Professional Documents

Culture Documents

12 Accountancy Lyp 2017 Outside Delhi Set1 PDF

Uploaded by

Ashish GangwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12 Accountancy Lyp 2017 Outside Delhi Set1 PDF

Uploaded by

Ashish GangwalCopyright:

Available Formats

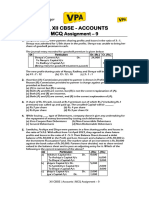

Question

Paper 2017 Outside Delhi set 1

CBSE Class 12 ACCOUNTANCY

General Instructions:

1) This question paper contains two parts A and B.

2) Part A is compulsory for all.

3) Part B has two options-Option-I Analysis of Financial Statements and Option-II

Computerized Accounting.

4) Attempt only one option of Part B.

5) All parts of a question should be attempted at one place.

Section A

(i) This section consists of 17 questions.

(ii) All the questions are compulsory.

(iii) Question Nos. 1 to 6 are very short-answer questions carrying 1 mark each.

(iv) Question Nos. 7 to 10 carry 3 marks each.

(v) Question Nos. 11 and 12 carry 4 marks each.

(vi) Question Nos. 13 to 15 carry 6 marks each.

(vii) Question Nos. 16 and 17 carry 8 marks each.

Section B

(i) This section consists of 6 questions.

(ii) All questions are compulsory

(iii) Question Nos. 18 and 19 are very short-answer questions carrying 1 mark each.

(iv) Question Nos. 20 to 22 carry 4 marks.

(v) Question No. 23 carries 6marks.

Q1. Distinguish between 'Fixed Capital Account' and 'Fluctuating Capital Account' on

the basis of credit balance.

Ans.

Basis Fixed Capital Method Fluctuating Capital Method

Material downloaded from myCBSEguide.com. 1 / 42

Under this method, Partners' Under this method, Partners' Capital Account

Credit

Capital Account always reveals a may either show a credit balance or a debit

Balance

credit balance. balance.

Q2. A and B were partners in a firm sharing profits and losses in the ratio of 5 : 3. They

admitted C as a new partner. The new profit sharing ratio between A, B and C was 3 : 2 :

3. A surrendered 15th of his share in favour of C. Calculate B's sacrifice.

Ans. B’s share of sacrifice is calculated below.

B's Sacrifice = Old Share - New Share

Q3. P and Q were partners in a firm sharing profits and losses equally. Their fixed

capitals were Rs 2,00,000 and Rs 3,00,000 respectively. The partnership deed provided

for interest on capital @ 12% per annum. For the year ended 31st March, 2016, the

profits of the firm were distributed without providing interest on capital.

Pass necessary adjustment entry to rectify the error.

Ans. Adjusting Journal Entry

Journal

Debit Credit

Date Particulars L.F. Amount Amount

(Rs) (Rs)

P’s Current A/c Dr. 6,000

To Q’s Current A/c 6,000

(Interest on capital omitted, now adjusted.)

Working Notes:

Statement Showing Adjustment

Particulars P Q Total

Material downloaded from myCBSEguide.com. 2 / 42

Interest on Capital @ 12% 24,000 36,000 (60,000)

Less: Profits wrongly distributed to the extent of interest

(30,000) (30,000) 60,000

amount

Net Effect (6,000) 6,000 NIL

Q4. X Ltd. invited applications for issuing 500, 12% debentures of Rs 100 each at a

discount of 5%. These debentures were redeemable after three years at par.

Applications for 600 debentures were received. Pro-rata allotment was made to all the

applicants. Pass necessary journal entries for the issue of debentures assuming that the

whole amount was payable with application.

Ans.

Journal

Debit Credit

Date Particulars L.F. Amount Amount

(Rs) (Rs)

Bank A/c (600 × 95) Dr. 57,000

To Debenture Application & Allotment A/c 57,000

(Amount received on 600 debentures issued at a

discount of 5%, face value Rs 100)

Debenture Application & Allotment A/c Dr. 57,000

Discount on Issue of Debentures A/c (500 × 5) Dr. 2,500

To 12% Debentures A/c (500 × 100) 50,000

To Bank A/c (100 × 95) 9,500

(Application and allotment money received transferred to

Debentures A/c and balance refunded)

Material downloaded from myCBSEguide.com. 3 / 42

Q5. Z Ltd. forfeited 1,000 equity shares of Rs 10 each for the non-payment of the first

call of Rs 2 per share. The final call of Rs 3 per share was yet to be made.

Calculate the maximum amount of discount at which these shares can be reissued.

Ans. The maximum discount at which these shares can be re-issued is the credit balance in

the Share Forfeiture A/c i.e. Rs 5,000 (1,000 × 5).

Q6. Durga and Naresh were partners in a firm. They wanted to admit five more

members in the firm. List any two categories of individuals other than minors who

cannot be admitted by them.

Ans. The individuals other than minors who cannot be admitted by a partnership firm are:

(a) Persons of unsound mind

(b) Persons disqualified by any law

Q7. BPL Ltd. converted 500, 9% debentures of Rs 100 each issued at a discount of 6% into

equity shares of Rs 100 each issued at a premium of Rs 25 per share. Discount on issue

of 9% debentures has not yet been written off.

Showing your working notes clearly, pass necessary journal entries for conversion of

9% debentures into equity shares.

Ans.

Journal

Debit Credit

Date Particulars L.F. Amount Amount

(Rs) (Rs)

9% Debentures A/c Dr. 50,000

To Debentureholders’ A/c 50,000

(500, 9% Debentures due for redemption)

Debentureholders’ A/c Dr. 50,000

Material downloaded from myCBSEguide.com. 4 / 42

To Equity Share Capital A/c (400 × 100) 40,000

To Securities Premium A/c (400 × 25) 10,000

(500, 9% Debentures redeemed by converting into 400

equity shares of Rs 100 each issued at a premium of Rs 25

per share)

Securities Premium A/c Dr. 3,000

To Discount on Issue of Debentures A/c 3,000

(Discount on issue of debentures written off against

balance in securities premium account)

Working Notes:

Q8. Kavi, Ravi, Kumar and Guru were partners in a firm sharing profits in the ratio of 3

: 2: 2: 1. On. 1.2.2017, Guru retired and the new profit sharing ratio decided between

Kavi, Ravi and Kumar was 3: 1: 1. On Guru's retirement the goodwill of the firm was

valued at Rs 3,60,000. Showing your working notes clearly, pass necessary journal entry

in the books of the firm for the treatment of goodwill on Guru's retirement.

Ans.

Journal

Debit Credit

Date Particulars L.F. Amount Amount

(Rs) (Rs)

Kavi’s Capital A/c Dr. 81,000

Material downloaded from myCBSEguide.com. 5 / 42

To Ravi’s Capital A/c 18,000

To Kumar’s Capital A/c 18,000

To Guru’s Capital A/c 45,000

(Goodwill adjusted through capitals)

Working Notes:

Q9. Disha Ltd. purchased machinery from Nisha Ltd. and paid to Nisha Ltd. as follows:

(i) By issuing 10,000, equity shares of Rs 10 each at a premium of 10%.

(ii) By issuing 200, 9% debentures of Rs 100 each at a discount of 10%.

(iii) Balance by accepting a bill of exchange of Rs 50,000 payable after one month.

Pass necessary journal entries in the books of Disha Ltd. for the purchase of machinery

and making payament to Nisha Ltd.

Ans.

Journal

In the books of Disha Ltd.

Material downloaded from myCBSEguide.com. 6 / 42

Debit Credit

Date Particulars L.F.

Amount Amount

(Rs) (Rs)

Machinery A/c Dr. 1,78,000

To Nisha Ltd. 1,78,000

(Purchased machinery from Nisha Ltd.)

Nisha Ltd. (1,10,000 + 18,000 + 50,000) Dr. 1,78,000

Discount on Issue of Debentures A/c (200 × 10) Dr. 2,000

To Equity Share Capital A/c (10,000 × 10) 1,00,000

To Securities Premium A/c (10,000 × 1) 10,000

To 9% Debentures A/c (200 × 100) 20,000

To Bills Payable A/c 50,000

(Issued 10,000 equity shares of Rs 10 each at a

premium of 10%, issued 200 9% Debentures of Rs 100

each at a discount of 10% and balance by accepting a

bills payable)

Q10. Ganesh Ltd. is registered with an authorised capital of Rs 10,00,00,000 divided into

equity shares of Rs 10 each. Subscribed and fully paid up capital of the company was Rs

6,00,00,000. For providing employment to the local youth and for the development of

the tribal areas of Arunachal Pradesh the company decided to set up a hydro power

plant there. The company also decided to open skill development centres in Itanagar,

Pasighat and Tawang. To meet its new financial requirements, the company decided to

issue 1,00,000 equity shares of Rs 10 each and 1,00,000, 9% debentures of Rs 100 each.

The debentures were redeemable after five years at par. The issue of shares and

Material downloaded from myCBSEguide.com. 7 / 42

debentures was fully subscribed. A shareholder holding 2,000 shares failed to pay the

final call of Rs 2 per share.

Show the share capital in the Balance Sheet of the company as per the provisions of

Schedule III of the Companies Act, 2013. Also identify any two values that the company

wishes to propagate.

Ans.

Balance Sheet

Amount

Particulars Note No.

(Rs)

I. Equity and Liabilities

1. Shareholders’ Funds

a. Share Capital 1 6,09,96,000

b. Reserves and Surplus

2. Non-Current Liabilities

1. Long-term Borrowings 2 1,00,00,000

Total

NOTES TO ACCOUNTS

Amount

Note No. Particulars

(Rs)

1 Share Capital

Authorised Capital

1,00,00,000 Equity Shares of Rs 10 each 10,00,00,000

Issued, Subscribed , Called up & Paid up Capital

Material downloaded from myCBSEguide.com. 8 / 42

61,00,000 Equity Shares of Rs 10 each fully called up 6,10,00,000

Less: Calls-in-Arrears (2,000×2) 4,000 6,09,96,000

2 Long Term Borrowings

1,00,000, 9% Debentures of Rs 100 each 1,00,00,000

Values Involved:

(a) Creating employment opportunities

(b) Promoting balance regional growth by contributing to development of tribal areas

Q11.Madhu and Neha were partners in a firm sharing profits and losses in the ratio of 3

: 5. Their fixed capitals were Rs 4,00,000 and Rs 6,00,000 respectively. On 1.1.2016, Tina

was admitted as a new partner for 14th share in the profits. Tina acquired her share of

profit from Neha. Tina brought Rs 4,00,000 as her capital which was to be kept fixed like

the capitals of Madhu and Neha. Calculate the goodwill of the firm on Tina's admission

and the new profit sharing ratio of Madhu, Neha and Tina. Also, pass necessary journal

entry for the treatment of goodwill on Tina's admisson considering that Tina did not

bring her share of goodwill premium in cash.

Ans.

Journal

Debit Credit

Date Particulars L.F. Amount Amount

(Rs) (Rs)

Cash A/c Dr. 4,00,000

To Tina’s Capital A/c 4,00,000

(Capital brought in cash)

Material downloaded from myCBSEguide.com. 9 / 42

Tina’s Current A/c Dr. 50,000

To Neha’s Current A/c 50,000

(Goodwill adjusted through current accounts)

Working Notes:

Q12. Ashok, Babu and Chetan were partners in a firm sharing profits in the ratio of 4 : 3

: 3. The firm closes its books on 31st March every year. On 31st December, 2016 Ashok

died. The partnership deed provided that on the death of a partner his executors will

be entitled to the following:

(i) Balance in his capital account. On 1.4.2016, there was a balance of Rs 90,000 in

Ashok's Capital Account.

(ii) Interest on capital @ 12% per annum.

(iii) His share in the profits of the firm in the year of his death will be calculated on the

basis of rate of net profit on sales of the previous year, which was 25%. The sales of the

firm till 30st December, 2016 were Rs 4,00,000.

Material downloaded from myCBSEguide.com. 10 / 42

(iv) His share in the goodwill of the firm. The goodwill of the firm on Ashok's detah was

valued at Rs 4,50,000.

The partnership deed also provided for the following deductions from the amount

payable to the executor of the deceased partner:

(i) His drawings in the year of his death. Ashok's drawings till 31.12.2016 were Rs 15,000.

(ii) Interest on drawing @ 12% per annum which was calculated as Rs 1,500.

The accountant of the firm prepared Ashok's Capital Account to be presented to the

executor of Ashok but in a hurry he left in incomplete. Ashok's Capital Account as

prepared by the firm's accountant is given below:

Dr. Ashok’s Capital Account Cr.

Amount Amount

Date Particulars Date Particulars

(Rs) (Rs)

2016 2016

Dec 31 …………… 15,000 April 1 …………… 90,000

Dec 31 …………… …………… Dec 31 …………… 8,100

Dec 31 …………… …………… Dec 31 …………… 40,000

Dec 31 …………… 90,000

Dec 31 …………… 90,000

3,18,100 3,18,100

You are required to complete Ashok's Capital Account.

Ans.

Dr. Ashok’s Capital Account Cr.

Amount Amount

Date Particulars Date Particulars

(Rs) (Rs)

2016 2016

Material downloaded from myCBSEguide.com. 11 / 42

Dec. Drawings A/c 15,000 April 1 Balance b/d 90,000

31

Dec. Interest on Drawings Dec.

Interest on Capital A/c 8,100

31 A/c 1,500 31

Dec. Dec. Profit and Loss Suspense

Ashok's Executor's A/c 3,01,600 40,000

31 31 A/c

Dec.

Babu's Capital A/c 90,000

31

Dec.

Chetan's Capital A/c 90,000

31

3,18,100 3,18,100

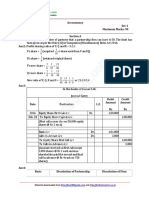

Q13. A, B, C and D were partners in a firm sharing profits in the ratio of 3 : 2 : 3 : 2. On

1.4.2016, their Balance Sheet was as follows: (6)

Balance Sheet of A, B, C and D

as on 1.4.2016

Amount Amount

Liabilities Assets

(Rs) (Rs)

Capitals: Fixed Assets 8,25,000

A 2,00,000 Current Assets 3,00,000

B 2,50,000

C 2,50,000

D 3,10,000 10,10,000

Sundry Creditors 90,000

Material downloaded from myCBSEguide.com. 12 / 42

Workmen Compensation Reserve 25,000

11,25,000 11,25,000

From the above date partners decided to share the future profits in the ratio of 4 : 3 : 2 :

1. For this purpose the goodwill of the firm was valued at Rs 2,70,000. It was also

considered that:

(i) The claims against Workmen Compensation Reserve has been estimated at Rs 30,000

and fixed assets will be depreciated by Rs 25,000.

(ii) Adjust the capitals of the partners according to the new profit sharing ratio by

opening Current Accounts of the partners.

Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet of the

reconstituted firm.

Ans.

Revaluation Account

Dr. Cr.

Amount Amount

Particulars Particulars

(Rs) (Rs)

Depreciation on Fixed Assets A/c 25,000 Revaluation Loss

Provision for Claim against WCF 5,000 A 9,000

B 6,000

C 9,000

D 6,000 30,000

30,000 30,000

Material downloaded from myCBSEguide.com. 13 / 42

Partners’ Capital Account

Dr. Cr.

Particulars A B C D Particulars A B C

Revaluation

9,000 6,000 9,000 6,000 Balance b/d 2,00,000 2,50,000 2,50,000

A/c

C's Capital A’s Capital

13,500 13,500 13,500

A/c A/c

D's Capital B’s Capital

13,500 13,500 13,500

A/c A/c

Current Current

72,000 2,33,000 2,28,000 77,000

A/c’s A/c’s

Balance c/d 3,92,000 2,94,000 1,96,000 98,000

4,28,000 3,27,000 2,77,000 3,37,000 4,28,000 3,27,000 2,77,000

Balance Sheet

Amount Amount

Liabilities Assets

(Rs) (Rs)

Capital A/c Fixed Assets (less dep.) 8,00,000

A 3,92,000 Current Assets 3,00,000

B 2,94,000 Current A/c

C 1,96,000 C 72,000

D 98,000 9,80,000 D 2,33,000 3,05,000

Current A/c

Material downloaded from myCBSEguide.com. 14 / 42

A 2,28,000

B 77,000 3,05,000

Claim against WCF 30,000

Sundry Creditors 90,000

14,05,000 14,05,000

Working Notes

Journal entry for Goodwill

A’s Capital A/c Dr. 27,000

B’s Capital A/c Dr. 27,000

To C’s Capital A/c 27,000

To D’s Capital A/c 27,000

(Gaining partners compensate sacrificing partners)

WN2: Calculation of Adjusted Capital

A = 2,00,000 – 36,000 = Rs 1,64,000

Material downloaded from myCBSEguide.com. 15 / 42

B = 2,50,000 – 33,000 = Rs 2,17,000

C = 2,77,000 – 9,000 = Rs 2,68,000

D = 3,37,000 – 6,000 = Rs 3,31,000

Total Combined Capital = 9,80,000

WN3: Calculation of New Capital

Q14. On 1.4.2015, J.K. Ltd. issued 8,000, 9% debentures of Rs 1,000 each at a discount of

6%, redeemable at a premium of 5% after three years. The company closes its books on

31st March every year. Interest on 9% debentures is payable on 30th September and 31st

March every year. The rate of tax deducted at source is 10%.

Pass necessary journal entries for the issue of debentures and debenture interest for

the year ended 31.3.2016.

Ans.

Journal

Debit Credit

Date Particulars L.F. Amount Amount

(Rs) (Rs)

Apr.01 Bank A/c (8,000 × 940) Dr. 75,20,000

To Debenture Application and Allotment A/c 75,20,000

(Received application money on 8,000 Debenture)

Material downloaded from myCBSEguide.com. 16 / 42

Apr.01 Debenture Application and Allotment A/c Dr. 75,20,000

Discount on Issue of Debenture A/c (8,000 × 60) Dr. 4,80,000

Loss on Issue of Debenture A/c (8,000 × 50) Dr. 4,00,000

To 9% Debentures A/c (8,000 × 1,000) 80,00,000

To Premium on Redemption of Debentures A/c

4,00,000

A/c (8,000 × 50)

(Application money transferred to Debentures A/c)

Sep.30 Debentures Interest A/c Dr. 3,60,000

To Debentureholders’ A/c 3,24,000

To TDS Payable A/c 36,000

(Interest due)

Sep.30 Debentureholders’ A/c Dr. 3,24,000

TDS Payable A/c Dr. 36,000

To Bank A/c 3,60,000

(Interest paid)

2016

Mar

Debenture Interest A/c 3,60,000

.31

To Debentureholders’ A/c 3,24,000

To TDS Payable A/c 36,000

(Interest due)

Material downloaded from myCBSEguide.com. 17 / 42

Mar.31 Debentureholders’ A/c Dr. 3,24,000

TDS Payable A/c Dr. 36,000

To Bank A/c 3,60,000

(Interest paid)

Mar.31 Statement of Profit & Loss A/c Dr. 7,20,000

To Debentures Interest A/c 7,20,000

(Interest transferred to P&L)

Q15. Pass necessary journal entries on the dissolution of a partnership firm in the

following cases:

(i) Dissolution expenses were Rs 800.

(ii) Dissolution expenses Rs 800 were paid by Prabhu, a partner.

(iii) Geeta, a partner, was appointed to look after the dissolution work, for which she

was allowed a remuneration of Rs 10,000. Geeta agreed to bear the dissolution

expenses. Actual dissolution expenses Rs 9,500 were paid by Geeta.

(iv) Janki, a partner, agreed to look after the dissolution work for a commission of Rs

5,000. Janki agreed to bear the dissolution expenses. Actual dissolution expenses Rs

5,500 were paid by Mohan, another partner, on behalf of Janki.

(v) A partner, Kavita, agreed to look after the dissolution process for a commission of

Rs 9,000. She also agreed to bear the dissolution expenses. Kavita took over furniture of

Rs 9,000 for her commission. Furniture had already been transferred to realisation

account.

(vi) A debtor, Ravinder, for Rs 19,000 agreed to pay the dissolution expenses which

were Rs 18,000 in full settlement of his debt.

Ans.

Material downloaded from myCBSEguide.com. 18 / 42

Journal

Debit Credit

Date Particulars L.F. Amount Amount

(Rs) (Rs)

(i) Realisation A/c Dr. 800

To Bank A/c 800

(Expenses borne and paid by firm)

(ii) Realisation A/c Dr. 800

To Prabhu’s Capital A/c 800

(Expenses paid by partner on behalf of firm)

(iii) Realisation A/c Dr. 10,000

To Geeta's Capital A/c 10,000

(Remuneration paid)

(iv) Realisation A/c Dr. 5,000

To Janki's Capital A/c 5,000

(Remuneration paid)

(iv) Janki's Capital A/c Dr. 5,500

To Mohan's Capital A/c 5,500

(Expenses paid by one partner, borne by other)

(v) No Entry

Material downloaded from myCBSEguide.com. 19 / 42

(vi) No Entry

Q16. C and D are partners in a firm sharing profits in the ratio of 4 : 1. On 31.3.2016,

their Balance Sheet was as follows:

Balance Sheet of C and D

as on 31.3.2016

Amount Amount

Liabilities Assets

(Rs) (Rs)

Sundry Creditors 40,000 Cash 24,000

Provision for Bad Debts 4,000 Debtors 36,000

Outstanding Salary 6,000 Stock 40,000

General Reserve 10,000 Furniture 80,000

Plant & Machinery 80,000

Capitals:

C 1,20,000

D 80,000 2,00,000

2,60,000 2,60,000

On the above date, E was admitted for 14th share in the profits on the following terms:

(i) E will bring Rs 1,00,000 as his capital and Rs 20,000 for his share of goodwill

premium, half of which will be withdrawn by C and D.

(ii) Debtors Rs 2,000 will be written off as bad debts and a provision of 4% will be

created on debtors for bad and doubtful debts.

Material downloaded from myCBSEguide.com. 20 / 42

(iii) Stock will be reduced by Rs 2,000, furniture will be depreciated by 4,000 and 10%,

depreciation will be charged on plant and machinery.

(iv) Investments Rs 7,000 not shown in the Balance Sheet will be taken into account.

(v) There was an an outstanding repairs bill of Rs 2,300 which will be recorded in the

books.

Pass necessary journal entries for the above transactions in the books of the firm on E’s

admission.

OR

Sameer, Yasmin and Saloni were partners in a firm sharing profits and losses in the

ratio of 4 : 3 : 3. On 31.3.2016, their Balance Sheet was as follows:

Balance Sheet of Sameer, Yasmin and Saloni

as on 31.3.2016

Amount Amount

Liabilities Assets

(Rs) (Rs)

Creditors 1,10,000 Cash 80,000

General Reserve 60,000 Debtors 90,000

Capitals: Less: Provision 10,000 80,000

Sameer 3,00,000 Stock 1,00,000

Yasmin 2,50,000 Machinery 3,00,000

Saloni 1,50,000 7,00,000 Building 2,00,000

Patents 60,000

Profit & Loss A/c 50,000

8,70,000 8,70,000

On the above date, Sameer retired and it agreed that:

(i) Debtors of Rs 4,000 will be written off as bad debts and a provision of 5% on debtors

for bad and doubtful debts will be maintained.

Material downloaded from myCBSEguide.com. 21 / 42

(ii) An unrecorded creditor of Rs 20,000 will be recorded.

(iii) Patents will be completely written off and 5% depreciation will be charged on

stock, machinery and building.

(iv) Yasmin and Saloni will share the future profits in the ratio of 3 : 2.

(v) Goodwill of the firm on Sameer’s retirement was valued at Rs 5,40,000.

Pass necessary journal entries for the above transactions in the books of the firm on

Sameer’s retirement.

Ans.

Journal

Debit Credit

Date Particulars L.F. Amount Amount

(Rs) (Rs)

Cash A/c Dr. 1,20,000

To E’s Capital A/c 1,00,000

To Premium for Goodwill A/c 20,000

(Capital & goodwill brought in cash)

Premium for Goodwill A/c Dr. 20,000

To C’s Capital A/c 16,000

To D’s Capital A/c 4,000

(Goodwill shared in sacrificing ratio of 4 : 1)

C’s Capital A/c Dr. 8,000

D’s Capital A/c Dr. 2,000

To Cash A/c 10,000

Material downloaded from myCBSEguide.com. 22 / 42

(Goodwill withdrawn)

General Reserve A/c Dr. 10,000

To C’s Capital A/c 8,000

To D’s Capital A/c 2,000

(General reserve shared among old partners in old

ratio)

Revaluation A/c Dr. 16,300

To Outstanding Repair Bill A/c 2,300

To Stock A/c 2,000

To Furniture A/c 4,000

To Plant & Machinery A/c 8,000

(Decrease in assets and increase in liabilities debited

to Revaluation A/c)

Investments A/c Dr. 7,000

Provision for Doubtful Debts A/c Dr. 640

To Revaluation A/c 7,640

(Increase in assets and decrease in liabilities credited

to Revaluation A/c)

C’s Capital A/c Dr. 6,928

D’s Capital A/c Dr. 1,732

To Revaluation A/c 8,660

(Loss on revaluation debited to old partners in old ratio)

Material downloaded from myCBSEguide.com. 23 / 42

Working Notes:

WN1: Calculation of Excess/Deficit Provision for Doubtful Debts

OR

Journal

Debit Credit

Date Particulars L.F. Amount Amount

(Rs) (Rs)

General Reserve A/c Dr. 60,000

To Sameer’s Capital A/c 24,000

To Yasmin’s Capital A/c 18,000

To Saloni’s Capital A/c 18,000

(Balance in reserve distributed among all partners in

old ratio)

Sameer’s Capital A/c Dr. 20,000

Yasmin’s Capital A/c Dr. 15,000

Saloni’s Capital A/c Dr. 15,000

To Profit & Loss A/c 50,000

(Debit balance P&L A/c written off among all partners

in old ratio)

Yasmin’s Capital A/c Dr. 1,62,000

Material downloaded from myCBSEguide.com. 24 / 42

Saloni’s Capital A/c Dr. 54,000

To Sameer’s Capital A/c 2,16,000

(Goodwill adjusted in gaining ratio)

Revaluation A/c Dr. 1,10,000

To Patent A/c 60,000

To Stock A/c 5,000

To Machinery A/c 15,000

To Building A/c 10,000

To Creditors A/c 20,000

(Decrease in assets and increase in liabilities debited

to Revaluation A/c)

Provision for Doubtful Debts A/c Dr. 1,700

To Revaluation A/c 1,700

(Excess provision written back)

Sameer’s Capital A/c Dr. 43,320

Yasmin’s Capital A/c Dr. 32,490

Saloni’s Capital A/c Dr. 32,490

To Revaluation A/c 1,08,300

(Loss on revaluation debited to partners’ capital

accounts in old ratio)

Sameer’s Capital A/c Dr. 4,76,680

Material downloaded from myCBSEguide.com. 25 / 42

To Sameer’s Loan A/c 4,76,680

(Amount due to Sameer transferred to his loan A/c)

Working Notes:

WN1: Calculation of Sameer’s Share of Goodwill

WN2: Calculation of Excess/Deficit Provision for Doubtful Debts

WN3: Calculation of Sameer’s Loan Balance

Amount due to Sameer = Opening Capital + Credits – Debits

= 3,00,000 + (24,000 + 2,16,000) – (20,000 + 43,320)

= Rs 4,76,680

Q17. VXN Ltd. invited applications for issuing 50,000 equity shares of Rs 10 each at a

Material downloaded from myCBSEguide.com. 26 / 42

premium of Rs 8 per share. The amount was payable as follows:

On Application Rs 4 per share (including Rs 2 premium).

On Allotment Rs 6 per share (including Rs 3 premium).

On First Call Rs 5 per share (including Rs 1 premium).

On Second and Final Call – Balance Amount.

The issue was fully subscribed. Gopal, a shareholder holding 200 shares, did not pay the

allotment money and Madhav, a holder of 400 shares, paid his entire share money

along with the allotment money. Gopal's shares were immediately forfeited after

allotment. Afterwards, the first call was made. Krishna, a holder of 100 shares, failed to

pay the first call money and Girdhar, a holder of 300 shares, paid the second call money

also along with the first call. Krishna's shares were forfeited immediately after the first

call. Second and final call was made afterwards and was duly received. All the forfeited

shares were reissued at Rs 9 per share fully paid up.

Pass necessary Journal Entries for the above transactions in the books of the company.

OR

JJK Ltd. invited applications for issuing 50,000 equity shares of Rs 10 each at par. The

amount was payable as follows:

On Application: Rs 2 per share.

On Allotment : Rs 4 per share.

On First and Final Call : Balance Amount

The issue was over-subscribed three times. Applications for 30% shares were rejected

and money refunded. Allotment was made to the remaining applicants as follows:

Category No. of Shares Applied No. of Shares Allotted

I 80,000 40,000

II 25,000 10,000

Excess money paid by the applicants who were allotted shares was adjusted towards

the sums due on allotment.

Deepak, a shareholder belonging to Category I, who had applied for 1,000 shares, failed

to pay the allotment money. Raju, a shareholder holding 100 shares, also failed to pay

Material downloaded from myCBSEguide.com. 27 / 42

the allotment money. Raju belonged to Category II. Shares of both Deepak and Raju

were forfeited immediately after allotment. Afterwards, first and final call was made

and was duly received. The forfeited shares of Deepak and Raju were reissued at Rs 11

per share fully paid up.

Pass necessary Journal entries for the above transactions in the books of the company.

Ans.

Journal

Debit Credit

Date Particulars L.F. Amount Amount

(Rs) (Rs)

Bank A/c (50,000 × 4) Dr. 2,00,000

To Equity Share Application A/c 2,00,000

(Received application money on 50,000 shares)

Equity Share Application A/c Dr. 2,00,000

To Equity Share Capital A/c 1,00,000

To Securities Premium Reserve A/c 1,00,000

(Transfer of application money to Share Capital)

Equity Share Allotment A/c (50,000 × 6) Dr. 3,00,000

1,50,000

To Equity Share Capital A/c

To Securities Premium Reserve A/c 1,50,000

(Allotment due on 50,000 shares )

Bank A/c (49,800 × 6) + (400 × 8) Dr. 3,02,000

Material downloaded from myCBSEguide.com. 28 / 42

To Equity Share Allotment A/c (49,800 × 5) 2,98,800

To Calls-in-Advance A/c (400 × 8) 3,200

(Allotment money received)

Equity Share Capital A/c (200 × 5) Dr. 1,000

Securities Premium Reserve A/c (200 × 3) Dr. 600

To Equity Share Allotment A/c (200 × 6) 1,200

To Equity Share Forfeiture A/c (200 × 2) 400

(Forfeiture of 200 shares for non-payment of

allotment money including premium of Rs 3)

Dr. 2,49,000

Equity Share First Call A/c (49,800 × 5)

To Equity Share Capital A/c 1,99,200

To Securities Premium Reserve A/c 49,800

(Call money due on 49,800 shares)

Bank A/c (49,700 × 5) − 2,000 + 900 Dr. 2,47,400

Calls-in-Advance A/c (400 × 5) Dr. 2,000

To Calls-in-Advance A/c (300 × 3) 900

To Equity Share First Call A/c 2,48,500

(Received call money)

Equity Share Capital A/c (100 × 9) Dr. 900

Securities Premium Reserve A/c (100 × 1) 100

To Equity Share First Call A/c (100 × 5) 500

Material downloaded from myCBSEguide.com. 29 / 42

To Equity Share Forfeiture A/c (100 × 5) 500

(Forfeiture of 100 shares for non-payment of call

money)

Equity Share Second and Final Call A/c (49,700 × 3) Dr. 1,49,100

To Equity Share Capital A/c 49,700

To Securities Premium A/c 99,400

(Call money due on 49,700 shares)

Bank A/c Dr. 1,47,000

Calls-in-Advance A/c (1,200 + 900) 2,100

To Equity Share Second and Final Call A/c 1,49,100

(Received call money on shares)

Bank A/c (300 × 9) Dr. 2,700

Equity Share Forfeiture A/c 300

To Equity Share Capital A/c 3,000

(Reissue of 300 shares at Rs 9 per share)

Equity Share Forfeiture A/c (400 + 500 − 300) Dr. 600

To Capital Reserve A/c 600

(Profit on re-issue transferred to Capital Reserve

Account)

Material downloaded from myCBSEguide.com. 30 / 42

OR

Journal

Debit Credit

Date Particulars L.F. Amount Amount

(Rs) (Rs)

Bank A/c (1,50,000 × 2) Dr. 3,00,000

To Share Application A/c 3,00,000

(Received application money on 1,50,000 shares)

Share Application A/c Dr. 3,00,000

To Share Capital A/c 1,00,000

To Share Allotment A/c 1,10,000

To Bank A/c 90,000

(Transfer of application money to Share Capital)

Share Allotment A/c (50,000 × 4) 2,00,000

To Share Capital A/c 2,00,000

(Allotment due on 50,000 shares )

Bank A/c Dr. 88,900

To Share Allotment A/c (WN 2) 88,900

(Allotment money received)

Share Capital A/c (600 × 6) Dr. 3,600

To Share Allotment A/c (1,000 + 100) 1,100

Material downloaded from myCBSEguide.com. 31 / 42

To Share Forfeiture A/c (2,000 + 500) 2,500

(600 shares forfeited for non-payment of allotment

money)

Share First and Final Call A/c Dr. 1,97,600

To Share Capital A/c 1,97,600

(Call money due on 49,400 shares)

Bank A/c Dr. 1,97,600

To Share First and Final Call A/c 1,97,600

(Call money received)

Bank A/c (600 × 11) Dr. 6,600

To Share Capital A/c 6,000

To Security Premium Reserve A/c 600

(Reissue of 600 shares at Rs 11 per share)

Share Forfeiture A/c Dr. 2,500

To Capital Reserve A/c 2,500

(Profit on re-issue transferred to Capital Reserve

Account)

Working Notes:

WN1: Computation Table

Material downloaded from myCBSEguide.com. 32 / 42

Money

Money Amount

transferred Excess

Shares Shares received on adjusted

Categories to Share Application Money

Applied Allotted Application on

Capital money refunded

@ Rs 2 each Allotment

@ Rs 2 each

I 80,000 40,000 1,60,000 80,000 80,000 80,000 -

II 25,000 10,000 50,000 20,000 30,000 30,000 -

III 45,000 - 90,000 - - - 90,000

1,50,000 50,000 3,00,000 1,00,000 1,10,000 1,10,000 90,000

WN2: Calculation of Amount Received on Allotment

Amount Due on Allotment 2,00,000

Less: Excess Received 1,10,000

Balance to be Received 90,000

Less: Amount not paid by Deepak (1,000)

Less: Amount not paid by Raju (100)

Amount received on Allotment 88,900

WN3: Calculation of Shares Applied/Allotted

Shares Allotted to Deepak=40,00080,000×1,000=500

Amount not paid by Deepak on Allotment

Amount received on Application 2,000

Less: Actual tfd to Sh. Capital (1,000)

Excess received on Application 1,000

Material downloaded from myCBSEguide.com. 33 / 42

Amount due on allotment 2,000

Less: Excess adjustment (1,000)

Amount unpaid by Deepak 1,000

Shares Applied by Raju=25,00010,000×100=250

Amount not paid by Raju on Allotment

Amount received on Application 500

Less: Actual tfd to Sh. Capital (200)

Excess received on Application 300

Amount due on allotment 400

Less: Excess adjustment (300)

Amount unpaid by Deepak 100

Q18. Normally, what should be the maturity period for a short term investment from

the date of its acquisition to be qualified as cash equivalents?

Ans. The maturity period for a short term investment from the date of its acquisition should

not be more than three months to be qualified as cash equivalents.

Q19. State the primary objective of preparing a cash flow statement.

Ans. The primary objective of preparing a cash flow statement is to report the flow of cash

and cash equivalents during the period under review (usually a financial year).

Q20. What is meant by 'Analysis of Financial Statements'? State any two objectives of

such an analysis.

Ans. A critical and thorough examination of the financial statements of a company in order

to understand the data contained in it, is known as 'Analysis of Financial Statements'.

Objectives of Financial Analysis

(i) It enables the conduct of meaningful comparisons of financial data. It provides better and

Material downloaded from myCBSEguide.com. 34 / 42

easy understanding of the changes in the financial data overtime.

(ii) It helps in designing effective plans and better execution of plans by enabling control and

checks over the use of the financial resources.

Q21. The proprietary ratio of M. Ltd. is 0.80 : 1.

State with reasons whether the following transactions will increase, decrease or not

change the proprietary ratio:

(i) Obtained a loan from bank Rs 2,00,000 payable after five years.

(ii) Purchased machinery for cash Rs 75,000.

(iii) Redeemed 5% redeemable preference shares Rs 1,00,000.

(iv) Issued equity shares to the vendors of machinery purchased for Rs 4,00,000.

Ans.

Transaction Implication

Obtained a loan from

Total assets are increasing by 2,00,000 (as cash is coming in) but

bank Rs 2,00,000

shareholders' funds remain intact, so proprietary ratio will

payable after five

decrease.

years.

Total assets are increasing and decreasing by 75,000

Purchased machinery simultaneously (as cash is going out and machinery is coming in),

for cash Rs 75,000. hence both numerator and denominator remain intact, therefore

proprietary ratio will not change.

Redeemed 5%

redeemable Both shareholders' funds and total assets decrease by 1,00,000

preference shares Rs simultaneously and proprietary ratio decreases.

1,00,000.

Issued equity shares

to the vendors of Both shareholders' funds and total assets increase by 4,00,000

machinery purchased simultaneously and proprietary ratio improves.

for Rs 4,00,000.

Material downloaded from myCBSEguide.com. 35 / 42

Q22. Financial statements are prepared following the consistent accounting concepts,

principles, procedures and also the legal environment in which the business

organisations operate. These statements are the sources of information on the basis of

which conclusions are drawn about the profitability and financial position of a

company so that their users can easily understand and use them in their economic

decisions in a meaningful way.

From the above statement identify any two values that a company should observe while

preparing its financial statements. Also, state under which major headings and sub-

headings the following items will be presented in the Balance Sheet of a company as per

Schedule III of the Companies Act, 2013.

(i) Capital Reserve

(ii) Calls-in-Advance

(iii) Loose Tools

(iv) Bank Overdraft

Ans. Values that a company must observe while preparing its financial statements.

(a) The financial statements must be drawn following the accounting concepts, principles,

procedures

(b) The financial statements must be drawn following the ethical and legal framework

Item Major Head Sub-Head

Capital Reserve Shareholders’ Funds Reserves & Surplus

Calls-in-Advance Current Liabilities Other Current Liabilities

Loose Tools Current Assets Inventories

Bank Overdraft Current Liabilities Short Term Borrowings

Q23. From the following Balance Sheet of SRS Ltd. and the additional information as on

31.3.2016, prepare a Cash Flow Statement:

Balance Sheet of SRS Ltd. as on 31.3.2016

31.03.2016 31.03.2015

Particulars Note No.

(Rs) (Rs)

Material downloaded from myCBSEguide.com. 36 / 42

I. Equity and Liabilities :

1. Shareholder's Funds :

(a) Share Capital 4,50,000 3,50,000

(b) Reserves and Surplus 1 1,25,000 50,000

2. Non-Current Liabilities :

Long-term Borrowings 2 2,25,000 1,75,000

3. Current Liabilities :

(a) Short-term Borrowings 3 75,000 37,500

(b) Short-term Provisions 4 1,00,000 62,500

Total 9,75,000 6,75,000

II. Assets :

1. Non-Current Assets :

(a) Fixed Assets :

(i) Tangible 5 7,32,500 4,52,500

(ii) Intangible 6 50,000 75,000

(b) Non-Current Investments 75,000 50,000

2. Current Assets :

(a) Current Investments 20,000 35,000

(b) Inventories 7 61,000 36,000

(c) Cash and Cash Equivalents 36,500 26,500

Total 9,75,000 6,75,000

Material downloaded from myCBSEguide.com. 37 / 42

Notes to Ac counts

Note 31.03.2016 31.03.2015

Particulars

No. (Rs) (Rs)

1. Reserves and Surplus

(Surplus i.e., Balance in the Statement of Profit and

1,25,000 50,000

Loss)

1,25,000 50,000

2. Long-term Borrowings

12% Debentures 2,25,000 1,75,000

2,25,000 1,75,000

3. Short-term Borrowings

Bank Overdraft 75,000 37,500

75,000 37,500

4. Short-term Provisions

Proposed Dividend 1,00,000 62,500

1,00,000 62,500

5. Tangible Assets

Machinery 8,37,500 5,22,500

Accumulated Depreciation (1,05,000) (70,000)

Material downloaded from myCBSEguide.com. 38 / 42

7,32,500 4,52,500

6. Intangible Assets

Goodwill 50,000 75,000

50,000 75,000

7. Inventories

Stock in Trade 61,000 36,000

61,000 36,000

Additional Information :

(i) Rs 50,000, 12% debentures were issued on 31.3.2016.

(ii) During the year a piece of machinery costing Rs 40,000 on which accumulated

depreciation was Rs 20,000, was sold at a loss of Rs 5,000.

Ans.

Cash Flow Statement

for the year ended March 31, 2016

Amount Amount

Particulars

(Rs) (Rs)

A Cash Flow from Operating Activities

Profit as per Statement of Profit and Loss 75,000

Proposed Dividend 1,00,000 1,75,000

Profit Before Taxation 1,75,000

Material downloaded from myCBSEguide.com. 39 / 42

Items to be Added:

Goodwill written off 25,000

Debentures interest 21,000

Depreciation 55,000

Loss on sale of machinery 5,000 1,06,000

Operating Profit before Working Capital Adjustments 2,81,000

Less: Increase in Current Assets

Inventories (25,000) (25,000)

Cash Generated from Operations 2,56,000

Less: Tax Paid -

Net Cash Flows from Operating Activities 2,56,000

B Cash Flow from Investing Activities

Sale of machinery 15,000

Purchase of machinery (3,55,000)

Purchase of non-current investment (25,000) (3,65,000)

Net Cash Used in Investing Activities (3,65,000)

C Cash Flow from Financing Activities

Proceeds from Issue of Share Capital

1,00,000

Increase in Bank Overdraft 37,500

Interest on Debentures paid (21,000)

Proceeds from Issue of Debentures 50,000

Proposed Dividend Paid (62,500)

Material downloaded from myCBSEguide.com. 40 / 42

Net Cash Flow from Financing Activities 1,04,000

D Net ↑/↓ in Cash and Cash Equivalents (A+B+C) (5,000)

Add: Cash and Cash Equivalent in the beginning of the period

61,500

(26,500+35,000)

Cash and Cash Equivalents at the end of the period

56,500

(36,500+20,000)

Working Notes:

Machinery Account

Dr. Cr.

Amount Amount

Particulars Particulars

(Rs) (Rs)

Balance b/d 5,22,500 Bank A/c (Sale) 15,000

Bank A/c (Purchase- Bal. Fig.) 3,55,000 Accumulated Depreciation A/c 20,000

Profit and Loss A/c (Loss on Sale) 5,000

Balance c/d 8,37,500

8,77,500 8,77,500

Accumulated Depreciation Account

Dr. Cr.

Amount Amount

Particulars Particulars

(Rs) (Rs)

Machinery

Material downloaded from myCBSEguide.com. 41 / 42

A/c 20,000 Balance b/d 70,000

Profit and Loss A/c (Dep. charged during the year- Bal.

Balance c/d 1,05,000 55,000

Fig.)

1,25,000 1,25,000

Material downloaded from myCBSEguide.com. 42 / 42

You might also like

- 12 Accountancy Lyp 2017 Outside Delhi Set1 PDFDocument42 pages12 Accountancy Lyp 2017 Outside Delhi Set1 PDFAshish GangwalNo ratings yet

- 12 Accountancy Lyp 2017 Outside Delhi Set3Document42 pages12 Accountancy Lyp 2017 Outside Delhi Set3Ramprasad Sarkar100% (1)

- Accounts 3Document42 pagesAccounts 3SubodhSaxenaNo ratings yet

- Accounts 2Document41 pagesAccounts 2SubodhSaxenaNo ratings yet

- 12 Accountancy Lyp 2017 Foreign Set3Document41 pages12 Accountancy Lyp 2017 Foreign Set3Ashish GangwalNo ratings yet

- 12 Accountancy Lyp 2017 Delhi Set1 PDFDocument39 pages12 Accountancy Lyp 2017 Delhi Set1 PDFAshish GangwalNo ratings yet

- 12 Accountancy sp04 230604 170905Document27 pages12 Accountancy sp04 230604 170905RishiNo ratings yet

- 12 Accountancy sp04Document26 pages12 Accountancy sp04vivekdaiv55No ratings yet

- Accountancy 2008Document23 pagesAccountancy 2008Piyush SrivastavaNo ratings yet

- 2016 12 Accountancy Lyp Set 01 Outside Delhi Ans Bw0uiwDocument18 pages2016 12 Accountancy Lyp Set 01 Outside Delhi Ans Bw0uiwVijayNo ratings yet

- Question Paper 2016 All India Set 1 Cbse Class 12 AccountancyDocument38 pagesQuestion Paper 2016 All India Set 1 Cbse Class 12 AccountancyAshish GangwalNo ratings yet

- 12 Accountancy Sp05Document27 pages12 Accountancy Sp05vivekdaiv55No ratings yet

- 12 Accountancy sp10Document26 pages12 Accountancy sp10Akshat AgarwalNo ratings yet

- Sample Paper 14 CBSE Accountancy Class 12: Install NODIA App To See The Solutions. Click Here To InstallDocument45 pagesSample Paper 14 CBSE Accountancy Class 12: Install NODIA App To See The Solutions. Click Here To Installumangsingh054No ratings yet

- Cbleacpu 01Document10 pagesCbleacpu 01Udaya RakavanNo ratings yet

- Xii Accountancy Question Bank 1Document46 pagesXii Accountancy Question Bank 1KavoNo ratings yet

- Debenture 10 Years ExplanationDocument17 pagesDebenture 10 Years Explanationoldtaxi9No ratings yet

- Accountancy Sample PaperDocument13 pagesAccountancy Sample PaperFatima IslamNo ratings yet

- Cbleacpu 08Document10 pagesCbleacpu 08Agastya KarnwalNo ratings yet

- Accounts SamplepaperDocument29 pagesAccounts SamplepaperPawni JadhavNo ratings yet

- Sample Paper 2023-24Document172 pagesSample Paper 2023-24shouryayadav87267% (3)

- Cbleacpu 07Document10 pagesCbleacpu 07sarathsivadamNo ratings yet

- 12 Accountancy sp09Document30 pages12 Accountancy sp09Dr.Santosh RaiNo ratings yet

- 12 Accountancy sp07Document26 pages12 Accountancy sp07vivekdaiv55No ratings yet

- 562087174Document12 pages562087174Maharukh AlamNo ratings yet

- Class 12 Accountancy Sample Paper 02 0253b8853045fDocument25 pagesClass 12 Accountancy Sample Paper 02 0253b8853045fVIDHI KASHYAPNo ratings yet

- Screenshot 2023-12-27 at 10.23.31Document2 pagesScreenshot 2023-12-27 at 10.23.31yuggolaniNo ratings yet

- Pre - Board Examination - Accountancy - Class XII - (2022-23)Document12 pagesPre - Board Examination - Accountancy - Class XII - (2022-23)Shipra GumberNo ratings yet

- Solution Ultimate Sample Paper 2Document7 pagesSolution Ultimate Sample Paper 2Nitin KumarNo ratings yet

- PB SQP 12th ACC (SS) 2023-24Document14 pagesPB SQP 12th ACC (SS) 2023-24aanchal prasad100% (4)

- Marking Scheme PRE-BOARD (2009-10) : Part ADocument9 pagesMarking Scheme PRE-BOARD (2009-10) : Part AIsha KembhaviNo ratings yet

- Accountancy 12 SapnleDocument21 pagesAccountancy 12 Sapnlemohit pandeyNo ratings yet

- MAA Assignment RKDocument9 pagesMAA Assignment RKKrishna RayasamNo ratings yet

- Sample Paperpre Board II Acct 2324-2Document10 pagesSample Paperpre Board II Acct 2324-2kanakchauhan206No ratings yet

- N Academy: Class 12 Accountancy CH 9 Company Accounts - Issue of Debentures Que and AnsDocument5 pagesN Academy: Class 12 Accountancy CH 9 Company Accounts - Issue of Debentures Que and AnsYashvi ShahNo ratings yet

- 055 AccountancyDocument14 pages055 AccountancyHari prakarsh NimiNo ratings yet

- Shares & Debentures TestDocument10 pagesShares & Debentures TestAthul Krishna KNo ratings yet

- FA Special 2010Document10 pagesFA Special 2010prakash9735No ratings yet

- Marking Scheme Sample Question Paper Accountancy, Class XII Board Examination, March, 2015Document13 pagesMarking Scheme Sample Question Paper Accountancy, Class XII Board Examination, March, 2015kamalNo ratings yet

- 12 Accountancy Lyp 2015 Foreign Set1Document42 pages12 Accountancy Lyp 2015 Foreign Set1Ashish GangwalNo ratings yet

- 12 Accountancy sp06Document28 pages12 Accountancy sp06Jaydev JaydevNo ratings yet

- Cbse Class XII Accountancy All India Board Paper Set 1 - 2019 SolutionDocument17 pagesCbse Class XII Accountancy All India Board Paper Set 1 - 2019 SolutionmeetuNo ratings yet

- Model Test Paper 13Document15 pagesModel Test Paper 13ganeshNo ratings yet

- Practice Paper Pre-Board Xii Acc 2023-24Document13 pagesPractice Paper Pre-Board Xii Acc 2023-24Pratiksha Suryavanshi100% (1)

- QUESTION PAPER 36195 (Solution)Document17 pagesQUESTION PAPER 36195 (Solution)Faizu KhamNo ratings yet

- AC Sample Paper 3 Unsolved-1Document10 pagesAC Sample Paper 3 Unsolved-1Appharnha Rs0% (1)

- 12th AccountancyDocument34 pages12th AccountancyDYNAMIC VERMA100% (1)

- Cbleacpu 02Document10 pagesCbleacpu 02mehtayogesh476No ratings yet

- QP Accountancy XIIDocument9 pagesQP Accountancy XIITûshar ThakúrNo ratings yet

- Paper 12-Company Accounts & Audit: Suggested Answers - Syl 2016 - December 2019 - Paper 12Document19 pagesPaper 12-Company Accounts & Audit: Suggested Answers - Syl 2016 - December 2019 - Paper 12Sannu VijayeendraNo ratings yet

- 055 AccountancyDocument15 pages055 AccountancyHari prakarsh NimiNo ratings yet

- CBSE Class 12 Accountancy Sample Paper 2018Document19 pagesCBSE Class 12 Accountancy Sample Paper 2018Mitesh SethiNo ratings yet

- Sample Question Paper 2022 Marking SchemeDocument16 pagesSample Question Paper 2022 Marking SchemeTûshar ThakúrNo ratings yet

- Accountancy SQPDocument15 pagesAccountancy SQPidealNo ratings yet

- Pe2 Acc Nov05Document19 pagesPe2 Acc Nov05api-3825774No ratings yet

- 17269pe2 Sugg June09 1 PDFDocument22 pages17269pe2 Sugg June09 1 PDFSahil GoyalNo ratings yet

- AccountancyDocument21 pagesAccountancyAriz AliNo ratings yet

- Fundamentals QuestionsDocument23 pagesFundamentals Questionsdhanvi1259No ratings yet

- XII CBSE - Accounts HY Exam - 01-Oct-2022 (Sug)Document7 pagesXII CBSE - Accounts HY Exam - 01-Oct-2022 (Sug)naviagrawal2006No ratings yet

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

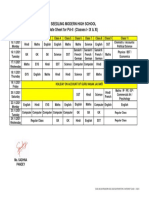

- Class 6 P.A.1 Syllabus and DatesheetDocument2 pagesClass 6 P.A.1 Syllabus and DatesheetAshish GangwalNo ratings yet

- S Subject: ARTS Class: U. K. G Subject Teacher: Swati GangwalDocument3 pagesS Subject: ARTS Class: U. K. G Subject Teacher: Swati GangwalAshish GangwalNo ratings yet

- Language Development English: Affiliated To The CISCE, New DelhiDocument4 pagesLanguage Development English: Affiliated To The CISCE, New DelhiAshish GangwalNo ratings yet

- Language Development English: Affiliated To The CISCE, New DelhiDocument4 pagesLanguage Development English: Affiliated To The CISCE, New DelhiAshish GangwalNo ratings yet

- S Subject: ARTS: Affiliated To The CISCE, New DelhiDocument3 pagesS Subject: ARTS: Affiliated To The CISCE, New DelhiAshish GangwalNo ratings yet

- Academic Remarks For MarksheetDocument2 pagesAcademic Remarks For MarksheetAshish GangwalNo ratings yet

- Class XI Entrepreneurship Ii Term Examination Answer KeyDocument3 pagesClass XI Entrepreneurship Ii Term Examination Answer KeyAshish GangwalNo ratings yet

- 3 Entrepreneurial JourneyDocument20 pages3 Entrepreneurial JourneyAshish GangwalNo ratings yet

- Pa 2 Datesheet Class I - Ix & XiDocument1 pagePa 2 Datesheet Class I - Ix & XiAshish GangwalNo ratings yet

- Math Readiness: Affiliated To The CISCE, New DelhiDocument4 pagesMath Readiness: Affiliated To The CISCE, New DelhiAshish GangwalNo ratings yet

- Business Studies Class XII I Pre-Board Paper (2021-22)Document4 pagesBusiness Studies Class XII I Pre-Board Paper (2021-22)Ashish GangwalNo ratings yet

- 1 Entrepreneurship - What, Why and HowDocument17 pages1 Entrepreneurship - What, Why and HowAshish Gangwal100% (1)

- 5 Concept of MarketDocument19 pages5 Concept of MarketAshish GangwalNo ratings yet

- Business Studies Class XII I Pre - Board ExaminationDocument7 pagesBusiness Studies Class XII I Pre - Board ExaminationAshish GangwalNo ratings yet

- Academic Remarks For MarksheetDocument2 pagesAcademic Remarks For MarksheetAshish Gangwal100% (1)

- Unit Ii-An Entrepreneur Multiple Choice QuestionsDocument16 pagesUnit Ii-An Entrepreneur Multiple Choice QuestionsAshish Gangwal100% (1)

- Aissce Practical Examination (2020-21) Shree Narayana Central School Ahmedabad Sample Paper For Revision by Simmi PrakashDocument1 pageAissce Practical Examination (2020-21) Shree Narayana Central School Ahmedabad Sample Paper For Revision by Simmi PrakashAshish GangwalNo ratings yet

- Notification: CBSE/Training Unit/2020 18.09.2020Document2 pagesNotification: CBSE/Training Unit/2020 18.09.2020Ashish GangwalNo ratings yet

- 31 Circular 2021Document3 pages31 Circular 2021Ashish GangwalNo ratings yet

- PA2 Blueprint Ep Class 11Document1 pagePA2 Blueprint Ep Class 11Ashish GangwalNo ratings yet

- High Court of Judicature For Rajasthan Bench at Jaipur: (Downloaded On 09/12/2020 at 08:31:14 PM)Document5 pagesHigh Court of Judicature For Rajasthan Bench at Jaipur: (Downloaded On 09/12/2020 at 08:31:14 PM)Ashish GangwalNo ratings yet

- Class XI Unit 1: EntrepreneurshipDocument1 pageClass XI Unit 1: EntrepreneurshipAshish GangwalNo ratings yet

- PA2 Blueprint Ep Class 11Document1 pagePA2 Blueprint Ep Class 11Ashish GangwalNo ratings yet

- Chapter 5 OrganisingDocument19 pagesChapter 5 OrganisingAshish GangwalNo ratings yet

- An Appeal: Forum of Private Schools of Rajasthan (All CBSE, RBSE, ICSE, Cambridge, IB Schools)Document1 pageAn Appeal: Forum of Private Schools of Rajasthan (All CBSE, RBSE, ICSE, Cambridge, IB Schools)Ashish GangwalNo ratings yet

- 12 Businessstudies 21Document18 pages12 Businessstudies 21Ashish GangwalNo ratings yet

- Unit 6: Business Finance: Multiple Choice QuestionsDocument16 pagesUnit 6: Business Finance: Multiple Choice QuestionsAshish GangwalNo ratings yet

- Chapter 9 Financial ManagementDocument18 pagesChapter 9 Financial ManagementAshish GangwalNo ratings yet

- Chapter 1 Nature and Significance of ManagementDocument17 pagesChapter 1 Nature and Significance of ManagementAshish GangwalNo ratings yet

- 11 Businessstudies 21Document16 pages11 Businessstudies 21Ashish GangwalNo ratings yet

- Analisa RAB Dan INCOME Videotron TrenggalekDocument2 pagesAnalisa RAB Dan INCOME Videotron TrenggalekMohammad Bagus SaputroNo ratings yet

- Safety Data Sheet: Fumaric AcidDocument9 pagesSafety Data Sheet: Fumaric AcidStephen StantonNo ratings yet

- INTERNSHIP PRESENTATION - Dhanya - 2020Document16 pagesINTERNSHIP PRESENTATION - Dhanya - 2020Sanitha MichailNo ratings yet

- SDFGHJKL ÑDocument2 pagesSDFGHJKL ÑAlexis CaluñaNo ratings yet

- CH 2 Nature of ConflictDocument45 pagesCH 2 Nature of ConflictAbdullahAlNoman100% (2)

- Vice President Enrollment Management in Oklahoma City OK Resume David CurranDocument2 pagesVice President Enrollment Management in Oklahoma City OK Resume David CurranDavidCurranNo ratings yet

- 1grade 9 Daily Lesson Log For Demo 1 4Document5 pages1grade 9 Daily Lesson Log For Demo 1 4cristy olivaNo ratings yet

- Intro S4HANA Using Global Bike Solutions EAM Fiori en v3.3Document5 pagesIntro S4HANA Using Global Bike Solutions EAM Fiori en v3.3Thăng Nguyễn BáNo ratings yet

- LICDocument82 pagesLICTinu Burmi Anand100% (2)

- Rehabilitation and Retrofitting of Structurs Question PapersDocument4 pagesRehabilitation and Retrofitting of Structurs Question PapersYaswanthGorantlaNo ratings yet

- Defeating An Old Adversary Cement Kiln BallsDocument5 pagesDefeating An Old Adversary Cement Kiln BallsManish KumarNo ratings yet

- Gis Tabels 2014 15Document24 pagesGis Tabels 2014 15seprwglNo ratings yet

- V Series: Three Wheel, Counterbalanced Lift TruckDocument126 pagesV Series: Three Wheel, Counterbalanced Lift TruckВиктор МушкинNo ratings yet

- Design of Flyback Transformers and Filter Inductor by Lioyd H.dixon, Jr. Slup076Document11 pagesDesign of Flyback Transformers and Filter Inductor by Lioyd H.dixon, Jr. Slup076Burlacu AndreiNo ratings yet

- AkDocument7 pagesAkDavid BakcyumNo ratings yet

- Nissan E-NV200 Combi UKDocument31 pagesNissan E-NV200 Combi UKMioMaulenovoNo ratings yet

- PlsqldocDocument21 pagesPlsqldocAbhishekNo ratings yet

- Flow Chart For SiFUS Strata Title ApplicationDocument5 pagesFlow Chart For SiFUS Strata Title ApplicationPhang Han XiangNo ratings yet

- Quality in CRDocument10 pagesQuality in CRkaushikcrNo ratings yet

- Ms Microsoft Office - WordDocument3 pagesMs Microsoft Office - WordFarisha NasirNo ratings yet

- Is.14785.2000 - Coast Down Test PDFDocument12 pagesIs.14785.2000 - Coast Down Test PDFVenkata NarayanaNo ratings yet

- Dynamics of Interest Rate and Equity VolatilityDocument9 pagesDynamics of Interest Rate and Equity VolatilityZhenhuan SongNo ratings yet

- CSA Report Fahim Final-1Document10 pagesCSA Report Fahim Final-1Engr Fahimuddin QureshiNo ratings yet

- QG To AIS 2017 PDFDocument135 pagesQG To AIS 2017 PDFMangoStarr Aibelle VegasNo ratings yet

- 7Document101 pages7Navindra JaggernauthNo ratings yet

- Engagement Letter TrustDocument4 pagesEngagement Letter Trustxetay24207No ratings yet

- Napoleon RXT425SIBPK Owner's ManualDocument48 pagesNapoleon RXT425SIBPK Owner's ManualFaraaz DamjiNo ratings yet

- Nat Law 2 - CasesDocument12 pagesNat Law 2 - CasesLylo BesaresNo ratings yet

- VP Construction Real Estate Development in NY NJ Resume Edward CondolonDocument4 pagesVP Construction Real Estate Development in NY NJ Resume Edward CondolonEdwardCondolonNo ratings yet

- Practical GAD (1-32) Roll No.20IF227Document97 pagesPractical GAD (1-32) Roll No.20IF22720IF135 Anant PatilNo ratings yet