Professional Documents

Culture Documents

Tugas Kelompok Ke-1 Week 3: Kasus 1

Uploaded by

Riza AdiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tugas Kelompok Ke-1 Week 3: Kasus 1

Uploaded by

Riza AdiCopyright:

Available Formats

Tugas Kelompok ke-1

Week 3

Kelompok 1 :

Ferry Bravo (2101785272)

Hanes Rahman A. Saragih (2101787593)

Paskalia Chrissanty Akoit (2101788223)

Riza Adi Nurisma (2101777195)

Stella Caroline Laurensia (2101779414)

Kasus 1

Park Co. membeli 90% saham Salt Co. pada tanggal 1 Januari 2014 dengan harga $465.000.

Pada saat itu, retained earnings Salt adalah sebesar $50.000 dan common stock sebesar

$450.000. Perbedaan antara book value dan implied value dialokasikan ke tanah. Selama tahun

2018, Salt mengumumkan dividen $10.000 dan melaporkan net income $40.000. Retained

earnings akhir tahun 2017 Salt Co. sebesar $160.000. Park menggunakan metode cost.

Diminta:

Buatlah workpaper entries yang dibutuhkan untuk pembuatan laporan keuangan konsolidasi

pada 31 Desember 2018!

Jawab :

Workpaper entries 31/12/18 – Cost Method :

Desc Debit Credit

Investment in Salt Company $ 99.000

Retained Earnings 1 Jan - Park Company $ 99.000

* To establish reciprocity (90% x ($ 160.000 - 50.000))

Dividend Income $ 9.000

Dividends Declared - Salt Company $ 9.000

Common Stock - Salt Company $ 450.000

Retained Earnings 1 Jan 2018 - Salt Company $ 160.000

Land $ 16.667

Investment in Salt Company $ 564.000

Noncontrolling Interest $ 62.667

F1314-Merger & Acquisition Accounting & Auditing Impact

Computation and Allocation of Difference between Implied and Book Value Acquired

Non -Controlling

Parent Share Entire Value

Share

Purchase price and implied value $ 465.000 $ 51.667 $ 516.667

* Less: Book value of equity acquired: $ 450.000 $ 50.000 $ 500.000

Difference between implied and book value $ 15.000 $ 1.667 $ 16.667

Allocated to undervalued land $ -15.000 $ -1.667 $ -16.667

Balance $ - $ -

Kasus 2

Place Co. membeli 92% saham Shaw Co. pada 1 Januari 2012 dengan harga $400.000. Trial

balances di akhir tahun 2012 adalah:

Place Shaw

Cash 80.350 87.000

Accounts and Notes Receivable 200.000 210.000

Inventory 1/1 70.000 50.000

Investment in Shaw Co. 400.000 0

Plant Assets 300.000 200.000

Dividend Declared 35.000 22.000

Purchases 240.000 150.000

Selling Expenses 28.000 20.000

Other Expenses 15.000 13.000

Total 1.368.350 752.000

Accounts and Notes Payable 99.110 38.000

Other Liabilities 45.000 15.000

Common Stock (par $10) 150.000 100.000

Other Contributed Capital 279.000 149.000

Retained Earnings 1/1 225.000 170.000

Sales 550.000 280.000

Dividend Income 20.240 0

Total 1.368.350 752.000

Saldo inventory per 31 Desember 2012 adalah $25.000 untuk Place dan $15.000 untuk Shaw.

Accounts and Notes Payable milik Shaw termasuk notes payable ke Place sebesar $15.000.

F1314-Merger & Acquisition Accounting & Auditing Impact

Diminta:

Buatlah workpaper untuk pembuatan laporan keuangan konsolidasi pada tangga 31 Desember

2012! Perbedaan antara book value dengan implied value dialokasikan ke plant assets.

Consolidated Statements Workpaper

Place Company and Subsidiary for the Year Ended December 31, 2013

Elimination Non-

Controlling Consolidated

Place Shaw Debit Credit Interest Balances

Income Statement

Sales 550.000 280.000 830.0

Dividend Income 20.240 20.240 (1)

Total Revenue 570.240 280.000 830.0

Cost of Goods Sold:

Inventory 1/1 70.000 50.000 120.0

Purchases 240.000 150.000 390.0

Available for Sale 310.000 200.000 510.0

Inventory 12/31 (25.000) (15.000) 40.0

Cost of Goods

Sold 285.000 185.000 470.0

Selling Expenses 28.000 20.000 48.0

Other Expenses 15.000 13.000 28.0

Total Cost and

Expense 328.000 218.000 546.0

F1314-Merger & Acquisition Accounting & Auditing Impact

Net Consolidated

Income 242.240 62.000 284.0

Noncontrolling

Interest in Consol.

Inc. (8% 4.960 (4.96

$62.000) = $4.960

Net Income to

Retained Earnings 242.240 62.000 20.240 4.960 279.0

Retained Earnings

Statement

Retained Earnings

1/1:

Place Company 225.000 225.0

Net Income 242.240 62.000 20.240 4.960 279.040

Dividends Declared

Place Company (35.000) (35.000)

Shaw Inc. (22.000) 20.240 (1) (1.760)

Retained Earnings

31/12

to Balance Sheet 432.240 210.000 190.240 20.240 3.200 469.040

Balance Sheet

Cash 80.350 87.000 167.350

Accounts and Notes

Receivable 200.000 210.000 15.000 (4) 395.000

Inventory 25.000 15.000 40.000

Investment in Shaw

Inc.. 400.000 400.000 (2)

Difference b/w (

Implied & Book 2

Value 15.783) 15.783 (3)

Plant Assets 300.000 200.000 15.783( 515.783

3

F1314-Merger & Acquisition Accounting & Auditing Impact

)

Total 1.005.350 512.000 1.118.133

(

Accounts and Notes 4

Payable 99.110 38.000 15.000) 122.110

Other Liabilities 45.000 15.000 60.000

Common Stock:

Place Company 150.000 150.000

(

2

Shaw 100.000 100.000)

Other Contributed

Capital

Place Company 279.000 279.000

(

2

Shaw Inc. 149.000 149.000)

Retained Earnings

from above 432.240 210.000 190.240 20.240 3.200 469.040

Noncontrolling

Interest 1/1 34.783 (2) 34.783

Noncontrolling

Interest 31/12 37.983 37.983

Total 1.005.350 512.000 485.806 485.806 1.118.133

Jurnal Eliminasi :

(1) Untuk menghilangkan dividen antar perusahaan

Dr. Dividend Income $ 20.240

Cr. Dividens Declared – Shaw Inc. $ 20.240

(2) Untuk menghilangkan Investasi di Shaw dan membuat noncontrolling interest account

Dr. Retained Earnings 1/1 – Shaw Inc. $ 170.000

F1314-Merger & Acquisition Accounting & Auditing Impact

Dr. Common Stock – Shaw Inc. $ 100.000

Dr. Difference between Implied & Book Value $ 15.783

Dr. Other Contributed Capital – Shaw Inc. $ 149.000

Cr. Investment in Shaw Inc. $400.000

Cr. Noncontrolling Interest 1/1 $34.783

(3) Untuk mengalokasikan perbedaan antara implied value dan nilai buku

Dr. Plant Assets $ 15.783

Cr. Difference between Implied & Book Value $15.783

(4) Untuk menghilangkan piutang dan hutang antar perusahaan

Dr. Accounts and Notes Payable $ 15.000

Cr. Accounts and Notes Receivable $ 15.000

Perhitungan dan Alokasi Perbedaan antara Nilai Implied dan Nilai Buku yang Diperoleh

Parent Non- Entire

Share Controlling Value

Share

Purchase price and implied value 400,000 34,783 434,783 *

Less: Book value of equity acquired: 385,480 33,520 419,000

Difference between implied and book value 14,520 1,263 15,783

Undervalued land (14,520) (1,263) (15,783)

Balance -0- -0- -0 -

* $ 434.783 = ($ 400,000/92%)

Kasus 3

F1314-Merger & Acquisition Accounting & Auditing Impact

Pada tanggal 1 Januari 2012, Perez Company membeli 90% saham Sanchez Company dengan

harga $85.000. Sanchez memiliki capital stock $70.000 dan retained earnings $12.000 pada saat

itu. Pada tanggal 31 Desember 2016, trial balance kedua perusahaan adalah sebagai berikut:

Perez Sanchez

Cash 13.000 14.000

Accounts and Notes Receivable 22.000 36.000

Inventory 1/1 14.000 8.000

Advance to Sanchez Co. 8.000 0

Investment in Sanchez Co. 85.000 0

Plant and Equipment 50.000 44.000

Land 17.800 6.000

Dividend Declared 10.000 12.000

Purchases 84.000 20.000

Other Expenses 10.000 16.000

Total 313.800 156.000

Accounts Payable 6.000 6.000

Other Liabilities 37.000 0

Advance from Perez Company 0 8.000

Capital Stock 100.000 70.000

Retained Earnings 50.000 30.000

Sales 110.000 42.000

Dividend Income 10.800 0

Total 313.800 156.000

Inventory 31/12 40.000 15.000

Perbedaan antara book value dan implied value dialokasikan ke goodwill.

Diminta:

Buatlah workpaper untuk pembuatan laporan keuangan konsolidasi pada tangga 31 Desember

2016!

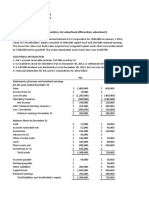

Perez Company and Subsidiary

Consolidated Statements Workpaper

Workpaper – Cost Method For the Year Ended December 31, 2016

Perez Sanchez Eliminating Entries Non- Consolidated

Company Company controlling Balance

Interest

F1314-Merger & Acquisition Accounting & Auditing Impact

Dr. Cr

Income Statement

Sales 110.000 42.000 152.000

Dividend Income 10.800 10.800

Total Revenue 120.800 42.000 152.000

Cost of Goods Sold

Inventory 1/1 14.000 8.000 22.000

Purchase 84.000 20.000 104.000

Available for Sale 98.000 28.000 126.000

Inventory 12/31 40.000 15.000 55.000

Cost of Goods Sold 58.000 13.000 71.000

Other Expenses 10.000 16.000 26.000

Total Cost and 68.000 29.000 97.000

Expenses

Net Income 52.800 13.000 55.000

Noncontrolling Interest 1.300 (1.300)

Net Income to 52.800 13.000 10.800 1.300 57.000

Retained Earnings

F1314-Merger & Acquisition Accounting & Auditing Impact

You might also like

- Transfer Pricng SolutionDocument3 pagesTransfer Pricng SolutionchandraprakashNo ratings yet

- Partnership FormatDocument2 pagesPartnership FormatGlenn Taduran100% (1)

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Ch2 TB Moodle 20201030Document6 pagesCh2 TB Moodle 20201030Wang JukNo ratings yet

- E 4-8 (APPENDIX B) Journal Entries and Computations (Cost and Equity Methods)Document10 pagesE 4-8 (APPENDIX B) Journal Entries and Computations (Cost and Equity Methods)Lusiana Purnama SariNo ratings yet

- MGMT AssignmentDocument79 pagesMGMT AssignmentLuleseged Gebre100% (1)

- Purchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalanceDocument14 pagesPurchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalancesallyNo ratings yet

- Latihan Soal With DiscussionDocument6 pagesLatihan Soal With DiscussionNicolas ErnestoNo ratings yet

- Latihan Soal Kombis (Answered)Document6 pagesLatihan Soal Kombis (Answered)Fajar IskandarNo ratings yet

- Adv 2 Tugas 2Document5 pagesAdv 2 Tugas 2Daniel ReyhansNo ratings yet

- (Quiz Uas Take Home) Akl-1 PDFDocument7 pages(Quiz Uas Take Home) Akl-1 PDFStephani ElvinaNo ratings yet

- PROBLEM 1: Intercompany Transfer of Inventory: Asistensi Akuntansi Keuangan Lanjutan IDocument4 pagesPROBLEM 1: Intercompany Transfer of Inventory: Asistensi Akuntansi Keuangan Lanjutan Izsaw zsawNo ratings yet

- 1822 Acct6137 Tdfa TK2 W5 S7 R0 Team1Document6 pages1822 Acct6137 Tdfa TK2 W5 S7 R0 Team1Sayang MeilyNo ratings yet

- Soal AkuntansiDocument4 pagesSoal AkuntansinairobiNo ratings yet

- B. Record The Entries in Python's Books To Reflect Its Transactions With Shark in 2013, Assuming The Cost MethodDocument5 pagesB. Record The Entries in Python's Books To Reflect Its Transactions With Shark in 2013, Assuming The Cost MethodAndera FitriaNo ratings yet

- Finals Quiz No. 1 AnswersDocument4 pagesFinals Quiz No. 1 AnswersMergierose DalgoNo ratings yet

- Latihan Arus KasDocument8 pagesLatihan Arus KasEka Junita HartonoNo ratings yet

- PRBA003 Week 10 Tutorialsolutions 10 EdDocument29 pagesPRBA003 Week 10 Tutorialsolutions 10 EdWang ChoiNo ratings yet

- Dian Sari (A031171703) Tugas Akl IiDocument3 pagesDian Sari (A031171703) Tugas Akl Iidian sariNo ratings yet

- Shadden PanaoDocument5 pagesShadden PanaoJoebin Corporal LopezNo ratings yet

- Activity 3.1Document13 pagesActivity 3.1kel dataNo ratings yet

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision QuestionskelvinmunashenyamutumbaNo ratings yet

- 001 AdvanceDocument6 pages001 AdvanceSa BilNo ratings yet

- Common Stock - S Company Other Contributed Capital - S Company Retained Earnings - S Company Difference Between Implied and Book ValueDocument11 pagesCommon Stock - S Company Other Contributed Capital - S Company Retained Earnings - S Company Difference Between Implied and Book ValueSavina SyachNo ratings yet

- Problem 1 1. Record The Transactions To Account The Investment. P Corporation's BooksDocument2 pagesProblem 1 1. Record The Transactions To Account The Investment. P Corporation's BooksArtisanNo ratings yet

- Consolidated Financial Statement Practice 3-2Document2 pagesConsolidated Financial Statement Practice 3-2Winnie TanNo ratings yet

- Comprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFDocument9 pagesComprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFamie honnagNo ratings yet

- Chapter 2 Advanced AccountingDocument9 pagesChapter 2 Advanced AccountingMohamad Adel Al AyoubiNo ratings yet

- Accounting 423 Professor Kang: Practice Problems For Chapter 2 Consolidation of Financial StatementsDocument14 pagesAccounting 423 Professor Kang: Practice Problems For Chapter 2 Consolidation of Financial StatementsJoel Christian MascariñaNo ratings yet

- Module 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)Document3 pagesModule 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)ariannealcaraz6No ratings yet

- Net Cash Flows From Operating ActivitiesDocument7 pagesNet Cash Flows From Operating ActivitiesShaneNiñaQuiñonezNo ratings yet

- Rayhan Dewangga Saputra - Tugas AKL TM 4Document6 pagesRayhan Dewangga Saputra - Tugas AKL TM 4Rayhan Dewangga SaputraNo ratings yet

- Acct 4010 Ch2-Handout-SolutionDocument4 pagesAcct 4010 Ch2-Handout-Solutionlokyee801mikiNo ratings yet

- (Ch4) Gina Purdiyanti - 20181211031 AKL4Document10 pages(Ch4) Gina Purdiyanti - 20181211031 AKL4gina amsyarNo ratings yet

- Let's Analyze: Name: Jerah Y. Torrejos Subject: ACP312 (4965)Document2 pagesLet's Analyze: Name: Jerah Y. Torrejos Subject: ACP312 (4965)Jerah TorrejosNo ratings yet

- Buscom SeatworkDocument3 pagesBuscom SeatworkTintin AquinoNo ratings yet

- Latihan IDocument8 pagesLatihan IPutri SariNo ratings yet

- Balances Preference Dividend Liquidation Premium Balance To Common Outstanding Shares Book Value/ShareDocument4 pagesBalances Preference Dividend Liquidation Premium Balance To Common Outstanding Shares Book Value/ShareJhazreel BiasuraNo ratings yet

- Problem 1: Cash Flow Statement (Class Practice)Document2 pagesProblem 1: Cash Flow Statement (Class Practice)ronamiNo ratings yet

- Dinar Annisa - 142180194 - Tugas 2Document4 pagesDinar Annisa - 142180194 - Tugas 2Salsa BilaNo ratings yet

- Tugas Chapter 4 - Part 2 - 041811333044 - Yefi Nia OpianaDocument4 pagesTugas Chapter 4 - Part 2 - 041811333044 - Yefi Nia OpianaYefinia OpianaNo ratings yet

- DONE BA 118.3 Module 2 Quiz 1answer KeyDocument8 pagesDONE BA 118.3 Module 2 Quiz 1answer KeyRed Ashley De LeonNo ratings yet

- Soal Akl Minggu 3Document3 pagesSoal Akl Minggu 3Mochamad HimawanNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- C6-Intercompany Inventory Transactions PDFDocument43 pagesC6-Intercompany Inventory Transactions PDFVico JulendiNo ratings yet

- Tugas Chapter 5: Persentase Kepemilikan Pay Corporation 75%Document6 pagesTugas Chapter 5: Persentase Kepemilikan Pay Corporation 75%Iche IcheNo ratings yet

- Homework Answer (Quiz 1-2 Revision)Document7 pagesHomework Answer (Quiz 1-2 Revision)Kccc siniNo ratings yet

- Akuntansi Keuangan Lanjutan 1Document4 pagesAkuntansi Keuangan Lanjutan 1Salsa BilaNo ratings yet

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- Randall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Document5 pagesRandall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Diane MagnayeNo ratings yet

- Firda Arfianti - LC53 - Equity Method, Two Consecutive YearsDocument5 pagesFirda Arfianti - LC53 - Equity Method, Two Consecutive YearsFirdaNo ratings yet

- S 5.8-5.13 Limited CompaniesDocument11 pagesS 5.8-5.13 Limited CompaniesIlovejjcNo ratings yet

- UAS-AKL 1 - IntlDocument2 pagesUAS-AKL 1 - IntlSweda ArifahNo ratings yet

- 2021 Unit 8 Tutorial QuestionsDocument7 pages2021 Unit 8 Tutorial Questions日日日No ratings yet

- P4-12 AnswerDocument5 pagesP4-12 AnswerPutri Apriliana100% (1)

- PROBLEM 1:consolidated Worksheet and Balance Sheet On The Acquisition Date (Equity Method)Document2 pagesPROBLEM 1:consolidated Worksheet and Balance Sheet On The Acquisition Date (Equity Method)zsaw zsawNo ratings yet

- Final Output - Ais Elect 1Document18 pagesFinal Output - Ais Elect 1Joody CatacutanNo ratings yet

- Mid Term ExamDocument6 pagesMid Term Examaika9maikaNo ratings yet

- Exercise 8 13 TemplateDocument4 pagesExercise 8 13 TemplateashibhallauNo ratings yet

- Financial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions ManualDocument36 pagesFinancial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions Manualandrewnealobrayfksqe100% (23)

- TK 5Document7 pagesTK 5Riza AdiNo ratings yet

- Nama Kelompok:: Tugas Kelompok Ke 3 Minggu Ke 8Document15 pagesNama Kelompok:: Tugas Kelompok Ke 3 Minggu Ke 8Riza AdiNo ratings yet

- TP5 W7 R2 1Document5 pagesTP5 W7 R2 1Riza AdiNo ratings yet

- TK 5Document7 pagesTK 5Riza AdiNo ratings yet

- TP5 W7 R2 1Document5 pagesTP5 W7 R2 1Riza AdiNo ratings yet

- TP5 W7 R2 1Document5 pagesTP5 W7 R2 1Riza AdiNo ratings yet

- Case National Medical Transportation NetworkDocument6 pagesCase National Medical Transportation NetworkIvan Fherdifha0% (2)

- Tugas Personal Ke 4 Minggu Ke 4: National Medical Transportation NetworkDocument7 pagesTugas Personal Ke 4 Minggu Ke 4: National Medical Transportation NetworkMargareta Jati100% (1)

- Case National Medical Transportation NetworkDocument6 pagesCase National Medical Transportation NetworkIvan Fherdifha0% (2)

- Key Answer Financial Statement - TP1Document7 pagesKey Answer Financial Statement - TP1Riza AdiNo ratings yet