Professional Documents

Culture Documents

Financial Statement Analysis for Entity Providing Trial Balance

Uploaded by

Mansour HamjaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Statement Analysis for Entity Providing Trial Balance

Uploaded by

Mansour HamjaCopyright:

Available Formats

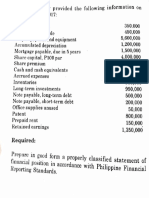

l . An ~ntity provided the follo\1.

ing trial balance on December 31, 2017 which has been adjusted except

for income ta.x expense:

Cash

600.000

Accounts receivable, net 3,500,000

Cost in excess of billings on long-term contracts 1,600,000

Billings in excess of cost on long-term contracts 700,000

Prepaid taxes 450,000

Property, plant and equipment, net 1,500,000

Note payable - noncurrent 1,600,000

Share capital 2,000,000

Share premium 800,000

Retained earnings unappropriated 900,000

Retained earnings restricted for note payable 150,000

Earnings from Iong-tenn contracts 7,000,000

Costs and expenses 5,500,000

13.150,0QQ 13,150.000

• The entity used the percentage of completion method to account for long-term construction

contracts for financial statement and income tax purposes. All receivables on these contracts are

considered to be collectible withir. 12 months.

• During the curr~nt year, estimated tax paymer.ts of P450,000 were charged to prepaid twces. The

entity has not recorded income tax expense. There were no temporary or permanent differences.

The tax rate is 30%.

On December 3 I, 2017, what amount should be reported as

I. Total retained earnings?

a. 1,950,000

b. 2,100,000

C. 2,400,000

d. 2,550,000

2. Total noncurrent liabilities?

a. 1,600,000

b. 1,750,000

C. 2,300,000

d. 2,450,000

3. Total current assets?

a. 5,000,000

b. 4,100,000

C. 5,700,000

d. 6,225,000

4. Totai shareholders' equity?

a. 2,800,000

b. 3,700,000

C. 4,900,000

d. 4,750,000

An entity provided the fo llowing statement of financial position on December 31.2017:

CUITent assets 2,700,000 Current liabilities 2,500,000

Other assets 6,600,000 Other liabilities 2,000,000

Equity 4,800,000

c _ash and cash equivaknts 500,000

Fmancial assets held for trading 600,000

Accounts receivable 750,000

Inventories 850,000

Total current assets 2,700,000

Property, plant and equipment, cost P6,000,000 4,000,000

Advan~es to subsidiary 2,250,000

Goodwill recorded to cancel losses incurred by the entity in prior years 350,000

Total other assets 6,600,000

Accrued expenses 100,000 ,

Customers' deposit 400,000

Advances from officer, not payable currently 200,000

Accounts payable 1,000,000

Note payable-bank due December 31, 2018 800,000

Total current liabilities 2,500.000

Other liabilities included bonds payable in annual installment of P500,000 2,000.000

I

Share capital \\-ith P 100 par value was originally issued and credited for a total consideration of

P5,500,000 but the losses of the entity for past years were charged against the share capital.

l . \\'hat a'llount should be reported as total assets?

a. 8,950,000

b. 9,300,000

C'. 6,700,000

d. 2,700,000

1

What amour1t should be reported as total current liabilities?

a. 1,500,000

b. 2,000,000

C. 2,800,000

d . 4,500,000

What amount should be repoited as total shareholders' equity?

a. 4,800,000

:,. 5,500,000

,. 5,000,000

,. 4,450,000

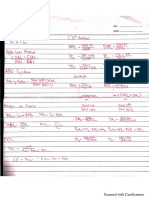

4. An entity provided the following net of tax figures for the current year:

Net income 7,700,000

Net remeasurement loss on defined benefit plan 300,000

Unrealized gain on available for sale securities ' 1,500,000

Reclassification adjustment for gain on sale of available for sale securities included

in net income 250,000

Share warrants outstanding 400,000

Cumulative effect of change in accowiting policy - credit 500,000

Interest revenue · 100,000

Equity in associate' s earnings 300,000

Prior period error - underdepreciation 200,000

/

1. Whal is the net amount of other comprehensive income?

a. 1?250,000

b. 1i200,000

C. 11800,000

d. 950,000 •

I

2. What is the comprehensive income for the current year?

a. 8;650,000

b. 8J900,000

C. 8~950,000

d. 9,oso,ooo

You might also like

- Statement of CashflowDocument2 pagesStatement of CashflowAna Marie IllutNo ratings yet

- W4 - SW1 - Statement of Financial PositionDocument2 pagesW4 - SW1 - Statement of Financial PositionJere Mae MarananNo ratings yet

- 162 003Document5 pages162 003Alvin John San Juan33% (3)

- 162 003Document4 pages162 003Angelli LamiqueNo ratings yet

- Statement of Cash FlowsDocument6 pagesStatement of Cash FlowsLuiNo ratings yet

- 6937 - Statement of Cash FlowsDocument2 pages6937 - Statement of Cash FlowsAljur SalamedaNo ratings yet

- CPA Review School Philippines Financial ReportingDocument2 pagesCPA Review School Philippines Financial ReportingAljur SalamedaNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- Indirect Method Cash Flow Statement for Hill CompanyDocument6 pagesIndirect Method Cash Flow Statement for Hill CompanyJessbel MahilumNo ratings yet

- 7295 - Single EntryDocument2 pages7295 - Single EntryJulia MirhanNo ratings yet

- Review Notes #2 - Comprehensive Problem PDFDocument3 pagesReview Notes #2 - Comprehensive Problem PDFtankofdoom 4No ratings yet

- Basic Accounting - With AnswersDocument12 pagesBasic Accounting - With AnswersMarie MeridaNo ratings yet

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDocument10 pagesAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNo ratings yet

- 6728 Statement of Comprehensive IncomeDocument4 pages6728 Statement of Comprehensive IncomeJane ValenciaNo ratings yet

- 6727 Statement of Financial PositionDocument3 pages6727 Statement of Financial PositionJane ValenciaNo ratings yet

- Ia3 Midterm QuizDocument11 pagesIa3 Midterm QuizJalyn Jalando-onNo ratings yet

- Cash Flow Statement QuizDocument7 pagesCash Flow Statement QuizAngelo HilomaNo ratings yet

- 3rd Year Diagnostic TestDocument11 pages3rd Year Diagnostic TestRaizell Jane Masiglat CarlosNo ratings yet

- Here are the requirements:1. Total current assets CA2. Total noncurrent assets NCA3. Total current liabilities CL4. Total noncurrent liabilities NCLDocument4 pagesHere are the requirements:1. Total current assets CA2. Total noncurrent assets NCA3. Total current liabilities CL4. Total noncurrent liabilities NCLBrit NeyNo ratings yet

- Audit of Financial StatementsDocument3 pagesAudit of Financial StatementsGwyneth TorrefloresNo ratings yet

- Exerc5se 2313Document5 pagesExerc5se 2313Chris tine Mae MendozaNo ratings yet

- CPA review financial accounting problems and solutionsDocument2 pagesCPA review financial accounting problems and solutionsIrene ArantxaNo ratings yet

- Financial Accounting and Reporting Final ExaminationDocument13 pagesFinancial Accounting and Reporting Final ExaminationBernardino PacificAce100% (1)

- Analysis of current assets and liabilities for Kabugao CompanyDocument10 pagesAnalysis of current assets and liabilities for Kabugao CompanyRenalyn ParasNo ratings yet

- Review - SFP To Interim ReportingDocument3 pagesReview - SFP To Interim ReportingAna Marie IllutNo ratings yet

- RequiredDocument11 pagesRequiredKean Brean GallosNo ratings yet

- Intermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreDocument2 pagesIntermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreGrezel NiceNo ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionmoNo ratings yet

- PFA 1 Chapter 1 Current Assets SolutionsDocument38 pagesPFA 1 Chapter 1 Current Assets SolutionsAsi Cas Jav0% (1)

- Cfas Pfa 01Document194 pagesCfas Pfa 01Kimberly Claire Atienza100% (1)

- Updates - Midterm Lspu ExamDocument6 pagesUpdates - Midterm Lspu ExamAngelo HilomaNo ratings yet

- Fa3 PDF LongDocument1 pageFa3 PDF LongAmir LMNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- 6884 - Statement of Comprehensive IncomeDocument2 pages6884 - Statement of Comprehensive IncomeMaximusNo ratings yet

- Financial Accounting Part 3 PDFDocument6 pagesFinancial Accounting Part 3 PDFFiona Mirasol P. BeroyNo ratings yet

- P1 (Statement of Change in Equity)Document1 pageP1 (Statement of Change in Equity)Shiela Mae Pon AnNo ratings yet

- 162 PresummativeDocument5 pages162 PresummativeMeichigo SwadeeNo ratings yet

- FAR MaterialDocument25 pagesFAR MaterialJerecko Ace ManlangatanNo ratings yet

- 150.curren and Non Current Assets and Liabilities 2Document3 pages150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNo ratings yet

- Cash-Flow-Online-April-6-2024-for-studentsDocument5 pagesCash-Flow-Online-April-6-2024-for-studentsraven.jumaoas.eNo ratings yet

- 7160 - FAR Preweek ProblemDocument14 pages7160 - FAR Preweek ProblemMAS CPAR 93No ratings yet

- Balance SheetDocument2 pagesBalance SheetKeight NuevaNo ratings yet

- PDF Chapter 2 CompressDocument33 pagesPDF Chapter 2 CompressRonel GaviolaNo ratings yet

- Balance Sheet IAS 1Document3 pagesBalance Sheet IAS 1briankuria21No ratings yet

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- AUDITING Material 2Document9 pagesAUDITING Material 2Blessy Zedlav LacbainNo ratings yet

- 5 6294322980864393322Document10 pages5 6294322980864393322CharlesNo ratings yet

- Far Quiz 2 Final W AnswersDocument6 pagesFar Quiz 2 Final W AnswersGia HipolitoNo ratings yet

- Cashflow Statement Problems & SolutionsDocument2 pagesCashflow Statement Problems & SolutionsHaidee Flavier Sabido100% (1)

- Toaz - Info Statement of Financial Position Required PRDocument33 pagesToaz - Info Statement of Financial Position Required PRDaniella Mae ElipNo ratings yet

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersHazel Pacheco100% (1)

- Quiz - SFP With AnswersDocument4 pagesQuiz - SFP With Answersjanus lopezNo ratings yet

- Accounting Intermediate Part 3 Statement of Financial PositionDocument3 pagesAccounting Intermediate Part 3 Statement of Financial PositionCj GarciaNo ratings yet

- Case 1.: Additional InformationDocument3 pagesCase 1.: Additional InformationPearl Jade YecyecNo ratings yet

- Chapter 2Document33 pagesChapter 2jake doinog93% (14)

- Chapter 2Document34 pagesChapter 2Marjorie PalmaNo ratings yet

- Interpretation and Application of International Standards on AuditingFrom EverandInterpretation and Application of International Standards on AuditingNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Accounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsFrom EverandAccounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsNo ratings yet

- Relevant Costing CPARDocument13 pagesRelevant Costing CPARxxxxxxxxx100% (2)

- ACCOUNTING REVIEW WORKSHOP QUIZDocument13 pagesACCOUNTING REVIEW WORKSHOP QUIZMansour HamjaNo ratings yet

- ARW Online Long Exam Part 1 PDFDocument35 pagesARW Online Long Exam Part 1 PDFMansour HamjaNo ratings yet

- ARW Online Long Exam Part 3 PDFDocument12 pagesARW Online Long Exam Part 3 PDFMansour HamjaNo ratings yet

- ARW Online Long Exam Part 3 PDFDocument12 pagesARW Online Long Exam Part 3 PDFMansour HamjaNo ratings yet

- (Agamata Relevant Costing) Chap 9 - Short-Term Decision PDFDocument66 pages(Agamata Relevant Costing) Chap 9 - Short-Term Decision PDFMatthew Tiu80% (20)

- Understanding Accounting Information SystemsDocument36 pagesUnderstanding Accounting Information SystemsMansour HamjaNo ratings yet

- Environmental-Scanning 6Document14 pagesEnvironmental-Scanning 6Mansour HamjaNo ratings yet

- 5 FinDocument35 pages5 FinMansour HamjaNo ratings yet

- (Agamata Relevant Costing) Chap 9 - Short-Term Decision PDFDocument66 pages(Agamata Relevant Costing) Chap 9 - Short-Term Decision PDFMatthew Tiu80% (20)

- CVP Formulas PDFDocument1 pageCVP Formulas PDFMansour HamjaNo ratings yet

- (Agamata Relevant Costing) Chap 9 - Short-Term Decision PDFDocument66 pages(Agamata Relevant Costing) Chap 9 - Short-Term Decision PDFMatthew Tiu80% (20)

- EVOL OF INFO SYS MODELSDocument13 pagesEVOL OF INFO SYS MODELSMansour HamjaNo ratings yet

- 04 - The Role of The Accountant PDFDocument5 pages04 - The Role of The Accountant PDFMansour HamjaNo ratings yet

- Understanding Accounting Information SystemsDocument36 pagesUnderstanding Accounting Information SystemsMansour HamjaNo ratings yet

- 02 - Organizational StructureDocument13 pages02 - Organizational StructureMansour HamjaNo ratings yet

- 02 - Organizational StructureDocument13 pages02 - Organizational StructureMansour HamjaNo ratings yet

- EVOL OF INFO SYS MODELSDocument13 pagesEVOL OF INFO SYS MODELSMansour HamjaNo ratings yet

- Mock Test Qe1 1Document31 pagesMock Test Qe1 1Ma. Fatima H. FabayNo ratings yet

- Week5 Fundamentals of ABM 2Document12 pagesWeek5 Fundamentals of ABM 2Janna Gunio100% (1)

- Project Resource & Financial StatementsDocument18 pagesProject Resource & Financial StatementsAsma ZeeshanNo ratings yet

- Advanced FA I - Chapter 02, BranchesDocument137 pagesAdvanced FA I - Chapter 02, BranchesUtban AshabNo ratings yet

- Excel File SuzukiDocument18 pagesExcel File SuzukiMahnoor AfzalNo ratings yet

- Reporting Intercorporate Investments in Common Stock: Douglas CloudDocument31 pagesReporting Intercorporate Investments in Common Stock: Douglas CloudYudhi SutanaNo ratings yet

- Quiz 1 2Document9 pagesQuiz 1 2Hồng ThơmNo ratings yet

- "One World, One Burger"-Mcdonald'SDocument77 pages"One World, One Burger"-Mcdonald'SDhiraj KumarNo ratings yet

- Mint Company Financial Statement AnalysisDocument3 pagesMint Company Financial Statement AnalysisRengeline LucasNo ratings yet

- Rules - EquityDocument7 pagesRules - EquityFabiano JoeyNo ratings yet

- Ar 2016 PDFDocument136 pagesAr 2016 PDFTohiroh FitriNo ratings yet

- Financial Analysis and Working Capital: Mba (Tech) Sem Vii Mpstme Course Facilitator: Dr. Nupur GuptaDocument53 pagesFinancial Analysis and Working Capital: Mba (Tech) Sem Vii Mpstme Course Facilitator: Dr. Nupur GuptaJake RoosenbloomNo ratings yet

- C38FM Financial Markets Theory Tutorial Problem Set 1 SummaryDocument3 pagesC38FM Financial Markets Theory Tutorial Problem Set 1 SummaryXiang Chin NGNo ratings yet

- Financial Statements SummaryDocument27 pagesFinancial Statements SummaryRina KusumaNo ratings yet

- 40 Practise MCQsDocument14 pages40 Practise MCQsMickey BrownNo ratings yet

- 2010 - ANTM - ANTM - Annual Report 2010 PDFDocument366 pages2010 - ANTM - ANTM - Annual Report 2010 PDFLadies90No ratings yet

- PNB Project Report On Financial AnalysisDocument58 pagesPNB Project Report On Financial AnalysisAmbient75% (8)

- Pfrs 11Document25 pagesPfrs 11rena chavezNo ratings yet

- Determinants of Brand Equity in Turkey's Beverage IndustryDocument20 pagesDeterminants of Brand Equity in Turkey's Beverage IndustryKiritonKunNo ratings yet

- Mid Exam Financial StatementsDocument12 pagesMid Exam Financial StatementsyustinusNo ratings yet

- Financial Planning and BudgetingDocument26 pagesFinancial Planning and BudgetingElaika DomingoNo ratings yet

- Case 31 An Introduction To Debt Policy and ValueDocument8 pagesCase 31 An Introduction To Debt Policy and ValueChittisa CharoenpanichNo ratings yet

- Chapter 3 PresentationDocument48 pagesChapter 3 Presentationhosie.oqbeNo ratings yet

- Accounting With Ifrs Essentials An Asia Edition 1St Edition Full ChapterDocument32 pagesAccounting With Ifrs Essentials An Asia Edition 1St Edition Full Chaptergloria.goodwin463100% (20)

- Sample Sumptuous Cuisine CateringDocument25 pagesSample Sumptuous Cuisine CateringPalo Alto Software100% (6)

- Investment EnvironmentDocument25 pagesInvestment EnvironmentK-Ayurveda WelexNo ratings yet

- Statement of Financial Position - Teachers GuideDocument4 pagesStatement of Financial Position - Teachers GuidefranklinNo ratings yet

- Exercise 2-General LedgerDocument2 pagesExercise 2-General LedgerTerefe DubeNo ratings yet

- Ass 12Document18 pagesAss 12noviNo ratings yet

- Mumias Sugar CompanyDocument10 pagesMumias Sugar CompanyDONALDNo ratings yet