Professional Documents

Culture Documents

Engg Eco-Quiz 2

Engg Eco-Quiz 2

Uploaded by

gailOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Engg Eco-Quiz 2

Engg Eco-Quiz 2

Uploaded by

gailCopyright:

Available Formats

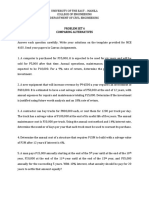

Engineering Economy

Quiz 2- Take Home

Solve the following…No Solution…No Credit

1. A P110000 chemical plant had an estimated life of 6 years and a projected scrap value of P10000.

After 3 years of operation an explosion made it a total loss. How much money would have to be raised

to put up a new plant costing P150000, if a depreciation reserve was maintained during its 3 years

operation by :

Straight-line Method

Sinking-Fund Method at 6% interest

2. A certain company makes it the policy that for any new piece of equipment the annual depreciation

cost should not exceed 10% of the original cost at any time with no salvage value. Determine the length

of service life necessary if the depreciation method is used is:

Straight-line Method

Sinking-Fund Method at 8% interest

Sum of the Year Depreciation

3. An existing machine in a factory has an annual maintenance cost of P40000. A new and more

efficient machine will require an investment of P90000 and is estimated to have a salvage value of

P30000 at the end of 8 years. Its annual expenses for maintenance and upkeep, etc. total P22000. If the

company expects to earn 12% on its investment, will it be worthwhile to purchase the new machine

using the (a) present worth method? (b) rate-of-return method?

4. A project capitalized for P50000 invested in depreciable assets will earn a uniform, annual income of

P19849 in 10 years. The costs for operation and maintenance total P9000 a year and taxes and

insurance will cost 4% of the first cost each year. If the company expects its capital to earn 12% before

income taxes, is the investment worthwhile?

You might also like

- Yaniza, Regine Mae L. - ULO 3A Let's Check: Situation 01Document7 pagesYaniza, Regine Mae L. - ULO 3A Let's Check: Situation 01Regine Mae Lustica Yaniza100% (1)

- Revised Accounting 15Document26 pagesRevised Accounting 15Jennifer Garnette50% (2)

- 100 Case Study In Project Management and Right Decision (Project Management Professional Exam)From Everand100 Case Study In Project Management and Right Decision (Project Management Professional Exam)Rating: 4 out of 5 stars4/5 (3)

- EngineeringeconomyanswerssssDocument13 pagesEngineeringeconomyanswerssssMalik MalikNo ratings yet

- 6 Comparing AlternativesDocument49 pages6 Comparing AlternativesTrimar DagandanNo ratings yet

- CISA EXAM-Testing Concept-Recovery Time Objective (RTO) & Recovery Point Objective (RPO)From EverandCISA EXAM-Testing Concept-Recovery Time Objective (RTO) & Recovery Point Objective (RPO)Rating: 1 out of 5 stars1/5 (2)

- Capital Budgeting NotesDocument5 pagesCapital Budgeting NotesCris Joy BiabasNo ratings yet

- Capital Budgeting ProblemsDocument4 pagesCapital Budgeting ProblemsLiana Monica Lopez0% (1)

- Practice Problems - Capital Budgeting PDFDocument2 pagesPractice Problems - Capital Budgeting PDFRamainne RonquilloNo ratings yet

- Practice Problems - Capital Budgeting PDFDocument2 pagesPractice Problems - Capital Budgeting PDFRamainne RonquilloNo ratings yet

- Basic Methods ModuleDocument12 pagesBasic Methods ModuleSarTomNo ratings yet

- 23Document2 pages23Heaven HeartNo ratings yet

- BES 221 (PART I - Prefinal Module)Document9 pagesBES 221 (PART I - Prefinal Module)Kristy SalmingoNo ratings yet

- Capital Budgeting Problems For Fin102Document2 pagesCapital Budgeting Problems For Fin102Marianne AgunoyNo ratings yet

- Learning Activity 4Document1 pageLearning Activity 4zyx xyzNo ratings yet

- Individual Activity No. 1 Straight Line MethodDocument2 pagesIndividual Activity No. 1 Straight Line MethodIroha IsshikiNo ratings yet

- Financial Management 2: Capital Budgeting Problems and Exercises PART 1 Problems Problem 1Document7 pagesFinancial Management 2: Capital Budgeting Problems and Exercises PART 1 Problems Problem 1Robert RamirezNo ratings yet

- CB ProblemsDocument4 pagesCB ProblemsSimmon Jr Morano Tan100% (1)

- Comparison of AlternativesDocument2 pagesComparison of AlternativesBryan YuNo ratings yet

- Chapter 3 DEPRECIATION SEMIDocument16 pagesChapter 3 DEPRECIATION SEMIJames EscribaNo ratings yet

- Engineering Economy 3 April 2024Document4 pagesEngineering Economy 3 April 2024Craeven AranillaNo ratings yet

- Capital Budgeting ExercisesDocument4 pagesCapital Budgeting ExercisescrissilleNo ratings yet

- Acc 223 CB PS1 2021 QDocument8 pagesAcc 223 CB PS1 2021 QAeyjay ManangaranNo ratings yet

- Problem SetDocument1 pageProblem SetJoy DimaanoNo ratings yet

- Cap BudDocument3 pagesCap BudRarajNo ratings yet

- Activity I. Straight Line MethodDocument2 pagesActivity I. Straight Line MethodJhune UrabaNo ratings yet

- Cbproblems PDF FreeDocument4 pagesCbproblems PDF FreeAmalgam EnterpriseNo ratings yet

- Em 5 Final Term Take Home Quiz Bsee2 1Document3 pagesEm 5 Final Term Take Home Quiz Bsee2 1ParisDelaCruzNo ratings yet

- MCQ - Capital BudgetingDocument2 pagesMCQ - Capital BudgetingRamainne Ronquillo0% (1)

- 32439287Document18 pages32439287Anjo Vasquez67% (3)

- Operating Cash InflowDocument11 pagesOperating Cash InflowRarajNo ratings yet

- This Study Resource Was: Financial Management Part IiDocument8 pagesThis Study Resource Was: Financial Management Part Iiaj dumpNo ratings yet

- PT 8Document6 pagesPT 8KidlatNo ratings yet

- CE A92 Final PlatesDocument2 pagesCE A92 Final PlatesMikaNo ratings yet

- Nes 124 - Quiz #6Document2 pagesNes 124 - Quiz #6PatrickNo ratings yet

- Refresh Module 25 (M19) - Engineering Economy 2Document2 pagesRefresh Module 25 (M19) - Engineering Economy 2Fely Joy RelatoresNo ratings yet

- PS Es301Document2 pagesPS Es301Rosel Marvie CareNo ratings yet

- AcmeDocument2 pagesAcmeAngeline RamirezNo ratings yet

- Economy Problem Set 1Document4 pagesEconomy Problem Set 1jung biNo ratings yet

- Capital Budgeting Quiz 1: Multiple ChoiceDocument7 pagesCapital Budgeting Quiz 1: Multiple ChoiceMark Jesus Aristo100% (1)

- Capital Investment Factors7to16Document15 pagesCapital Investment Factors7to16Spencer Tañada100% (1)

- 1231231Document5 pages1231231joshua espirituNo ratings yet

- TVM Applications To Investment and Comparison of AlternativesDocument7 pagesTVM Applications To Investment and Comparison of Alternativessab x btsNo ratings yet

- 2 Tutorial Economy FactorDocument3 pages2 Tutorial Economy FactorAizul FaizNo ratings yet

- UGRD ENG6203 Engineering Economics Prelim ExamDocument3 pagesUGRD ENG6203 Engineering Economics Prelim ExamJay R EstanislaoNo ratings yet

- Video Lecture 10 Comparing AlternativesDocument7 pagesVideo Lecture 10 Comparing Alternativesjerromecymouno.garciaNo ratings yet

- FA1 - Capital BudgetingDocument1 pageFA1 - Capital BudgetingMomena LampatanNo ratings yet

- ANGELICADocument7 pagesANGELICAAngel Reconalla Lapadan100% (2)

- MAS Ass1Document4 pagesMAS Ass1Tin BulaoNo ratings yet

- FT Problem Set 01 DepreciationDocument2 pagesFT Problem Set 01 DepreciationshaneNo ratings yet

- Problem Set 6. Comparing AlternativesDocument2 pagesProblem Set 6. Comparing AlternativesMICHAELDANE SALANGUIT100% (1)

- Engg. EconomicsDocument2 pagesEngg. EconomicsStevenNo ratings yet

- Engineering Eco PDF FreeDocument26 pagesEngineering Eco PDF FreeMJ ArboledaNo ratings yet

- Maxwell CompanyDocument1 pageMaxwell CompanyAngeline RamirezNo ratings yet

- FinalsDocument7 pagesFinalsPaola Marie CabariosNo ratings yet

- Ae23 Capital Budgeting 2Document2 pagesAe23 Capital Budgeting 2Hanielyn TagupaNo ratings yet

- Leveraging on India: Best Practices Related to Manufacturing, Engineering, and ItFrom EverandLeveraging on India: Best Practices Related to Manufacturing, Engineering, and ItNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Calculus (Applications) : Refresher MODULEDocument1 pageCalculus (Applications) : Refresher MODULEgailNo ratings yet

- Graditel TPDocument1 pageGraditel TPgailNo ratings yet

- Lesson 8: Soil Bearing Capacity For Shallow FoundationsDocument30 pagesLesson 8: Soil Bearing Capacity For Shallow FoundationsgailNo ratings yet

- Water Supply-Water Resource MCQDocument8 pagesWater Supply-Water Resource MCQgailNo ratings yet

- ANNUITYDocument10 pagesANNUITYgailNo ratings yet

- Engg Eco-Quiz 2Document1 pageEngg Eco-Quiz 2gailNo ratings yet

- Transpo EngDocument5 pagesTranspo EnggailNo ratings yet

- Eng EconDocument1 pageEng EcongailNo ratings yet

- Choices: A. Traffic Congestion and Parking DifficultiesDocument3 pagesChoices: A. Traffic Congestion and Parking DifficultiesgailNo ratings yet

- Fluid Ch.2 FinalDocument21 pagesFluid Ch.2 FinalgailNo ratings yet

- Probset EeconDocument3 pagesProbset Eecongail0% (1)