Professional Documents

Culture Documents

Cla 6

Uploaded by

Von Andrei Medina0 ratings0% found this document useful (0 votes)

71 views2 pagesOriginal Title

CLA 6

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

71 views2 pagesCla 6

Uploaded by

Von Andrei MedinaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

ENABLING ASSESSMENT

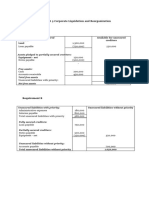

1. Hikahos Corporation is undergoing liquidation. Relevant information as of January 1, 2021 is shown

below:

ASSETS Carrying Amount Net Realizable Value

Cash 200,000 200,000

Accounts Receivable 500,000 450,000

Equipment-net 600,000 150,000

Land 1,000,000 1,300,000

Total Assets 2,300,000 2,100,000

LIABILITIES

Accounts Payable 700,000 700,000

Salaries Payable 800,000 800,000

Notes Payable 500,000 500,000

Loan Payable 750,000 750,000

Total Liabilities 2,750,000 2,750,000

EQUITY

Share Capital 1,000,000

Deficit (1,450,000)

Capital Deficiency (450,000)

Total Liabilities and Equity 2,300,000

Additional information:

❏ Administrative expenses expected to be incurred during the liquidation process is P180,000.

❏ The equipment is pledged as collateral security for the notes payable.

❏ The land is pledged as collateral security for the loan payable.

● The estimated recovery percentage is ___.

20.95%

● Assuming all the assets were sold, and all the liabilities were settled, Ms. E, an unsecured and

non-priority creditor would expect to receive from her P500,000 claim from Hikahos Corporation

an amount equal to ___.

104762

● The net free assets amount to ___.

220000

● The estimated deficiency is ___.

830000

You might also like

- Accounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsFrom EverandAccounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsNo ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakNo ratings yet

- Understanding Kohlberg's Stages of Moral DevelopmentDocument4 pagesUnderstanding Kohlberg's Stages of Moral DevelopmentVon Andrei Medina100% (3)

- Chapter 2Document34 pagesChapter 2Marjorie PalmaNo ratings yet

- Chapter 2Document33 pagesChapter 2jake doinog93% (14)

- Magsino, Hannah Florence DDocument19 pagesMagsino, Hannah Florence DMaxine SantosNo ratings yet

- (LAB) Activity - Preparation of Financial Statements Using SpreadsheetDocument3 pages(LAB) Activity - Preparation of Financial Statements Using SpreadsheetJUVEN LOGAGAY0% (1)

- Partnership profit sharing and liquidation calculationsDocument4 pagesPartnership profit sharing and liquidation calculationsVon Andrei MedinaNo ratings yet

- BS1Document5 pagesBS1Von Andrei MedinaNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- Pfea 1Document1 pagePfea 1Von Andrei MedinaNo ratings yet

- Pfea 1Document1 pagePfea 1Von Andrei MedinaNo ratings yet

- Advacc 1 Millan 2019 Advac 1 Special Transactions 2019Document11 pagesAdvacc 1 Millan 2019 Advac 1 Special Transactions 2019Charlene BolandresNo ratings yet

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- Csa 9Document1 pageCsa 9Von Andrei MedinaNo ratings yet

- Partnership Formation: Only Statement 1 Is TrueDocument1 pagePartnership Formation: Only Statement 1 Is TrueVon Andrei MedinaNo ratings yet

- Module 2 - Business CombinationsDocument4 pagesModule 2 - Business Combinations수지No ratings yet

- Classic Lit Summative #3Document2 pagesClassic Lit Summative #3Von Andrei MedinaNo ratings yet

- PDF Chapter 2 CompressDocument33 pagesPDF Chapter 2 CompressRonel GaviolaNo ratings yet

- Unit I VDocument15 pagesUnit I VLeslie Mae Vargas ZafeNo ratings yet

- Corporate LiquidationDocument4 pagesCorporate LiquidationMae100% (1)

- A. Statement of Affairs B. State of Realization and LiquidationDocument9 pagesA. Statement of Affairs B. State of Realization and Liquidationloyd smithNo ratings yet

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersHazel Pacheco100% (1)

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersCarlos John Talania 1923No ratings yet

- Corporate Liquidation FinancialsDocument11 pagesCorporate Liquidation FinancialsJenny LelisNo ratings yet

- 8-2 at 8-3Document6 pages8-2 at 8-3danmatthew265No ratings yet

- Activity 3.1Document13 pagesActivity 3.1kel dataNo ratings yet

- Activity-4-CLDocument2 pagesActivity-4-CLfrancesdimplesabio06No ratings yet

- Case 1.: Additional InformationDocument3 pagesCase 1.: Additional InformationPearl Jade YecyecNo ratings yet

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDocument10 pagesAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNo ratings yet

- Toaz - Info Statement of Financial Position Required PRDocument33 pagesToaz - Info Statement of Financial Position Required PRDaniella Mae ElipNo ratings yet

- Quiz 3 Acctg For Business Combination - EntriesDocument6 pagesQuiz 3 Acctg For Business Combination - EntriesNhicoleChoiNo ratings yet

- Advanced Accounting 1 - Millan: Problem 1-4: Exercises: ComputationalDocument10 pagesAdvanced Accounting 1 - Millan: Problem 1-4: Exercises: ComputationalFritzNo ratings yet

- CHAPTER 5 Corporate Liquidation and Reorganization Problem 5 Requirement ADocument6 pagesCHAPTER 5 Corporate Liquidation and Reorganization Problem 5 Requirement AArtisanNo ratings yet

- Business Combination Exercises StudentDocument7 pagesBusiness Combination Exercises StudentDenise RoqueNo ratings yet

- Performance Task 1Document1 pagePerformance Task 1wivadaNo ratings yet

- Financial Statement Analysis for Entity Providing Trial BalanceDocument3 pagesFinancial Statement Analysis for Entity Providing Trial BalanceMansour HamjaNo ratings yet

- Assignment Bus. CombiDocument49 pagesAssignment Bus. CombiAe AsisNo ratings yet

- INTACC 3 Dilemma Company (Financial Position)Document1 pageINTACC 3 Dilemma Company (Financial Position)Ian SantosNo ratings yet

- AST Prob 5 SolutionDocument6 pagesAST Prob 5 SolutionPamela EvangelistaNo ratings yet

- Relax CompanyDocument7 pagesRelax CompanyRegine CalipusanNo ratings yet

- Financial StatementsDocument1 pageFinancial StatementsjaphethadadNo ratings yet

- CORPORATION LIQUIDATION - AcctnfDocument2 pagesCORPORATION LIQUIDATION - AcctnfJewel CabigonNo ratings yet

- Lesson 1.2Document4 pagesLesson 1.2LifelessNo ratings yet

- Problem 2 6Document6 pagesProblem 2 6Abe Mayores CañasNo ratings yet

- Practical Accounting P-2Document7 pagesPractical Accounting P-2KingChryshAnneNo ratings yet

- Partnership Operation - AssignmentDocument2 pagesPartnership Operation - AssignmentCathleen TenaNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Acc For Business CombinationDocument4 pagesAcc For Business CombinationBabyann BallaNo ratings yet

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocument4 pagesAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- PROBLEM 1:consolidated Worksheet and Balance Sheet On The Acquisition Date (Equity Method)Document2 pagesPROBLEM 1:consolidated Worksheet and Balance Sheet On The Acquisition Date (Equity Method)zsaw zsawNo ratings yet

- Intermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreDocument2 pagesIntermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreGrezel NiceNo ratings yet

- Corporate Liquidation DFCAMCLPDocument13 pagesCorporate Liquidation DFCAMCLPJessaNo ratings yet

- 150.curren and Non Current Assets and Liabilities 2Document3 pages150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNo ratings yet

- Patinio FinalexamDocument2 pagesPatinio FinalexamchristianshakobepatinioNo ratings yet

- Global Corporation Liquidation Statement AnalysisDocument14 pagesGlobal Corporation Liquidation Statement AnalysisKez MaxNo ratings yet

- Practice Exercise 1.4Document1 pagePractice Exercise 1.4leshz zynNo ratings yet

- Corporate Liquidation PDFDocument6 pagesCorporate Liquidation PDFJae DenNo ratings yet

- Corliq CheatDocument2 pagesCorliq CheatShaina GarciaNo ratings yet

- Book Value Assets Total Unsecured Realizable ValueDocument9 pagesBook Value Assets Total Unsecured Realizable ValueJPNo ratings yet

- Saliva Robin Jaycob M Statement of AffairsDocument6 pagesSaliva Robin Jaycob M Statement of AffairsRobin SalivaNo ratings yet

- Indirect Method Cash Flow Statement for Hill CompanyDocument6 pagesIndirect Method Cash Flow Statement for Hill CompanyJessbel MahilumNo ratings yet

- Let's Analyze: Name: Jerah Y. Torrejos Subject: ACP312 (4965)Document2 pagesLet's Analyze: Name: Jerah Y. Torrejos Subject: ACP312 (4965)Jerah TorrejosNo ratings yet

- Balance Sheet With ExplanationDocument2 pagesBalance Sheet With ExplanationTrinadh KNo ratings yet

- 286practice Questions - AnswerDocument17 pages286practice Questions - Answerma sthaNo ratings yet

- Corporation LiquidationDocument1 pageCorporation LiquidationMelisa DomingoNo ratings yet

- EE7Document1 pageEE7Von Andrei MedinaNo ratings yet

- Bill Signs A Contract To Buy Furniture For Official Use in The PartnershipDocument4 pagesBill Signs A Contract To Buy Furniture For Official Use in The PartnershipVon Andrei MedinaNo ratings yet

- BS4Document4 pagesBS4Von Andrei MedinaNo ratings yet

- Business With Two or More Owners That Is Not Organized As A CorporationDocument1 pageBusiness With Two or More Owners That Is Not Organized As A CorporationVon Andrei MedinaNo ratings yet

- Both Statements Are FalseDocument1 pageBoth Statements Are FalseVon Andrei MedinaNo ratings yet

- Century Peak Metals Holdings Corp Officers and Directors OverviewDocument1 pageCentury Peak Metals Holdings Corp Officers and Directors OverviewVon Andrei MedinaNo ratings yet

- Officers DirectorsDocument1 pageOfficers DirectorsVon Andrei MedinaNo ratings yet

- What Is The P/L Ratio of Jas? (34% - Kath 16% - Pau)Document1 pageWhat Is The P/L Ratio of Jas? (34% - Kath 16% - Pau)Von Andrei MedinaNo ratings yet

- Officers DirectorsDocument1 pageOfficers DirectorsVon Andrei MedinaNo ratings yet

- EE10Document1 pageEE10Von Andrei MedinaNo ratings yet

- Introduction to Management ScienceDocument3 pagesIntroduction to Management ScienceVon Andrei MedinaNo ratings yet

- Officers DirectorsDocument1 pageOfficers DirectorsVon Andrei MedinaNo ratings yet

- S-MATH311LA BSM31 1st Sem (2021-2022) - 1st Sem AY2021-2022Document4 pagesS-MATH311LA BSM31 1st Sem (2021-2022) - 1st Sem AY2021-2022Von Andrei MedinaNo ratings yet

- S-MATH311LA BSM31 1st Sem (2021-2022) - 1st Sem AY2021-2022Document3 pagesS-MATH311LA BSM31 1st Sem (2021-2022) - 1st Sem AY2021-2022Von Andrei MedinaNo ratings yet

- Officers DirectorsDocument1 pageOfficers DirectorsVon Andrei MedinaNo ratings yet

- S-MATH311LA BSM31 1st Sem (2021-2022) - 1st Sem AY2021-2022Document2 pagesS-MATH311LA BSM31 1st Sem (2021-2022) - 1st Sem AY2021-2022Von Andrei MedinaNo ratings yet

- Dissolution Defined: A Partnership Is Characterized by Limited Life. A Partnership Is Dissolved When A Partner CeasesDocument2 pagesDissolution Defined: A Partnership Is Characterized by Limited Life. A Partnership Is Dissolved When A Partner CeasesVon Andrei MedinaNo ratings yet

- Introduction to Management Science and Decision MakingDocument3 pagesIntroduction to Management Science and Decision MakingVon Andrei MedinaNo ratings yet

- Consignment Sales CalculationsDocument1 pageConsignment Sales CalculationsVon Andrei MedinaNo ratings yet

- Enable assessment of consigned goodsDocument2 pagesEnable assessment of consigned goodsVon Andrei MedinaNo ratings yet

- Pdpe 6Document1 pagePdpe 6Von Andrei MedinaNo ratings yet

- Partnership Formation DocumentDocument1 pagePartnership Formation DocumentVon Andrei MedinaNo ratings yet