Professional Documents

Culture Documents

Payslip 147988 202312-27

Uploaded by

SUNKARA ISOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Payslip 147988 202312-27

Uploaded by

SUNKARA ISCopyright:

Available Formats

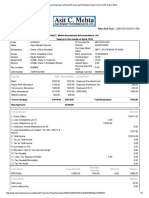

KOTAK MAHINDRA LIFE INSURANCE COMPANY LIMITED (KLIP)

Payslip for the month of DECEMBER - 2023

Emp. No : 147988 Gender : M Bank Name : STATE BANK OF INDIA

Old Id : Designation : ASSOCIATE AGENCY PARTNER Payment Mode : BANK - OTHERS

Name : SUNKARA VEERAIAH Grade : L1 Dt.of Joining : 18/08/2023

PAN No : ASAPS6722M Department : SALES - KOTAK AGENCY (UT) Days worked : 4.00

PF No : MH/BAN/45187/374255 Location : GUNTUR LOP Days : 0

UAN NO. : 100615195313 Bank A/C No : 30760368689 Refund Days : 0

ESI No : 6209992694 Worked Days : 0

Current

Earnings Daily Rate Month Arrears Total Deductions Total

Basic 450.00 1800.00 0.00 1800.00 Esic Deduction 24.00

House Rent Allow. 225.00 900.00 0.00 900.00 Provident Fund 216.00

Field Allowance 105.00 420.00 0.00 420.00 Employee Lwf 30.00

Statutory Bonus Monthly 47.00 188.00 0.00 188.00

Sales Incentive 11400.00 0.00 11400.00

Total Gross Earnings 827.00 14708.00 0.00 14708.00 Gross Deductions 270.00

Net Salary Payable 14438.00

Net Salary Payable(In Words) Fourteen Thousand Four Hundred Thirty Eight Only

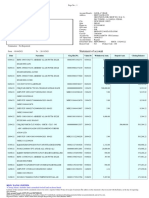

Income Tax Calculation for the Financial Year 2023 - 2024

Income Tax Calculation

Details of Perquisites

Particulars Cummulative Add: Projected Add: Current Annual Loan Perquisites : 0.00

Investment Details

BASIC 7200.00 5400.00 1800.00 14400.00

HOUSE RENT ALLOW 3600.00 2700.00 900.00 7200.00 CLA Details

FIELD ALLOWANCE 1680.00 1260.00 420.00 3360.00 Start Date End Date Amount

STATUTORY BONUS 752.00 564.00 188.00 1504.00 Car Perk Details

MONTHLY Start Date End Date Car CC

SALES INCENTIVE 27270.00 0.00 11400.00 38670.00 Tax Regime : NEW

Total 40502.00 9924.00 14708.00 65134.00

Salary for the Year 65134.00 Slab wise Tax Details

Add : Income received from Previous Employer Salary 0.00 From Amt To Amt Tax Rate % Tax Amt

Net Taxable Income 65134.00 0.00 15140.00 0.00 0.00

Less : Standard Deduction 50000.00 Total 0.00

Add : Other Taxable Income reported by the Employee 0.00 LOP Dates :

Gross Taxable Income 15134.00 Refund Dates :

LESS: DEDUCTIONS U/S 80CCD(1b), 80CCD(2) 0.00

Income Chargable to Tax (Rounded off) 15140.00

Income Tax Deduction

Net Income Tax Payable 0.00

Total Income Tax & S/C Payable 0.00

I Tax & S/C to be recovered 0.00

Marginal Tax To Be Recovered For This Month 0.00

I. Tax & S/C Recovered Till Current Month 0.00

Tax Payable/Refundable 0.00

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Payslip 147988 202311-10Document1 pagePayslip 147988 202311-10SUNKARA ISNo ratings yet

- PAYSLIP_59904_202401Document1 pagePAYSLIP_59904_202401Sk Imran IslamNo ratings yet

- Payslip - May - 2020 PDFDocument1 pagePayslip - May - 2020 PDFchanduNo ratings yet

- Payslip 102703 202303 PDFDocument1 pagePayslip 102703 202303 PDFAnagha AnuNo ratings yet

- Kirandeep September SalaryDocument1 pageKirandeep September Salaryprince.gill07No ratings yet

- Nikhil KotakDocument2 pagesNikhil Kotaknikhilkadam607No ratings yet

- Kirandeep August SalaryDocument1 pageKirandeep August Salaryprince.gill07No ratings yet

- 'KS21596'NovDocument1 page'KS21596'NovRiya paiNo ratings yet

- Kotak Mahindra Bank Limited Payslip For The Month of AUGUST - 2010Document1 pageKotak Mahindra Bank Limited Payslip For The Month of AUGUST - 2010Bharat Shahane33% (3)

- Chola Business Services Pay SlipDocument3 pagesChola Business Services Pay SlipsathyaNo ratings yet

- Kotak Mahindra Bank LTD: Full and Final SettlementDocument2 pagesKotak Mahindra Bank LTD: Full and Final SettlementvasssssssSNo ratings yet

- March 2019Document1 pageMarch 2019Anonymous 2uvubjzzNo ratings yet

- 4 MergedDocument12 pages4 MergedPonugoti Pavan kumarNo ratings yet

- Sify Technologies payslip title for Vinod Kumar BoseDocument1 pageSify Technologies payslip title for Vinod Kumar BoseJOOOOONo ratings yet

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- Kotak Securities Payslip for August 2020Document1 pageKotak Securities Payslip for August 2020Aakash PrajapatiNo ratings yet

- Salary Slip OctDocument1 pageSalary Slip OctRahul RajawatNo ratings yet

- Latha R (KT083)-payslip (1)Document1 pageLatha R (KT083)-payslip (1)rangaswamy8194No ratings yet

- Jan SlipDocument1 pageJan Slipherlyn8762No ratings yet

- Aug2023 38349 SalarySlipwithTaxDetailsDocument1 pageAug2023 38349 SalarySlipwithTaxDetailsshyam kumarNo ratings yet

- Salary Slip NovDocument1 pageSalary Slip NovRahul RajawatNo ratings yet

- Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationDocument2 pagesDescription Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationRakesh6nairNo ratings yet

- Jul 2023Document1 pageJul 2023Praveen SainiNo ratings yet

- INTELENET BUSINESS SERVICES LIMITED PAYSLIP FOR AUGUST 2017Document2 pagesINTELENET BUSINESS SERVICES LIMITED PAYSLIP FOR AUGUST 2017shailNo ratings yet

- Aditya Birla Sun Life Insurance Company Limited Full and Final Settlement Jan-2022Document1 pageAditya Birla Sun Life Insurance Company Limited Full and Final Settlement Jan-2022Praneeth Sasanka TadepalliNo ratings yet

- 97Document2 pages97rusingh932No ratings yet

- Payslip 2023 2024 4 200000000029454 IGSLDocument1 pagePayslip 2023 2024 4 200000000029454 IGSLMohit SagarNo ratings yet

- Schneider Settlement SlipDocument1 pageSchneider Settlement SlipBhanuranjan S BNo ratings yet

- SettlementReportDocument1 pageSettlementReportBhanuranjan S BNo ratings yet

- Payslip 2023 2024 5 200000000029454 IGSLDocument2 pagesPayslip 2023 2024 5 200000000029454 IGSLMohit SagarNo ratings yet

- Payslip 2022 2023 1 Aso8807 SOAGBALICDocument1 pagePayslip 2022 2023 1 Aso8807 SOAGBALICRamesh Kumar PrasadNo ratings yet

- Payslip 2023 2024 5 100000000546055 IGSL PDFDocument1 pagePayslip 2023 2024 5 100000000546055 IGSL PDFKapilNo ratings yet

- You Have Opted For Old Tax RegimeDocument2 pagesYou Have Opted For Old Tax RegimeRamsheed Ashraf100% (1)

- Manthan Aug NewDocument1 pageManthan Aug NewManthan ShahNo ratings yet

- DownloadDocument1 pageDownloadJitaram SamalNo ratings yet

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDocument15 pagesPricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghNo ratings yet

- Payslip 2023 2024 10 05607 VASTUGROUPDocument1 pagePayslip 2023 2024 10 05607 VASTUGROUPNavamani VigneshNo ratings yet

- SettlementReportDocument1 pageSettlementReportSarath KumarNo ratings yet

- C001 SP RMC3720 202106Document1 pageC001 SP RMC3720 202106suprakash samantaNo ratings yet

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedR SEETHARAMANNo ratings yet

- OE0036Document1 pageOE0036kumud kalaNo ratings yet

- Fortis Hospital February 2019 PayslipDocument1 pageFortis Hospital February 2019 PayslipmkumarsejNo ratings yet

- Payslip 2023 2024 5 100000000546055 IGSL PDFDocument1 pagePayslip 2023 2024 5 100000000546055 IGSL PDFKapilNo ratings yet

- 31 Oct 2023Document1 page31 Oct 2023Mrlalit VermaNo ratings yet

- Payslip Tax 1 2024Document2 pagesPayslip Tax 1 2024Trilok SHARMANo ratings yet

- Earning Rate Amount (RS.) Deductions Amount (RS.)Document2 pagesEarning Rate Amount (RS.) Deductions Amount (RS.)Ajay KharwarNo ratings yet

- Salary PDFDocument2 pagesSalary PDFAjay KharwarNo ratings yet

- Infogain Solutions settlement statement summaryDocument1 pageInfogain Solutions settlement statement summaryArmaanNo ratings yet

- Payslip Jun 2023Document1 pagePayslip Jun 2023SanthoshRajNo ratings yet

- April Payment SleepDocument1 pageApril Payment Sleepizajahamed1No ratings yet

- Vodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021Document1 pageVodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021sanket shah100% (1)

- Employee Salary Slip For August, 2022: Lucky Cement LimitedDocument124 pagesEmployee Salary Slip For August, 2022: Lucky Cement LimitedAdeen MohsinNo ratings yet

- Payslip2 PDFDocument1 pagePayslip2 PDFSumanthNo ratings yet

- 00331686_SalarySlipwithTaxDetails (10)Document1 page00331686_SalarySlipwithTaxDetails (10)Nilesh GopnarayanNo ratings yet

- Inr014298 53291001Document2 pagesInr014298 53291001NARASIMHS MURTHYNo ratings yet

- Paywithtaxslip 102324 PDFDocument1 pagePaywithtaxslip 102324 PDFamitshrivastava154218No ratings yet

- Noveltech Feeds Private Limited: Earnings DeductionsDocument1 pageNoveltech Feeds Private Limited: Earnings DeductionsPrakash LamaniNo ratings yet

- Tasleem MayDocument2 pagesTasleem MayManthan ShahNo ratings yet

- Chapter 3 Financial PlanningDocument25 pagesChapter 3 Financial PlanningChristopher Beltran CauanNo ratings yet

- E-Banking Impact on Customer Satisfaction in PakistanDocument43 pagesE-Banking Impact on Customer Satisfaction in PakistanRameez AbbasiNo ratings yet

- Validate, Verify & Check Credit Card or Debit Card NumberDocument1 pageValidate, Verify & Check Credit Card or Debit Card NumberDaniel GrekinNo ratings yet

- Aeon MP Payment RequestDocument2 pagesAeon MP Payment RequestRyanNo ratings yet

- Far Eastern University Audit of Cash Auditing C.T.EspenillaDocument13 pagesFar Eastern University Audit of Cash Auditing C.T.EspenillaUn knownNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceNew NewNo ratings yet

- Accounting Slides Income StatmentDocument20 pagesAccounting Slides Income StatmentEdouard Rivet-BonjeanNo ratings yet

- Hard Choices Needed On Proposed North Peace Leisure FacilityDocument5 pagesHard Choices Needed On Proposed North Peace Leisure FacilityTom SummerNo ratings yet

- RandomDocument2 pagesRandomLakhan PatidarNo ratings yet

- Cae07 All Chapter PDFDocument108 pagesCae07 All Chapter PDFJocelyn Sta AnaNo ratings yet

- Orchids International School fee receiptDocument1 pageOrchids International School fee receiptPrafulla Kailash TajaneNo ratings yet

- Partnership Operation Problem SolvingDocument1 pagePartnership Operation Problem Solvinglebronanthony.jaena-17No ratings yet

- Walter Wurster, Et Al. v. Deloitte Et Al.Document63 pagesWalter Wurster, Et Al. v. Deloitte Et Al.Matthew Kish100% (1)

- Bs in Hospitality Management: St. Nicolas College of Business and TechnologyDocument4 pagesBs in Hospitality Management: St. Nicolas College of Business and TechnologyMaria Charise TongolNo ratings yet

- COM2602 Advanced Accounts L T P C 2018 3 0 0 3 Pre-requisites/Exposure Co-RequisitesDocument2 pagesCOM2602 Advanced Accounts L T P C 2018 3 0 0 3 Pre-requisites/Exposure Co-RequisitesKamakshi MehtaNo ratings yet

- Yosra Turki's Resume Highlighting Financial Analysis and Modeling ExperienceDocument2 pagesYosra Turki's Resume Highlighting Financial Analysis and Modeling ExperienceEmdadul Hoque TusherNo ratings yet

- CRED AnalysisDocument20 pagesCRED Analysisharsh agarwalNo ratings yet

- Nov - 2023 11 08Document8 pagesNov - 2023 11 08praveen kumar100% (1)

- Star Q3 2022 Bursa Announcement FinalDocument19 pagesStar Q3 2022 Bursa Announcement FinalAimran AmirNo ratings yet

- TAX399 - 2024 - Chapter 3-6 - RevisionDocument54 pagesTAX399 - 2024 - Chapter 3-6 - Revisionobenakemtiku15No ratings yet

- Zerodha Brokerage Charges and CalculatorsDocument9 pagesZerodha Brokerage Charges and CalculatorsMrugen ShahNo ratings yet

- Managerial Economics MB 0042Document23 pagesManagerial Economics MB 0042Prafull VarshneyNo ratings yet

- Chapter 2 Partnership OperationsDocument27 pagesChapter 2 Partnership OperationsKenaniah SanchezNo ratings yet

- Project Financing and Verticalization in Infrastructure Project Evaluation. A Case Study of AbengoaDocument25 pagesProject Financing and Verticalization in Infrastructure Project Evaluation. A Case Study of AbengoaVivian Nwanze AdamolekunNo ratings yet

- FIN242: Preferred Stock Investment GuideDocument10 pagesFIN242: Preferred Stock Investment GuideMūhãmmâd Åïmãñ Bïn ÂbddūllähNo ratings yet

- Case Capital BudgetingDocument10 pagesCase Capital Budgetingvinagoya100% (1)

- Debentures TestDocument2 pagesDebentures TestVarun BhomiaNo ratings yet

- Your Bofa Core Checking: Account SummaryDocument8 pagesYour Bofa Core Checking: Account SummaryArgenis Del Jesus VillalbaNo ratings yet

- CFAB Accounting QB Chapter 10 C601Document14 pagesCFAB Accounting QB Chapter 10 C601VânAnh NguyễnNo ratings yet

- Notes On Negotiable InstrumentsDocument62 pagesNotes On Negotiable InstrumentsLet it beNo ratings yet