Professional Documents

Culture Documents

Polo Company and Subsidiary Consolidated Statement of Financial Position As of December 31, 2020 Assets

Uploaded by

Junzen Ralph YapOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Polo Company and Subsidiary Consolidated Statement of Financial Position As of December 31, 2020 Assets

Uploaded by

Junzen Ralph YapCopyright:

Available Formats

A. Investment in Subsidiary - Solo Co.

250,000 Polo

Common Stock 100,000 Consolidate

Additional Paid-in Capital 150,000 As

To record the acquisition of the Solo Co.'s stocks by issuing

own shares and acquisition-related costs

Cash

Receivables

B. Professional fees expense 10,000 Inventory

Additional Paid-in Capital 20,000 Property, plant and equ

Cash 30,000 Goodwill

To record the professional fees and stock issuance costs paid Total Assets

LIABILITIE

Current Liabilities

E (1) PPE (more than its book value) 40,000 Long-term Liabilities

Common Stock - Solo Co. 90,000 Common Stock

Retained Earnings - Solo Co. 100,000 Additional Paid-in Capit

Goodwill 20,000 Retained Earnings

Investment in Subsidiary - Solo CO. 250,000 Total Liabilities and Sh

To eliminate the subsidiary account against the equity

accounts from Solo Co.

Shares Consideration 250,000

Less: Book value of Interest Acquired

Common Stock 90,000

Retained Earnings 100,000 190,000

Balance 60,000

Less: Equipment (more than book value) 40,000

Goodwill 20,000

A. Investment in Sotto Company 950,000

Cash 950,000

To record the acquisition of the Sotto Company's stocks

B. Fair Value Pedro (80%) Sotto (20%)

Fair Value of subsidiary 1,180,000 950,000 230,000

Less: Book value of interest acquired

Common stock 100,000

APIC 200,000

Retained earnings 600,000

Total equity 900,000 900,000 900,000

Interest acquired 0.80 0.20

Book value 720,000 180,000

Excess 280,000 230,000 50,000

Adjustment of Identifiable Net Assets:

Currents assets 50,000

PPE (Net) - 100,000

Current liabilities 0

Long-term liabilities - 40,000

Goodwill 190,000

E (1) Common stock - Sotto Co. 100,000

APIC - Sotto Co. 200,000

Retained Earnings - Sotto Co. 600,000

Investment in Sotto Company 720,000

Non-controlling interest 180,000

To eliminate the subsidiary accounts against equity accounts

from Sotto Co.

E (2) Property and equipment (Net) 100,000

Long-term liabilities 40,000

Goodwill 190,000

Current assets 50,000

Investment in Sotto Company 230,000

Non-controlling interest 50,000

To eliminate the subsidiary accounts against the adjustments

of the net assets at their fair values

Polo Company and Subsidiary

Consolidated Statement of Financial Position

As of December 31, 2020

ASSETS

70,000

Receivables 120,000

170,000

Property, plant and equipment (net) 340,000

20,000

Total Assets 720,000

LIABILITIES AND SHAREHOLDERS' EQUITY

Current Liabilities 30,000

Long-term Liabilities 120,000

Common Stock 210,000

Additional Paid-in Capital 150,000

Retained Earnings 210,000

Total Liabilities and Shareholders' Equity 720,000

You might also like

- Mgeb02 FinalDocument4 pagesMgeb02 FinalexamkillerNo ratings yet

- Jun Zen Ralph V. Yap 3 Year - BSA Let's CheckDocument4 pagesJun Zen Ralph V. Yap 3 Year - BSA Let's CheckJunzen Ralph YapNo ratings yet

- Jun Zen Ralph V. Yap 3 Year - BSA Let's CheckDocument4 pagesJun Zen Ralph V. Yap 3 Year - BSA Let's CheckJunzen Ralph YapNo ratings yet

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- Yap - ACP312 - ULOb - Let's CheckDocument4 pagesYap - ACP312 - ULOb - Let's CheckJunzen Ralph YapNo ratings yet

- 14 - Audit Other Related ServicesDocument38 pages14 - Audit Other Related ServicesSyafiq AhmadNo ratings yet

- Let's Analyze: Pacalna, Anifah BDocument2 pagesLet's Analyze: Pacalna, Anifah BAnifahchannie PacalnaNo ratings yet

- Consolidation of Financial Statements at Acquisition DateDocument4 pagesConsolidation of Financial Statements at Acquisition DateShiela Mae RedobleNo ratings yet

- Solution For Activity On Consolidation at The Date of AcquisitionDocument4 pagesSolution For Activity On Consolidation at The Date of AcquisitionRea June SumatraNo ratings yet

- Business CombinationDocument10 pagesBusiness CombinationJaira ClavoNo ratings yet

- Chap 14 1-2Document4 pagesChap 14 1-2Buenaventura, Lara Jane T.No ratings yet

- Solution For Activity On Consolidation at The Date of Acquisition For BmaDocument4 pagesSolution For Activity On Consolidation at The Date of Acquisition For BmaMaria Beatriz NavecisNo ratings yet

- Quiz 3 Acctg For Business Combination - EntriesDocument6 pagesQuiz 3 Acctg For Business Combination - EntriesNhicoleChoiNo ratings yet

- Josie B. Aguila, Mbmba: Financial Accounting For IeDocument6 pagesJosie B. Aguila, Mbmba: Financial Accounting For IeCATHERINE FRANCE LALUCISNo ratings yet

- B CorporationDocument11 pagesB CorporationMelizze MejicoNo ratings yet

- FINAL EXAM - Part 2Document4 pagesFINAL EXAM - Part 2Elton ArcenasNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Seatwork Ratio AnalysisDocument2 pagesSeatwork Ratio AnalysisMARIBEL SANTOSNo ratings yet

- Name: Fe C. Leyros Bsa 2 Acctg TTH 3:00-4:30 PM Solutions: Problem 1Document7 pagesName: Fe C. Leyros Bsa 2 Acctg TTH 3:00-4:30 PM Solutions: Problem 1AlexNo ratings yet

- Problem Solving Updates in Philippine Accounting and Financial Reporting StandardsDocument5 pagesProblem Solving Updates in Philippine Accounting and Financial Reporting StandardsgnlynNo ratings yet

- Book Value Market Value Pole Co. Sole Co. Sole CoDocument7 pagesBook Value Market Value Pole Co. Sole Co. Sole CoJericho SumagueNo ratings yet

- Advanced AccountingDocument10 pagesAdvanced AccountingLhyn Cantal CalicaNo ratings yet

- Accounting For Business Combination - PRELIMDocument5 pagesAccounting For Business Combination - PRELIMAnonymouslyNo ratings yet

- Buscom 3Document4 pagesBuscom 3dmangiginNo ratings yet

- Big Company LimitedDocument6 pagesBig Company LimitedFariha MaharinNo ratings yet

- A. The Following Account Balances Were Presented On December 31, 2017Document3 pagesA. The Following Account Balances Were Presented On December 31, 2017Shiela Mae Pon AnNo ratings yet

- Accounting 315 - Quiz Business CombinationDocument5 pagesAccounting 315 - Quiz Business CombinationAlexNo ratings yet

- Activity 3.1Document13 pagesActivity 3.1kel dataNo ratings yet

- AdvactDocument6 pagesAdvactChelsea DizonNo ratings yet

- Unit I VDocument15 pagesUnit I VLeslie Mae Vargas ZafeNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- Learning Unit 7 - Elimination of Intragroup TransactionsDocument61 pagesLearning Unit 7 - Elimination of Intragroup TransactionsThulani NdlovuNo ratings yet

- TPBALANCESHEET DeloyDocument1 pageTPBALANCESHEET DeloyJen DeloyNo ratings yet

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocument4 pagesAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- Cashflwo TABBA F7Document6 pagesCashflwo TABBA F7Pocpoca100% (2)

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionAnnabeth BrionNo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Consolidation WorksheetDocument1 pageConsolidation WorksheetJean Kathyrine ChiongNo ratings yet

- Entry For The AcquisitionDocument5 pagesEntry For The AcquisitionEnalem OtsuepmeNo ratings yet

- Module 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)Document3 pagesModule 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)ariannealcaraz6No ratings yet

- Cash Flow Tutorial QnsDocument13 pagesCash Flow Tutorial QnsCristian Renatus100% (1)

- MODULE BLR301 BusinessLawsandRegulations1Document14 pagesMODULE BLR301 BusinessLawsandRegulations1Jr Reyes PedidaNo ratings yet

- Abc ProbsDocument12 pagesAbc ProbsZNo ratings yet

- Financial PositionDocument4 pagesFinancial PositionBeth Diaz Laurente100% (2)

- Quiz 2Document11 pagesQuiz 2Sophia Anne MonillasNo ratings yet

- Nature of Consolidated StatementsDocument8 pagesNature of Consolidated StatementsRoldan Arca PagaposNo ratings yet

- P2-22, 28, 32Document8 pagesP2-22, 28, 32jyraEB9390No ratings yet

- Advacc 2Document4 pagesAdvacc 2RynveeNo ratings yet

- Problem 1 1. Record The Transactions To Account The Investment. P Corporation's BooksDocument2 pagesProblem 1 1. Record The Transactions To Account The Investment. P Corporation's BooksArtisanNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- PREA4Document7 pagesPREA4Buenaventura, Elijah B.No ratings yet

- Use The Following Information For The Next Two Items:: 1. Prepare The Consolidated Statement of Financial PositionDocument15 pagesUse The Following Information For The Next Two Items:: 1. Prepare The Consolidated Statement of Financial PositionJacqueline OrtegaNo ratings yet

- Buscom 1Document4 pagesBuscom 1dmangiginNo ratings yet

- Malabanan - Activity Chapter 2 2 PDFDocument5 pagesMalabanan - Activity Chapter 2 2 PDFJv MalabananNo ratings yet

- BFA301 Solution For Lecture Example 7-1Document11 pagesBFA301 Solution For Lecture Example 7-1erinNo ratings yet

- 2076 - Varias, Aizel Ann B - Module 2Document20 pages2076 - Varias, Aizel Ann B - Module 2Aizel Ann VariasNo ratings yet

- BuscomDocument5 pagesBuscomdmangiginNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- HW5.FT222004.Archit KumarDocument7 pagesHW5.FT222004.Archit KumarARCHIT KUMARNo ratings yet

- Chap 13 - 1 To 5Document5 pagesChap 13 - 1 To 5Buenaventura, Lara Jane T.No ratings yet

- Chow2019 SIM AC2091 MockExamA StudentDocument23 pagesChow2019 SIM AC2091 MockExamA StudentPadamchand PokharnaNo ratings yet

- Business Combination-Intercompany Sale of InventoriesDocument2 pagesBusiness Combination-Intercompany Sale of InventoriesMixx MineNo ratings yet

- HI5020 Corporate Accounting: Session 7c Accounting For Group StructuresDocument30 pagesHI5020 Corporate Accounting: Session 7c Accounting For Group StructuresFeku RamNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- C. Let's Check: Pacalna, Anifah B. BSA-3 Year Week 1 UloaDocument17 pagesC. Let's Check: Pacalna, Anifah B. BSA-3 Year Week 1 UloaJunzen Ralph YapNo ratings yet

- Book 1Document4 pagesBook 1Junzen Ralph YapNo ratings yet

- National Service Training Program 1 First ExaminationDocument2 pagesNational Service Training Program 1 First ExaminationJunzen Ralph YapNo ratings yet

- Section 1Document1 pageSection 1Junzen Ralph YapNo ratings yet

- (Yap, Jun Zen Ralph V.) - NSTP 1Document5 pages(Yap, Jun Zen Ralph V.) - NSTP 1Junzen Ralph YapNo ratings yet

- StakeholdersDocument2 pagesStakeholdersJunzen Ralph YapNo ratings yet

- When It Comes To Inventory Valuation of Expedia Industries Using The FIFO MethodDocument1 pageWhen It Comes To Inventory Valuation of Expedia Industries Using The FIFO MethodJunzen Ralph YapNo ratings yet

- Jun Zen Ralph Yap BSA - 3 Year Let's CheckDocument2 pagesJun Zen Ralph Yap BSA - 3 Year Let's CheckJunzen Ralph Yap100% (1)

- Yap - ACP312 - ULOb - in A NutshellDocument2 pagesYap - ACP312 - ULOb - in A NutshellJunzen Ralph YapNo ratings yet

- Jun Zen Ralph Yap BSA - 3 Year Let's AnalyzeDocument2 pagesJun Zen Ralph Yap BSA - 3 Year Let's AnalyzeJunzen Ralph YapNo ratings yet

- Yap - ACP312 - ULOd - in A NutshellDocument1 pageYap - ACP312 - ULOd - in A NutshellJunzen Ralph YapNo ratings yet

- Yap - ACP312 - ULOb - in A NutshellDocument2 pagesYap - ACP312 - ULOb - in A NutshellJunzen Ralph YapNo ratings yet

- Yap - ACP312 - ULOb - in A NutshellDocument1 pageYap - ACP312 - ULOb - in A NutshellJunzen Ralph YapNo ratings yet

- Yap - ACP312 - ULOa - in A NutshellDocument2 pagesYap - ACP312 - ULOa - in A NutshellJunzen Ralph YapNo ratings yet

- 10 Major Problems in Measuring National IncomeDocument4 pages10 Major Problems in Measuring National IncomeJunzen Ralph YapNo ratings yet

- Jun Zen Ralph V. Yap BSA - 3 Year Let's CheckDocument5 pagesJun Zen Ralph V. Yap BSA - 3 Year Let's CheckJunzen Ralph YapNo ratings yet

- Lets AnalyzeDocument2 pagesLets AnalyzeJunzen Ralph YapNo ratings yet

- Yap - ACP312 - ULOa - in A NutshellDocument1 pageYap - ACP312 - ULOa - in A NutshellJunzen Ralph YapNo ratings yet

- Discuss The Following Concepts in The Conduct of Audit: Materiality, Reasonable Assurance, Professional Scepticism, and Professional JudgmentDocument8 pagesDiscuss The Following Concepts in The Conduct of Audit: Materiality, Reasonable Assurance, Professional Scepticism, and Professional JudgmentJun Zen Ralph YapNo ratings yet

- NCI in Net Income of SubsidiaryDocument2 pagesNCI in Net Income of SubsidiaryJunzen Ralph YapNo ratings yet

- Actual Cost (240,000 + 162,000) + 35,000Document1 pageActual Cost (240,000 + 162,000) + 35,000Junzen Ralph YapNo ratings yet

- Jun Zen Ralph Yap BSA - 3 Year Let's AnalyzeDocument2 pagesJun Zen Ralph Yap BSA - 3 Year Let's AnalyzeJunzen Ralph YapNo ratings yet

- Gain On Acquisition (Bargain Purchase) - 105,000Document2 pagesGain On Acquisition (Bargain Purchase) - 105,000Junzen Ralph YapNo ratings yet

- Yap - ACP312 - ULOb - in A NutshellDocument2 pagesYap - ACP312 - ULOb - in A NutshellJunzen Ralph YapNo ratings yet

- Jun Zen Ralph Yap BSA - 3 Year Let's AnalyzeDocument2 pagesJun Zen Ralph Yap BSA - 3 Year Let's AnalyzeJunzen Ralph YapNo ratings yet

- Reflection - Yap, Jun Zen RalphDocument1 pageReflection - Yap, Jun Zen RalphJunzen Ralph YapNo ratings yet

- 8th PageDocument4 pages8th PageJunzen Ralph YapNo ratings yet

- Ferry Van Asperen and Bram Van Besouw de Sotos Thesis and The Roman EmpireDocument21 pagesFerry Van Asperen and Bram Van Besouw de Sotos Thesis and The Roman EmpireFerdinandAlxNo ratings yet

- An Interpretation of Unequal Exchange From Prebisch-Singer To EmmanuelDocument12 pagesAn Interpretation of Unequal Exchange From Prebisch-Singer To EmmanuelMariano FélizNo ratings yet

- Practice For Midterm 1Document136 pagesPractice For Midterm 1ennaira 06No ratings yet

- On Tap Ke Toan Quan Tri 1 Quiz Ke Toan Quan TriDocument45 pagesOn Tap Ke Toan Quan Tri 1 Quiz Ke Toan Quan TriPhan HieuNo ratings yet

- Diagnostic Exam 1.23 AKDocument13 pagesDiagnostic Exam 1.23 AKmarygraceomacNo ratings yet

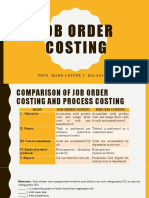

- Job Order Costing: Prof. Mark Lester T. Balasa, CpaDocument24 pagesJob Order Costing: Prof. Mark Lester T. Balasa, CpaNah HamzaNo ratings yet

- 8505 - 505m Buy-Sell ProgramDocument2 pages8505 - 505m Buy-Sell Programnab2nabNo ratings yet

- Managerial Economics: (The Course Guide) The NeedDocument72 pagesManagerial Economics: (The Course Guide) The NeedKintu GeraldNo ratings yet

- Income Tax AustraliaDocument23 pagesIncome Tax AustraliaDarshit PrajapatiNo ratings yet

- Your PNG Bill For The Month of OCT'19Document1 pageYour PNG Bill For The Month of OCT'19Darius DsouzaNo ratings yet

- Logical Ability For XATDocument52 pagesLogical Ability For XATBharat BajajNo ratings yet

- AFSA Cash Flow AnalysisDocument19 pagesAFSA Cash Flow AnalysisRikhabh DasNo ratings yet

- ProjectDocument24 pagesProjectLohith Sunny Reddy KaipuNo ratings yet

- Audit Eunice Cheatsheet (Autosaved) PrintDocument8 pagesAudit Eunice Cheatsheet (Autosaved) PrintEric OngNo ratings yet

- Materials From HBS and Text Book - Summary of Management AccountingDocument145 pagesMaterials From HBS and Text Book - Summary of Management AccountingMuhammad Helmi FaisalNo ratings yet

- An Introduction To Lic (Life Insurance Corporation of India)Document34 pagesAn Introduction To Lic (Life Insurance Corporation of India)mrmnshNo ratings yet

- Accountancy - Part 1 - Class 12 PDFDocument264 pagesAccountancy - Part 1 - Class 12 PDFCode 1No ratings yet

- Ellerby ResumeDocument3 pagesEllerby ResumeRobEllerbyNo ratings yet

- 1 Chapter 5 Internal Reconstruction PDFDocument22 pages1 Chapter 5 Internal Reconstruction PDFAbhiramNo ratings yet

- HR Strategy For EXIM Bank HRM 503Document8 pagesHR Strategy For EXIM Bank HRM 503Tasnim MumuNo ratings yet

- Uniform Format of Accounts For Central Automnomous Bodies PDFDocument46 pagesUniform Format of Accounts For Central Automnomous Bodies PDFsgirishri4044No ratings yet

- Chap 1 ExercisesDocument3 pagesChap 1 ExercisesThabet HomriNo ratings yet

- Leasco Corporation, Plaintiff-Respondent v. Peter T. Taussig, 473 F.2d 777, 2d Cir. (1972)Document13 pagesLeasco Corporation, Plaintiff-Respondent v. Peter T. Taussig, 473 F.2d 777, 2d Cir. (1972)Scribd Government DocsNo ratings yet

- Tugas 6 - Aulia KhairaniDocument3 pagesTugas 6 - Aulia KhairaniadvokesmahmmbNo ratings yet

- 2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Question PaperDocument12 pages2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Question PaperChantelle IsaksNo ratings yet

- Fin304 1midterm2Document5 pagesFin304 1midterm2darkhuman343No ratings yet

- 55 - Chapter 6 Exercises With AnswersDocument4 pages55 - Chapter 6 Exercises With Answersgio gioNo ratings yet