Professional Documents

Culture Documents

Pay Advice: C3/Customer Contact Channel

Uploaded by

JoyPanoncillo0 ratings0% found this document useful (0 votes)

28 views1 pageprice

Original Title

1541987555178454

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentprice

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views1 pagePay Advice: C3/Customer Contact Channel

Uploaded by

JoyPanoncilloprice

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

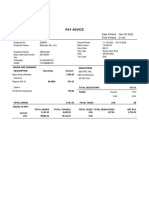

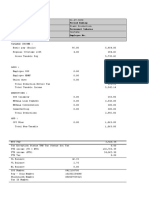

PAY ADVICE

C3/CUSTOMER CONTACT CHANNEL Date Printed : Oct 30 2018

Time Printed : 23:39

Payroll Period : 10-16-2018 - 10-31-2018

Employee ID : 606184 Basic Salary : 0.00

Employee Name : Tan Niandra Teresita Hour Rate : 0.00

Tinguha Pay Type : Salary-Auto Paid

Employee Status : REGULAR SSS : 1011113312

Dept Code/Cost Centre : Direct Labor Tax Code : S00

TIN : 950212607000

PhilHealth : 010519401016

HDMF : 121151465730

HOURS AND EARNINGS DEDUCTIONS BALANCE Current

DESCRIPTION Hours/Days Amount BEFORE TAX

Basic Salary-Monthly EE SSS 0.00 254.30

0.0000 8,856.00

EE PHIC 0.00 106.04

Overtime

TARDINESS 0.5000 -50.90 AFTER TAX

NIGHT DIFF 22.0000 223.94 HDMF LOAN 4,480.90 144.55

Others TOTAL DEDUCTIONS 504.89

INCENTIVES 0.0000 2,000.00

TAXES Current YTD

NON-TAXABLE EARNINGS 0.00 0.00

N/TAX

0.0000 625.00

ALLOWANCE

TOTAL GROSS 11,654.04 TOTAL TAXES 0.00 0.00

GROSS TO NET :

TOTAL GROSS TOTAL TAXABLE TOTAL TAXES TOTAL DEDUCTIONS NET PAY

Current 11,654.04 10,668.70 0.00 504.89 11,149.15

193,659.32 172,493.84 0.00 - -

YTD

You might also like

- Paystub 1Document1 pagePaystub 1PeterJamesNo ratings yet

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- FNP00765Document1 pageFNP00765Rajaram RayNo ratings yet

- 4 MergedDocument12 pages4 MergedPonugoti Pavan kumarNo ratings yet

- Employee Salary Slip For August, 2022: Lucky Cement LimitedDocument124 pagesEmployee Salary Slip For August, 2022: Lucky Cement LimitedAdeen MohsinNo ratings yet

- Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationDocument2 pagesDescription Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationRakesh6nairNo ratings yet

- Dec Salary SlipDocument1 pageDec Salary SlipShubhamNo ratings yet

- Payslip - May - 2020 PDFDocument1 pagePayslip - May - 2020 PDFchanduNo ratings yet

- Payslip - 2021 03 05Document1 pagePayslip - 2021 03 05Mark Lawrence Yusi100% (1)

- Tax CalculaterDocument2 pagesTax CalculaterMahimaNo ratings yet

- Sutherland Global Services Philippines, Inc. - Philippine BranchDocument3 pagesSutherland Global Services Philippines, Inc. - Philippine BranchAngelo Mark Ordoña PorgatorioNo ratings yet

- PayslipDocument1 pagePayslipSahil shahNo ratings yet

- Earnings Deductions: B9 Beverages LimitedDocument1 pageEarnings Deductions: B9 Beverages LimitedStark Satindra SunnyNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- PDFDocument1 pagePDFRaman DiwakarNo ratings yet

- Kotak Mahindra Bank LTD: Full and Final SettlementDocument2 pagesKotak Mahindra Bank LTD: Full and Final SettlementvasssssssSNo ratings yet

- Concentrix Daksh Services India Private Limited Payslip For The Month of November - 2022Document1 pageConcentrix Daksh Services India Private Limited Payslip For The Month of November - 2022Mohammad AnisNo ratings yet

- April PayslipDocument1 pageApril PayslipDev CharanNo ratings yet

- Deccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095Document1 pageDeccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095David PenNo ratings yet

- CB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedDocument3 pagesCB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedsathyaNo ratings yet

- Nhiel - Serentas Payroll PayslipSelfService ExternalPayslipPDFProcessPHDocument1 pageNhiel - Serentas Payroll PayslipSelfService ExternalPayslipPDFProcessPHnhiel anthony SerentasNo ratings yet

- Sutherland Global Services Philippines, Inc. - Philippine BranchDocument2 pagesSutherland Global Services Philippines, Inc. - Philippine BranchJonathan Diane SasisNo ratings yet

- Dec 5Document1 pageDec 5Marvin DavidNo ratings yet

- FNP00765Document1 pageFNP00765Rajaram RayNo ratings yet

- Fiserv December SalaryDocument1 pageFiserv December SalarySiddharthNo ratings yet

- Payslip - JULY 22 - TRIXTANDocument1 pagePayslip - JULY 22 - TRIXTANbktsuna0201100% (1)

- Payslip - 1Document1 pagePayslip - 1bktsuna0201No ratings yet

- SALNONEXEMPT 20221105 366924 PayslipDocument1 pageSALNONEXEMPT 20221105 366924 PayslipMarie LizaNo ratings yet

- SALNONEXEMPT 20221020 366924 PayslipDocument1 pageSALNONEXEMPT 20221020 366924 PayslipMarie LizaNo ratings yet

- Payslip 59904 202401Document1 pagePayslip 59904 202401Sk Imran IslamNo ratings yet

- Amedisys Holding, LLC: Plan Description Starting Balance Earned Taken Adjustments Available BalanceDocument1 pageAmedisys Holding, LLC: Plan Description Starting Balance Earned Taken Adjustments Available BalanceMETRO PACNo ratings yet

- Payslip 147988 202312-27Document1 pagePayslip 147988 202312-27SUNKARA ISNo ratings yet

- Pay No. Period EndingDocument1 pagePay No. Period EndingMa Regina ArizoNo ratings yet

- Pay No. Period EndingDocument1 pagePay No. Period Endingswakie88No ratings yet

- E010072 Payslip 01-JanDocument1 pageE010072 Payslip 01-JanhariprasadhpNo ratings yet

- IGA61306 SalSlipWithTaxDetailsMiscDocument1 pageIGA61306 SalSlipWithTaxDetailsMiscSanthoshNo ratings yet

- Payslip 102703 202303 PDFDocument1 pagePayslip 102703 202303 PDFAnagha AnuNo ratings yet

- SSPCNADVDocument1 pageSSPCNADVChristopher WongNo ratings yet

- Feb PayslipDocument1 pageFeb Payslipnegishilpa051No ratings yet

- Mahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahDocument4 pagesMahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahMUHAMMAD SALEEM RAZANo ratings yet

- Uber Philippines Centre of Excellence LLC: PayslipDocument1 pageUber Philippines Centre of Excellence LLC: PayslipKatey Yumul - OdiamanNo ratings yet

- Sutherland Global Services Philippines, Inc. - Philippine BranchDocument3 pagesSutherland Global Services Philippines, Inc. - Philippine BranchJonathan Diane SasisNo ratings yet

- Emp No: Emp Name::::::::::::: Division. Grade Complex Esi No. Eps No. PANDocument1 pageEmp No: Emp Name::::::::::::: Division. Grade Complex Esi No. Eps No. PANEnigmatic EthicsNo ratings yet

- RRSL 001001499 Payslip 2023-11 Mrinal Ray BarmanDocument1 pageRRSL 001001499 Payslip 2023-11 Mrinal Ray Barmanformega25456No ratings yet

- Jul 2023Document1 pageJul 2023Praveen SainiNo ratings yet

- April Moth PayslipDocument1 pageApril Moth PayslipLoan LoanNo ratings yet

- Pay Advice: Results Alaska IncDocument1 pagePay Advice: Results Alaska Incbktsuna0201No ratings yet

- SalarySlip (1001) 8 - 2019Document1 pageSalarySlip (1001) 8 - 2019Laavanyah ManimaranNo ratings yet

- Payslip 147988 202311-10Document1 pagePayslip 147988 202311-10SUNKARA ISNo ratings yet

- Aug2023 38349 SalarySlipwithTaxDetailsDocument1 pageAug2023 38349 SalarySlipwithTaxDetailsshyam kumarNo ratings yet

- ComputationDocument1 pageComputationLakshay RajoraNo ratings yet

- EMP23 Tax Sheet Report202311152219Document2 pagesEMP23 Tax Sheet Report202311152219SoumyaranjanNo ratings yet

- SettlementReportDocument1 pageSettlementReportSarath KumarNo ratings yet

- C001 SP RMC3720 202106Document1 pageC001 SP RMC3720 202106suprakash samantaNo ratings yet

- 1700584538377Document1 page1700584538377Ishtiyaq RatherNo ratings yet

- Jan PayslipDocument1 pageJan Payslipnegishilpa051No ratings yet

- Employee Details: Computer Generated Slip. No Signature RequiredDocument1 pageEmployee Details: Computer Generated Slip. No Signature RequiredANU MITTALNo ratings yet

- 2023 12 31 PayslipDocument2 pages2023 12 31 PayslipSami SayyedNo ratings yet

- Nikhil KotakDocument2 pagesNikhil Kotaknikhilkadam607No ratings yet