Professional Documents

Culture Documents

Maxwell Company

Uploaded by

Angeline RamirezCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maxwell Company

Uploaded by

Angeline RamirezCopyright:

Available Formats

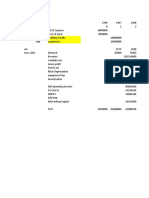

Maxwell Company has an opportunity to acquire a new machine to replace one of its present machines.

The new machine would cost $90,000, have a 5-year life, and no estimated salvage value. Variable

operating costs would be $100,000 per year. The present machine has a book value of $50,000 and a

remaining life of 5 years. Its disposal value now is $5,000, but it would be zero after 5 years. Variable

operating costs would be $125,000 per year. Ignore income taxes. Considering the 5 years in total, what

would be the difference in profit before income taxes by acquiring the new machine as opposed to

retaining the present one? A. $10,000 decrease B. $15,000 decrease C. $35,000 increase D. $40,000

increase 11. A project under consideration by the White Corp. would require a working capital

investment of $200,000. The working capital would be liquidated at the end of the project's 10-year life.

If White Corp. has an after-tax cost of capital of 10 percent and a marginal tax rate of 30 percent, what is

the present value of the working capital cash flow expected to be received in year 10? a. $36,868 b.

$77,100 c. $53,970 d. $23,130 12. Lyben Inc. is planning to produce a new product. To do this, it is

necessary to acquire a new equipment that will cost the company P100,000. The estimated life of the

new equipment is five years with no salvage value. The estimated income and costs based on expected

sales of P10,000 units per year are: Sales @ P10.00 per unit P100,000 Costs @ P8.00 per unit 80,000 Net

income P 20,000 The accounting rate of return based on initial investment is 20% What will be the

accounting rate of return based on initial investment of P100,000 if management decrease its selling

price of the new product by 10%? a. 5% b. 10% c. 15% d. 20% 13. MLF Corporation is evaluating the

purchase of a P500,000 die attach machine. The cash inflows expected from the investment is P145,000

per year for five years with no equipment salvage value. The cost of capital is 12%. The net present value

factor for five (5) years at 12% is 3.6048 and at 14% is 3.4331. The internal rate of return for this

investment is a. 3.45% b. 2.04% c. 13.8% d. 15.48% MSQ-08 Page 7 14. APJ, Inc. is planning to purchase a

new machine that will take six years to recover the cost. The new machine is expected to produce cash

flow from operations, net of income taxes, of P4,500 a year for the first three years of the payback

period and P3,500 a year of the last three years of the payback period. Depreciation of P3,000 a year

shall be charged to income of the six years of the payback period. How much shall the machine cost? a.

P12,000 b. P18,000 c. P24,000 d. P36,000 15. Sweets, Etc., Inc. plans to undertake a capital expenditure

requiring P2 million cash outlay. Below are the projected after-tax cash inflow for the five year period

covering the useful life. The company’s tax rate is 35%. Year 1 2 3 4 5 P’000 600 700 480 400 400 The

founder and president of the candy company believes that the best gauge for capital expenditure is cash

payback period and that the recovery period should not be more than 75% of the useful life of the

project or the asset. Should the company undertake the project? a. No, since the payback period is 4

years or 80% of the useful life of the project. b. Yes, since the payback period is 3.55 years or 71% of the

useful life of the project. c. No, since the payback period extends beyond the life of the project. d. Yes,

since the payback period is 4 years and still shorter than the useful life of the project. 16. Womark

Company purchased a new machine on January 1 of this year for $90,000, with an estimated useful life

of 5 years and a salvage value of $10,000. The machine will be depreciated using the straight-line

method. The machine is expected to produce cash flow from operations, net of income taxes, of

$36,000 a year in each of the next 5 years. The new machine’s salvage value is $20,000 in years 1 and 2,

and $15,0000 in years 3 and 4. What will be the bailout period (rounded) for the new machine? a. 1.4

years. b. 2.2 years. c. 1.9 years. d. 3.4 years.

You might also like

- Discount RateDocument2 pagesDiscount RateAngeline RamirezNo ratings yet

- A Complete Roofing & Roof Repair Business Plan: A Key Part Of How To Start A Roofing CompanyFrom EverandA Complete Roofing & Roof Repair Business Plan: A Key Part Of How To Start A Roofing CompanyRating: 5 out of 5 stars5/5 (1)

- Lecture Notes: Afar G/N/E de Leon 2813-Joint and by Product Costing MAY 2020Document4 pagesLecture Notes: Afar G/N/E de Leon 2813-Joint and by Product Costing MAY 2020May Grethel Joy PeranteNo ratings yet

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNo ratings yet

- MCQ - Capital BudgetingDocument2 pagesMCQ - Capital BudgetingRamainne Ronquillo0% (1)

- Capital Budgeting Problems and ExercisesDocument7 pagesCapital Budgeting Problems and ExercisesRobert RamirezNo ratings yet

- How To Start A Patio Installation Business: A Complete Patio & Concrete Installation Business PlanFrom EverandHow To Start A Patio Installation Business: A Complete Patio & Concrete Installation Business PlanRating: 3 out of 5 stars3/5 (1)

- Capital Budgeting Quiz 1: Multiple ChoiceDocument7 pagesCapital Budgeting Quiz 1: Multiple ChoiceMark Jesus Aristo100% (1)

- Revised Accounting 15Document26 pagesRevised Accounting 15Jennifer Garnette50% (2)

- Questions on Capital Budgeting TechniquesDocument6 pagesQuestions on Capital Budgeting Techniqueskaf_scitNo ratings yet

- Chapter 10 ProblemsDocument21 pagesChapter 10 ProblemsJane Hzel Lopez MilitarNo ratings yet

- Capital Budgeting Techniques for Evaluating Investment ProjectsDocument15 pagesCapital Budgeting Techniques for Evaluating Investment ProjectsSpencer Tañada100% (1)

- Operating Cash InflowDocument11 pagesOperating Cash InflowRarajNo ratings yet

- For Students Capital BudgetingDocument3 pagesFor Students Capital Budgetingwew123No ratings yet

- Engineering EconomyDocument16 pagesEngineering EconomyHazel Marie Ignacio PeraltaNo ratings yet

- ANGELICADocument7 pagesANGELICAAngel Reconalla Lapadan100% (2)

- Practice Problems - Capital Budgeting PDFDocument2 pagesPractice Problems - Capital Budgeting PDFRamainne RonquilloNo ratings yet

- Capital BudgetingDocument4 pagesCapital BudgetingYaj CruzadaNo ratings yet

- CB ProblemsDocument4 pagesCB ProblemsSimmon Jr Morano Tan100% (1)

- Quiz On Cap BudgDocument3 pagesQuiz On Cap BudgjjjjjjjjNo ratings yet

- Capital Budgeting PowerpointDocument15 pagesCapital Budgeting PowerpointAlisa Gabriela Sioco OrdasNo ratings yet

- Ifrs vs. Indian GaapDocument4 pagesIfrs vs. Indian GaapPankaj100% (1)

- AcmeDocument2 pagesAcmeAngeline RamirezNo ratings yet

- Finman Midterms Part 1Document7 pagesFinman Midterms Part 1JerichoNo ratings yet

- Strategic Business AnalysisDocument8 pagesStrategic Business AnalysisAdora Chielka SalesNo ratings yet

- MAS Ass1Document4 pagesMAS Ass1Tin BulaoNo ratings yet

- MANAGEMENT ACCOUNTING PART 2 CAPITAL BUDGETING COSTDocument5 pagesMANAGEMENT ACCOUNTING PART 2 CAPITAL BUDGETING COSTCris Joy BiabasNo ratings yet

- Capital Budgeting Problems SolvedDocument4 pagesCapital Budgeting Problems SolvedLiana Monica Lopez0% (1)

- Infosys LTD Standalone Audit Report To Shareholders For FY 2019Document3 pagesInfosys LTD Standalone Audit Report To Shareholders For FY 2019Sundarasudarsan RengarajanNo ratings yet

- MAS Synchronous May 13 Part 2Document4 pagesMAS Synchronous May 13 Part 2Marielle GonzalvoNo ratings yet

- Problems - Capital BudgetingDocument5 pagesProblems - Capital BudgetingDianne TorresNo ratings yet

- 1 Sample-AssignmentDocument1 page1 Sample-AssignmentKatherine McLarneyNo ratings yet

- Capital Budgeting ExercisesDocument4 pagesCapital Budgeting ExercisescrissilleNo ratings yet

- Capital BudgetingDocument14 pagesCapital BudgetingRoanne SantillanNo ratings yet

- Capital Budgeting Sample Questions ExplainedDocument2 pagesCapital Budgeting Sample Questions ExplainedNCTNo ratings yet

- True or FalseDocument3 pagesTrue or FalseKarlo D. ReclaNo ratings yet

- Capital Budgeting NPV Analysis for Earth Mover ProjectDocument6 pagesCapital Budgeting NPV Analysis for Earth Mover ProjectMarcoBonaparte0% (1)

- SFM Practice QuestionsDocument13 pagesSFM Practice QuestionsAmmar Ahsan0% (1)

- Capital Budgeting Problems For Fin102Document2 pagesCapital Budgeting Problems For Fin102Marianne AgunoyNo ratings yet

- Tennessee-Atlantic Paper Company capital investment analysisDocument3 pagesTennessee-Atlantic Paper Company capital investment analysisYasir AamirNo ratings yet

- Group Assignment Fm2 A112Document15 pagesGroup Assignment Fm2 A112Ho-Ly Victor67% (3)

- Practice question on Capital BudegetingDocument4 pagesPractice question on Capital Budegetingaditisarkar080No ratings yet

- Capital Budgeting ExampleDocument12 pagesCapital Budgeting Exampleljohnson10950% (4)

- Practice Problems - Capital Budgeting PDFDocument2 pagesPractice Problems - Capital Budgeting PDFRamainne RonquilloNo ratings yet

- MasDocument2 pagesMasEmma Mariz GarciaNo ratings yet

- Chapter 10 - Capital Budgeting - ProblemsDocument4 pagesChapter 10 - Capital Budgeting - Problemsbraydenfr05No ratings yet

- Corporate Finance - I Questions BSC Finance Sem IDocument36 pagesCorporate Finance - I Questions BSC Finance Sem IRahul SinghNo ratings yet

- Tutorial CashflowDocument2 pagesTutorial CashflowArman ShahNo ratings yet

- PGPM FM I Glim Assignment 3 2014Document5 pagesPGPM FM I Glim Assignment 3 2014sexy_sam280% (1)

- S 12Document15 pagesS 12AbhishekKumar0% (3)

- Exercise Chapter 6Document3 pagesExercise Chapter 6Siti AishahNo ratings yet

- Cbproblems PDF FreeDocument4 pagesCbproblems PDF FreeAmalgam EnterpriseNo ratings yet

- Case 1 - Capital BudetingDocument3 pagesCase 1 - Capital BudetingPooja KhimaniNo ratings yet

- Add - L Problems CBDocument4 pagesAdd - L Problems CBJamesCarlSantiagoNo ratings yet

- Capital BudgetingDocument2 pagesCapital BudgetingEdmon ManalotoNo ratings yet

- 1 Problem Assignment TwoDocument23 pages1 Problem Assignment TwoFerdinand Dave0% (1)

- Assignment For CB TechniquesDocument2 pagesAssignment For CB TechniquesRahul TirmaleNo ratings yet

- Exercises Capital BudgetingDocument3 pagesExercises Capital BudgetingSwap WerdNo ratings yet

- Bài Tập Buổi 4 (Updated)Document4 pagesBài Tập Buổi 4 (Updated)Minh NguyenNo ratings yet

- Year 1 2 3 4 Sales Volume (Units/year) 350,000 380,000 400,000 400,000Document13 pagesYear 1 2 3 4 Sales Volume (Units/year) 350,000 380,000 400,000 400,000সৈকত হাবীবNo ratings yet

- Finman MidtermDocument4 pagesFinman Midtermmarc rodriguezNo ratings yet

- Incremental cash flows and NPV of Miller Corporation's new productDocument5 pagesIncremental cash flows and NPV of Miller Corporation's new producttrelvisd0% (1)

- A Complete Patio Installation Business Plan: A Key Part Of How To Start A Patio & Concrete Installation BusinessFrom EverandA Complete Patio Installation Business Plan: A Key Part Of How To Start A Patio & Concrete Installation BusinessNo ratings yet

- Optimal CapitalDocument2 pagesOptimal CapitalAngeline RamirezNo ratings yet

- Cash Flow Projection: Total Request PHP 4,880,000Document1 pageCash Flow Projection: Total Request PHP 4,880,000Angeline RamirezNo ratings yet

- Xoxo Cosmetics: Accentuate Your Natural Beauty and Let Your Features Take The StageDocument2 pagesXoxo Cosmetics: Accentuate Your Natural Beauty and Let Your Features Take The StageAngeline RamirezNo ratings yet

- Avery Azalea: Certificate of AchievementDocument1 pageAvery Azalea: Certificate of AchievementAngeline RamirezNo ratings yet

- Tactical Marketing Plan: Document SubtitleDocument7 pagesTactical Marketing Plan: Document SubtitleAngeline RamirezNo ratings yet

- THEORYDocument1 pageTHEORYAngeline RamirezNo ratings yet

- XOXO Cosmetics Company: Trip DescriptionDocument3 pagesXOXO Cosmetics Company: Trip DescriptionAngeline RamirezNo ratings yet

- Inventory Excess Land ExcessDocument1 pageInventory Excess Land ExcessAngeline RamirezNo ratings yet

- Management Advisory Services: Solution To ProblemDocument1 pageManagement Advisory Services: Solution To ProblemAngeline RamirezNo ratings yet

- LIMITATIONSDocument4 pagesLIMITATIONSAngeline RamirezNo ratings yet

- Product A Product B Product C TotalDocument2 pagesProduct A Product B Product C TotalAngeline RamirezNo ratings yet

- Price Variance - Favorable P 420 DDocument2 pagesPrice Variance - Favorable P 420 DAngeline RamirezNo ratings yet

- Budgeting For Profit and ControlDocument2 pagesBudgeting For Profit and ControlAngeline RamirezNo ratings yet

- Cost.: Absorption Costing Variable CostingDocument4 pagesCost.: Absorption Costing Variable CostingAngeline RamirezNo ratings yet

- DateDocument1 pageDateAngeline RamirezNo ratings yet

- Reflection 1Document1 pageReflection 1Angeline RamirezNo ratings yet

- Problem 3Document1 pageProblem 3Angeline RamirezNo ratings yet

- AICPADocument2 pagesAICPAAngeline RamirezNo ratings yet

- Inventory Excess Land ExcessDocument1 pageInventory Excess Land ExcessAngeline RamirezNo ratings yet

- Equity method accounting for investmentsDocument2 pagesEquity method accounting for investmentsAngeline RamirezNo ratings yet

- Reflection 1Document1 pageReflection 1Angeline RamirezNo ratings yet

- Equity method questionsDocument1 pageEquity method questionsAngeline RamirezNo ratings yet

- Variable Costing and AnalysisDocument1 pageVariable Costing and AnalysisAngeline RamirezNo ratings yet

- PAS 28 Does Not Require The Equity Method To Be Applied To Which of The Following InstanceDocument2 pagesPAS 28 Does Not Require The Equity Method To Be Applied To Which of The Following InstanceAngeline RamirezNo ratings yet

- Perpetual Co downstream inventory sale EVERLASTINGDocument1 pagePerpetual Co downstream inventory sale EVERLASTINGAngeline RamirezNo ratings yet

- Loss of Significant InfluenceDocument2 pagesLoss of Significant InfluenceAngeline RamirezNo ratings yet

- Use The Following For The Next Two Questions:: Potential Voting SharesDocument1 pageUse The Following For The Next Two Questions:: Potential Voting SharesAngeline RamirezNo ratings yet

- Adopting Tools from Cost and Management AccountingDocument13 pagesAdopting Tools from Cost and Management AccountingJOYDIP PRODHANNo ratings yet

- Chapter07 XlssolDocument49 pagesChapter07 XlssolEkhlas AmmariNo ratings yet

- Financial Accounting GlossaryDocument5 pagesFinancial Accounting GlossaryDheeraj SunthaNo ratings yet

- ACT1122 Conceptual Framework and Accounting Standards - Revised - 2024Document14 pagesACT1122 Conceptual Framework and Accounting Standards - Revised - 2024Migz labianoNo ratings yet

- Intacc (Non Current Assets Held For Sale-Changes On Equity) Reviewer.Document22 pagesIntacc (Non Current Assets Held For Sale-Changes On Equity) Reviewer.Roselynne GatbontonNo ratings yet

- Illustrative Problems Formation of PartnershipDocument12 pagesIllustrative Problems Formation of PartnershipSassy GirlNo ratings yet

- GC University M.Com Corporate Finance AssignmentDocument4 pagesGC University M.Com Corporate Finance AssignmentKashif KhurshidNo ratings yet

- Kuliah I AkpDocument51 pagesKuliah I AkpMuhammad Tamul FikriNo ratings yet

- For December 31Document4 pagesFor December 31Bopha vongNo ratings yet

- WePROMOTE EditedDocument9 pagesWePROMOTE EditedBrian BlazerNo ratings yet

- Q3 2022 Financial Results: Orders Up 16%, Operational EBITA Rises 27Document48 pagesQ3 2022 Financial Results: Orders Up 16%, Operational EBITA Rises 27MATHU MOHANNo ratings yet

- SP Setia Corporate PresentationDocument64 pagesSP Setia Corporate PresentationSya NmjNo ratings yet

- Carrefour 2022 Half-Year Financial ReportDocument71 pagesCarrefour 2022 Half-Year Financial Reportgarcia.heberNo ratings yet

- Model Grace CorporationDocument9 pagesModel Grace CorporationEhtisham AkhtarNo ratings yet

- Difference Between Relevant Cost and Irrelevant CostDocument13 pagesDifference Between Relevant Cost and Irrelevant CostAmit SinghNo ratings yet

- Test Bank For Fundamental Financial Accounting Concepts 10th by EdmondsDocument53 pagesTest Bank For Fundamental Financial Accounting Concepts 10th by Edmondschompbowsawpagb8No ratings yet

- Accounting Standards For CBSE Scools in IndiaDocument70 pagesAccounting Standards For CBSE Scools in IndiaAnupam GoyalNo ratings yet

- Oman - Oil SectorDocument15 pagesOman - Oil Sectorsultana792No ratings yet

- ACTBFAR Exercise Set #1Document7 pagesACTBFAR Exercise Set #1Nikko Bowie PascualNo ratings yet

- Principles of Property ValuationDocument8 pagesPrinciples of Property ValuationcivilsadiqNo ratings yet

- Partnership FormationDocument5 pagesPartnership FormationAra AlcantaraNo ratings yet

- Guas Inc A Major Retailer of Bicycles and Accessories Operates PDFDocument3 pagesGuas Inc A Major Retailer of Bicycles and Accessories Operates PDFTaimur TechnologistNo ratings yet

- FINANCIAL STATEMENT For PrintDocument4 pagesFINANCIAL STATEMENT For PrintGkgolam KibriaNo ratings yet

- Taxonomy Iti 2023 by FsDocument199 pagesTaxonomy Iti 2023 by FsLakshmancagNo ratings yet

- CH 05Document77 pagesCH 05Minh ThưNo ratings yet

- Solutions of Cash Flow Statement QuestionsDocument7 pagesSolutions of Cash Flow Statement QuestionsSuvana YasminNo ratings yet

- XYZ TagumDocument8 pagesXYZ TagumBSA3Tagum MariletNo ratings yet

- TS Grewal Solutions For Financial Statements of Not-for-Pro T Organisations Class 11 AccountancyDocument39 pagesTS Grewal Solutions For Financial Statements of Not-for-Pro T Organisations Class 11 AccountancyVills GondaliyaNo ratings yet