Professional Documents

Culture Documents

Variable and Absorption Costing

Uploaded by

Franz CampuedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Variable and Absorption Costing

Uploaded by

Franz CampuedCopyright:

Available Formats

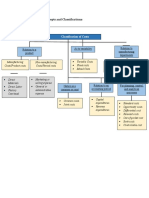

Period Cost Product Cost

Product costing: Absorption, Variable and Throughput -Cost that is charged against -Cost that is included in the

Costing current revenue during a computation of product cost

time period regardless of the that is apportioned between

☛Absorption costing difference between the sold and unsold units.

production and sales

also called full costing or conventional costing volumes.

A product costing method that includes all manufacturing costs (direct

materials, direct labor and both variable and fixed overhead) as product

costs. -Does not form part of the -An inventoriable cost. The

cost of inventory portion of the cost that has

Presents nonmanufacturing costs on the income statement according to

been allocated to the unsold

functional areas.

units becomes part of the cost

Under this method, fixed factory overhead is treated as a product cost. of inventory.

☛Variable costing -Diminishes income for the -Diminishes current income by

current period by its full the portion allocated to the

Also called direct costing, marginal costing or contribution margin amount. sold units; the portion

reporting. allocated to unsold units is

A product costing method that includes only variable costs of production treated as an asset, being part

(direct materials, direct labor, and variable manufacturing overhead) as of the cost of inventory

product costs.

Presents both nonmanufacturing and manufacturing costs on the income

VARIABLE COSTING: ARGUMENTS

statement according to cost behavior. FOR AGAINST

Under this method, fixed factory overhead is treated as a period cost. *Reports are simpler and more *Segregation of costs into

understandable fixed and variable might be

PRODUCT COST COMPONENTS *Applicable for break-even and difficult

CVP analysis *Matching principle is

Absorption Costing Variable Costing *Problems involved in allocating violated for it excludes fixed

Direct materials Direct materials fixed costs are eliminated OH from product costs

+ Direct labor + Direct labor *More compatible with *Inventory costs and other

+ Variable OH + Variable OH standard cost accounting system related accounts, such as

+ Fixed OH --- *Reports provide useful working capital, current

----------------------- ----------------------- information for pricing decisions ratio, and acid-test ratio, are

and other decision-making understated because of the

Product Cost Product Cost

problems encountered by exclusion of fixed OH in the

mgmt. computation of product

costs.

DISTINCTIONS BETWEEN PERIOD COSTS AND PRODUCT COSTS

Absorption Variable

1.Cost Seldom segregate costs Costs are segregated

segregation into variable and fixed into variable and fixed VC Fixed OH expense

2.Cost of Includes all the Includes only VARIABLE is < than AC > than AC equal to AC

inventory manufacturing costs manufacturing costs

3.Treatmen Treated as PRODUCT Treated as PERIOD

VC Operating Income

t of Fixed COST COST

OH is > than AC < than AC equal to AC

4.Income Distinguishes between Distinguishes between

statement production and other variable and fixed costs

costs S XX

S XX -VC XX

-CGS XX CM XX

Gross profit XX -Fixed costs XX

-S&A costs XX Profit XX

Profit XX

5.Net Net Income between the two methods may differ

Income from each other because of the difference in the

amount of fixed OH costs recognized as expense o Absorption costing income follows production; that is:

during an accounting period. This is due to

variations between sales and production. In the

long run, however, both methods give Table 2: Absorption Costing

substantially the same results since sales cannot

continually exceed production, nor production If

can continuously exceed sales.

Therefore, P>S P<S P=S

no change

Sales and variable costing, production and absorption costing. (Which AC Operating Income Increases Decreases (ceteris paribus)

follows which?)

o Variable costing income follows sales; that is: Inventory Increases Decreases no change

< than

Table 1: Variable Costing AC Fixed OH expense is VC > than VC equal to VC

> than

If

AC Operating Income is VC < than VC equal to VC

Therefore, S>P S<P S=P Let P=Production

no change S= Sales

(ceteris AC=Absorption Costing

VC Operating Income Increases Decreases paribus) VC=Variable Costing

Inventory Decreases Increases no change

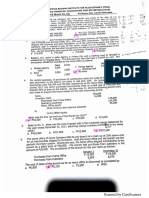

RECONCILIATION OF ABSORPTION AND VARIABLE COSTING INCOME FIGURES

e. While variable costing neither rewards nor penalizes production that is higher or

Absorption costing income XX lower than sales, throughput costing penalizes high production and rewards low

Add: Fixed OH in the beginning inventory XX production. Throughput costing is therefore very much in tune with JIT and other

Total XX philosophies that seek lower inventories.

Less: Fixed OH in the ending inventory XX

Variable costing income XX 2. SUPERABSORPTION COSTING- treats costs from all links in the value chain as

inventoriable costs.

ACCOUNTING FOR DIFFERENCE IN INCOME

[NOTE:]When Production>Sales: Throughput income<Variable

income<Absorption income.

Change in inventory (Production less Sales) XX

X Fixed FOH cost per unit XX When Sales>production: Throughput income>Variable

Difference in income XX income>Absorption income.

Once a company has reduced inventories to near zero: Throughput

STANDARD COSTS UNDER ABSORPTION AND VARIABLE COSTING

income=Variable income=Absorption income.

1. COGS is computed at standard

2. Standard COGS is adjusted to actual costs by adding unfavorable ☛Treatment of costs variance

variances and/or deducting favorable variances

Cost variance

3. In absorption costing, both variable and fixed manufacturing cost

variances are used as adjustment to the std. COGS The difference between actual and standard amounts.

4. In variable costing, only the variable manufacturing cost variances are

used as adjustments to the std. COGS. Variance Treatment

Actual costs > standard Unfavorable Added to cost of goods sold at

THE EXTREMES costs variance standard/ deducted from operating

income

1. SUPERVARIABLE COSTING OR THROUGHPUT COSTING- treats direct materials as Actual costs< standard Favorable Deducted from cost of goods sold

the only variable costs. costs variance at standard/ added to operating

income

☛FEATURES:

a. Only material costs are inventoried; work-in process or finished goods inventories

are not recorded

b. Treats all direct labor and manufacturing OH costs as period costs, expensing

them as they are incurred.

c. COGS is the cost of materials put into process.

d. Sales – COGS= Throughput in TOC parlance

- Actual capacity in unit’s xx

Volume variance in unit’s xx

X standard fixed costs per unit xx

Volume variance in pesos xx

Variance Treatment

Normal capacity > actual unfavorable Added to cost of goods

capacity sold at standard or

deducted from operating

income

Normal capacity < actual favorable Deducted from cost of

capacity goods sold at standard or

added to operating income

Volume variance

applicable only in the absorption costing

Happens when the normal capacity is not equal to the actual

capacity.

Normal capacity

The average level of activity over a long period or over the

budgeting period.

Computation of volume variance:

Normal capacity in units’ xx

You might also like

- Module 4 Absorption Variable Throughput CostingDocument3 pagesModule 4 Absorption Variable Throughput CostingSky Soronoi100% (1)

- Module 4 Absorption Variable Throughput CostingDocument3 pagesModule 4 Absorption Variable Throughput CostingSky SoronoiNo ratings yet

- Absorption and Variable CostingDocument22 pagesAbsorption and Variable CostingJamaica David100% (4)

- (Cpar2017) Mas-8205 (Product Costing) PDFDocument12 pages(Cpar2017) Mas-8205 (Product Costing) PDFSusan Esteban Espartero50% (2)

- 04 Absorption Vs Variable CostingDocument4 pages04 Absorption Vs Variable CostingBanna SplitNo ratings yet

- STCM 03AbsorptionandVariableCostingDocument5 pagesSTCM 03AbsorptionandVariableCostingdin matanguihanNo ratings yet

- MS Absorption-and-Variable-CostingDocument2 pagesMS Absorption-and-Variable-Costingkalloni.zoeNo ratings yet

- ACT121 - Topic 5Document5 pagesACT121 - Topic 5Juan FrivaldoNo ratings yet

- Cost.: Absorption Costing Variable CostingDocument4 pagesCost.: Absorption Costing Variable CostingAngeline RamirezNo ratings yet

- Chapter 9: Compare Absorption and Marginal CostingDocument18 pagesChapter 9: Compare Absorption and Marginal CostingNUR ANIS SYAMIMI BINTI MUSTAFA / UPMNo ratings yet

- MODULE 1 Variable and Absorption CostingDocument9 pagesMODULE 1 Variable and Absorption Costingjerico garciaNo ratings yet

- LP3-Product Costing MethodsDocument12 pagesLP3-Product Costing MethodsCarla GarciaNo ratings yet

- Module - Absorption and Variable CostingDocument10 pagesModule - Absorption and Variable CostingUchayya100% (1)

- SIM - Variable and Absorption Costing - 0Document5 pagesSIM - Variable and Absorption Costing - 0lilienesieraNo ratings yet

- WMSU Chapter 3 Costing MethodsDocument6 pagesWMSU Chapter 3 Costing Methodschelsea kayle licomes fuentesNo ratings yet

- Absorption and Variable CostingDocument15 pagesAbsorption and Variable CostingApril Pearl VenezuelaNo ratings yet

- 2. LAZY NOTES- PRODUCT COSTINGDocument3 pages2. LAZY NOTES- PRODUCT COSTINGAlyza AlmoniaNo ratings yet

- Product Cost MethodsDocument3 pagesProduct Cost Methodsjaninasachadelacruz0119No ratings yet

- Reconcile managerial and financial accounting reportsDocument6 pagesReconcile managerial and financial accounting reportsRhea Royce CabuhatNo ratings yet

- Mas 1.2.4 Assessment For-PostingDocument5 pagesMas 1.2.4 Assessment For-PostingJustine CruzNo ratings yet

- Chapter 2Document5 pagesChapter 2Hania M. CalandadaNo ratings yet

- Variable and Absorption CostingDocument2 pagesVariable and Absorption CostingLaura OliviaNo ratings yet

- Mas: Variable and Absorption Costing Concept Summary: Comparison As To Treatment of Operating CostsDocument3 pagesMas: Variable and Absorption Costing Concept Summary: Comparison As To Treatment of Operating CostsClyde RamosNo ratings yet

- Chapter-13 Marginal CostingDocument26 pagesChapter-13 Marginal CostingAdi PrajapatiNo ratings yet

- Chapter 7Document12 pagesChapter 7Camille GarciaNo ratings yet

- Final AssignmentDocument19 pagesFinal AssignmentManoj JainNo ratings yet

- Variable and Absorption CostingDocument5 pagesVariable and Absorption CostingAllan Jay CabreraNo ratings yet

- MS103 SendingDocument3 pagesMS103 SendingEthel Joy Tolentino GamboaNo ratings yet

- Analyze Costs Using Marginal CostingDocument13 pagesAnalyze Costs Using Marginal CostingmohitNo ratings yet

- MAS 9204 Product Costing Activity-Based Costing (ABC)Document19 pagesMAS 9204 Product Costing Activity-Based Costing (ABC)Mila Casandra CastañedaNo ratings yet

- Cost AccountingDocument2 pagesCost AccountingSherilyn LozanoNo ratings yet

- A Level Accounting NotesDocument16 pagesA Level Accounting NotesChaiwatTippuwananNo ratings yet

- Variable and Absorption CostingDocument2 pagesVariable and Absorption Costingnclann.martinNo ratings yet

- Variable Costing vs Absorption CostingDocument12 pagesVariable Costing vs Absorption CostingMarriah Izzabelle Suarez RamadaNo ratings yet

- ACCT102 II Cheat SheetDocument3 pagesACCT102 II Cheat SheetJanice OwusuNo ratings yet

- Mas - Absorption and Variable Costing PDFDocument11 pagesMas - Absorption and Variable Costing PDFNicole Anne M. ManansalaNo ratings yet

- Management Advisory Services-Ho1Document4 pagesManagement Advisory Services-Ho1kehlaniNo ratings yet

- Mas 9404 Product CostingDocument11 pagesMas 9404 Product CostingEpfie SanchesNo ratings yet

- VariableandRelevant Costing Method - SCMDocument4 pagesVariableandRelevant Costing Method - SCMryokie dumpNo ratings yet

- MANAGEMENT SERVICES – VARIABLE & ABSORPTION COSTINGDocument11 pagesMANAGEMENT SERVICES – VARIABLE & ABSORPTION COSTINGKristine MagsayoNo ratings yet

- MAS NotesDocument3 pagesMAS NotesMaricon Rillera PatauegNo ratings yet

- Marginal CostingDocument41 pagesMarginal CostingaayanyohaanNo ratings yet

- Marginal & Absorption CostingDocument12 pagesMarginal & Absorption CostingMayal Sheikh100% (1)

- Topic 3 Variable Costing and Absorption Costing (2)Document3 pagesTopic 3 Variable Costing and Absorption Costing (2)digididoghakdogNo ratings yet

- Variable and Absorption CostingDocument3 pagesVariable and Absorption CostingAnna Pamela MarianoNo ratings yet

- Job Costing vs Process Costing: Key DifferencesDocument2 pagesJob Costing vs Process Costing: Key DifferencesJayceelyn OlavarioNo ratings yet

- MAS-05 Variable and Absorption CostingDocument8 pagesMAS-05 Variable and Absorption CostingKrizza MaeNo ratings yet

- Notes and Summary in Product Costing With QuizzerDocument12 pagesNotes and Summary in Product Costing With QuizzerCykee Hanna Quizo LumongsodNo ratings yet

- 3.1 Pricing and ProfitabilityDocument1 page3.1 Pricing and ProfitabilityLea GerodiazNo ratings yet

- Mas 9203 - Standard Costs and Variance AnalysisDocument20 pagesMas 9203 - Standard Costs and Variance AnalysisShefannie PaynanteNo ratings yet

- Essay Los 2015 Section D. Cost Management 20 %Document18 pagesEssay Los 2015 Section D. Cost Management 20 %lassaadNo ratings yet

- absorption and marginalDocument7 pagesabsorption and marginalshafinasimanNo ratings yet

- Strategic Costing: Variable vs AbsorptionDocument9 pagesStrategic Costing: Variable vs AbsorptionMargie Garcia LausaNo ratings yet

- MAS Absorption Costing/Variable Costing Study ObjectivesDocument6 pagesMAS Absorption Costing/Variable Costing Study ObjectivesMarjorie ManuelNo ratings yet

- 2 Albarillo Bano Duncano Lisondra OconDocument34 pages2 Albarillo Bano Duncano Lisondra OconMariael PinasoNo ratings yet

- An Introduction To Cost Terms and PurposesDocument33 pagesAn Introduction To Cost Terms and PurposesAi LatifahNo ratings yet

- Finals Reviewer Cost AccDocument12 pagesFinals Reviewer Cost AccLuna KimNo ratings yet

- Strategic Cost Management: Absorption vs Variable CostingDocument3 pagesStrategic Cost Management: Absorption vs Variable CostingMarites AmorsoloNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- AFAR Mastery Part4 PDFDocument3 pagesAFAR Mastery Part4 PDFFranz CampuedNo ratings yet

- Midterms Quiz 2 Answers PDFDocument7 pagesMidterms Quiz 2 Answers PDFFranz Campued100% (1)

- Finals Quiz 1 PDFDocument6 pagesFinals Quiz 1 PDFFranz CampuedNo ratings yet

- Midterm Quiz 2 PDFDocument5 pagesMidterm Quiz 2 PDFFranz Campued100% (1)

- Finals Quiz 2Document6 pagesFinals Quiz 2Franz CampuedNo ratings yet

- AFAR Mastery Part1 PDFDocument3 pagesAFAR Mastery Part1 PDFFranz CampuedNo ratings yet

- Financial Statements AnalysisDocument8 pagesFinancial Statements AnalysisFranz CampuedNo ratings yet

- Management Information and Accounting SystemsDocument5 pagesManagement Information and Accounting SystemsFranz CampuedNo ratings yet

- Midterms Quiz 2 - 20181206074625Document5 pagesMidterms Quiz 2 - 20181206074625Franz CampuedNo ratings yet

- Fa 3 2014-CC PDFDocument207 pagesFa 3 2014-CC PDFColor BlueNo ratings yet

- MAS OverviewDocument4 pagesMAS OverviewFranz CampuedNo ratings yet

- AFAR Mastery Part5 PDFDocument7 pagesAFAR Mastery Part5 PDFFranz CampuedNo ratings yet

- Responsibility Accounting: Segment Margin Is The Same As Segment Income or Segment ProfitDocument2 pagesResponsibility Accounting: Segment Margin Is The Same As Segment Income or Segment ProfitFranz CampuedNo ratings yet

- CVP Analysis and Marginal Costing and BEPDocument2 pagesCVP Analysis and Marginal Costing and BEPFranz CampuedNo ratings yet

- Standard Costing and Variance AnalysisDocument3 pagesStandard Costing and Variance AnalysisFranz CampuedNo ratings yet

- Taxation - 1principles of TaxationDocument8 pagesTaxation - 1principles of TaxationFranz CampuedNo ratings yet

- 11completing The AuditDocument7 pages11completing The AuditFranz CampuedNo ratings yet

- Budgeting BasicsDocument4 pagesBudgeting BasicsFranz CampuedNo ratings yet

- Passive income tax rates for individuals and corporationsDocument1 pagePassive income tax rates for individuals and corporationsFranz CampuedNo ratings yet

- CPALE Syllabi 2018 PDFDocument32 pagesCPALE Syllabi 2018 PDFLorraine TomasNo ratings yet

- Cost Concepts and AnalysisDocument3 pagesCost Concepts and AnalysisFranz CampuedNo ratings yet

- 8assertions, Audit Procedures and Audit EvidenceDocument10 pages8assertions, Audit Procedures and Audit EvidenceFranz CampuedNo ratings yet

- 6audit PlanningDocument13 pages6audit PlanningFranz CampuedNo ratings yet

- 7consideration of Internal ControlDocument8 pages7consideration of Internal ControlFranz CampuedNo ratings yet

- 5preliminary Engagement ActivitiesDocument5 pages5preliminary Engagement ActivitiesFranz CampuedNo ratings yet

- 3fundamentals of Assurance EngagementsDocument7 pages3fundamentals of Assurance EngagementsFranz CampuedNo ratings yet

- 12the Auditors Report On FS (Samples)Document22 pages12the Auditors Report On FS (Samples)Franz CampuedNo ratings yet

- Understanding AuditingDocument13 pagesUnderstanding AuditingFranz CampuedNo ratings yet

- 9audit SamplingDocument9 pages9audit SamplingFranz CampuedNo ratings yet

- Chapter 4 - Inventory MGTDocument31 pagesChapter 4 - Inventory MGTMelak TsehayeNo ratings yet

- During The Fiscal Year Ended December 31 Swanlee Corporation EngagedDocument1 pageDuring The Fiscal Year Ended December 31 Swanlee Corporation Engagedtrilocksp SinghNo ratings yet

- Inventory Managemnt, Inventory Control, and Benfits of Inventory CotrolDocument6 pagesInventory Managemnt, Inventory Control, and Benfits of Inventory CotroltomNo ratings yet

- Determining the Optimal Level of Product AvailabilityDocument74 pagesDetermining the Optimal Level of Product AvailabilitydevendrasinghchavhanNo ratings yet

- Training Material For Kanban, Heijunka and Pull SystemDocument15 pagesTraining Material For Kanban, Heijunka and Pull SystemMD ABDULLAH AL MANSURNo ratings yet

- Optimal inventory ordering policy for raw materialsDocument5 pagesOptimal inventory ordering policy for raw materials19R21A05C0 19 - CSE BNo ratings yet

- Sewing Silver SparkDocument15 pagesSewing Silver SparkRahul SasidharanNo ratings yet

- Inventory Internal Audit ProgramDocument2 pagesInventory Internal Audit ProgramZegera MgendiNo ratings yet

- FFM PPTDocument33 pagesFFM PPTorkuch69No ratings yet

- Answer To Assignment #2 - Variable Costing PDFDocument14 pagesAnswer To Assignment #2 - Variable Costing PDFVivienne Rozenn LaytoNo ratings yet

- Chapter 2 Inventory ValuationDocument10 pagesChapter 2 Inventory ValuationlovelysyafiqahNo ratings yet

- Assets of The Government Agencies: ACCT 1133 Accounting For Government and Non-for-Profit OrganizationDocument23 pagesAssets of The Government Agencies: ACCT 1133 Accounting For Government and Non-for-Profit OrganizationMark Angelo BustosNo ratings yet

- CV - Picker & PackerDocument2 pagesCV - Picker & PackerAkhilesh kumarNo ratings yet

- 4 Financial Planning and Forecasting Day 1Document11 pages4 Financial Planning and Forecasting Day 1Airon Keith AlongNo ratings yet

- Slimstock-USA ABCXYZ-Analysis en 2019Document6 pagesSlimstock-USA ABCXYZ-Analysis en 2019Stubborn Ronnie17No ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2020-2021Document20 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2020-2021AB CloydNo ratings yet

- Supply Chain Managment - Chap 2,4,5Document150 pagesSupply Chain Managment - Chap 2,4,5Bùi Nam KhánhNo ratings yet

- Chapter 3 - Cost CycleDocument1 pageChapter 3 - Cost CycleLara Jane Dela CruzNo ratings yet

- Process CostingDocument13 pagesProcess CostingAmie Jane MirandaNo ratings yet

- Operations Management Assignment on Supply Chain Design and Inventory ManagementDocument5 pagesOperations Management Assignment on Supply Chain Design and Inventory ManagementIrfaN TamimNo ratings yet

- Problem 2Document1 pageProblem 2KATHRYN CLAUDETTE RESENTENo ratings yet

- OPN 501 Final Exam QuestionsDocument2 pagesOPN 501 Final Exam QuestionsLydia PhilipNo ratings yet

- EOQ Problems: Economic Order Quantity SolutionsDocument4 pagesEOQ Problems: Economic Order Quantity SolutionsGhilman HabibNo ratings yet

- Object Cost: "Sorbeteros" Will Keep Inventory For The Ice Cream Making IngredientsDocument3 pagesObject Cost: "Sorbeteros" Will Keep Inventory For The Ice Cream Making IngredientsLester SardidoNo ratings yet

- Immrp Unit 5Document29 pagesImmrp Unit 5vikramvsuNo ratings yet

- Supply Chain Network - NIPA BHOWMICK - 11001419036Document13 pagesSupply Chain Network - NIPA BHOWMICK - 11001419036Md AliujjamanNo ratings yet

- Haier A.C Supply Chain Management Mid ProjectDocument12 pagesHaier A.C Supply Chain Management Mid ProjectAdeel AhmadNo ratings yet

- Adigrat University Colleg of Bussiness and Economics Department of Accounting and FinaniceDocument53 pagesAdigrat University Colleg of Bussiness and Economics Department of Accounting and Finanicemubarek oumerNo ratings yet

- Accounting DocumentsDocument7 pagesAccounting DocumentsAryan Sofia FranciscoNo ratings yet

- Sta. Lucia Elementary School Canteen Action PlanDocument1 pageSta. Lucia Elementary School Canteen Action PlanMark Aaron Felizardo100% (2)