Professional Documents

Culture Documents

Prior To Revaluation As at 31-12-2018 Estimated Useful Life As Originally Estimated Cost Accumulated Depreciation Revalued Amount

Uploaded by

Babar MalikOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prior To Revaluation As at 31-12-2018 Estimated Useful Life As Originally Estimated Cost Accumulated Depreciation Revalued Amount

Uploaded by

Babar MalikCopyright:

Available Formats

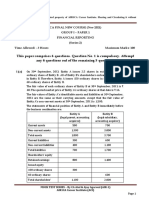

CAF-01 (FAR-1) Property, Plant and Equipment (IAS-16)

Lecture 15 (IAS-16) Lecture 15 (Overall)

Classwork:

1. Umer Limited (UL) uses the revaluation model for subsequent measurement of its property, plant

and equipment and has a policy of revaluing its assets on an annual basis using the net

replacement value method.

The following information pertains to UL’s buildings:

(i) 10 buildings were acquired in same vicinity on 1 January 2015 at a cost of Rs.500 million.

The useful life of the buildings on the date of acquisition was 10 years.

(ii) AL depreciates buildings on the straight line basis over their useful life.

(iii) The results of revaluations carried out during the last three years by Expert Valuation

Service, an independent firm of valuers, are as follows:

Fair value

Revaluation date

Rs. in million

1 January 2016 800

1 January 2017 300

1 January 2018 600

(iv) On 31 March 2018, 4 buildings were sold for Rs. 80 million each.

Required: Prepare a note on “Property, plant and equipment” (including comparative figures)

for inclusion in UL’s financial statements for the year ended 31 December 2018 in accordance

with International Financial Reporting Standards. (Ignore taxation) (13)

2. KL uses the revaluation model for subsequent measurement of its property, plant and equipment.

(i) 5 buildings were acquired in same vicinity on 1 January 2010 at a cost of Rs.200 million.

The useful life of the buildings on the date of acquisition was 20 years.

(ii) The results of revaluations carried out is as follows:

Revaluation date Fair value (Rs. in million)

1 January 2016 480

(iii) On 31 March 2016, 3 buildings were sold for Rs. 30 million each.

Required: Prepare a note on “Property, plant and equipment” for the year ended 31 December

2016 in accordance with International Financial Reporting Standards. (Ignore taxation) (6)

Homework:

1. On 31 December 2018, Omega Chemicals Limited (OCL) changed its valuation model from cost to

revaluation for its buildings. The following information pertains to its buildings as at 31 December

2018:

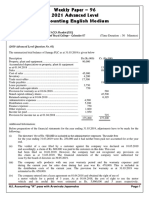

Prior to revaluation as at 31-12-2018

Estimated useful Accumulated

Revalued

life as originally Cost depreciation*

amount

estimated

-------------------------Rs. In million ---------------------

Office buildings 20 Years 600 150 800

*Including depreciation for the year ended 31 December 2018

Umair Sheraz Utra, ACA Page |1

CAF-01 (FAR-1) Property, Plant and Equipment (IAS-16)

As per the report of the professional valuer, there was no change in estimated useful life of the buildings.

OCL recorded revaluation effect for the office buildings on 31 December 2018 as per the valuation

report.

On 1 April 2019, one of the office buildings was sold for Rs. 45 million. On 31 December 2018, written

down value before revaluation and revalued amount of the sold building amounted to Rs. 80 million

and Rs. 95 million respectively.

OCL uses straight line method of depreciation which is charged from the date the asset is available for

use upto the date of disposal. Revaluation is to be accounted for by using net replacement value method.

Required: In the light of the requirements of the International Financial Reporting Standards, prepare

accounting entries from the above information for the year ended 31 December 2019. (10)

2. ABC Limited purchased a plant for Rs. 350,000 on 1 July 2010. The plant has an estimated useful

life of 20 years and no residual value.

ABC uses revaluation model for subsequent measurement of its property, plant and equipment and

accounts for revaluations on net replacement value method. The details of revaluations performed

by an independent firm of valuers are as follows:

Revaluation date Fair value

30 June 2011 Rs. 475,000

30 June 2012 Rs. 390,000

30 June 2013 Rs. 380,000

Required:

a) Prepare journal entries to record the above transactions from the date of acquisition of the

plant to the year ended 30 June 2013. (16)

b) Prepare asset and accumulated depreciation account to record the above transactions from the

date of acquisition of the plant to the year ended 30 June 2013. (08)

c) Assume the plant was sold for Rs. 350,000 on 01 July, 2013. Prepare journal entry to be

recorded on disposal. (02)

Umair Sheraz Utra, ACA Page |2

You might also like

- Lecture 13 14Document2 pagesLecture 13 14Ali Optimistic0% (1)

- Module 1 Ias 16 & Ias 38Document6 pagesModule 1 Ias 16 & Ias 38Muhammad Zulqarnain NainNo ratings yet

- Practice Questions For Ias 16Document6 pagesPractice Questions For Ias 16Uman Imran,56No ratings yet

- Assessment 1 (QP) IAS 16 + 23Document2 pagesAssessment 1 (QP) IAS 16 + 23Ali Optimistic100% (1)

- Crescent All CAF Mocks QP With Solutions Compiled by Saboor AhmadDocument124 pagesCrescent All CAF Mocks QP With Solutions Compiled by Saboor AhmadAr Sal AnNo ratings yet

- Lecture 16Document2 pagesLecture 16Ali OptimisticNo ratings yet

- Financial Accounting and Reporting 1Document11 pagesFinancial Accounting and Reporting 1BablooNo ratings yet

- MOCK EXAMS CAF AUTUMN 2022 FINANCIAL ACCOUNTING AND REPORTING IDocument130 pagesMOCK EXAMS CAF AUTUMN 2022 FINANCIAL ACCOUNTING AND REPORTING IHadeed HafeezNo ratings yet

- IAS 36 Final 08122022 104310amDocument6 pagesIAS 36 Final 08122022 104310amAdnan MaqboolNo ratings yet

- Ias 2Document5 pagesIas 2FarrukhsgNo ratings yet

- AspDocument6 pagesAspCaramakr ManthaNo ratings yet

- Workbook 2Document19 pagesWorkbook 2zfy020807No ratings yet

- SKANS School of Accountancy Financial Accounting and Reporting-IIDocument11 pagesSKANS School of Accountancy Financial Accounting and Reporting-IImaryNo ratings yet

- Fac611s - Financial Accounting 201 - 2nd Opp - July 2019Document6 pagesFac611s - Financial Accounting 201 - 2nd Opp - July 2019Lizaan CloeteNo ratings yet

- Term Test-1 FAR-1Document6 pagesTerm Test-1 FAR-1Dua FarmoodNo ratings yet

- AFAB233 Tutorial - PPE - 021819Document7 pagesAFAB233 Tutorial - PPE - 021819Leshiga GunasegarNo ratings yet

- Financial Reporting Test 1 May 2024 Test Paper 1702362463Document12 pagesFinancial Reporting Test 1 May 2024 Test Paper 1702362463shauryagupta20013007No ratings yet

- Lecture 9-9Document1 pageLecture 9-9rohab muhammadNo ratings yet

- Assignment 1Document8 pagesAssignment 1Ivan SsebugwawoNo ratings yet

- Sample 2Document3 pagesSample 2Thanh HuynhNo ratings yet

- FR 2 New Question PaperDocument7 pagesFR 2 New Question PaperkrishNo ratings yet

- PL M17 Far Uk GaapDocument8 pagesPL M17 Far Uk GaapIssa BoyNo ratings yet

- Q2Document2 pagesQ2Wathz NawarathnaNo ratings yet

- Certificate in Accounting and Finance: Adjusting Entries and Financial StatementsDocument7 pagesCertificate in Accounting and Finance: Adjusting Entries and Financial StatementsZahidNo ratings yet

- ACCT6003 FAP Assessment Brief Part BDocument5 pagesACCT6003 FAP Assessment Brief Part BCrystal Welch0% (1)

- RTP June 2018 QnsDocument14 pagesRTP June 2018 QnsbinuNo ratings yet

- COMSATS University Islamabad: Accounting IDocument3 pagesCOMSATS University Islamabad: Accounting IHassan MalikNo ratings yet

- PPE and ImpairmentDocument3 pagesPPE and ImpairmentSelma IilongaNo ratings yet

- Seatwork - Module 3Document4 pagesSeatwork - Module 3Alyanna AlcantaraNo ratings yet

- 5 Nov 2020Document28 pages5 Nov 2020Aditya PrajapatiNo ratings yet

- FAR2 ModelpaperDocument7 pagesFAR2 ModelpaperSaif SiddNo ratings yet

- MFR203 FAR-4 AssignmentDocument5 pagesMFR203 FAR-4 Assignmentgillian soonNo ratings yet

- Mock Test QuestionsDocument36 pagesMock Test QuestionsKish VNo ratings yet

- Questions Related To NCADocument2 pagesQuestions Related To NCAIQBAL MAHMUDNo ratings yet

- 2021 Revision QuestionsDocument10 pages2021 Revision QuestionsTawanda Tatenda HerbertNo ratings yet

- Final MockDocument5 pagesFinal MockAbdullahSaqibNo ratings yet

- ACW2491 Financial Accounting Tutorial QuestionsDocument2 pagesACW2491 Financial Accounting Tutorial QuestionsAhsan MasoodNo ratings yet

- ARM - FAR 1 Mock For March 2024 With Solution - FinalDocument26 pagesARM - FAR 1 Mock For March 2024 With Solution - FinalTooba MaqboolNo ratings yet

- Sir Kahlil Far 1 Batch 4Document6 pagesSir Kahlil Far 1 Batch 4Asim MahmoodNo ratings yet

- 007 - Chapter 04 - IAS 16 Property, Plant and EquipmentDocument7 pages007 - Chapter 04 - IAS 16 Property, Plant and EquipmentHaris ButtNo ratings yet

- LO5 QuestionDocument2 pagesLO5 QuestionFrederick LekalakalaNo ratings yet

- Extra Questions For AsDocument35 pagesExtra Questions For AsAmish DebNo ratings yet

- PPE Assignment - Depreciation, Revaluation, DisposalDocument3 pagesPPE Assignment - Depreciation, Revaluation, DisposalRajes ManoNo ratings yet

- Accounting English Medium: Weekly Paper - 96 2021 Advanced LevelDocument2 pagesAccounting English Medium: Weekly Paper - 96 2021 Advanced LevelMalar SrirengarajahNo ratings yet

- IAS 16 PracticeDocument3 pagesIAS 16 PracticeWaqas Younas Bandukda0% (1)

- Mock Test - Update (PPE)Document2 pagesMock Test - Update (PPE)IQBAL MAHMUDNo ratings yet

- Tutorial 2 - Ias16 PpeDocument4 pagesTutorial 2 - Ias16 Ppe猪mongNo ratings yet

- RT#1 CAF-1 FAR-1 - Question PaperDocument2 pagesRT#1 CAF-1 FAR-1 - Question Paperawaisawais95138No ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) : Group - I Paper - 1: AccountingHarsh KumarNo ratings yet

- Property, Plant and Equipment (IAS-16)Document2 pagesProperty, Plant and Equipment (IAS-16)Raneem BilalNo ratings yet

- CA (Final) Financial Reporting: InstructionsDocument5 pagesCA (Final) Financial Reporting: InstructionsNakul GoyalNo ratings yet

- IAS 40 ICAB QuestionsDocument5 pagesIAS 40 ICAB QuestionsMonirul Islam Moniirr100% (1)

- Far-1 Revaluation JE 2Document2 pagesFar-1 Revaluation JE 2Janie HookeNo ratings yet

- Assets and liabilities questionsDocument371 pagesAssets and liabilities questionsPeter Osundwa Kiteki50% (2)

- B Com 2023 Examination PaperDocument9 pagesB Com 2023 Examination PaperAkshitaNo ratings yet

- Fa May June - 2017Document5 pagesFa May June - 2017xodic49847No ratings yet

- Accounting for Borrowing CostsDocument9 pagesAccounting for Borrowing Costsgracel angela tolejanoNo ratings yet

- Accounting Test 1 CH 1 Nov 2022 Test PaperDocument5 pagesAccounting Test 1 CH 1 Nov 2022 Test PaperGaurav JhaNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Lecture 18-18Document2 pagesLecture 18-18Babar MalikNo ratings yet

- CAF-01 IAS-36: Impairment of AssetsDocument1 pageCAF-01 IAS-36: Impairment of AssetsBabar MalikNo ratings yet

- Lecture 18-18Document2 pagesLecture 18-18Babar MalikNo ratings yet

- Lecture 12 12Document1 pageLecture 12 12Babar MalikNo ratings yet

- Lecture 9-9Document1 pageLecture 9-9rohab muhammadNo ratings yet

- Lecture 11 (IAS-16) Lecture 11 (Overall) : Cost Depreciation NBV Rs. 000 Rs. 000 Rs. 000Document1 pageLecture 11 (IAS-16) Lecture 11 (Overall) : Cost Depreciation NBV Rs. 000 Rs. 000 Rs. 000Babar MalikNo ratings yet

- Lecture 12 12Document1 pageLecture 12 12Babar MalikNo ratings yet

- Basic Reconciliation StatementDocument13 pagesBasic Reconciliation StatementEaster Adina-LumangNo ratings yet

- Rivas-Extrajudicial Settlement of Estate2Document4 pagesRivas-Extrajudicial Settlement of Estate2Stewart Paul TorreNo ratings yet

- Code of Civil Procedure ExplainedDocument15 pagesCode of Civil Procedure ExplainedYash100% (1)

- Agriculture Bearer Plants Amendments To MFRS 116 2015 ReprintDocument4 pagesAgriculture Bearer Plants Amendments To MFRS 116 2015 ReprintTenglum LowNo ratings yet

- Registration Dynamic PrintDocument1 pageRegistration Dynamic PrintakhilNo ratings yet

- RMO No. 10-2019 - DigestDocument3 pagesRMO No. 10-2019 - DigestAMNo ratings yet

- Expression of Interest FinalDocument25 pagesExpression of Interest FinalMbiganyi ButaleNo ratings yet

- Borrower AgreementDocument7 pagesBorrower AgreementMija MedeNo ratings yet

- Modes of Constitutional Interpretation 1Document2 pagesModes of Constitutional Interpretation 1Namrata Priya100% (1)

- Law of Copyright - Winter Semester.2018-19Document113 pagesLaw of Copyright - Winter Semester.2018-19prarthana rameshNo ratings yet

- Directors of A CompanyDocument56 pagesDirectors of A CompanyZafry TahirNo ratings yet

- Victoria Police loses Supreme Court Appeal over validity of vaccine mandateDocument48 pagesVictoria Police loses Supreme Court Appeal over validity of vaccine mandatebexleybornNo ratings yet

- Cornelius AffidavitDocument5 pagesCornelius AffidavitJessica SchulbergNo ratings yet

- Media Law An Ethics NOTESDocument63 pagesMedia Law An Ethics NOTESRic DNo ratings yet

- Affidavit FORM OfflineDocument2 pagesAffidavit FORM OfflineKhyl Owen BatallonesNo ratings yet

- Read Jujutsu Kaisen Chapter 251 Manga Online - Read Jujutsu Kaisen Manga OnlineDocument20 pagesRead Jujutsu Kaisen Chapter 251 Manga Online - Read Jujutsu Kaisen Manga OnlinemarileyserNo ratings yet

- Public and Private AdministrationDocument4 pagesPublic and Private Administrationkaushal yadavNo ratings yet

- Laurel v. Abrograr GR No. 155076, January 13, 2009Document2 pagesLaurel v. Abrograr GR No. 155076, January 13, 2009Mikail Lee BelloNo ratings yet

- Extra Judicial With Waiver of RightsDocument3 pagesExtra Judicial With Waiver of RightsKEICHIE QUIMCONo ratings yet

- Chuka University ReportDocument30 pagesChuka University ReportDIANA MWANGINo ratings yet

- Energy Regulatory Commission: of Distribution UtilitiesDocument11 pagesEnergy Regulatory Commission: of Distribution Utilitiesluis moralesNo ratings yet

- Redacted InvoiceDocument8 pagesRedacted InvoiceUSA TODAY NetworkNo ratings yet

- Gujarat HC Order on Anticipatory Bail ApplicationDocument11 pagesGujarat HC Order on Anticipatory Bail ApplicationSreejith NairNo ratings yet

- Constitution of PakistanDocument2 pagesConstitution of PakistanTahir AzizNo ratings yet

- IA - 2 Provision, Contingent Liability: Presented By: Renato O. Daquioag CPA, MBA, CFCDocument15 pagesIA - 2 Provision, Contingent Liability: Presented By: Renato O. Daquioag CPA, MBA, CFCaehy lznuscrfbjNo ratings yet

- Social Security and Cess in Respect of Building and Other Construction WorkersDocument19 pagesSocial Security and Cess in Respect of Building and Other Construction WorkersAkhil DheliaNo ratings yet

- Gupta SirDocument54 pagesGupta Sirshiwani sharmaNo ratings yet

- Excused absences for student film projectDocument1 pageExcused absences for student film projectEmman CastroNo ratings yet

- List of Unvaccinated and 1st Dose Vaccine of Class KASIDLAKDocument17 pagesList of Unvaccinated and 1st Dose Vaccine of Class KASIDLAKServus DeiNo ratings yet

- Private Prosecutions in Canada-Guide PDFDocument58 pagesPrivate Prosecutions in Canada-Guide PDFaweb1No ratings yet