Professional Documents

Culture Documents

Week5 Fundamentals of ABM 2

Uploaded by

Janna GunioOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Week5 Fundamentals of ABM 2

Uploaded by

Janna GunioCopyright:

Available Formats

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS AND MANAGEMENT 2

WEEK 5:

CASH FLOW STATEMENT

Cash is an important asset. It is an account affected by many transactions. The debit and credit

side of the cash account generally represent cash receipts and cash disbursements

respectively. Cash receipts may come from (1) cash sales to customers, (2) collection of

customer accounts, (3) loans and other borrowings and (4) owner’s contribution. On the other

hand, cash disbursements may be for payments of (1) business expenses, (2) purchases of

inventories and other assets (3) liabilities to creditors and (4) dividends to owners.

Objectives

By the end of this lesson, the student should be able to:

1. discuss the components and structures of a CFS (ABM_FABM12-lf-10)

2. prepare a CFS (ABM_FABM12_lf-11)

Activity No.1

Pre-Assessment

Classify the following situations if belong to operating, investing and financing activities.

Cash received from customers Salaries paid

Interest paid Utilities paid

Cash drawings of owners Payment for acquisition of equipment

Cash contributions from owners Depreciation

Payments to suppliers Amortization

Principal payments for bank loans Cash received from sale of land

Operating Investing Financing

_________ __________ ___________

_________ __________ ___________

_________ __________ ___________

_________ __________ ___________

Discussion:

Cash Flow Statement

Cash Flow Statement- Provides an analysis of inflows and/or outflows of cash from/to

operating, investing and financing activities. This statement shows cash transactions only

compared to the Statement of Comprehensive Income (SCI) which follows the accrual principle.

Module 1: Fundamentals of Accountancy, Business and Management 2 Page 1

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS AND MANAGEMENT 2

The CFS provides the net change in the cash balance of a company for a period. This helps

owners see if their revenues are actually translated to cash collections or if they have enough

cash inflows in order to pay any maturing liabilities.

Operating Activities- Activities that are directly related to the main revenue producing activities

such as cash received from customers, cash received from fees, commissions and other income,

cash payments to suppliers, cash payments to employees, cash payments for other operating

expenses and interest payments.

Investing Activities- Cash transactions related to cash payments to acquire property, plant and

equipment, intangible assets and other long term assets, cash receipts from sale of property, plant

and equipment, intangible assets and other long term assets, cash loans made to other parties

(long term note receivable) and cash collection on lone term note receivable.

Financing Activities-Cash transactions related to changes in equity and borrowings such as cash

received from issuing common shares, cash received from issuing notes or getting loan from a

bank, cash dividends distributed to shareholders, cash withdrawals of owners and cash payment

for principal of long term loan.

Example of Direct Approach Cash Flow Statement

ABC COMPANY

CASH FLOW STATEMENT

FOR THE YEAR ENDED DECEMBER 31, 2019

Cash flows from Operating Activities

Receipts from Customers P 119,700

Payments to Suppliers (38,700)

Payment to employees (35,000)

Rent Payments (25,000)

Utility Payments (7,890)

Interest Payments (7,500)

Net Cash generated by Operating Activities 5,610

______________________________________________________________________________

Cash flows from Investing Activities

Acquisition of computers (P 60,000)

Net Cash used in Investing Activities (60,000)

______________________________________________________________________________

Cash flows from Financing Activities

Additional contribution from owner P 75,000

Owner’s drawings 4,000

Proceeds from bank borrowing 150,000

Loan payment (18,760)

Net cash generated by Financing Activities 202,240

______________________________________________________________________________

Net change in cash 147,850

Cash, January 1, 2019 120,000

Cash, December 31, 2019 P 267,850

Example No.1 Collection from Customer

The information below are taken from the Statement of Financial Position of ABC Company

December 31,2019 December 31, 2018

Accounts Receivable P18,400 P10,000

Module 1: Fundamentals of Accountancy, Business and Management 2 Page 2

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS AND MANAGEMENT 2

December 31, 2019 Statement of Comprehensive income revealed the following:

Credit Sales 120,000

Cash Sales 8,100

Determine the (1) collection from credit sales and (2) total collection from customers

Let us begin with analysis of the AR account. Recall that credit sales increases AR because credit

sales represent right to collect from the customers. On the other hand, the right to collect (AR) is

extinguished when customers pay their accounts. Therefore, collections of receivables decrease

AR. Following this, the accounts receivable ending balance will be computed as follows.

AR, Beg. Balance + Credit Sales – Customer payments = AR, End Balance

P10,000 + P120,000 - ? = P18,400

We get the beginning balance of AR from the December 31, 2018 SFP. The December 31, 2019

SFP gives us the ending balance of AR. Moreover, we look at the current year SCI to determine

credit sales. Using Algebra, we determined that customer payments amount to P111,600.

However, this amount represents only the collections on credit sales. The company also

generated cash sales. Therefore, total collection is computed as follows

Collection from credit sales P111,600

Add: Receipts from cash sales 8,100

Receipts from customers 119,700

The analysis implies that when collection from customer is less than credit sales, then the

uncollected portion of credit sales increases AR. On the other hand, when collection from

customers is greater than credit sales, then the excess must mean some of the beginning AR were

collected leading to a decrease in AR at the end of the year.

Example No.2 Payment to Suppliers

The following are excerpts from the SFP of ABC Company

December 31, 2019 December 31, 2018

Inventory 4,800 5,000

Accounts payable 1,090 2,300

December 31, 2019 Income Statement revealed the following:

Cost of Good Sold 37,690

Let us begin with the analysis of the Inventory Account. Recall that purchases increase the

inventory account. On the other hand, inventory is decreased when goods are sold. We refer to

this as Cost of Goods Sold. Following this, inventory ending balance is computed as follows:

Inventory Beg. Balance + Purchases – Cost of goods sold = Inventory End balance

P5,000 + ? - P37,690 = P4,800

We get the beginning balance of inventory from the December 31, 2018 SFP. The December 31,

2019 SFP gives us and ending balance of inventory. Moreover, we look at the current year SCI to

determine Cost of goods sold. Using algebra, we determine that Purchases amount to P36,490.

However, this is not necessarily the payment to supplier. So far,we know how much we have

purchased from the suppliers during the year. To determine the amount we have paid to the

suppliers, we need to looks at Accounts Payable.

Module 1: Fundamentals of Accountancy, Business and Management 2 Page 3

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS AND MANAGEMENT 2

Purchases made during the year increase AP. On the other, the suppliers claim is extinguished

when payment is made. Therefore, payments to suppliers decrease AP. Following this, AP ending

balance is computed as follows:

AP, Beg. Balance + Purchases – Payments = AP, End Balance

P2,300 + P37,490 - ? = P1,090

We get the beginning balance of AP from the December 31, 2018 SFP. The December 31, 2019

SFP gives us the ending balance of AP. We will use the amount of inventory purchases computed

above.

Using algebra, we determine that payments to suppliers amount to P38,700.

From this analysis, it is deduced that AP increases when there are unpaid portions of current year

purchases such that payment to suppliers is less than purchases. On the other hand, payment to

supplier is greater than purchases when AP decreases which implies that some of the beginning

AP must have been paid.

Indirect Method

The indirect method shows the reconciliation from accrual net income to net cash flows from

operations. Adjustments to net income include the following:

a. Non-cash expenses such as depreciation and amortization are added back to net income. Recall

that depreciation decreases the net book value of property, plant and equipment and increases

expense. This is an expense that does not have a cash counterpart. We refer to these as “non-

cash” expense.

b. Changes in current assets and current liabilities

Example No.3 CFO- Indirect Method

December 31, 2019 Statement of Comprehensive Income are given below

Sales P128,100

Cost of goods sold 37,690

Gross Profit 90,410

Less: Operating Expenses

Salaries expense 35,000

Rent expense 25,000

Utilities expense 7,890

Depreciation 2,500

Interest expense 7,500

Net Income P12,520

December 31, 2018 December 31, 2019

Accounts Receivable P18,400 P10,000

Inventory 4,800 5,000

Accounts payable 1,090 2,300

Determine cash flows from operation.

Answer:

Net income P12,520

Add: Depreciation 2,500

Changes in current assets and current liabilities

Module 1: Fundamentals of Accountancy, Business and Management 2 Page 4

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS AND MANAGEMENT 2

Increase in accounts receivable (8,400)

Decrease in inventory 200

Decrease in accounts payable (1,210)

Net cash flows provided by operating activities P5,610

Let us analyze the adjustments for the changes in current assets and current liabilities.

Recall our Account Receivable analysis from Example No.1

AR, Beg. Balance + Credit sales – Customer payments = AR, End Balance

Using algebra, we move the variables around to determine customer payments

Credit Sales – (AR, End Balance – AR, Beg. Balance) = Customer payments

Our Starting point is the Net Income. Our goal is to arrive at customer payments (as part of cash

flows from operations). Recall that net income is computed as Sales-Expenses. Credit sales is

already included in net income. The second component of the computation is ending balance of

AR less beginning balance of AR. We refer to this as change in AR. From the equation, we see

than an increase in AR is deducted from net income. On the other hand, a decrease in AR is a

positive adjustment to net income.

Moving on, recall our inventory analysis from example 2.

Inventory, Beg. Balance + Purchases – Cost of Goods Sold = Inventory, End Balance

AP, Beg. Balance + Purchases – Payments = AP, End Balance

Using variables around to determine inventory purchased during the year.

Cost of goods sold + (Inventory, End Balance – Inventory, Beg. Balance)=Purchases

To determine the payments, plug in purchases in the AP analysis

AP + Cost of goods sold + (Inventory End Bal – Inventory Beg. Bal) – Payments = AP, End Bal

Using algebra, move around the variables to compute for payments.

Cost of goods sold + (Inventory End bal-Inventory Beg. Bal) + (AP Beg bal – AP End bal)

=Payments

Finally, recall the net cash flows from operations is collections less payments. Since we are

computing for the payments, we need to get negative of the equation.

-Cost of goods sold- (Inventory End-Inventory Beg. Bal) + (AP End balance-AP Beg. Bal) = -

payments

Our starting point is net income. Our goal is to arrive at payments to suppliers (as part of the

CFO). Recall that cost of goods sold is deducted from sales to determine net income. Hence, in

our equation, cost of goods sold is a negative number.

The second component of the computation is ending balance less beginning balance of inventory.

We refer to this as change in inventory. From the equation, we see that increase in inventory is

deducted from net income. A decrease in inventory is positive adjustment to net income.

Module 1: Fundamentals of Accountancy, Business and Management 2 Page 5

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS AND MANAGEMENT 2

The third component of the computation is the ending balance less beginning balance of AP. We

refer to this as change in AP. We see that an increase in AP is added to net income. On the other

hand, a decrease in AP is deducted from net income.

Based on the above analysis, we summarize the adjustments for current assets and current

liabilities as follows:

Change in current assets/current liabilities Adjustment to net income

Increase in current assets Deduct from net income

Decrease in current assets Add to net income

Increase in liabilities Add to net income

Decrease in current liabilities Deduct from net income

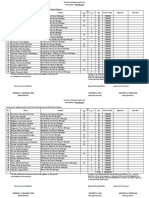

Comprehensive Illustrative Problems: Mira’s Store

On February 1, 2004, Mira Delamer opened a store that sells school supplies. She asked for your

help to prepare a Cash Flow Statement for her store. The following information were provided to

you

Mira’s Store

Statement of Financial Position

As of December, 2004

ASSETS

Current Assets

Cash P44,535.00

Accounts Receivable 575.00

Inventories 15,345.00

Prepaid Rent 5,000.00

Total current assets 65,455.00

Non-Current Assets

Property, plant, and equipment 30,000.00

Accumulated depreciation (500.00)

Net book Value 29,500.00

Total Assets P94,955.00

LIABILITIES AND OWNER’S EQUITY

Current Liabilities

Accounts payable P8,110.00

Salaries payable 1,000.00

Utilities payable 4,000.00

Unearned income 1,395.00

Total current liabilities 14,505.00

Non-Current Liabilities

Long-term note payable 23,000.00

Total Liabilities 37,505.00

Owner’s Equity

Mira, capital 57,450.00

Total Liabilities and Equity 94,955.00

Module 1: Fundamentals of Accountancy, Business and Management 2 Page 6

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS AND MANAGEMENT 2

Mira’s Store

Statement of Comprehensive Income

For the period ended December 31, 2004

Net Sales P111,348.00

Cost of goods sold (45,398.00)

Gross Profit 65,950.00

Less: expenses

Salaries expense 14,000.00

Rent expense 10,000.00

Utilities expense 4,000.00

Depreciation 500.00

28,500.00

Net Income P37,450.00

Below is the cash ledger account for Mira’s Store

CASH

PARTICULARS DEBIT CREDIT

Owner’s contribution 30,000.00

Rent payment 15,000.00

Purchase of fixtures 30,000.00

Collection from credit sales 110,773.00

Payment of salaries 13,000.00

Owner’s contribution 5,000.00

Payment to suppliers 52,633.00

Owner’s withdrawals 15,000.00

Proceeds from bank loan 23,000.00

Customer deposit 1,395.00

170,168.00 125,633.00

P44,535.00

Note: Customer deposit was received at the end of the year. Delivery will be made on January

2005

Required:

1. Prepare the Statement of Cash Flows by re-arranging and classifying the transactions in the

cash T-account

2. Using the Statements of Financial Position and Statement of Comprehensive Income show the

computation of the components of the direct method operating section of the Statement of Cash

Flows. Hint: This is the first year of operations for Mira’s Store. This means that the beginning

balances of all SFP account is zero.

3. Prepare the operating section of the Statement of Cash Flow using the indirect method.

Solution:

1. Prepare the cash flow statement by re-arranging and classifying the transactions in the cash T-

account.

Mira’s Store

Module 1: Fundamentals of Accountancy, Business and Management 2 Page 7

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS AND MANAGEMENT 2

Statement of Cash Flows

For the year ended December 31,2004

Operating Activities

Collection from credit sales P110,773.00

Customer deposit 1,395.00

Payment to suppliers (52,633.00)

Rent payment (15,000.00)

Payment of salaries (13,000.00)

Net Cash Flows from Operating Activities P31,535.00

Investing activities

Purchase of fixtures (30,000)

Net Cash Flows from Investing P(30,000.00

Financing Activities

Owner’s contribution 35,000.00

Proceeds from bank loan 23,000.00

Owner’s withdrawal (15,000.00)

Net Cash Flows from Financing Activities P43,000.00

Net Change in Cash 44,535.00

Cash, Beginning ____0____

Cash, End 44,535.00

2. Using the SFP and the SCI, show the computation of the components of the direct method

operating section of the Cash Flow statements

Collection from credit sales

AR,beg 0

Net sales 111,348.00

Less: Collection ?

AR, end 575.00

Collection: AR,beg + Net Sales – AR,end = 110,773.00

Customer deposit

Unearned income, beg 0

Deposit received from customer ?

Less: deliveries made pertaining to customer deposit 0

Unearned Income, end 1,395.00

Customer deposit: Unearned Income,end + deliveries – unearned income, beg = 1,395.00

Payment to Suppliers

Inventory beg 0

Net purchase ?

Less: Cost of sales 45,398.00

Inventory, end 15,345.00

Module 1: Fundamentals of Accountancy, Business and Management 2 Page 8

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS AND MANAGEMENT 2

Net Purchase= Inventory end + Cost of Sales –Inventory beg =60,743.00

AP beg, 0

Net purchase 60,743.00

Less: Payments ?

AP end 8,110.00

Payments: AP beg + Net Purchase-AP, end = (52,633.00)

Rent payments

Prepaid rent beg 0

Rent payments ?

Less: rent expense 10,000

Prepaid Rent, End 5,000

Rent Payments: Prepaid rent,end + rent expense – Prepaid rent, beg = 15,000

Payment of Salaries

Salaries payable, beg 0

Salaries expense 14,000

Less: Payments ?

Salaries payable end 1,000

Payments: Salary payable beg + salary expense-salary payable end = 13,000

Payment of Utilities

Utilities Payable, beg 0

Utilities expense 4,000

Less: Payments ?

Utilities Payable, end 4,000

Payments: Utilities payable beg + Utilities Expense – Utilities Payable end = 4,000

3. Prepare the operating section of the SCF using indirect method.

Net Income 37,450.00

Add: Depreciation 500.00

37,950.00

Changes in working capital

Increase in Accounts Receivable (575.00)

Increase in inventory (15,345.00)

Increase in Prepaid rent (5,000.00)

Increase in Accounts Payable 8,110.00

Increase in Salaries Payable 1,000.00

Increase in Utilities Payable 4,000.00

Increase in Unearned Income 1,395.00

Net Cash Flows from Operating Activities 31,535.00

Note: Net Cash Flows from Operating Activities computed using the direct method is always

equal to that derived from the indirect method.

Module 1: Fundamentals of Accountancy, Business and Management 2 Page 9

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS AND MANAGEMENT 2

Activity No. 2

True or False

Read each sentence carefully and determine whether the statement is True or False. Write your

answers in the space provided before the number.

_________ 1. The Cash Flow Statement shows the amount of cash received and used in the

business organized according to operating, investing, and financing activities.

activities.

_________3. If the company has no accounts receivable balance at the beginning an at the end of

the year, then net Sales reported in the Statement of Comprehensive income will most likely be

equal to the cash received from customers reported in the cash Flow Statement

_________4. Payments for acquisition of merchandise inventory are reported as investing

activities.

_________5. Cash Flow Statement explains the observed difference in the cash balance from the

beginning to the end of the period.

_________6. Business activities are classified into operating, investing and funding activities in

the Cash Flow Statement.

_________7. Salary and utility payments are reported as operating activities.

_________8.Non-cash expenses such as depreciation and amortization are deducted from net

income to arrive at the cash flow from operating activities.

_________9. A negative cash flow from investing activities is a bad indicator of the company’s

ability to generate cash.

_________10. The bottomline of the Cash Flow Statement is equivalent to the cash balance

presented on the Statement of Financial Position.

Activity No. 3

Problem Solving

1. The cash account of XYZ Company has a beginning balance of P129, 937.50. Its year end

balance stands at P254,925.00. The table below show the summarized transactions from the cash

account of XYZ Company.

Cash received from customers 725,175.00

Payments to Suppliers 300,547.50

Payments for other operating expenses 58, 850.00

Salaries paid 19,992.50

Purchase of equipment 253,000.00

Sale of Delivery equipment(motorcycle) 6,875.00

Proceeds from sale of computer equipment 42,762.50

Withdrawals of owners 229,350.00

Proceeds from bank loan 82,500.00

Contributions of owners 137,500.00

Interest Paid 8,085.00

Required:

1. Prepare the operating, financing and investing section of XYZ’s Cash Flow Statement.

2. Is XYZ’s Cash Flow Statement reconciled with the balance of the cash account as of the end

of the year? Show your computation

Activity No.4

Module 1: Fundamentals of Accountancy, Business and Management 2 Page 10

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS AND MANAGEMENT 2

1. The information on the table below are taken from the financial statements of XYZ

Corporation. Based on these information, compute for the amount of cash that the company had

received from the customers. Does your answer tie up with the summarized date from the cash

account given in the table in activity no. 3

Accounts receivable, beginning of the year P156,750.00

Accounts receivable, end of the year 249,700.00

Sales

2. The information on the table below are taken from the financial statements of XYZ

Corporation. Based on these information, compute for the amount of cash that the company paid

to suppliers. Did your answer tie up with the summarized data from the cash account in the

activity no. 3.

Inventory, beginning of the year P282,287.50

Inventory, end of the year 335,225.00

Accounts payable, beginning of the year 132,770.00

Accounts payable, end of the year 158,675.00

Cost of goods sold 273,515.00

Activity No.5

The Statement of Comprehensive Income for the year ended December 31, 2004 of ABC

Company is given below:

Sales revenue P1,212,500.00

Cost of goods sold 780,000.00

Operating expenses, excluding depreciation 70,000.00

Depreciation 75,000.00

Net income P287,500.00

The following were also taken from ABC Company’s comparative balance sheet as of December

31.

2004 2003

Accounts receivable P93,750.00 P75,000.00

Inventory 13,750.00 8,750.00

Accounts payable 51,250.00 35,000.00

Required:

1. Prepare the operating section of the Cash flow statement of ABC Company using indirect

method.

2. Determine the amount of cash collected from ABC’s customer? Assume that all ABC’s sales

are made on credit.

3. Determine how much inventory was purchased by ABC during the year?

4. Determine the amount of cash paid to ABC’s suppliers? Assume that all ABC’s inventory

purchases were made on credit.

Remember:

Cash Flow Statement is the financial statement that explains the net change in cash for

the year.

Module 1: Fundamentals of Accountancy, Business and Management 2 Page 11

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS AND MANAGEMENT 2

The cash flow statement summarized the cash transactions that occurred during the year.

The Cash Flow Statement shows cash transactions organized based on the three major

activities of the business-operating, investing and financing.

Operating Activities- Activities that are directly related to the main revenue producing

activities such as cash received from customers, cash received from fees, commissions

and other income, cash payments to suppliers, cash payments to employees, cash

payments for other operating expenses and interest payments.

Investing Activities- Cash transactions related to cash payments to acquire property,

plant and equipment, intangible assets and other long term assets, cash receipts from sale

of property, plant and equipment, intangible assets and other long term assets, cash loans

made to other parties (long term note receivable) and cash collection on lone term note

receivable.

Financing Activities-Cash transactions related to changes in equity and borrowings such

as cash received from issuing common shares, cash received from issuing notes or getting

loan from a bank, cash dividends distributed to shareholders, cash withdrawals of owners

and cash payment for principal of long term loan.

Reference:

Salazar, Dani Rose C., Fundamentals of Accountancy, Business and Management 2, Rex

Bookstore, 2017.

De Guzman Angeles A., Fundamentals of Accountancy, Business and Management 2, Lorimar

Publishing Inc., 2018.

Module 1: Fundamentals of Accountancy, Business and Management 2 Page 12

You might also like

- FundamentalsofABM2 Q1 M5Revised.-1Document12 pagesFundamentalsofABM2 Q1 M5Revised.-1Jomein Aubrey Belmonte60% (5)

- FABM 2 Lesson3Document7 pagesFABM 2 Lesson3---0% (2)

- FABM 2 Lesson2Document11 pagesFABM 2 Lesson2---No ratings yet

- FABM2 Week5Document14 pagesFABM2 Week5Hazel TolentinoNo ratings yet

- FABMQ1 Mod4 R.OlegarioDocument28 pagesFABMQ1 Mod4 R.OlegarioVon Violo Buenavides100% (1)

- Fabm2 Module 5Document4 pagesFabm2 Module 5Rea Mariz Jordan100% (1)

- Fundamentals of Accountancy, Business and Management 2: Quarter 1-Module 5Document28 pagesFundamentals of Accountancy, Business and Management 2: Quarter 1-Module 5Leigh Guittap100% (2)

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisJasper Briones IINo ratings yet

- FABM 2 M2 Activity 2 My AnsDocument3 pagesFABM 2 M2 Activity 2 My AnsLeny Glyn B. CabreraNo ratings yet

- Seatwork 5: Application A. Owner's EquityDocument7 pagesSeatwork 5: Application A. Owner's EquityAngela GarciaNo ratings yet

- Sdo Batangas: Department of EducationDocument15 pagesSdo Batangas: Department of EducationPrincess GabaynoNo ratings yet

- Preparing Statement of Changes in Equity (SCE) for a Single ProprietorshipDocument13 pagesPreparing Statement of Changes in Equity (SCE) for a Single ProprietorshipMicah GNo ratings yet

- HULA MEDocument4 pagesHULA MEEnrique BongaisNo ratings yet

- 1234 Statement of Cash FlowDocument9 pages1234 Statement of Cash Flowahmie banez100% (1)

- Lesson 1 - The Statement of Financial Position - ActivityDocument3 pagesLesson 1 - The Statement of Financial Position - ActivityEmeldinand Padilla Motas100% (4)

- FABM2 Module 04 (Q1-W5)Document5 pagesFABM2 Module 04 (Q1-W5)Christian Zebua100% (1)

- Fabm 2Document19 pagesFabm 2leiNo ratings yet

- FABM 2 Worksheet 1 Q4Document4 pagesFABM 2 Worksheet 1 Q4Darwin MenesesNo ratings yet

- FABM2 Module 5Document35 pagesFABM2 Module 5calibur HonsaloNo ratings yet

- ABM2 Q1 Mod3 Statement of Comprehensive Income Multi StepDocument27 pagesABM2 Q1 Mod3 Statement of Comprehensive Income Multi StepLeigh GuittapNo ratings yet

- Cash Received From Customers: XYZ Company Cash Account Beg. Bal 129, 937.50 End Balance Stands at 254, 925.00Document11 pagesCash Received From Customers: XYZ Company Cash Account Beg. Bal 129, 937.50 End Balance Stands at 254, 925.00Mylene Santiago100% (2)

- FABM2 Q1 Module 5 Analysis and Interpretation of Financial Statements - editEDDocument31 pagesFABM2 Q1 Module 5 Analysis and Interpretation of Financial Statements - editEDMecaila libaton100% (2)

- Cindy Lota - Activity No. 4 - SFP Antonio TradingDocument5 pagesCindy Lota - Activity No. 4 - SFP Antonio TradingCindy Lota100% (2)

- Statement of Changes in EquityDocument3 pagesStatement of Changes in EquityAnonymousNo ratings yet

- Sales Cost of SalesDocument4 pagesSales Cost of SalesRio Awitin50% (2)

- FABM2 12 Q2 M5 Income and Business Taxation V5 PDFDocument19 pagesFABM2 12 Q2 M5 Income and Business Taxation V5 PDFLady Hara100% (1)

- FABM2 Q2 MOD3 Income and Business Taxation 1Document27 pagesFABM2 Q2 MOD3 Income and Business Taxation 1Minimi Lovely33% (3)

- This Study Resource Was: Module 1. Week 1 Statement of Financial PositionDocument8 pagesThis Study Resource Was: Module 1. Week 1 Statement of Financial PositionVhia Rashelle Galzote100% (1)

- Business Finance: Basic Long-Term Financial ConceptsDocument37 pagesBusiness Finance: Basic Long-Term Financial ConceptsLala BubNo ratings yet

- Fabm2 Module 1 SLMDocument29 pagesFabm2 Module 1 SLMlove natividad67% (3)

- FABM2Document32 pagesFABM2Ylena AllejeNo ratings yet

- Bamuya Fabm Act-3Document2 pagesBamuya Fabm Act-3Irish C. BamuyaNo ratings yet

- RECORDING BUSINESS TRANSACTIONS LESSON 8Document28 pagesRECORDING BUSINESS TRANSACTIONS LESSON 8Nicole Austria Nazareno75% (4)

- Fundamentals of Accountancy, Business and Management 2Document20 pagesFundamentals of Accountancy, Business and Management 2Noor Yassin H. Jamel100% (1)

- 2QUIZ3 - With AnswerDocument1 page2QUIZ3 - With AnswerMarilyn Nelmida Tamayo100% (1)

- Chapter 2 Abm 3Document9 pagesChapter 2 Abm 3Joan Mae Angot - Villegas50% (2)

- G12 Fabm2 Week 8Document11 pagesG12 Fabm2 Week 8Whyljyne GlasanayNo ratings yet

- Fabm 2 Edited Lesson 1 SFPDocument16 pagesFabm 2 Edited Lesson 1 SFPJhon Jhon100% (1)

- Fabm2 Module 3 SLMDocument35 pagesFabm2 Module 3 SLMRisha AlarasNo ratings yet

- Problem 4 SFPDocument11 pagesProblem 4 SFPMylene SantiagoNo ratings yet

- Module 7.2Document23 pagesModule 7.2Yen AllejeNo ratings yet

- Fabm2 SLK Week 1 SFPDocument17 pagesFabm2 SLK Week 1 SFPMylene Santiago100% (3)

- 1.module Business Finance q4 Week 1Document25 pages1.module Business Finance q4 Week 1Zia Mola0% (5)

- Fabm 2-5Document24 pagesFabm 2-5Andrei Bana100% (2)

- FABM2 - Lesson 1Document27 pagesFABM2 - Lesson 1wendell john mediana100% (1)

- Cash Flow StatementDocument10 pagesCash Flow StatementSheilaMarieAnnMagcalasNo ratings yet

- Finance Module 04 - Week 4Document15 pagesFinance Module 04 - Week 4Christian Zebua100% (1)

- Fabm 2 - Q1 - W4Document20 pagesFabm 2 - Q1 - W4Liam Aleccis Obrero CabanitNo ratings yet

- CHAPTER 2 Horizontal-AnalysisDocument1 pageCHAPTER 2 Horizontal-AnalysisAiron Bendaña0% (1)

- FABM2 Q2 Module WS 2Document10 pagesFABM2 Q2 Module WS 2Mitch Dumlao100% (1)

- Financial Ratios Analysis and InterpretationDocument8 pagesFinancial Ratios Analysis and InterpretationChristian Zebua75% (4)

- Fabm2 Module 3Document18 pagesFabm2 Module 3Rea Mariz Jordan50% (2)

- Lesson 2 - The Statement of Comprehensive Income - ActivityDocument3 pagesLesson 2 - The Statement of Comprehensive Income - ActivityEmeldinand Padilla Motas0% (2)

- FABM2 Q1 Module 4 Statement of Cash Flows VER 3Document22 pagesFABM2 Q1 Module 4 Statement of Cash Flows VER 3Astro Astro89% (9)

- Fabm2 Module 4Document8 pagesFabm2 Module 4Rea Mariz Jordan67% (3)

- Preparing SCI for Service and Merchandising BusinessesDocument9 pagesPreparing SCI for Service and Merchandising BusinessesChristian Zebua100% (1)

- FUNDAMENTALS OF ACCOUNTANCY BUSINESS AND MANAGEMENT PPP 1Document185 pagesFUNDAMENTALS OF ACCOUNTANCY BUSINESS AND MANAGEMENT PPP 1Janelle Dela Cruz100% (1)

- Statement of Cash FlowsDocument9 pagesStatement of Cash FlowsNini yaludNo ratings yet

- Wlof Hsac Gnitarepo Gncinfina: Jumble LettersDocument23 pagesWlof Hsac Gnitarepo Gncinfina: Jumble LettersAce Soleil RiegoNo ratings yet

- 3 CFSDocument65 pages3 CFSRocky Bassig100% (1)

- Department of Education: Learning Activity Sheet in Principles of MarketingDocument11 pagesDepartment of Education: Learning Activity Sheet in Principles of MarketingJanna GunioNo ratings yet

- What Business Do You Want To EstablishedDocument1 pageWhat Business Do You Want To EstablishedJanna GunioNo ratings yet

- Business EthicsDocument7 pagesBusiness EthicsJanna GunioNo ratings yet

- Module 1 EnterpreneurshipDocument6 pagesModule 1 EnterpreneurshipJanna GunioNo ratings yet

- Business PlanDocument4 pagesBusiness Plangwynce0% (1)

- Statistical Treatment of DataDocument1 pageStatistical Treatment of DataJanna GunioNo ratings yet

- Module 1 EnterpreneurshipDocument6 pagesModule 1 EnterpreneurshipJanna GunioNo ratings yet

- Rowena I. Dalangin, RSW Dolores A. Gaa Antonio A. DimayugaDocument38 pagesRowena I. Dalangin, RSW Dolores A. Gaa Antonio A. DimayugaJanna GunioNo ratings yet

- Simple Electric Motor I. Problem: How Can A Simple Electric Motor Work?Document2 pagesSimple Electric Motor I. Problem: How Can A Simple Electric Motor Work?Janna GunioNo ratings yet

- Subject of The StudyDocument3 pagesSubject of The StudyJanna GunioNo ratings yet

- Research LitDocument3 pagesResearch LitJanna GunioNo ratings yet

- Most Common Challenges Faced by Grade 12 Abm StudeDocument3 pagesMost Common Challenges Faced by Grade 12 Abm StudeJanna Gunio50% (2)

- Research Paper PNKDocument15 pagesResearch Paper PNKJanna GunioNo ratings yet

- Activity 1 EntrepreneurshipDocument1 pageActivity 1 EntrepreneurshipJanna GunioNo ratings yet

- Finding Joy in The "New Normal": LessonDocument7 pagesFinding Joy in The "New Normal": LessonJanna GunioNo ratings yet

- Department of Education: Republic of The PhilippinesDocument3 pagesDepartment of Education: Republic of The PhilippinesJanna GunioNo ratings yet

- The Researchers Aim at Analyzing The Status of Waste Management of Barangay ResplandorDocument6 pagesThe Researchers Aim at Analyzing The Status of Waste Management of Barangay ResplandorJanna GunioNo ratings yet

- Owner's Equity AccountsDocument6 pagesOwner's Equity AccountsJanna GunioNo ratings yet

- Fabm 2 Q2-M3Document20 pagesFabm 2 Q2-M3Randy Magbudhi80% (5)

- 03 UCSP AS v1.0 PDFDocument21 pages03 UCSP AS v1.0 PDFEDSEL ALAPAG100% (2)

- Company A Was Incorporated On January 1Document5 pagesCompany A Was Incorporated On January 1Fakihusman Aliyasa80% (15)

- What Do You Read?Document25 pagesWhat Do You Read?Janna GunioNo ratings yet

- Fabm 2 Q2-M3Document20 pagesFabm 2 Q2-M3Randy Magbudhi80% (5)

- Physical Education Week 4Document3 pagesPhysical Education Week 4Janna GunioNo ratings yet

- Owner's Equity AccountsDocument6 pagesOwner's Equity AccountsJanna GunioNo ratings yet

- Activity 1.1 List On How To Express Attraction, Love and CommitmentDocument3 pagesActivity 1.1 List On How To Express Attraction, Love and CommitmentJanna GunioNo ratings yet

- PR2 WK1Document6 pagesPR2 WK1Glean VasquezNo ratings yet

- Senior 12 Business Finance - Q1 - M1 For PrintingDocument30 pagesSenior 12 Business Finance - Q1 - M1 For PrintingAngelica Paras100% (8)

- Understanding Data and Ways To Systematically Collect Data PDFDocument33 pagesUnderstanding Data and Ways To Systematically Collect Data PDFMike Ladoc80% (10)

- Fabm2: Quarter 1 Module 1.2 New Normal ABM For Grade 12Document19 pagesFabm2: Quarter 1 Module 1.2 New Normal ABM For Grade 12Janna Gunio0% (1)

- Test PracticeDocument26 pagesTest PracticeStephanie NaamaniNo ratings yet

- Model Project ProfilesDocument13 pagesModel Project Profilesabhisek guptaNo ratings yet

- Bvz5a Bpf5c Bvc5aDocument6 pagesBvz5a Bpf5c Bvc5aLakshmi MeganNo ratings yet

- CILO 4 - Prepare The Financial Statements.: Profit or Loss)Document5 pagesCILO 4 - Prepare The Financial Statements.: Profit or Loss)Neama1 RadhiNo ratings yet

- Receive $1 today or $1 one year from now? Comparing simple and compound interestDocument52 pagesReceive $1 today or $1 one year from now? Comparing simple and compound interestXenopol XenopolNo ratings yet

- 08the Master BudgetDocument35 pages08the Master Budgetprincess bubblegum100% (2)

- Prior To Revaluation As at 31-12-2018 Estimated Useful Life As Originally Estimated Cost Accumulated Depreciation Revalued AmountDocument2 pagesPrior To Revaluation As at 31-12-2018 Estimated Useful Life As Originally Estimated Cost Accumulated Depreciation Revalued AmountBabar MalikNo ratings yet

- Lecture-8.2 Job Order Costing (Theory With Problem)Document13 pagesLecture-8.2 Job Order Costing (Theory With Problem)Nazmul-Hassan Sumon100% (2)

- Sap Fico Configuration: Sap R/3 Enterprise Ecc6Document56 pagesSap Fico Configuration: Sap R/3 Enterprise Ecc6Banuchandhar Mamidala25% (4)

- FM Lesson 3Document2 pagesFM Lesson 3asif iqbalNo ratings yet

- Cost Analysis and Financial Projections for Gerbera Cultivation ProjectDocument26 pagesCost Analysis and Financial Projections for Gerbera Cultivation ProjectshroffhardikNo ratings yet

- 1f Chart of Accounts Eng PDFDocument48 pages1f Chart of Accounts Eng PDFTijana DoberšekNo ratings yet

- Blue Star India LTDDocument17 pagesBlue Star India LTDSwati ChorariaNo ratings yet

- Exam Integ ExamDocument10 pagesExam Integ ExamRisalyn BiongNo ratings yet

- Cash Budgeting QuestionsDocument5 pagesCash Budgeting QuestionsAnissa GeddesNo ratings yet

- 10 PriorPeriodErrorsDocument9 pages10 PriorPeriodErrorsstudent100% (3)

- Kunci Jawaban Elensi CorporationDocument77 pagesKunci Jawaban Elensi CorporationAulia RahmaNo ratings yet

- Revision Questions PDFDocument9 pagesRevision Questions PDFMarlisa RosemanNo ratings yet

- Aptitude and Reasoning Sample 1Document30 pagesAptitude and Reasoning Sample 1Gopesh Panda100% (1)

- On September IDocument37 pagesOn September IYuki Takeno100% (2)

- Auditing ProblemsDocument53 pagesAuditing ProblemsZerjo Cantalejo0% (1)

- ACC101 - Chap 3 - SPR2020Document1 pageACC101 - Chap 3 - SPR2020Hà TrangNo ratings yet

- Jun-10, Dec-10, Jun-11, Dec 11Document64 pagesJun-10, Dec-10, Jun-11, Dec 11Celena Daiton83% (6)

- Cost BehaviorDocument11 pagesCost BehaviorfelipemagalhaeslemosNo ratings yet

- Bart M ManuelDocument27 pagesBart M ManuelBea TiuNo ratings yet

- Sawrapped PotatoDocument26 pagesSawrapped PotatoStefanie RamosNo ratings yet

- Depreciation and Its AccountingDocument4 pagesDepreciation and Its AccountingSatish SheoranNo ratings yet

- Chapter 11Document24 pagesChapter 11eilsel_ljNo ratings yet

- Accounting Level-3/Series 2-2004 (Code 3001)Document20 pagesAccounting Level-3/Series 2-2004 (Code 3001)Hein Linn KyawNo ratings yet

- Project Mine EconDocument19 pagesProject Mine Econphoebus ramirez100% (1)