Professional Documents

Culture Documents

Let's Analyze: Name: Jerah Y. Torrejos Subject: ACP312 (4965)

Uploaded by

Jerah TorrejosOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Let's Analyze: Name: Jerah Y. Torrejos Subject: ACP312 (4965)

Uploaded by

Jerah TorrejosCopyright:

Available Formats

Name: Jerah Y.

Torrejos

Subject: ACP312 (4965)

Let's Analyze

Consideration: Goodwill:

30,000 shares, 40 per share Consideration 1,200,000

= 1,200,000 Net Assets (930,000)

Goodwill 270,000

40 per share

Investment in Susidiary 1,200,000

Common Stock, 5 par 150,000

Share Premium 1,050,000

Retained Earnings 50,000

Cash 50,000

Share Premium 20,000

Cash 20,000

Common Stock 400,000

Share Premium 280,000

Retained Earnings 200,000

Goodwill 270,000

Land 50,000

Investment in Subsidiary 1,200,000

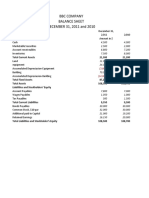

Palisade and Subsidiary

Consolidated Financial Statement

January 1, 2011

Assets

Current Assets 310,000

Equipment 920,000

Buildings 800,000

Land 350,000

Goodwill 270,000

TOTAL ASSETS 2,650,000

Liabilities and Equity

Current Liabilitites 220,000

Common Stock 1,150,000

Additional Paid-in Capital 1,130,000

Retained Earnings 150,000

TOTAL LIABILITIES AND EQUITY 2,650,000

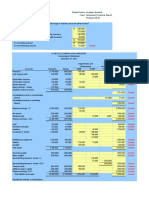

Eliminations

PARENT SUBSIDIARY DEBIT CREDIT CONSOLIDATED

Current Assets 260,000 120,000 70,000 310,000

Equipment 440,000 480,000 920,000

Buildings 600,000 200,000 800,000

Land 100,000 200,000 50,000 350,000

Goodwill 270,000 270,000

Investment in Subsidiary 1,200,000 1,200,000 -

TOTAL ASSETS 2,600,000 1,000,000 320,000 1,270,000 2,650,000

Current Liabilities 100,000 120,000 220,000

Common Stock: -

Parent 1,150,000 1,150,000

Subsidiary 400,000 400,000 -

Share Premium: -

Parent 1,150,000 20,000 1,130,000

Subsidiary 280,000 280,000 -

Retained Earnings: -

Parent 200,000 50,000 150,000

Subsidiary 200,000 200,000 -

TOTAL LIABILITIES

AND EQUITY

2,600,000 1,000,000 - 950,000 2,650,000

You might also like

- Wan Aidi Pra Uts Adv. AccDocument10 pagesWan Aidi Pra Uts Adv. AccWan Aidi AbdurrahmanNo ratings yet

- Consolidation WorksheetDocument1 pageConsolidation WorksheetJean Kathyrine ChiongNo ratings yet

- Sample ProblemDocument3 pagesSample ProblemZaldy Magante MalasagaNo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Consolidated Financial Statements Worked ExampleDocument5 pagesConsolidated Financial Statements Worked ExampleEnalem OtsuepmeNo ratings yet

- FINAL EXAM - Part 2Document4 pagesFINAL EXAM - Part 2Elton ArcenasNo ratings yet

- College Business ConsolidationDocument4 pagesCollege Business ConsolidationMaria Beatriz NavecisNo ratings yet

- PROBLEM 1:consolidated Worksheet and Balance Sheet On The Acquisition Date (Equity Method)Document2 pagesPROBLEM 1:consolidated Worksheet and Balance Sheet On The Acquisition Date (Equity Method)zsaw zsawNo ratings yet

- Consolidation of Financial Statements at Acquisition DateDocument4 pagesConsolidation of Financial Statements at Acquisition DateShiela Mae RedobleNo ratings yet

- Cla 6Document2 pagesCla 6Von Andrei MedinaNo ratings yet

- Solution For Activity On Consolidation at The Date of AcquisitionDocument4 pagesSolution For Activity On Consolidation at The Date of AcquisitionRea June SumatraNo ratings yet

- Accounting For Business Combination - PRELIMDocument5 pagesAccounting For Business Combination - PRELIMAnonymouslyNo ratings yet

- ACC9005M - Lecture 4 - Financial Analysis (Recycle LTD) QUESTIONDocument2 pagesACC9005M - Lecture 4 - Financial Analysis (Recycle LTD) QUESTIONPravallika RavikumarNo ratings yet

- Name: Fe C. Leyros Bsa 2 Acctg TTH 3:00-4:30 PM Solutions: Problem 1Document7 pagesName: Fe C. Leyros Bsa 2 Acctg TTH 3:00-4:30 PM Solutions: Problem 1AlexNo ratings yet

- Financial Ratios IIDocument27 pagesFinancial Ratios IIMohamad Gammaz0% (1)

- Prelim Quiz Preparation of Balance Sheet and Income StatementDocument8 pagesPrelim Quiz Preparation of Balance Sheet and Income StatementCHARRYSAH TABAOSARES100% (2)

- Exercise 8 13 TemplateDocument4 pagesExercise 8 13 TemplateashibhallauNo ratings yet

- Quiz 3 Acctg For Business Combination - EntriesDocument6 pagesQuiz 3 Acctg For Business Combination - EntriesNhicoleChoiNo ratings yet

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocument4 pagesAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- Activity 3.1Document13 pagesActivity 3.1kel dataNo ratings yet

- Acc For Business CombinationDocument4 pagesAcc For Business CombinationBabyann BallaNo ratings yet

- 8-2 at 8-3Document6 pages8-2 at 8-3danmatthew265No ratings yet

- Advac 2 Prelims 1 - PALACIODocument4 pagesAdvac 2 Prelims 1 - PALACIOPinky DaisiesNo ratings yet

- Module 4 - Consolidation Subsequent to the Date of Acquisition (Hand - Outs 1)Document3 pagesModule 4 - Consolidation Subsequent to the Date of Acquisition (Hand - Outs 1)ariannealcaraz6No ratings yet

- Problem 1 1. Record The Transactions To Account The Investment. P Corporation's BooksDocument2 pagesProblem 1 1. Record The Transactions To Account The Investment. P Corporation's BooksArtisanNo ratings yet

- Business Combination Valuation Case StudyDocument3 pagesBusiness Combination Valuation Case StudyHuỳnh Minh Gia HàoNo ratings yet

- From The Following Information, Prepare A Cash Flow StatementDocument2 pagesFrom The Following Information, Prepare A Cash Flow StatementAgANo ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionAnnabeth BrionNo ratings yet

- Financial StatementsDocument1 pageFinancial StatementsjaphethadadNo ratings yet

- Analyze financial statements and construct cash flow statementDocument14 pagesAnalyze financial statements and construct cash flow statementMirkan OrdeNo ratings yet

- Paw & Saw Downstream ConsolidationDocument3 pagesPaw & Saw Downstream ConsolidationLorie Roncal JimenezNo ratings yet

- Seatwork Ratio AnalysisDocument2 pagesSeatwork Ratio AnalysisMARIBEL SANTOSNo ratings yet

- Meiditya Larasati - 01017190019 - PR Pertemuan 03Document9 pagesMeiditya Larasati - 01017190019 - PR Pertemuan 03Haikal RafifNo ratings yet

- Polo Company and Subsidiary Consolidated Statement of Financial Position As of December 31, 2020 AssetsDocument3 pagesPolo Company and Subsidiary Consolidated Statement of Financial Position As of December 31, 2020 AssetsJunzen Ralph YapNo ratings yet

- FRS - 7 - Ie - (2016)Document9 pagesFRS - 7 - Ie - (2016)David LeeNo ratings yet

- Bengal Financial Statements AnalysisDocument1 pageBengal Financial Statements AnalysisTenghour LyNo ratings yet

- Cash Flow Tutorial QnsDocument13 pagesCash Flow Tutorial QnsCristian Renatus100% (1)

- Acct 108 Consolidated Financial Statements QuizDocument5 pagesAcct 108 Consolidated Financial Statements QuizGround ZeroNo ratings yet

- PDF Chapter 2 CompressDocument33 pagesPDF Chapter 2 CompressRonel GaviolaNo ratings yet

- BBC Company Balance Sheet DECEMBER 31, 2011 and 2010: AssetsDocument2 pagesBBC Company Balance Sheet DECEMBER 31, 2011 and 2010: AssetsMuhammad EhtishamNo ratings yet

- Mids Excel WorkDocument2 pagesMids Excel WorkMuhammad EhtishamNo ratings yet

- Fin CH 2 ProblemsDocument9 pagesFin CH 2 Problemsshah118850% (4)

- Finals Quiz No. 1 AnswersDocument4 pagesFinals Quiz No. 1 AnswersMergierose DalgoNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- Sheet at Acquisition: A. P.3-2. Allocation Schedule For Fair Value/book Value Differential and Consolidated BalanceDocument4 pagesSheet at Acquisition: A. P.3-2. Allocation Schedule For Fair Value/book Value Differential and Consolidated BalancePrince Frederic Mangambu100% (1)

- Project 4 - Chap 5Document3 pagesProject 4 - Chap 5Waqar ZulfiqarNo ratings yet

- 1Document7 pages1JessaNo ratings yet

- Cfas ComputationDocument4 pagesCfas ComputationSherica VirayNo ratings yet

- Audit Journal Entries GuideDocument7 pagesAudit Journal Entries Guidereina maica terradoNo ratings yet

- Yohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 5Document5 pagesYohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 5YOHANNES WIBOWONo ratings yet

- Ae 17 Midterms Assignment 1Document6 pagesAe 17 Midterms Assignment 1Ronald YNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- Mid Term ExamDocument6 pagesMid Term Examaika9maikaNo ratings yet

- Advanced Accounting 4Document2 pagesAdvanced Accounting 4Tax TrainingNo ratings yet

- Extra session 2 (30 Sept 2022) spreadsheet (Ch 3)Document2 pagesExtra session 2 (30 Sept 2022) spreadsheet (Ch 3)georgius gabrielNo ratings yet

- Group 1Document2 pagesGroup 1Niro MadlusNo ratings yet

- Adv Acc 2 Sol Man 2008 BaysaDocument8 pagesAdv Acc 2 Sol Man 2008 BaysaNorman DelirioNo ratings yet

- Framework: 2 Types of Assurance EngagementDocument41 pagesFramework: 2 Types of Assurance EngagementJerah TorrejosNo ratings yet

- Assignment 3Document2 pagesAssignment 3Jerah TorrejosNo ratings yet

- Ratings and EvaluationDocument1 pageRatings and EvaluationJerah TorrejosNo ratings yet

- Assignment For 25Document1 pageAssignment For 25Jerah TorrejosNo ratings yet

- Let's AnalayzeDocument1 pageLet's AnalayzeJerah TorrejosNo ratings yet

- Assignment For 30no2Document1 pageAssignment For 30no2Jerah TorrejosNo ratings yet

- Part 2 Assignment PDFDocument1 pagePart 2 Assignment PDFJerah TorrejosNo ratings yet

- Accounting For Branches and Combined FSDocument112 pagesAccounting For Branches and Combined FSMuhammad Fahad100% (2)

- Third Examination Review (ACP 312/8B)Document20 pagesThird Examination Review (ACP 312/8B)Jerah TorrejosNo ratings yet

- Understanding Chapter 14 Multiple Choice and ProblemsDocument15 pagesUnderstanding Chapter 14 Multiple Choice and Problemsmarycayton77% (13)

- AFAR Notes by Dr. Ferrer PDFDocument21 pagesAFAR Notes by Dr. Ferrer PDFjexNo ratings yet

- Audit OpinionDocument39 pagesAudit OpinionJerah TorrejosNo ratings yet

- Health and Wellness, Financial Stability, Career Advancement, Personal Satisfaction, Community Engagement, and Added SkillsDocument4 pagesHealth and Wellness, Financial Stability, Career Advancement, Personal Satisfaction, Community Engagement, and Added SkillsJerah TorrejosNo ratings yet

- Assignment 3Document2 pagesAssignment 3Jerah TorrejosNo ratings yet

- Home Office SolutionDocument8 pagesHome Office SolutionJerah TorrejosNo ratings yet

- College of Business Administration EducationDocument2 pagesCollege of Business Administration EducationJerah TorrejosNo ratings yet

- Advanced Accounting Dayag Solution Manual PDFDocument234 pagesAdvanced Accounting Dayag Solution Manual PDFAnggë Crüz89% (9)

- Iggy and SwaggyDocument3 pagesIggy and SwaggyJerah TorrejosNo ratings yet

- Let's Check For Oct.10 PDFDocument1 pageLet's Check For Oct.10 PDFJerah TorrejosNo ratings yet

- Assignment For 25 PDFDocument1 pageAssignment For 25 PDFJerah TorrejosNo ratings yet

- Third Examination Review (ACP 312/8B)Document20 pagesThird Examination Review (ACP 312/8B)Jerah TorrejosNo ratings yet

- In A Nutshell - TorrejosDocument1 pageIn A Nutshell - TorrejosJerah TorrejosNo ratings yet

- Assignment 3Document2 pagesAssignment 3Jerah TorrejosNo ratings yet

- Iggy and SwaggyDocument3 pagesIggy and SwaggyJerah TorrejosNo ratings yet

- Assignment 1Document1 pageAssignment 1irahQNo ratings yet

- Let's Check: Jerah Y. TorrejosDocument2 pagesLet's Check: Jerah Y. TorrejosirahQNo ratings yet

- Let's Analyze For Oct 10 PDFDocument1 pageLet's Analyze For Oct 10 PDFJerah TorrejosNo ratings yet

- Home Office SolutionDocument8 pagesHome Office SolutionJerah TorrejosNo ratings yet

- Assignment 3Document2 pagesAssignment 3Jerah TorrejosNo ratings yet

- Let's Check For 26-1Document1 pageLet's Check For 26-1Jerah TorrejosNo ratings yet

- HR For Competitive AdvantageDocument19 pagesHR For Competitive AdvantageAtul ChanodkarNo ratings yet

- AC - ARK StructuralDocument9 pagesAC - ARK StructuralM Q ASLAMNo ratings yet

- BHC Customer DrivenDocument3 pagesBHC Customer DrivenKhanh NguyễnNo ratings yet

- QP-DILG-BLGS-RO-03-Issuance of Certificate For Foreign Travel Authority of Local Government Officials and EmployeesDocument12 pagesQP-DILG-BLGS-RO-03-Issuance of Certificate For Foreign Travel Authority of Local Government Officials and EmployeesCar DilgopcenNo ratings yet

- Security Analysis and Portfolio Management - Lesson 5 - Risk Management, Concept, Sources & Types of RiskDocument4 pagesSecurity Analysis and Portfolio Management - Lesson 5 - Risk Management, Concept, Sources & Types of RiskEdwin HauwertNo ratings yet

- Inheritance FormatDocument3 pagesInheritance FormatTega Tosin88% (8)

- Problem From Conceptual Framework and Accounting Standards by Valix Et Al., 2018Document3 pagesProblem From Conceptual Framework and Accounting Standards by Valix Et Al., 2018Jessel Mae Lim CabasagNo ratings yet

- Multiple Choice QuestionsDocument9 pagesMultiple Choice Questionskhankhan1No ratings yet

- ACC0 20053 - Intermediate Accounting 1 - 2022 Final Departmental ExamDocument41 pagesACC0 20053 - Intermediate Accounting 1 - 2022 Final Departmental ExamNathalie Faye TajaNo ratings yet

- Pathao-MIS205-Group-Project FinalDocument18 pagesPathao-MIS205-Group-Project FinalAmir Nahian100% (1)

- Fintech and E Commerce in MyanmarDocument34 pagesFintech and E Commerce in MyanmarTHU RA AUNGNo ratings yet

- Job Analysis at Go-ForwardDocument2 pagesJob Analysis at Go-ForwardHoàng Nam29No ratings yet

- Social Media Marketing Impact On Delivery CompaniesDocument12 pagesSocial Media Marketing Impact On Delivery CompaniesSaima AsadNo ratings yet

- Project Formulation - Solidaridad NetworkDocument22 pagesProject Formulation - Solidaridad NetworkLuis Raúl Arzola TorresNo ratings yet

- ACC 557 Week 2 Chapter 3 (E3-6, E3-7, E3-11, P3-2A) 100% ScoredDocument26 pagesACC 557 Week 2 Chapter 3 (E3-6, E3-7, E3-11, P3-2A) 100% ScoredJoseph W. RodgersNo ratings yet

- ITM Course Outline - Spring 2024Document9 pagesITM Course Outline - Spring 2024Ashar ZiaNo ratings yet

- Company AccountsDocument3 pagesCompany AccountsYATTIN KHANNANo ratings yet

- North South University: School of Business and EconomicsDocument24 pagesNorth South University: School of Business and EconomicsJamiNo ratings yet

- Impact of Online Digital Communication On CustomerDocument10 pagesImpact of Online Digital Communication On CustomerShipali ShandilyaNo ratings yet

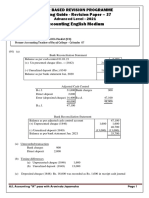

- Accounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 37Document6 pagesAccounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 37Malar SrirengarajahNo ratings yet

- SSRN Id4045914Document51 pagesSSRN Id4045914Jack CrossNo ratings yet

- Intercompany Transactions Bonds LeasesDocument49 pagesIntercompany Transactions Bonds LeasesAndrea Mcnair-West100% (1)

- Literature ReviewDocument2 pagesLiterature ReviewLokesh SharmaNo ratings yet

- Essentials of Entrepreneurship and Small Business Management 9th Edition Scarborough Test BankDocument20 pagesEssentials of Entrepreneurship and Small Business Management 9th Edition Scarborough Test Banksarahhant7t86100% (23)

- Unit 3-Statement of Changes in Equity (2023)Document13 pagesUnit 3-Statement of Changes in Equity (2023)Chalé DarwinNo ratings yet

- MBA Project Guidelines (Synopsis and Project Report)Document34 pagesMBA Project Guidelines (Synopsis and Project Report)rebelrahul04No ratings yet

- R.Chitra Devi 10MBA58: Click To Edit Master Subtitle StyleDocument17 pagesR.Chitra Devi 10MBA58: Click To Edit Master Subtitle StyleShyamala RajendranNo ratings yet

- Switzer, Janet - Instant IncomeDocument338 pagesSwitzer, Janet - Instant IncomeMichael Andrews100% (2)

- MacalalagDocument1 pageMacalalagChristian Nehru ValeraNo ratings yet

- PM0010 Introduction To Project Management Fall 10Document2 pagesPM0010 Introduction To Project Management Fall 10santoshbn7No ratings yet