Professional Documents

Culture Documents

Korbel Foundation College Inc.: (Messenger)

Uploaded by

Jeanmay CalseñaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Korbel Foundation College Inc.: (Messenger)

Uploaded by

Jeanmay CalseñaCopyright:

Available Formats

KORBEL FOUNDATION COLLEGE INC.

ACCTG 11 ACCOUNTING FOR SERVICE AND MERCHANDISING ENTITIES

(1st Term IST SEM, 2021-2022)

ASSESSMENT II

General Instructions: Read each requirement carefully. Write your answers on sheets of paper

and submit it to https://www.facebook.com/michaelangelo.mateo.50

(messenger) on or before Tuesday, November 30,2021.

Late submission will result in a total score reduction.

Problem I

Guadalupe Rosario, tax consultant, began his practice on December 1, 2021. The transactions of the

firm are as follows:

Dec. 1 Rosario invested P150,000 in the firm,

2 Paid rent for December to Recoletos Realty, P8,000,

2 Purchased supplies on account, P7,200.

3 Acquired P75,000 of the office equipment, paying P37,000 down with the

balance due in 30 days.

8 Paid 7,200 on account for supplies purchased.

14 Paid assistants’ salaries for two weeks, P6,000.

20 Performed consulting services for cash, P20,000.

28 Paid assistant’s salaries for two weeks, P6,000.

30 Billed clients for December consulting services, P48,000.

31 Rosario withdrew P12,000 from the business.

Requirements:

1. Open the following general ledger accounts, using the account numbers shown: Cash

(110); Accounts Receivable (120); Fees Receivable (130); Supplies (140); Office

Equipment (150); Accumulated Depreciation- Office Equipment (155); Accounts Payable

(210); Salaries Payable (220); Rosario, Capital (310); Rosario, Withdrawals (320); Income

Summary (330); Consulting Revenues (410); Salaries Expense (510); Supplies Expense

(520); Rent Expense (530); and Depreciation Expense (540).

2. Journalize the December transactions and post to the ledger.

3. Prepare and complete the worksheet using the following information:

a. Supplies on hand at Dec. 31 amounted to 4,700.

b. Salaries of P1,800 have accrued at month-end.

c. Depreciation is 800 for December.

d. Rosario has spent 20 hours on a tax fraud case during December. When completed

in January, his work will be billed at 500 per hour. Note: The firm uses the account

Fees Receivable to reflect the amount earned but not yet billed.

4. Prepare an income statement, a statement of changes in equity; a balance sheet and a

statement of cash flows.

5. Journalize and post adjusting and closing entries.

6. Prepare a post-closing trial balance.

7. Journalize and post the reversing entries.

KORBEL FOUNDATION COLLEGE INC. ACCTG 11 ACCOUNTING FOR SERVICE AND MERCHANDISING ENTITIES

(1st Term IST SEM, 2021-2022)

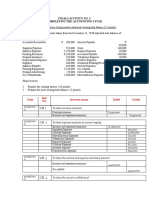

Problem II

Listed below are the accounts taken from the December 31, 2021 adjusted trial balance of

Catherine Cordero Publishers:

Accounts Receivable P 270,000 Interest payable P 40,000

Supplies Expense 710,000 Cash 160,000

Salaries Expense 2,270,000 Repairs expense 10,000

Printing Revenues 8,130,000 Accounts payable 190,000

Prepaid Insurance 320,000 Telephone expense 20,000

Depreciation Expense 250,000 Utilities expense 80,000

Supplies 160,000 Unearned printing revenues 210,000

Salaries Payable 310,000 Interest expense 300,000

Printing Equipment 5,600,000 Cordero, Capital 340,000

Prepaid Advertising 70,000 Notes payable 2,500,000

Cordero, Withdrawals 1,500,000 Miscellaneous Expense 90,000

Allowance for Doubtful accounts 10,000 Accumulated Depreciation 80,000

Requirement:

Prepare the Worksheet, Income Statement, Statement of Changes in Equity and Statement of

Financial Position in good form.

END OF ASSESSMENT

“FOR THE GREATER GLORY OF GOD”

You might also like

- Bsa Quiz IiDocument2 pagesBsa Quiz IiJanet AnotdeNo ratings yet

- Exercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessDocument4 pagesExercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessShiela Rengel0% (2)

- Activity - Preparation of Financial StatementsDocument4 pagesActivity - Preparation of Financial StatementsJoy ValenciaNo ratings yet

- AUDITING-Adjusting Entries-Correction of ErrorsDocument10 pagesAUDITING-Adjusting Entries-Correction of ErrorsJamhel MarquezNo ratings yet

- 05 Completing The Accounting Cycle PROBLEMSDocument5 pages05 Completing The Accounting Cycle PROBLEMSbetlogNo ratings yet

- Make-Up AssignmentDocument5 pagesMake-Up AssignmentRileyNo ratings yet

- Midterms Problem SolvingDocument3 pagesMidterms Problem SolvingTRINA ARUTANo ratings yet

- Dra. Santiago Medical ServicesDocument6 pagesDra. Santiago Medical ServicesFelicity BondocNo ratings yet

- Exercise Adjusting Entries To Reversing EntriesDocument2 pagesExercise Adjusting Entries To Reversing EntriesJunmirMalicVillanuevaNo ratings yet

- Assignment 1 Accounting Cycle For Service Business Part 2Document3 pagesAssignment 1 Accounting Cycle For Service Business Part 2Iya GarciaNo ratings yet

- Seatwork (Adjusting Entries)Document2 pagesSeatwork (Adjusting Entries)Dan Edriel RonabioNo ratings yet

- 4 6026199395324659830Document30 pages4 6026199395324659830Beka Asra100% (1)

- Accounting Process HandoutsDocument6 pagesAccounting Process HandoutsMichael BongalontaNo ratings yet

- Quiz ZDocument5 pagesQuiz ZShannen CalimagNo ratings yet

- 2022 April FarDocument23 pages2022 April FarXavier Xanders100% (2)

- Assignment Accounting For BusinessDocument5 pagesAssignment Accounting For BusinessValencia CarolNo ratings yet

- 201.AFA IP.L II December 2020Document4 pages201.AFA IP.L II December 2020leyaketjnuNo ratings yet

- 18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Document3 pages18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Jr.No ratings yet

- 1 Partnership-YTDocument7 pages1 Partnership-YTSherwin DueNo ratings yet

- BKNC3 - Activity 1 - Review ExamDocument3 pagesBKNC3 - Activity 1 - Review ExamDhel Cahilig0% (1)

- Cash Accrual Practice SetDocument2 pagesCash Accrual Practice SetMa. Trixcy De VeraNo ratings yet

- Individual Assignment 1 ACTDocument4 pagesIndividual Assignment 1 ACTKalkidanNo ratings yet

- PART B - SET A (Odd Groups - 1,3,5,7,9)Document4 pagesPART B - SET A (Odd Groups - 1,3,5,7,9)ngocanhhlee.11No ratings yet

- Handout Fin Man 2302Document2 pagesHandout Fin Man 2302Ranz Nikko N PaetNo ratings yet

- Accounting CycleDocument6 pagesAccounting CycleElla Acosta0% (1)

- Chapter 2 Problems and Solutions EnglishDocument8 pagesChapter 2 Problems and Solutions EnglishyandaveNo ratings yet

- Instructions:: 1. Mr. Musfiq Is A Chartered Accountant (CA) - He Started A New Consultancy Firm On July 1Document3 pagesInstructions:: 1. Mr. Musfiq Is A Chartered Accountant (CA) - He Started A New Consultancy Firm On July 1Mahin TabassumNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- FAR - Final Preboard CPAR 92Document14 pagesFAR - Final Preboard CPAR 92joyhhazelNo ratings yet

- IA3 5copiesDocument6 pagesIA3 5copiesChloe CataluñaNo ratings yet

- ACT301 (Final), Spring-21Document4 pagesACT301 (Final), Spring-21Papon SarkerNo ratings yet

- Review - SFP To Interim ReportingDocument3 pagesReview - SFP To Interim ReportingAna Marie IllutNo ratings yet

- AccountingDocument6 pagesAccountingaya walidNo ratings yet

- Additional Exercises Transaction Analaysis Journalizing Posting and Unadjusted TDocument4 pagesAdditional Exercises Transaction Analaysis Journalizing Posting and Unadjusted TRenalyn Ps MewagNo ratings yet

- FAR - Midterms and FinalsDocument14 pagesFAR - Midterms and FinalsShanley Vanna EscalonaNo ratings yet

- Assignment 1Document2 pagesAssignment 1YaredNo ratings yet

- ACCTBA1 - Quiz 3Document2 pagesACCTBA1 - Quiz 3Marie Beth BondestoNo ratings yet

- Sample Midterm Exam With SolutionDocument17 pagesSample Midterm Exam With Solutionq mNo ratings yet

- Quiz # 2 NewsDocument20 pagesQuiz # 2 NewsSaram NadeemNo ratings yet

- Acctg 205A Cash & Receivables Quiz 10-10-20Document3 pagesAcctg 205A Cash & Receivables Quiz 10-10-20Darynn LinggonNo ratings yet

- Fundamentals of Accounting Business and Management - II 2Document4 pagesFundamentals of Accounting Business and Management - II 2Kathlene JaoNo ratings yet

- Nerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Document3 pagesNerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Mica Mae Correa100% (1)

- ENG - Soal Mojakoe Pengantar Akuntansi UAS Genap 2021 - 2022Document9 pagesENG - Soal Mojakoe Pengantar Akuntansi UAS Genap 2021 - 202202Adibah Seila NafazaNo ratings yet

- FundAcct I @2015 AssignmntDocument6 pagesFundAcct I @2015 AssignmntGedion FeredeNo ratings yet

- PACOAC AssignmentDocument3 pagesPACOAC AssignmentRaven PinedaNo ratings yet

- Branch Accounting ProblemDocument6 pagesBranch Accounting ProblemGONZALES, MICA ANGEL A.No ratings yet

- Group Assignment OneDocument2 pagesGroup Assignment Oneehitemariam berhanu100% (2)

- Extra Questions - A LevelDocument8 pagesExtra Questions - A LevelMUSTHARI KHANNo ratings yet

- Quiz - Topic 5Document3 pagesQuiz - Topic 5mariakate LeeNo ratings yet

- QuizDocument2 pagesQuizaprilbetito02No ratings yet

- Quizbee Practice IntaccDocument21 pagesQuizbee Practice IntaccCharles Kevin MinaNo ratings yet

- Financial Acctg & Reporting 1 - CASE ANALYSIS SUMMARYDocument23 pagesFinancial Acctg & Reporting 1 - CASE ANALYSIS SUMMARYJaquelyn ClataNo ratings yet

- FAR Problem SET A PDFDocument11 pagesFAR Problem SET A PDFNicole Aragon0% (1)

- Ias 12 QDocument2 pagesIas 12 QPinias ShefikaNo ratings yet

- Assets Liabilities + Equity + Income - Expenses: Oct. TransactionsDocument4 pagesAssets Liabilities + Equity + Income - Expenses: Oct. Transactionsalford sery Cammayo0% (1)

- Cpa Review School of The Philippines ManilaDocument14 pagesCpa Review School of The Philippines ManilaVanessa Anne Acuña DavisNo ratings yet

- Chapter 1 Practice Test - Problems (Answers)Document12 pagesChapter 1 Practice Test - Problems (Answers)anonymousNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Accounting AssignmentDocument2 pagesAccounting AssignmentAdrian Christian Lee100% (6)

- Tayongchristine Jae P. Bsba FM 1BDocument9 pagesTayongchristine Jae P. Bsba FM 1BJeanmay CalseñaNo ratings yet

- AnswersDocument1 pageAnswersJeanmay CalseñaNo ratings yet

- Calsena, Jeanmay C. Bsba-Fm 1BDocument7 pagesCalsena, Jeanmay C. Bsba-Fm 1BJeanmay CalseñaNo ratings yet

- SYLLABUSDocument1 pageSYLLABUSJeanmay CalseñaNo ratings yet

- Red Ribbon Marketing PlanDocument3 pagesRed Ribbon Marketing PlanJeanmay Calseña100% (2)

- Food Panda Delivery: Marketing PlanDocument5 pagesFood Panda Delivery: Marketing PlanJeanmay Calseña100% (1)

- Red Ribbon Marketing Plan FinalDocument7 pagesRed Ribbon Marketing Plan FinalJeanmay Calseña100% (7)

- AnswersDocument1 pageAnswersJeanmay CalseñaNo ratings yet

- AnswersDocument1 pageAnswersJeanmay CalseñaNo ratings yet

- AnswersDocument1 pageAnswersJeanmay CalseñaNo ratings yet

- AnswersDocument1 pageAnswersJeanmay CalseñaNo ratings yet

- Fernan DebateDocument2 pagesFernan DebateJULLIE CARMELLE H. CHATTONo ratings yet

- All You Need To Know About Track Visitor PermitsDocument2 pagesAll You Need To Know About Track Visitor PermitsGabriel BroascaNo ratings yet

- Annex 2. 4. 1-Water Storage Final ReportDocument46 pagesAnnex 2. 4. 1-Water Storage Final ReportMonday Gahima DeoNo ratings yet

- Kevin The Dino: Free Crochet PatternDocument3 pagesKevin The Dino: Free Crochet PatternMarina Assa100% (4)

- Breaking News English Newtown and The NraDocument3 pagesBreaking News English Newtown and The NraAngel Angeleri-priftis.100% (1)

- Review of Related LiteratureDocument14 pagesReview of Related LiteratureRenelyn Rodrigo SugarolNo ratings yet

- Unit 1 Finding Business OpportunitiesDocument9 pagesUnit 1 Finding Business OpportunitiesBERNA RIVERANo ratings yet

- Dutch Lady NK Present Isnin 1 C PDFDocument43 pagesDutch Lady NK Present Isnin 1 C PDFAbdulaziz Farhan50% (2)

- Free CV Templates AustraliaDocument6 pagesFree CV Templates Australiaafazbsaxi100% (2)

- Myth and Media Constructing Aboriginal ArchitecturDocument6 pagesMyth and Media Constructing Aboriginal ArchitecturDuyên PhạmNo ratings yet

- Comprehensive Review For CorporationDocument14 pagesComprehensive Review For CorporationJoemar Santos Torres33% (3)

- Lyn2x Checking Vouchers (1) 06.24.23Document1,094 pagesLyn2x Checking Vouchers (1) 06.24.23Rowelma Shirley Gonzaga BongatoNo ratings yet

- 21 ST Century Lit Module 3Document6 pages21 ST Century Lit Module 3aljohncarl qui�onesNo ratings yet

- ArunasuraDocument2 pagesArunasuraZoth BernsteinNo ratings yet

- CISF HCM Oct 2023 Eng Official Format All Shifts RBE CompressedDocument163 pagesCISF HCM Oct 2023 Eng Official Format All Shifts RBE Compressedravi198235201No ratings yet

- (Ang FORM Na Ito Ay LIBRE at Maaaring Kopyahin) : Republic of The Philippines 11 Judicial RegionDocument10 pages(Ang FORM Na Ito Ay LIBRE at Maaaring Kopyahin) : Republic of The Philippines 11 Judicial RegionKristoffer AsetreNo ratings yet

- Marsden Victor Emile - The Protocols of ZionDocument156 pagesMarsden Victor Emile - The Protocols of ZionPeter100% (4)

- Filipino-Social ThinkersDocument2 pagesFilipino-Social ThinkersadhrianneNo ratings yet

- Tyre Air Pressure 2010 enDocument172 pagesTyre Air Pressure 2010 enbruteforce2000No ratings yet

- Enabling Organizational Agility in An Age of Speed and DisruptionDocument28 pagesEnabling Organizational Agility in An Age of Speed and DisruptionAbdelmadjid djibrineNo ratings yet

- Barcoo Independent 130309Document6 pagesBarcoo Independent 130309barcooindependentNo ratings yet

- Cunya Vargas PA1 CCDocument5 pagesCunya Vargas PA1 CCDELSY ALESSANDRA CUNYA VARGASNo ratings yet

- The Mystery of Belicena Villca - Nimrod de Rosario - Part-1Document418 pagesThe Mystery of Belicena Villca - Nimrod de Rosario - Part-1Pablo Adolfo Santa Cruz de la Vega100% (1)

- Popular Cuban Music - Emilio Grenet 1939Document242 pagesPopular Cuban Music - Emilio Grenet 1939norbertedmond100% (18)

- Journal of Eurasian Studies 6Document10 pagesJournal of Eurasian Studies 6Pheourn ChhannyNo ratings yet

- 50 bt Mức độ nhận biết - phần 1Document4 pages50 bt Mức độ nhận biết - phần 1Mai BùiNo ratings yet

- FFFDocument12 pagesFFFever.nevadaNo ratings yet

- Language ChangeDocument10 pagesLanguage ChangeDiana Ari SusantiNo ratings yet

- Document 1Document3 pagesDocument 1Micky YnopiaNo ratings yet

- PDFDocument6 pagesPDFShowket IbraheemNo ratings yet