Professional Documents

Culture Documents

Withdrawable: Annual Pension If Not Withdrawn Insurance Coverage

Uploaded by

C.A. Ankit Jain0 ratings0% found this document useful (0 votes)

6 views1 pageCZDFEDXRY SFERWTT4REY SEDRRITRT RTRIETO

Original Title

ETERTYR4Y

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCZDFEDXRY SFERWTT4REY SEDRRITRT RTRIETO

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageWithdrawable: Annual Pension If Not Withdrawn Insurance Coverage

Uploaded by

C.A. Ankit JainCZDFEDXRY SFERWTT4REY SEDRRITRT RTRIETO

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Jeevan Umang Jeevan Labh

Withdrawable: Anytime after 16 Years On 16th Year Compulsory Remarks

Annual Pension if not Withdrawn Yes @ 8% annually No Pension or Increment.

(With incremental withdrawal).

Insurance Coverage: First Year (66,87,500/-) Fixed 60,00,000/-. In future if you plan to take an

increasing upto 1,06,25000/-. insurance of 40,00,000/- it will cost

around 12000/- or more per year

which will sum to more than 2 lac in

total of premium for 20 years.

Term of Payment Can be paid for three years only Compulsorily to be paid for 10 If we want to be free of burden and

and still avail benefits of all years. If not paid for full term want a proportionate return of our

bonuses. the benefit of bonuses will invested amount we can prefer

i.e. No need to pay full term. lapse and return will be only Umang in total the benefits are way

at the rate nearby savings more in Umang compared to Labh.

interest.

Term of Payment Can be paid for any term Compulsory for 10 years.

between 3 to 15 years.

Payout: 1,00,82,160/- 1,02,78,000/- Fixed Return is higher in Jeevan Labh

in 16th year.

Cash Back: 18-20% (90000-1,00,000) 12-13% (60,000-65000) Additional 35-40K whose

compounding is also to be considered

if put in 8% non-taxable sums to

1,70,000/- on maturity.

Double Accidental Bonus In case of accidental death Rider is not considered while If that rider is added an amount of

double amount of the insured preparing the plan. minimum Rs.1500 per annum gets

amount is receivable. Rider is increased in the premium.

considered while preparing the

plan.

Loan Against Policy Same in both the Policies. Same in Both Policies.

In case not withdrawn Life Coverage till 100 years with Life Coverage only till 15

incremental sum insured and years.

incremental return.

You might also like

- Smart - Platina - Assure - Brochure - Brand ReimagineDocument12 pagesSmart - Platina - Assure - Brochure - Brand ReimaginepankajNo ratings yet

- Summer Training Project Report On: Investors Behaviour in Insurance and Their Likeliness in Aegon LifeDocument30 pagesSummer Training Project Report On: Investors Behaviour in Insurance and Their Likeliness in Aegon LifeavnishNo ratings yet

- GCAP - EnglishDocument2 pagesGCAP - EnglishJITENDRANo ratings yet

- PruCash Double Reward BrochureDocument31 pagesPruCash Double Reward BrochureDavid ChungNo ratings yet

- Assured Returns Savings Plan Provides Life Cover & Guaranteed ReturnsDocument12 pagesAssured Returns Savings Plan Provides Life Cover & Guaranteed ReturnsVinodkumar ShethNo ratings yet

- Money Plus 1Document31 pagesMoney Plus 1adwfaceNo ratings yet

- SBI Life - Smart Platina Assure - BrochureDocument12 pagesSBI Life - Smart Platina Assure - Brochuresourav agarwalNo ratings yet

- Smart Income Protect BrochureDocument12 pagesSmart Income Protect BrochureSumit RpNo ratings yet

- Premier Money Back PlanDocument12 pagesPremier Money Back PlanPraveen Kumar JeyaprakashNo ratings yet

- ENGLISH One Pager Sanchay Plus Long Term Income Retail FinalDocument2 pagesENGLISH One Pager Sanchay Plus Long Term Income Retail FinalAbhisek BrahmaNo ratings yet

- SBI Life - Smart Platina Assure - BrochureDocument12 pagesSBI Life - Smart Platina Assure - BrochureSanjeev KulkarniNo ratings yet

- Smart Platina Assure Brochure FinalDocument12 pagesSmart Platina Assure Brochure Finalsksen007No ratings yet

- HDFC Capital GuaranteeDocument34 pagesHDFC Capital GuaranteeRanjan SharmaNo ratings yet

- HDFC Life Click 2 Wealth - Brochure - Retail - V3Document16 pagesHDFC Life Click 2 Wealth - Brochure - Retail - V3a26geniusNo ratings yet

- SBI Life - Saral Jeevan Bima - BrochureDocument9 pagesSBI Life - Saral Jeevan Bima - BrochureH.O. Rajendra TiwariNo ratings yet

- Kotak Guaranteed Savings Plan Brochure1Document12 pagesKotak Guaranteed Savings Plan Brochure1balaNo ratings yet

- Get annual cashback and income with ICICI Pru Lakshya GoldDocument2 pagesGet annual cashback and income with ICICI Pru Lakshya GoldMehul Bajaj100% (1)

- Fulfil dreams with HDFC Life Super Income PlanDocument8 pagesFulfil dreams with HDFC Life Super Income PlanSajeed ShaikhNo ratings yet

- Jeevan Sathi PlusDocument6 pagesJeevan Sathi Plusap87No ratings yet

- Multiplies Your Happiness An Investment That: Why Should You Buy This Plan?Document2 pagesMultiplies Your Happiness An Investment That: Why Should You Buy This Plan?Taksh DhamiNo ratings yet

- Double Your Advantage: Savings With Regular Bonus AdditionsDocument7 pagesDouble Your Advantage: Savings With Regular Bonus AdditionsMitul Kumar JainNo ratings yet

- Smart Platina Assure - One - Pager FinalDocument2 pagesSmart Platina Assure - One - Pager FinalpankajNo ratings yet

- Edelweiss Tokio Life - GCAP - : OverviewDocument2 pagesEdelweiss Tokio Life - GCAP - : OverviewarunNo ratings yet

- Nishchit Samrudhi Plan BrochureDocument16 pagesNishchit Samrudhi Plan BrochureManish SahuNo ratings yet

- Tax Touch Up: Which Is That Amt DepositedDocument5 pagesTax Touch Up: Which Is That Amt DepositedVelayudham ThiyagarajanNo ratings yet

- Ulip BrochureDocument20 pagesUlip BrochureTelus InternationalNo ratings yet

- Reliance Traditional Super InvestAssure Plan Double GuaranteeDocument11 pagesReliance Traditional Super InvestAssure Plan Double GuaranteepuninagpalNo ratings yet

- Premier: Income PlanDocument11 pagesPremier: Income PlansrinathpsgNo ratings yet

- EndowmentDocument2 pagesEndowmentcryptomaxxtrade4No ratings yet

- 165 Jeevan Saral PlanDocument16 pages165 Jeevan Saral Planidtrs100% (1)

- When It Comes To Securing Your Loved Ones, Trust Us.: Saral JeevanDocument10 pagesWhen It Comes To Securing Your Loved Ones, Trust Us.: Saral Jeevanjithin jayNo ratings yet

- HDFC Life Brochure-15Document16 pagesHDFC Life Brochure-15nayaksaismritiNo ratings yet

- Unique Life Solution HandbookDocument8 pagesUnique Life Solution HandbookPaluri GowthamNo ratings yet

- LIC PS Presentation 23092013 2Document12 pagesLIC PS Presentation 23092013 2Bhramar AgarwalNo ratings yet

- SBI - Life - Smart Privilege BrochureDocument16 pagesSBI - Life - Smart Privilege BrochureAvinash SinghNo ratings yet

- SBI Life - Saral Retirement Saver - BrochureDocument14 pagesSBI Life - Saral Retirement Saver - BrochureNitin KumarNo ratings yet

- Prime SaverDocument17 pagesPrime SaversimonNo ratings yet

- Guaranteed Savings Insurance PlanDocument5 pagesGuaranteed Savings Insurance PlanAnoop MannadathilNo ratings yet

- Lic Market Plus IDocument8 pagesLic Market Plus Ianpuselvi125No ratings yet

- Lic Jeevan Umang Plan ExampleDocument3 pagesLic Jeevan Umang Plan ExampleAnil KUMAR H.VNo ratings yet

- Flexi Income IncomeDocument7 pagesFlexi Income Incomeharshad malusareNo ratings yet

- Saral Jeevan Bima Brochure-BRDocument10 pagesSaral Jeevan Bima Brochure-BRprabuNo ratings yet

- PNB Metlife Saving PlanDocument6 pagesPNB Metlife Saving PlanPurnima PurohitNo ratings yet

- Reach For The Stars With Guaranteed Benefits.: Exide LifeDocument10 pagesReach For The Stars With Guaranteed Benefits.: Exide LifeRajishkumar RadhakrishnanNo ratings yet

- Goal Assure BrochureDocument20 pagesGoal Assure BrochureBharat19No ratings yet

- Applicable For Pcc/Ipcc May-2010/Nov-2010Document17 pagesApplicable For Pcc/Ipcc May-2010/Nov-2010Anshul AgarwalNo ratings yet

- Fulfill Every Wish: Smart Income PlusDocument7 pagesFulfill Every Wish: Smart Income PlusArindam PandayNo ratings yet

- Jeevan Umang: Benefits Illustration SummaryDocument4 pagesJeevan Umang: Benefits Illustration SummarySelvam RamanathanNo ratings yet

- Bima Bachat Plan 175 For Aged 20 All Term 9,12,15 Years Call LIC Agent Anandaraman at 9843146519 PDFDocument7 pagesBima Bachat Plan 175 For Aged 20 All Term 9,12,15 Years Call LIC Agent Anandaraman at 9843146519 PDFMutual Funds Advisor ANANDARAMAN 944-529-6519No ratings yet

- Grip Leaflet LatestDocument14 pagesGrip Leaflet LatestsaurabNo ratings yet

- Product DetailsDocument13 pagesProduct Detailskannakumar1983No ratings yet

- Kotak Money Back PlanDocument2 pagesKotak Money Back PlanDriptendu MaitiNo ratings yet

- HDFC Life Super Income Plan SHAREDocument6 pagesHDFC Life Super Income Plan SHARESandeep MookerjeeNo ratings yet

- Why Loyalty Additions Not Conventional Regular Bonus in Lic Jeevan Saral Policy?Document1 pageWhy Loyalty Additions Not Conventional Regular Bonus in Lic Jeevan Saral Policy?uketechNo ratings yet

- Guarantee Growth: When Partners WithDocument7 pagesGuarantee Growth: When Partners WithMahadevaNo ratings yet

- ICICI Future Perfect - BrochureDocument11 pagesICICI Future Perfect - BrochureChandan Kumar SatyanarayanaNo ratings yet

- Unique Life Solution HandbookDocument5 pagesUnique Life Solution HandbookPaluri GowthamNo ratings yet

- Form 9 ReceiptDocument1 pageForm 9 ReceiptC.A. Ankit JainNo ratings yet

- Scan Oct 21, 2022Document1 pageScan Oct 21, 2022C.A. Ankit JainNo ratings yet

- DemandDocument1 pageDemandC.A. Ankit JainNo ratings yet

- Sakar SCN pt1Document25 pagesSakar SCN pt1C.A. Ankit JainNo ratings yet

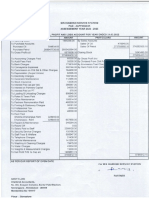

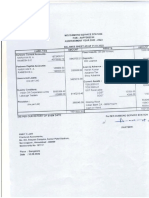

- Profit & LossDocument1 pageProfit & LossC.A. Ankit JainNo ratings yet

- Balance SheetDocument1 pageBalance SheetC.A. Ankit JainNo ratings yet

- ITNS 281 TDS/TCS ChallanDocument3 pagesITNS 281 TDS/TCS ChallanC.A. Ankit JainNo ratings yet

- Account Statement SummaryDocument4 pagesAccount Statement SummaryC.A. Ankit JainNo ratings yet

- COVID-19 Vaccination Appointment Details: Center Preferred Time SlotDocument1 pageCOVID-19 Vaccination Appointment Details: Center Preferred Time SlotC.A. Ankit JainNo ratings yet

- Bank interest and deposit detailsDocument2 pagesBank interest and deposit detailsC.A. Ankit JainNo ratings yet

- Abcd PDFDocument4 pagesAbcd PDFC.A. Ankit JainNo ratings yet

- GST-Challan Receipt - JKDocument1 pageGST-Challan Receipt - JKC.A. Ankit JainNo ratings yet

- Gst-Challan Ymagro DecDocument2 pagesGst-Challan Ymagro DecC.A. Ankit JainNo ratings yet

- Arn Receipt Nil Filing 24aadfs3443a1zs Invitc 201707-201909Document1 pageArn Receipt Nil Filing 24aadfs3443a1zs Invitc 201707-201909C.A. Ankit JainNo ratings yet

- Abcd PDFDocument4 pagesAbcd PDFC.A. Ankit JainNo ratings yet

- Individual FormDocument1 pageIndividual FormC.A. Ankit JainNo ratings yet

- ICAI Payment FormDocument1 pageICAI Payment FormC.A. Ankit JainNo ratings yet

- Property Tax Payment ReceiptDocument1 pageProperty Tax Payment ReceiptC.A. Ankit JainNo ratings yet

- Lic Payment Chandrakant JainDocument1 pageLic Payment Chandrakant JainC.A. Ankit JainNo ratings yet

- ICAI Payment Form PDFDocument1 pageICAI Payment Form PDFC.A. Ankit JainNo ratings yet

- Consolidated statement of financial position for Hever group incorporating associateDocument2 pagesConsolidated statement of financial position for Hever group incorporating associateGueagen1969No ratings yet

- Three Point SystemDocument2 pagesThree Point SystemtrionjetNo ratings yet

- Profile PPCBL FEB 2010Document8 pagesProfile PPCBL FEB 2010alamgir786786No ratings yet

- Tax Invoice / Bill of SupplyDocument2 pagesTax Invoice / Bill of SupplyKapil SinglaNo ratings yet

- IBP Part 05 Inventory Warehouse v02Document77 pagesIBP Part 05 Inventory Warehouse v02Rajesh Kumar Sugumaran100% (1)

- City Limits Magazine, June/July 1985 IssueDocument32 pagesCity Limits Magazine, June/July 1985 IssueCity Limits (New York)0% (1)

- Chapter 7 Acctg For Financial InstrumentsDocument32 pagesChapter 7 Acctg For Financial InstrumentsjammuuuNo ratings yet

- Agreement To Sell2Document6 pagesAgreement To Sell2om packersNo ratings yet

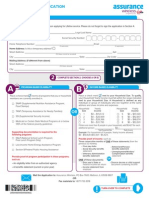

- Assurance Wireless ApplicationDocument2 pagesAssurance Wireless ApplicationMichelle KajikawaNo ratings yet

- MTTC Investor Pitch Template: A Guide To Developing Your 10 Minute Investor PitchDocument53 pagesMTTC Investor Pitch Template: A Guide To Developing Your 10 Minute Investor PitchKhalid Gul100% (1)

- Unit VII - Consignment SalesDocument5 pagesUnit VII - Consignment SalesNovylyn AldaveNo ratings yet

- Questions of Business Administration - CSSDocument6 pagesQuestions of Business Administration - CSSSyed Faizan BariNo ratings yet

- Chapter 6-Forever Young Case Solution-UpdateDocument5 pagesChapter 6-Forever Young Case Solution-UpdateYUSHIHUI75% (8)

- Warren Buffett 1997 BRK Annual Report To ShareholdersDocument20 pagesWarren Buffett 1997 BRK Annual Report To ShareholdersBrian McMorrisNo ratings yet

- Mathuradas Vassanji v. Raimal Hirji, 1935 SCC OnLine Bom 81Document10 pagesMathuradas Vassanji v. Raimal Hirji, 1935 SCC OnLine Bom 81arunimaNo ratings yet

- Case InstructionsDocument4 pagesCase InstructionsHw SolutionNo ratings yet

- BEC Study NotesDocument4 pagesBEC Study NotesCPA ChessNo ratings yet

- Profit LossDocument8 pagesProfit LossVishnu S. M. YarlagaddaNo ratings yet

- Sharpe RatiosDocument56 pagesSharpe RatiosbobmezzNo ratings yet

- Cash and Cash EquivalentsDocument20 pagesCash and Cash EquivalentsPetrina100% (1)

- Formation of DD and EE partnershipDocument3 pagesFormation of DD and EE partnershipmiss independent100% (1)

- Quiz 1 AnswersDocument6 pagesQuiz 1 AnswersAlyssa CasimiroNo ratings yet

- Errata 2020Document3 pagesErrata 2020SamNo ratings yet

- Chapter 1 Capital MarketsDocument7 pagesChapter 1 Capital MarketsNovel LampitocNo ratings yet

- Capital MarketDocument16 pagesCapital Marketdeepika90236100% (1)

- Specpro CasesDocument31 pagesSpecpro CasesJoy DalesNo ratings yet

- Real Downstream Internet-Based Supply Chain Management: Hcorrea@Document23 pagesReal Downstream Internet-Based Supply Chain Management: Hcorrea@JeanCassioNo ratings yet

- Project On RaymondDocument36 pagesProject On Raymonddinesh beharaNo ratings yet

- Invoice 614918Document1 pageInvoice 614918Santiago SánchezNo ratings yet

- Building A Trading PlanDocument38 pagesBuilding A Trading Planamy100% (1)