Professional Documents

Culture Documents

PAS 14 SEGMENT REPORT

Uploaded by

randyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PAS 14 SEGMENT REPORT

Uploaded by

randyCopyright:

Available Formats

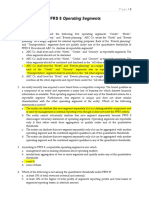

PAS 14 SEGMENT REPORTING

1. It is a distinguishable component of an enterprise that is engaged in providing an individual products or service or a

group of related product or service

a. business segment b. geographical segment c. segment reportable segment

2. In financial reporting for segments of a business enterprise, the segment results includes a portion of

a. Interest expense c.Indirect operating expenses

b. Extraordinary losses d. General corporate expenses

3. The method used to determine what information to report for business segments is referred to as

a. Segment approach b. Management approach c. Operating approach d. Enterprise approach

4. A group is organized into a number of business divisions across the world. The group has two main classes of

business: insurance and banking. The management Board receives information from each business division on a quarterly

basis and wishes to report segmental information on the basis of these divisions. What should be the group’s reporting of

the primary segmental information?

a. The worldwide business divisions

b. The classes of business

c. The entity should make full disclosure on the basis of the worldwide divisions and the classes of business

d. It would depend on the different risks and rewards but is likely to be the different classes of business.

5. An entity is in the entertainment industry and organizes outdoor concerts in four different areas of the world: Europe,

North America, Australia, and Japan. The entity reports to the board of directors on the basis of each of the four regions.

The concerts are two types: popular music and classical music. What is the appropriate basis for segment reporting in this

entity?

a. The segments should be reported by class of business, that is popular and classical music.

b. The segments should be reported by region, so Australia and Japan would be combined

c. The segment information should be reported as North America and the rest of the world.

d. Segment information should be reported for each of the four different regions.

6. Segment assets include all of the following, except

a. Income tax assets

b. Goodwill directly attributable to a segment

c. Operating assets shared by two or more segments

d. Current assets used in the operating activities of the segment

7. What is the approach of looking into an enterprise’s organizational and management structure and its financial

reporting system in order to identify the enterprise’s geographical and business segments?

a. Enterprise approach c. Operating approach

b. Segment approach d. Management approach

8. A business or geographical segment is a reportable segment if a majority of its revenue is earned from sales to

external customers and (choose the incorrect one)

a. Segment internal and external revenue is 10% or more of total internal and external revenue of all segments

b. Segment external revenue is 10% or more of total internal and external revenue of all segments

c. Segment result is 10% or more of the combined result of all segments in profit or combined result of all segments in

loss, whichever is greater in absolute amount

d. Segment assets are 10% or more of the total assets of all segments

9. Under IAS 14 Segment Reporting, where a segment is not primarily of a financial nature, segment revenue will include:

a. interest income; b. dividend income; c. gain on sale of investments; d. an entity’s share of profit of

associates.

10. According to IAS 14 Segment Reporting, segment revenue includes all of the following items:

I. A joint venturer’s share of the revenue of a jointly controlled entity that is accounted for by

proportionate consolidation.

II. An entity’s share of profits or losses of associates.

III. An entity’s share of other investments accounted for under the equity method.

IV. Gains on the extinguishment of debt.

a. I, II, III and IV; b. I, II and III only; c. III and IV only; d. II and III only.

11. Under IAS 14 Segment Reporting, segment expense include:

a joint venturer’s share of the expenses of a jointly controlled entity that is accounted for by a proportionate

consolidation;

b. income tax expense;

c. interest, unless the segment’s operations are primarily of a financial nature;

d. general administrative expenses that relate to the entity as a whole.

12. Under IAS 14 Segment Reporting, segment result is described as:

a. total segment income;

b. segment revenue less segment expense;

c. segment profit after any adjustments for minority interests;

d. segment profit after any adjustments for income tax.

13. According to IAS 14 Segment Reporting, segment assets do not include:

a. income tax assets;

b. a joint venturer’s share of the operating assets of a jointly controlled entity that is accounted for by proportionate

consolidation;

c. investments accounted for under the equity method where the profit or loss from such investments is included in

segment revenue;

d. operating assets employed by a segment in its operating activities that can be allocated to the segment on a

reasonable basis.

14. According to IAS 14 Segment Reporting, segment liabilities exclude:

a. liabilities that result from the operating activities of a segment that are directly attributable to a segment;

b. interest bearing liabilities if the segment result excludes interest expense;

c. income tax liabilities;

d. a joint venturer’s share of the liabilities of a jointly controlled entity that is accounted for by proportionate

consolidation.

15. Under IAS 14 Segment Reporting, a segment is reportable if a majority of its sales are to external customers and its:

a. revenue from external customers is 10% or more of total revenue;

b. result is 5% or more of the combined result of all segments;

c. liabilities are 5% or more of total liabilities;

d. assets are 5% or more of total assets.

16. According to IAS 14 Segment Reporting, if an entity has two segments and the primary segment is a geographic

segment, then the secondary segment will be:

a. a business segment;

b. a organisational segment;

c. an economic segment;

d. a financial segment.

17. Cherry Group has operations in three different geographic locations. It has total assets as follows:

Region 1 P400 000

Region 2 P80 000

Region 3 P20 000

The reportable geographic segments are:

a. All regions are reportable segments;

b. Region 1 and 2 are the only reportable segments;

c. Regions 2 and 3 are the only reportable segments;

d. Region 1 is the only reportable segment.

18. Under IAS 14 Segment Reporting, separate segments of an entity must be identified as reportable segments until at

least:

a. 100% of total entity result is included;

b. 80% of total entity liabilities are included;

c. 75% of total entity revenue is included;

d. 70% of total entity assets are included.

19. When an entity’s primary segment format is geographical segments, in relation the segment result, it is required to

make the following disclosures:

a. segment result by location of assets;

b. segment result by location of customers;

c. segment result by location of business segment;

d. segment result after tax.

20. If an entity’s primary segment format is geographical segments by location of customers, under IAS 14 Segment

Reporting, it is required to make the following disclosures:

a. depreciation and amortisation by location of assets;

b. depreciation and amortisation by location of liabilities;

c. depreciation and amortisation by business segment;

d. depreciation and amortisation expense, by location of customers.

21. A geographical segment may be

a. a single coutry

b. a group of 2 or more countries

c. a or b

d. neither a nor b

22. It is a business segment or a geographical segment for which segment information is required to be disclosed

a. Reportable segment b. Accountable segment c. Measurable segment d. Ordinary segment

23. In financial reporting of segment data, which of the following items is used in determining segment’s operating

income?

a. Income tax expense b. Sales to other segments c. General corporate expense d. Gain or loss on discontinued

operations

24.

ANSWER KEY:

1. A

2. C

3. B

4. D

5. D

6. A

7. D

8. B

9. D

10. B

11.A

12.B

13.A

14. C

15. A

16. A

17. B

18. C

19. A

20. D

21. C

22.

You might also like

- PFRS 8 Segment Reporting EssentialsDocument7 pagesPFRS 8 Segment Reporting EssentialsCyrus IsanaNo ratings yet

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- PFRS 8 Operating Segment DisclosuresDocument10 pagesPFRS 8 Operating Segment DisclosuresDip PerNo ratings yet

- PFRS 8-17 Conceptual Framework and Accounting StandardsDocument13 pagesPFRS 8-17 Conceptual Framework and Accounting StandardsJea Baroy50% (2)

- Ifrs 8 Operating SegmentsDocument1 pageIfrs 8 Operating SegmentsMark Lord Morales BumagatNo ratings yet

- Useful To The Users of The Financial StatementsDocument3 pagesUseful To The Users of The Financial StatementsBrian VillaluzNo ratings yet

- OPERATING SEGMENT With ANSWERSDocument8 pagesOPERATING SEGMENT With ANSWERSRaven Sia100% (1)

- Chapter 20 - Operating Segments: Question 20-16 Multiple Choice (PFRS 8)Document2 pagesChapter 20 - Operating Segments: Question 20-16 Multiple Choice (PFRS 8)Asi Cas JavNo ratings yet

- Reporting Segment and Interim Financial PeriodsDocument20 pagesReporting Segment and Interim Financial PeriodsM Rafi PriyambudiNo ratings yet

- AS 17 Segment Reporting Key RequirementsDocument35 pagesAS 17 Segment Reporting Key RequirementsrsivaramaNo ratings yet

- Final PB ToaDocument6 pagesFinal PB ToaYaj CruzadaNo ratings yet

- AS 17 Segment Reporting - Objective Type Question PDFDocument44 pagesAS 17 Segment Reporting - Objective Type Question PDFrsivaramaNo ratings yet

- PFRS 8 Operating Segments ReviewDocument3 pagesPFRS 8 Operating Segments ReviewGlen JavellanaNo ratings yet

- Chapter 19 - Operating SegmentsDocument11 pagesChapter 19 - Operating Segmentsjr7mondo7edoNo ratings yet

- Q2 Sce, Sci AkDocument6 pagesQ2 Sce, Sci AkGraceila CalopeNo ratings yet

- Module Two QuizzerDocument23 pagesModule Two QuizzerFery AnnNo ratings yet

- Chapter 20 - Operating Segments: QUESTION 20-15 Multiple Choice (PFRS 8)Document3 pagesChapter 20 - Operating Segments: QUESTION 20-15 Multiple Choice (PFRS 8)Amiel Christian MendozaNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionYan DumalaganNo ratings yet

- Ifrs 8Document11 pagesIfrs 8TasminNo ratings yet

- Part 2 - ProblemsDocument4 pagesPart 2 - ProblemsLayla MainNo ratings yet

- 1 PasDocument2 pages1 PasEliz QilNo ratings yet

- Operating SegmentDocument24 pagesOperating SegmentGelaNo ratings yet

- Segment Reporting-As17: Compiled By: - AKHIL KOHLI (MBA - Marketing) MANJU (MBA - Finance)Document32 pagesSegment Reporting-As17: Compiled By: - AKHIL KOHLI (MBA - Marketing) MANJU (MBA - Finance)AmolNo ratings yet

- ACYFAR1 CE On PAS1 (IAS1) Presentation of FSDocument4 pagesACYFAR1 CE On PAS1 (IAS1) Presentation of FSElle KongNo ratings yet

- As-17 Segment Reporting: Segment Revenue: SR - Includes ExcludesDocument5 pagesAs-17 Segment Reporting: Segment Revenue: SR - Includes ExcludesRajesh BhatiaNo ratings yet

- 02 Objective Type IFRS 8 Operating Segments B22Document4 pages02 Objective Type IFRS 8 Operating Segments B22Haris IshaqNo ratings yet

- Ifrs 8Document3 pagesIfrs 8Samantha IslamNo ratings yet

- Segment ReportingDocument45 pagesSegment ReportingNidhi AnandNo ratings yet

- Segment Reporting-As17: Ca. Pankaj AgrwalDocument41 pagesSegment Reporting-As17: Ca. Pankaj AgrwalV ArvindNo ratings yet

- Accounting Standard 17Document8 pagesAccounting Standard 17Aram SivaNo ratings yet

- Interim and Segment ReportingDocument6 pagesInterim and Segment Reportingallforgod19No ratings yet

- Cfas Final Exam QuestionnaireDocument9 pagesCfas Final Exam Questionnaire2ND MobileLegendNo ratings yet

- Reporting and SegmentsDocument3 pagesReporting and SegmentsHortanNo ratings yet

- AS 17 Segment Reporting OverviewDocument31 pagesAS 17 Segment Reporting OverviewAthira100% (1)

- Advanced Accounting 10th Edition Hoyle Solutions ManualDocument29 pagesAdvanced Accounting 10th Edition Hoyle Solutions Manualcliniqueafraidgfk1o100% (22)

- BY DR - Pranav SaraswatDocument18 pagesBY DR - Pranav SaraswatsaraswatpranavNo ratings yet

- Segment Reporting RequirementsDocument4 pagesSegment Reporting RequirementsSHIENA TECSONNo ratings yet

- Segment AnalysisDocument53 pagesSegment AnalysisamanNo ratings yet

- 2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (B)Document10 pages2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (B)ahmedNo ratings yet

- 16 - Discontinued OperationsDocument3 pages16 - Discontinued OperationsJessaNo ratings yet

- Chapter 37 IntaccDocument23 pagesChapter 37 IntaccShiela DimaculanganNo ratings yet

- Advanced Accounting 9th Edition Hoyle Solutions ManualDocument33 pagesAdvanced Accounting 9th Edition Hoyle Solutions Manualcemeteryliana.9afku100% (23)

- Chapter 08 IMSMDocument31 pagesChapter 08 IMSMZachary Thomas Carney100% (1)

- Operating Segments PDFDocument4 pagesOperating Segments PDFAvi MartinezNo ratings yet

- IncomeTax Banggawan2019 Ch13cDocument12 pagesIncomeTax Banggawan2019 Ch13cNoreen Ledda33% (3)

- Ca - Bharat Bhushan B-Com, ACA: Presented byDocument23 pagesCa - Bharat Bhushan B-Com, ACA: Presented byEshetieNo ratings yet

- MC Questions CH 24-1Document19 pagesMC Questions CH 24-1lynn_mach_1No ratings yet

- FA Vol.3 Operating SegmentsDocument7 pagesFA Vol.3 Operating SegmentsRyan SanitaNo ratings yet

- Toa Drill 2 (She, SFP, Sme, Lease, Govt GrantsDocument15 pagesToa Drill 2 (She, SFP, Sme, Lease, Govt GrantsROMAR A. PIGANo ratings yet

- Discontinued Operation, Segment and Interim ReportingDocument22 pagesDiscontinued Operation, Segment and Interim Reportinghis dimples appear, the great lee seo jinNo ratings yet

- PFRS 8 Operating Segments: QuizDocument2 pagesPFRS 8 Operating Segments: QuizGonzalo Jr. RualesNo ratings yet

- Segment Reporting - As17Document41 pagesSegment Reporting - As17nikitsharmaNo ratings yet

- Oci TheoriesDocument5 pagesOci TheoriesArriety KimNo ratings yet

- Contemporary Issues in AccountingDocument45 pagesContemporary Issues in AccountingRamneet Parmar100% (2)

- FARAP-4519Document4 pagesFARAP-4519Accounting StuffNo ratings yet

- Understanding Cash Flow StatementsDocument8 pagesUnderstanding Cash Flow StatementsDecery BardenasNo ratings yet

- Brines Christian Joseph C. Operating SegmentsDocument58 pagesBrines Christian Joseph C. Operating SegmentsAllana MierNo ratings yet

- Segment ReportingDocument1 pageSegment ReportingCharry RamosNo ratings yet

- Advanced Accounting Hoyle 12th Edition Solutions ManualDocument33 pagesAdvanced Accounting Hoyle 12th Edition Solutions ManualBrentBrowncgwzm100% (90)

- Call To Action-ChallengespptDocument20 pagesCall To Action-ChallengespptrandyNo ratings yet

- Lesson 4 Reorganizing The Financial Statements in Practice Part 3Document4 pagesLesson 4 Reorganizing The Financial Statements in Practice Part 3randyNo ratings yet

- Common Good PPT FINAL One HourDocument46 pagesCommon Good PPT FINAL One HourrandyNo ratings yet

- TOA Reviewer (UE) - Bank Reconcilation PDFDocument1 pageTOA Reviewer (UE) - Bank Reconcilation PDFrandyNo ratings yet

- 40 Cross Number Puzzles - Add'n & Sub'n - GR 4-6Document49 pages40 Cross Number Puzzles - Add'n & Sub'n - GR 4-6kjeanpi2550% (4)

- Framework, FS, Assets - TheoriesDocument9 pagesFramework, FS, Assets - TheoriesMonarizza Nicole LopezNo ratings yet

- Oips - List of Resources - Year 1Document5 pagesOips - List of Resources - Year 1AbdulBasitBilalSheikhNo ratings yet

- Revenue Cycle: Sales To Cash CollectionsDocument37 pagesRevenue Cycle: Sales To Cash Collectionsrsh765No ratings yet

- TOA Reviewer (UE) - Biological AssetsDocument1 pageTOA Reviewer (UE) - Biological AssetsTestNo ratings yet

- Oips Stage 1 Workbook AnswersDocument13 pagesOips Stage 1 Workbook AnswersUrim Ndou40% (5)

- Source: CPA Review Schools: Cash, Receivables, Inventory, Biological Assets, PPEDocument7 pagesSource: CPA Review Schools: Cash, Receivables, Inventory, Biological Assets, PPEasdfNo ratings yet

- IAS 7 CASH FLOWDocument7 pagesIAS 7 CASH FLOWRechelleNo ratings yet

- Pas 12 Income TaxesDocument15 pagesPas 12 Income TaxesrandyNo ratings yet

- Theory of AccountsDocument39 pagesTheory of AccountsJohn Elnor Pable JimenezNo ratings yet

- P1 & TOA Quizzer (UE) (Cash & Cash Equivalents) PDFDocument10 pagesP1 & TOA Quizzer (UE) (Cash & Cash Equivalents) PDFrandy0% (1)

- PAS 23 BORROWING COST CAPITALIZATIONDocument1 pagePAS 23 BORROWING COST CAPITALIZATIONYaniNo ratings yet

- Lesson 1 - Cash and Cash EquivalentsDocument2 pagesLesson 1 - Cash and Cash EquivalentsPol Moises Gregory Clamor88% (16)

- Pas 40 Investment PropertyDocument1 pagePas 40 Investment PropertyrandyNo ratings yet

- Pas 17 LeasesDocument1 pagePas 17 LeasesYaniNo ratings yet

- University of San Jose-Recoletos Theory of AccountsDocument9 pagesUniversity of San Jose-Recoletos Theory of AccountsChelseyNo ratings yet

- PAS 8 Accounting PoliciesDocument7 pagesPAS 8 Accounting PoliciesrandyNo ratings yet

- Pas 24 Related Party DisclosuresDocument1 pagePas 24 Related Party DisclosuresJNo ratings yet

- P1 & TOA Quizzer (UE) (Cash & Cash Equivalents) Answer KeyDocument1 pageP1 & TOA Quizzer (UE) (Cash & Cash Equivalents) Answer KeyTestNo ratings yet

- Pas 28 Investment in AssociatesDocument1 pagePas 28 Investment in AssociatesrandyNo ratings yet

- Theory of Accounts - Exam2Document1 pageTheory of Accounts - Exam2Alvin YercNo ratings yet

- Nonprofit and Government Accounting EssentialsDocument2 pagesNonprofit and Government Accounting EssentialsMark Lord Morales BumagatNo ratings yet

- Pas 18 RevenueDocument1 pagePas 18 RevenuerandyNo ratings yet

- Pas 16 PpeDocument2 pagesPas 16 PpeRitchel Casile100% (1)

- Pas 2 InventoryDocument8 pagesPas 2 InventoryMark Lord Morales BumagatNo ratings yet

- The 1,500% Loophole: Better Than BitcoinDocument10 pagesThe 1,500% Loophole: Better Than BitcoinJeff Sturgeon100% (1)

- Basic Concept of TQMDocument2 pagesBasic Concept of TQMChristian lugtuNo ratings yet

- Spare Parts Catalog CIAT 2019Document184 pagesSpare Parts Catalog CIAT 2019samanNo ratings yet

- LEXUSDocument59 pagesLEXUSShubham KhuranaNo ratings yet

- Walled City of Lahore AuthorityDocument2 pagesWalled City of Lahore Authoritydanyal mubashirNo ratings yet

- Math for EconomicsDocument6 pagesMath for EconomicsTrường VũNo ratings yet

- How to Successfully Operate a Food BusinessDocument54 pagesHow to Successfully Operate a Food Businessariel paglinawanNo ratings yet

- Insurance Contract Quiz - CompressDocument11 pagesInsurance Contract Quiz - CompressChristian GarciaNo ratings yet

- iBend-Catalog (WEB - ENG) 201904Document21 pagesiBend-Catalog (WEB - ENG) 201904MOISESNo ratings yet

- Consumer Equalibrium - Unit 3Document19 pagesConsumer Equalibrium - Unit 3JEHAN mNo ratings yet

- Rights and Responsibilities of Partners Outlined in Partnership DeedDocument5 pagesRights and Responsibilities of Partners Outlined in Partnership DeedLegends FunanzaNo ratings yet

- Preparation of Company Accounts: Chapter-01Document18 pagesPreparation of Company Accounts: Chapter-01My ComputerNo ratings yet

- The Importance of e Service Quality in The Livestreaming Music Concert BusinessDocument18 pagesThe Importance of e Service Quality in The Livestreaming Music Concert BusinessCaptain SkyNo ratings yet

- Angga Putra Aditya PurchasingDocument7 pagesAngga Putra Aditya PurchasingsatugarisbackofficeNo ratings yet

- Midterm Solution Case Study: Downtown Video Rental SystemDocument10 pagesMidterm Solution Case Study: Downtown Video Rental SystempapageorgioNo ratings yet

- Bat4M Adjusting Entries: Learning Goal: Review: How To Record Adjusting Entries For A Service BusinessDocument5 pagesBat4M Adjusting Entries: Learning Goal: Review: How To Record Adjusting Entries For A Service BusinessJohnMurray111No ratings yet

- Human Resource Management ofDocument13 pagesHuman Resource Management ofAbdur RehmanNo ratings yet

- Henry SyDocument2 pagesHenry Sydaenarrold76No ratings yet

- Assignment 2Document8 pagesAssignment 2Prakash ShuklaNo ratings yet

- Start-Up E-Commerce Financial ModelDocument8 pagesStart-Up E-Commerce Financial ModelManish SharmaNo ratings yet

- Assignment For Week 1Document8 pagesAssignment For Week 1Soumyashis BhattacharyaNo ratings yet

- Unilever Independent Assurance ReportDocument5 pagesUnilever Independent Assurance ReportAbdeljalil OuiNo ratings yet

- Uae Corporate Tax Law SummaryDocument37 pagesUae Corporate Tax Law SummarypankajNo ratings yet

- Job satisfaction sample confidence intervalsDocument6 pagesJob satisfaction sample confidence intervalsHồng HàNo ratings yet

- Project ProposalDocument5 pagesProject Proposalhoney moreno100% (1)

- EntrepreneurshipDocument32 pagesEntrepreneurshipVivek Kumar Singh100% (2)

- IFAS TableDocument6 pagesIFAS TableAgneesh DuttaNo ratings yet

- 5 Stages of Design ThinkingDocument63 pages5 Stages of Design ThinkingsampathsamudralaNo ratings yet

- Principles of Macroeconomics 7th Edition Gregory Mankiw Test Bank 1Document279 pagesPrinciples of Macroeconomics 7th Edition Gregory Mankiw Test Bank 1dallas100% (40)

- ConWorld - Quiz 1Document4 pagesConWorld - Quiz 1John Paul JalemNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Tax Savvy for Small Business: A Complete Tax Strategy GuideFrom EverandTax Savvy for Small Business: A Complete Tax Strategy GuideRating: 5 out of 5 stars5/5 (1)

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemFrom EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemNo ratings yet

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- Freight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesFrom EverandFreight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesRating: 5 out of 5 stars5/5 (1)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)