Professional Documents

Culture Documents

Long Term Recommendation Bata India LTD.: The Growth Sprint

Uploaded by

PAOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Long Term Recommendation Bata India LTD.: The Growth Sprint

Uploaded by

PACopyright:

Available Formats

Long Term Recommendation

Bata India Ltd. The Growth Sprint…

Bata, India’s largest footwear retailer, we believe is at an inflection point driven by: a) rejig of top Sangeeta Tripathi

management; b) parent company’s sharpened focus on the India market; and c) management’s Research Analyst

potent cost rationalisation initiatives. Furthermore, with an eye on bolstering its brand’s strength sangeeta.tripathi@edelweissfin.com

and perception among young consumers, Bata has: i) overhauled its product range; ii) revitalised

visual displays; and iii) reworked its brand communication strategy. This, we believe, will boost

footfalls & conversion and spur same store sales growth. Bata’s earnings are estimated to post

CMP INR: 1255

28% CAGR over FY08-21 driven by: a) 14.7% revenue CAGR over FY18-21E; and (b)390bps margin

expansion over FY18-21E led by improvement in gross margins & operating leverage. Moreover, Rating: BUY

the asset-light business model is estimated to result in core RoCE expanding to 42.4% in FY21 from

32.8% currently. Over the long term, given its pole position and management’s potent initiatives

Target Price INR1500

to get its mojo back, Bata is likely to post industry leading growth, margins and efficiency hence, Upside: 20%

we initiate with ‘BUY’ and target price of INR 1,500.

Market leader and a one-stop footwear destination

Bata is a strong brand in India’s footwear retail market with a formidable pan-India distribution retail

network aggregating 1,400 plus stores encompassing 3 mn sq ft retail space. The company is present

across 550-600 towns & cities and offers products across price points, segments and categories.

Based on the strength of its distribution, product portfolio, width and assortment, Bata is far ahead

of peers at the national level and serves as a one-stop footwear destination.

Bloomberg: BATA:IN

Entering virtuous growth phase driven by confluence of macro and company-driven initiatives

We believe: (a) parent’s sharpened focus on India operations; (b) rejig of management & operations 52-week

1283 / 674

with clear focus on brand rejuvenation, product portfolio re-orientation & cost rationalisation; (c) range (INR):

marked improvement in merchandising, brand communication & customer engagement; and (d)

Share in issue (cr): 13

increased thrust on technology, will lead to Bata clocking industry-leading growth. Hence, we

estimate it to post 14.7% revenue and 28% earnings CAGR over FY18-21.

M cap (INR cr): 16,123

Solid balance sheet coupled with revival of growth to propel RoCE and free cash generation Avg. Daily Vol.

1079

Bata has a strong balance sheet with zero debt and cash constituting ~35% of the overall balance BSE/NSE :(‘000):

sheet. With growth revival, followed by marked improvement in margin (estimate 250 bps operating

Promoter

profit margin improvement over FY18-21), the core RoCE is likely to expand to 42.4% by FY21 from 52.96

Holding (%)

32% currently. Over the next 3 years, we estimate Bata to generate an aggregate of INR 670 cr free

cash.

Outlook and valuations: High quality proxy to play robust footwear demand; initiate with ‘BUY’

We believe that a high quality consumer brand in the growing fast fashion footwear category taking

all the right initiatives to drive growth, improve brand strength and propel earnings is likely to trade

akin to the leader in the consumer space, thus assign 42x PER multiple to FY21 earnings to arrive at

our medium term price target of INR 1,500. Further this high quality consumer brand has all the

potent ingredients in place for further surprise on growth levers, which we believe makes it a

compelling compounding story to be played over long term time frame

Year to March FY18 FY19 FY20E FY21E

Revenues (INR Cr) 2,641 2,968 3,450 3,984

Rev growth (%) 6.7 12.4 16.2 15.5

EBITDA (INR Cr) 351 484 593 685

PAT (INR Cr) 221 312 391 462

EPS (INR) 17.2 24.3 30.4 36.0

EPS Growth (%) 26.3 41.1 25.3 18.4

P/E (x) 72.7 51.5 41.1 34.7

P/B (x) 10.4 8.7 7.1 5.9

RoCE 23.8% 27.6% 28.6% 28.0%

Date: 16th January2019

Core RoCE (ex cash) 32.4% 40.6% 42.6% 42.4%

RoAE (%) 16.1% 18.7% 18.9% 18.6%

Edelweiss Professional Investor Research 1

Table of Contents

Structure ............................................................................................................................. 3

Business Value Drivers ........................................................................................................ 5

Focus Charts 1 ..................................................................................................................... 6

Focus Charts 2 ..................................................................................................................... 7

I. Bata: Market leader with products across categories and segments .............................. 8

II. Bata in the right cycle; making right moves resulting in revival of its growth phase ..... 10

III. Asset-light balance sheet + improved margin to lead to strong core RoCE expansion 24

IV. Competitive positioning ................................................................................................ 25

Outlook and Valuations ...................................................................................................... 27

Business Overview ............................................................................................................. 16

Key Management ............................................................................................................... 16

Timeline .............................................................................................................................. 18

Financials ............................................................................................................................ 30

Edelweiss Professional Investor Research 2

Bata India Ltd Structure

Orient Electric Ltd Structure

Bata is estimated to clock 28% earnings CAGR over FY18-21E. This will be driven by double-digit revenue growth (led by

management’s initiatives to drive footfalls, conversion and thereby improve same store sales) and cost optimization

measures for overheads that are estimated to lead to 390bps margin expansion to 17.2% by FY21E from 13.3% in FY18.

Bata has a strong balance sheet with 35%

28% PAT CAGR will be driven by healhty A market leader in the fast-growing

in cash. Bolstered by robust business

reveue growth (aided by 8-9% same store footwear category with potent

mometum and asset-light model, the free

sales growth), premium offerings and initiatives and on growth threshold,

cash is enviaged to increase. Core RoCE is

sharpened focus on cost optimisation we expect Bata to trade at a

estimated to expand to 42.4% in FY21

premium. Assigning 42xFY21 PER we

from 32.8% in FY18

arrive at target price of INR1,500

FY18 FY19 FY20E FY21E FY18 FY19 FY20E FY21E PER FY21E EPS CMP/Target

Revenue 2,641 2,968 3,450 3,984 ROE (%) 16% 18.7% 18.9% 18.6% 42x 36 1500

EBITDA Core ROCE

13.3 16.3 -17.2 17.2 32.4% 40.6% 42.6% 42.4%

margin (%)

PAT 221 312 391 462

EPS growth of 28% over FY18-FY21 FY21E – core RoCE of 42.4% 42x FY21EPS of 36

Upside of 20%

Edelweiss Professional Investor Research 3

Bata India Ltd Structure

Orient Electric Ltd Structure

Price Target INR 1500 Based on revenue CAGR of 14.7%, EBITDA margin of 17.2% and applying PER at 42x FY21E

Bull Case

Market leader on the

cusp of revival and INR 1800 Based on revenue CAGR of 14.7%, EBITDA margin of 18% and applying P/E multiple of 50x

growth curve to trade

at 50x FY21E earnings

Base Case

Bata valued at 42X

Based on revenue CAGR of 14%, EBITDA margin of 17.2% and applying PEG of 1.8x (implied

FY21E; discount to INR 1500

PER at 42x FY21E)

leaders

Bear Case

Bata to trade at a

steep discount to INR 950 Based on revenue CAGR of 11%, EBITDA margin of 15% and applying P/E of 32x FY21E

consumer staples at

32x FY21

Edelweiss Professional Investor Research 4

Bata India Ltd

Business Value Drivers

Orient Electric Ltd

Business Value Drivers

Bata is one the oldest players in India’s footwear segment and has successfully navigated various business

Sustainability & economic cycles over the years. Despite increased competition, the company has retained its pole position

and currently commands 14-15% share of the overall organised footwear market.

Disproportionate We envisage Bata to clock industry-leading growth driven by: a) rejig of top management; b) parent

Future company’s sharpened focus on the India market; and c) management’s cost rationalisation initiatives.

Business Strategy With an eye on bolstering its brand’s strength and perception among young consumers, Bata has: i)

& Planned overhauled its product range; ii) revitalised visual displays; and iii) reworked its brand communication

Initiatives strategy. This, management believes, will boost footfalls & conversion and spur same store sales growth.

Bata’s earnings are estimated to post 28% CAGR over FY08-21 driven by: a) 14.7% revenue CAGR over FY18-

Near-Term 21E; and (b) 390bps margin expansion over FY18-21E led by cost rationalisation & operating leverage.

Visibility Moreover, the asset-light business model is estimated to result in core RoCE expanding to 42.4% in FY21

from 32.8% currently.

Over the long term, given Bata’s leadership and management’s potent initiatives to get back its mojo, the

Long-Term

company’s performance is likely to grow in line with the industry at ~14-15%, along with superior RoCE and

Visibility

high free cash generation.

Inventory mismanagement on account of SKU and new product introduction, risk of new merchandise failing

Near Term Risk

to appeal to younger customers.

Long Term Risk Exit of key managerial personnel, lack of focus.

Edelweiss Professional Investor Research 5

Bata India Ltd Focus Charts

Orient Electric Ltd Investment Hypothesis

Part I: Story in a Nutshell

Footwear consumption growth in a sweet spot

Bata India – Strong distribiution moat ; presence across 1400

Indian footwear – INR 55,000 crore industry; expected to grow at

stores in 550 cities

CAGR of 15% over FY17-20

15 1800

1600

1400

1200

No. od EBO's

1000 Khadim Bata

12.7 Liberty

800

Metro

600

400 Relaxo

200

FY14-17 FY17-20 0 Mirza

-200 0 100 200 300 400 500 600 700

Cities Presence (Reach)

Bata’s increased focus on high growth Women and Kids

Spread across price points and category; best play

category to drive growth

23.6%

Sundrops Hush Puppies

Premium Hush Puppies Nike

Dr. Scholl Naturalizer Dr. Scholl Weinbrenner 17.8%

(>Rs 3,000) Ambassador Adidas

Clarks Clarks Sundrops Woodland

Clarks Puma Clarks

Bata

Mid-premium Bata Bata comfit Marie Claire

Bata 11.4%

(Rs 1,500)-3,500) Power Bata comfit

Mocassino North Star North Star Bata

Reebok Catwalk

Metro Red Tape Catwalk Metro

Metro

Bubblegummers

Value/Mass Sandak Footin

Bata Sparx

segment Relaxo Bata & I Relaxo Liberty

Liberty Liberty

(< 1,500) Liberty Relaxo

Men’s casual/ Sports Women’s Women’s Youth/Kids Trekking/

Mens Womens Kids

Men’s formal

comfort fashion casual/comfort Outdoor

Bata India

Growth Engine

Enhanced Instore customer Focus on High Growth

Revamp product offerings Increased Marketing Spent

experience Categories

Red Label Collection Kirti Sanon Larger Stores/Stores in High Women

Casual Collection Smriti Mandhana Footfall Areas Kids

Premium Offerings Sushant Singh Rajput Enhanced Ambiance Sports

Higher Footfalls = Higher Conversion = Higher SSG

Edelweiss Professional Investor Research 6

Bata India Ltd Focus Charts

Orient Electric Ltd Investment Hypothesis

Part II Bata’s potent initiatives to revitalise business bound to spur growth

All efforts on brand rejevenutation, visual merchandising and customer engagemnet to result in double digit revenue

ahead

Sales Growth Trend

22% 23%

19%

16%

Impacted by micro + Macro 15%

15%

14% challenges 13%

10.61% 11% 11%

9%

Trending towards

6%

4% growth

3% 6 years of double digit growth 3% 2%

2%

FY04 FY05 FY06 FY7 FY8 FY9 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19E FY20 FY21

..EBITDA margin to improve on back of growth and Operating

Series of efforts undertaken to bring swagger back to Bata..

leverage ahead

The Problem Statement Operational Factors/Plan of Action Status

1.70% 0.30% 17.2%

13.30% 0.20%

Merchandise lacking novelty Identified and Addressing 2.50%

Lack of traction in same

1 store sales growth (SSSG)

Brand Fatigue Identified and Addressing

Not up to the mark Retail Experience Identified and Addressing

Reduced focus on Addressing the opportunity through B2B

2 wholesale channel distribution model

No Concrete strategy yet

High cost of retail Increase revenue base from non-rental

3 Identified and Addressing

expansion avenues -0.80%

FY18OPM

Employee Cost

Rental

Sales & Distribution

Other Overheads

FY21 OPM

Gross Profit Margin

E-Commerce strategy Manage channel conflict and focus on it

4 missing as a growth channel

Work in Progress

Rationalize rental cost, negotiate existing

spent

Operating margin rentals, re calibrate store size, etc. Identified and Addressing

5 pressures

Control Overheads

Focus from the Global leadership Identified and Addressing

6 Is Bata India important

Commitment on India business Identified and Addressing

to be parent?

Importance to Global business Identified and Addressing

Strong balance sheet; with 40% in cash ..and robust core RoCE; likley to grow further

700 50.0%

600 42.6% 42.4%

40.0% 40.6%

500

32.4%

400 30.0%

25.6% 26.9%

300 20.0%

200

10.0%

100

- 0.0%

FY15 FY16 FY17 FY18

Cash and Bank % cash to balance sheet size FY16 FY17 FY18 FY19E FY20E FY21E

Source: Edelweiss Professional Investor Research

Edelweiss Professional Investor Research 7

Bata India Ltd Investment Hypothesis

Orient Electric Ltd Investment Hypothesis

(I) Bata: Market leader with products across categories and segments

In the fast-growing INR 23,000 crore branded footwear segment, Bata is the market leader with

~14-15% share. The company is present in the value for money as well premium categories, which

cumulatively constitute ~40% of the total market.in this focused segment, Bata is the market leader

with ~20% market share. The segment of mid to premium products wherein Bata is present is

growing at a higher pace than the overall footwear market , presenting opportunity to Bata to

benefit from with its increased focus

a. Bata India – Strong distribution moat ; presence across 1400 stores in 550-600 cities

Bata India is the only player in the organized footwear space with an exclusive EBO led model of

1400 stores, spread across 550-600 towns and cities. We believe this exclusive owned distribution

spread is the greatest moat of the company.

EBO a cut above MBO-focused model

EBO MBO

Product exclusivity Competition from other products

Pricing power Price comparisons

Control over brand communication Dealer driven push

Helps build brands in the long run Only creates reach with limited capex

Market Leader With Widest Reach

1800

Charles & Keith

1600

Aldo

1400

Clarks India

1200 Catwalk

Bata Nike

1000

No. od EBO's

Khadim

Liberty Puma

800

Adidas

Metro

600 Relaxo

400 Liberty

Relaxo

Metro

200

Khadim

Mirza

0 Bata

0 100 200 300 400 500 600 700

-200 0 500 1000 1500

Cities Presence (Reach)

No of Stores

Source: Edelweiss Professional Investor Research

b. Bata India – Widest offerings- across price points and categories

Bata offers a wide range of products across categories and segments including men, women and

kids. Presence across price points insulates the company during down turn.

Edelweiss Professional Investor Research 8

Bata India Ltd Investment Hypothesis

Orient Electric Ltd Investment Hypothesis

Bata is present across categories and across price points

Sundrops Hush Puppies

Premium Hush Puppies Nike

Dr. Scholl Naturalizer Dr. Scholl Weinbrenner

(>Rs 3,000) Ambassador Adidas

Clarks Clarks Sundrops Woodland

Clarks Puma Clarks

Bata

Mid-premium Bata Bata

Bata comfit Marie Claire

(Rs 1,500)-3,500) Mocassino Power Bata comfit

North Star North Star Bata

Reebok Catwalk

Metro Red Tape Catwalk Metro

Metro

Bubblegummers

Value/Mass Sandak Footin

Bata Power

segment Relaxo Bata & I Relaxo Liberty

Liberty Sparx

(< 1,500) Liberty Relaxo

Liberty

Men’s formal Men’s casual/ Sports Women’s Women’s Youth/Kids Trekking/

comfort fashion casual/comfort Outdoor

Source: Edelweiss Professional Investor Research

Edelweiss Professional Investor Research 9

Bata India Ltd Investment Hypothesis

Orient Electric Ltd Investment Hypothesis

(II) Bata in the right cycle; making right moves resulting in revival of its growth

phase

Starting its journey from 1931; as a manufacturer of branded footwear; Bata has witnessed

series of ups and down in its journey and has successfully sailed through. The company

has scripted a strong turnaround every time faced with challenges and problems and

currently is the largest footwear retailer. Over FY15-18; in the last three years time frame

the company has grappled with various internal and external issues. With improving macro

environment towards consistent growth and addressing of internal problems, we believe

Bata is now at a cusp of strong earnings revival , which is likely to unfold in the profits and

returns ahead.

4,500 23% 25%

22%

4,000

19%

3,500 20%

16.2%

3,000 15% 15.5%

14% 15%

2,500 12.6%

11% 11%

10.61%

2,000 9%

10%

1,500

5.6%

1,000 4%

3% 5%

3% 2.1%

2%

500

- 0%

FY03 FY04 FY05 FY06 FY7 FY8 FY9 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19E FY20E FY21E

NetSales % growth

800 20

17

700 17

16

15 16 15 15 15

600 13 13

12 12

11 11

500 10

9

400 7

6 5

300

3

200 0 0

100

-5

0 -6

FY03 FY04 FY05 FY06 FY7 FY8 FY9 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19E FY20E FY21E

-100 Core Operating profit opm (%) -10

Restructuring Strong double digit growth Weak economy + Series of efforts

undertaken, VRS result of efforts and initiative company grappling undertaken from improved

under taken and undertaken also resulting in with internal issues product, increased

increasing marked improvement in OPM like inventory, weak customer engagement,

consumer focus from 2.6% in FY06 to 16% in product profile and increased marketing spent

FY13 low consumer and slew of cost

engagement rationalization drive to

yield results ahead..

10

Edelweiss Professional Investor Research 10

Bata India Ltd Investment Hypothesis

Orient Electric Ltd Investment Hypothesis

(a) Rejig at the top level with enhanced focus from the parent

Over the past 24-36 months, Bata India has been gaining marked Importance in the global parent’s

portfolio with Mr. Thomas Archer Bata (Global Chief Marketing Officer) ) visiting India multiple

times for store launches and other events. This is led by strong growth opportunity presented by

the Indian market; by end FY19; Bata India would emerge as the largest market of Bata global. To

drive on this robust growth and get Bata India into the fashion index, it has inducted talent at the

top level to drive growth

Name Designation Profile

Currently, Alexis Nasard is the CEO of Bata global and comes with 24 years’ experience in the consumer

goods business and six years’ experience in Heineken. He heads the business since August 2016. This is for

Alexis Nasard Global CEO the first time that Thomas Bata has inducted some body from outside to lead the company. The current CEO

has visited India a couple of times and has maintained that India is one of the most important markets for

Bata.

Sandeep Kataria was inducted and elevated to CEO’s position at the India level in order to drive the brand’s

equity strength, improve customer engagement and marketing quotient to contemporise the brand’s image.

Sandeep Kataria has strong academic background (IIT Kanpur+ XLRI Jamshedpur) and rich experience in the

Sandeep Kataria CEO

consumer industry. His previous assignments include Vodafone India, Yum brands and Unilever. He was

inducted as country manager in August 2017 and within three months was elevated to the CEO’s office to

handle revenue growth and brand rejuvenation.

The CFO Mr. Ram Kumar Gupta (R.K. Gupta) has rejoined Bata. He has been associated with the company

since 1986 and has worked in different positions. In August 2015, he was Director-Finance, before he

Executive Director relocated to Kenya as Director- Finance of Bata Shoe Kenya. R.K. Gupta is one of the key people involved in

Ram Kumar Gupta

Finance and CFO Bata’s major restructuring over 2005-12. Post rejoining Bata, despite macro setbacks like demonetisation

and GST hitting the entire domestic consumption space, R.K. Gupta has managed to undertake a slew of cost

rationalisation initiatives which have led to earnings growth.

Rajeev Gopalakrishnan has been President of Asia South at Bata India since August 1, 2017, and serves as its

President of Asia Managing Director. He served as the CEO and Managing Director of Bata India from October 1, 2011 to

Rajeev

South at Bata August 1, 2017. He has been associated with Bata since the start of his career and has served in various

Gopalakrishnan

India Limited positions including Managing Director of Bata Bangladesh. He holds a Bachelor of Engineering (Mechanical)

degree from the University of Kerala.

Head Visual Design graduate from New Delhi- 1998 Batch ; Has worked in senior position across industry with over 20

Deepak Chakravarty Merchandising & years’ experience His experience includes working in companies like ITC and Adidas group as head

Retail Marketing merchandising

Anand Narag has been roped in from Reliance Jio. He will be taking care of marketing and customer

service/loyalty at Bata. His mandate is to drive footfalls in stores and create clutter-breaking campaigns. He

Anand Narag VP Marketing will also be closely looking at customer behaviour to strengthen the brand—customer interactions and hence

drive category business. Anand Narag has over two decades of experience and has worked with big

companies such as Nokia, Huawei Technologies, Bharti Airtel and Comverse.

11

Edelweiss Professional Investor Research 11

Bata India Ltd Investment Hypothesis

Orient Electric Ltd Investment Hypothesis

(b) Revitalising the brand

Over the past 18-24 months, Bata has identified the problem areas and has been addressing them

to drive revenue and profitability. We list below details of the same and our view.

The problem and the company’s solution

The Problem Statement Operational Factors/Plan of Action Status

Merchandise lacking novelty Identified and Addressing

Lack of traction in same

1 store sales growth (SSSG)

Brand Fatigue Identified and Addressing

Not up to the mark Retail Experience Identified and Addressing

Reduced focus on Addressing the opportunity through B2B

2 wholesale channel distribution model

No Concrete strategy yet

High cost of retail Increase revenue base from non-rental

3 expansion avenues

Identified and Addressing

E-Commerce strategy Manage channel conflict and focus on it

4 missing as a growth channel

Work in Progress

Rationalize rental cost, negotiate existing

Operating margin rentals, re calibrate store size, etc. Identified and Addressing

5 pressures

Control Overheads

Focus from the Global leadership Identified and Addressing

6 Is Bata India important

Commitment on India business Identified and Addressing

to be parent?

Importance to Global business Identified and Addressing

12

Edelweiss Professional Investor Research 12

Bata India Ltd Investment Hypothesis

Orient Electric Ltd Investment Hypothesis

(i) Improved /enhanced product offerings – Despite being a strong brand with sturdy quality

image, Bata remained largely a non stylish and a fuddy duddy brand in the Indian context. The

aspirational quotient both on the product and the brand image was lacking, Over the last 24-

36 months , lot of effort has undergone to change this image and make the brand more trendy

, stylish and palatable to the younger and the millennial audience The complete revamp of

offerings in each category (Men, Women, Kids and sports) is done to woo the consumers along

with keeping the pricing equation intact.

It has refreshed its products in various categories – In power it has launched power walking

collection with memory foam, trendy power shoes for women.

It introduced new stylish range of ladies footwear under the new collection naming the same as

the Red label collection

Under the Hush puppies brand, further premiumization and range is being added towards higher

price points

New launches in the youth oriented spaces under its brands like Power, Weinbrenner, Footin etc

13

Edelweiss Professional Investor Research 13

Bata India Ltd Investment Hypothesis

Orient Electric Ltd Investment Hypothesis

(ii) Brand building to spur revenue growth

Revamped marketing - For any consumer brand, in order to drive mind share along with

wallet share of the consumer, it is imperative to continuously engage the consumer with

its products, communication and aspirational quotient. FMCG/ consumer facing

companies spent a substantial amount of their revenue, which drives revenue growth for

the company.

Historically seen that Over FY06-12, Bata posted revenue CAGR of 15.4% driven by increased

branding and new store addition aggression. It was during this period that the company’s

advertising and marketing spends increased substantially. Its advertisement spends averaged 1.5%,

which was pivotal in driving footfalls and conversion at the store level.

However, over FY13-Y17, Bata under-invested in brand building and communication—ad spends

largely remained range bound at 0.9-1.0% of sales. But, over the past 12-18 months, the company

has made efforts to improve its marketing quotient along with improvement in product offerings—

advertisement cost to sales increased from less than 1.0% to 1.5% in FY18.

Bata’s advertisement spent is increasing

45 2.0%

40 Advertisment Ad to sales 1.8%

1.7%

1.7% 1.5%

35 1.6%

1.4% 1.4%

30 Under investment in brands

1.3%

1.2%

25 Investment in 1.1%

(INR cr)

brand, results in 1.0% 1.0%

1.0% 1.0%

20 0.9%

0.8%

15 0.7%

0.6%

10 0.4%

5 0.2%

0 0.0%

FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY15 FY16 FY17 FY18

Source: Edelweiss Professional Investor Research

For 9MFY19, Bata has spent around INR 50 crores (2-2.5%) of its revenue towards advertisement

and brand building, which has resulted in strong footfalls and better conversion, visible in the last

six months revenue performance. For Q3FY19, Bata reported a Same store Sales growth of 12%.

Enthused by the response on the revamped positioning,, the company has upped its ante further

and for FY20, it aims to increase its advertisement and brand building spent to around 3%, to further

drive revenue, and enhance its brand image.

14

Edelweiss Professional Investor Research 14

Bata India Ltd Investment Hypothesis

Orient Electric Ltd Investment Hypothesis

Bata’s spent on advertising still lower than other discretionary players- Increase to propel

growth (Percentage to Revenue)

4.7 4.8

4.4

3.8 3.9

3.4

2.8 3.0

2.0 1.8

HAVELLS

ABFRL

BATA

METRO

ASIAN PAINTS

SHEELA FOAM

RELAXO Footwear

TRENT

TITAN

FOODWORKS

JUBILANT

Source: Edelweiss Professional Investor Research

It has roped in bollywood actress Kirti Sanon as its brand ambassador for fashion forward women’s

footwear. It has also appointed Smriti Mandhana (India’s youngest woman cricketer) as the

ambassador for its sports brand Power. In men’s footwear, while the company is still largely known

for its formal range, the shifting trend in favour of casual footwear has led to the company

improving its range in the latter; to communicate the same, it has roped in bollywood actor Sushant

Rajput as brand ambassador.

Kiriti Sanon- Surpisingly Bata TVC

Sushant Rajput – Casual collection Smirit Mandhana- Power collection

15

Edelweiss Professional Investor Research 15

Bata India Ltd Investment Hypothesis

Orient Electric Ltd Investment Hypothesis

(iv) Improved instore consumer expereince to enhance brand image and drive growth -

Bata India over last 2-3 years has been working on improving its instore expereince right from

opening bigger stores, opening stores in high footfall areas like malls/ High streets.Over FY16-18, it

has added 165 stores, while in the same period it has also closed smaller stores (~1,000 sq ft.

The bigger stores provide a complete range of products, further with enhanced visual merchandise

and improved product placement the store and the shopping experience improves manifold for a

customer. All this aids to higher revenue and better margins

It aims to continue its expansion spree and has guided to add around l 100 stores. Of these, ~50

will be company owned & operated and balance 50 will follow the new franchisee store model

which Bata is exploring to reach out in tier 3 & 4 towns and cities.,

Along with opening new stores, it would also continue to renovate existing stores and improve

layouts with the objective of increasing same store sales growth.

By FY21, we expect Bata to reach 1575 stores with an aggregate 3.4mn sqft area

1800 4.0

1575

1600 1510

1445 3.5

1400

1400 1295

1235 3.4 3.0

1200

(No. of Stores)

3.0 2.5

1000

2.4 2.0

800

1.5

600

400 1.0

200 0.5

0 -

FY16 FY17 FY18 FY19E FY20E FY21E

Overall Total Retail space (mn sq ft)

Source: Edelweiss Professional Investor Research

We believe, Bata’s efforts to: (a) improving product portfolio; (b) enhance visual merchandising,

look & feel of its stores; and (c) improvement in communication & marketing layout, will boost

footfalls & higher conversion and lead to double digit revenue growth.

16

Edelweiss Professional Investor Research 16

Bata India Ltd Investment Hypothesis

Orient Electric Ltd Investment Hypothesis

Larger stores with improved layout and premium merchandise

17

Edelweiss Professional Investor Research 17

Bata India Ltd Investment Hypothesis

Orient Electric Ltd Investment Hypothesis

v) Focusing on high growth categories to drive growth

Women share to increase to 35% in next three years

Currently, while women’s footwear constitutes ~30-35% of the overall market, men’s

constitutes ~55-60%. However, the former category is growing at ~18-20%, almost 2x the latter.

Thus, it becomes imperative for any footwear player to focus on the ~INR 20,000 crore

women’s footwear segment.

Women and kids category to grow at faster pace

23.6%

17.8%

11.4%

Mens Womens Kids

Source: Edelweiss Professional Investor Research

This segment contributes 26% to Bata’s revenue as the company was largely focused on the men’s

segment. Over the past three years, it has started focusing on this category and aims to take its

share to 35%. We believe this strategy, underpinned by appropriate customer engagement, better

products and wise pricing, will fetch rich returns.

Kids category focus to drive growth

Around 18% of India’s population falls between 0 and 14 years and currently this (kids)

category forms ~9% of the total footwear market, which is highly unorganised. Shift to

formalisation of this segment is expected to drive strong growth for this category. Industry

estimates peg the kids category to grow at the fastest pace of ~23.6% over FY17-20. Kids’

overall share in the footwear segment is estimated to increase to 11%.

Bata is focusing on this huge market with its Bubblegummer brand and expects strong traction

from this category. Kids contribute less than 9% to Bata’s revenue, which it envisages to

increase to ~11%.

18

Edelweiss Professional Investor Research 18

Bata India Ltd Investment Hypothesis

Orient Electric Ltd Investment Hypothesis

Exclusive 2 kids stores in Banaglore

Marked increase in the space dedicated towards kids

19

Edelweiss Professional Investor Research 19

Bata India Ltd Investment Hypothesis

Orient Electric Ltd Investment Hypothesis

Sharpening focus on sportswear category to Power growth

INR 8,000 crore sports and athleisure category growing in double digits: The sports and athleisure

category in India is growing in strong double digits. Though a formal size and estimates are not

available, industry sources peg the market at INR 8,000 crore, constituting ~20% of the overall

footwear market. This segment is dominated by global players with Adidas leading the pack with

INR 1,100 crore (for FY18) revenue. Though Bata was present in this category through its franchisee

Power brand, focus on the category was missing. With growth in the category and rising domination

of global players, Bata has rejuvenated its focus on its Power brand.

Exploiting sports category via brand Power: Currently, the Power brand contributes ~10% to Bata’s

overall revenue. With swift growth in the category coupled with the company’s focus to take the

brand out of Bata stores to an exclusive format is likely to propel Power’s growth. In order to

resonate with the youth and sport enthusiasts, Bata has roped in Indian women cricket batsman

Smriti Mandhana as its brand ambassador.

Using online channel to expand reach, coverage and growth: Another notable trend in India’s

footwear industry is the spectacular growth in the online segment. The sportswear category has

embraced this distribution channel to the hilt. Currently, the online channel contributes ~20-22%

to total sports footwear sales. Initially, the company was in denial mode and hence lost revenue

and market share to the fast growing online mode. Over the last 18 months, the company has

focused on the online mode and now all its products are available across all market place model –

Amazon, Flipkart, Jabong and also it has its own exclusive online portal. The sports category has

highest online share at the industry level (at 18-20%), while Bata currently has only less than 3% of

the revenue from this mode, the growth potential is high with focus and leverage on this

distribution mode.

Exclusive formats: Sensing the opportunity in the category, Bata has enlarged its collection of

Power offerings for men, women and kids. Also, to create a brand identity & uniqueness in line with

its strategy of Hush Puppies, it is planning to open exclusive Power stores as well as those that will

display the entire width and depth of the product.

Exclusive Power stores

20

Edelweiss Professional Investor Research 20

Bata India Ltd Investment Hypothesis

Orient Electric Ltd Investment Hypothesis

Power to contribute 18-20% to turnover in next five years: With this mix of well placed strategy

and positive macros, we expect brand Power to grow in higher double digits and double its share

from current 10% to ~18% over the ensuing five years.

Top Sports Footwear brands in India (INR Cr) Geographical presence

1,100 800

1,000 900

450

500 360

300 250 250

Adidas Puma Nike Reebok Power Bata Power Adidas Puma Nike Reebok

Source- RoC; industry estimates

Bata India

Growth Engine

Enhanced Instore customer Focus on High Growth

Revamp product offerings Increased Marketing Spent

experience Categories

Red Label Collection Kirti Sanon Larger Stores/Stores in High Women

Casual Collection Smriti Mandhana Footfall Areas Kids

Premium Offerings Sushant Singh Rajput Enhanced Ambiance Sports

Higher Footfalls = Higher Conversion = Higher SSG

We estimate Bata to post 14.7% revenue CAGR over FY18-21 driven by high single digit same store

sales growth and an annual 60 new store additions.

Bata India: expected to grow at CAGR of 14.7% over FY18-21E

5,000 20.0

15.0

4,000

10.0

3,000 5.0

(INR cr)

(%)

2,000 -

(5.0)

1,000

(10.0)

- (15.0)

FY16 FY17 FY18E FY19E FY20E FY21E

Net Sales % growth

Source: Edelweiss Professional Investor Research

21

Edelweiss Professional Investor Research 21

Bata India Ltd Investment Hypothesis

Orient Electric Ltd Investment Hypothesis

Premiumization trend to result in higher gross margin

Over the years, shopping preferences of consumers have changed from price sensitive to fashion

quotient. Bata’s positioning has always been of a sturdy, but low fashion quotient brand. The

company has now consciously changed this perception with trendier and much more fashionable

merchandise. Towards this end, it has exited value category of footwear (MRP < 200; in plastic and

rubber categories) and entering high fashion and premium products.

Brand wise revenue mix (%) Price wise revenue mix (%)

Acessories,

10

Power, 10 20%

30% INR 1500+

INR 1000+ - 1500

Hush

Puppies, 10 INR 500+- 1000

Bata, 70 27%

INR > 500

20%

Source: Edelweiss Professional Investor Research

Within each category and sub segment, Bata is moving towards the premium range and has vacated

the low end of the market. Currently the premium portfolio contributes around 30% to the company

revenue and with increasing focus in driving growth for this segment, the share is likely to reach

45% in the next three years time frame .

The premium collection for Bata is Hush Puppies, Naturalizer, European Collection, Power

International Range and North Star. Bata has also entered collections of casual, daily wear, sports

and outdoor categories for the 10-14 year age group.

Premium product portfolio helps push the brand quotient on one hand with better connect with

spending millennial class, while on the other hand it leads to higher gross margin and thereby

propels overall margin in higher orbit.

A continuous focus on the premium segment, has resulted in Bata’s per pair realisation growing at

a CAGR of 7.7% from INR 485 per pair in FY15 to INR 562 in FY18, and we expect the same to increase

by 8-10% further in the ensuing years to reach around INR 660 by FY21

Further towards this drive, we expect this to impact gross profit margin positively. Historically as

well, Bata’s gross profit margin has improved from 52.5% in FY16 to 55.9% in FY18 (expansion of

340bps over four years). We believe, the trend is likely to sustain with further aggression and hence

estimate the company to post 56.7% gross margin by FY21.

Improving Average Realization (INR per pair) 562

526

485

FY16 FY17 FY18

Source: Edelweiss Professional Investor Research

22

Edelweiss Professional Investor Research 22

Bata India Ltd Investment Hypothesis

Orient Electric Ltd Investment Hypothesis

Expanding Gross margins (%)

56.7 56.7

55.9 56.0

54.2

53.2

52.5

FY16 FY17 FY18 9MFY19 FY19E FY20E FY21E

Source: Edelweiss Professional Investor Research

Cost rationalisation efforts to result in huge operating leverage benefits

Despite clocking 54% plus gross margin, Bata’s current operating margin is ~13%. For FY18, ~40%

of the total cost is largely fixed. Rentals and employees are major fixed costs for Bata constituting

13.3% and 11.2% of revenue, respectively. Evaluation of discretionary and retail players indicates

that this ratio of rentals to revenue is extremely high for Bata.

Bata’s rental remain high visa-vis other retailers…providing scope for improvement

13.7%

12.1%

10.1% 10.8%

7.5% 7.6%

4.4%

V-Mart Metro Future Retail Future Lifestyle Jubilant Trent Bata

Foodworks

Source: Edelweiss Professional Investor Research

However, we expect it to improve on: (a) improvement in sales per sq ft; (b) renegotiation of lease

rentals across stores; (c) rationalisation of store size to improve store economies; and (c)

renegotiation with suppliers. These efforts to rationalise overheads coupled with the ongoing

premiumisation drive will positively impact margin.

We estimate Bata’s operating profit margin to expand by 390 bps over the ensuing 9 quarters to

17.2% by FY21.

Journey of operating profit margin from 13.3% in FY18 to 17.2% in FY21E

1.70% 17.2%

0.20% 0.30%

2.50%

13.3%

-0.80%

FY18OPM Gross Profit Employee Cost Rental Sales & Other FY21 OPM

Margin Distribution Overheads

spent

Source: Edelweiss Professional Investor Research

23

Edelweiss Professional Investor Research 23

Bata India Ltd Investment Hypothesis

Orient Electric Ltd Investment Hypothesis

(III) Asset-light balance sheet + improved margin to lead to strong core RoCE

expansion

Bata, over the years, has evolved from a manufacturing-cum-retailer in to a mid-premium retail

branded player. It has taken a conscious decision to reduce its presence in manufacturing, thereby

creating an asset-light business model.

Currently, ~60-65% of the products sold at Bata are outsourced, resulting in better asset turns and

also margin improvement. Going forward we expect Bata’s EBITDA margin to improve from 13.3%

in FY18 to 17.2 % in FY21E.

With improvement in margin, we estimate Bata’s core RoCE to jump from 32.8% in FY18 to 42% by

FY21

40.6% 42.6% 42.4%

32.4%

25.6% 26.9%

FY16 FY17 FY18 FY19E FY20E FY21E

Source: Edelweiss Professional Investor Research

Strong operating cash flow generation ahead to provide scope for inorganic expansion- Driven

by strong margin expansion and stable working capital cycle, Bata is expected to generate strong

operating cash flows ahead, we expect the company to post an aggregate free cash flow of INR

670 crore over FY18-21E. This strong operating cash flow generation along with already high cash

in the books (around INR 600 crore) further strengthens Bata balance sheet. By FY21, we expect

Bata’s cash on books to almost double from present INR 600 crore to INR 1100 crore, thereby

providing it an opportunity to expand via acquisition or takeover.

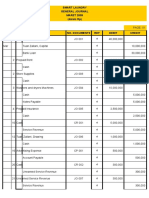

FY15 FY16 FY17 FY18 FY19 FY20 FY21

Net profit 200 159 175 221 312 391 462

Add: Depreciation 79 79 65 60 67 77 88

Gross cash flow 279 238 240 281 379 467 550

Less: Changes in W. C. 77 113 226 93 209 103 114

Operating cash flow 202 125 14 188 170 365 436

24

Edelweiss Professional Investor Research 24

Bata India Ltd Investment Hypothesis

Orient Electric Ltd Investment Hypothesis

IV. Competitive positioning

Resilient performance even during downturns

50%

40%

30%

20%

10%

0%

-10%

-20%

Bata Relaxo Khadim Metro Mirza Liberty Adidas

FY13 FY14 FY15 FY16 FY17 FY18

Source: Edelweiss Professional Investor Research

Amongst the best Gross Margins; likely to improve (%)

54.5 54 55

47.8

45.7

41.5

38

Bata Relaxo Khadim Metro Mirza Liberty Adidas

Scope for improvement in operating margin (%)

15.4 15.3

13.4

10.3

Bata Relaxo Khadim Metro

Source: Edelweiss Professional Investor Research

25

Edelweiss Professional Investor Research 25

Bata India Ltd Investment Hypothesis

Orient Electric Ltd Investment Hypothesis

Well placed on RoCE to EBITDA profile; with scope for improvement

18%

16%

14%

12% Metro

EBITDA Margin

Relaxo

10% Bata

8% Khadim

6%

4%

2%

0%

15% 20% 25% 30% 35% 40%

RoCE

Source: Edelweiss Professional Investor Research

26

Edelweiss Professional Investor Research 26

Bata India Ltd

Outlook and Valuation

Orient Electric Ltd

Outlook

We initiate coverage on Bata India with and Valuations

“Buy” recommendation and TP of INR 1500, entailing 20%

upside based on current market price. Our TP is based on 42x FY21 EPS of INR 36. We belevie that

Bata being a market leader in the fast growing footwear category with right intervention, strong

ROCE and strong balance sheet with 40% cash is at the cusp of growth is likely to trade at in line

with the other leading consumer plays.

Relative Valuation

Diluted EPS (INR) P/E( x) EV/EBITDA(x) ROCE

M-cap

Company EPS CAGR

(INR cr) FY18E FY19E FY20E FY18E FY19E FY20E FY18E FY19E FY20E FY18E FY19E FY20E

FY18-20

Havell's India 43073 11.2 13.9 17.3 24.1 63.1 50.8 41.0 40.8 32.7 26.5 28.1 31.5 34.9

Asian Paints 133674 21.1 24.2 29.6 18.5 68.8 60.1 49.0 43.4 39.0 32.0 34.3 34.6 37.5

Pidilite Industries 55680 19.0 19.2 23.7 11.6 59.7 59.3 47.9 42.3 39.5 32.2 36.2 33.8 35.5

Jubilant Foodworks 17167 15.6 24.6 29.6 37.5 83.0 52.7 43.9 37.5 27.2 22.4 33.0 42.5 41.8

Titan Company 92241 12.6 16.3 20.3 26.8 84.6 65.4 52.6 57.2 44.6 35.9 34.0 36.8 38.7

Aditya Birla Fashion

16836 1.5 3.4 5.3 86.7 137.7 61.4 39.5 38.8 25.4 19.5 7.0 15.0 19.2

and Retail

Avenue Supermarts

91385 12.9 15.4 20.3 25.3 111.6 93.7 71.2 66.3 54.1 41.6 25.6 28.0 29.8

Limited

Trent LTD 11069 2.6 5.5 7.7 71.1 130.1 61.5 44.4 57.9 40.9 30.7 10.4 13.0 15.4

Median 26.0 83.8 60.7 46.2 42.8 39.3 31.4 30.5 32.7 35.2

Bata India 16127 17.2 24.3 30.4 33.0 73.0 51.7 41.3 38.4 28.7 22.9 32.4 40.6 42.6

Key Risks

Exit of key management personnel: Exit of senior management (Mr. Sandeep Kataria and

senior management employees like R.K. Gupta ) is a key risk for Bata as it has played an

important role in turning around the company over the past 3 years.

Intense competition: Bata may face intense competition from existing players in the form of

aggressive pricing, increased spending on marketing & distribution, launch of improved

products with attractive features, etc. Furthermore, entry of large international companies in

the footwear segment can lead to intense competition in the industry in the future.

Slowdown in economy: Rise in disposable incomes is a key driver of consumer discretionary.

Hence, any slowdown in the economy could pose downside risk to Bata’s earnings.

27

Edelweiss Professional Investor Research 27

Bata India Ltd

Business Overview

Orient Electric Ltd

Business Overview

Company Description

Bata, India’s largest footwear retailer, has been operating in the Indian subcontinent for around 9 decades with a retail

network of 1,400 stores across 550 cities, entailing 3 mn sq ft retail space. It has 5 manufacturing plants at West Bengal, Bihar,

Karnataka and Tamil Nadu.

Bata is a part of Bata Shoe Organization (BSO) that has presence in 70 countries and operates through 3 business units—Bata

India is the largest entity of the BSO in terms of pairs sold and will overtake Italy in FY19 in terms of revenue (currently Italy is

the largest revenue market for BSO).

BSO provides access to the technical research and innovative programmes of Global Footwear Services, Singapore. This

arrangement is currently valid up till 2021 and Bata pays 1% as a technical charge for the same.

The company retails shoes across all price points via its own EBO network of 1,300 plus stores. It

Business Model

manufactures as well as outsources products that it retails.

Strategic Positioning It has pan-India presence and strong brand equity in the minds of its target consumers.

Competitive Edge Wide product portfolio—men, women as well as kids, with store presence in key geographies.

Financial Structure Strong balance sheet, with zero debt on books and ~35% plus of the balance sheet in cash.

Key Competitors Relaxo, unorganised players.

Industry Revenue

Increasing per capita consumption of footwear along with premiumisation trend.

Drivers

Shareholder Value The company is likely to clock EPS of INR 30.4for FY20E. At valuation of 42x FY21E, we arrive at

Proposition target price of INR1500 which offers an upside of 20% from the current level.

28

Edelweiss Professional Investor Research 28

Bata India Ltd Timeline

Orient Electric Ltd Timeline

Major Milestones

1931: 2002: 2012: 2015: The company tried 2017:

Incorporated in Massive operational • Achieved annual sales of to change the inventory Further restructuring towards

Kolkata as Bata Shoes restructuring initiated – 50 mn pairs tracking system from new management, cost

Co. Batanagar plant closed down cash traditional basis to SAP rationalization efforts continued

was the first footwear drain stores, employee module, the changeover

manufacturing facility VRS, technology had problem, resulting in

to receive ISO 9001 upgradation, higher inventory pile up

certification outsourcing etc and lower sales

1931 1971 2002 2011 2012 2013 2015 2016 2017 2018

1971: 2011: 2013: 2016: 2018

Public issue and name Restructuring nearly • General slowdown and the online • Rejig at the • Marked change in the product,

was changed to Bata complete; focus shifts slaughter and weak product portfolio management level positioning, pricing and

India Limited to aggressively impacted the performance was done to fix on communication undertaken to cater

opening large format the inventory to the evolving young generation

destination stores and problem; which was

EBO’s for certain resolved

scalable sub-brands

29

Edelweiss Professional Investor Research 29

Bata India Ltd Financials

Orient Electric Ltd Financials

Year to March (INR cr) FY17 FY18 FY19E FY20E FY21E

Income from operations 2,474 2,641 2,968 3,450 3,984

Direct costs 1,158 1,209 1,306 1,494 1,725

Employee costs 273 296 329 380 438

Renal expenses 357 362 365 414 478

Other expenses 408 423 484 569 657

Total operating expenses 2,196 2,290 2,484 2,857 3,299

EBITDA 278 351 484 593 685

Depreciation and amortisation 65 60 68 77 87

EBIT 213 291 416 516 598

Interest expenses 4 4 4 4 4

Other income 46 51 53 70 97

Profit before tax 255 337 465 582 691

Provision for tax 75 116 153 192 228

Core profit 180 221 311 390 463

Extraordinary items -22 0 0 0 0

Profit after tax 158 221 311 390 463

Minority Interest 0 0 0 0

Share from associates 0 0 0 0

Adjusted net profit 180 221 311 390 463

Equity shares outstanding (mn) 13 13 13 13 13

EPS (INR) basic 14 17 24 30 36

Dividend per share 4 4 4 4 4

Dividend payout (%) 29 23 17 13 11

Common size metrics- as % of net revenues

Year to March FY17 FY18 FY19E FY20E FY21E

Operating expenses 88.8 86.7 83.7 82.8 82.8

Depreciation 2.6 2.3 2.3 2.2 2.2

Interest expenditure 0.2 0.2 0.1 0.1 0.1

EBITDA margins 11.2 13.3 16.3 17.2 17.2

Net profit margins 7.3 8.4 10.5 11.3 11.6

Growth metrics (%)

Year to March FY17 FY18 FY19E FY20E FY21E

Revenues 2.1 6.7 12.4 16.2 15.5

EBITDA 2.3 4.3 8.5 15.0 15.5

PBT 14.9 32.3 37.8 25.3 18.7

Net profit (27.3) 39.8 41.0 25.3 18.7

EPS 25.9 23.0 41.0 25.3 18.7

30

Edelweiss Professional Investor Research 30

Bata India Ltd Financials

Orient Electric Ltd Financials

Balance sheet (Standalone)

As on 31st March FY18 FY19E FY20E FY21E

Equity share capital 64 64 64 64

Reserves & surplus 1,481 1,793 2,183 2,646

Shareholders funds 1,545 1,857 2,248 2,710

Long Term Borrowing - - -

Short Term Borrowing - - -

Minority interest - - -

Other Liabilties - - -

Sources of funds 1,545 1,857 2,248 2,710

Gross block 485 585 685 785

Depreciation 293 373 453 533

Net block 192 212 232 252

Capital work in progress 14 14 14 14

Total fixed assets 206 226 246 266

Intangible Assets

Deferred tax assets 105 105 105 105

Inventories 762 829 964 1,113

Sundry debtors 89 98 113 131

Cash and equivalents 636 659 867 1,135

Loans and advances 188 207 228 251

Other current assets 105 115 132 152

Total current assets 1,780 1,908 2,305 2,782

Sundry creditors and others 657 554 639 735

Provisions

Total CL & provisions 657 554 639 735

Net current assets 1,123 1,355 1,665 2,048

Uses of funds 1,545 1,857 2,247 2,710

Book value per share (INR) 120 144 175 211

Cash flow statement

Year to March FY18 FY19E FY20E FY21E

Net profit 221 312 391 462

Add: Depreciation 60 67 77 88

Add: Deferred tax

Add: Others 0 0 0

Gross cash flow 281 379 467 550

Less: Changes in W. C. 93 209 103 114

Operating cash flow 188 170 365 436

Less: Capex 83 100 100 100

Free cash flow 105 70 265 336

31

Edelweiss Professional Investor Research 31

Bata India Ltd Financials

Orient Electric Ltd Financials

Ratios

Year to March FY17 FY18 FY19E FY20E FY21E

ROAE (%) 13% 16% 19% 19% 19%

ROACE (%) 21% 24% 28% 29% 28%

Current ratio 3 3 3 4 4

Debtors (days) 10 10 11 12 12

Inventory (days) 104 103 102 102 102

Payable (days) 68 79 65 65 65

Cash conversion cycle (days) 46 34 48 49 49

Debt/EBITDA

Debt/Equity

Adjusted debt/Equity

Valuation parameters

Year to March FY17 FY18 FY19E FY20E FY21E

Diluted EPS (INR) 14.0 17.2 24.3 30.4 36.0

Y-o-Y growth (%) 25.9 23.0 41.1 25.3 18.4

CEPS (INR)

Diluted P/E (x) 101.7 72.7 51.5 41.1 34.7

Price/BV(x) 12.1 10.4 8.7 7.1 5.9

EV/Sales (x) 6.3 5.8 5.2 4.4 3.7

EV/EBITDA (x) 48.0 38.4 28.7 22.9 19.1

Diluted shares O/S 12.9 12.9 12.9 12.9 12.9

Basic EPS 14.0 17.2 24.3 30.4 36.0

Basic PE (x) 101.7 72.7 51.5 41.1 34.7

Dividend yield (%) 0.32 0.32 0.32 0.32 0.32

32

Edelweiss Professional Investor Research 32

Bata India Ltd Financials

Orient Electric Ltd Financials

I. India favourably placed to ride on the consumption boom.

Footwear consumption remain low in India

Per Capita Consumption (No. of 9.0

8.0 UK

7.0

6.0 Mexico

5.0 Indonessia USA

pairs)

4.0 Brazil

3.0 China

2.0 India

1.0

0.0

- 10,000 20,000 30,000 40,000 50,000 60,000 70,000

Per capita GDP (USD)

...And per spent on footwear is low

70,000 50

60,000

40

Per capita GDP (US$)

Spent per pair in US$

50,000

40,000 30

30,000 20

20,000

10

10,000

- 0

India Indonessia China Mexico UK Brazil USA

Per capita GDP Spent per pair

Source: Edelweiss Professional Investor Research

India’s per capita consumption as well as per capita spent on footwear is low, and with the growth

in the per capita GDP, the per person consumption along with the per pair spent on footwear is

likely to grow.

Indian footwear industry estimated to grow in mid-teens over medium term

Industry estimates peg the overall footwear industry at INR 55,000 crore, having clocked 12.7%

CAGR over the past five years and estimated to clock 15% CAGR till FY20. Within the industry, while

men’s category is likely to grow at 11.4%, women’s category is expected to grow at a faster clip of

17.8%; kids segment is estimated to register 23% CAGR over the ensuing three years.

33

Edelweiss Professional Investor Research 33

Bata India Ltd Financials

Orient Electric Ltd Financials

Footwear Industry expected to grow in mid teens Women and kids category to grow at faster pace

15 23.6%

17.8%

11.4%

12.7

FY14-17 FY17-20 Mens Womens Kids

Source: Edelweiss Professional Investor Research

The women’s and kids composition in the footwear category is likely to increase from present level of 37%/ 9% to around 41%/11%

by FY20.

Footwear

industry

Kids, 9% break-up - Kids, 11%

2020, 0%

Men, 48%

Women, Men, 54% Women,

37%

41%

Source: Edelweiss Professional Investor Research

The share of branded footwear in India is estimated to jump to 50% by FY20 from 42% currently led

by: (a) penetration of existing brands in tier 2 & smaller cities; (b) existing international premium

brands expanding their presence via launch of new stores; (c) deepening reach of mid & economy

brands to tier 2-3 towns & cities; and (d) demand shift from unbranded to branded.

The urban segment constitutes ~67% and within the urban cluster, top 8 cities that constitute

metros contribute ~40% to total revenue; tier 1 & 2 cumulatively contribute the next 40% of the

urban share. Broadly based on these estimates, Metro + tier 1 & 2 cities together contribute ~55-

60% to the overall footwear market and the same is estimated to have higher organised share.

Category and price point wise, around 45% of the footwear is sold at >INR 500 and the same is

growing at a higher rate than the mass footwear category (in higher single or lower double digit);

higher price point footwear is growing in double digits.

34

Edelweiss Professional Investor Research 34

Bata India Ltd Financials

Orient Electric Ltd Financials

Breakup of Footwear Market by Price Point

Price Segments

% Share, Value (Avg. Selling Price at Retail Stores in INR)

6% Premium

(3000+)

Micl

10% (1000-3000)

Economy

30%

(800-1000)

54% Mass

<600

Source: Edelweiss Professional Investor Research

Footwear segment: Key trends

Rising trust in branded footwear: Though the market share of branded and non-branded footwear

in India has remained almost the same till date, brand consciousness has increased significantly. A

fast-growing economy and a rising number of affluent consumers have pushed India into the league

of most brand conscious countries globally. However, most consumers prefer a price point ranging

between INR 999 and INR 4,999 in national and international brands.

Growing opportunities in women’s segment: Though women’s footwear has only 30% market

share currently, its growth rate is double that of the men’s segment. Men’s category is expected to

grow at 10% ; while women is expected to grow at 20% for the next 3-5 years time frame

Omni-channel retailing: Retailers have started venturing in omni-channel retailin are trying in-store

marketing solutions such as beacons to enrich the shopping experience and are finding ways to

bridge the gap between offline and digital channels. In addition to engaging users on the digital

platform and influencing their merchandising decisions, many retailers are using platform not just

to showcase products, but to actually sell them. The same goes for mobile phones. Companies are

using the small screen to not just ‘get in front’ of customers (i.e., through geo-fencing and mobile-

enabled sites but also for parts of the customer journey, including order fulfilment, payments, and

loyalty.

Online Contribution

13

10 11

8

6

3

2013 2014 2015 2016 2017 2018

Source: Edelweiss Professional Investor Research

35

Edelweiss Professional Investor Research 35

Bata India Ltd

Orient Electric Ltd

Edelweiss Broking Limited, 1st Floor, Tower 3, Wing B, Kohinoor City Mall, Kohinoor City, Kirol Road, Kurla(W)

Board: (91-22) 4272 2200

Vinay Khattar

VINAY

Digitally signed by VINAY KHATTAR

DN: c=IN, o=Personal, postalCode=400072,

st=Maharashtra,

2.5.4.20=87db74ffb17a70c89e8519a4d13e40e93

Head Research c4bcaba1a64d00f3c841d2fee3fa678,

KHATTAR

serialNumber=cd5737057831c416d2a5f7064cb6

93183887e7ff342c50bd877e00c00e2e82a1,

vinay.khattar@edelweissfin.com cn=VINAY KHATTAR

Date: 2019.02.16 20:19:38 +05'30'

Rating Expected to

Buy appreciate more than 15% over a 12-month period

Hold appreciate between 5-15% over a 12-month period

Reduce Return below 5% over a 12-month period

260

240

220

200

(Indexed)

180

160

140

120

100

80

60

Jul-14

Oct-14

Jul-15

Oct-15

Jul-16

Oct-16

Jul-17

Oct-17

Jul-18

Oct-18

Apr-14

Apr-15

Apr-16

Apr-17

Apr-18

Jan-14

Jan-15

Jan-16

Jan-17

Jan-18

Jan-19

Bata Sensex

36

Edelweiss Professional Investor Research 36

Disclaimer

Edelweiss Broking Limited (“EBL” or “Research Entity”) is regulated by the Securities and Exchange Board of India (“SEBI”) and is licensed to carry on the business of broking, depository

Disclaimer

services and related activities. The business of EBL and its Associates (list available on www.edelweissfin.com) are organized around five broad business groups – Credit including Housing

and SME Finance, Commodities, Financial Markets, Asset Management and Life Insurance.

Broking services offered by Edelweiss Broking Limited under SEBI Registration No.: INZ000005231; Name of the Compliance Officer: Mr. Brijmohan Bohra, Email ID:

complianceofficer.ebl@edelweissfin.com Corporate Office: Edelweiss House, Off CST Road, Kalina, Mumbai - 400098; Tel. 18001023335/022-42722200/022-40094279

This Report has been prepared by Edelweiss Broking Limited in the capacity of a Research Analyst having SEBI Registration No.INH000000172 and distributed as per SEBI (Research

Analysts) Regulations 2014. This report does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

The information contained herein is from publicly available data or other sources believed to be reliable. This report is provided for assistance only and is not intended to be and must

not alone be taken as the basis for an investment decision. The user assumes the entire risk of any use made of this information. Each recipient of this report should make such

investigation as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks

involved), and should consult his own advisors to determine the merits and risks of such investment. The investment discussed or views expressed may not be suitable for all investors.

This information is strictly confidential and is being furnished to you solely for your information. This informatio n should not be reproduced or redistributed or passed on directly or

indirectly in any form to any other person or published, copied, in whole or in part, for any purpose. This report is not directed or intended for distribution to, or use by, any person or

entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribut ion, publication, availability or use would be contrary to law,

regulation or which would subject EBL and associates / group companies to any registration or licensing requirements within such jurisdiction. The distribution of this report in certain

jurisdictions may be restricted by law, and persons in whose possession this report comes, should observe, any such restrictions. The information given in this report is as of the date of

this report and there can be no assurance that future results or events will be consistent with this information. This information is subject to change without any prior notice. EBL reserves

the right to make modifications and alterations to this statement as may be required from time to time. EBL or any of its associates / group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. EBL is committed to providing independent and transparent

recommendation to its clients. Neither EBL nor any of its associates, group companies, directors, employees, agents or representatives shall be liable for any damages whether direct,

indirect, special or consequential including loss of revenue or lost profits that may arise from or in connection with the us e of the information. Our proprietary trading and investment

businesses may make investment decisions that are inconsistent with the recommendations expressed herein. Past performance is not necessarily a guide to future performance .The

disclosures of interest statements incorporated in this report are provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in the

report. The information provided in these reports remains, unless otherwise stated, the copyright of EBL. All layout, design, original artwork, concepts and other Intellectual Properties,

remains the property and copyright of EBL and may not be used in any form or for any purpose whatsoever by any party without the express written permission of the copyright holders.

EBL shall not be liable for any delay or any other interruption which may occur in presenting the data due to any reason including network (Internet) reasons or snags in the system,

break down of the system or any other equipment, server breakdown, maintenance shutdown, breakdown of communication services or inability of the EBL to present the data. In no

event shall EBL be liable for any damages, including without limitation direct or indirect, special, incidental, or consequential damages, losses or expenses arising in connection with the

data presented by the EBL through this report.

We offer our research services to clients as well as our prospects. Though this report is disseminated to all the customers simultaneously, not all customers may receive this report at

the same time. We will not treat recipients as customers by virtue of their receiving this report.

EBL and its associates, officer, directors, and employees, research analyst (including relatives) worldwide may: (a) from time to time, have long or short positions in, and buy or sell the

securities thereof, of company(ies), mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market

maker in the financial instruments of the subject company/company(ies) discussed herein or act as advisor or lender/borrower to such company(ies) or have other potential/material

conflict of interest with respect to any recommendation and related information and opinions at the time of publication of research report or at the time of public appearance. EBL may

have proprietary long/short position in the above mentioned scrip(s) and therefore should be considered as interested. The views provided herein are general in nature and do not

consider risk appetite or investment objective of any particular investor; readers are requested to take independent professional advice before investing. This should not be construed

as invitation or solicitation to do business with EBL.

EBL or its associates may have received compensation from the subject company in the past 12 months. EBL or its associates may have managed or co-managed public offering of

securities for the subject company in the past 12 months. EBL or its associates may have received compensation for investment banking or merchant banking or brokerage services from

the subject company in the past 12 months. EBL or its associates may have received any compensation for products or services other than investment banking or merchant banking or

brokerage services from the subject company in the past 12 months. EBL or its associates have not received any compensation or other benefits from the Subject Company or third party

in connection with the research report. Research analyst or his/her relative or EBL’s associates may have financial interest in the subject company. EBL, its associates, research analyst

and his/her relative may have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of

research report or at the time of public appearance.

Participants in foreign exchange transactions may incur risks arising from several factors, including the following: ( i) exchange rates can be volatile and are subject to large fluctuations;

( ii) the value of currencies may be affected by numerous market factors, including world and national economic, political and regulatory events, events in equity and debt marke ts and

changes in interest rates; and (iii) currencies may be subject to devaluation or government imposed exchange controls which could affect the value of the currency. Investors in securities

such as ADRs and Currency Derivatives, whose values are affected by the currency of an underlying security, effectively assume currency risk.

Research analyst has served as an officer, director or employee of subject Company: No

EBL has financial interest in the subject companies: No

EBL’s Associates may have actual / beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of

research report.

Research analyst or his/her relative has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of

publication of research report: No

EBL has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report: No

Subject company may have been client during twelve months preceding the date of distribution of the research report.

There were no instances of non-compliance by EBL on any matter related to the capital markets, resulting in significant and material disciplinary action during the last three years.

A graph of daily closing prices of the securities is also available at www.nseindia.com

Analyst Certification:

The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their

securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report.

37

Edelweiss Professional Investor Research 37

Disclaimer

Additional Disclaimer for U.S. Persons Disclaimer

Edelweiss is not a registered broker – dealer under the U.S. Securities Exchange Act of 1934, as amended (the“1934 act”) and under applicable state laws in the United States. In addition

Edelweiss is not a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended (the "Advisers Act" and together with the 1934 Act, the "Acts), and under

applicable state laws in the United States. Accordingly, in the absence of specific exemption under the Acts, any brokerage and investment services provided by Edelweiss, including the

products and services described herein are not available to or intended for U.S. persons.

This report does not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment services and/or shall not be considered

as an advertisement tool. "U.S. Persons" are generally defined as a natural person, residing in the United States or any entity organized or incorporated under the laws of the United

States. US Citizens living abroad may also be deemed "US Persons" under certain rules.

Transactions in securities discussed in this research report should be effected through Edelweiss Financial Services Inc.

Additional Disclaimer for U.K. Persons

The contents of this research report have not been approved by an authorised person within the meaning of the Financial Services and Markets Act 2000 ("FSMA").

In the United Kingdom, this research report is being distributed only to and is directed only at (a) persons who have professional experience in matters relating to investments falling

within Article 19(5) of the FSMA (Financial Promotion) Order 2005 (the “Order”); (b) persons falling within Article 49(2)(a) to (d) of the Order (including high net worth companies and

unincorporated associations); and (c) any other persons to whom it may otherwise lawfully be communicated (all such persons together being referred to as “relevant persons”).

This research report must not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this research report relates is available

only to relevant persons and will be engaged in only with relevant persons. Any person who is not a relevant person should not act or rely on this research report or any of its contents.

This research report must not be distributed, published, reproduced or disclosed (in whole or in part) by recipients to any other person.

Additional Disclaimer for Canadian Persons

Edelweiss is not a registered adviser or dealer under applicable Canadian securities laws nor has it obtained an exemption from the adviser and/or dealer registration requirements

under such law. Accordingly, any brokerage and investment services provided by Edelweiss, including the products and services described herein, are not available to or intended for

Canadian persons.

This research report and its respective contents do not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment

services.

Disclosures under the provisions of SEBI (Research Analysts) Regulations 2014 (Regulations)

Edelweiss Broking Limited ("EBL" or "Research Entity") is regulated by the Securities and Exchange Board of India ("SEBI") and is licensed to carry on the business of broking, depository

services and related activities. The business of EBL and its associates are organized around five broad business groups – Credit including Housing and SME Finance, Commodities,