Professional Documents

Culture Documents

Lecture 11 (IAS-16) Lecture 11 (Overall) : Cost Depreciation NBV Rs. 000 Rs. 000 Rs. 000

Uploaded by

Babar MalikOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lecture 11 (IAS-16) Lecture 11 (Overall) : Cost Depreciation NBV Rs. 000 Rs. 000 Rs. 000

Uploaded by

Babar MalikCopyright:

Available Formats

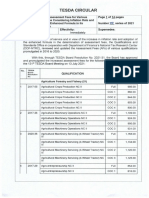

CAF-01 (FAR-1) Property, Plant and Equipment (IAS-16)

Lecture 11 (IAS-16) Lecture 11 (Overall)

Classwork:

1) Prepared note of PPE in lecture 7 classwork Q1;

2) Prepared note of PPE in lecture 8 classwork Q1;

3) Prepared note for the year ended 31 December 2017 directly;

4) Prepared note of PPE for the year ended 31 December 2017 in lecture 9 classwork Q1;

Homework:

1. FAM had the following tangible fixed assets at 31 December 2014.

Cost Depreciation NBV

Rs. 000 Rs. 000 Rs. 000

Land 500 - 500

Buildings 400 80 320

Plant and machinery 1,613 458 1,155

Fixtures and fittings 390 140 250

Assets under construction 91 - 91

2,994 678 2,316

In the year ended 31 December 2015 the following transactions occur.

(1) Further costs of Rs.53,000 are incurred on buildings being constructed by the company. A building

costing Rs.100,000 is completed during the year.

(2) A deposit of Rs.20,000 is paid for a new computer system which is undelivered at the year end.

(3) Additions to plant are Rs.154,000.

(4) Additions to fixtures, excluding the deposit on the new computer system, are Rs.40,000.

(5) The following assets are sold.

Depreciation brought

Cost Proceeds

forward

Rs. 000 Rs. 000 Rs. 000

Plant 277 195 86

Fixtures 41 31 2

(6) Land and buildings were revalued at 1 January 2015 to Rs. 1,500,000, of which land is worth Rs.

900,000. The revaluation was performed by Messrs Jackson & Co, Chartered Surveyors, on the basis of

existing use value on the open market.

(7) The useful economic life of the buildings is unchanged. The buildings were purchased ten years before

the revaluation.

(8) Depreciation is provided on all assets in use at the year end at the following rates.

Buildings 2% per annum straight line

Plant 20% per annum straight line

Fixtures 25% per annum reducing balance

Required:

Show the disclosure under IAS 16 in relation to fixed assets in the notes to the published accounts for

the year ended 31 December 2015.

Umair Sheraz Utra, ACA Page |1

You might also like

- Financial Accounting and Reporting 1Document11 pagesFinancial Accounting and Reporting 1BablooNo ratings yet

- IAS 16 PracticeDocument3 pagesIAS 16 PracticeWaqas Younas Bandukda0% (1)

- Cost Attemptwise PPDocument317 pagesCost Attemptwise PPHassnain SardarNo ratings yet

- Specific Financial Reporting Ac413 MAY2016Document5 pagesSpecific Financial Reporting Ac413 MAY2016AnishahNo ratings yet

- Assignment 5 4.2Document1 pageAssignment 5 4.2ehte19797177No ratings yet

- Taxation Practice: Dunhinda (PVT) Ltd. Was Incorporated On 01Document8 pagesTaxation Practice: Dunhinda (PVT) Ltd. Was Incorporated On 01Muhazzam MaazNo ratings yet

- The Institute of Chartered Accountants of PakistanDocument4 pagesThe Institute of Chartered Accountants of PakistanShehrozSTNo ratings yet

- Mock Test QuestionsDocument36 pagesMock Test QuestionsKish VNo ratings yet

- Ias16 Q3Document2 pagesIas16 Q3ziamz219No ratings yet

- Lecture 11-11Document2 pagesLecture 11-11Nouman ShamasNo ratings yet

- Cost Accounting: T I C A PDocument6 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- MAY 2016 SkillsDocument188 pagesMAY 2016 SkillsOnaderu Oluwagbenga EnochNo ratings yet

- Q06A Audit of Non Cash AssetsDocument7 pagesQ06A Audit of Non Cash AssetsChristine Jane ParroNo ratings yet

- CAF-3 CMAModelpaperDocument5 pagesCAF-3 CMAModelpaperAsad ZahidNo ratings yet

- CafDocument5 pagesCaftokeeer100% (1)

- Jun Zen Ralph V. Yap BSA - 3 Year Let's CheckDocument5 pagesJun Zen Ralph V. Yap BSA - 3 Year Let's CheckJunzen Ralph YapNo ratings yet

- Live: Exam Questions (Asset Disposal) 12 November 2014 Lesson DescriptionDocument5 pagesLive: Exam Questions (Asset Disposal) 12 November 2014 Lesson DescriptionsandiekaysNo ratings yet

- Group Assignment On FSDocument4 pagesGroup Assignment On FSHuyền TrangNo ratings yet

- Accountancy Auditing 2021Document5 pagesAccountancy Auditing 2021Abdul basitNo ratings yet

- OSA Question - Cost AccountingDocument9 pagesOSA Question - Cost AccountingMohola Tebello GriffithNo ratings yet

- Caf 5 Far-IDocument5 pagesCaf 5 Far-IYahyaNo ratings yet

- As 10Document8 pagesAs 10krithika vasanNo ratings yet

- Laboratory Activity #5 Depreciation: ITEC 30 Accounting Information SystemDocument2 pagesLaboratory Activity #5 Depreciation: ITEC 30 Accounting Information SystemSohfia Jesse VergaraNo ratings yet

- Exercise IAS 16Document1 pageExercise IAS 16robertallie73No ratings yet

- CHP 2. Contract Costing SumsDocument59 pagesCHP 2. Contract Costing SumsUchit MehtaNo ratings yet

- CAF-07 FAR-II Q. Paper (Final)Document5 pagesCAF-07 FAR-II Q. Paper (Final)ANo ratings yet

- Cma Past PapersDocument437 pagesCma Past PapersTooba MaqboolNo ratings yet

- Form 6 Accounts (C)Document8 pagesForm 6 Accounts (C)David MutandaNo ratings yet

- Chapter 6Document40 pagesChapter 6vukicevic.ivan5No ratings yet

- TESDA Circular No. 072-2021, Mecha, TM EtcDocument14 pagesTESDA Circular No. 072-2021, Mecha, TM EtcAldwin Olivo100% (1)

- QQAA GREEN TECH Comprehensive ExampleDocument7 pagesQQAA GREEN TECH Comprehensive ExampleZulhelmy NazriNo ratings yet

- 2018 Accounts Paper PracticalDocument5 pages2018 Accounts Paper PracticalHmingsangliana HauhnarNo ratings yet

- Practice Question (Accounting Cycle) With Solution v2Document17 pagesPractice Question (Accounting Cycle) With Solution v2Laiba ManzoorNo ratings yet

- Cost Accounting: T I C A PDocument4 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- Unit 7 Audit of Property Plant and Equipment Handout Final t21516Document10 pagesUnit 7 Audit of Property Plant and Equipment Handout Final t21516Mikaella BengcoNo ratings yet

- Unit 7 Audit of Property Plant and Equipment Handout Final t21516Document10 pagesUnit 7 Audit of Property Plant and Equipment Handout Final t21516Mikaella BengcoNo ratings yet

- Question-Ias 2 - Ias 16 and Ias 40 - Admin-2019-2020-1Document6 pagesQuestion-Ias 2 - Ias 16 and Ias 40 - Admin-2019-2020-1Letsah BrightNo ratings yet

- Q2Document2 pagesQ2Wathz NawarathnaNo ratings yet

- Diy-Problems (Questionnaire)Document10 pagesDiy-Problems (Questionnaire)May RamosNo ratings yet

- FFA MockDocument4 pagesFFA MockGeeta LalwaniNo ratings yet

- PPE NotesDocument4 pagesPPE Notesaldric taclanNo ratings yet

- As GR 1 Ipcc Compiler 2015-18Document24 pagesAs GR 1 Ipcc Compiler 2015-18KRISHNA MANDLOINo ratings yet

- 2.manufacturing Accounts IllustrationDocument2 pages2.manufacturing Accounts Illustrationdaniel.maina2005No ratings yet

- Test Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingDocument7 pagesTest Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingMusic WorldNo ratings yet

- Lecture 3 - Practice QuestionDocument6 pagesLecture 3 - Practice QuestionBhunesh KumarNo ratings yet

- Group AssignmentDocument12 pagesGroup AssignmentAn Phan Thị HoàiNo ratings yet

- Unit and Output Costing QuestionDocument14 pagesUnit and Output Costing QuestionSilver TricksNo ratings yet

- 5BAP5D03 PPEforprintingDocument8 pages5BAP5D03 PPEforprintingCykee Hanna Quizo LumongsodNo ratings yet

- ND 10 To ND 14Document164 pagesND 10 To ND 14Abdullah al MahmudNo ratings yet

- Acco 30053 - Audit of Ppe - MarpDocument10 pagesAcco 30053 - Audit of Ppe - MarpBanna SplitNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelAnonymous OtUvYI4No ratings yet

- Chapter 1-Job and Batch Costing: Ref: Cost & Management Accounting by K.S.AdigaDocument14 pagesChapter 1-Job and Batch Costing: Ref: Cost & Management Accounting by K.S.AdigaAR Ananth Rohith BhatNo ratings yet

- 11.11.2017 Audit of PPEDocument9 pages11.11.2017 Audit of PPEPatOcampoNo ratings yet

- BU5504BU5501Document4 pagesBU5504BU5501abinaya590455No ratings yet

- Exercises Ppe PDFDocument6 pagesExercises Ppe PDFمعن الفاعوري100% (1)

- Midterm 5101Document4 pagesMidterm 5101MD Hafizul Islam HafizNo ratings yet

- Acc3201 (F) Aug2014Document5 pagesAcc3201 (F) Aug2014natlyhNo ratings yet

- Number 4Document5 pagesNumber 4Marie Fe GullesNo ratings yet

- June 2021Document64 pagesJune 2021new yearNo ratings yet

- PM Quiz 1Document7 pagesPM Quiz 1Daniyal NasirNo ratings yet

- CIX Pilot Auction Press ReleaseDocument5 pagesCIX Pilot Auction Press ReleaseJNo ratings yet

- CPMI - Cross Border PaymentsDocument60 pagesCPMI - Cross Border PaymentsTarik IrrouNo ratings yet

- Caf 6 Tax Autumn 2015Document4 pagesCaf 6 Tax Autumn 2015ملک محمد کاشف شہزاد اعوانNo ratings yet

- Introduction To Public IssueDocument15 pagesIntroduction To Public IssuePappu ChoudharyNo ratings yet

- Test Bank For Global Business 3rd Edition PengDocument11 pagesTest Bank For Global Business 3rd Edition Pengamplywidenessbwjf100% (47)

- Financial Crises: Lessons From The Past, Preparation For The FutureDocument298 pagesFinancial Crises: Lessons From The Past, Preparation For The FutureJayeshNo ratings yet

- Liquidity GapsDocument18 pagesLiquidity Gapsjessicashergill100% (1)

- How To Read Your Account Analysis StatementDocument2 pagesHow To Read Your Account Analysis StatementhanhNo ratings yet

- Case 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTDocument4 pagesCase 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTkunalNo ratings yet

- Frutybox S.A.: Week # 45 Commercial Invoice No. 001-001-0003012Document1 pageFrutybox S.A.: Week # 45 Commercial Invoice No. 001-001-0003012danielNo ratings yet

- 11 7110 22 FP Webonly AfpDocument89 pages11 7110 22 FP Webonly AfpAminaarshadwarriachNo ratings yet

- Acknowledgement: Mr. Rahul Shah For His Exemplary Guidance, Monitoring and Constant EncouragementDocument42 pagesAcknowledgement: Mr. Rahul Shah For His Exemplary Guidance, Monitoring and Constant EncouragementVineeth MudaliyarNo ratings yet

- Fas 141 R PDFDocument2 pagesFas 141 R PDFToniaNo ratings yet

- MM 314 Engineering Economy - 2. Interest Rate and Economic EquivalenceDocument61 pagesMM 314 Engineering Economy - 2. Interest Rate and Economic EquivalenceOğulcan AytaçNo ratings yet

- Chapter 18 - Equity Valuation ModelsDocument44 pagesChapter 18 - Equity Valuation ModelsQingXu1986No ratings yet

- SEx 2Document20 pagesSEx 2Amir Madani100% (3)

- Rent Receipt Generator Online - House Rent ReceiptDocument5 pagesRent Receipt Generator Online - House Rent ReceiptManish GhadgeNo ratings yet

- RR 2-98 (As Amended)Document74 pagesRR 2-98 (As Amended)Mariano RentomesNo ratings yet

- Orchids The International SchoolDocument1 pageOrchids The International SchoolPrafulla Kailash TajaneNo ratings yet

- Week 2 - Fabm 1 - Accounting Cycle of A Merchandising BusinessDocument19 pagesWeek 2 - Fabm 1 - Accounting Cycle of A Merchandising BusinessSheila Marie Ann Magcalas-GaluraNo ratings yet

- 1-4e Income Taxes: Formula For Federal Income Tax On IndividualsDocument3 pages1-4e Income Taxes: Formula For Federal Income Tax On IndividualsMeriton KrivcaNo ratings yet

- Ea2 TaxationDocument3 pagesEa2 TaxationBlythe teckNo ratings yet

- Case Study - LBO Tata Tea and TetleyDocument4 pagesCase Study - LBO Tata Tea and TetleySumit RathiNo ratings yet

- Tradewinds Corporation BHDDocument10 pagesTradewinds Corporation BHDkhldHANo ratings yet

- Export Document Covering LetterDocument4 pagesExport Document Covering Lettertechindia2010No ratings yet

- Credit Line AgreementDocument14 pagesCredit Line AgreementAdriana MendozaNo ratings yet

- IAS 8 - How To Account For Artwork Under IFRSDocument5 pagesIAS 8 - How To Account For Artwork Under IFRSMuhammad Moin khanNo ratings yet

- Tyler Tysdal September 2019 Securities and Exchange Commission OrderDocument15 pagesTyler Tysdal September 2019 Securities and Exchange Commission OrderMichael_Roberts2019No ratings yet

- Class Slides - Chapter 7Document54 pagesClass Slides - Chapter 7rav kundiNo ratings yet