA 27.7 21.1 15.5 14.2 11.5 8.7

RoE 18.6 26.2 20.3 12.0 13.3 16.3

Source: Company, HDFC sec Research

Comparison with Other Players

Presence

Dominant in Value

Divesrsified Position Added Multi Region

Company Product Portfolio in B2C Products Presence

Hatsun Yes Yes Yes No

Britannia No Yes Yes Yes

Parag Milk Yes Yes Yes Yes

Heritage Yes Yes Yes No

Kwality No No Yes Yes

Prabhat Yes No Yes No

Source: HDFC sec Research

Private Client Group - PCG RESEARCH Page |9

PCG RESEARCH

Valuations

Parag Milk FY19E FY21E

Revenues (Rs cr) 2453 3383

PAT (Rs cr) 137 218

EPS (Rs) 16.3 25.8

Trgt PE (x) 23 21

CMP (Rs) 263 263

Trgt Price (Rs) 370 548

Implied Upside (%) 40.7 108.5

Source: HDFC sec Research

Peer Group Valuations

Revenues (Rs cr) CMP Mcap EV/EBITDA

Company [FY19E] EBITDA PAT (Rs) (Rs cr) PE (x) (x)

Hatsun 4,990 492 195 382 5,815 29.2 13.3

Heritage 2,498 214 118 889 2,063 17.5 10.4

Parag

Milk 2,453 264 137 263 2,213 16.1 8.7

Kwality 7,380 490 282 129 3,070 11.5 8.2

Prabhat 1,715 187 78 106 1,038 13.3 6.8

Source: HDFC sec Research

Private Client Group - PCG RESEARCH P a g e | 10

PCG RESEARCH

Milk Products Rev to witness 17% cagr over FY16-19E EBITDA and PAT to witness strong growth momentum

80 300

2100

1900 70

1700 250

60

1500

1300 50 200

1100

40

900 150

700 30

500 100

20

300

100 10 50

FY13 FY14 FY15 FY16 FY17E FY18E FY19E

VAP Revenue (Rs Cr) 0

FY14 FY15 FY16 FY17E FY18E FY19E

Value Added Products Rev Contribution (RHS, %)

Source: Company, HDFC sec Research

Source: Company, HDFC sec Research

FY16 Revenues Split (%) FY19E Revenues Split (%)

15

% 13 %

18 16

4 Fresh Milk Fresh Milk

9

Skimmed Milk Powder Skimmed Milk Powder

5

Ghee & Butter 9 Ghee & Butter

12 Cheese & Paneer 8 Cheese & Paneer

UHT products UHT products

Whey Products Whey Products

Others Others

25 20

24

21

Source: Company, HDFC sec Research Source: Company, HDFC sec Research

Private Client Group - PCG RESEARCH P a g e | 11

PCG RESEARCH

Region wise Distributors Whey Proteins Usage

% 8 10

%

10 5

South 40 Infant Food

15 West 15

40 Health Supplements

North

Dairy

East

Mumbai Pharma

Confectionary &

Others

27 30

Source: Company, HDFC sec Research Source: Company, HDFC sec Research

Indian Dairy Industry Market Size (Rs Bn) Indian Cheese Market (Rs Bn)

8000 70

7000 59

60

6000

50 47

5000

4000 40 35

29

3000 30

22

2000 17

20

1000 12

10

0

2014 2015 2016 2017E 2018E 2019E 2020E

0

Unorganized Organized 2014 2015 2016 2017E 2018E 2019E 2020E

Source: Company, HDFC sec Research Source: Company, HDFC sec Research

Private Client Group - PCG RESEARCH P a g e | 12

PCG RESEARCH

Income Statement (Consolidated) Balance Sheet (Consolidated)

(Rs Cr) FY14 FY15 FY16 FY17E FY18E FY19E (Rs Cr) FY14 FY15 FY16 FY17E^ FY18E FY19E

Net Revenue 1089 1444 1645 1780 2048 2453 SOURCE OF FUNDS

Growth (%) 12.3 32.6 13.9 8.2 15.0 19.8 Share Capital 16.0 16.0 70.4 84.2 84.2 84.2

Reserves 81 107 291 603 693 820

Operating Expenses 1006 1337 1496 1618 1848 2188

Shareholders' Funds 97 123 362 688 777 905

EBITDA 83 109 149 162 200 264

Minority Interest 0 0 0 0 0 0

Growth (%) -3 31 36 9 23 32 Long term debt 273 173 125 107 100 88

EBITDA Margin (%) 8.0 7.9 9.1 9.1 9.8 10.8 Net Deferred Taxes 4 6 11 11 11 11

Depreciation 28 28 33 42 44 47 Long Term Provisions &

Others 11 17 19 22 25 27

EBIT 57 84 118 125 163 225 Total Source of Funds 385 319 517 827 914 1031

Other Income 1 2 2 5 7 8 APPLICATION OF FUNDS

Interest 44 49 49 34 28 29 Net Block 242 292 349 352 383 371

PBT 13 34 69 92 135 196 CWIP 38 26 28 23 23 33

Investment 0 0 0 0 0 0

Tax -4 5 20 27 39 57

Long Term Loans & Advances 105 69 17 27 36 45

RPAT 17 29 49 63 98 137 Total Non Current Assets 385 387 394 402 442 449

Growth (%) -19 74 70 28 55 41 Inventories 190 212 272 317 348 403

EPS 2.0 3.4 5.8 7.5 11.6 16.3 Trade Receivables 163 171 236 263 292 336

Source: Company, HDFC sec Research Cash & Equivalents 4 6 8 98 110 181

Other Current Assets 81 148 86 92 99 108

Total Current Assets 438 537 601 770 848 1028

Trade Payables 125 180 167 220 236 269

Other Current Liab &

Provisions 313 425 307 264 253 281

Total Current Liabilities 438 605 474 483 489 550

Net Current Assets 0 -67 127 287 381 500

Total Application of Funds 385 319 517 827 914 1031

Source: Company, HDFC sec Research, ^After IPO

Private Client Group - PCG RESEARCH P a g e | 13

PCG RESEARCH

Cash Flow Statement (Consolidated) Key Ratio (Consolidated)

(Rs Cr) FY14 FY15 FY16 FY17E FY18E FY19E Key Ratios (%) FY14 FY15 FY16 FY17E FY18E FY19E

Reported PBT 13 34 69 92 135 196 EBITDA Margin 8.0 7.9 9.1 9.1 9.8 10.8

Non-operating & EO items -1 -2 -2 -5 -7 -8 EBIT Margin 5.5 6.1 7.2 7.0 8.0 9.2

Interest Expenses 44 49 49 34 28 29 APAT Margin 1.6 2.1 3.0 3.5 4.8 5.6

Depreciation 28 28 33 42 44 47 RoE 18.6 26.2 20.3 12.0 13.3 16.3

Working Capital Change -21 69 -192 -69 -61 -48 RoCE 20.6 20.0 20.1 13.3 13.3 16.4

Tax Paid 4 -5 -20 -27 -39 -57 Solvency Ratio

OPERATING CASH FLOW ( a ) 46 370 -1 66 100 160 Net Debt/EBITDA (x) 6.7 4.9 2.6 1.1 0.7 0.2

Capex -25 -77 -90 -45 -75 -35 Net D/E 5.7 4.4 1.1 0.3 0.2 0.1

Free Cash Flow 21 293 -91 21 25 125 Interest Coverage 1.3 1.7 2.4 3.7 5.8 7.8

Investments -10 36 52 -9 -9 -9 PER SHARE DATA

Non-operating income 1 2 2 5 7 8 EPS 2.0 3.4 5.8 7.5 11.6 16.3

INVESTING CASH FLOW ( b ) -34 -39 -36 -49 -77 -36 CEPS 27.6 35.3 11.7 12.5 16.8 21.9

Debt Issuance / (Repaid) 43 -91 -35 -15 -3 -10 BV 61 77 51 82 92 107

Interest Expenses -44 -49 -49 -34 -28 -29 Dividend 0.0 0.0 0.0 0.0 1.2 2.0

FCFE 21 152 -176 -27 -6 86 VALUATION (x)

Share Capital Issuance 0 0 54 14 0 0 P/E 132.9 76.3 44.8 35.1 22.6 16.1

Dividend -5 0 0 0 -12 -20 P/BV 4.3 3.4 5.1 3.2 2.8 2.4

FINANCING CASH FLOW ( c ) -6 -140 -30 -35 -43 -58 EV/EBITDA 27.7 21.1 15.5 14.2 11.5 8.7

NET CASH FLOW (a+b+c) 7 190 -68 -18 -20 65 EV / Revenues 2.3 1.7 1.4 1.1 1.0 0.8

Source: Company, HDFC sec Research Source: Company, HDFC sec Research

Private Client Group - PCG RESEARCH P a g e | 14

PCG RESEARCH

Price Chart

400

350

300

250

200

150

100

50

Sep-16

May-16

Nov-16

Jul-16

Jun-16

Oct-16

Dec-16

Aug-16

Rating Definition:

Buy: Stock is expected to gain by 10% or more in the next 1 Year.

Sell: Stock is expected to decline by 10% or more in the next 1 Year.

Private Client Group - PCG RESEARCH P a g e | 15

PCG RESEARCH

Rating Chart

R HIGH

E

T

MEDIUM

U

R

N LOW

LOW MEDIUM HIGH

RISK

Ratings Explanation:

RATING Risk - Return BEAR CASE BASE CASE BULL CASE

IF RISKS MANIFEST

IF INVESTMENT

IF RISKS MANIFEST PRICE CAN FALL 15% &

LOW RISK - LOW RATIONALE FRUCTFIES

BLUE PRICE CAN FALL 20% IF INVESTMENT

RETURN STOCKS PRICE CAN RISE BY

OR MORE RATIONALE FRUCTFIES

20% OR MORE

PRICE CAN RISE BY 15%

IF RISKS MANIFEST

IF INVESTMENT

MEDIUM RISK - IF RISKS MANIFEST PRICE CAN FALL 20% &

RATIONALE FRUCTFIES

YELLOW HIGH RETURN PRICE CAN FALL 35% IF INVESTMENT

PRICE CAN RISE BY

STOCKS OR MORE RATIONALE FRUCTFIES

35% OR MORE

PRICE CAN RISE BY 30%

IF RISKS MANIFEST

IF INVESTMENT

IF RISKS MANIFEST PRICE CAN FALL 30% &

HIGH RISK - HIGH RATIONALE FRUCTFIES

RED PRICE CAN FALL 50% IF INVESTMENT

RETURN STOCKS PRICE CAN RISE BY

OR MORE RATIONALE FRUCTFIES

50% OR MORE

PRICE CAN RISE BY 30%

Private Client Group - PCG RESEARCH P a g e | 16

PCG RESEARCH

I, Kushal Rughani, MBA, author and the name subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about the subject

issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report.

Research Analyst or his/her relative or HDFC Securities Ltd. does not have any financial interest in the subject company. Also Research Analyst or his relative or HDFC Securities Ltd. or its

Associate may have beneficial ownership of 1% or more in the subject company at the end of the month immediately preceding the date of publication of the Research Report. Further

Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any material conflict of interest.

Any holding in stock – No

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have been compiled or

arrived at, based upon information obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of

warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. This document is for information

purposes only. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as an

offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any

locality, state, country or other jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HDFC Securities

Ltd or its affiliates to any registration or licensing requirement within such jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may not

be reproduced, distributed or published for any purposes without prior written approval of HDFC Securities Ltd .

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived

from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HDFC Securities Ltd may from time to time solicit from, or perform broking, or other services for,

any company mentioned in this mail and/or its attachments.

HDFC Securities and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies)

mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the

company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and

other related information and opinions.

HDFC Securities Ltd, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any

action taken on basis of this report, including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the

dividend or income, etc.

HDFC Securities Ltd and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report, or

may make sell or purchase or other deals in these securities from time to time or may deal in other securities of the companies / organizations described in this report.

HDFC Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other

assignment in the past twelve months.

HDFC Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report

for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or

specific transaction in the normal course of business.

HDFC Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research

report. Accordingly, neither HDFC Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is not

based on any specific merchant banking, investment banking or brokerage service transactions. HDFC Securities may have issued other reports that are inconsistent with and reach different

conclusion from the information presented in this report. Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an

officer, director or employee of the subject company. We have not received any compensation/benefits from the Subject Company or third party in connection with the Research Report.

HDFC Securities Ltd. is a SEBI Registered Research Analyst having registration no. INH000002475

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg

(East), Mumbai 400 042

HDFC securities Limited, 4th Floor, Above HDFC Bank, Astral Tower, Nr. Mithakali 6 Road, Navrangpura, Ahmedabad-380009, Gujarat.

Website: www.hdfcsec.com Email: pcg.advisory@hdfcsec.com

Private Client Group - PCG RESEARCH P a g e | 17

You might also like

- The Legalized Crime of Banking and A Constitutional Remedy (1958)Document265 pagesThe Legalized Crime of Banking and A Constitutional Remedy (1958)johnrose521No ratings yet

- Expense CoaDocument12 pagesExpense Coa175pauNo ratings yet

- Ease of Doing BusinessDocument16 pagesEase of Doing BusinessNathaniel100% (1)

- UCC MockBoardExam 2021 FAR 70Document15 pagesUCC MockBoardExam 2021 FAR 70Y JNo ratings yet

- PGL DTC 47 Tri Db-Strong - 11 August 2023Document8 pagesPGL DTC 47 Tri Db-Strong - 11 August 2023Joel MURILLONo ratings yet

- PG CaseDocument12 pagesPG CaseVivek PrakashNo ratings yet

- Parag Milk Foods-Buy: Ideas For A New DayDocument8 pagesParag Milk Foods-Buy: Ideas For A New DayKanav GuptaNo ratings yet

- AngelBrokingResearch ParagMilkFoods IPONote 030516Document11 pagesAngelBrokingResearch ParagMilkFoods IPONote 030516durgasainathNo ratings yet

- International Paper - Pick of The Week - 171218Document15 pagesInternational Paper - Pick of The Week - 171218gogit97223No ratings yet

- Viewpoint: Godrej Agrovet (GAVL)Document3 pagesViewpoint: Godrej Agrovet (GAVL)ADNo ratings yet

- Granules Emkay Research Report PDFDocument15 pagesGranules Emkay Research Report PDFrchawdhry123No ratings yet

- Granules Emkay Research ReportDocument15 pagesGranules Emkay Research Reportrchawdhry123No ratings yet

- Esearch Eport: Riddhi Siddhi Gluco Biols LTDDocument9 pagesEsearch Eport: Riddhi Siddhi Gluco Biols LTDanny2k1No ratings yet

- Greaves CottonDocument11 pagesGreaves CottonMahesh Karande (KOEL)No ratings yet

- The Best Stock To Add To Your Portfolio This Month Is Here!: December 2020Document9 pagesThe Best Stock To Add To Your Portfolio This Month Is Here!: December 2020Vighnesh KurupNo ratings yet

- How Parle Agro Digitized Sales & Distribution To Grow: 2X in Three YearsDocument3 pagesHow Parle Agro Digitized Sales & Distribution To Grow: 2X in Three YearsVivek SheoranNo ratings yet

- A Study of Audience Perception About TheDocument2 pagesA Study of Audience Perception About TheRahat HaneefNo ratings yet

- Stock Update: Relaxo FootwearsDocument3 pagesStock Update: Relaxo FootwearsADNo ratings yet

- Heritage Foods LTD: Dairy Sector Outlook - PositiveDocument31 pagesHeritage Foods LTD: Dairy Sector Outlook - PositiveGourav BaidNo ratings yet

- HDFC Weekly May20Document18 pagesHDFC Weekly May20HarishKumarNo ratings yet

- CFA Institute Research Challenge: CFA Society India (IAIP) Team Code - ArtumeDocument31 pagesCFA Institute Research Challenge: CFA Society India (IAIP) Team Code - Artumeshreyansh naharNo ratings yet

- KaveriSeeds StockNote04081720170804114204Document21 pagesKaveriSeeds StockNote04081720170804114204PIBM MBA-FINANCENo ratings yet

- La Opala RG - Initiating Coverage - Centrum 30062014Document21 pagesLa Opala RG - Initiating Coverage - Centrum 30062014Jeevan PatwaNo ratings yet

- Stock Idea: Coromandel International LimitedDocument27 pagesStock Idea: Coromandel International Limitediam pruthvi tradingNo ratings yet

- Fairchem Speciality Pick of The Week 090320Document19 pagesFairchem Speciality Pick of The Week 090320flying400No ratings yet

- The Indian Wood Products Co. LTDDocument4 pagesThe Indian Wood Products Co. LTDAnjan BanerjeeNo ratings yet

- Habib Oil Mills Limited (HOM) : Rating ReportDocument7 pagesHabib Oil Mills Limited (HOM) : Rating ReportAbu HurairaNo ratings yet

- Godrej Agrovet Limited: Branded Player in High Growth SegmentsDocument10 pagesGodrej Agrovet Limited: Branded Player in High Growth SegmentsVaibhav SinghNo ratings yet

- Kaveri Seeds Company LTD: Retail ResearchDocument15 pagesKaveri Seeds Company LTD: Retail ResearchElanthiraiyan GCNo ratings yet

- DFM Foods (BSE Code: 519588) - Alpha/Alpha + Stock Recommendation For Apr'15Document25 pagesDFM Foods (BSE Code: 519588) - Alpha/Alpha + Stock Recommendation For Apr'15Joji VargheseNo ratings yet

- Investor Presentation (Company Update)Document26 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- Sonai Cattle Feed - R - 28012020Document8 pagesSonai Cattle Feed - R - 28012020Saloni GujarNo ratings yet

- SolaraDocument23 pagesSolarapratham2508arora.slNo ratings yet

- Godrej Agrovet: Agri Behemoth in The MakingDocument38 pagesGodrej Agrovet: Agri Behemoth in The MakingADNo ratings yet

- Godrej Agrovet: Agri Behemoth in The MakingDocument38 pagesGodrej Agrovet: Agri Behemoth in The MakingADNo ratings yet

- Agri Inputs: Sector Valuations Price in A Good SeasonDocument12 pagesAgri Inputs: Sector Valuations Price in A Good SeasonPrahladNo ratings yet

- Investor Presentation (Company Update)Document28 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- Sunfresh Agro Industries Private Limited: Summary of Rated InstrumentsDocument7 pagesSunfresh Agro Industries Private Limited: Summary of Rated InstrumentsWalter PNo ratings yet

- Heranba - Initiating CoverageDocument33 pagesHeranba - Initiating CoverageTejesh GoudNo ratings yet

- IEA Report 6th FebruaryDocument19 pagesIEA Report 6th FebruarynarnoliaNo ratings yet

- Colgate-May14 2024Document6 pagesColgate-May14 2024vanshNo ratings yet

- IDirect GSKConsumer ICDocument26 pagesIDirect GSKConsumer ICChaitanya JagarlapudiNo ratings yet

- Sharekhan's Research Report On Godrej Consumer Products-Godrej-Consumer-Products-26-03-2021-khanDocument9 pagesSharekhan's Research Report On Godrej Consumer Products-Godrej-Consumer-Products-26-03-2021-khansaran21No ratings yet

- Stock Pitch - Nocil LTDDocument13 pagesStock Pitch - Nocil LTDDeepak SonawaneNo ratings yet

- Nurpur Milk Case StudyDocument15 pagesNurpur Milk Case StudyS. AnjumNo ratings yet

- Saakh Pharma (Private) Limited: Rating ReportDocument7 pagesSaakh Pharma (Private) Limited: Rating ReportMuhammad Ahmed MirzaNo ratings yet

- JOCIL LTD - Initiating Coverage - Sept 10 - 16 Sep 2010Document13 pagesJOCIL LTD - Initiating Coverage - Sept 10 - 16 Sep 2010Amber GuptaNo ratings yet

- ReportDocument9 pagesReportshobhaNo ratings yet

- Adani Wilmar Limited: Strong Business, But Fairly Valued Initiate at NeutralDocument71 pagesAdani Wilmar Limited: Strong Business, But Fairly Valued Initiate at Neutralpal kitNo ratings yet

- NDDB Ar 2019 English 24022020 - 2 PDFDocument98 pagesNDDB Ar 2019 English 24022020 - 2 PDFAsanga KumarNo ratings yet

- Whopper of An Opportunity: Burger King IndiaDocument38 pagesWhopper of An Opportunity: Burger King IndiaVidhi MiraniNo ratings yet

- Tata Global Beverages Supply Chain and Logistics ManagementDocument7 pagesTata Global Beverages Supply Chain and Logistics ManagementPooja MaliNo ratings yet

- IEA Report 8th MarchDocument28 pagesIEA Report 8th MarchnarnoliaNo ratings yet

- AnnualReport 2013 14 CoromandelDocument140 pagesAnnualReport 2013 14 Coromandelnikhildsi4481No ratings yet

- Nimishamohanp CV 2023Document1 pageNimishamohanp CV 2023santosh kumarNo ratings yet

- Auditing Report Baba Farid Sugar MillsDocument7 pagesAuditing Report Baba Farid Sugar MillsWaasfaNo ratings yet

- Heritage Foods Discounted Cash Flow Valuation CaseDocument9 pagesHeritage Foods Discounted Cash Flow Valuation CasePriya DurejaNo ratings yet

- Bharat Rasayan - Deep Dive - Template - Rohit BalakrishnanDocument8 pagesBharat Rasayan - Deep Dive - Template - Rohit BalakrishnanAnil RainaNo ratings yet

- Heritage FoodsDocument31 pagesHeritage FoodsBskkamNo ratings yet

- July 21 2022 HDFC - Securities - Retail - Research - Initiation - Supriya - LifescienceDocument17 pagesJuly 21 2022 HDFC - Securities - Retail - Research - Initiation - Supriya - LifescienceHarish SubramaniamNo ratings yet

- Global PVT LTDDocument12 pagesGlobal PVT LTDmohitdesigntreeNo ratings yet

- Augmentation of Productivity of Micro or Small Goat Entrepreneurship through Adaptation of Sustainable Practices and Advanced Marketing Management Strategies to Double the Farmer’s IncomeFrom EverandAugmentation of Productivity of Micro or Small Goat Entrepreneurship through Adaptation of Sustainable Practices and Advanced Marketing Management Strategies to Double the Farmer’s IncomeNo ratings yet

- 16find and Replace Text Using Regular Expressions - JetBrains RiderDocument6 pages16find and Replace Text Using Regular Expressions - JetBrains Riderarun_algoNo ratings yet

- En Bloc,: No.l 34IRGIDHC/2021Document2 pagesEn Bloc,: No.l 34IRGIDHC/2021arun_algoNo ratings yet

- HSL PCG "Currency Daily": 10 January, 2017Document6 pagesHSL PCG "Currency Daily": 10 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 11 January, 2017Document6 pagesHSL PCG "Currency Daily": 11 January, 2017arun_algoNo ratings yet

- Indian Currency Market: Retail ResearchDocument6 pagesIndian Currency Market: Retail Researcharun_algoNo ratings yet

- HSL PCG "Currency Daily": 05 January, 2017Document6 pagesHSL PCG "Currency Daily": 05 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 07 January, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 07 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 17 January, 2017Document6 pagesHSL PCG "Currency Daily": 17 January, 2017arun_algoNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail Researcharun_algoNo ratings yet

- HSL PCG "Currency Daily": 06 January, 2017Document6 pagesHSL PCG "Currency Daily": 06 January, 2017arun_algoNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail Researcharun_algoNo ratings yet

- Indian Currency Market: Retail ResearchDocument6 pagesIndian Currency Market: Retail Researcharun_algoNo ratings yet

- Suzlon Energy: Momentum Building UpDocument9 pagesSuzlon Energy: Momentum Building Uparun_algoNo ratings yet

- HSL PCG "Currency Daily": 31 January, 2017Document6 pagesHSL PCG "Currency Daily": 31 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 19 January, 2017Document6 pagesHSL PCG "Currency Daily": 19 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 18 January, 2017Document6 pagesHSL PCG "Currency Daily": 18 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 24 January, 2017Document6 pagesHSL PCG "Currency Daily": 24 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 25 January, 2017Document6 pagesHSL PCG "Currency Daily": 25 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 21 January, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 21 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 20 January, 2017Document6 pagesHSL PCG "Currency Daily": 20 January, 2017arun_algoNo ratings yet

- KNR Constructions: Outperformance Priced inDocument8 pagesKNR Constructions: Outperformance Priced inarun_algoNo ratings yet

- Techno Electric & Engineering: Expensive ValuationsDocument9 pagesTechno Electric & Engineering: Expensive Valuationsarun_algoNo ratings yet

- Coal India: Back To Business As UsualDocument9 pagesCoal India: Back To Business As Usualarun_algoNo ratings yet

- Challenges To Continue: NeutralDocument12 pagesChallenges To Continue: Neutralarun_algoNo ratings yet

- Hindustan Zinc: Strong TailwindsDocument8 pagesHindustan Zinc: Strong Tailwindsarun_algoNo ratings yet

- Slowing Growth: Results Review 3qfy17 13 FEB 2017Document10 pagesSlowing Growth: Results Review 3qfy17 13 FEB 2017arun_algoNo ratings yet

- Sanghvi Movers: Compelling ValuationsDocument9 pagesSanghvi Movers: Compelling Valuationsarun_algoNo ratings yet

- Project Chapter 1 EditedDocument18 pagesProject Chapter 1 Editedsamuel debebeNo ratings yet

- Tax ComplianceDocument12 pagesTax ComplianceHendrie ArdhiansyahNo ratings yet

- Sample Business Plan DoxDocument7 pagesSample Business Plan DoxAsther MantuaNo ratings yet

- The Keynesian School Versus The Monetarist SchoolDocument7 pagesThe Keynesian School Versus The Monetarist SchoolTinotenda DubeNo ratings yet

- Case Enager IndustriesDocument4 pagesCase Enager IndustriesNikko Sucahyo50% (2)

- FmisDocument49 pagesFmisIqra AfsarNo ratings yet

- Third Space Learning Simple Compound Interest GCSE WorksheetDocument15 pagesThird Space Learning Simple Compound Interest GCSE WorksheetClara RizzutiNo ratings yet

- Working Capital Management and Its Impact On Profitability-A Study On Janata Bank Ltd.Document57 pagesWorking Capital Management and Its Impact On Profitability-A Study On Janata Bank Ltd.Technology And movies100% (1)

- Vikings Stadium Bond OfferDocument232 pagesVikings Stadium Bond OfferTim NelsonNo ratings yet

- En BookDocument46 pagesEn BookEnid CallaNo ratings yet

- AGLF 2018 Annual Spring Conference - Attendee ListDocument8 pagesAGLF 2018 Annual Spring Conference - Attendee Listkarthik83.v209No ratings yet

- Literature Review On Foreign ExchangeDocument6 pagesLiterature Review On Foreign ExchangeChetan Sahu0% (2)

- Daily Metals and Energy Report September 2 2013Document6 pagesDaily Metals and Energy Report September 2 2013Angel BrokingNo ratings yet

- WalmartcaseDocument30 pagesWalmartcaseBarret RobisonNo ratings yet

- A Study On "Market Potential in Indian Stock Markets" With Special Reference To (Karvy Stock Broking Ltd. Visakhapatnam)Document109 pagesA Study On "Market Potential in Indian Stock Markets" With Special Reference To (Karvy Stock Broking Ltd. Visakhapatnam)Ramesh SahukariNo ratings yet

- Case 5: Merger Analysis Computer Concepts/computechDocument9 pagesCase 5: Merger Analysis Computer Concepts/computechLouis De MoffartsNo ratings yet

- 003 PamDocument60 pages003 PamStephen valeriano solivenNo ratings yet

- Austin ISD Preliminary Draft Ten Year Facility Master PlanDocument320 pagesAustin ISD Preliminary Draft Ten Year Facility Master PlanKUTNewsNo ratings yet

- Budget Synopsis 2015-16 PDFDocument12 pagesBudget Synopsis 2015-16 PDFBhagwan PalNo ratings yet

- Gulf Skill LLP Proforma InvoiceDocument1 pageGulf Skill LLP Proforma Invoiceshrey kukadeNo ratings yet

- Res551 Lecture Notes Part BDocument106 pagesRes551 Lecture Notes Part BMUHAMMAD DANIEL BIN MOHD SALIMNo ratings yet

- Square Pharmaceuticals Limited (12-15AM)Document30 pagesSquare Pharmaceuticals Limited (12-15AM)MostafijurRahmanNahid100% (1)

- Cag Duties and Powers of The Comptroller and Auditor General of IndiaDocument7 pagesCag Duties and Powers of The Comptroller and Auditor General of IndiaSubhajit Adhikari100% (1)

- Hola-Kola: Section: E05 Group Number: G04 Name of ParticipantsDocument7 pagesHola-Kola: Section: E05 Group Number: G04 Name of ParticipantsSuvinay SethNo ratings yet

- Accenture Adding Value To Parcel DeliveryDocument22 pagesAccenture Adding Value To Parcel DeliverypippoplutoNo ratings yet