Professional Documents

Culture Documents

Taxpayers

Taxpayers

Uploaded by

Jha Niz0 ratings0% found this document useful (0 votes)

6 views1 pageThis document outlines the different types of tax residency statuses in Singapore and their corresponding tax rates. It provides 6 types of tax residency classifications - RC, NRC, OCW, RA, NRA-ETB, and NRA-NETB - and notes their sources of income and applicable tax rates of 0-35%. It also shows the personal income tax rates in Singapore for annual income brackets between 2018-2022 and rates starting in 2023. Tax rates range from 0% to 35% depending on the income bracket.

Original Description:

Original Title

taxpayers.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the different types of tax residency statuses in Singapore and their corresponding tax rates. It provides 6 types of tax residency classifications - RC, NRC, OCW, RA, NRA-ETB, and NRA-NETB - and notes their sources of income and applicable tax rates of 0-35%. It also shows the personal income tax rates in Singapore for annual income brackets between 2018-2022 and rates starting in 2023. Tax rates range from 0% to 35% depending on the income bracket.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageTaxpayers

Taxpayers

Uploaded by

Jha NizThis document outlines the different types of tax residency statuses in Singapore and their corresponding tax rates. It provides 6 types of tax residency classifications - RC, NRC, OCW, RA, NRA-ETB, and NRA-NETB - and notes their sources of income and applicable tax rates of 0-35%. It also shows the personal income tax rates in Singapore for annual income brackets between 2018-2022 and rates starting in 2023. Tax rates range from 0% to 35% depending on the income bracket.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

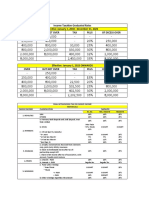

TYPE SOURCES OF TI TAX BASE TAX RATE

1 RC w/i and w/o NI 0-35%

2 NRC w/i NI 0-35%

3 OCW w/i NI 0-35%

4 RA w/i NI 0-35%

5 NRA-ETB w/i NI 0-35%

6 NRA-NETB w/i GI 35% final wtax

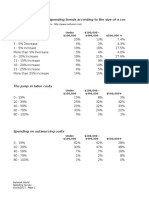

annual income Jan 1, 2018 to Dec. 31, 2022 2023 onwards

1 250k and below 0% 0%

2 over 250k to 400k 20% of excess over 250k 15% of excess over 250k

3 over 400k to 800k 30k + 25% of excess over 400k 22.5k + 20% of excess over 400k

4 over 800k to 2M 130k + 30% of excess over 800k 102.5k + 25% of excess over 800k

5 over 2M to 8M 490k + 32% of excess over 2M 402.5k + 30% of excess over 800k

6 above 8M 2.41M + 35% of excess over 8M 2.2025M + 35% of excess over 8M

You might also like

- Indiv. TaxpayersDocument1 pageIndiv. TaxpayersJha NizNo ratings yet

- Federal Budget FY24 ReviewDocument7 pagesFederal Budget FY24 ReviewhannasocialmediamanagerNo ratings yet

- 5 6170280447000445052 PDFDocument358 pages5 6170280447000445052 PDFmanoj mohanNo ratings yet

- DSP The Report Card 1h23Document30 pagesDSP The Report Card 1h23NikhilKapoor29No ratings yet

- Tax Rates 2021Document6 pagesTax Rates 2021Muazam memonNo ratings yet

- 23.3 Cash Flow Classification by ActivitiesDocument19 pages23.3 Cash Flow Classification by ActivitiesSiham Ait imaNo ratings yet

- ECO PPT Team 6Document10 pagesECO PPT Team 6Darshan Changole PCMNo ratings yet

- Bangladesh - Highlights of Finance Bill 2021Document10 pagesBangladesh - Highlights of Finance Bill 2021sihalim17No ratings yet

- Za Deloitte 2023 Tax CardDocument11 pagesZa Deloitte 2023 Tax CardNgozaNo ratings yet

- Train Law PhilippinesDocument64 pagesTrain Law PhilippinesThe BeatlessNo ratings yet

- Sensitivity AnalysisDocument25 pagesSensitivity AnalysisStevenTsaiNo ratings yet

- Project BS ItemsDocument25 pagesProject BS ItemsSumeet BhatereNo ratings yet

- PRTC 1stpb - 05.22 Sol TaxDocument21 pagesPRTC 1stpb - 05.22 Sol TaxCiatto SpotifyNo ratings yet

- Ex 3Document16 pagesEx 3Bách HuyNo ratings yet

- Mobility Industry Report - June 2022Document42 pagesMobility Industry Report - June 2022Sanjay BaidNo ratings yet

- DPD Call Crime Arrest DashboardDocument8 pagesDPD Call Crime Arrest Dashboardjamestatum573No ratings yet

- Power Discos Presentation Jan 19 Final 1579776963Document10 pagesPower Discos Presentation Jan 19 Final 1579776963babu balochNo ratings yet

- HULDocument31 pagesHULAlley excursion designerNo ratings yet

- 0 - 10000 1-Jan-17 1 3500 15-Feb-18 2 4500 1-Mar-19 3 6500 25-Mar-20 4 7000 15-Mar-21 5 7500 5-Mar-22 Discount Rate 10% 41.93% Mirr 28%Document15 pages0 - 10000 1-Jan-17 1 3500 15-Feb-18 2 4500 1-Mar-19 3 6500 25-Mar-20 4 7000 15-Mar-21 5 7500 5-Mar-22 Discount Rate 10% 41.93% Mirr 28%Alpana RastogiNo ratings yet

- ABP - v16 (R)Document74 pagesABP - v16 (R)Rezwan NawsherNo ratings yet

- Direct Tax Summary For Ay 2023-24Document39 pagesDirect Tax Summary For Ay 2023-24CA PASSNo ratings yet

- Indian Electrical Equip Ind Overview - Upto Sep 18Document9 pagesIndian Electrical Equip Ind Overview - Upto Sep 18anandpurushothamanNo ratings yet

- Jeevan Saral Plan Presentation: Harish ChandDocument3 pagesJeevan Saral Plan Presentation: Harish ChandHarish ChandNo ratings yet

- AEO2023 Release PresentationDocument25 pagesAEO2023 Release PresentationMuhammad BaihaqiNo ratings yet

- EVALUACION Plaza Jose OlayaDocument140 pagesEVALUACION Plaza Jose OlayaDaNnY VILLACORTANo ratings yet

- Cement Production: Macro Assumptions ReportsDocument32 pagesCement Production: Macro Assumptions Reportsfawwad_46No ratings yet

- Mo Claims Discount RulesDocument6 pagesMo Claims Discount Rulessaqib AliNo ratings yet

- Old BIR Income Tax Rates (Used Until 2017)Document2 pagesOld BIR Income Tax Rates (Used Until 2017)Sean Mitch Ibañez LangubNo ratings yet

- Covid-19 Auto Industry ImpactDocument10 pagesCovid-19 Auto Industry ImpactHimadri RoyNo ratings yet

- Financial Model CourseraDocument49 pagesFinancial Model CourseraSANJEEV DAS 01No ratings yet

- 0124 SpendingDocument18 pages0124 SpendingChristopher BrownNo ratings yet

- Survey Findings : The Power of CommunityDocument24 pagesSurvey Findings : The Power of CommunityNew England WindNo ratings yet

- Practice QuestionsDocument3 pagesPractice QuestionsnaseemNo ratings yet

- Tax SummariesDocument8 pagesTax SummariesLuisa Victoria BelmonteNo ratings yet

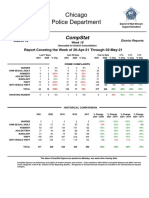

- 23 PDFsam CompStat Public 2021 Week 18Document1 page23 PDFsam CompStat Public 2021 Week 18Adam HarringtonNo ratings yet

- DS ProjectsDocument6 pagesDS ProjectsChairman PUNo ratings yet

- SSC Si Ci WBDocument8 pagesSSC Si Ci WBChandrasekharVarmaNo ratings yet

- Listed Company Valuation Complete Valuation With Relative ValuationDocument22 pagesListed Company Valuation Complete Valuation With Relative ValuationYo TuNo ratings yet

- Statement Report: To Date Status Channel All DR/CR From Date Generate Don Prop Value Generate DbyDocument2 pagesStatement Report: To Date Status Channel All DR/CR From Date Generate Don Prop Value Generate DbyD. BibekNo ratings yet

- Direct Tax For Assessment Year 2020-21Document28 pagesDirect Tax For Assessment Year 2020-21CA PASSNo ratings yet

- Analytics Solved ExampleDocument20 pagesAnalytics Solved ExampleSaqlain AliNo ratings yet

- Taxation RA 10963 - TRAIN LAW: Readings in Philippine History Kurt Zeus L. DizonDocument16 pagesTaxation RA 10963 - TRAIN LAW: Readings in Philippine History Kurt Zeus L. DizonLennon Jed AndayaNo ratings yet

- New BIR Tax Tables For 2023 OnwardsDocument8 pagesNew BIR Tax Tables For 2023 OnwardsLykaArcheNo ratings yet

- UntitledDocument5 pagesUntitledRwings JeansNo ratings yet

- Final Income TaxDocument6 pagesFinal Income TaxJñelle Faith Herrera SaludaresNo ratings yet

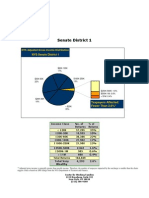

- Senate District Income DistributionDocument62 pagesSenate District Income DistributionRick KarlinNo ratings yet

- TaxTables20062010Document2 pagesTaxTables20062010Moazam FakeyNo ratings yet

- Public Notice 8 of 2022 Finance Act No 7 of 2021 Major HighlightsDocument6 pagesPublic Notice 8 of 2022 Finance Act No 7 of 2021 Major HighlightsZvikomborero Tavonga MuchandibayaNo ratings yet

- Model 11 4 2Document28 pagesModel 11 4 2fawwad_46No ratings yet

- Settings and MacroDocument32 pagesSettings and Macrofawwad_46No ratings yet

- DCF Valuation: 1.inputDocument25 pagesDCF Valuation: 1.inputDushyant yadavNo ratings yet

- AKIN To Recover-Layout1Document1 pageAKIN To Recover-Layout1Jayr PurisimaNo ratings yet

- Ports Report CareEdgeDocument5 pagesPorts Report CareEdgeKaushalNo ratings yet

- MLT Out Look 2023 EditionDocument46 pagesMLT Out Look 2023 EditionhambaliNo ratings yet

- Changes in The Personal Income Tax Rate (PIT - PPh21) in 2024 - Effective Rate and Calculation Example - Legal IndonesiaDocument14 pagesChanges in The Personal Income Tax Rate (PIT - PPh21) in 2024 - Effective Rate and Calculation Example - Legal IndonesiaRima PutriNo ratings yet

- Profit Lags As Chengdu Revenue Recognition Delayed, Mall Recovery StallsDocument8 pagesProfit Lags As Chengdu Revenue Recognition Delayed, Mall Recovery StallsJajahinaNo ratings yet

- Tax Rates For Tax Year 2020Document5 pagesTax Rates For Tax Year 2020Ghulam MuhiuddinNo ratings yet

- Old BIR Income Tax RatesDocument3 pagesOld BIR Income Tax RatesDenise DianeNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Economic Indicators for Southeast Asia and the Pacific: Input–Output TablesFrom EverandEconomic Indicators for Southeast Asia and the Pacific: Input–Output TablesNo ratings yet

- 2013 Poli Bar QsDocument12 pages2013 Poli Bar QsJha NizNo ratings yet

- 2012 Poli Bar QsDocument16 pages2012 Poli Bar QsJha NizNo ratings yet

- Bar Exam 2016 Suggested Answers in Political Law by The UP Law ComplexDocument11 pagesBar Exam 2016 Suggested Answers in Political Law by The UP Law ComplexJha NizNo ratings yet

- Alitalia VS IacDocument4 pagesAlitalia VS IacJha NizNo ratings yet

- CALTEX v. PNOC SHIPPING, GR NO. 150711, 2006-08-10Document3 pagesCALTEX v. PNOC SHIPPING, GR NO. 150711, 2006-08-10Jha NizNo ratings yet

- AgencyDocument3 pagesAgencyJha NizNo ratings yet

- Quinto VS Comelec, 606 Scra 258Document12 pagesQuinto VS Comelec, 606 Scra 258Jha Niz100% (1)

- G.R. No. 200784 Malayan Insurance Company, Inc., Petitioner, Vspap Co, LTD (Phil Branch), RespondentDocument6 pagesG.R. No. 200784 Malayan Insurance Company, Inc., Petitioner, Vspap Co, LTD (Phil Branch), RespondentJha NizNo ratings yet

- Transpo Case DigestDocument52 pagesTranspo Case DigestJha NizNo ratings yet

- 4-Arroyo Vs DojDocument1 page4-Arroyo Vs DojJha NizNo ratings yet

- 5-Reyes Vs Comelec DigestDocument1 page5-Reyes Vs Comelec DigestJha NizNo ratings yet

- Transpo Law IiDocument6 pagesTranspo Law IiJha NizNo ratings yet

- Romeo M. Jalosjos, JR Vs Comelec, 2012Document4 pagesRomeo M. Jalosjos, JR Vs Comelec, 2012Jha NizNo ratings yet

- Qualifications: Postal ID Senior Citizen's ID Driver's License NBI PNP Passport SSS GsisDocument3 pagesQualifications: Postal ID Senior Citizen's ID Driver's License NBI PNP Passport SSS GsisJha NizNo ratings yet