Professional Documents

Culture Documents

PSAK 25 and PSAK 46 Case Study on Accounting for Changes in Accounting Policies, Estimates and Recognition of Deferred Tax

Uploaded by

fari3d0 ratings0% found this document useful (0 votes)

85 views2 pagesABC Building Limited acquired investment properties in 2016 and considered this an accounting policy change. In 2018, ABC proposed changing to the cost model for investment properties from the fair value model. In 2020, ABC increased the depreciation period for buildings from 20 to 30 years, which is considered a change in estimate. These should be accounted for as a change in accounting policy in 2016, but the 2018 and 2020 changes are not changes in policy.

XYZ Co. prepared a reconciliation of pretax income to taxable income in 2018, its first year. It has estimated expenses and depreciation that will impact future taxable income. The journal entry to record 2018 income tax expense includes deferred tax and income tax payable accounts.

Original Description:

Original Title

Case PSAK 25 and 46

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentABC Building Limited acquired investment properties in 2016 and considered this an accounting policy change. In 2018, ABC proposed changing to the cost model for investment properties from the fair value model. In 2020, ABC increased the depreciation period for buildings from 20 to 30 years, which is considered a change in estimate. These should be accounted for as a change in accounting policy in 2016, but the 2018 and 2020 changes are not changes in policy.

XYZ Co. prepared a reconciliation of pretax income to taxable income in 2018, its first year. It has estimated expenses and depreciation that will impact future taxable income. The journal entry to record 2018 income tax expense includes deferred tax and income tax payable accounts.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

85 views2 pagesPSAK 25 and PSAK 46 Case Study on Accounting for Changes in Accounting Policies, Estimates and Recognition of Deferred Tax

Uploaded by

fari3dABC Building Limited acquired investment properties in 2016 and considered this an accounting policy change. In 2018, ABC proposed changing to the cost model for investment properties from the fair value model. In 2020, ABC increased the depreciation period for buildings from 20 to 30 years, which is considered a change in estimate. These should be accounted for as a change in accounting policy in 2016, but the 2018 and 2020 changes are not changes in policy.

XYZ Co. prepared a reconciliation of pretax income to taxable income in 2018, its first year. It has estimated expenses and depreciation that will impact future taxable income. The journal entry to record 2018 income tax expense includes deferred tax and income tax payable accounts.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

PSAK 25 dan PSAK 46 Case Study

Case 1

Bellow are elements in the financial statements on which the director of ABC Building Limited

require advice:

• In 2016, ABC Building Limited acquired several properties as investment properties.

Since ABC has not adopted accounting policy in accounting for property as investment

properties before, the financial director considered such adoption is change in

accounting policy. ABC Building Limited has no investment property before 2016.

• In 2018, ABC Building Limited proposed to change to the cost model instead of fair

value model in accounting for its investment property in accordance with PSAK 13. Its

financial director considered whether ABC could make such changes and, if change

could be made, how ABC should account for the changes

• In 2020, ABC Building limited decided to make a change in estimate as to the duration

of depreciation of its building, increasing it from 20 to 30 years.

Please Discuss how the above items should be dealt with in the financial statements of ABC

Building Limited based on PSAK 25

Case 2

Part 1

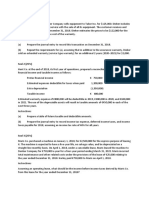

XYZ Co. at the end of 2018, its first year of operations, prepared a reconciliation between

pretax financial income and taxable income as follows:

Pretax financial income € 750,000

Estimated expenses deductible for taxes when paid 1,200,000

Extra depreciation (1,350,000)

Taxable income € 600,000

Estimated warranty expense of €800,000 will be deductible in 2019, €300,000 in 2020, and

€100,000 in 2021. The use of the depreciable assets will result in taxable amounts of €450,000

in each of the next three years.

Instructions

(a) Prepare a table of future taxable and deductible amounts.

(b) Prepare the journal entry to record income tax expense, deferred income taxes, and

income taxes payable for 2018, assuming an income tax rate of 40% for all years.

Part 2

ABC Corp calculated that it had sustained a deferred tax asset of $450,000 in respect of a tax

loss and deductible temporary difference of $2.25 million but it had not recognised any such

asset in the balance sheet. During the year, a business was injected to the company by the

major shareholder and the company began to derive taxable profit to offset with the loss

brought forward.

Required:

1. Discuss the implication of the current development on ABC’s deferred tax asset.

2. Suggest journal entries to effect the implication in (1).

3. If the tax rate is increased to 30%, discuss and suggest journal entries.

You might also like

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Group Assignments Acc 217Document4 pagesGroup Assignments Acc 217Phebieon MukwenhaNo ratings yet

- Illustrative Examples - Changes in Accounting Estimates, Policies and Correction of ErrorsDocument3 pagesIllustrative Examples - Changes in Accounting Estimates, Policies and Correction of ErrorsMs QuiambaoNo ratings yet

- Accounting For Income TaxDocument4 pagesAccounting For Income TaxShaira Bugayong0% (2)

- Statement of Clhanges in EquityDocument21 pagesStatement of Clhanges in EquityBon juric Jr.No ratings yet

- Income Taxes Batch 4 (Repaired)Document10 pagesIncome Taxes Batch 4 (Repaired)Lealyn Martin BaculoNo ratings yet

- Tax accounting set ADocument4 pagesTax accounting set AGopti EmmanuelNo ratings yet

- FAR Vol 2 Chapter 16 18Document14 pagesFAR Vol 2 Chapter 16 18Allen Fey De Jesus100% (1)

- FAR MA-2023 QuestionDocument4 pagesFAR MA-2023 QuestionMd HasanNo ratings yet

- Modernise Precision Equipment with Debenture FinanceDocument6 pagesModernise Precision Equipment with Debenture Financeparthasarathi_inNo ratings yet

- Mock Exam Questions 2022Document21 pagesMock Exam Questions 2022ZHANG EmilyNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Kate PaquizNo ratings yet

- Ammar Yasir - 041911333245 - Tugas AKM III WEEK 8Document7 pagesAmmar Yasir - 041911333245 - Tugas AKM III WEEK 8sari ayuNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Dethzaida AsebuqueNo ratings yet

- AccountingDocument6 pagesAccountingBlue HourNo ratings yet

- Accounting For Taxes 6Document7 pagesAccounting For Taxes 6charlene kate bunaoNo ratings yet

- Accounting For Income Tax SeatworkDocument3 pagesAccounting For Income Tax SeatworkKenneth TorresNo ratings yet

- Let's Analyze-Long TermDocument2 pagesLet's Analyze-Long TermJona Mae Cuarto AyopNo ratings yet

- CORPORATE INCOME TAX (Answer Key)Document5 pagesCORPORATE INCOME TAX (Answer Key)Rujean Salar AltejarNo ratings yet

- Chapter 11Document13 pagesChapter 11jake doinog100% (6)

- Calculate Income Tax Expense and Deferred TaxDocument10 pagesCalculate Income Tax Expense and Deferred Taxlana del reyNo ratings yet

- AccountingDocument8 pagesAccountingGuiamae GuaroNo ratings yet

- Chapter 18Document12 pagesChapter 18ks1043210No ratings yet

- June 2019 QuestionsDocument6 pagesJune 2019 QuestionsHuma SarfrazNo ratings yet

- Intermediate Accounting II Assignment Session 7Document2 pagesIntermediate Accounting II Assignment Session 7izza zahratunnisaNo ratings yet

- ReSA CPA Review Batch 41 Audit Problems Weeks 1-3Document4 pagesReSA CPA Review Batch 41 Audit Problems Weeks 1-3Angela AlejandroNo ratings yet

- Bài tập chủ đề 6Document7 pagesBài tập chủ đề 6thanhtrucNo ratings yet

- CHAPTER-22-DEFERRED-TAX-ASSET-AND-LIABILITYDocument8 pagesCHAPTER-22-DEFERRED-TAX-ASSET-AND-LIABILITYCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Ind As 8Document4 pagesInd As 8qwertyNo ratings yet

- Deferred Income Tax Asset and LiabilityDocument4 pagesDeferred Income Tax Asset and Liabilityalcazar rtuNo ratings yet

- Ac5007 QuestionsDocument8 pagesAc5007 QuestionsyinlengNo ratings yet

- 105 DepaDocument12 pages105 DepaLA M AENo ratings yet

- Lecture 5 Events After The Reporting Period Multiple ChoiceDocument7 pagesLecture 5 Events After The Reporting Period Multiple ChoiceJeane Mae Boo0% (1)

- Tax Practice Quiz QuestionsDocument3 pagesTax Practice Quiz QuestionsDanji MisoNo ratings yet

- Strategic Business Reporting - Irish (SBR - Irl)Document6 pagesStrategic Business Reporting - Irish (SBR - Irl)vaaniNo ratings yet

- F1 CIMA Workbook Q PDFDocument169 pagesF1 CIMA Workbook Q PDFKhadija Rampurawala100% (1)

- Income Tax Expense and Deferred Tax Asset & Liability CalculationsDocument3 pagesIncome Tax Expense and Deferred Tax Asset & Liability Calculationskrisha millo0% (1)

- Lamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)Document14 pagesLamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)lana del reyNo ratings yet

- SBR 2019 Mar-Jun QDocument6 pagesSBR 2019 Mar-Jun QmajasumNo ratings yet

- #3 Deferred Taxes PDFDocument3 pages#3 Deferred Taxes PDFjanus lopezNo ratings yet

- FAR05 - Accounting For Income and Deferred TaxesDocument4 pagesFAR05 - Accounting For Income and Deferred TaxesDisguised owlNo ratings yet

- SOAL Kuis Materi UAS Inter 2Document2 pagesSOAL Kuis Materi UAS Inter 2vania 322019087No ratings yet

- SOAL Kuis Materi UAS Inter 2Document2 pagesSOAL Kuis Materi UAS Inter 2vania 322019087No ratings yet

- TAX DEDUCTIONS GUIDEDocument4 pagesTAX DEDUCTIONS GUIDEAnonymous LC5kFdtcNo ratings yet

- 12275. TAX PLANNING & COMPLIANCE_MA-2024_QuestionDocument6 pages12275. TAX PLANNING & COMPLIANCE_MA-2024_QuestionmizanacmaNo ratings yet

- SW ErrorsDocument5 pagesSW ErrorsArlea AsenciNo ratings yet

- Fragment M 11Document7 pagesFragment M 11sm munNo ratings yet

- Hakdog PDFDocument18 pagesHakdog PDFJay Mark AbellarNo ratings yet

- As 22 Accounting For Taxes On IncomeDocument20 pagesAs 22 Accounting For Taxes On IncomeNishant Jha Mcom 2No ratings yet

- Error Correction - ExercisesDocument4 pagesError Correction - ExercisesDe Chavez May Ann M.No ratings yet

- INCOME TAXATION OF CORPORATION ExercisesDocument3 pagesINCOME TAXATION OF CORPORATION ExercisesCheska DizonNo ratings yet

- Business Finance Tutorial 1Document2 pagesBusiness Finance Tutorial 1katiemmo2016No ratings yet

- Chapter 10 - Prior Period Errors: Problem 10-1 (IAA)Document12 pagesChapter 10 - Prior Period Errors: Problem 10-1 (IAA)Asi Cas JavNo ratings yet

- ActivityDocument3 pagesActivitycaryl remillaNo ratings yet

- Exercises P Class2-2022Document9 pagesExercises P Class2-2022Angel MéndezNo ratings yet

- (L) Chapter 13 Accounts For Limited CompanyDocument13 pages(L) Chapter 13 Accounts For Limited CompanyCHZE CHZI CHUAHNo ratings yet

- May 2020 Error SHE Intangibles Liabilities LeasesDocument14 pagesMay 2020 Error SHE Intangibles Liabilities Leasesiraleigh17No ratings yet

- Far-Single Entry PDFDocument7 pagesFar-Single Entry PDFJanica June FiscalNo ratings yet

- Chapter 9 - Interim Financial ReportingDocument8 pagesChapter 9 - Interim Financial ReportingXiena0% (1)

- Quiz Chapter+9 Income+Taxes+-+Document5 pagesQuiz Chapter+9 Income+Taxes+-+Rena Jocelle NalzaroNo ratings yet

- Case Lease RDocument1 pageCase Lease RNirwana PuriNo ratings yet

- Summary Psak Forex Dan Kombinasi BisnisDocument47 pagesSummary Psak Forex Dan Kombinasi Bisnisfari3dNo ratings yet

- Case - Intangible Assets PDFDocument1 pageCase - Intangible Assets PDFwellaNo ratings yet

- Basics of Hypothesis TestingDocument42 pagesBasics of Hypothesis TestingRandy NatalNo ratings yet

- Lesson 2Document10 pagesLesson 2angeliquefaithemnaceNo ratings yet

- INSYS - EBW Serie EbookDocument4 pagesINSYS - EBW Serie EbookJorge_Andril_5370No ratings yet

- Mark Wildon - Representation Theory of The Symmetric Group (Lecture Notes) (2015)Document34 pagesMark Wildon - Representation Theory of The Symmetric Group (Lecture Notes) (2015)Satyam Agrahari0% (1)

- EBSD Specimen Prep PaperDocument36 pagesEBSD Specimen Prep PaperPaul RosiahNo ratings yet

- Constructivism improves a lesson on nounsDocument6 pagesConstructivism improves a lesson on nounsOlaniyi IsaacNo ratings yet

- FMAI - Ch04 - Stock MarketDocument105 pagesFMAI - Ch04 - Stock Marketngoc duongNo ratings yet

- A Report On Kantajew MandirDocument21 pagesA Report On Kantajew MandirMariam Nazia 1831388030No ratings yet

- SMC Dialog Plus Conversion To Another SMC 8 - 22 - 2014Document15 pagesSMC Dialog Plus Conversion To Another SMC 8 - 22 - 2014vivek kumarNo ratings yet

- Bài Tập Phần Project ManagementDocument11 pagesBài Tập Phần Project ManagementhunfgNo ratings yet

- Design and Analysis of Buck ConverterDocument18 pagesDesign and Analysis of Buck Converterk rajendraNo ratings yet

- KJR 20 880 PDFDocument14 pagesKJR 20 880 PDFNam LeNo ratings yet

- Natural GasDocument86 pagesNatural GasNikhil TiwariNo ratings yet

- AlternatorDocument3 pagesAlternatorVatsal PatelNo ratings yet

- Lecture01 PushkarDocument27 pagesLecture01 PushkarabcdNo ratings yet

- Tle 10 4quarterDocument2 pagesTle 10 4quarterCaryll BaylonNo ratings yet

- Introduction to Globalization ExplainedDocument27 pagesIntroduction to Globalization ExplainedMichael Ron DimaanoNo ratings yet

- Crashing Pert Networks: A Simulation ApproachDocument15 pagesCrashing Pert Networks: A Simulation ApproachRavindra BharathiNo ratings yet

- Bareos Manual Main ReferenceDocument491 pagesBareos Manual Main ReferenceAlejandro GonzalezNo ratings yet

- Training Report On Machine LearningDocument27 pagesTraining Report On Machine LearningBhavesh yadavNo ratings yet

- The Joint Force Commander's Guide To Cyberspace Operations: by Brett T. WilliamsDocument8 pagesThe Joint Force Commander's Guide To Cyberspace Operations: by Brett T. Williamsأريزا لويسNo ratings yet

- An Introduction To Log ShootingDocument10 pagesAn Introduction To Log ShootingSorin GociuNo ratings yet

- Fisher - Techincal Monograph 42 - Understanding DecibelsDocument8 pagesFisher - Techincal Monograph 42 - Understanding Decibelsleslie.lp2003No ratings yet

- TM T70 BrochureDocument2 pagesTM T70 BrochureNikhil GuptaNo ratings yet

- Curriculam VitaeDocument3 pagesCurriculam Vitaeharsha ShendeNo ratings yet

- REMOVE CLASS 2024 SOW Peralihan MajuDocument4 pagesREMOVE CLASS 2024 SOW Peralihan MajuMohd FarezNo ratings yet

- GSAA HET 2005-15, Tranche B2 / BSABS 2005-TC2, Tranche M6 Shown As An Asset of Maiden LaneDocument122 pagesGSAA HET 2005-15, Tranche B2 / BSABS 2005-TC2, Tranche M6 Shown As An Asset of Maiden LaneTim BryantNo ratings yet

- 2008-14-03Document6 pages2008-14-03RAMON CALDERONNo ratings yet

- Little ThingsDocument3 pagesLittle ThingszwartwerkerijNo ratings yet

- Cheat Codes SkyrimDocument13 pagesCheat Codes SkyrimDerry RahmaNo ratings yet

- Qcs 2010 Section 13 Part 3 Accessories PDFDocument3 pagesQcs 2010 Section 13 Part 3 Accessories PDFbryanpastor106No ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNo ratings yet

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Stiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreFrom EverandStiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreRating: 4.5 out of 5 stars4.5/5 (13)

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemFrom EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemNo ratings yet

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Canadian International Taxation: Income Tax Rules for ResidentsFrom EverandCanadian International Taxation: Income Tax Rules for ResidentsNo ratings yet

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- Decrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationFrom EverandDecrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationNo ratings yet

- Freight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesFrom EverandFreight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesRating: 5 out of 5 stars5/5 (1)