Professional Documents

Culture Documents

Taxation - 1principles of Taxation

Uploaded by

Franz Campued0 ratings0% found this document useful (0 votes)

30 views8 pagesOriginal Title

TAXATION - 1PRINCIPLES OF TAXATION

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

30 views8 pagesTaxation - 1principles of Taxation

Uploaded by

Franz CampuedCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 8

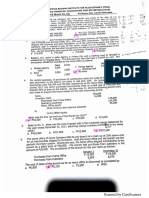

PRINCIPLES OF TAXATION 4.

Cooperative Development Act

***Other Tax exemptions: Implied (Omission which is intentional or

Nature, scope, classification, and essential characteristics incidental); Contractual (entered into by Gov’t like bonds and

debentures)

TAXATION CLASSIFICATION OF TAXES

Inherent power of the State. (Without constitutional grant) Purpose

Legislative Process of levying (charge) taxes by legislature. a. Fiscal (general purpose: Revenue = Gov’t Expenses)

Cost distribution/imposing proportionate burden upon person, property, b. Regulatory (regulate business, inflation, promote investments,

rights or transactions to raise revenue in order to defray gov’t expenses. restrict trade relations etc.)

i. Tools to protect trade relations (SPECIAL DUTIES)

NATURE/CHARACTERISTICS 1. Discriminatory-offset foreign discrimination to

1. Inherent Power of Sovereignty local commerce

Only national Gov’t exercise the inherent power of taxation not by 2. Countervailing-offset foreign subsidy granted to

LGU’s. imported goods to prejudice local industries

Except: 1. Express constitutional provision 3. Marking- imported article and/or containers

2. Valid delegation of tax power (Local Tax Code) with improper classifications

2. Essential legislative function 4. Dumping – duty taxes on imported goods with

Non-delegation of Legislative Power to Tax lower prices than local goods.

Tax Delegation (valid) vs. Tax Administration c. Sumptuary (social/economic objectives – distribution of wealth)

Tax legislation is delegated (invalid) but if tax administration is Subject matter

delegated, non-delegation rule is not violated a) Personal (Natural or Juridical)/Poll/Capitation (residents)

3. For Public Purpose (Common good) b) Property (Property: Real or Personal, and Tangible or Intangible)

4. Territorial in Operation (Only within the territories of the State) c) Excise (privilege(D&E)/transaction/right/Interest)

5. Tax Exemption of Gov’t ( Immunity) d) Custom Duties – import and export

6. Strongest among inherent powers Incidence

7. Subject to limitations (Inherent and Constitutional) a) Direct (Statutory = Economic taxpayer ex. PT)

b) Indirect (Statutory ≠ Economic taxpayer ex. VAT)

Amount

Philippine Tax Laws

a) Specific (fixed on per unit)

Civil and not Political in nature (effective even during

b) Ad Valorem (based on value)

periods of enemy occupation)

Rate

Tax payments made during foreign occupation is VALID

a) Proportional (fixed) – Corporate Income Tax and Business Tax

Not Penal in nature but it is to secure COMPLIANCE b) Progressive (increasing) – Individual Income Tax and Transfer Tax

c) Regressive (decreasing)- Not used in PH

TYPES OF TAXATION LAWS d) Mixed

Tax Laws Authority

1. NIRC a) National

2. Tariff and Customs Code i. Income Tax (Profit)

3. Local Tax Code ii. Estate Tax (decedent)

4. Real Property Tax Code iii. Donors Tax (living donor)

Tax Exemption Laws iv. VAT

1. Minimum Wage Law v. OPT

2. Omnibus Investment Code of 1987 (E.O 226) vi. Excise (sin Products) – non essential

3. Barangay Micro-Business Enterprise (BMBE) Law vii. DST

b. Local ELEMENTS OF VALID TAX

i. Real Property Tax 1. Levied by taxing power having jurisdiction over the object of taxation

ii. Professional Tax 2. Do not violate inherent and constitutional limitations

iii. Business Tax (Mayor’s Permit) 3. Uniform and equitable

iv. Community Tax 4. For Public Purpose

v. Taxes on Banks and Other Financial Institutions 5. Proportional in character

SCOPE OF TAXATION 6. Payable in money

1. Comprehensive (extent)

2. Supreme (degree) STAGES OF EXERCISE OF TAXATION POWER

3. Plenary (unrestricted and unlimited) – but not absolutely unlimited 1. Levy or Imposition – enactment of Laws (CONGRESS)

due to limitations. (C&I) Legislative discretion in exercise of taxation:

Determine object of taxation

GAAP vs. Tax Laws Setting tax rate and amount to be collected

GAAP are not laws but mere conventions for fair and Purpose for charging tax

relevant reporting. Kind of tax

Follow Tax law over GAAP when preparing Tax returns Apportionment of tax between national and local

(conflict) Situs of Taxation

Method of Collection

2. Assessment and Collection (Tax liabilities-BIR)

SOURCES OF TAXATION LAWS INHERENT POWERS OF STATE

1. Constitution

2. Statutes and Presidential Decrees Difference Taxation Police Eminent Domain

3. Judicial Decisions and Case laws Authority Gov’t Gov’t Gov’t and Private

4. Executive orders and Batas Pambansa Utilities

5. Administrative Issuances Purpose Support General Public Purpose

Revenue Regulations – defined rules and regulations (signed Gov’t Welfare

by Secretary of Finance/Recommendations of CIR) Persons Community Community/ Owner

Revenue Memorandum Orders – Affected /Individuals Individuals

directives/instructions/guidelines in implementation of tax Amount of Unlimited Limited No amount

laws. Imposition (Cost of imposed (just

Revenue Memorandum rulings –rulings/opinions/ Regulation) compensation)

interpretation of CIR Importance Most Most Important

Revenue Memorandum Circulars – applicability and Important Superior

amplification of laws Rel. with Inferior Superior Superior

Revenue Bulletins – Periodic Issuances by CIR Constitution

BIR rulings – official position of BIR to queries (maybe reverse Limitation Constitutio Public Public purpose

by BIR anytime) nal and interest and and just

Other rulings: Inherent due process compensation

i. VAT rulings *Similarities: necessary, inherent, legislative, ways to interfere private rights and

ii. International Tax Affairs rulings (ITAD) property, independent of Constitution, presuppose equivalent form of

iii. Delegated Authority rulings (DA) compensation, LGU exercise of these powers is limited by National Legislature.

6. Local Ordinances

7. Tax Treaties and Conventions with Foreign Countries

8. Revenue Regulations

TAX COLLECTING SYSTEM 3. Others: Cases require expedient and effective admin and

1. Withholding implementation of assessment and collection of taxes

a. Compensation (employed) – creditable to IT Territoriality of Taxation (within its boundaries)

b. Expanded ( self-employed professionals ex. Doctors) – creditable Exceptions: (within and outside PH)

to IT 1. Income Tax: RC and DC are taxable on income derived

c. Final – Not creditable to IT 2. Transfer Tax: Residents or Citizen are taxable on transfer

d. Gov’t payments (Gov’t and GOCC’s) – net of tax of properties

2. Voluntary International Comity (reciprocity)

3. Assessment/Enforcement (non-compliant tax payers) (Gov’t) Embassies, or consular agencies of foreign gov’t including

(GOCC’s) international orgs and their non-Filipino staff are not

SIMILAR TERMS TO TAX subject to income tax.

1. Revenue – All income collections of gov’t ( Tax and GOCC’s 2. Constitutional Limitations

2. License Fee – Police power/imposed before engagement in activity Due Process of Law (trial and hearing)

3. Toll – charge for use of property o Substantive – reasonable and not oppressive

4. Debt – Private Contracts/ do not lead to imprisonment due to non- o Procedural – opportunity to be heard in proper court

payment/can be paid in kind litigation before judgment

5. Special assessment – land only/appreciation in land/non-payment to Equal protection of law (same circumstances taxed the same)

gov’t do not lead to imprisonment Uniformity rule ( dissimilar circumstances are not taxed the same)

6. Tariffs/Custom Duties- imported and exported goods – progressive tax system

7. Penalty – payment imposed to discourage act Non- Impairment of obligation and contracts

8. Subsidy-monetary aid Non-imprisonment for non-payment of debt or basic community

9. Margin Fee –tax in forex designed to curb the excessive demands upon tax (poll tax) only. (debt: estafa – crime) (non-payment of

our international reserves. additional community tax: tax evasion – imprisonment)

Free Worship rule – tithes and offerings not subject to tax but

Principles of sound Tax System (FAT) income from properties or activities that are commercial in nature

Fiscal Adequacy (sufficient to cover gov’t cost) are taxable

Administrative Feasibility (efficient and effective compliance) Exemption from Property Tax: Properties used PRIMARILY for

o EFPS charitable, religious or educational entities, non-profit cemeteries,

o Substituted filing System for employees church and mosques, lands, buildings and improvements.

o Final Withholding Tax on NRA NRFC (DOCTRINE OF USE)

o AABs (Landbank, BPI etc.) Public money not for religious purpose (separation of the State

Theoretical Justice (ability to pay) – should not be oppressive, unjust or and church)

confiscatory. Note: Compensation to priest working in military, penal

Limitations on the power of taxation institutions, orphanage or leprosarium is not religious

1. Inherent Limitation (PENTI) appropriation.

Public Purpose (common good not for private interest) Exemption from taxes of revenues and assets of non-profit, non-

Exemption of Gov’t stock educational institutions including grants, endowments,

Non-delegation of taxing power – legislative taxing power is donations, or contributions EDUCATIONAL PURPOSES.

vested only to CONGRESS Gov’t educational institutions –exempt from IT

Exceptions: Private educational Institutions – minimal 10% IT

1. Constitution: LGU are allowed to exercise power to tax Congress Granting Tax Exemption – ABSOLUTE MAJORITY OFF ALL

(fiscal autonomy) MEMBERS OF CONGRESS.

2. Tariff and Custom Code : President is empowered to fix Note: Withdrawal of tax exemption only RELATIVE MAJORITY

the amount of tariffs to flexible trade conditions Non-diversification of tax collections (Public Purpose)

Non-delegation of the power of taxation (CONGRESS ONLY)

Note: BIR and Dept. of Finance – only interpret and clarify Types

Supreme Court: Final Judgment and Jurisdiction of Tax cases DIRECT – All elements exist (Income Taxes)

Appropriations, Revenue or Tariff Bills shall originate exclusively in INDIRECT – at least one secondary element exist (National and LGU)

HR, but Senate may propose or concur with amendments

Each LGU’s shall exercise the power to create its own source of MINIMIZATION OF DOUBLE TAXATION

revenue (legislative branch of LGU’s) and shall have share with Tax exemptions

national taxes. Foreign Tax Credit

Tax evasion vs. Tax Avoidance Reciprocity Rule

ESCAPES FROM TAXATION Treaties and Bilateral Agreements

1. Result to loss of Gov’t Revenue

o Tax Evasion (illegal) – under Income Over Expense Legislation of Tax laws

o Tax Avoidance (Legal) – Options/Tax Planning

o Tax Exemption – Tax Holiday/ Immunity BRANCHES OF GOVERNMENT

***All forms of exemptions can be revoked by the Congress except

those granted by Constitution and Contracts. (Implement) (Make) (Interpret)

2. Does not result to loss of Gov’t Revenue Executive Legislative Judiciary

o Shifting (Forward (VAT) ,Backward (Importation), Onward) President Congress Courts

o Capitalization- Value of Asset House of Representatives

o Transformation – eliminate loss or waste to form savings Senate

TAX AMNESTY The Bill becomes law if the

Pardon/absolute forgiveness/retrospective/to enable taxpayer fresh start/Civil and president signed otherwise

Criminal Liability/Conditional Payment of Taxpayer vetoed by president

(Item Veto)

TAX CONDONATION Inaction of president within

Tax remission/forgiveness/prospective (paid portion not refunded)/Civil Liability/No 30 days after date of receipt

Payment required causes the bill to become

law

Situs/Place of Taxation If President vetoed the bill

1. Business Tax – Place of business is conducted 2/3 of the members of

2. Income Tax (Services) – Place rendered Congress is required to

3. Income Tax (Sale of goods) – Place of sale make the bill into a law

4. Property Tax – Location of Property

5. Personal Tax – Place of Residence Impact of taxes in nation building

BASIS OF TAXATION

Double Taxation (taxed twice same tax jurisdiction and same thing)

ELEMENTS

SERVICE

1. Primary: Same OBJECT

2. Secondary: GOV’T PEOPLE

a. Same Tax type

TAXES

b. Same purpose of tax

c. Same taxing jurisdiction

d. Same Tax Period THEORIES OF TAX COST ALLOCATION

Benefit Received

Ability to Pay Tax administration is a system of collecting taxes in accordance with tax policies

o Vertical Equity- Gross (ability/extent) 200k vs. 400k income (Assessment and Collection) it is entrusted to BIR which is under the supervision

o Horizontal Equity- Net (circumstances) with or without child and administration of Dept. of Finance

ADMINISTRATIVE PROVISIONS

LIFE BLOOD DOCTRINE (Tax is essential and indispensable) Requirements for compliance of taxpayer employed or engaged in business:

“Tax is the lifeblood of Gov’t to cover its expenses” BIR FORMS: See Attached File

Tax is imposed even in absence of Constitutional grant (inherent) Registration

Claims for tax exemptions are construed against tax payer a. Appropriate Revenue office (RDO)

Gov’t reserves the right to choose object of taxation b. Secure Tax Identification Number (only one)

Courts are not allowed to interfere collection of taxes Exceptions:

In Income Taxation: 1. FCDU is merely a division of local or foreign bank in the PH is

o Deferred Income – Taxable assigned with another TIN (Final Tax Compliance.

o Capital Expenditures and Prepayments- not allowed as deduction 2. Registered Tax Payer dies – Estate (new TIN)

o Claimable expense with limit – Lower amount Registration Period:

o Multiple Tax Base – Higher Tax Base 1. Within 10 days from date of employment

2. On or before the commencement of business

OTHER FUNDAMENTAL DOCTRINES IN TAXATION 3. Before payment of any tax due

Marshall Doctrine – Police Power/Power to destroy 4. Upon filing of a return or statement of declaration as required in

Holme’s Doctrine – Power to build the Tax Code

Prospectivity of tax laws ***Annual Registration Fee: Php 500 for every separate or distinct establishment

Non Compensation or set-off (off-set) before the last day of January.

Non-assignment of taxes (shifting) Contents of Registration Form:

Imprescriptibility in taxation 1. Tax Payer’s name and Type of Business

Note: 2. Place of Business

1. Collection w/ assessment – 5 years from date of assessment 3. Other Info required by CIR

2. Collection w/o assessment – 3 years from the date the return is BIR FORM 0605 (Payment Form):

required to be filed 1. Annual Registration Fee

3. No return filed/fraudulent – do not prescribe 2. Upon receipt of Assessment notice/collection letter from BIR

Doctrine of estoppel – error of gov’t employee does not bind gov’t BIR FORM 1905 (Application for Registration Update):

Judicial non-interference 1. Used to update taxpayers information (Chang in Tax Type and

Strict Construction of Tax Laws other taxpayers details)

“Taxation is the rule, exemption is the exception” Transfer of Ownership Rules: (Owner dies)

***Vague Tax Law – no tax law 1. No additional payment for remaining period which tax is paid

***Vague Exemption Law – no exemption law 2. Person continue: submit inventories of goods to BIR 30 days

Equitable Recoupment – Tax refund as payment to unsettled tax from death of decedent

liabilities as long as arise from same transactions *same rules if change of name of establishment

Compromise Transfer if Business Place:

CIR – civil and criminal liabilities 1. Same RDO: Form 1905

Collector of Customs – remission of duties 2. Different RDO: Secure necessary tax clearance

Customs Commissioner – subject to approval by Sec. of Finance ***Any tax return currently due must still be filed with the RDO

(fines, surcharge and forfeitures) where taxpayer is presently registered to avoid 25% surcharge due to

Ethical Tax compliance and administration wrong RDO.

Cancellation of Registration: FORM 1905

Printing of Receipts, Sales or Commercial Invoice

Sales or Commercial Invoice – Goods v. Report to Congressional Oversight Committee in matters of

Receipts – Service taxation

Requirements: ***Agents of BIR

1. BIR Authority to Print ( FORM 1906) *Commissioner of Customs – imported goods taxes

2. Other requirements: *Head of Appropriate Gov’t Office-Energy Taxes

a. Serially numbered *AAB’s – Collection of Tax dues

b. Name, business style, TIN, address ***Composition of BIR

c. Other Requirements promulgated by Sec. Of One Commissioner

Finance upon recommendation of CIR (VAT 4 Deputy Commissioner

Taxpayer) i. Legal and Enforcement group

Issuance of Receipts, Sales or Commercial Invoice Rules ii. Operation Group

1. Time of issuance iii. Information System Group

2. Value of sale is Php 25.00 or more required to issue receipt/invoice iv. Resource Management Group

(NON VAT) Regional Revenue Director

3. Receipt is not required: Revenue District Office

a. Below Php 25.00 Revenue Office

b. Exempted by CIR

4. Issuance of Receipt is required POWERS OF BIR COMMISSIONER

a. Payment of rentals, commissions, compensations or fees 1. Interpret provisions of NIRC to be reviewed by Sec. of Finance

b. VAT to VAT sale taxpayers 2. Decide tax cases subject to reversal of CTA (DROP)

5. Name(if any), address of purchaser is required if: a. Disputed assessments

a. Payment of rentals, commissions, compensations or fees b. Refunds

b. VAT to VAT sale taxpayers c. Penalties

6. Validity of receipt/invoice as to BIR (3 years) d. Other NIRC and Special Laws under BIR

Certificate of Payment (Rules) 3. Obtain info and summon and take testimony of persons to effect tax

***Annual Registration Fee – displayed in place of business. collection (assessment)

**** Without fixed place – kept in possession of the holder and a. Correctness

presented upon demand by revenue officer b. Tax Liability

c. Compliance

Organization of BIR, BOC, Local Gov’t Tax Collecting Units, BOI and PEZA Authorized acts:

BIR 1. Examine book or records

Under supervision of Dept. of Finance which is under the Office of 2. Obtain any info from other persons

President 3. Summon employee/person in custody of records to give

Primary in-charge to assess and collect national taxes testimony

Enforce all forfeitures, penalties and fines 4. Take testimony of person concerned

Execute judgment in all cases decided in its favor by CTA and 5. Cause revenue officers/employees to canvass of any revenue

ordinary courts district

Give effect to and administer the supervisory and police power 4. To make assessment and prescribe additional requirement for tax admin

conferred to it by the Code or Other Laws. and enforcement

i. Assign officers to other duties 5. Examine returns and determine tax due (Returns can be amended within 3

ii. Provision and distribution of forms, receipts, certificates, years from date of filling/due date of filing whichever is earlier, except if

stamps, etc. to proper officials your already under assessment)

iii. Issuance of receipts and clearance 6. Conduct inventory taking

iv. Submission of Annual Report to Congress 7. Prescribe presumptive gross sales when:

a. Tax payer failed to issue receipts Commissioner

b. CIR believes fraudulent return (understatement of tax due) Deputy Commissioner

8. Terminate tax period: o Customs Revenue Collection Monitoring Group

a. Retiring from business o Customs Assessment and Operations Coordinating Group

b. Intended to leave PH o Intelligence and Enforcement Group

c. Intending to hide, remove or conceal property o Internal Administration Group

d. Intending to obstruct collection of tax or same effect o Management System Technology Group

9. Prescribe real property values (ZONAL VALUE) 14 District Collectors

*** Whichever higher Zonal vs. Assessed Value (City/Province Assessor *** Appointment of Commissioner and Deputy Commissioners (By the President)

Office)

10. Compromise tax liabilities of taxpayer LOCAL GOV’T TAX COLLECTING UNITS

11. Inquire bank deposits under the ff. Scope: Provinces, municipalities, cities and barangays

a. Determine gross estate Sanggunian: Local Taxing Authority (Thru Local Ordinances)

b. Substantiate financial incapacity (compromise) Treasurer of LGU: Venue of filing local tax, fees and charges

12. Accredit and register tax agents (Expanded withholding tax) Timing: First 20 days of January or of each subsequent quarters as the case maybe

13. Refund tax ***Sanggunian concerned may extend filing for justifiable reason but for only a

14. Abate or Cancel tax liabilities period not exceeding six months

15. Prescribe additional procedures/requirements

16. Delegate Powers to any subordinate office with rank equivalent to division BOARD OF INVESTMENTS (BOI)

chief of an office Role: Promotion of investments in PH by assisting Filipino or Foreign investors to

***Non-delegated Power of CIR venture/Supervise the grant of tax incentives (Omnibus Investment Code)/Attached

a. Promulgation of Regulations to Sec. of Finance agency of DTI

b. Power to issue rulings of first impression or to reverse/revoke/modify Composition: (7) Governors:

existing BIR rulings DTI Secretary (Chairman); Vice Chairman (Appointed by President); (3)

c. Power to compromise or abate tax due Undersecretaries of DTI (Appointed by President); (3) representatives from other

Exception: gov’t agencies and private sectors

Regional Evaluation Boards may compromise tax liabilities

Assessments issued by Regional offices involving basic PHILIPPINE ECONOMIC ZONE AUTHORITY

deficiency of 500,000 or less Purpose: Promote investments in export-oriented manufacturing industries

Minor criminal violations discovered by regional or district ***PEZA registered enterprises enjoy TAX HOLIDAY for certain years (Exemption

officials from import or export taxes including local taxes.

Composition of REV *** Also attached agency of DTI

Regional Director (chairman) *** Also assist investors who locate facilities inside selected areas in the country

Assistant RD (PEZA Special Economic Zones) – business process outsourcing and knowledge

Heads of Legal/Assessment and Collection Division process outsourcing firms.

RDO of the taxpayer Composition: Secretary of DTI (chairman); Vice Chairman (Director General of PEZA;

d. Power to assign and reassign revenue officers to other duties Members of Board (Undersecretaries of nine (9) key gov’t departments

Revenue officer – excisable articles (2 years) Incentives Offered:

Revenue officer – Assessment and Collection function (3 Fiscal

years) o Income tax holiday (100% exempt from CIT)

Revenue officer – Special duties (1 year) o Tax and Duty free importation of raw materials

BUREAU OF CUSTOMS (International Taxes) o Exempt from wharfage dues and export tax, import or fees

***Collection of Tariffs and Vat on Importation

***Composition

o VAT zero rating of local purchases subject to compliance BIR and

PEZA requirements

o Exempt from Local Taxes

o Exemption in administering Expanded Withholding Tax

Non Fiscal

o Simplified import-export procedure, extended VISA facilitation

assistance to foreign national lands

o Spouses and dependents, special VISA multiple entry privileges

and others.

Ready to Occupancy Business Locations in World-Class Economic Zones

and IT parks and buildings.

OTHER TAX ENFORCERS:

LTO (Registration and Motor Vehicle Tax) – Also Tax Admin

Authorize Accredited Banks (Tax Dues)

Courts

Register of Deeds

Secretary of Public Works and Highways

LARGE TAXPAYERS (UNDER SUPERVISION OF LARGE TAXPAYER SERVICE)

***Non-Large (respective RDO’s)

Types:

As to Payment

o VAT/PT – 200,000/quarter

o Excise(preceding year)/Income(preceding year)/WT(all

types)/DST(aggregate) – 1,000,000/year

As to Financial conditions and operations

o Gross receipts/Sales – 1,000,000,000

o Net worth – 300,000,000

o Gross Purchases(preceding year) – 800,000,000

o Top Corporate Taxpayer listed and Published by SEC

Automatic LTP:

1. Branches of LTP

2. Subsidiaries, Affiliates and entities of conglomerates or group of LTP

3. Surviving Company (Merger/Consolidation)

4. Corporation who absorbs operations of bankrupt LTP

5. Corp. with capitalization if at least 300,000,000 with SEC

6. Multinational Enterprise with capitalization if at least 300,000,000

7. Publicly Listed Corp.

8. Universal, Commercial and Foreign Banks (even as branch whole entity LTP)

9. Banking, Insurance, Telecom, Utilities, Petroleum, Tobacco and Alcohol Industry

(100,000,000 Capital)

10. Metallic Materials Corporations.

You might also like

- Limitation of Taxation Power A. Inherent Limilations: Resident Citizen and Domestic CorporationDocument5 pagesLimitation of Taxation Power A. Inherent Limilations: Resident Citizen and Domestic CorporationEunice JusiNo ratings yet

- BA CORE 4 Module in Income and Business Taxation 7.12.20Document119 pagesBA CORE 4 Module in Income and Business Taxation 7.12.20Andrea Kriselle Abesamis CristobalNo ratings yet

- General Principles AND National Taxation: As Lectured by Atty. Rizalina LumberaDocument137 pagesGeneral Principles AND National Taxation: As Lectured by Atty. Rizalina LumberaMarvin Marciano DiñoNo ratings yet

- Coursework 1: Module: Business Communication Module Code: Sbl-105 Module Leader: Patience ConlonDocument13 pagesCoursework 1: Module: Business Communication Module Code: Sbl-105 Module Leader: Patience ConlonLame JoelNo ratings yet

- Tax 1: Unit 1 Chapter 2 TaxesDocument9 pagesTax 1: Unit 1 Chapter 2 TaxesJamaica ManilaNo ratings yet

- CH 2 TaxationDocument7 pagesCH 2 Taxationshannethy muñozNo ratings yet

- Incotax PDFDocument7 pagesIncotax PDFLara LaquiNo ratings yet

- 1 Introduction To GSTDocument20 pages1 Introduction To GSTNovel Bipin Kr SawNo ratings yet

- What is taxation? An overviewDocument28 pagesWhat is taxation? An overviewHi HelloNo ratings yet

- Tax 1 CompleteDocument95 pagesTax 1 CompleteRia EsguerraNo ratings yet

- General Principles of TaxationDocument5 pagesGeneral Principles of TaxationDenise MedranoNo ratings yet

- TAXATION Chapter 1-2Document3 pagesTAXATION Chapter 1-2shielamaemae0No ratings yet

- Taxation Fundamentals NotesDocument3 pagesTaxation Fundamentals Noteslayla scotNo ratings yet

- Income Tax Summary TulibasDocument66 pagesIncome Tax Summary TulibasVan DahuyagNo ratings yet

- Taxation Law Review Prelims Finals PeriodDocument118 pagesTaxation Law Review Prelims Finals Periodmarcus.pebenitojrNo ratings yet

- AC 2202 - Notes (1 TO 4)Document40 pagesAC 2202 - Notes (1 TO 4)SMT awesomeNo ratings yet

- 1) Specific. Tax of Fixed Amount Imposed by The Head or Number, or by Some Standard of Weight orDocument4 pages1) Specific. Tax of Fixed Amount Imposed by The Head or Number, or by Some Standard of Weight orSha LeenNo ratings yet

- Nature of TaxesDocument3 pagesNature of TaxesCaliboso DaysieNo ratings yet

- Income Taxation NotesDocument14 pagesIncome Taxation NotesbrennaNo ratings yet

- TAXATION ReviewerDocument18 pagesTAXATION ReviewerAyessa GayamoNo ratings yet

- Taxa 1Document17 pagesTaxa 1Cheenee Nuestro SantiagoNo ratings yet

- Supplemental Note #1 - General Principles of Taxation, Intro To Income TaxationDocument9 pagesSupplemental Note #1 - General Principles of Taxation, Intro To Income TaxationRicojay FernandezNo ratings yet

- Income TaxationDocument10 pagesIncome TaxationCamille Anne GalvezNo ratings yet

- TAX-1802 (Basic Principles in Taxation 2)Document3 pagesTAX-1802 (Basic Principles in Taxation 2)bulasa.jefferson16No ratings yet

- Taxation ReviewerDocument145 pagesTaxation ReviewerNeka Mariel Zarceno StaAnaNo ratings yet

- General PrinciplesDocument5 pagesGeneral PrinciplesGraceGolimlimNo ratings yet

- Eneral Rinciples Imitation Axing Ower: Taxation Ii Finals Atty. Kim Aranas Eh 402Document26 pagesEneral Rinciples Imitation Axing Ower: Taxation Ii Finals Atty. Kim Aranas Eh 402John MarstonNo ratings yet

- INCOME TAXATION Tabag Summary Chapter 1 and Chapter 2 Docx (Repaired)Document3 pagesINCOME TAXATION Tabag Summary Chapter 1 and Chapter 2 Docx (Repaired)Beus0% (1)

- TAX QUIZ 1 ReviewerDocument8 pagesTAX QUIZ 1 ReviewerArrianne ObiasNo ratings yet

- BUSLAW3 Midterm ReviewerDocument3 pagesBUSLAW3 Midterm ReviewerJanineNo ratings yet

- Taxation Notes (Tabag)Document10 pagesTaxation Notes (Tabag)Mary Angeline SalvaneraNo ratings yet

- Taxation Reviewer General Principles of Taxation: 2. Legislative in CharacterDocument8 pagesTaxation Reviewer General Principles of Taxation: 2. Legislative in CharacterTomas FloresNo ratings yet

- Remedies in Taxation Reviewer (Japatax)Document14 pagesRemedies in Taxation Reviewer (Japatax)Janine AranasNo ratings yet

- Group 12Document18 pagesGroup 12Dump LenseNo ratings yet

- Inbound 3957617422269830470Document59 pagesInbound 3957617422269830470Ashley BrozasNo ratings yet

- FYCE BM1804 - Income Taxation HandoutDocument17 pagesFYCE BM1804 - Income Taxation HandoutLisanna DragneelNo ratings yet

- Purposes of Taxation A. The Primary Purpose of Taxation Is To Raise RevenuesDocument5 pagesPurposes of Taxation A. The Primary Purpose of Taxation Is To Raise RevenuesRoswin MatigaNo ratings yet

- Module-02-Taxes, Laws, Systems and AdministrationDocument8 pagesModule-02-Taxes, Laws, Systems and AdministrationElle LegaspiNo ratings yet

- INCOME TAXATION Tabag Summary Chapter 1 and Chapter 2 PDFDocument3 pagesINCOME TAXATION Tabag Summary Chapter 1 and Chapter 2 PDFPinky DaisiesNo ratings yet

- Summary Chapters 1&2 - Income Taxation Summary Chapters 1&2 - Income TaxationDocument4 pagesSummary Chapters 1&2 - Income Taxation Summary Chapters 1&2 - Income TaxationSha LeenNo ratings yet

- Estate Tax ExplainedDocument3 pagesEstate Tax ExplainedAbraham ChinNo ratings yet

- Taxation LawsDocument7 pagesTaxation Lawsrhenzadrian.11No ratings yet

- Introduction to Canadian Income Tax LawDocument113 pagesIntroduction to Canadian Income Tax LawJoel McleishNo ratings yet

- Tax Assign1Document4 pagesTax Assign1Leoreyn Faye MedinaNo ratings yet

- Chapter IIDocument12 pagesChapter IIshirileon08No ratings yet

- Fundamentals of TaxationDocument13 pagesFundamentals of TaxationKatrina MaglaquiNo ratings yet

- H03 - Principles of Income TaxationDocument10 pagesH03 - Principles of Income Taxationnona galidoNo ratings yet

- Tax 1 Income Taxation Midterm ReviewerDocument6 pagesTax 1 Income Taxation Midterm ReviewerMiaNo ratings yet

- Module in Income and Business TaxationDocument126 pagesModule in Income and Business TaxationKatryn Mae Yambot CabangonNo ratings yet

- Ethics Reviewer (Finals)Document4 pagesEthics Reviewer (Finals)Jean SamonteNo ratings yet

- Income Tax ReviewerDocument28 pagesIncome Tax ReviewerJestine Mae ViloriaNo ratings yet

- Taxation Law NotesDocument15 pagesTaxation Law NotesKuracha LoftNo ratings yet

- TAX REVIEW - Activity 1 - Answer KeyDocument10 pagesTAX REVIEW - Activity 1 - Answer KeyCorin Ahmed CorinNo ratings yet

- Income Taxation - General Principles Review NotesDocument8 pagesIncome Taxation - General Principles Review NotesJohn Lemuel CabiliNo ratings yet

- The Inherent Powers of Government and TaxationDocument5 pagesThe Inherent Powers of Government and TaxationElaiza LozanoNo ratings yet

- I. General PrinciplesDocument3 pagesI. General PrinciplesMarian Gae MerinoNo ratings yet

- BAR 2023 Coverage in TaxationDocument14 pagesBAR 2023 Coverage in TaxationkbayudanNo ratings yet

- Income Taxation Tabag Summary Chapter 1 and Chapter 2Document4 pagesIncome Taxation Tabag Summary Chapter 1 and Chapter 2angellachavezlabalan.cpalawyerNo ratings yet

- Part 4Document17 pagesPart 4Marc Lester Hernandez-Sta AnaNo ratings yet

- Consolidated Syllabus in Taxation As of January, 2019Document6 pagesConsolidated Syllabus in Taxation As of January, 2019Angela ParadoNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Midterms Quiz 2 Answers PDFDocument7 pagesMidterms Quiz 2 Answers PDFFranz Campued100% (1)

- Midterm Quiz 2 PDFDocument5 pagesMidterm Quiz 2 PDFFranz Campued100% (1)

- Finals Quiz 1 PDFDocument6 pagesFinals Quiz 1 PDFFranz CampuedNo ratings yet

- AFAR Mastery Part5 PDFDocument7 pagesAFAR Mastery Part5 PDFFranz CampuedNo ratings yet

- Finals Quiz 2Document6 pagesFinals Quiz 2Franz CampuedNo ratings yet

- Financial Statements AnalysisDocument8 pagesFinancial Statements AnalysisFranz CampuedNo ratings yet

- AFAR Mastery Part1 PDFDocument3 pagesAFAR Mastery Part1 PDFFranz CampuedNo ratings yet

- Midterms Quiz 2 - 20181206074625Document5 pagesMidterms Quiz 2 - 20181206074625Franz CampuedNo ratings yet

- Variable and Absorption CostingDocument4 pagesVariable and Absorption CostingFranz CampuedNo ratings yet

- AFAR Mastery Part4 PDFDocument3 pagesAFAR Mastery Part4 PDFFranz CampuedNo ratings yet

- CVP Analysis and Marginal Costing and BEPDocument2 pagesCVP Analysis and Marginal Costing and BEPFranz CampuedNo ratings yet

- 7consideration of Internal ControlDocument8 pages7consideration of Internal ControlFranz CampuedNo ratings yet

- MAS OverviewDocument4 pagesMAS OverviewFranz CampuedNo ratings yet

- Fa 3 2014-CC PDFDocument207 pagesFa 3 2014-CC PDFColor BlueNo ratings yet

- Management Information and Accounting SystemsDocument5 pagesManagement Information and Accounting SystemsFranz CampuedNo ratings yet

- Budgeting BasicsDocument4 pagesBudgeting BasicsFranz CampuedNo ratings yet

- Standard Costing and Variance AnalysisDocument3 pagesStandard Costing and Variance AnalysisFranz CampuedNo ratings yet

- 12the Auditors Report On FS (Samples)Document22 pages12the Auditors Report On FS (Samples)Franz CampuedNo ratings yet

- Passive income tax rates for individuals and corporationsDocument1 pagePassive income tax rates for individuals and corporationsFranz CampuedNo ratings yet

- Cost Concepts and AnalysisDocument3 pagesCost Concepts and AnalysisFranz CampuedNo ratings yet

- 8assertions, Audit Procedures and Audit EvidenceDocument10 pages8assertions, Audit Procedures and Audit EvidenceFranz CampuedNo ratings yet

- 6audit PlanningDocument13 pages6audit PlanningFranz CampuedNo ratings yet

- CPALE Syllabi 2018 PDFDocument32 pagesCPALE Syllabi 2018 PDFLorraine TomasNo ratings yet

- Responsibility Accounting: Segment Margin Is The Same As Segment Income or Segment ProfitDocument2 pagesResponsibility Accounting: Segment Margin Is The Same As Segment Income or Segment ProfitFranz CampuedNo ratings yet

- 11completing The AuditDocument7 pages11completing The AuditFranz CampuedNo ratings yet

- Understanding AuditingDocument13 pagesUnderstanding AuditingFranz CampuedNo ratings yet

- 5preliminary Engagement ActivitiesDocument5 pages5preliminary Engagement ActivitiesFranz CampuedNo ratings yet

- 9audit SamplingDocument9 pages9audit SamplingFranz CampuedNo ratings yet

- 3fundamentals of Assurance EngagementsDocument7 pages3fundamentals of Assurance EngagementsFranz CampuedNo ratings yet

- Antalya BBQ KitchenDocument1 pageAntalya BBQ KitchencanmaclondonNo ratings yet

- Unit 2 Marketing ResearchDocument6 pagesUnit 2 Marketing ResearchDr Priyanka TripathyNo ratings yet

- Assessment Test Week 6 (ECO 2) - Google FormsDocument3 pagesAssessment Test Week 6 (ECO 2) - Google FormsNeil Jasper CorozaNo ratings yet

- 14 Determining Project Progress and Results & Finishing The Projects and Realizing The BenefitsDocument41 pages14 Determining Project Progress and Results & Finishing The Projects and Realizing The BenefitsFarrukh AhmedNo ratings yet

- Abm NewDocument46 pagesAbm NewSafiyya DevoraNo ratings yet

- Survey On Customer Satisfaction of Medical Tourism in INDIA With Special Reference To Kerela StateDocument41 pagesSurvey On Customer Satisfaction of Medical Tourism in INDIA With Special Reference To Kerela Statebapunritu0% (1)

- PAS 14 SEGMENT REPORTDocument3 pagesPAS 14 SEGMENT REPORTrandyNo ratings yet

- Oa Sba 1Document18 pagesOa Sba 1Darion JeromeNo ratings yet

- Project Management FundamentalsDocument25 pagesProject Management FundamentalsAmo Frimpong-Manso100% (1)

- Rosetta NetDocument24 pagesRosetta NetYashpal SinghNo ratings yet

- FiboDocument49 pagesFiboCerio DuroNo ratings yet

- 15.1 Shopping On Instagram PDFDocument6 pages15.1 Shopping On Instagram PDFMuhammad FaisalNo ratings yet

- G 4.1 2019 Steel Bridge Fabrication QC - Qa GuidelinesDocument48 pagesG 4.1 2019 Steel Bridge Fabrication QC - Qa Guidelinesniinee100% (1)

- Procurement of Works, Service and Equipment: Construction Project Engineering and AdministrationDocument57 pagesProcurement of Works, Service and Equipment: Construction Project Engineering and AdministrationJoseph Rana SangpangNo ratings yet

- Maruti Suzuki 1 - 5Document78 pagesMaruti Suzuki 1 - 5sedhubbaNo ratings yet

- Pricing Decisions: Global MarketingDocument19 pagesPricing Decisions: Global MarketingAsif_Jamal_9320No ratings yet

- Self-Employment Tax 2021Document2 pagesSelf-Employment Tax 2021Finn KevinNo ratings yet

- Sir Sabir Ability Center Test No.1 General MathsDocument2 pagesSir Sabir Ability Center Test No.1 General MathsParisa UjjanNo ratings yet

- Adani acquires Krishnapatnam Port for Rs 13,572 CrDocument21 pagesAdani acquires Krishnapatnam Port for Rs 13,572 CrNUTHI SIVA SANTHANNo ratings yet

- Examination Session 2019-20: Exam Form # Verification #Document2 pagesExamination Session 2019-20: Exam Form # Verification #arjun guptaNo ratings yet

- Accounting for Investments under AS 13Document6 pagesAccounting for Investments under AS 13anshNo ratings yet

- GMM Pfaudler to host OFS update callDocument1 pageGMM Pfaudler to host OFS update callSwap gotuNo ratings yet

- Shopzilla Clone 07 July 2009Document4 pagesShopzilla Clone 07 July 2009Suvrajit BanerjeeNo ratings yet

- List of Nodal OfficersDocument52 pagesList of Nodal OfficersSunny SinghNo ratings yet

- Periode: 11-MAY-2020 S/D 11-MAY-2020 Shipper: 03-Services: All Cnote Type: All Payment Type: ALL Username: All UsersDocument3 pagesPeriode: 11-MAY-2020 S/D 11-MAY-2020 Shipper: 03-Services: All Cnote Type: All Payment Type: ALL Username: All UsersElis Ummu HafshahNo ratings yet

- J910 DT03 P0ZEN 040001 SQCP 0010 (Quality Control Procedure Index) - Rev.0Document3 pagesJ910 DT03 P0ZEN 040001 SQCP 0010 (Quality Control Procedure Index) - Rev.0Budi SetiawanNo ratings yet

- State Bank of IndiaDocument5 pagesState Bank of IndiaBhavika GuptaNo ratings yet

- Pro Forma Problem Forecasting, Data, Table, Goal Seek: Assumptions: Regular Lease Automated MachineryDocument2 pagesPro Forma Problem Forecasting, Data, Table, Goal Seek: Assumptions: Regular Lease Automated MachineryMarjhon TubillaNo ratings yet

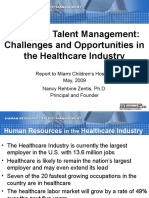

- Healthcare Talent Management Strategies for GrowthDocument25 pagesHealthcare Talent Management Strategies for GrowthShweta_Shinde_8051No ratings yet