Professional Documents

Culture Documents

Variable Costing and Analysis

Uploaded by

Angeline Ramirez0 ratings0% found this document useful (0 votes)

13 views1 pageOriginal Title

REVIEWER

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views1 pageVariable Costing and Analysis

Uploaded by

Angeline RamirezCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

REVIEWER when

the units are sold, and is

still deferred in the inventory when the

Variable Costing and Analysis

units are still

Variable costing is an extension of marginal unsold. This follows the principle of mat

costing, direct costing, or contribution margin ching of costs against revenues.

costing. Variable costing includes variable

Under variable costing, fixed overhead

production costs as part of the product cost.

is a period cost, meaning, outright an

Direct costing includes all costs directly

expense. This means the fixed overhead

identified with the segment as product

is immediately charged against

Basic principles revenues without regard as to whether

the units are already sold or stiff unsold.

Variable costing is the same as marginal This follows the immediate

costing, direct costing, or contribution recognitionprinciple. The rationale for t

margin costing. his treatment is because the fixed

Variable costing is an extension of CVP overhead would

analysis be incurred regardless of whether

the production occurs or not, and

The basicassumptions in the marginal therefore, should not be treated as

Costing (i.e., CVP analysis) are followed product cost

except that production is not equal to

sales. Direct materials, direct labor, and

variable overhead -are product

Technically speaking, variable costing costs, both to absorption and variable

and direct costing are different. costing systems.

Variable costing includes -variable

production costs as part of the product Variable expenses and fixed expenses

cost while direct costing includes all are period costs> both to absorption

costs directly identified with the and variable costing-systems.

segment as product costs- Another,

variable costing focuses on the

contribution margin while direct costing

zeroes-in on segment margin.

The unit costs from the preceding

period are the same in the current

period; meaning, unit costs are

assumed to be constant

Treatment of fixed overhead, and other

costs and expenses

Under absorption costing, fixed overhe

ad is a product cost, inventoriable

costs, or deferrable costs. This means

that the cost assigned

to- the product is charged against sales

You might also like

- Group Work Case 10 Berkshire InstrumentsDocument3 pagesGroup Work Case 10 Berkshire InstrumentsPatrick Alsim100% (4)

- Module 1-3 ACCTG 201Document32 pagesModule 1-3 ACCTG 201Sky SoronoiNo ratings yet

- PAS 28 Does Not Require The Equity Method To Be Applied To Which of The Following InstanceDocument2 pagesPAS 28 Does Not Require The Equity Method To Be Applied To Which of The Following InstanceAngeline RamirezNo ratings yet

- Leases Part 1 (Accounting by Lessees)Document22 pagesLeases Part 1 (Accounting by Lessees)Queen ValleNo ratings yet

- Product Cost MethodsDocument3 pagesProduct Cost Methodsjaninasachadelacruz0119No ratings yet

- Week 1 COST ACCOUNTINGDocument12 pagesWeek 1 COST ACCOUNTINGAlthea Lorraine MedranoNo ratings yet

- STCM 03AbsorptionandVariableCostingDocument5 pagesSTCM 03AbsorptionandVariableCostingdin matanguihanNo ratings yet

- AssignmentDocument4 pagesAssignmentSaransh KatyalNo ratings yet

- Final AssignmentDocument19 pagesFinal AssignmentManoj JainNo ratings yet

- Chapter OneDocument19 pagesChapter OneChera HabebawNo ratings yet

- Mas.02 Variable and Absorption CostingDocument6 pagesMas.02 Variable and Absorption CostingRhea Royce CabuhatNo ratings yet

- Checkpoint Activity 1:: Term/ConceptDocument2 pagesCheckpoint Activity 1:: Term/ConceptlalalalaNo ratings yet

- Concept of Marginal Cost, Marginal CostingDocument14 pagesConcept of Marginal Cost, Marginal CostingMaheen KhanNo ratings yet

- Answer:: Q1. What Is Marginal Costing? Explain and How Is It Different From Absorption Costing?Document2 pagesAnswer:: Q1. What Is Marginal Costing? Explain and How Is It Different From Absorption Costing?Jay PatelNo ratings yet

- Module 4 Absorption Variable Throughput CostingDocument3 pagesModule 4 Absorption Variable Throughput CostingSky SoronoiNo ratings yet

- Module 4 Absorption Variable Throughput CostingDocument3 pagesModule 4 Absorption Variable Throughput CostingSky Soronoi100% (1)

- Module 4 MACDocument4 pagesModule 4 MACBroniNo ratings yet

- Marginal Costing and Absorption CostingDocument10 pagesMarginal Costing and Absorption Costingferos100% (12)

- Chapter 01 (Overview of Cost)Document21 pagesChapter 01 (Overview of Cost)Yogita SinghNo ratings yet

- Week 1 InsightsDocument1 pageWeek 1 InsightsKatrina PaquizNo ratings yet

- Marginal Costing TheoryDocument16 pagesMarginal Costing TheoryGabriel BelmonteNo ratings yet

- E1-E2 - Text - Chapter 6. Cost RecordsDocument14 pagesE1-E2 - Text - Chapter 6. Cost Recordspintu_dyNo ratings yet

- Module 3 MacDocument8 pagesModule 3 MacBroniNo ratings yet

- VariableandRelevant Costing Method - SCMDocument4 pagesVariableandRelevant Costing Method - SCMryokie dumpNo ratings yet

- Variable and Absorption CostingDocument3 pagesVariable and Absorption CostingLiana Monica LopezNo ratings yet

- MA Module - 4Document6 pagesMA Module - 4Yash JatNo ratings yet

- AFM-Module 5 TheoryDocument7 pagesAFM-Module 5 TheorykanikaNo ratings yet

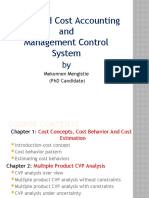

- Advanced Cost Accounting and Management Control System: Mekonnen Mengistie (PHD Candidate)Document62 pagesAdvanced Cost Accounting and Management Control System: Mekonnen Mengistie (PHD Candidate)Kalkidan ZerihunNo ratings yet

- Marginal CostingDocument37 pagesMarginal Costingbhavinpoldiya100% (1)

- Marginal CostingDocument17 pagesMarginal CostingGovind PrajapatiNo ratings yet

- Variable CostingDocument32 pagesVariable CostingNicole J. CentenoNo ratings yet

- Variable and Absorption CostingDocument4 pagesVariable and Absorption CostingFranz CampuedNo ratings yet

- Marginal Costing IntroductionDocument5 pagesMarginal Costing IntroductionPavan AcharyaNo ratings yet

- Variable and Absorption CostingDocument2 pagesVariable and Absorption CostingLaura OliviaNo ratings yet

- Absorption Costing Vs Marginal CostingDocument5 pagesAbsorption Costing Vs Marginal Costingsani02No ratings yet

- Pre-Study Session 4Document10 pagesPre-Study Session 4Narendralaxman ReddyNo ratings yet

- MAS-05 Variable and Absorption CostingDocument8 pagesMAS-05 Variable and Absorption CostingKrizza MaeNo ratings yet

- Cost TerminologyDocument2 pagesCost TerminologyChristine TutorNo ratings yet

- Cost Classification or Cost Flow in An OrgaizationDocument8 pagesCost Classification or Cost Flow in An OrgaizationvaloruroNo ratings yet

- PDF Topic 2 COST CONCEPT AND CLASSIFICATIONDocument53 pagesPDF Topic 2 COST CONCEPT AND CLASSIFICATIONJessaNo ratings yet

- HR Accounting Unit 2Document12 pagesHR Accounting Unit 2Cassidy DonahueNo ratings yet

- Marginal CostingDocument16 pagesMarginal CostingShainaNo ratings yet

- Cost Ac Sol PDFDocument22 pagesCost Ac Sol PDFpandeynityyaNo ratings yet

- Cost Accounting Reviewer (Theories)Document4 pagesCost Accounting Reviewer (Theories)flatunocutieNo ratings yet

- MODULE 1 Variable and Absorption CostingDocument9 pagesMODULE 1 Variable and Absorption Costingjerico garciaNo ratings yet

- Elementary Principal of Marginal - 1projectDocument18 pagesElementary Principal of Marginal - 1projectprasannamrudulaNo ratings yet

- Marginal CostingDocument41 pagesMarginal CostingaayanyohaanNo ratings yet

- Chapter 10Document5 pagesChapter 10Ailene QuintoNo ratings yet

- Conceptual Map On Absorption and Variable CostingDocument3 pagesConceptual Map On Absorption and Variable CostingChristian Ryan BaronNo ratings yet

- Chapter 1: Marginal Costing & Profit PlanningDocument32 pagesChapter 1: Marginal Costing & Profit PlanningSwatiNo ratings yet

- Marginal Costing - DefinitionDocument15 pagesMarginal Costing - DefinitionShivani JainNo ratings yet

- Topic 3 Variable Costing and Absorption CostingDocument3 pagesTopic 3 Variable Costing and Absorption CostingdigididoghakdogNo ratings yet

- 4 MarginalCostingDocument7 pages4 MarginalCostingSoham DeNo ratings yet

- Unit 4 Variable and Absorption CostingDocument8 pagesUnit 4 Variable and Absorption CostingKarthi SkNo ratings yet

- Marginal and Absorption CostingDocument4 pagesMarginal and Absorption CostingNabeel Ismail/GDT/BCR/SG4No ratings yet

- Chapter 2Document10 pagesChapter 2Aklil TeganewNo ratings yet

- Marginal Costing: Made By:-Manveer Singh C204 Btech-ExtcDocument18 pagesMarginal Costing: Made By:-Manveer Singh C204 Btech-ExtcPriyaRajNo ratings yet

- Costing and Profit PlanningDocument27 pagesCosting and Profit PlanningSIDDHANT CHUGHNo ratings yet

- Marginal Costing PDFDocument26 pagesMarginal Costing PDFMasumiNo ratings yet

- Class - Marginal CostingDocument45 pagesClass - Marginal CostingAMBIKA MALIKNo ratings yet

- Classification of CostDocument33 pagesClassification of CostGeet SharmaNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- THEORYDocument1 pageTHEORYAngeline RamirezNo ratings yet

- Discount RateDocument2 pagesDiscount RateAngeline RamirezNo ratings yet

- Tactical Marketing Plan: Document SubtitleDocument7 pagesTactical Marketing Plan: Document SubtitleAngeline RamirezNo ratings yet

- Xoxo Cosmetics: Accentuate Your Natural Beauty and Let Your Features Take The StageDocument2 pagesXoxo Cosmetics: Accentuate Your Natural Beauty and Let Your Features Take The StageAngeline RamirezNo ratings yet

- Maxwell CompanyDocument1 pageMaxwell CompanyAngeline RamirezNo ratings yet

- AcmeDocument2 pagesAcmeAngeline RamirezNo ratings yet

- Cost.: Absorption Costing Variable CostingDocument4 pagesCost.: Absorption Costing Variable CostingAngeline RamirezNo ratings yet

- Product A Product B Product C TotalDocument2 pagesProduct A Product B Product C TotalAngeline RamirezNo ratings yet

- Equipment Amortization: Investments in Associates?Document2 pagesEquipment Amortization: Investments in Associates?Angeline RamirezNo ratings yet

- Budgeting For Profit and ControlDocument2 pagesBudgeting For Profit and ControlAngeline RamirezNo ratings yet

- AICPADocument2 pagesAICPAAngeline RamirezNo ratings yet

- Loss of Significant InfluenceDocument2 pagesLoss of Significant InfluenceAngeline RamirezNo ratings yet

- Equity MethodDocument1 pageEquity MethodAngeline RamirezNo ratings yet

- Inventory Excess Land ExcessDocument1 pageInventory Excess Land ExcessAngeline RamirezNo ratings yet

- Use The Following Information For The Next Two Questions:: Downstream Sale of InventoryDocument1 pageUse The Following Information For The Next Two Questions:: Downstream Sale of InventoryAngeline RamirezNo ratings yet

- Use The Following For The Next Two Questions:: Potential Voting SharesDocument1 pageUse The Following For The Next Two Questions:: Potential Voting SharesAngeline RamirezNo ratings yet

- Strategic Cost ManagementDocument7 pagesStrategic Cost ManagementAngeline RamirezNo ratings yet

- Ais (FINALS) Pascual (3) YODocument69 pagesAis (FINALS) Pascual (3) YOMarinel FelipeNo ratings yet

- Intermediate Accounting Vol 1 Canadian 3rd Edition Lo Test Bank 1Document97 pagesIntermediate Accounting Vol 1 Canadian 3rd Edition Lo Test Bank 1anthony100% (44)

- Entrepreneurship LAS 5 Q4 Week 5 6Document10 pagesEntrepreneurship LAS 5 Q4 Week 5 6Desiree Jane SaleraNo ratings yet

- 3005 Business CombinationDocument4 pages3005 Business CombinationTatianaNo ratings yet

- Poa Week 8 LectureDocument14 pagesPoa Week 8 LectureTabsheer KamranNo ratings yet

- CFAS Reviewer - Module 3Document8 pagesCFAS Reviewer - Module 3Lizette Janiya SumantingNo ratings yet

- Literature ReviewDocument9 pagesLiterature ReviewDaleNo ratings yet

- Cost of Good SaleDocument6 pagesCost of Good SaleArvin VillanuevaNo ratings yet

- ENG AR Pegadaian 2020 280521Document496 pagesENG AR Pegadaian 2020 280521Ibrahim SalimNo ratings yet

- LAS ABM - FABM12 Ie 9 Week 4Document7 pagesLAS ABM - FABM12 Ie 9 Week 4ROMMEL RABONo ratings yet

- uNIT V-IFMDocument28 pagesuNIT V-IFMgangaananthNo ratings yet

- CW Mackie 2015-16Document136 pagesCW Mackie 2015-16aselabollegala100% (1)

- MA 104 Team ActivityDocument5 pagesMA 104 Team ActivityRhema BashzieeNo ratings yet

- Illustration: Debt Service Accounting For Regular Serial Bonds (2011 Transaction)Document3 pagesIllustration: Debt Service Accounting For Regular Serial Bonds (2011 Transaction)Jichang HikNo ratings yet

- Budgetary Control System and Its ApplicationsDocument38 pagesBudgetary Control System and Its ApplicationsMukesh ManwaniNo ratings yet

- Trend AnalysisDocument4 pagesTrend AnalysisKha DijaNo ratings yet

- 05 Budgeting QuestionsDocument5 pages05 Budgeting QuestionsWynie AreolaNo ratings yet

- Ratio AnalysisDocument34 pagesRatio Analysismohitsingh1997No ratings yet

- Grand Banks Yachts Limited Annual Report 2020Document184 pagesGrand Banks Yachts Limited Annual Report 2020WeR1 Consultants Pte LtdNo ratings yet

- Chapter 19 - Sources of Intermediate and Long-Term Financing - Debt & EquityDocument6 pagesChapter 19 - Sources of Intermediate and Long-Term Financing - Debt & Equitylou-924No ratings yet

- Cupid ReportDocument8 pagesCupid ReportShonit SinghalNo ratings yet

- 2009 Form 990 For Harvard Management CompanyDocument55 pages2009 Form 990 For Harvard Management CompanyresponsibleharvardNo ratings yet

- TorrentDocument8 pagesTorrentkaranbarmecha90No ratings yet

- Wrting Task 1Document7 pagesWrting Task 1Minh KhôiNo ratings yet

- Unit 4Document25 pagesUnit 4Vinita ThoratNo ratings yet

- Causes and Consequences of LBODocument25 pagesCauses and Consequences of LBODead EyeNo ratings yet

- Corporate IssuersDocument55 pagesCorporate IssuersKirti MeenaNo ratings yet

- Max Flex & Imaging Systems Ltd.Document383 pagesMax Flex & Imaging Systems Ltd.GaneshNo ratings yet