Professional Documents

Culture Documents

Variable and Absorption Costing

Uploaded by

nclann.martin0 ratings0% found this document useful (0 votes)

2 views2 pagesMy notes

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMy notes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views2 pagesVariable and Absorption Costing

Uploaded by

nclann.martinMy notes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

CONCEPT SUMMARY

Monday, 28 August 2023 11:57 pm

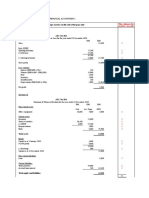

VARIABLE AND ABSORPTION COSTING

Preparation of Statement of Profit and Loss

External Reporting

→ Conventional format AKA absorption costing p/l (total sales minus COS and expenses)

Internal Reporting

→ Contribution margin format AKA variable costing p/l

Distinction Between Product Cost and Period Cost

PRODUCT COST PERIOD COST

1. Inventoriable Yes No

2. Cost Flow Incurrence → Inventories → p/l Incurrence → p/l

3. Accounting Treatment Capitalized first Expensed outright

4. P/L Item Cost of goods sold Operating expenses

5. Principle (by matching principle) Cost and effect Immediate recognition

Variable Costing, Absorption Costing, Throughput Costing and Super Absorption Costing Compared

1. As to treatment of the various operating costs

VARIABLE ABSORPTION TRHROUGHPUT SUPER

COSTING COSTING COSTING ABSORPTION

COSTING

a. Direct Materials Product cost Product cost Product cost Product cost

b. Direct Labor - Variable Product cost Product cost Period cost Product cost

c. Factory Overhead

i. Variable Product cost Product cost Period cost Product cost

ii. Fixed Period cost Product cost Period cost Product cost

d. Selling and Administrative Expense

i. Variable Period cost Period cost Period cost Product cost

ii. Fixed Period cost Period cost Period cost provided it is

value adding

e. Use in Decision Making Internal External reporting Theory of Life cycle

reporting constraints (profit costing (looking

maximization) at the entire

profitability)

2. As to Net Operating Income and Inventory Levels

RELATIONSHIP NET INCOME INVENTORIES

BETWEEN Where:

PRODUCTION P - production

AND SALES S - sales

a. P=S AC=VC BE=BB AC - absorption costing

VC - variable costing

b. P>S AC>VC BE>BB

BE - balance end

c. P<S AC<VC BE<BB BB - balance beginning

3. As to Cost Segregation

Variable Costing → segregate costs according to behavior

Absorption Costing → segregate costs according to function

4. As to Presentation of Income Statement

Variable Costing → contribution margin income approach

Absorption Costing → conventional income statement

Throughput Costing → throughput contribution income statement

Nature and Treatment of Fixed Factory Overhead Costs

Four (4) Different Capacity Levels Used to Compute the Budgeted Fixed Manufacturing Cost Rate

Variable and Absorption Costing Page 1

1. Theoretical Capacity → based on producing at full efficiency all the time

2. Practical Capacity → reduces theoretical capacity by considering unavoidable operating interruptions

3. Normal Capacity → satisfies average customer demand

4. Master-budget Capacity Utilization → what managers expect for the current period

Alternative Cost Methods in Allocation of Overhead to the Units Produced

1. Actual Cost Method → uses actual rates and quantities

2. Normal Cost Method → direct materials and direct labor - uses actual costs; factory overhead - uses predetermined factory overhead rates

3. Extended Normal Cost System or Flexible Budget → used to track production costs (budgeted costs multiply by actual quantity)

4. Standard Cost System or Static Budget → a tool for planning budgets, managing and controlling costs, and evaluating cost management performance

Variable and Absorption Costing Page 2

You might also like

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Module - Absorption and Variable CostingDocument10 pagesModule - Absorption and Variable CostingUchayya100% (1)

- Chapter-13 Marginal CostingDocument26 pagesChapter-13 Marginal CostingAdi PrajapatiNo ratings yet

- Management Services - 2: Variable & Absorption CostingDocument11 pagesManagement Services - 2: Variable & Absorption CostingKristine MagsayoNo ratings yet

- Variable and Absorption CostingDocument5 pagesVariable and Absorption CostingAllan Jay CabreraNo ratings yet

- SCM Unit 4 Variable and Absorption CostingDocument9 pagesSCM Unit 4 Variable and Absorption CostingMargie Garcia LausaNo ratings yet

- SIM - Variable and Absorption Costing - 0Document5 pagesSIM - Variable and Absorption Costing - 0lilienesieraNo ratings yet

- MAS 9204 Product Costing Activity-Based Costing (ABC)Document19 pagesMAS 9204 Product Costing Activity-Based Costing (ABC)Mila Casandra CastañedaNo ratings yet

- MODULE 1 Variable and Absorption CostingDocument9 pagesMODULE 1 Variable and Absorption Costingjerico garciaNo ratings yet

- Marginal & Absorption CostingDocument12 pagesMarginal & Absorption CostingMayal Sheikh100% (1)

- MAS-Reviewer 1Document13 pagesMAS-Reviewer 1Raven BermalNo ratings yet

- Cost AccountingDocument4 pagesCost AccountingKrizia Mae Lorica0% (1)

- Variable and Absorption CostingDocument4 pagesVariable and Absorption CostingFranz CampuedNo ratings yet

- Mas: Variable and Absorption Costing Concept Summary: Comparison As To Treatment of Operating CostsDocument3 pagesMas: Variable and Absorption Costing Concept Summary: Comparison As To Treatment of Operating CostsClyde RamosNo ratings yet

- 04 ABSORPTION AND VARIABLE COSTING - Rev23 24Document4 pages04 ABSORPTION AND VARIABLE COSTING - Rev23 24Kyn RusselNo ratings yet

- 04 Absorption Vs Variable CostingDocument4 pages04 Absorption Vs Variable CostingBanna SplitNo ratings yet

- 2 Albarillo Bano Duncano Lisondra OconDocument34 pages2 Albarillo Bano Duncano Lisondra OconMariael PinasoNo ratings yet

- ACCA F5 SlidesDocument255 pagesACCA F5 SlidesNguyễn Đức Tài100% (1)

- Absorption and Variable CostingDocument22 pagesAbsorption and Variable CostingJamaica David100% (4)

- MS Absorption-and-Variable-CostingDocument2 pagesMS Absorption-and-Variable-Costingkalloni.zoeNo ratings yet

- Multiple Choice Questions Variable vs. Absorption CostingDocument106 pagesMultiple Choice Questions Variable vs. Absorption CostingNicole CapundanNo ratings yet

- (Cpar2017) Mas-8205 (Product Costing) PDFDocument12 pages(Cpar2017) Mas-8205 (Product Costing) PDFSusan Esteban Espartero50% (2)

- 07 Module 03 AVC PDFDocument12 pages07 Module 03 AVC PDFMarriah Izzabelle Suarez RamadaNo ratings yet

- Team Work Makes The Dream Work Acctg15 Var. Absorption CostingDocument4 pagesTeam Work Makes The Dream Work Acctg15 Var. Absorption Costinggeorgia cerezoNo ratings yet

- MAS 04 Absorption and Variable CostingDocument6 pagesMAS 04 Absorption and Variable CostingJericho G. Bariring0% (1)

- MAS NotesDocument3 pagesMAS NotesMaricon Rillera PatauegNo ratings yet

- Review Session 01 MA Topics 1-6 AfterDocument32 pagesReview Session 01 MA Topics 1-6 AftermisalNo ratings yet

- Review Session 01 MA Topics 1-6 BeforeDocument32 pagesReview Session 01 MA Topics 1-6 BeforemisalNo ratings yet

- Cost Accounting Study GuideDocument5 pagesCost Accounting Study GuideJudith GarciaNo ratings yet

- MS-04 (Absorption & Variable Costing With Pricing Decisions)Document6 pagesMS-04 (Absorption & Variable Costing With Pricing Decisions)yshizamNo ratings yet

- Marginal CostingDocument13 pagesMarginal CostingmohitNo ratings yet

- Finals Acctg 7Document50 pagesFinals Acctg 7Rohny AbaquinNo ratings yet

- Mas 1.2.4 Assessment For-PostingDocument5 pagesMas 1.2.4 Assessment For-PostingJustine CruzNo ratings yet

- Sample MAS (Absorption & Variable Costing With Pricing Decision)Document6 pagesSample MAS (Absorption & Variable Costing With Pricing Decision)Gwyneth CartallaNo ratings yet

- Topic 7 - Absorption & Marginal CostingDocument8 pagesTopic 7 - Absorption & Marginal CostingMuhammad Alif100% (5)

- Variable Costing and Segment Reporting: Tools For ManagementDocument66 pagesVariable Costing and Segment Reporting: Tools For ManagementsofiaNo ratings yet

- Management Advisory Services Adb/Jju/Bdt MAS.2814 - Activity-Based Costing System MAY 2020Document2 pagesManagement Advisory Services Adb/Jju/Bdt MAS.2814 - Activity-Based Costing System MAY 2020Donny TrumpNo ratings yet

- 03 MAS - Var. & Absorption CostingDocument6 pages03 MAS - Var. & Absorption CostingManwol JangNo ratings yet

- NOTE CHAPTER 9 - Absorption Costing & Marginal CostingDocument18 pagesNOTE CHAPTER 9 - Absorption Costing & Marginal CostingNUR ANIS SYAMIMI BINTI MUSTAFA / UPMNo ratings yet

- Variable and Absorption CostingDocument3 pagesVariable and Absorption CostingAnna Pamela MarianoNo ratings yet

- Management Advisory Services-Ho1Document4 pagesManagement Advisory Services-Ho1kehlaniNo ratings yet

- Financial Accounting Management Accounting: Internal Users Managers For PlanningDocument4 pagesFinancial Accounting Management Accounting: Internal Users Managers For PlanningEpfie SanchesNo ratings yet

- Absorption and Variable CostingDocument15 pagesAbsorption and Variable CostingApril Pearl VenezuelaNo ratings yet

- 04 Absorption & Variable Costing With Pricing DecisionsDocument6 pages04 Absorption & Variable Costing With Pricing Decisionsrandomlungs121223No ratings yet

- MS103 SendingDocument3 pagesMS103 SendingEthel Joy Tolentino GamboaNo ratings yet

- Topic 3 Variable Costing and Absorption CostingDocument3 pagesTopic 3 Variable Costing and Absorption CostingdigididoghakdogNo ratings yet

- Chapter - 6 - Variable Costing and Segment Tools For ManagementDocument66 pagesChapter - 6 - Variable Costing and Segment Tools For Managementshamsirarefin275285No ratings yet

- Lecture-9.1 Variable & Absorption Costing PDFDocument24 pagesLecture-9.1 Variable & Absorption Costing PDFNazmul-Hassan Sumon100% (1)

- ACT121 - Topic 5Document5 pagesACT121 - Topic 5Juan FrivaldoNo ratings yet

- Standard Costing and Variance AnalysisDocument2 pagesStandard Costing and Variance AnalysisCasey MagpileNo ratings yet

- Ilovepdf Merged MergedDocument12 pagesIlovepdf Merged MergedMa. Trina AnotnioNo ratings yet

- Marginal Costing by Raj Awate PDFDocument17 pagesMarginal Costing by Raj Awate PDFmahendra hadagaliNo ratings yet

- F2-08 Absorption and Marginal CostingDocument16 pagesF2-08 Absorption and Marginal CostingJaved ImranNo ratings yet

- Bab 2 - Perilaku BiayaDocument40 pagesBab 2 - Perilaku BiayaAndy ReynaldyyNo ratings yet

- Bab 2 - Perilaku BiayaDocument40 pagesBab 2 - Perilaku BiayaAndy ReynaldyyNo ratings yet

- 2 - Cost Terms, Concepts and BehaviorDocument12 pages2 - Cost Terms, Concepts and BehaviorARISNo ratings yet

- Chapter 3 - Product CostingDocument6 pagesChapter 3 - Product Costingchelsea kayle licomes fuentesNo ratings yet

- Contribution Approach 2Document16 pagesContribution Approach 2kualler80% (5)

- Prepared By: Jessy ChongDocument7 pagesPrepared By: Jessy ChongDaleNo ratings yet

- 3 - Discussion - Joint Products and ByproductsDocument2 pages3 - Discussion - Joint Products and ByproductsCharles TuazonNo ratings yet

- Nucor Annual Reports 2018Document106 pagesNucor Annual Reports 2018Anggitaridha SeptirendiniNo ratings yet

- MBA101 - Almario - Parco - Chapters 1-3 - 1st - RevisionDocument41 pagesMBA101 - Almario - Parco - Chapters 1-3 - 1st - RevisionJesse Rielle Caras100% (3)

- QA Accounting For DepreciationDocument7 pagesQA Accounting For DepreciationAhmed RawyNo ratings yet

- Correct Response Answer ChoicesDocument11 pagesCorrect Response Answer ChoicesArjay Dela PenaNo ratings yet

- Sol Man Chapter 7 Construction Contracts 2020 EditionDocument38 pagesSol Man Chapter 7 Construction Contracts 2020 EditionTricia AranillaNo ratings yet

- AAFR Notes IFRS - 16Document27 pagesAAFR Notes IFRS - 16WaqasNo ratings yet

- INTACC-chapter-35-1 ColumnDocument12 pagesINTACC-chapter-35-1 ColumnKonrad Lorenz Madriaga UychocoNo ratings yet

- Module 2 - Practice Questions: Introduction To Cost Behavior and Cost-Volume Relationships True/FalseDocument21 pagesModule 2 - Practice Questions: Introduction To Cost Behavior and Cost-Volume Relationships True/FalseAakash KumarNo ratings yet

- DateienDocument7 pagesDateienياسين البيرنسNo ratings yet

- Department of Education: Gigaquit National School of Home Industries Entrepreneurship 10Document6 pagesDepartment of Education: Gigaquit National School of Home Industries Entrepreneurship 10Liza BanoNo ratings yet

- 7110 w14 Ms 21Document11 pages7110 w14 Ms 21Muhammad Umair100% (1)

- PSAK 23, RevenueDocument15 pagesPSAK 23, Revenueapi-370878350% (2)

- Korbel Foundation College Inc.: (Messenger)Document2 pagesKorbel Foundation College Inc.: (Messenger)Jeanmay CalseñaNo ratings yet

- BSRM Steel LimitedDocument15 pagesBSRM Steel LimitedSarjil alamNo ratings yet

- First Solar, Inc. (FSLR) : 3 - NeutralDocument6 pagesFirst Solar, Inc. (FSLR) : 3 - NeutralCarlos TresemeNo ratings yet

- Process Costing Sample ProblemDocument1 pageProcess Costing Sample ProblemHannah CaparasNo ratings yet

- Netflix PresentationDocument19 pagesNetflix PresentationDiego EscalanteNo ratings yet

- Business Finance 2.2: Financial Ratios: Lecture NotesDocument16 pagesBusiness Finance 2.2: Financial Ratios: Lecture NotesElisabeth HenangerNo ratings yet

- December 2003 ACCA Paper 2.5 AnswersDocument16 pagesDecember 2003 ACCA Paper 2.5 AnswersUlanda2100% (2)

- AppendixDocument36 pagesAppendixJudy PulongNo ratings yet

- Sam's Introductory Accounting AnswersDocument1 pageSam's Introductory Accounting AnswersSamuelNo ratings yet

- Book 123Document3 pagesBook 123Andres WijayaNo ratings yet

- Go Digit General Insurance Limited Financials Income StatementDocument3 pagesGo Digit General Insurance Limited Financials Income StatementShuchita AgarwalNo ratings yet

- Analisis Pengaruh Free Cash Flow Dan Financial Good Corporate Governance Sebagai Variabel ModerasiDocument15 pagesAnalisis Pengaruh Free Cash Flow Dan Financial Good Corporate Governance Sebagai Variabel Moderasirevita agustinaNo ratings yet

- Business Combination & ConsolidationDocument2 pagesBusiness Combination & ConsolidationShaira Bugayong100% (1)

- Valuation KPMG IvcaDocument27 pagesValuation KPMG IvcaAshish SharmaNo ratings yet

- CashDocument29 pagesCashQuendrick SurbanNo ratings yet

- Bond Valuation ProblemsDocument4 pagesBond Valuation ProblemsMary Justine Paquibot100% (1)

- Case PSAK 25 and 46Document2 pagesCase PSAK 25 and 46fari3dNo ratings yet