0% found this document useful (0 votes)

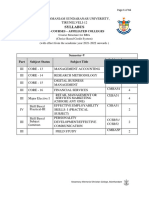

28 views3 pagesCertified General Accounting Specialist Course

This 292-hour course is designed to develop skills in general accounting processes like analyzing transactions, recording in journals, posting to ledgers, preparing trial balances, making adjustments, and preparing financial statements. Students will learn accounting, prioritization, and coping with workplace environments. The core competencies cover 224 hours developing understanding of accounting concepts, analyzing economic events, and recording financial data in the accounting system.

Uploaded by

Mariz SiasonCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

28 views3 pagesCertified General Accounting Specialist Course

This 292-hour course is designed to develop skills in general accounting processes like analyzing transactions, recording in journals, posting to ledgers, preparing trial balances, making adjustments, and preparing financial statements. Students will learn accounting, prioritization, and coping with workplace environments. The core competencies cover 224 hours developing understanding of accounting concepts, analyzing economic events, and recording financial data in the accounting system.

Uploaded by

Mariz SiasonCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd